Why Specialized Landlord Insurance Matters for Housing Voucher Tenants

Cheap landlord insurance for dss tenants is a critical concern for property owners renting to individuals receiving housing assistance in Massachusetts and New Hampshire. While the term “DSS” (Department of Social Services) originated in the UK, American landlords use it to describe tenants participating in programs like Section 8 Housing Choice Vouchers. Here’s what you need to know:

Quick Answer: Finding Affordable Coverage

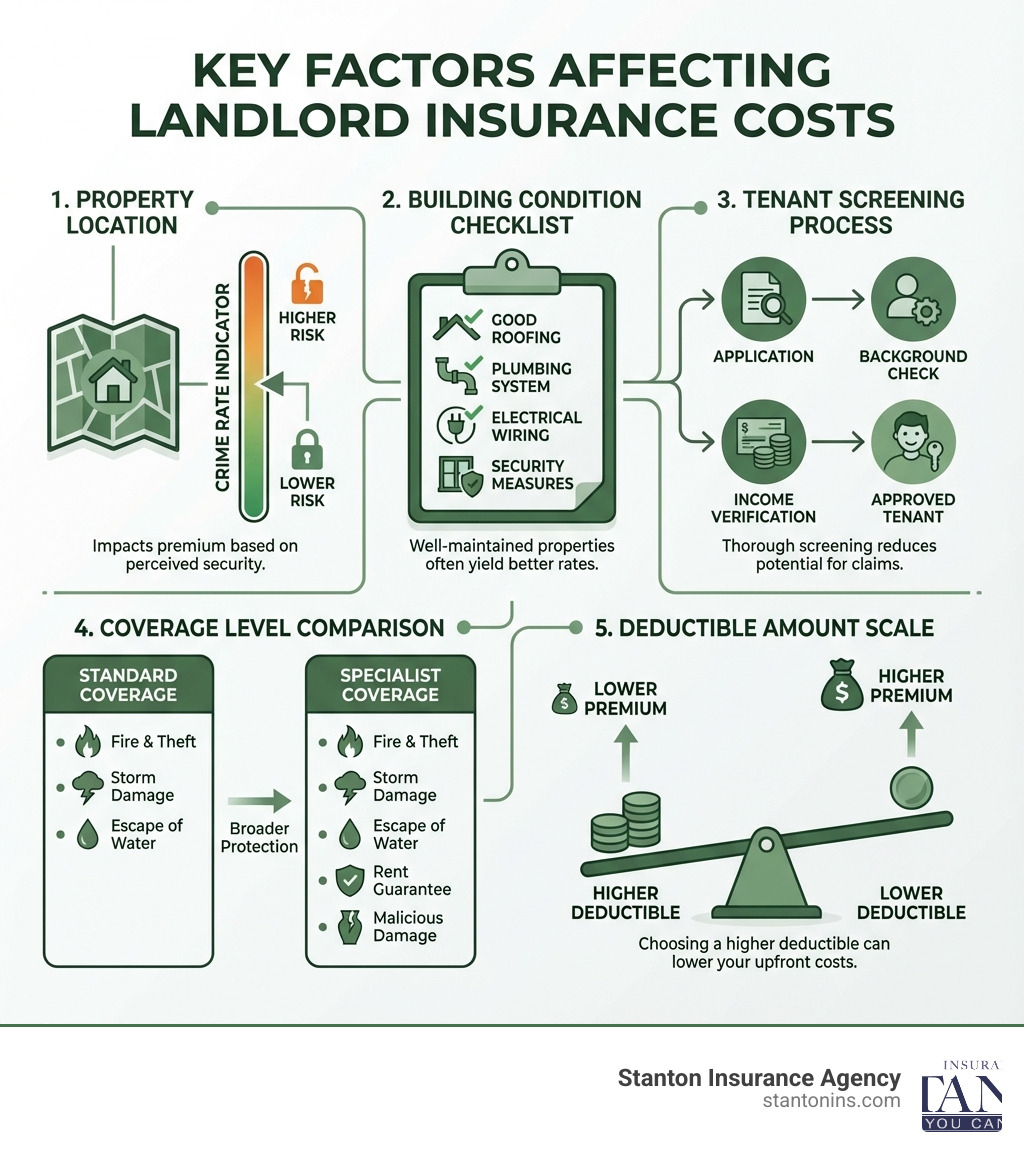

- Standard landlord insurance may not adequately cover risks perceived with voucher tenants

- Specialist policies offer broader protection including rent guarantee and malicious damage coverage

- Premiums depend on property location, condition, claims history, and tenant screening practices

- Massachusetts law prohibits discrimination based on source of income, including housing vouchers

- Working with an independent insurance agent helps compare multiple carriers for the best rates

Many landlords worry that insuring properties for voucher tenants will be prohibitively expensive. The reality is more nuanced. According to industry research, while premiums for these properties can be higher, the increase depends on multiple factors—not just tenant type. Property location, crime rates, building age, and your own risk management practices often matter more than whether rent comes from a housing authority or directly from the tenant.

The landscape has shifted significantly. In the United States, housing voucher recipients represent a substantial and growing segment of the rental market. “Many housing voucher recipients live in privately rented accommodation, so no landlord should neglect this demographic,” notes industry research. More importantly, refusing to rent to voucher holders is unlawful discrimination in Massachusetts under Chapter 151B.

I’m Geoff Stanton, President of Stanton Insurance Agency in Waltham, Massachusetts, and I’ve spent over two decades helping property owners protect their investments with appropriate coverage. Through my work specializing in commercial property and liability insurance, I’ve guided many landlords through the process of securing cheap landlord insurance for dss tenants while ensuring they have comprehensive protection that addresses the unique aspects of voucher tenancies.

Handy cheap landlord insurance for dss tenants terms:

What is Landlord Insurance for Tenants with Housing Vouchers and Why is it Necessary?

Landlord insurance for tenants with housing assistance is a specialized policy designed to protect property owners from the financial risks of renting. While standard Residential Landlord Insurance is a solid foundation, some insurers may perceive tenants in voucher programs as higher risk, which can affect premiums or coverage requirements. These perceptions, often based on outdated stereotypes, may relate to concerns about property maintenance, payment consistency, or longer vacancy periods. Specialist insurance addresses these concerns, ensuring you have robust protection.

We understand that owning rental property in Massachusetts and New Hampshire is a significant investment. Whether you own a single-family home, a multi-family dwelling, or an apartment building, you’re exposed to a unique set of risks that standard homeowner’s insurance simply won’t cover. This is especially true when renting to tenants participating in housing voucher programs.

The term “DSS” is an outdated British acronym, but in the context of the U.S., particularly in states like Massachusetts and New Hampshire, it refers to tenants who receive housing benefits, such as those under the Section 8 Housing Choice Voucher Program. These programs help low-income families, the elderly, and people with disabilities afford safe and sanitary housing.

Why is specialized landlord insurance needed for these tenants? Unfortunately, some insurers may hold historical biases or perceive an liftd risk when renting to voucher tenants. This perception can sometimes lead to higher premiums or a reluctance to offer certain types of coverage under a standard policy. However, as independent insurance agents, we know that many tenants receiving housing assistance are reliable, long-term renters. The key is to find an insurer who understands the realities of these programs and offers fair, comprehensive coverage.

Specialist landlord insurance recognizes these unique dynamics. It’s designed to fill the gaps that might exist in a standard policy, offering improved protection against risks such as:

- Tenant-related damage: While all tenants can cause accidental or malicious damage, specialist policies can provide more robust coverage custom to these situations.

- Rent payment issues: Although housing authorities typically guarantee a portion of the rent, understanding the nuances of these payments and having protection for the tenant’s portion is crucial.

- Legal expenses: Should you face eviction proceedings or other legal disputes, specialized policies often include broader legal expenses coverage.

This type of insurance is needed to protect your valuable asset, ensure consistent rental income, and shield you from potential liabilities, giving you peace of mind as a landlord.

How Does it Differ from Standard Landlord Insurance?

The fundamental difference lies in the specific risks and perceptions associated with renting to tenants receiving housing assistance. While standard landlord insurance covers basic perils like fire, storm damage, and general liability, specialist policies often include or offer improved versions of coverages critical for voucher tenancies.

| Feature | Standard Landlord Insurance | Specialist Housing Voucher Insurance |

|---|---|---|

| Rent Guarantee | Optional | Often Included/Improved |

| Malicious Damage Cover | Limited | Broader |

| Tenant Default Coverage | Limited | Broader |

| Underwriting Criteria | Standard | Custom to voucher tenancies |

Let’s dig into these differences:

- Rent Guarantee: While standard policies might offer rent guarantee as an add-on, specialist policies often provide more comprehensive options. This covers lost rent if a tenant defaults on their portion of the payment, or if the housing authority’s payment is delayed. This is distinct from “loss of rent” coverage, which typically applies when your property becomes uninhabitable due to a covered peril (like a fire), not tenant non-payment.

- Malicious Damage Cover: Standard policies may have limited coverage for malicious damage, especially if caused by a tenant. Specialist policies often offer broader protection against intentional damage caused by tenants beyond normal wear and tear. For example, if a tenant deliberately damages fixtures or fittings, a specialist policy is more likely to cover the repair or replacement costs.

- Tenant Default Coverage: This is closely related to rent guarantee but can also encompass legal costs associated with evicting a non-paying tenant. Some policies may even cover costs if you have to evict tenants for reasons other than non-payment, such as breach of tenancy terms.

- Underwriting Criteria: Insurers offering specialist policies are more familiar with the dynamics of housing voucher programs. Their underwriting process is designed to assess the actual risks more accurately, rather than relying on broad generalizations. This can result in more favorable terms and comprehensive coverage options for landlords.

We aim to ensure you have coverage that is specifically designed for your situation, rather than a one-size-fits-all solution that might leave you exposed.

The Legal Obligation: Renting to Tenants with Vouchers in MA & NH

Understanding your legal obligations is paramount for any landlord. In Massachusetts, it is illegal to discriminate against tenants based on their source of income, including housing vouchers, under Massachusetts General Law Chapter 151B. This means that landlords cannot implement a blanket “no Section 8” policy. Such practices are considered unlawful discrimination. While you can refuse a tenant based on legitimate business reasons (e.g., poor credit history, insufficient income to cover their portion of rent, negative landlord references, or failing a background check), you cannot refuse solely because they participate in a housing assistance program.

New Hampshire’s state laws differ, but federal Fair Housing Act protections still apply, prohibiting discrimination based on race, color, religion, sex, national origin, familial status, and disability. While source of income is not a federally protected class, local ordinances or specific program rules might offer additional protections. It’s always best practice to apply the same screening criteria to all applicants, regardless of their income source, to avoid any perception of discrimination.

Compliance with these laws not only ensures ethical practices but also protects you from costly legal disputes and penalties. Having a clear, consistent rental policy for all applicants is essential.

More information on landlord expenses and taxes can be found on the IRS website.

What Does Specialist Landlord Insurance Cover?

A robust landlord insurance policy protects both your physical asset and your rental income. While policies are customizable, they are built on a foundation of core coverages. Understanding what is included—and what requires an add-on—is crucial. We work with you to craft a policy that fits your unique needs, ensuring you’re neither over-insured nor under-protected.

Foundational Property Protection

These are the bedrock of any landlord insurance policy, protecting the physical structure of your property and the items you provide for your tenants.

- Landlord building insurance: This covers the cost of repairing or rebuilding your rental property if it’s damaged by events such as fire, storms, floods, or vandalism. It also typically covers the structure itself, including the roof, walls, floors, and permanent fixtures like fitted kitchens and bathrooms. When determining your coverage, we’ll help you estimate the rebuild value, not the market value, to ensure adequate protection.

- Landlord’s contents insurance: If you rent out a furnished or partially furnished property, this coverage protects the items you own and provide for your tenants. This can include furniture, appliances (like refrigerators and washing machines), carpets, and curtains. It pays for the repair or replacement of these items if they are damaged or stolen due to a covered peril. This doesn’t cover your tenant’s personal belongings; they would need their own Renters Insurance for that.

- Landlord Kitchen Appliance Cover: Essential appliances in a rental property, such as ovens, dishwashers, and refrigerators, are crucial for tenant satisfaction and property function. This specialized coverage safeguards these items against breakdowns or damage, ensuring quick repairs or replacements and minimizing disruption for your tenants.

Liability and Income Protection

Beyond the physical property, landlord insurance also shields you from potential legal claims and safeguards your rental income.

- Property owners’ liability insurance: This is a critical component. It covers legal fees and compensation costs if someone (like a tenant, a visitor, or even a tradesperson) sues you for injury or property damage that they blame on your rental property. For example, if a tenant trips over a loose floorboard and breaks an arm, this coverage would protect you against a liability claim. We ensure your liability limits are sufficient to protect your assets.

- Loss of rent: Should your property become uninhabitable due to a covered event (e.g., a fire or severe storm damage), this coverage compensates you for the rental income you lose while the property is being repaired or rebuilt. This helps ensure your cash flow isn’t completely disrupted during unforeseen circumstances. Some policies can cover lost rent for up to three years, providing significant financial stability.

- Alternative accommodation: If your property becomes uninhabitable due to an insured event, and your tenants need to be rehoused temporarily, this coverage can help cover the costs of their alternative living arrangements. This is a vital part of maintaining good tenant relations and fulfilling your obligations as a landlord.

Add-On Coverage for Improved Security

While core coverages are essential, adding specialized protections can significantly improve your security, particularly when renting to tenants with housing vouchers.

- Rent guarantee insurance: This is a highly valuable add-on, especially for properties with housing voucher tenants. It protects you against financial loss if your tenants fail to pay their share of the rent. It can also cover legal costs associated with evicting non-paying tenants. It’s important to distinguish this from “loss of rent” coverage; rent guarantee specifically addresses tenant default. For this coverage, insurers often require thorough tenant screening and a clear tenancy agreement.

- Malicious damage by tenants: Standard landlord policies might cover malicious damage by members of the public, but damage intentionally caused by your own tenants can be a gray area. This add-on provides specific protection against deliberate damage to your property by tenants or their guests, beyond normal wear and tear. This is particularly relevant as signs of forcible entry might be absent if the tenant has keys, making claims more complex without this specific extension.

- Accidental damage insurance: Accidents happen, and this coverage protects your property and contents against unintentional incidents. Examples include a tenant accidentally spilling red wine on a carpet, drilling into a pipe, or putting a nail through a wall. This coverage pays for the repair or replacement costs, ensuring minor mishaps don’t turn into major financial burdens. We can help you determine if this is a worthwhile addition to your policy.

To ensure you are getting adequate coverage for your specific needs, we always recommend a thorough review of your property, your tenant agreements, and a detailed discussion of your risk tolerance. We’ll help you understand the nuances of each coverage option and tailor a policy that provides comprehensive protection.

How to Find Cheap Landlord Insurance for DSS Tenants

Finding affordable coverage is about smart strategy, not just cutting corners. Insurers calculate premiums based on risk, so taking steps to reduce that risk can directly lower your costs. This is a key part of managing a profitable Apartment Building Insurance portfolio. While the term cheap landlord insurance for dss tenants might imply simply finding the lowest price, our focus is on finding you the best value: comprehensive coverage at a competitive rate.

Factors Influencing the Cost of Cheap Landlord Insurance for DSS Tenants

Several factors come into play when insurers determine your premium. Understanding these can empower you to make informed decisions and potentially lower your costs:

- Property location and local crime rates: Properties in areas with higher crime rates or those prone to natural disasters (like flood zones, which would also necessitate Flood Insurance) will generally have higher premiums. Conversely, choosing to purchase a rental property in an area with low crime rates, if possible, can help reduce costs.

- Property age and condition: Older properties or those in poor repair may pose higher risks for claims related to structural issues, plumbing, or electrical failures. Well-maintained, newer properties often qualify for lower rates.

- Rebuild value: The estimated cost to completely rebuild your property after a total loss significantly impacts your building insurance premium. An accurate assessment here is crucial.

- Claims history: A history of frequent claims, regardless of the tenant type, will likely result in higher premiums. Managing your property proactively to prevent small issues from escalating can help keep your claims history clean.

- Level of coverage and deductible amount: The more extensive your coverage, the higher your premium. Similarly, choosing a lower deductible (the amount you pay out-of-pocket before insurance kicks in) will result in a higher premium, and vice-versa.

- Tenant screening process: While you cannot discriminate, a rigorous and consistent tenant screening process (including credit checks, references, and background checks) demonstrates to insurers that you are actively managing risk, which can be viewed favorably.

Actionable Steps to Lower Your Premiums

We believe that finding cheap landlord insurance for dss tenants means being proactive and strategic. Here are some steps you can take to make your policy more affordable without compromising essential protection:

- Increase Your Deductible: This is one of the most direct ways to lower your premium. By agreeing to pay a larger amount out-of-pocket if you make a claim, your insurer takes on less risk, and passes those savings on to you. Just ensure the deductible is an amount you can comfortably afford in an emergency.

- Bundle Policies: Many insurance providers offer discounts when you bundle multiple policies with them. If you have your primary home insurance, auto insurance, or even Business Insurance with us, combining your landlord policy could lead to significant savings. We excel at finding these bundled opportunities for our clients.

- Improve Property Safety: Investing in your property’s security and maintenance can pay off in lower premiums. Install reliable security systems, smoke detectors, carbon monoxide detectors, and deadbolts on all exterior doors. A well-maintained property with updated electrical and plumbing systems is less likely to experience costly claims, making it a more attractive risk for insurers. Regular maintenance also prevents minor issues from becoming major, expensive problems.

- Thorough Tenant Screening: While you must adhere to non-discrimination laws in Massachusetts and New Hampshire, implementing a consistent and fair screening process for all applicants is crucial. This includes credit checks, criminal background checks (where permissible), and contacting previous landlord references. Demonstrating due diligence in selecting tenants shows insurers that you are actively mitigating risks, which can be reflected in your premium.

- Work with an Independent Agent: This is perhaps the most powerful step you can take. As an independent agency, Stanton Insurance Agency isn’t tied to a single insurance provider. We work with a wide network of carriers, including those who specialize in niche markets like landlord insurance for tenants with housing vouchers. This allows us to compare landlord insurance policies from multiple carriers, finding the best combination of coverage and price for your specific needs. We can help you steer the complexities, understand the fine print, and advocate on your behalf to secure comprehensive and cheap landlord insurance for dss tenants.

Frequently Asked Questions about Landlord Insurance for Tenants with Vouchers

We often encounter similar questions from landlords in Massachusetts and New Hampshire regarding insurance for properties rented to tenants with housing vouchers. Here are some of the most common inquiries and our expert answers:

Can a landlord require tenants to have renters insurance in Massachusetts?

Yes, absolutely. Landlords in Massachusetts can require tenants to obtain Renters Insurance as a condition of the lease, provided this requirement is applied to all tenants consistently and without discrimination. This is an excellent practice for several reasons:

- Protects Tenant’s Personal Property: Your landlord insurance covers your property, not your tenant’s belongings. Renters insurance ensures their furniture, electronics, clothing, and other valuables are protected against perils like fire, theft, or water damage.

- Provides Personal Liability Coverage for Tenants: If a tenant accidentally causes damage to your property (e.g., leaves a bathtub overflowing causing water damage) or if a guest is injured in their unit, their renters insurance can cover the costs. This reduces the likelihood of them being unable to pay for damages and potentially pursuing a claim against your own liability policy.

- Reduces Landlord’s Overall Risk: By requiring renters insurance, you transfer some of the risk of property damage and liability away from yourself and onto the tenant’s policy, helping to protect your investment further.

We highly recommend including this requirement in your lease agreements. More info on this topic is available here.

What are common exclusions in these policies?

Even the most comprehensive policies have exclusions. Understanding what your landlord insurance policy doesn’t cover is just as important as knowing what it does. Common exclusions in landlord insurance policies, including those for tenants with housing vouchers, typically include:

- General Wear and Tear: Damage that occurs naturally over time due to normal use of the property is not covered. This includes faded paint, worn carpets, or aging appliances. Landlords are responsible for routine maintenance and property upkeep.

- Damage from Pests: Damage caused by rodents, insects, or other pests (like termites or bed bugs) is generally excluded. Proactive pest control and regular inspections are part of property management.

- Mold (unless caused by a covered peril): While mold damage can be devastating, it’s often excluded unless it’s a direct result of a sudden and accidental covered event, such as a burst pipe. Gradual leaks or neglected moisture issues that lead to mold growth are typically not covered.

- Damage Resulting from Illegal Acts: Any damage or loss that occurs as a result of illegal activities conducted on the property by the tenant or their guests will almost certainly be excluded from coverage.

- Tenant’s Personal Property: As mentioned, your landlord policy covers your property. Your tenant’s personal belongings are not covered and require their own renters insurance.

- Vacancy Beyond a Specified Period: Most standard policies have limits on how long a property can be unoccupied before coverage is reduced or voided.

It’s vital to read your policy documents carefully to understand all exclusions and limitations. If you have any questions, we’re here to help clarify the details.

Does this insurance cover periods of unoccupancy?

This is a crucial question for landlords, as vacancies are an inevitable part of the rental business. Standard landlord insurance policies typically have strict limits on how long a property can be vacant or unoccupied before coverage is either reduced significantly or completely voided.

- Typical Limits: Many policies define “unoccupied” as a property without residents for a specified period, often 30 to 60 days. Beyond this timeframe, standard coverage for perils like vandalism, malicious mischief, burst pipes, or even fire may be severely restricted or eliminated. Insurers view unoccupied properties as higher risk due to lack of oversight and increased vulnerability.

- The Need for Specific Coverage: If you anticipate a longer vacancy between tenants, or if your property is undergoing extensive renovations where it will be empty for an extended period, you will likely need to purchase specific Unoccupied property insurance. This specialized policy is designed to cover the unique risks associated with vacant properties. We can help you assess your needs and secure this additional coverage if necessary, ensuring your investment remains protected even when no one is living there. Always inform your insurance provider if your property becomes or is expected to become unoccupied for more than a few weeks to avoid potential claim denials.

Conclusion: Secure Your Investment with the Right Partner

Protecting your rental property with the right insurance is not just a financial safeguard; it’s a cornerstone of a successful landlord business. By understanding the nuances of insuring properties for tenants with housing assistance, you can mitigate risks, comply with the law, and secure affordable, comprehensive coverage. While the search for cheap landlord insurance for dss tenants is important, true value lies in adequate protection that won’t leave you exposed when you need it most.

Navigating the complexities of landlord insurance, especially with the added layer of housing voucher programs and specific state laws in Massachusetts and New Hampshire, can be challenging. That’s where an experienced, Independent Insurance Agency like Stanton Insurance Agency becomes your invaluable partner. We don’t just offer policies; we offer expertise, guidance, and peace of mind. We can steer the market for you, comparing options from multiple providers to find a policy that fits your budget and protects your valuable asset.

Don’t leave your investment vulnerable to unforeseen risks. To discuss your specific needs and get a personalized quote for your rental property, explore our Multi-Family Dwelling Insurance options today. We’re here to help you build a secure and profitable rental business.