Insurance cost for apartment building 2024: Smart Guide

Why Understanding Apartment Building Insurance Costs Matters

The insurance cost for apartment building properties commonly falls between $300 and $800 per unit annually, but this varies significantly based on location, building characteristics, and risk factors. Property owners are facing rising premiums, with some regions seeing increases over 30% year-over-year.

Quick Cost Breakdown:

- Small buildings (1–4 units): $1,500 – $5,000 per building annually

- Medium buildings (10 units): $3,000 – $8,000 total annually

- Larger buildings (20+ units): $6,000 – $16,000+ total annually

- Typical monthly cost per building: $125 – $1,500+, depending on size and risk factors

Owning an apartment building represents a significant investment, but it comes with substantial risks that extend far beyond typical property concerns. From slip-and-fall liability claims in common areas to major structural damage from storms, apartment building owners face unique exposures that require specialized protection.

The insurance landscape for multifamily properties has become increasingly complex, with insurers departing high-risk markets and tightening underwriting standards. This means property owners must be more strategic than ever about understanding their coverage needs and managing costs effectively.

As a fourth-generation owner of Stanton Insurance Agency and Certified Insurance Counselor, I’ve helped countless property owners steer the complexities of insurance cost for apartment building coverage throughout Massachusetts and New Hampshire. My 25+ years of experience in commercial property and liability insurance has shown me that informed property owners who understand their risks can achieve both comprehensive protection and cost-effective premiums.

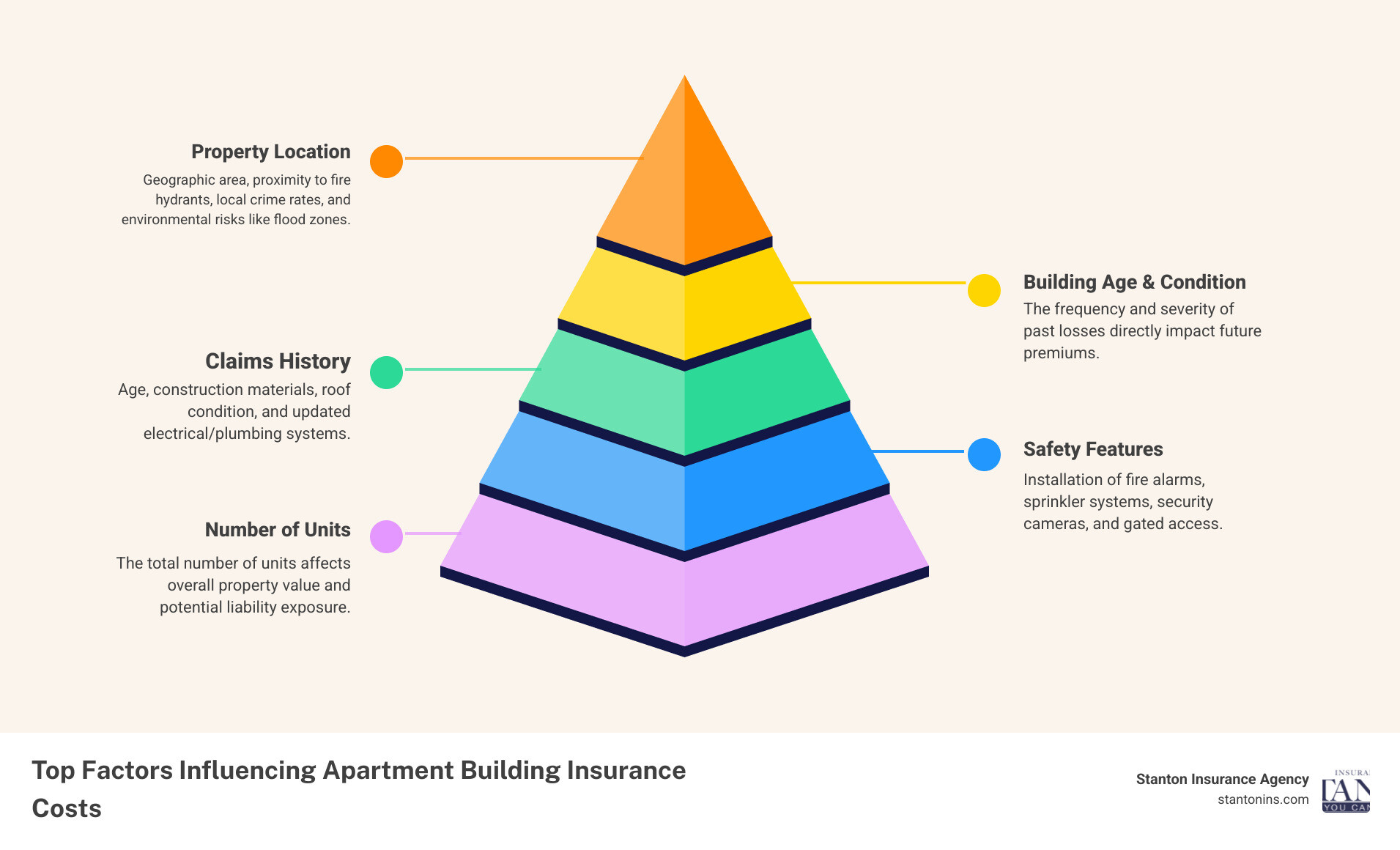

Key Factors That Determine the Insurance Cost for an Apartment Building

The premium for your https://stantonins.com/commercial-property-insurance/ is not a random number; it’s a calculated risk assessment. Insurers weigh several critical factors to determine your final cost, with some elements carrying more weight than others, especially in states like Massachusetts and New Hampshire. Understanding these factors is crucial to anticipating and managing your overall insurance cost for apartment building properties.

Property Location and Environmental Risks

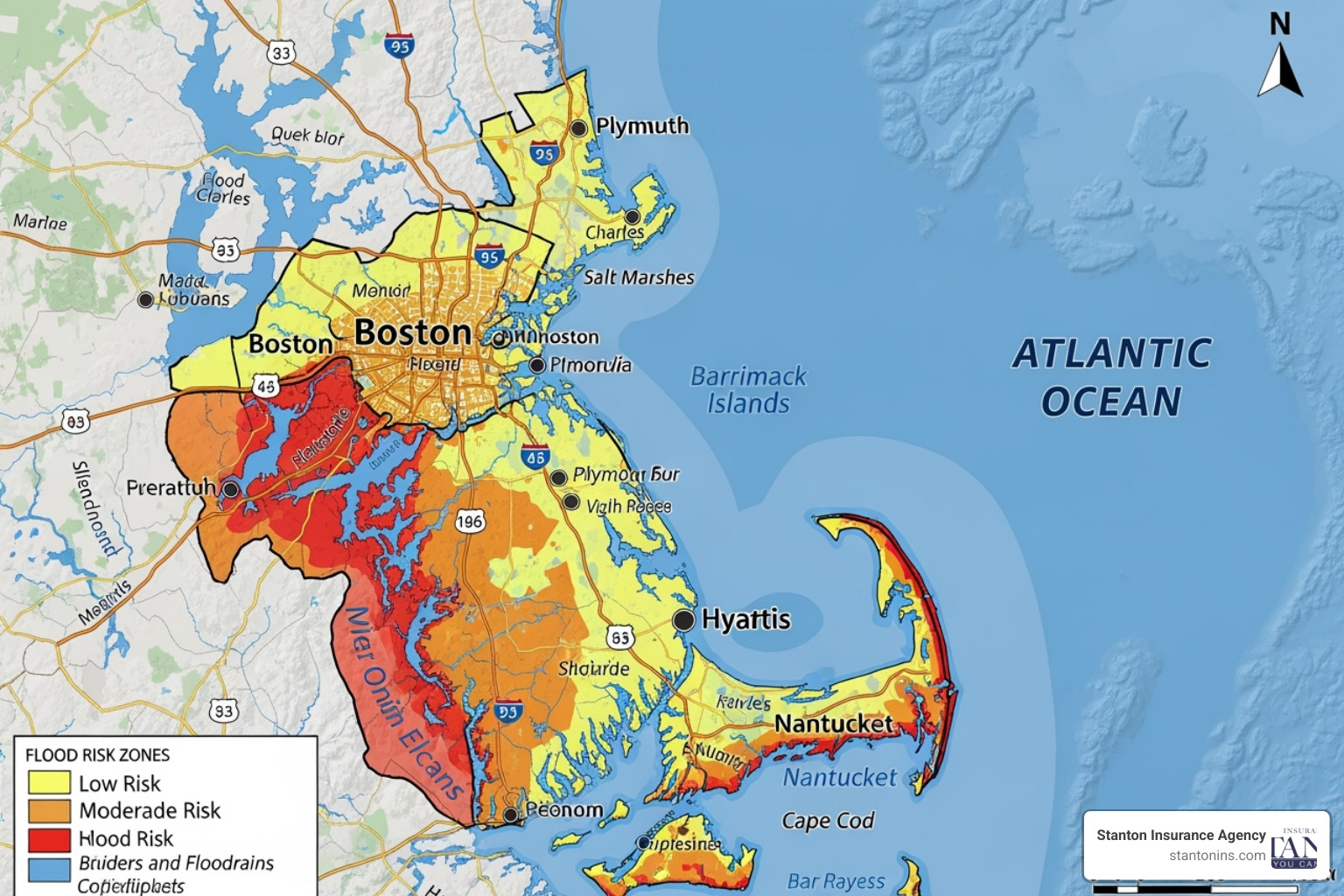

Where your apartment building stands plays a monumental role in its insurance costs. Insurers carefully evaluate geographic location, considering everything from the crime rates of the surrounding neighborhood to its susceptibility to natural disasters.

For instance, a property located in an urban area with higher crime statistics might face higher premiums due to increased risks of vandalism, theft, or even riots. Conversely, a building in a quiet, low-crime suburban setting could enjoy lower rates. Proximity to essential services like fire hydrants and fire stations also matters significantly; quicker emergency response times can reduce potential damage, leading to lower premiums.

Beyond immediate surroundings, environmental risks are a major concern. Properties in designated flood zones, for example, will almost certainly require additional https://stantonins.com/personal-insurance/flood-insurance/, which can add significantly to your overall cost. As we’ve seen, particularly in coastal regions of Massachusetts and New Hampshire, coastal proximity brings higher risks from hurricanes and severe storms. Speaking of storms, regional weather patterns, like the infamous Nor’easters we experience, can cause extensive wind, snow, and ice damage, directly impacting insurance rates. That’s why understanding https://stantonins.com/are-natural-disasters-covered/ is so vital for property owners in our area. As experts in the field, we always emphasize https://stantonins.com/why-is-flood-insurance-important/ for properties in susceptible areas. According to FEMA’s flood zone maps (https://www.fema.gov/flood-maps), properties in high-risk flood areas face significantly higher insurance requirements and costs.

Building Characteristics and Condition

The physical attributes of your apartment building are central to how insurers assess risk and calculate your premium.

The building age is a primary consideration. Older buildings, while charming, often come with outdated electrical, plumbing, and HVAC systems that pose higher risks of fire, water damage, or mechanical breakdown. This can lead to higher premiums or even limitations on available coverage types. Conversely, newer constructions, or older buildings with documented system updates, generally fare better.

The construction materials also play a significant role. A building constructed with masonry or steel (fire-resistive materials) typically carries lower premiums than a wood-frame structure due to reduced fire risk. Similarly, the condition of the roof is paramount. A well-maintained, newer roof provides better protection against water intrusion and wind damage, leading to more favorable rates. We can’t stress enough https://stantonins.com/why-its-important-to-replace-your-roof-for-your-homeowners-insurance/ – it’s a critical component in mitigating property damage.

The number of units directly correlates with exposure; more units mean more potential for claims. Lastly, the building value and replacement cost are fundamental. Insurers want to know how much it would cost to rebuild your property from the ground up after a total loss, not just its market value. This is often significantly higher than the purchase price, and ensuring adequate coverage to rebuild is key to protecting your investment. Understanding factors like https://stantonins.com/how-much-does-builders-risk-insurance-cost/ can offer insights into construction-related expenses that impact replacement costs.

Liability Risks and Occupancy

Beyond the physical structure, the people who inhabit and visit your building introduce significant liability risks. This is a major component of the insurance cost for apartment building policies.

The tenant profile can influence premiums. For example, a building primarily housing college students might be perceived as having a different risk profile (e.g., higher potential for property damage or noise complaints leading to disputes) than one with long-term, established residents or senior living.

Common areas are hotbeds for liability claims. Features like swimming pools, fitness centers, or even playgrounds, while attractive amenities, significantly increase your risk of bodily injury claims. We always advise clients on robust https://stantonins.com/swimming-pool-safety/ measures to mitigate these risks. Even seemingly innocuous areas like lobbies and walkways can pose slip-and-fall hazards, which are among the most frequent and costly liability claims. Proper maintenance and signage are crucial.

The quality of your tenant screening process can also impact your risk profile, as responsible tenants are less likely to cause property damage or engage in activities that lead to liability issues. As highlighted by Multifamily Dive (https://www.multifamilydive.com/news/insurance-premiums-climate-change-coastal-real-estate/652114/), properties with higher occupancy types often see increased liability risks. Your liability coverage protects you from claims that arise from injuries or property damage where you, as the property owner, are deemed responsible. Understanding https://stantonins.com/what-is-personal-liability-in-home-insurance/ can provide a foundational understanding of this critical coverage type.

Safety, Security, and Claims History

These factors directly reflect your proactive approach to risk management and your past experience with insurable events.

Robust safety features can lead to significant discounts on your premiums. This includes having monitored fire alarm systems, automatic sprinkler systems, and ensuring that carbon monoxide detectors are properly installed and maintained in all units and common areas. We frequently remind our clients to https://stantonins.com/install-carbon-monoxide-detector/ as a vital safety measure.

Similarly, comprehensive security features like surveillance cameras in common areas, secure entry systems (e.g., gated access), and ample lighting can deter crime and reduce risks of vandalism or break-ins. Taking steps to https://stantonins.com/protect-your-home-against-break-ins/ is not just about peace of mind; it’s about protecting your investment and potentially lowering your insurance costs.

Perhaps one of the most impactful factors is your previous claims history. Insurers look at both the frequency and severity of past losses. A property with a history of frequent small claims or a few large, costly claims will almost certainly face higher premiums than a property with a clean claims record. This is why effective risk management and preventative maintenance are so crucial – preventing claims keeps your record clean and your premiums lower.

The Rising Insurance Cost for Apartment Building Properties: A 2024 Snapshot

It’s no secret that property owners across the country are seeing their insurance premiums climb, and apartment building owners are certainly feeling the pinch. Premiums have been pressured by a combination of more frequent and severe weather events, higher rebuilding costs (materials and labor), reinsurance rate hikes, and a tightening insurance market. New England is not immune to these trends; Massachusetts and New Hampshire owners are seeing the effects, particularly for coastal and older properties.

National Averages vs. Regional Realities

While national figures vary, a useful rule of thumb is that insurance cost for apartment building properties often ranges around $300 to $800 per unit annually. In Massachusetts and New Hampshire, premiums can skew higher for coastal exposures, older building systems, high-rise construction, or locations with elevated crime or loss activity. Our region also contends with Nor’easters, heavy snow loads, ice dams, and salt-air roof wear along the coast, all of which influence pricing.

Estimating the Insurance Cost for Your Apartment Building

Thinking in terms of “cost per door” is a helpful way to compare properties:

- 1–4 units: typically $1,500–$5,000 per building annually, depending on age, updates, and location

- 10 units: roughly $3,000–$8,000 per year in total

- 20 units: roughly $6,000–$16,000+ per year in total

These are averages. High-rise buildings often carry higher premiums due to more complex systems (elevators, boilers, extensive HVAC), greater potential for large losses, and amenities like rooftop access or on-site staff.

For a tailored estimate based on your specific address, construction details, updates, and loss history, request a customized quote from our team: https://stantonins.com/apartment-building-insurance/ We also have resources like https://stantonins.com/how-much-is-insurance-on-multi-family-home/ that dig deeper into these cost considerations.

Understanding Your Apartment Building Insurance Coverage

A comprehensive Multi-Family Dwelling Insurance policy (https://stantonins.com/multi-family-dwelling-insurance/) is far more than just a single type of coverage. It’s a carefully crafted package of protections designed to address the unique and multifaceted risks associated with owning and managing a rental property. Understanding the difference between standard and optional coverages is absolutely key to avoiding dangerous gaps that could lead to significant financial losses.

Standard Coverages in a Policy

Most apartment building insurance policies will include several foundational coverages. These are the bedrock of your protection:

| Coverage Type | What It Covers |

|---|---|

| Property Damage | This is the core of your policy, covering the physical structure of the building, including walls, roofs, floors, and permanently installed fixtures, against perils like fire, wind, hail, and vandalism. It also typically covers other structures on the property, such as garages or fences. |

| General Liability | Protects you financially from claims of bodily injury or property damage that occur on your premises. This is crucial for covering incidents like a tenant slipping on an icy walkway or a visitor’s car being damaged by falling debris from your building. |

| Loss of Income | Also known as Business Interruption coverage, this reimburses you for lost rental income if your property becomes uninhabitable due to a covered event (like a fire or major storm). This helps you continue to meet your financial obligations, like mortgage payments, while repairs are underway. |

| Equipment Breakdown | Covers the cost to repair or replace essential building equipment, such as boilers, HVAC systems, and elevators, after a sudden and accidental mechanical or electrical failure. This is a vital protection that is often excluded from standard property coverage. |