Apartment Building Insurance: 3 Essential Pillars

Why Apartment Building Insurance is Your Property’s Essential Safety Net

Apartment Building Insurance protects property owners from the unique risks of managing multi-unit residential buildings. Unlike standard homeowner’s insurance, this specialized commercial coverage addresses tenant-related liabilities, property damage, and business income loss that apartment owners face daily.

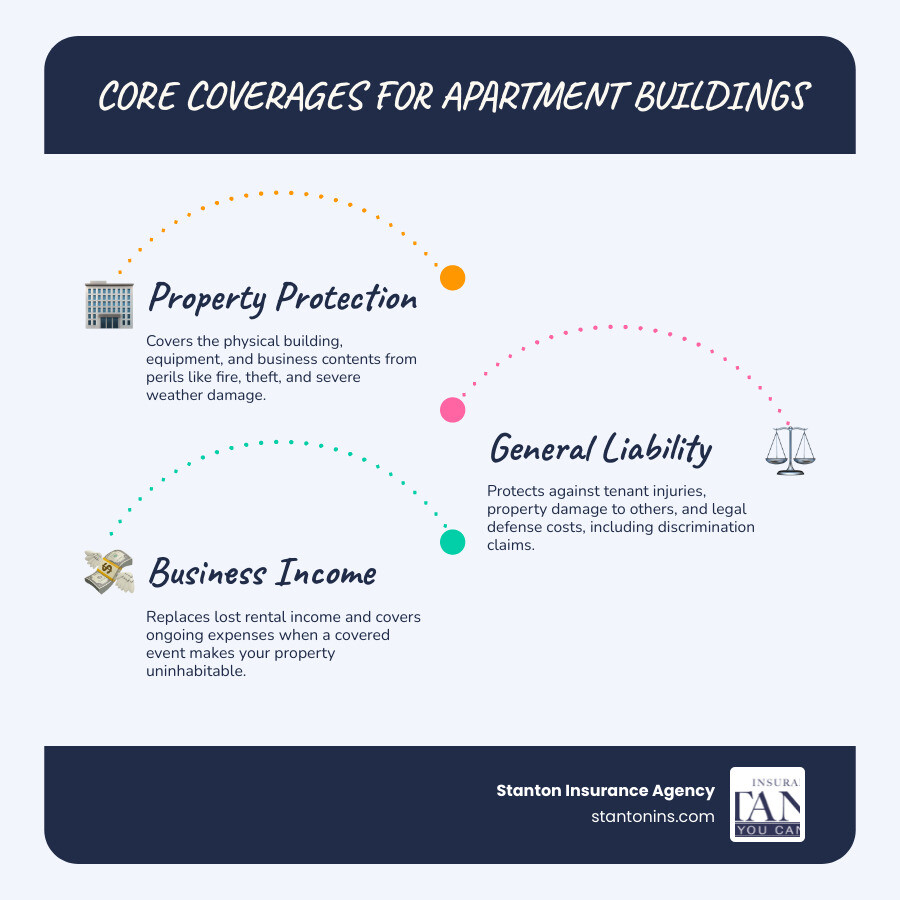

Key Coverage Components:

- Property Protection – Building structure, equipment, and business contents

- General Liability – Tenant injuries, discrimination claims, legal defense

- Business Income – Lost rental income during repairs after covered events

- Ordinance & Law – Building code compliance costs after damage

Essential for: Buildings with 4+ units, required by most lenders, protects against slip-and-fall lawsuits (some reaching $13 million in damages), fire damage, water damage, and tenant-caused incidents.

As an owner of a multi-family apartment complex, you face more risks than a traditional homeowner. Events like loss of income from rent and lawsuits stemming from tenant injuries are significantly more likely to affect your business. The real estate insurance sector has faced major challenges due to frequent claims and high payouts in multi-family housing, making proper coverage more critical than ever.

Water damage leads to costly property damage claims, with many insurers now imposing sublimits that reduce payouts for water-related damages. Statistics show that 25% of businesses don’t reopen after facing a natural disaster, highlighting why comprehensive protection isn’t optional—it’s essential for your investment’s survival.

I’m Geoff Stanton, President of Stanton Insurance Agency, and I’ve spent over two decades helping Massachusetts and New Hampshire property owners steer the complexities of Apartment Building Insurance. My experience in claims management and commercial property coverage has shown me how the right policy protects both your financial investment and your peace of mind.

What is Apartment Building Insurance and Why is It Essential?

As an apartment building owner, you’re juggling more responsibilities than most people realize. You’re not just managing a property—you’re running a business that involves tenant safety, asset protection, and meeting lender requirements. That’s where Apartment Building Insurance becomes your financial lifeline.

This specialized coverage is designed specifically for the unique challenges of multi-unit properties. Unlike your personal home insurance or even basic landlord policies, Apartment Building Insurance recognizes that apartment buildings face distinctly different risks and exposures. When you have multiple families living under one roof, the potential for claims multiplies exponentially.

Think of it this way: a single slip-and-fall incident, a burst pipe affecting multiple units, or a fire that displaces dozens of tenants creates financial consequences that would devastate most property owners. Without proper coverage, one unfortunate event could wipe out years of rental income and force you into bankruptcy.

To learn more about how we can protect your assets, visit our Commercial Property Insurance page.

| Feature | Standard Landlord Policy (Single-Family) | Comprehensive Commercial Apartment Building Policy |

|---|---|---|

| Property Coverage | Basic dwelling, limited contents | Building, outbuildings, business contents, equipment |

| Liability Limits | Lower, personal focus | Higher, commercial scale, tenant-specific |

| Business Income | Often limited or none | Extensive, covers lost rent and ongoing expenses |

| Building Codes | Generally not covered | Ordinance & Law endorsement available |

| Target Property | 1-4 unit owner-occupied or rental | Multi-unit apartment complexes, commercial scale |

The Critical Difference: Landlord vs. Commercial Policies

Here’s something that surprises many new apartment building owners: your standard homeowner’s insurance won’t cut it, and neither will basic landlord insurance. Even if you’re managing just a four-unit building, you’re essentially operating a business with all the complexities that come with it.

Single-family rental properties can often get by with basic landlord coverage because the risks are more contained. But multi-unit apartment buildings create a perfect storm of increased liability and operational challenges. You’re dealing with more tenants, more visitors, more maintenance issues, and unfortunately, more opportunities for things to go wrong.

For smaller apartment buildings with fewer units and minimal staff, a Business Owners Policy (BOP) might provide adequate protection by bundling property and liability coverage into one convenient package. However, if you own a large apartment complex or multiple properties, you’ll need the comprehensive protection that only a full commercial package can provide.

The difference isn’t just about coverage limits—it’s about understanding the unique risks you face as a commercial property owner and ensuring every potential exposure is properly addressed.

Common Risks and Claims in Apartment Buildings

Let’s talk about what keeps apartment building owners awake at night. Slip-and-fall incidents top the list, and the financial consequences can be staggering. With the potential for lawsuits in Massachusetts and New Hampshire to reach seven figures, these aren’t just minor inconveniences—they’re business-threatening events.

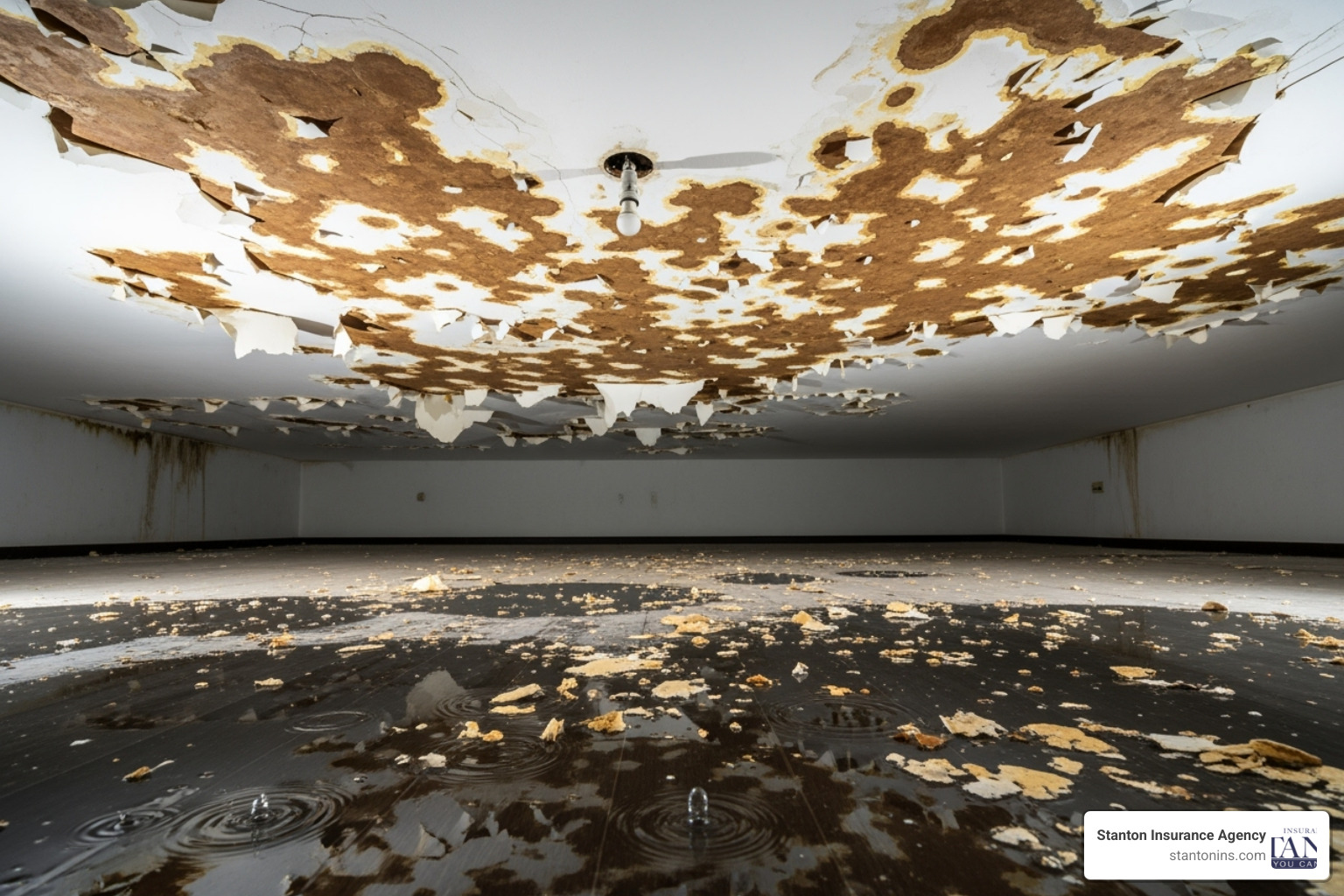

Water damage is another major headache for apartment owners. Whether it’s from burst pipes, leaking appliances, or roof damage, water has an uncanny ability to cause maximum destruction in minimum time. The problem has become so widespread that many insurance companies now impose sublimits that reduce payouts for water-related damages.

Fire damage remains one of the most devastating risks, capable of displacing multiple families and destroying your entire investment overnight. Meanwhile, vandalism and severe weather events—particularly the heavy snow, ice, and high winds we see here in New England—can cause significant property damage and business interruption.

Don’t overlook other exposures like employee theft, which can impact your daily operations, or tenant discrimination lawsuits, which fall under your liability coverage. It’s worth noting that many policies now exclude coverage for assault and battery incidents, making proactive security measures more important than ever.

These risks aren’t just theoretical—they’re real threats that apartment building owners face every day. Understanding how vandalism affects your coverage is crucial, which is why we encourage you to learn more at Is Vandalism Covered by Commercial Property Insurance?.

Core Coverages Every Apartment Building Owner Needs

Building a comprehensive policy means tailoring coverage to your property, avoiding common exclusions, and protecting your investment from all angles. Think of Apartment Building Insurance as a three-legged stool—remove any leg, and the whole thing becomes unstable. Your policy needs property protection, liability coverage, and business income insurance working together to keep your investment secure.

Commercial Property and Business Contents Coverage

Your building is likely your largest single investment, so protecting its physical structure should be your top priority. Commercial Property coverage acts as a financial safety net for your building’s structure—walls, roofs, foundations, and permanently installed fixtures. But it doesn’t stop there. This coverage extends to protect other structures on your property like garages, clubhouses, storage buildings, and even that community swimming pool your tenants love.

What many apartment owners don’t realize is that this coverage also safeguards your business contents. We’re talking about your maintenance equipment, office furniture, appliances in common areas, and yes, even your landscaping investments. If a fire damages your on-site laundry equipment or a storm destroys your outdoor furniture, you’re covered.

The coverage protects against the usual suspects: fire, theft, windstorms, hail, and vandalism. But here’s where many property owners get caught off guard—understanding the difference between Replacement Cost and Actual Cash Value.

Replacement Cost coverage pays to rebuild or repair your property with new materials of similar quality, without factoring in depreciation. Actual Cash Value, on the other hand, considers how much your property has aged and gives you less money accordingly. We always recommend Replacement Cost coverage because when disaster strikes, you want to fully restore your property, not settle for something less.

Here’s another critical point: make sure your coverage matches your property’s full replacement value. If you’re underinsured, you could face a co-insurance penalty, leaving you to cover part of the repair costs out of your own pocket. Nobody wants that surprise during an already stressful time.

General Liability Protection

If Property coverage protects your building, General Liability protects your bank account from lawsuits. This is arguably the most critical component of your Apartment Building Insurance policy, and frankly, it’s what keeps me up at night when I think about unprotected property owners.

Picture this scenario: a tenant’s guest slips on a wet floor in your lobby and breaks their wrist. Without General Liability coverage, you’re looking at medical bills, potential lost wages, pain and suffering claims, and legal fees that could easily reach six figures. With proper coverage, your insurance handles the financial burden while you focus on running your business.

General Liability covers tenant and guest injuries that occur on your premises, including medical costs and legal defense fees. It includes Bodily Injury Liability for physical harm to others and Property Damage Liability when someone’s belongings get damaged due to your negligence.

The coverage also handles legal defense costs, which is huge. Even if you’re completely innocent, defending yourself against a lawsuit can cost tens of thousands of dollars. Your General Liability coverage steps in to handle these expenses, giving you access to experienced attorneys without breaking your budget.

Personal and advertising injury protection rounds out this coverage, protecting you from claims like libel, slander, false arrest, or copyright infringement in your marketing materials. It’s broader protection than most people realize.

However, pay attention to common exclusions. Many policies now specifically exclude claims from assault and battery incidents. This means if a tenant attacks someone on your property, your standard liability coverage won’t respond. We can help you understand these limitations and explore additional coverage options if needed.

Business Income (Business Interruption) Insurance

Here’s a sobering thought: what happens to your monthly cash flow when half your building becomes uninhabitable after a kitchen fire? Your Property coverage will pay to repair the damage, but who covers the lost rental income while your units sit empty during repairs?

Business Income Insurance, also called Business Interruption Insurance, fills this critical gap. It reimburses you for the rental income you would have earned if the covered damage hadn’t occurred. But it goes beyond just replacing lost rent.

This coverage also handles your ongoing expenses during the restoration period. Your mortgage payments don’t stop because you had a fire. Property taxes keep coming. You still need to pay essential staff and maintain utilities. Business Income coverage ensures you can meet these financial obligations even when your property isn’t generating income.

The statistics are stark: 25% of businesses don’t reopen after facing a natural disaster. Often, it’s not the initial damage that closes them permanently—it’s the financial strain of lost income during the recovery period. Business Income coverage helps ensure your investment survives not just the initial disaster, but the challenging months that follow.

For a deeper dive into this essential protection, visit our Business Income Insurance page.

Essential Endorsements: Ordinance & Law Coverage

If you own an older apartment building, Ordinance & Law coverage isn’t just important—it’s absolutely essential. This endorsement addresses one of the most expensive surprises property owners face after a covered loss: being forced to upgrade to current building codes.

Here’s how this works in practice. Let’s say a fire damages 30% of your roof. Your standard property policy pays to repair that damaged 30%. Sounds fair, right? But then the building inspector shows up and declares that local codes now require you to replace the entire roof to meet current standards. Without Ordinance & Law coverage, you’re personally responsible for the cost difference, which could easily be tens of thousands of dollars.

This endorsement typically includes three components. Coverage A pays for demolishing or repairing undamaged parts of your building to bring everything up to current codes. Coverage B handles demolition costs when the law requires you to tear down undamaged portions. Coverage C covers the increased construction costs of rebuilding to modern standards, which are often much more stringent than when your building was originally constructed.

For buildings that haven’t been significantly updated in recent decades, Ordinance & Law coverage is a crucial investment. It ensures you can rebuild to modern standards without facing financial ruin. Building codes evolve constantly—what was acceptable twenty years ago might not meet today’s safety, accessibility, or environmental standards.

Learn more about this vital protection on our Ordinance & Law Coverage page. Trust me, this endorsement has saved countless property owners from devastating out-of-pocket expenses when disaster strikes.

Understanding the Cost of Your Apartment Building Insurance Policy

Here’s the truth about Apartment Building Insurance costs: asking “How much does it cost?” is like asking “How much does a car cost?” The answer depends entirely on what you’re buying and what you need to protect.

Annual premiums can range from a few thousand dollars for a small, well-maintained building to tens of thousands for larger complexes in high-risk areas. I’ve seen premiums vary dramatically even between similar buildings just a few miles apart. That’s why getting an accurate Apartment Building Insurance Quote custom to your specific property is so important.

The insurance market for apartment buildings has become increasingly challenging in recent years. With more frequent severe weather events and rising construction costs, insurers are being more selective about the risks they take on. This means that having a clear understanding of what drives your costs—and how to manage them—has never been more critical.

Key Factors That Influence Apartment Building Insurance Costs

Your insurance premium is essentially a reflection of risk, and every aspect of your property tells a story about that risk. Location plays a huge role in determining your costs. Properties near the Massachusetts or New Hampshire coast face higher premiums due to hurricane and storm surge risks, while buildings in areas with higher crime rates will see increased liability costs. However, being close to a fire station or having good access to emergency services can work in your favor.

The age and construction type of your building significantly impact your rates. I often tell clients that insurers love brick and stone but get nervous around older wood-frame construction. A building constructed in the 1970s with original wiring and plumbing will cost more to insure than a newer property with updated systems. It’s not just about age, though—it’s about maintenance and modernization.

Building condition is where you have real control over your costs. Insurers pay close attention to the condition of your roof, wiring, and plumbing because these are the sources of the most expensive claims. A roof that’s been well-maintained and recently inspected signals to insurers that you’re a responsible property owner who takes care of their investment.

The number of units in your building creates a multiplier effect for both potential claims and premium costs. More units mean more tenants, more foot traffic, and more opportunities for something to go wrong. However, larger properties can sometimes benefit from economies of scale with certain insurers.

Safety and security systems are investments that pay dividends in reduced premiums. Modern fire suppression systems, security cameras, controlled access, and monitored alarm systems all demonstrate that you’re serious about protecting your property and tenants. Your claims history also follows you—frequent small claims can hurt you more than one larger claim that was clearly beyond your control.

Finally, your coverage limits and deductibles directly impact your premium. Higher limits mean more protection but also higher costs. Choosing a higher deductible can significantly reduce your annual premium, but make sure you have the cash reserves to handle that larger out-of-pocket expense if a claim occurs.

How to Reduce Your Premiums and Mitigate Risks

The good news is that you’re not powerless when it comes to controlling your insurance costs. Smart property management and proactive risk reduction can lead to meaningful premium savings while also protecting your investment.

Regular property maintenance is your best defense against claims and high premiums. Stay on top of routine repairs, especially anything involving water—leaky roofs, aging pipes, and faulty appliances are claim magnets. When you can show an insurer documentation of regular maintenance and prompt repairs, you’re demonstrating that you’re a low-risk account they want to keep.

Upgrading safety features is an investment that pays for itself over time. Installing sprinkler systems, updating fire alarms, adding security cameras, and improving lighting in common areas all reduce your risk profile. Many insurers offer specific discounts for these improvements, so make sure your agent knows about every safety feature you’ve added.

Tenant screening might seem unrelated to insurance, but good tenants mean fewer claims. Thorough background checks, employment verification, and reference checks help you find responsible tenants who are less likely to cause property damage or create liability situations. Additionally, requiring all tenants to carry Renters Insurance protects both of you—their policy handles their personal property and some liability claims that might otherwise fall on your commercial policy.

Increasing your deductible is one of the fastest ways to reduce your premium, but only do this if you have adequate cash reserves. Going from a $1,000 to a $5,000 deductible might save you several hundred dollars annually, but make sure you can comfortably afford that higher out-of-pocket cost.

Bundling policies with the same carrier can sometimes open up discounts, especially if you have multiple properties or need other business coverages. However, don’t assume bundling always saves money—sometimes separate policies from different carriers provide better overall value and coverage.

The key is working with an experienced agent who understands the apartment building market and can help you balance adequate protection with reasonable costs. Every building is unique, and your insurance strategy should be too.

Frequently Asked Questions about Apartment Building Insurance

Here, we address some of the most common inquiries we receive from apartment building owners in Massachusetts and New Hampshire.

Is apartment building insurance required in Massachusetts and New Hampshire?

While state law doesn’t explicitly mandate Apartment Building Insurance for every multi-unit building, the reality is that virtually every property owner needs it. Your mortgage lender will almost certainly require comprehensive coverage as a condition of financing—they want to protect their investment just as much as you want to protect yours.

Beyond lender requirements, this coverage is simply smart business. You’ve invested hundreds of thousands, maybe millions, of dollars in your property. Operating without adequate protection is like driving without a seatbelt—you might be fine most of the time, but when something goes wrong, the consequences can be devastating.

Massachusetts has specific requirements too. Landlords must carry liability insurance to cover injuries in common areas, which makes sense when you consider how many people walk through lobbies, hallways, and stairwells every day. In both Massachusetts and New Hampshire, we strongly recommend never operating without proper coverage—the financial risk is simply too great.

What is the difference between apartment building insurance and condo master insurance?

The key difference comes down to who owns what and who’s responsible for what gets damaged.

Apartment Building Insurance is for buildings owned by one person or company who rents out all the units. Think of it as comprehensive protection for the entire property—the structure, common areas like lobbies and gyms, the roof, the parking lot, everything. If something happens anywhere on the property, from a slip-and-fall in the hallway to storm damage on the roof, this policy responds.

Condo Master Insurance, on the other hand, is held by a condo association for buildings where people own their individual units. This policy typically covers the common areas and the building’s shell, but it stops at each unit’s front door. Individual condo owners need their own insurance for their unit’s interior, their personal belongings, and their personal liability.

It’s like the difference between owning an entire apartment building versus owning just one slice of it. The insurance follows the ownership structure.

Does the policy cover special perils like floods or earthquakes?

Here’s where many property owners get a surprise: standard commercial property policies, including Apartment Building Insurance, typically exclude flood and earthquake damage. These are considered “special perils” that require separate coverage.

This exclusion might seem frustrating, but there’s a reason for it. Floods and earthquakes can cause widespread damage across entire regions, creating massive claims all at once. Insurance companies handle these risks through specialized programs and separate policies.

Given New England’s coastal location and our increasingly unpredictable weather patterns, flood coverage deserves serious consideration. We’ve seen properties flood from nor’easters, rapid snowmelt, and even broken water mains—and many of these weren’t in designated flood zones. Flood Insurance can be purchased through the National Flood Insurance Program or private carriers.

Earthquake coverage is less common in our area since major seismic activity is rare, but it’s not impossible. If you’re concerned about earthquake risk, we can discuss separate earthquake coverage options.

The important thing is having an honest conversation about your property’s specific risks. We’ll help you understand what your standard policy covers and what additional protection might make sense for your peace of mind and financial security.

Choosing the Right Partner for Your Insurance Needs

Finding the right insurance partner for your Apartment Building Insurance can feel overwhelming, but it doesn’t have to be. Think of it like choosing a trusted advisor for your business—because that’s exactly what you’re doing. The right agency will guide you through the complexities, help you avoid costly gaps in coverage, and be there when you need them most.

Financial stability should be your first checkpoint. Always choose a carrier with a strong A.M. Best rating of A or higher. This rating tells you they have the financial muscle to pay claims, even the big ones that could otherwise devastate your investment. There’s nothing worse than finding your insurance company can’t deliver when disaster strikes.

The claims process is where insurance companies either shine or fail their customers. Look for carriers known for efficient, fair claims handling. A smooth claims experience can transform what’s already a stressful situation into something manageable. Ask potential agents about their carriers’ claims reputation—any hesitation in their answer should raise red flags.

Experience matters tremendously in apartment building coverage. The nuances of multi-family properties are vastly different from standard homeowner’s policies. You want an agency that understands tenant liability, business income protection, and the specific challenges apartment owners face. Generic insurance advice simply won’t cut it when you’re dealing with the complexities of rental property ownership.

Local knowledge becomes especially valuable for Massachusetts and New Hampshire property owners. Regional weather patterns, local building codes, and state-specific liability laws all impact your coverage needs. An independent agent who understands these local factors can spot potential coverage gaps that out-of-state providers might miss entirely.

At Stanton Insurance Agency, we’ve built our reputation on being that trusted partner for apartment building owners throughout Massachusetts and New Hampshire. Our deep community roots mean we understand the unique challenges you face, from coastal weather risks to evolving local regulations. We work with multiple financially stable carriers, giving us the flexibility to find you the best coverage at competitive rates.

We take pride in our comprehensive policy reviews, ensuring your Apartment Owner Insurance truly fits your specific property and risk profile. Our personalized approach means you’re not just another policy number—you’re a valued client whose success matters to us.

Don’t leave your significant investment to chance or settle for generic coverage that might leave you exposed. Contact us today for a custom consultation, and let’s build an Apartment Building Insurance policy that provides the robust protection and genuine peace of mind your investment deserves.