Don’t Wait for Disaster: Secure Your Belongings in Minutes

A quick renters insurance quote is easier than ever to obtain—most providers can generate a personalized quote in under five minutes by gathering basic information about your rental address, personal property value, desired coverage limits, and deductible preferences. You can complete the entire process online or over the phone, often in less time than it takes to order takeout.

What You Need for a Quick Quote:

- Your rental property address

- Estimated value of your personal belongings

- Desired liability coverage amount (typically $100,000-$500,000)

- Preferred deductible ($500-$2,500 is common)

- Basic personal information

Moving into a new apartment is exciting, but have you thought about what would happen if the unexpected occurred? A fire, a theft, or a guest slipping and falling could turn your world upside down financially. Many renters mistakenly believe their landlord’s insurance covers their personal items, but it doesn’t.

That’s a critical misconception. Your landlord’s policy protects the building structure itself—the walls, roof, and floors—but does absolutely nothing to replace your laptop, furniture, clothing, or other belongings if they’re damaged or stolen. It also won’t protect you if you’re held legally responsible for injuring someone or damaging their property.

That’s where renters insurance comes in. It’s an affordable safety net that protects your personal property, shields you from liability claims, and can even cover temporary housing if your rental becomes uninhabitable. The best part? Getting a protective policy in place is faster and easier than you think. You can get a personalized quick renters insurance quote in the time it takes to brew your morning coffee—often for as little as $5 to $30 per month.

I’m Geoff Stanton, President at Stanton Insurance Agency in Waltham, Massachusetts, and I’ve spent over two decades helping renters and homeowners across Massachusetts and New Hampshire protect what matters most. Whether you’re searching for a quick renters insurance quote or need guidance on the right coverage for your situation, I’m here to make the process simple and stress-free.

What is Renters Insurance and Why is it Essential?

Renters insurance, sometimes called tenant insurance, is a policy designed specifically to protect you and your possessions when you rent your home. While your landlord’s insurance covers the physical building, it does nothing to protect your furniture, electronics, clothes, or other personal items. It also doesn’t protect you from liability if you’re held responsible for an accident. Think of it as a homeowner’s policy, but without coverage for the structure itself. It’s a crucial, low-cost investment to safeguard your financial well-being.

Your landlord’s insurance covers their property – the physical structure of the building. It doesn’t extend to your personal belongings. So, if a fire rips through your apartment building, or a pipe bursts and floods your unit, your landlord’s insurance will help them rebuild the property, but it won’t replace your couch, your computer, or your cherished heirlooms. That’s a common misconception that leaves many renters vulnerable. Without your own policy, you’d be left to cover the costs of replacing everything out of your own pocket.

This is why renters insurance is so important. It acts as your personal financial safety net, providing coverage for your belongings against various perils and protecting you from potential liability claims. It’s a small monthly investment that can prevent a massive financial setback.

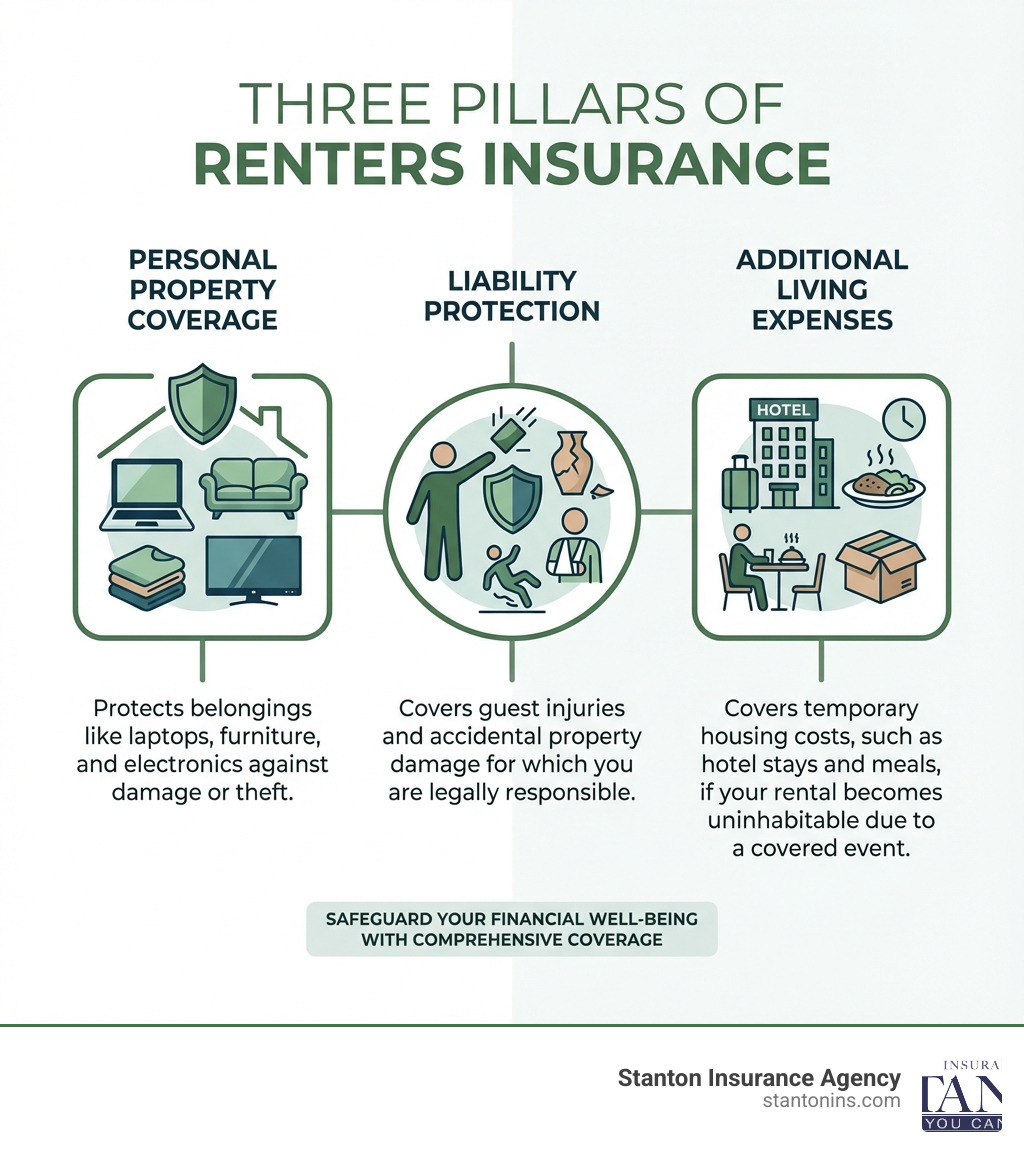

The Core Protections Your Policy Provides

A standard renters insurance policy is a three-part shield. First, Personal Property Coverage helps you replace your belongings—like your laptop, TV, furniture, and wardrobe—if they are stolen or damaged by a covered event like a fire, theft, or windstorm. This coverage extends beyond just your home; if your laptop is stolen from your car or your luggage goes missing on vacation, your personal property coverage can still apply. We’ll help you determine the right amount of coverage to ensure all your treasured possessions are accounted for.

Second, Personal Liability protects you if someone is injured in your apartment or if you accidentally damage someone else’s property. For example, if a guest slips on a wet floor in your kitchen and breaks an arm, or if you accidentally leave a faucet running and cause water damage to your downstairs neighbor’s unit, your liability coverage can step in. It can cover legal fees and settlement costs, which could otherwise be financially devastating. Does Renters Insurance Cover Personal Injury? This protection extends beyond your rental unit, too, covering incidents that might occur away from home, such as accidentally injuring someone on a golf course.

Finally, Additional Living Expenses (ALE) helps pay for temporary housing, food, and other essentials if your rental becomes uninhabitable due to a covered loss. Imagine a fire makes your apartment unlivable for a month. ALE coverage would help cover the cost of a hotel, meals out, and other increased expenses until you can move back in or find a new permanent residence. It’s the “you can’t sleep in your home tonight because something happened to it” insurance, ensuring you don’t have to worry about where you’ll stay after a disaster.

These three pillars work together to provide comprehensive protection, giving you peace of mind knowing that your financial future is secure, even in the face of unexpected events. To learn more about what’s covered, visit our page on What Does Renters Insurance Cover?.

How to Get a Quick Renters Insurance Quote in 5 Minutes

Getting protected doesn’t have to be a long, complicated process. Thanks to modern technology, you can get a quick renters insurance quote online in just a few simple steps. Most providers have streamlined their process so you can see your price and options in about five minutes. We understand your time is valuable, and we’ve made it our mission to make obtaining insurance as efficient as possible. Some policies can even be activated and coverage obtained in as little as 90 seconds!

What Information Do I Need for a Quick Renters Insurance Quote?

To get your quote, you’ll need some basic information handy. Don’t worry, you won’t need to dig through piles of documents. Just be prepared to provide:

- Rental Address: The full street address of your apartment, condo, or house in Massachusetts or New Hampshire.

- Personal Information: Your name, date of birth, and contact details.

- Coverage Needs: An estimate of the value of your personal belongings. It’s helpful to do a quick home inventory to estimate how much coverage you need for your personal property. Start with big-ticket items, then add up smaller items. Many people underestimate the total value of their possessions.

- List of common high-value items to inventory:

- Jewelry

- Electronics (laptops, smartphones, TVs, gaming consoles)

- Musical Instruments

- Bicycles and sporting equipment

- Fine art or collectibles

- Designer clothing and accessories

- List of common high-value items to inventory:

- Desired Liability Limit: Typically ranging from $100,000 to $500,000. This is the amount your policy would pay out if you’re found liable for damages or injuries.

- Preferred Deductible: This is the amount you pay out-of-pocket before your insurance kicks in if you file a claim. Common deductibles range from $500 to $2,500.

Having this information ready before you start will make the process even faster.

The 5-Step Process to Your Instant Quote

Getting your Renters Insurance Quotes Massachusetts is straightforward:

- Enter Your Address: Provide the full address of the property you’re renting in MA or NH. This helps us assess location-specific factors like crime rates or fire protection.

- Answer a Few Questions: You’ll be asked about the type of building (apartment, house, condo unit) and any safety features like smoke detectors, deadbolts, or security alarms. These features can sometimes qualify you for discounts!

- Estimate Your Property Value: Based on your quick inventory, choose a personal property coverage amount that reflects the cost to replace your belongings. It’s about what it would cost to buy new, not what you paid originally.

- Select Your Limits: Choose your desired personal liability coverage and your preferred deductible. Don’t worry, you can adjust these later to see how they impact your premium.

- Get Your Quote: Instantly see your personalized premium. You can then adjust coverage amounts and deductibles to see how it affects the price, allowing you to tailor the policy to your budget and needs.

It’s really that simple. In minutes, you can go from wondering about renters insurance to having a personalized quote in hand, ready to protect your belongings and your future.

Understanding Your Quote: Customizing Coverage and Cost

Your renters insurance quote is determined by several factors, allowing you to tailor the policy to your specific needs and budget. Understanding these elements helps you secure the right protection without overpaying. While costs can vary, renters insurance is generally very affordable. In the U.S., policies can start as low as $5 per month, with many falling in the $15 to $30 per month range, making it one of the most accessible types of insurance. We’re here to help you steer these options.

Key Factors That Influence Your Premium

Several key factors influence your final price. We consider these elements to provide you with an accurate and fair quote:

- Location: The specific postal code of your rental unit in Massachusetts or New Hampshire plays a role. Factors like local crime rates, proximity to fire stations, and historical claims data in the area can affect your premium.

- Coverage Amount: The higher the personal property coverage limit you choose, and the higher your liability limit, the more your policy will cost. It’s a balance between comprehensive protection and affordability.

- Deductible: Your chosen deductible directly impacts your premium. A higher deductible (meaning you pay more out-of-pocket if you file a claim) generally results in a lower monthly premium.

- Claims History: If you’ve filed previous insurance claims, this could influence your rates. A clean claims history often leads to lower premiums.

- Pets: Owning certain pets, especially specific dog breeds, can sometimes increase your liability risk and, consequently, your premium.

- Credit-Based Insurance Score: In many states, including Massachusetts and New Hampshire, insurers use a credit-based insurance score as one factor in determining rates. A higher score can sometimes lead to discounts.

- Replacement Cost vs. Actual Cash Value: This is a crucial distinction.

- Replacement Cost Value (RCV): This pays to replace your damaged or stolen items with brand-new ones, without deducting for depreciation. While it costs slightly more, it provides significantly better protection, ensuring you can truly replace what you lost.

- Actual Cash Value (ACV): This pays what your items were worth at the time of the loss, accounting for depreciation. For example, a five-year-old laptop would be reimbursed at its depreciated value, not the cost of a new one. We generally recommend RCV for better peace of mind.

Understanding these factors helps us personalize your coverage. To explore how much a policy might cost for you, visit How Much Is Renters Insurance?.

How to Get the Cheapest Possible Quick Renters Insurance Quote

We know everyone wants to save money, and we’re here to help you find the most affordable rate without sacrificing essential protection. Here are a few proven strategies to help you get the Cheap Renters Insurance possible:

- Bundle Your Policies: One of the easiest ways to save is to combine your renters and auto insurance policies with the same provider. Many insurers offer a multi-policy discount, which can significantly reduce your overall premiums. This is often called a “bundle discount.”

- Choose a Higher Deductible: As mentioned, opting for a higher deductible will lower your monthly premium. Just be sure you can comfortably afford to pay that amount out-of-pocket if you ever need to file a claim.

- Install Safety Devices: Making your home safer can lead to discounts. Installing deadbolts, smoke detectors, carbon monoxide detectors, and a monitored security system can often qualify you for lower rates.

- Maintain a Good Credit Score: If you have a good credit history, allowing a credit check (where permitted) can sometimes result in a lower premium, as insurers view it as an indicator of financial responsibility.

- Ask for Discounts: Always inquire about any other available discounts! You might be eligible for discounts based on your age, if you’re a non-smoker, or if you’ve maintained a claims-free history for a certain period.

- Review Your Coverage Annually: Your needs change, and so should your policy. Regularly reviewing your coverage ensures you’re not over-insuring items you no longer own or under-insuring new valuable acquisitions.

Optional Coverages to Personalize Your Policy

A standard policy is a great start, but you may need extra protection for specific situations or valuable items. We can help you add endorsements (add-ons) to truly personalize your coverage:

- Jewelry & Valuables: Standard renters insurance policies often have limits on coverage for high-value items like jewelry, fine art, furs, or collectibles. If you have significant pieces, we can add a scheduled personal property endorsement to ensure they are fully protected, often with no deductible for these specific items.

- Water Backup: Standard policies typically cover water damage from sudden events like burst pipes. However, they might not cover damage from backed-up sewers or drains. A water backup endorsement adds crucial protection against this common and costly peril.

- Identity Theft Protection: Identity theft is a growing concern. This endorsement can help cover the costs associated with recovering your identity, such as legal fees and lost wages.

- Earthquake Coverage: While less common in Massachusetts and New Hampshire than in some other regions, earthquake coverage is typically an optional add-on that we can discuss if you’re concerned about this specific risk.

- Home-Based Business Coverage: If you run a small business out of your rental, your standard renters policy might not cover your business equipment or liability. We can explore specific endorsements or separate policies for this.

These optional coverages allow us to craft a truly custom Personal Insurance plan that meets all your unique needs, providing peace of mind for every aspect of your life as a renter.

Frequently Asked Questions about Renters Insurance

Is renters insurance mandatory in Massachusetts or New Hampshire?

No, neither Massachusetts nor New Hampshire legally requires tenants to have renters insurance. However, your landlord can—and very often will—require you to purchase a policy as a condition of your lease agreement. This protects them if your negligence causes damage to the building and ensures you have liability coverage. Check your lease to confirm your landlord’s requirements. Is Apartment Renters Insurance Policy Required in Massachusetts.

How are claims handled by renters insurance providers?

If you need to file a claim, the process is generally straightforward. You’ll contact your insurance provider online or by phone to report the incident. You will be assigned a claims adjuster who will investigate the loss, ask you to provide documentation (like a police report for theft or photos of the damage), and guide you through the process. Once the claim is approved, the insurer will issue payment, minus your deductible, to help you repair or replace your property or cover liability costs.

Can I deduct moving expenses on my taxes?

If you are an active-duty member of the Armed Forces moving due to a permanent change of station, you may be able to deduct your unreimbursed moving expenses. For most other individuals, the 2017 tax law changes suspended the moving expense deduction. To learn more about the specific rules and qualifications, you can visit the IRS website on moving expenses and the general IRS resource on moving expenses.

Protect Your Valuables with Stanton Insurance Agency

Getting a quick renters insurance quote is the first step toward securing your financial future as a renter. For just a few dollars a month, you can protect thousands of dollars worth of personal property and shield yourself from costly liability claims. The process is fast, simple, and provides invaluable peace of mind. Don’t leave your life’s belongings to chance. Let the experts at Stanton Insurance Agency help you find the perfect coverage for your needs in Massachusetts and New Hampshire. We are committed to providing trusted protection for the things you value most, always aiming to exceed your expectations.

Ready to see how affordable peace of mind can be? Get your personalized renters insurance quote today, or explore our full range of personal insurance options.