MA Condo Insurance: Avoid 2 Major Gaps Now

Your Guide to Navigating Condo Insurance in the Bay State

MA Condo Insurance is a specialized form of coverage that protects your condominium unit’s interior, personal belongings, and liability exposure—filling the gaps left by your HOA’s master policy. Here’s what you need to know:

What to Look for in an Insurer:

- Strong financial ratings (A- or better from AM Best, Moody’s, or Standard & Poor’s)

- Responsive, local claims service

- Experience underwriting HO-6 condo policies in New England

- Multi-policy discounts when you bundle auto, umbrella, or business coverage

Key Coverage Areas:

- Interior walls, flooring, and fixtures (“walls-in” coverage)

- Personal belongings and furniture

- Personal liability protection

- Additional living expenses if your unit becomes uninhabitable

- Loss assessment coverage for shared building expenses

Average Cost: About $669 annually—roughly $56 per month—for Massachusetts condo owners (actual premiums vary by location, building construction, and coverage limits).

Owning a condo in Massachusetts offers a fantastic lifestyle, but it comes with a unique insurance puzzle. Many new condo owners mistakenly believe their Homeowners Association (HOA) master policy covers everything. This common misconception can lead to devastating financial gaps if a fire, theft, or liability issue occurs within your unit.

The reality is stark: Your HOA’s master policy typically covers only the building’s exterior and common areas. Your personal belongings, interior improvements, and individual liability are your responsibility to insure.

As a common misconception highlighted in the research, “new condo buyers often think that the condo association’s master insurance policy covers your personal belongings and the interior of your unit.” This gap in understanding can cost you thousands—or even tens of thousands—in uncovered losses.

I’m Geoff Stanton, President of Stanton Insurance Agency, and I’ve been helping Massachusetts residents steer complex insurance needs for over two decades. With my expertise in MA Condo Insurance, I’ll guide you through the essential coverage decisions that protect both your investment and your peace of mind.

MA Condo Insurance terms explained:

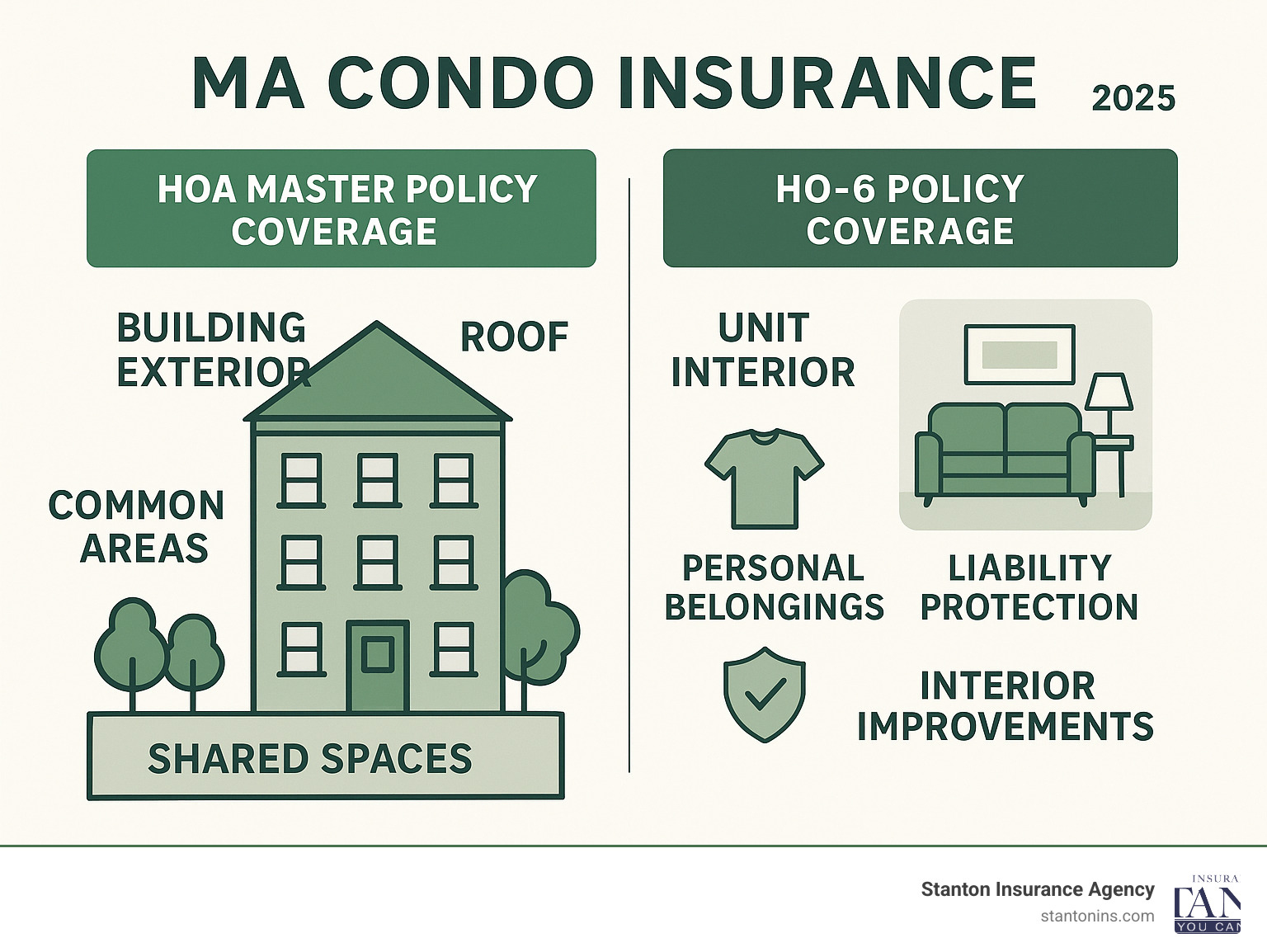

The Two-Policy Puzzle: Your HO-6 Policy vs. The HOA’s Master Policy

The most critical concept for any Massachusetts condo owner to understand is that you are protected by two distinct policies. Your personal policy works in tandem with your HOA’s master policy, and knowing where one ends and the other begins is key to avoiding coverage gaps.

Think of it like a puzzle where two pieces need to fit together perfectly. Your MA Condo Insurance works hand-in-hand with your association’s master policy to create complete protection. The problem? Many condo owners don’t realize there’s a puzzle at all.

Understanding this relationship is crucial because, as research shows, “when it comes to insuring your condominium, an experienced insurance agent is crucial to making sure you’re properly insured.” Without proper coordination between these policies, you could face significant financial exposure when disaster strikes.

What the HOA Master Policy Covers

Your monthly HOA dues contribute to a condo master insurance policy that covers the entire condominium complex. However, the extent of this coverage varies significantly depending on the type of master policy your association has chosen.

The master policy typically protects everything you share with your neighbors. This includes common areas like lobbies, hallways, and elevators, along with amenities such as swimming pools and fitness centers. The policy also covers the building structure including the roof, exterior walls, foundation, and central plumbing and electrical systems.

Your association also carries liability coverage for shared spaces. If someone slips in the lobby or gets injured at the pool, this coverage kicks in to protect the association.

But here’s where it gets tricky. There are different types of policies your HOA might have chosen:

Bare Walls-In Policies cover only basic structural components like walls, electrical, and plumbing. Single Entity Policies include those basics plus standard features like cupboards, counters, and flooring. All-In Policies provide the most comprehensive coverage, including basic components, standard features, and even owner improvements like hardwood flooring and granite countertops.

The type of master policy your HOA carries dramatically affects what you need to insure personally. As noted in research, “the level of coverage provided by a Master Condo Policy can differ significantly.”

What Your Personal MA Condo Insurance (HO-6) Policy Covers

This is where your personal responsibility begins. The policy you purchase for yourself is known as an HO-6 Policy, and it’s designed to protect what the master policy doesn’t: your personal space and belongings from the “walls-in.”

Your HO-6 policy is quite different from homeowners insurance, which covers an entire standalone property. Instead, it focuses on your unit’s interior and your personal belongings.

Your policy typically covers interior walls and drywall, flooring and carpeting, and cabinets and countertops. It protects your personal belongings including furniture, electronics, and clothes. The policy also includes personal liability in home insurance protection and covers upgrades and renovations you’ve made to your unit.

One unique feature is loss assessment coverage, which helps pay for shared building expenses that exceed the master policy limits. This coverage can save you from unexpected bills when the association faces a large claim.

The HO-6 designation stands for coverage specifically designed for condo and co-op owners. As research explains, “The HO-6 stands for coverage for those who own a condo or co-op. It covers your belongings and building structure. Also called additions and alterations, this policy covers changes or renovations to the inside of your unit.”

If you’re wondering do I need home insurance for a condo, the answer is yes – but it’s this specialized HO-6 coverage that fits your unique situation perfectly.

What Your MA Condo Insurance Policy Actually Protects

A standard HO-6 policy in Massachusetts is far more than just “stuff” insurance. It’s a comprehensive safety net designed to protect your finances, your lifestyle, and your peace of mind when the unexpected happens.

Think of your MA Condo Insurance as a financial shield that kicks in when life throws you a curveball. Whether it’s a kitchen fire that damages your cabinets, a burglar who steals your electronics, or a guest who slips and falls in your hallway, your HO-6 policy steps up to handle the costs that could otherwise devastate your budget.

Understanding what does condo insurance cover helps you see why this protection is so valuable. It’s not just about replacing your belongings—it’s about maintaining your quality of life when disaster strikes.

Key Coverage Components

Your HO-6 policy works like a well-organized team, with each coverage component handling different aspects of your protection. Let me walk you through what each part does for you.

Dwelling and Building Property Coverage takes care of everything inside your unit that’s attached or built-in. This includes your cabinets, countertops, flooring, and even built-in appliances. When a covered loss like a fire or water leak damages these fixtures, this coverage pays to repair or replace them. The amount you need depends entirely on your HOA’s master policy—if they have bare walls coverage, you might need at least 20% of your unit’s value, but if they have comprehensive all-in coverage, you might only need $10,000 over their deductible.

Personal Property Coverage protects all the stuff that makes your condo feel like home. Your furniture, clothing, electronics, artwork, and even your kitchen gadgets are all covered. One insurance expert puts it perfectly: “Imagine turning your unit upside down and shaking it; everything that falls out is your personal property.” What’s really nice is that this coverage often follows you around—so if your laptop gets stolen from your car or your jewelry disappears from your hotel room, you’re still protected.

Personal Liability Protection is your financial bodyguard when accidents happen. If a guest slips on your freshly mopped floor, or your bathtub overflows and causes water damage to the unit below, this coverage handles the legal costs and damages. We typically recommend at least $500,000 in liability coverage, though $1,000,000 gives you even better peace of mind. Trust me, lawsuits can get expensive quickly, and this protection is worth every penny.

Additional Living Expenses (also called Loss of Use) becomes your lifeline when your condo becomes temporarily unlivable. If a fire forces you out while repairs are being made, this coverage pays for your hotel bills, restaurant meals, and other extra costs of living elsewhere. It’s typically set at 20% of your dwelling coverage limit, which usually provides plenty of breathing room during a stressful time.

Loss Assessment Coverage is the unsung hero of condo insurance—and it’s unique to condo policies. Here’s why it matters: if there’s a major claim in your building’s common areas that exceeds the HOA’s master policy limits, or if there’s a large deductible, the remaining costs get divided among all unit owners. Without this coverage, you could suddenly face a bill for thousands of dollars. This protection steps in to cover your share, saving you from an unexpected financial hit.

What Isn’t Typically Covered

Your HO-6 policy is comprehensive, but it’s not magic. There are some things it won’t cover, and knowing these exclusions helps you avoid unpleasant surprises.

Flood damage is the big one that catches people off guard. Standard condo policies don’t cover flooding, whether it’s from a hurricane, heavy rain, or a burst dam. You need separate flood insurance for that protection.

Earthquake damage is another exclusion that matters here in Massachusetts, especially if you’re near fault lines. Intentional damage or criminal acts you commit aren’t covered either—insurance is for accidents, not deliberate destruction.

Routine maintenance issues like a leaky faucet or worn-out carpet aren’t covered because they’re considered normal wear and tear. Your policy is for sudden, unexpected events, not the gradual aging of your home.

Some other common exclusions include water or sewer backup damage (though you can often add this as an endorsement), insect or pest damage, and general wear and tear from normal use.

For a complete breakdown of what’s excluded, check out our detailed guide on what is not covered by condo insurance. Understanding these gaps helps you make informed decisions about additional coverage you might need.

Decoding the Cost and Determining Your Needs

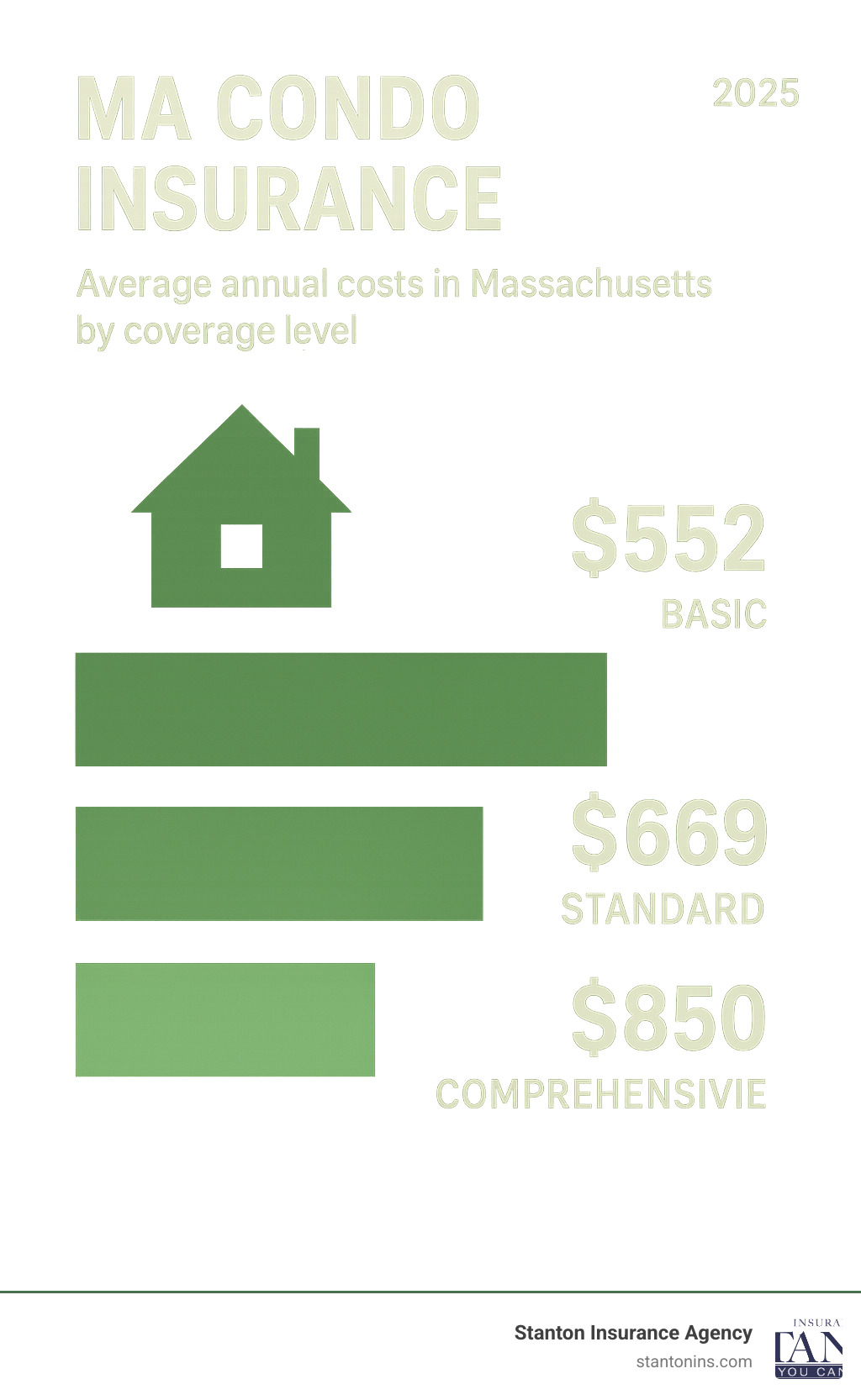

One of the most pleasant surprises for new condo owners is finding just how affordable MA Condo Insurance can be. Many people expect sky-high premiums, but the reality is much more budget-friendly. You can often secure solid coverage for as little as $35-$40 per month – that’s less than what many people spend on their monthly streaming services!

The exact cost of your policy depends on several factors, but understanding how much does condo insurance cost helps you budget appropriately and avoid both underinsurance and overpaying for unnecessary coverage.

Factors That Influence Your MA Condo Insurance Rate

Insurance companies are a bit like detectives – they examine multiple clues to determine your premium. The average cost of condo insurance in Massachusetts hovers around $669 per year, but your rate could be significantly higher or lower depending on your specific situation.

Your location plays a starring role in your premium calculation. A condo in downtown Boston averages about $940 annually, while the same coverage in Cambridge might cost around $650. If you’re living near the coast on Cape Cod, expect higher premiums due to storm and flooding risks. Meanwhile, inland areas like Springfield often enjoy lower rates thanks to their distance from ocean hazards.

The value of your belongings directly impacts your premium – it’s simple math, really. If you need $75,000 in personal property coverage for your designer furniture and high-end electronics, you’ll pay more than someone who needs just $25,000 to cover basic furnishings. Most policies offer coverage ranging from $15,000 to $100,000 or more.

Your building’s construction matters more than you might think. A brand-new brick building with modern fire suppression systems and security features will typically qualify for lower rates than an older wooden structure. Insurance companies love safety features like sprinkler systems, security cameras, and updated electrical systems.

Your claims history follows you like a shadow. Filing multiple claims in recent years can bump up your premium, while maintaining a clean record for three years or more often qualifies you for claim-free discounts. It’s like a good driving record, but for your home.

Your deductible choice gives you direct control over your premium. Choosing a $1,000 deductible instead of $500 will lower your monthly cost, but make sure you can comfortably afford that higher out-of-pocket expense if disaster strikes.

How Much Coverage Do I Need?

Determining your coverage needs isn’t guesswork – it’s a methodical process that starts with understanding what you actually own and what you’re responsible for protecting. The most crucial step is reviewing your HOA’s master policy to see exactly what it covers. This document is your roadmap to avoiding both coverage gaps and unnecessary overlap.

Start by creating a home inventory of your belongings. Walk through your condo with a notebook (or your phone’s camera) and catalog everything from your furniture and electronics to your clothing and kitchen appliances. You might be surprised by how much it would cost to replace everything from scratch.

For dwelling coverage, you need to know whether your HOA has bare walls, single entity, or all-in coverage. If your association has bare walls coverage, you might need dwelling coverage worth 20% of your unit’s appraised value. With an all-in master policy, you might only need $10,000 over the master policy deductible.

Liability limits deserve careful consideration too. While $100,000 might sound like a lot, it’s often not enough in our litigious society. We typically recommend at least $500,000, though $1,000,000 provides even better peace of mind without dramatically increasing your premium.

Don’t forget about loss assessment coverage – this unique protection can save you thousands if your HOA faces a large claim that exceeds their master policy limits. Imagine your building’s roof needs emergency replacement after a storm, and each unit owner gets billed $5,000 for their share. Loss assessment coverage handles this unexpected expense.

A local insurance agent can be your best ally in navigating these decisions. They can review your HOA documents, assess your personal situation, and help you build the right protection without paying for coverage you don’t need. For a personalized assessment of your needs, get a condo insurance quote from our experienced team.

The goal isn’t to buy the cheapest policy or the most expensive one – it’s to find the coverage that fits your specific needs and budget. For more detailed guidance on coverage amounts, check out our comprehensive guide on how much condo insurance do I need.

Frequently Asked Questions about MA Condo Insurance

Is condo insurance required by law in Massachusetts?

Here’s something that surprises many new condo owners: MA Condo Insurance isn’t actually required by Massachusetts state law. You won’t get a ticket or face legal penalties for going without it.

But here’s the catch – virtually every mortgage lender in the state will require you to purchase an HO-6 policy as a condition of your loan. They’re protecting their investment, and honestly, they’re protecting you too.

Even more importantly, most condo associations have bylaws that mandate unit owners carry their own coverage. This isn’t the HOA being difficult – it’s smart business. Without individual policies, one neighbor’s claim could create financial disputes that tear apart the entire community.

As our research confirms, “Condo insurance is not required by Massachusetts law, but most condo associations will require you to have coverage.” So while it’s not legally mandated, it’s practically essential.

Are townhomes insured like condos?

This question comes up constantly, and the answer is: it depends on your specific situation. Many townhome communities operate just like condo complexes, with an HOA master policy covering exteriors and common areas. In these cases, you’d need an HO-6 policy just like any condo owner.

However, if you own the entire structure and the land underneath it, you’d need standard homeowners insurance instead. The key difference is ownership responsibility.

The critical step is understanding what your HOA’s master policy actually covers. As our research notes, “Townhomes and condos often share similarities in insurance needs. Typically, townhome insurance is similar to condo insurance, covering the structure’s interior, personal property, and liability, though townhome owners might have greater responsibility for insuring the exterior.”

When in doubt, review your HOA documents carefully or have an experienced agent help you determine the right coverage type.

What information do I need to get a condo insurance quote?

Getting an accurate quote requires more than just your name and address. You’ll need your personal information like contact details and the condo’s address, plus an estimate of your belongings’ value. But the real key is having your condo association’s documents ready.

Your master insurance policy documents are absolutely crucial. These tell an agent exactly what’s already covered so they can tailor a policy that fills the gaps perfectly. You’ll also need your condo association’s bylaws and declarations, which outline your responsibilities as a unit owner.

Don’t forget to mention any upgrades or improvements you’ve made to your unit. That new kitchen or hardwood flooring might need additional coverage depending on your master policy type.

Without the master policy information, you’re basically shopping blind. You could end up overpaying for duplicate coverage or leaving dangerous gaps in protection. It’s worth the extra effort to gather these documents upfront.

Does condo insurance cover my belongings outside of my unit?

Here’s one of the most valuable features that many people don’t realize they have: your MA Condo Insurance typically protects your belongings worldwide, not just inside your four walls.

Your laptop stolen from your car? Covered. Your luggage damaged on vacation? Covered. Items in storage while you’re renovating? Usually covered for a limited time. Even belongings being moved to a new location are typically protected for about 30 days.

This worldwide coverage transforms your HO-6 policy from simple “apartment insurance” into comprehensive personal property protection. It’s like having a security blanket that follows you wherever you go.

What is “loss assessment” coverage and why do I need it?

Loss assessment coverage might be the most important part of your policy that you’ve never heard of. It protects you from one of condo ownership’s biggest financial surprises.

Here’s how it works: if your HOA faces a large claim that exceeds their master policy limits or falls within a hefty deductible, the association can assess each unit owner for their share of the costs. This isn’t optional – it’s typically written into your condo documents.

Imagine your building suffers $500,000 in damage and the master policy has a $100,000 deductible. That entire $100,000 could be divided among all unit owners. In a 50-unit building, that’s $2,000 per owner – due immediately.

Loss assessment coverage steps in to pay your share of these unexpected expenses, protecting you from sudden bills that could reach thousands of dollars. It’s like insurance for your insurance, and it’s absolutely essential for every condo owner.

Secure Your Peace of Mind

Understanding your MA Condo Insurance isn’t just about checking a box for your lender—it’s about protecting your financial future and ensuring you can bounce back from life’s unexpected curveballs. The key insight that many condo owners miss is that your HOA’s master policy simply isn’t enough. A personal HO-6 policy is absolutely essential to cover your interior structure, your personal belongings, and your liability exposure.

Think of it this way: your condo insurance is like a safety net that catches you when things go wrong. Without it, a kitchen fire could leave you not only displaced but also facing thousands in out-of-pocket costs for repairs and temporary housing. Your beautiful hardwood floors, custom cabinets, and all your personal belongings would be your financial responsibility to replace.

The complexity of condo insurance lies in understanding the intricate dance between your personal policy and your HOA’s master coverage. As highlighted in our research, “Clients who find out about their coverage only after a claim are often disappointed, frustrated, and at a loss.” Don’t let that be you.

Here’s what you need to remember: Your HOA’s master policy doesn’t cover your personal belongings or interior improvements, no matter how much you pay in monthly fees. HO-6 policies are specifically designed for condo owners and work very differently from regular homeowners insurance. Loss assessment coverage protects you from those surprise HOA bills that can hit when the building faces a major claim. And the type of master policy your HOA carries—whether it’s bare walls, single entity, or all-in coverage—dramatically affects what you need to insure personally.

The good news? MA Condo Insurance is typically very affordable, often costing less than what you spend on your monthly coffee habit. Most policies run under $60 per month, making proper protection accessible for virtually every condo owner.

Navigating the complexities of master policies and coverage gaps can feel overwhelming, but you don’t have to figure it out alone. At Stanton Insurance Agency, we specialize in helping Massachusetts, New Hampshire, and Maine residents understand their unique insurance needs. Our experienced agents can review your HOA documents, assess your coverage gaps, and help you build the right protection for your Bay State condo.

We’ve seen too many condo owners learn about their coverage shortfalls only after filing a claim. Don’t let coverage slip through the cracks. Contact us today to get a personalized condo insurance quote and ensure your valuable investment is properly protected. With decades of experience serving the region, we’ll help you steer the two-policy puzzle and secure the peace of mind you deserve.