Affordable Rental Property Insurance: Smart Guide 2025

Why Rental Property Owners Need the Right Coverage

Affordable rental property insurance is essential protection for landlords who want to safeguard their investment without overspending. Here’s what you need to know:

Quick Answer: Finding Affordable Rental Property Insurance

- Shop Around – Compare quotes from multiple carriers to find the best value

- Bundle Policies – Combine your landlord insurance with auto or primary home insurance for discounts

- Raise Your Deductible – Increasing from $500 to $1,000 can save nearly 9% on premiums

- Install Safety Features – Add smoke detectors, security systems, and sprinkler systems for discounts

- Maintain Your Property – Keep your rental in good condition to reduce risk and lower rates

- Work with an Independent Agent – Get access to multiple carriers and expert guidance

Take a quick mental inventory of your rental property. The structure, the appliances you provide, the rent you collect each month—how much would it cost you if a fire destroyed the building or a tenant sued you after an injury? For most landlords, the answer is financially devastating.

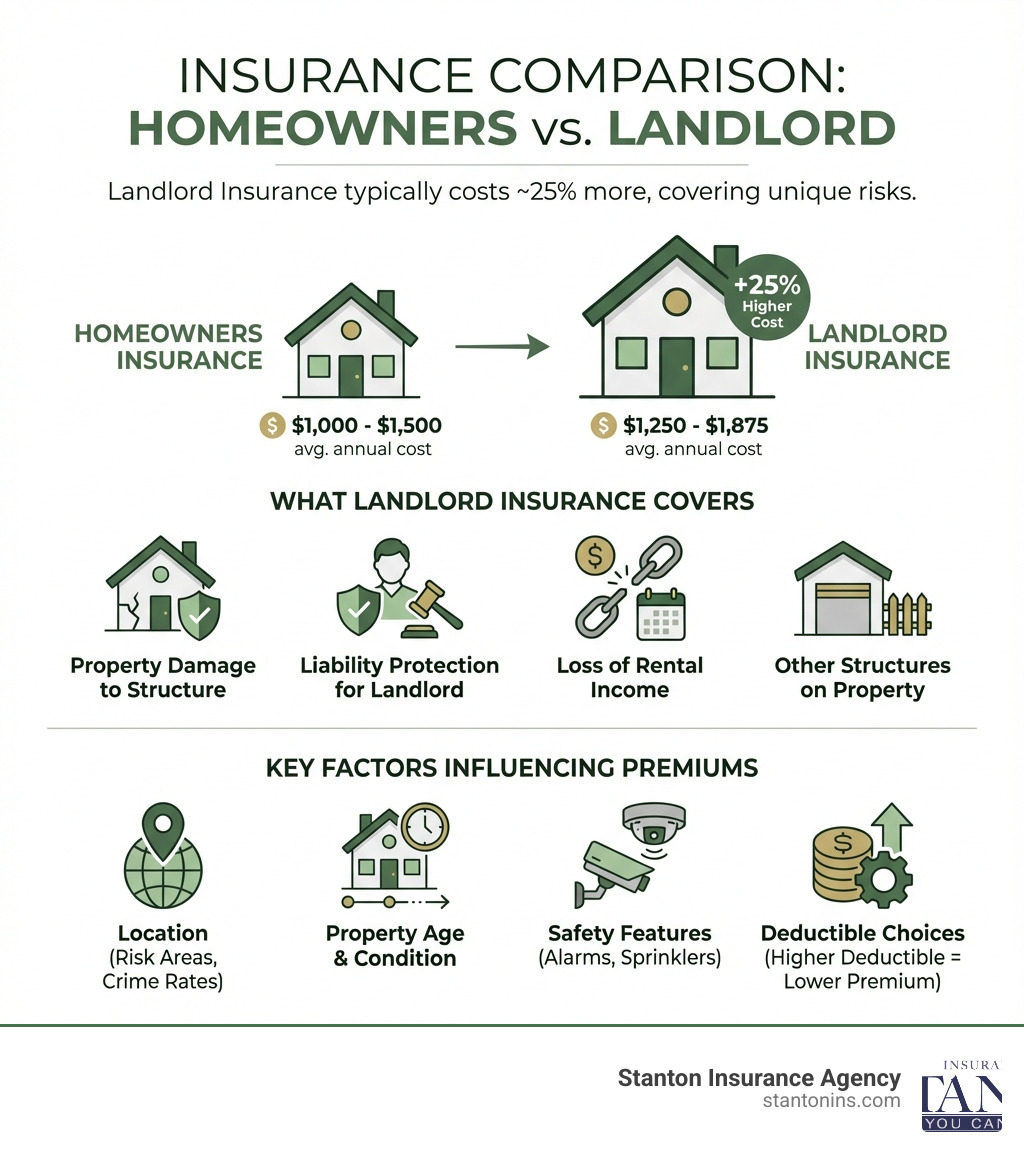

Landlord insurance typically costs about 25% more than standard homeowners insurance, but it’s designed specifically for the unique risks of rental properties. The coverage you need is different from the policy on your own home, and using the wrong type can leave you exposed to significant financial loss.

Here’s the reality: your standard homeowners policy won’t cover you once you rent out your property. If a tenant’s guest is injured on your property, if a fire makes your rental uninhabitable, or if vandalism occurs between tenants, you need specialized protection. Without it, you’re personally liable for potentially hundreds of thousands of dollars in damages, legal fees, and lost rental income.

The good news? You don’t have to sacrifice quality coverage to stay within budget. With the right strategies and guidance, you can find comprehensive protection that fits your financial situation.

As Geoff Stanton, President of Stanton Insurance Agency and a Certified Insurance Counselor, I’ve helped countless property owners in Massachusetts and New Hampshire secure affordable rental property insurance that protects their investments. My goal is to help you understand your options and make informed decisions that balance protection with cost.

Understanding Landlord Insurance vs. Other Policies

Before you can find the right policy, it’s crucial to understand what landlord insurance is and how it differs from the standard home insurance you have on your own residence. While they share similarities, they are not interchangeable. Using the wrong policy can lead to a denied claim, leaving you to cover expensive damages out-of-pocket.

What is Landlord Insurance and How is it Different?

Landlord insurance, sometimes called landlord property insurance or a dwelling policy, is a specialized policy for people who rent their homes to others. It’s built for non-owner-occupied properties, recognizing the distinct set of risks that come with having tenants. Unlike a homeowners policy, which assumes the owner lives on-site and actively maintains the property, landlord insurance is specifically designed to protect against risks you may face when renting out a property.

The core reason for this distinction is that your regular homeowners policy is unlikely to cover damage that occurs while you are renting out your home or a portion of it. Insurers write homeowners policies with the understanding that the owner is present to mitigate risks, perform routine maintenance, and supervise the property. When the property is rented out, this dynamic changes, leading to increased liability and different property risks.

The primary differences between landlord insurance and homeowners insurance lie in three key areas:

- Coverage Focus: Landlord insurance primarily protects the physical structure of your rental property and your financial interest as a property owner. It covers damage to the building itself and any other structures on the property, like a detached garage or shed, from covered perils such as fire, windstorms, and hail.

- Liability: This is a critical distinction. Landlord insurance provides liability coverage specifically for your role as a landlord. If a tenant or their guest sustains an injury on your property due to your negligence—for instance, if they trip on a broken step you failed to repair—and you are held responsible, this coverage can help with legal fees, medical expenses, and potential settlements. A homeowners policy’s liability typically wouldn’t extend to incidents involving tenants.

- Personal Property: Landlord insurance does not cover your tenant’s personal belongings. While it might cover your personal property that you leave on-site for the tenant’s use (like appliances or a lawnmower), it doesn’t protect the tenant’s furniture, electronics, or clothing. This leads us to another crucial point: the difference between landlord and renters insurance.

Landlord Insurance vs. Renters Insurance

This is a common point of confusion, but understanding the distinction is vital for both landlords and tenants. These two policies are designed to complement each other, providing comprehensive protection without overlapping.

- Landlord Insurance: As we’ve discussed, this policy protects your investment as the property owner. It covers the building’s structure, other structures on the property (like a detached garage), any personal property you own that is on-site and used to service the rental (such as a washer, dryer, or lawnmower), and perhaps most importantly, your liability as the property owner. Additionally, many landlord policies include “loss of rental income” coverage, which can be a lifesaver if your property becomes uninhabitable due to a covered event and you lose out on rent.

- Renters Insurance: This policy protects your tenant’s personal property and their financial liability. It covers their belongings—everything from their couch and TV to their clothes and kitchen gadgets—against perils like theft, fire, or water damage. It also provides personal liability coverage for the tenant if they accidentally cause damage to the property or injure someone else. Furthermore, renters insurance often includes “additional living expenses” coverage, which helps tenants pay for temporary housing and food if they need to move out during repairs after a covered loss.

As a landlord in Massachusetts or New Hampshire, it is a best practice—and highly recommended—to require your tenants to carry their own renters insurance policy. This isn’t just about protecting them; it reduces your risk. If their belongings are damaged, they won’t look to you for compensation. You can even request to be named as an “additional interest” on their policy. This means you’ll be notified if the policy is canceled or lapses, giving you peace of mind that your tenant maintains their coverage.

Core Coverages and Optional Endorsements

A standard landlord insurance policy provides a strong foundation of protection for your rental property. However, we understand that every property is unique, and you can customize your policy with endorsements (also known as riders) to match your specific needs and address potential vulnerabilities.

Essential Landlord Insurance Coverages

Most landlord policies are built around three key protections, forming the backbone of your coverage:

- Property Damage (Dwelling Coverage): This is the core of your landlord insurance, covering the physical structure of your rental property. This includes the building itself, its walls, roof, and built-in systems like plumbing and electrical. It protects against damage caused by covered perils such as fire, wind, hail, and vandalism. It also extends to other structures on your property, like a detached garage, a shed, or even a fence. This coverage is crucial for rebuilding or repairing your investment after an unforeseen event.

- Liability Protection: This is arguably one of the most vital components of landlord insurance, especially given the increased risk exposure when you have tenants. If a tenant, their guest, or even a trespasser is injured on your property due to your negligence—for example, a fall on an icy walkway you failed to clear, or an injury caused by faulty wiring you neglected to fix—and you are sued, this coverage is your shield. It helps pay for legal defense fees, medical expenses, and any settlements or judgments against you, up to your policy limit. This protects your personal assets from potentially devastating lawsuits.

- Loss of Rental Income: Imagine your rental property becomes uninhabitable due to a covered event, like a severe fire or a burst pipe. While the property damage coverage handles the repairs, what about the rent you’re losing during that time? This coverage, often called “fair rental income” or “loss of use,” reimburses you for the rent you would have collected while the property is being repaired or rebuilt. This financial safety net helps you continue to meet your mortgage payments, property taxes, and other financial obligations even when your rental isn’t generating income.

Common Endorsements to Consider

While the core coverages are essential, tailoring your policy with specific endorsements can provide extra layers of protection that are particularly relevant to rental properties in Massachusetts and New Hampshire.

- Vandalism Coverage: Unfortunately, rental properties, especially when vacant between tenants, can be targets for vandalism. Standard policies might have limitations or exclusions for vandalism, particularly if the property is unoccupied for an extended period (often 30-60 days). This endorsement specifically covers intentional damage caused by vandals, protecting your property from costly repairs.

- Burglary Coverage: If you provide certain appliances (like a refrigerator, stove, or washer/dryer) or maintenance equipment (like a lawnmower or snowblower) for your tenants’ use, these items are your personal property on the rental premises. Standard policies may not fully cover the theft of these items. A burglary endorsement can provide specific protection for your owned property located within the rental unit or on the premises.

- Building Code Coverage: If your rental property is older, especially common in many areas of Massachusetts and New Hampshire, and suffers significant damage, local ordinances might require you to upgrade certain components (like electrical systems or plumbing) to meet current building codes during repairs. This can significantly increase rebuilding costs beyond what a standard policy covers. A building code endorsement helps bridge this gap, covering the additional expenses required to bring your property up to current code.

- Flood Insurance: It’s a common misconception that standard property insurance covers flood damage. In reality, standard landlord policies, like homeowners policies, explicitly exclude damage from floods. Given the potential for heavy rains and coastal flooding in some parts of Massachusetts and New Hampshire, if your property is in a flood-prone area, a separate flood insurance policy through the National Flood Insurance Program (NFIP) or a private insurer is absolutely essential.

- Umbrella Liability: For landlords with substantial assets, multiple rental properties, or those simply seeking maximum protection, an umbrella policy is a wise investment. This type of policy provides an extra layer of liability protection that kicks in once the liability limits of your landlord insurance (and other underlying policies like auto insurance) are exhausted. It offers broad coverage for catastrophic liability claims, often in increments of $1 million, safeguarding your wealth from large judgments.

Decoding the Cost of Landlord Insurance

One of the first questions landlords ask us is, “How much will this cost?” It’s a fair question, and while we’ve noted that landlord insurance typically costs about 25% more than a standard homeowners policy, this price is justified by the increased risk profile of a rental property. Insurers see rental properties as a higher liability risk because tenants may not be as diligent about maintenance or safety as an owner-occupant would be. Additionally, the property itself is often not occupied by the owner, which can increase the risk of undetected issues or vandalism.

Key Factors That Influence Your Premium

The rate you pay for your affordable rental property insurance is not an arbitrary number. It’s carefully calculated based on a variety of risk factors specific to your property and situation:

- Property Location: Where your rental property is located in Massachusetts or New Hampshire significantly impacts your premium. Factors considered include local crime rates, the property’s proximity to a fire station and fire hydrants (which affects response times), and regional risks like severe weather patterns (heavy snow, ice storms, or potential coastal flooding). A property in a high-crime area or one far from emergency services will generally have a higher premium.

- Property Age and Construction: The older your building, the more it may cost to insure. Older structures can have outdated electrical systems, plumbing, or roofing, which insurers view as higher risks for fires, water damage, or structural issues. The type of construction (e.g., wood frame vs. masonry) also plays a role, with more fire-resistant materials often leading to lower rates.

- Number of Rental Units: The risk profile and, consequently, the cost of insurance will differ greatly depending on the size of your investment. A single-family rental home will have a different premium than a multi-family dwelling with two, three, or more units. More units mean more tenants, which can increase liability exposure.

- Safety and Security Features: Proactively reducing risk in your rental property can lead to significant savings. Insurers often provide discounts for the presence of modern safety devices such as centrally monitored fire and burglar alarms, smoke detectors in every unit, fire extinguishers, sprinkler systems, and even deadbolt locks. These features demonstrate a commitment to safety and reduce the likelihood and severity of potential claims.

- Your Claims History: Just like with your personal auto or home insurance, a history of frequent claims on your rental properties can lead to higher rates. If you’ve filed multiple claims in the past few years, an insurer might view you as a higher risk, which could result in a higher premium.

- Coverage Limits and Deductible: This is a direct trade-off you control. Higher coverage limits, which provide more financial protection in the event of a major loss, will naturally increase your premium. Conversely, choosing a higher deductible—the amount you pay out-of-pocket before your insurance kicks in—will lower your monthly or annual premium. For example, raising your deductible from $500 to $1,000 can save you an average of nearly 9% on premiums. It’s important to choose a deductible you can comfortably afford in an emergency.

How to Find Affordable Rental Property Insurance

Protecting your investment doesn’t have to break the bank. With a few strategic moves and a clear understanding of your options, you can secure comprehensive affordable rental property insurance at a competitive price. The goal isn’t just to find the cheapest policy; it’s about finding the best value—robust coverage that protects your assets without overspending.

Smart Strategies for Finding affordable rental property insurance

- Bundle Your Policies: This is often one of the easiest and most effective ways to save money. By purchasing multiple insurance policies from the same carrier, you can often qualify for a multi-policy discount. Consider bundling your landlord policy with other insurance you already have, such as your primary home insurance or even your auto insurance. We can help you explore these options.

- Increase Your Deductible: Your deductible is the amount you agree to pay out-of-pocket before your insurance coverage kicks in. There’s a direct relationship between your deductible and your premium: if you choose a higher deductible, you’ll have a lower monthly payment. For example, raising your deductible from $500 to $1,000 can save you an average of nearly 9% on your premiums. Just be sure that the higher deductible is an amount you can comfortably afford to pay in the event of a claim.

- Install Safety Devices: Proactively reducing the risk of a claim is a win-win for both you and your insurer, and it can lead to discounts. Insurance companies often provide discounts for having protective devices installed in your rental property. This includes basics like smoke detectors, carbon monoxide detectors, fire extinguishers, and deadbolt locks. More advanced features like centrally monitored fire and burglar alarms, or even sprinkler systems, can also lead to significant premium reductions.

- Maintain Your Property: A well-maintained property presents less risk to an insurer. Regularly inspecting and updating your rental property—such as replacing an old roof, updating electrical wiring, or upgrading plumbing systems—can lead to better insurance rates. Showing that you are a responsible property owner who actively mitigates potential hazards can make your property more attractive to insurers and reduce the likelihood of costly claims.

- Shop Around and Compare: Never settle for the first quote you receive. Insurance rates can vary significantly between different companies for the exact same coverage. To find the most affordable rental property insurance without sacrificing necessary protection, you need to shop around. This is where working with an independent insurance agent, like us at Stanton Insurance Agency, becomes invaluable. We can gather quotes from multiple top-rated carriers in Massachusetts and New Hampshire, allowing you to compare options side-by-side and find the best combination of coverage and price for your specific needs.

Choosing the right provider for affordable rental property insurance

When you’re comparing quotes for affordable rental property insurance, it’s crucial to look beyond just the price tag. A reliable insurance provider should have strong financial ratings from independent agencies like AM Best (which indicates their ability to pay claims), positive customer service reviews, and a straightforward, efficient claims process.

While some landlords might be tempted to simply purchase the cheapest landlord insurance, checking reviews and understanding an insurer’s reputation for service and fair payouts is essential for long-term peace of mind. An experienced local agent can help you vet providers, explain the nuances of different policies, and ensure you’re making an apples-to-apples comparison of coverage terms, helping you find truly affordable rental property insurance that doesn’t compromise on protection.

Frequently Asked Questions about Rental Property Insurance

We often hear similar questions from landlords in Massachusetts and New Hampshire regarding their rental property insurance. Here are some of the most common inquiries, answered clearly and concisely:

Is landlord insurance required by law?

No, landlord insurance is not legally mandated in states like Massachusetts or New Hampshire. However, this doesn’t mean it’s optional. If you have a mortgage on your rental property, your lender will almost certainly require you to carry a policy. This requirement is in place to protect their financial interest in the asset, ensuring that if the property is damaged or destroyed, there are funds available for repair or rebuilding. Even without a mortgage, it’s a critical component of responsible property ownership.

Can I just use my homeowners insurance for a rental property?

No, this is a risky mistake that can leave you severely exposed. Your standard homeowners insurance policy is designed for an owner-occupied residence. If you rent out your property and a claim occurs—whether it’s property damage or a liability issue—your homeowners insurance provider can deny the claim because the property is no longer being used as your primary residence. This means you would be personally responsible for all repair costs, legal fees, and other expenses. You must have a specific residential landlord insurance policy in place to properly protect your investment.

Is landlord insurance tax-deductible?

Yes, in most cases, the premiums you pay for landlord insurance are generally considered a business expense. Because your rental property is typically viewed as a business venture, you can usually deduct these premiums on your taxes. This tax deductibility helps to offset the overall cost of the policy, making affordable rental property insurance even more attainable. We always recommend consulting with a qualified tax professional for advice specific to your financial situation and to ensure you’re taking advantage of all applicable deductions.

Secure Your Investment with the Right Protection

Your rental property is more than just a building; it’s a valuable asset and a significant source of income. Protecting it with the right insurance isn’t just a good idea—it’s a fundamental part of being a responsible and successful landlord in Massachusetts or New Hampshire. By understanding your specific coverage needs, actively implementing safety measures, and diligently comparing your options, you can find affordable rental property insurance that provides robust protection without straining your budget.

Don’t leave your investment vulnerable to the unexpected. The complexities of landlord insurance can be daunting, but you don’t have to steer them alone. An independent agent, like us at Stanton Insurance Agency, can help you steer through these complexities, clarify policy details, and build a customized policy that perfectly fits your property and your financial goals.

To explore your options and get a personalized quote for your rental property, contact the experts at Stanton Insurance Agency today. Let us help you find the peace of mind that comes with knowing your investment is well-protected.

Ready to protect your rental property? Learn more about our Residential Landlord Insurance options and get a personalized quote.