Business liability coverage: Ultimate #1 Protection

Your First Line of Defense Against Business Risks

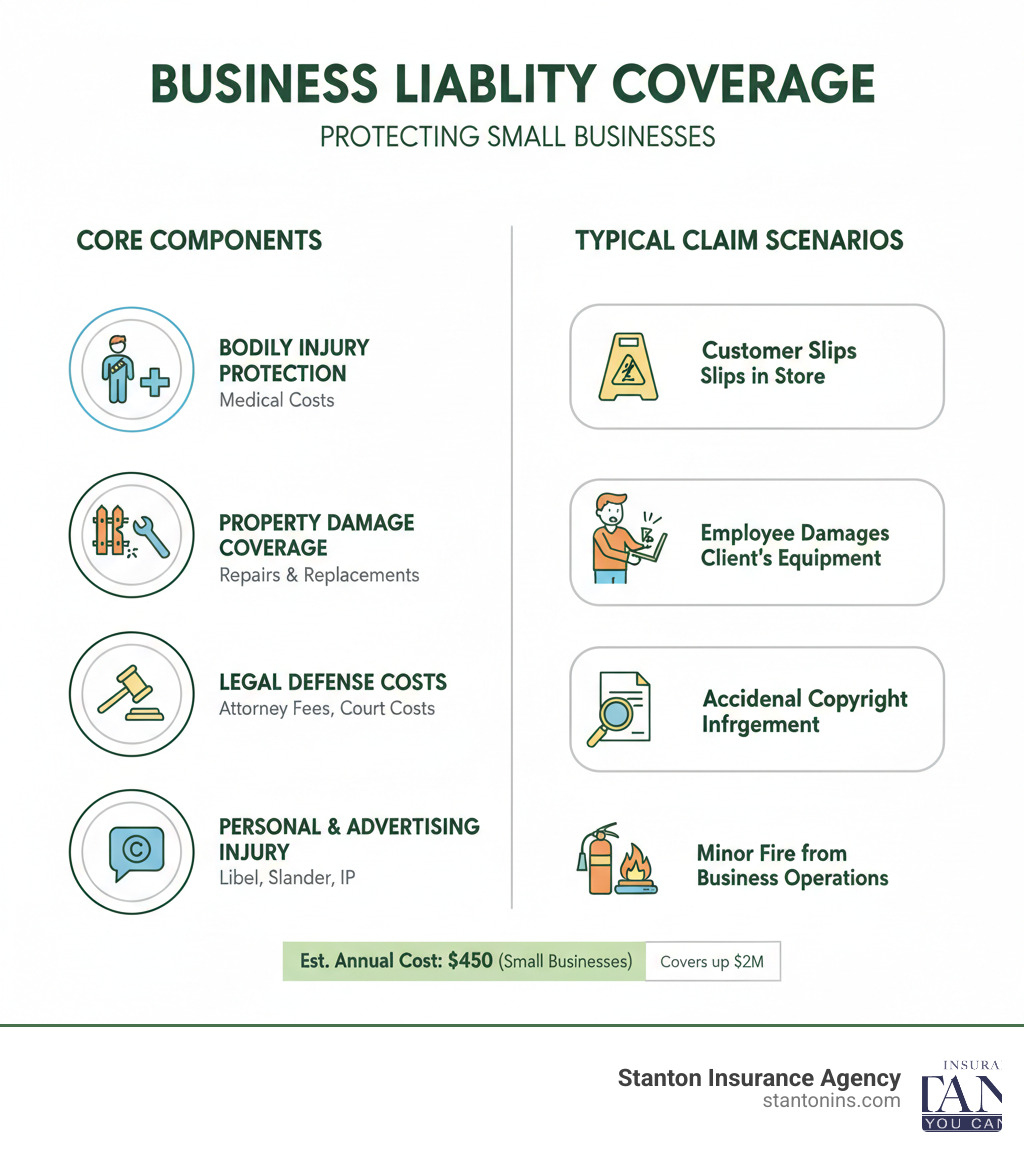

Business liability coverage is your company’s financial shield against claims that your operations caused bodily injury, property damage, or personal and advertising injury to a third party. From a customer slipping on a wet floor to an employee damaging a client’s property, a single incident can lead to a costly lawsuit. Even baseless claims can cost tens of thousands in legal fees alone.

This essential protection covers:

- Bodily Injury: Medical costs and damages if someone is injured on your premises.

- Property Damage: Costs to repair or replace third-party property your business damages.

- Personal & Advertising Injury: Claims of libel, slander, or copyright infringement.

- Legal Defense: Attorney fees and court costs, even if you are not at fault.

- Medical Payments: Immediate medical expenses for minor injuries, regardless of liability.

Many states, licensing boards, and client contracts require proof of insurance to operate legally or win projects. Beyond these requirements, adequate coverage is simply good business sense, protecting your assets and peace of mind.

I’m Geoff Stanton, President of Stanton Insurance Agency in Waltham, Massachusetts. With over two decades of experience as a Certified Insurance Counselor specializing in Commercial Property & Liability, I’ve seen how the right Business liability coverage can save a business from financial disaster.

What Business Liability Insurance Covers (and What It Doesn’t)

Operating a business comes with inherent risks. Business liability coverage is designed to address these unexpected events, acting as a financial shield against claims of negligence that could otherwise prove catastrophic.

What is typically covered by business liability coverage?

Business liability coverage responds when a third party claims your business caused them harm, whether it’s a physical injury, damaged property, or reputational damage.

-

Bodily Injury: This covers medical expenses, lost income, and other damages when someone other than an employee is injured on your premises or due to your business activities. A simple slip-and-fall incident can quickly escalate into a major claim.

-

Property Damage: This protects you when your operations accidentally harm someone else’s property. For example, if a contractor damages a client’s home during a renovation, this coverage would handle the repair costs.

-

Personal and Advertising Injury: This is crucial. It covers claims of libel, slander, false arrest, malicious prosecution, and copyright infringement in your advertising.

-

Medical Payments: This coverage offers a way to handle minor injuries quickly by paying for immediate medical expenses, regardless of who was at fault. This can prevent small incidents from becoming large lawsuits.

-

Legal Defense Costs: Perhaps the most valuable component, this pays for your attorney fees and court costs to defend against a lawsuit, whether you are found liable or not. This coverage mitigates losses and shields your business’s financial stability.

Common Exclusions: What’s Not Covered?

While comprehensive, business liability coverage is not a catch-all policy. Understanding its exclusions helps you identify potential gaps in your protection.

-

Employee Injuries: Injuries to your employees are covered by Workers Compensation Insurance Importance, which is legally required for most businesses with employees in Massachusetts and New Hampshire.

-

Professional Errors: If your advice or professional service causes a client financial loss, you need Professional Liability (or Errors & Omissions) insurance. General liability does not cover these non-physical damages.

-

Commercial Auto Accidents: Accidents involving vehicles used for business require a separate Commercial Auto Insurance policy.

-

Intentional Acts: Insurance is for accidents and negligence. Deliberate harm or damage caused by you or your employees is never covered.

-

Damage to Your Own Property: Liability insurance protects against damage to third-party property. To cover your own building, equipment, or inventory, you need Commercial Property Insurance.

-

Cyber Incidents: Data breaches and other digital threats require specialized Cyber Liability Insurance.

Understanding these exclusions is the first step toward building a complete Business Insurance Policy that protects everything you’ve built.

Understanding Your Business Liability Coverage Options

“Business liability” is an umbrella term for several distinct types of insurance. While Commercial General Liability (CGL) is the foundation for most businesses, you may need specialized coverage for full protection. Understanding these options is key to building a comprehensive Business Insurance Policy.

Commercial General Liability (CGL) Insurance

CGL is the cornerstone of business liability coverage. It protects your business from third-party claims of bodily injury, property damage, and personal and advertising injury. CGL shields you from everyday operational risks, like a customer falling in your store or an employee damaging a client’s property. It is often required to sign commercial leases or win client contracts.

Professional Liability (Errors & Omissions)

Also known as E&O insurance, this is vital for businesses providing professional services or advice. While CGL covers physical damages, Professional Liability covers a client’s financial losses resulting from your professional negligence, errors, or omissions. Consultants, accountants, IT professionals, and designers need E&O to protect against claims that their work caused a client financial harm.

Directors and Officers (D&O) Liability

This specialized insurance protects the personal assets of a company’s directors and officers if they are sued for alleged wrongful acts in their management role. Such acts can include breach of fiduciary duty or misrepresentation. D&O coverage is important for corporations and non-profits of all sizes, as it shields decision-makers from personal financial ruin. Learn more about Directors and Officers Liability Insurance.

Commercial Umbrella Liability

Think of this as an extra safety net. A Commercial Umbrella policy provides additional liability coverage that kicks in after the limits of your primary policies (like CGL or Commercial Auto) are exhausted. It’s a cost-effective way to secure higher limits for catastrophic events, such as a multi-million dollar judgment, that could otherwise bankrupt your business.

Here’s a quick overview of these key types of business liability coverage:

| Coverage Type | What It Covers | Who Needs It | Common Claim Example |

|---|---|---|---|

| CGL | Bodily injury, property damage, personal/advertising injury | Most businesses | Customer slips and falls in your store |

| Professional Liability | Errors, omissions, negligence in professional services | Consultants, advisors, service pros | Client claims financial loss due to your advice |

| D&O | Wrongful acts by directors/officers | Corporations, nonprofits | Shareholder sues over alleged mismanagement |

| Commercial Umbrella | Additional coverage beyond primary policy limits | Businesses with high-risk exposure | A large lawsuit exhausts CGL limits, umbrella pays the rest |

How to Determine Your Coverage Needs and Costs

Determining how much business liability coverage you need is a critical decision. The right amount depends on a careful assessment of your unique risks. Underinsuring exposes your business to financial ruin, while overinsuring wastes resources.

Factors That Influence Your Premium

Insurance carriers assess your likelihood of filing a claim and its potential size. Key factors include:

- Industry Risk: High-risk industries like construction will have higher premiums than low-risk ones like freelance writing.

- Business Location: Operating in a densely populated urban area like Boston often costs more than in rural New Hampshire due to higher foot traffic and litigation rates. Local regulations in Massachusetts Business Insurance and New Hampshire also play a role.

- Annual Revenue: Higher revenue generally indicates more business activity and greater exposure to risk.

- Number of Employees: More employees increase the statistical likelihood of an incident involving the public or clients.

- Claims History: A history of frequent claims will increase your premium, while a clean record helps keep costs down.

- Coverage Limits and Deductibles: Higher coverage limits increase your premium, while a higher deductible (your out-of-pocket cost per claim) can lower it.

How much business liability coverage do you need?

To find the right amount of business liability coverage, you must think strategically about protecting your assets.

First, assess your perceived risk. Do customers visit your location? Do you work at client sites? Do you sell products? The more interaction you have with third parties, the higher your exposure.

Next, check your contractual requirements. Many client contracts, commercial leases, and vendor agreements specify minimum coverage amounts, often $1 million or $2 million per occurrence.

Also, consider state and licensing board mandates. Some professions in Massachusetts and New Hampshire require specific liability insurance to operate legally.

Finally, think about your assets and future earnings. A major lawsuit could jeopardize your entire business. Your coverage should be sufficient to protect your hard-earned assets and ensure business continuity.

A basic CGL policy with $2 million in coverage can start around $450 annually, but this varies widely. A Business Insurance Broker can help you assess your specific risks and find coverage that fits your exposure and budget.

Securing Your Business Liability Policy

Getting the right business liability coverage is a straightforward process with an experienced partner. We’ve helped hundreds of businesses in Massachusetts and New Hampshire secure the protection they need, and we’re here to make it simple for you.

Information Needed for a Quote

To provide an accurate quote, we need to understand your business. Having this information ready helps us find the best options quickly:

- Business name, address, and structure (e.g., LLC, Corporation)

- Annual revenue and payroll

- Number of employees

- A clear description of your business operations

- Details of any prior claims

- Current insurance policy details (if applicable)

The Process of Getting Insured

Our process is clear and collaborative:

- Assess Your Risks: We start with a conversation about your daily operations to understand your unique exposures.

- Compare Quotes: As an independent agency, we shop the market on your behalf, comparing quotes from multiple top-rated carriers to find the best value.

- Review the Policy: We walk you through the policy details, including limits, deductibles, and exclusions, ensuring you understand your coverage completely. A reputable agent will help you steer offerings from various Commercial Insurance Agencies to find the right fit.

Why Work with an Independent Agent?

Instead of contacting multiple companies yourself, you can work with us to do the heavy lifting.

- Expert Guidance: Our team includes Certified Insurance Counselors who specialize in commercial coverage and know the market inside and out.

- Access to Multiple Carriers: We find competitive options because we aren’t tied to a single insurance company.

- Customized Coverage: We build a policy around your specific operations, so you don’t pay for coverage you don’t need or find dangerous gaps when a claim occurs.

- Long-Term Partnership: We’re here to support you as your business grows, reviewing your policy annually and assisting with claims.

Learn more about Liability Insurance and how we can help protect your business.

Frequently Asked Questions about Business Liability Insurance

Business liability coverage can seem complex. Here are answers to some of the most common questions we hear from business owners.

Is business liability insurance required by law in Massachusetts or New Hampshire?

While neither state universally mandates general liability insurance for every business, it is often a practical necessity. Many professional licenses, commercial leases, and client contracts require you to carry it. For example, a landlord will likely demand proof of insurance before you can rent a commercial space. Furthermore, Workers Compensation Insurance Importance is legally required for most businesses with employees in both states. Even when not required, the financial protection it offers makes it essential.

What is the difference between a “claims-made” and an “occurrence” policy?

This distinction is crucial for understanding when you are covered.

- An “occurrence” policy covers incidents that happen during the policy period, regardless of when the claim is filed. This provides long-term protection for events that occurred while you were insured.

- A “claims-made” policy only covers claims that are filed while the policy is active. If a claim is filed after the policy expires, it won’t be covered unless you purchase an extension, known as “tail coverage.”

Most Commercial General Liability (CGL) policies are “occurrence”-based. However, Professional Liability (E&O) policies are often “claims-made,” requiring careful management to avoid coverage gaps.

Can I bundle my liability insurance with other policies?

Yes, and it’s often recommended. A Business Owner’s Policy (BOP) is a popular option for small to medium-sized businesses. It bundles general liability, commercial property, and often business income insurance into one package, typically at a lower cost than buying each policy separately. A BOP streamlines your coverage into a single, efficient policy. Not all businesses qualify for a BOP, but an agent can help determine if it’s the right fit for you. Explore What is Business Owners Insurance and When Do You Need It? to learn more.

Protect Your Business with the Right Partner

You’ve worked hard to build your business, and the last thing you want is for a single lawsuit to put it all at risk. Choosing the right business liability coverage is one of the most important decisions you can make.

It’s about more than just meeting a contractual requirement; it’s about protecting your assets, your reputation, and your future from the unexpected. Business liability coverage provides a financial shield against third-party claims, giving you peace of mind.

The key is to work with a trusted advisor who understands your unique risks. At Stanton Insurance Agency, we have helped Massachusetts and New Hampshire business owners for decades. We take the time to understand your operations and secure a policy that provides the protection you need without paying for coverage you don’t.

We are your long-term partner, ready to help as your business grows and changes. Ready for peace of mind? Connect with one of our local experts for a comprehensive review of your business insurance needs.

Find the right protection with independent insurance agencies near you.