Understanding the Basics: Your Car Insurance Protection

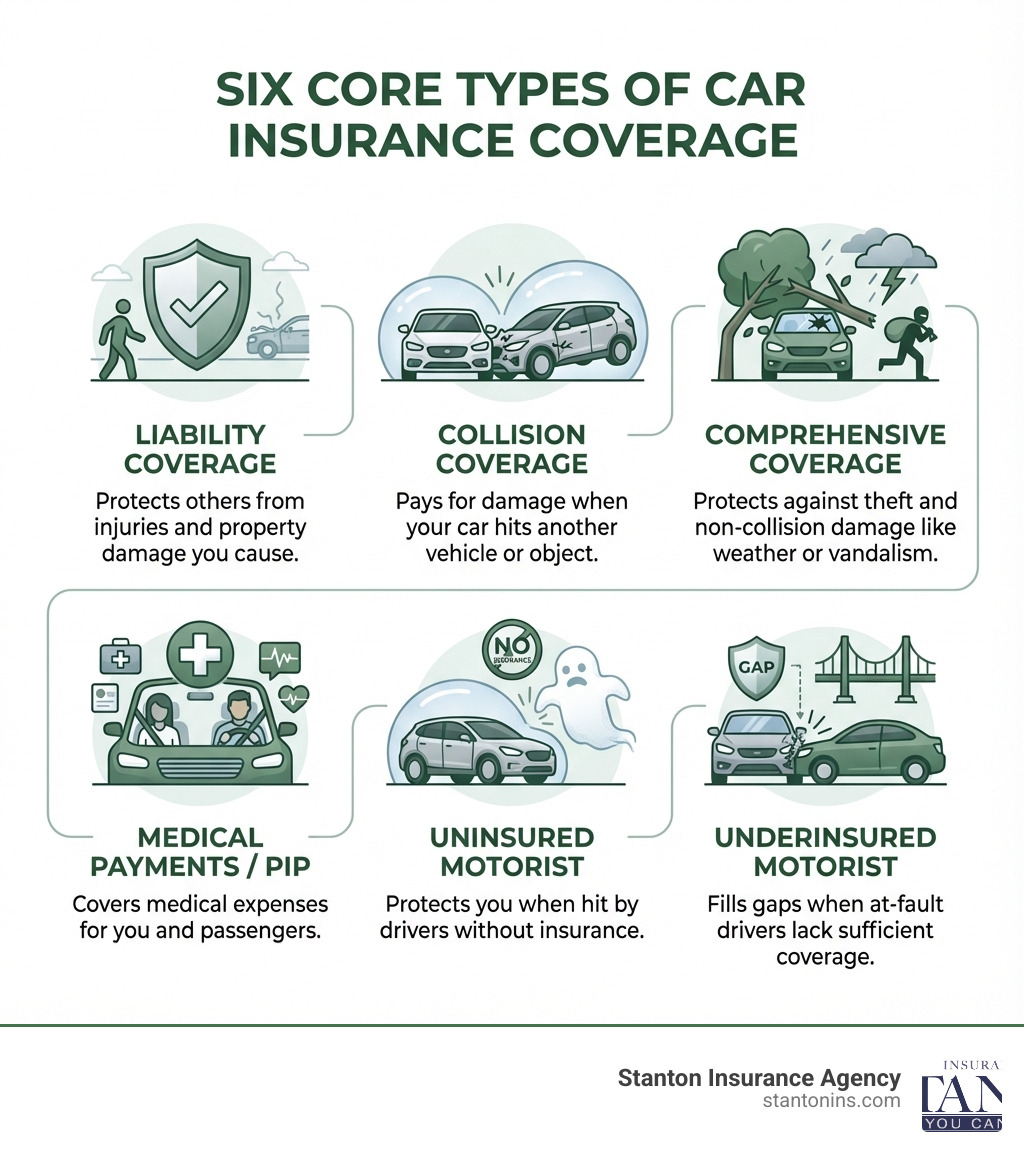

What does car insurance cover? Car insurance provides financial protection against vehicle damage, liability for injuries and property damage you cause to others, and medical expenses for you and your passengers. Here’s a quick overview of the core coverages:

- Liability Coverage – Pays for injuries or property damage you cause to others

- Collision Coverage – Pays for damage to your car from crashes with vehicles or objects

- Comprehensive Coverage – Pays for damage from theft, vandalism, weather, fire, and hitting animals

- Medical Payments/PIP – Covers medical expenses for you and your passengers after an accident

- Uninsured/Underinsured Motorist – Protects you when hit by drivers with no or insufficient insurance

Car insurance is a contract where you pay a premium to an insurer for protection against costly accidents. Without it, a single incident could jeopardize your savings or home.

Many drivers only learn what their policy covers after a claim. Policies vary greatly, from “full coverage” to state minimums. The right protection depends on your vehicle, assets, and specific needs.

This guide breaks down car insurance in plain language, from mandatory coverages to optional add-ons, helping you understand your policy whether you’re a new or existing customer.

I’m Geoff Stanton, President of Stanton Insurance Agency, and I’ve spent over two decades helping Massachusetts and New Hampshire drivers understand what does car insurance cover and find the right protection for their needs. Let me walk you through everything you need to know about car insurance coverage, so you can make informed decisions about protecting yourself and your family on the road.

The Core Components: What Does Car Insurance Cover?

The answer to what does car insurance cover starts with three core protections: liability, collision, and comprehensive. These pillars of most auto policies protect you in different scenarios, from at-fault accidents to unexpected vehicle damage.

These core coverages shield you from the financial fallout of various incidents. Liability covers harm you cause to others, collision handles damage to your own car from hitting something, and comprehensive is your safety net for non-collision events. Understanding these distinctions is key to building a policy that truly protects you. For a deeper dive, check out the Auto Insurance Basics from the Insurance Information Institute.

Liability Coverage: Protecting Others

This is the bedrock of your policy and is mandatory in Massachusetts. Liability coverage protects others if you’re found responsible for an accident, paying for the harm you cause to other people and their property.

Liability insurance has two parts:

- Bodily Injury Liability (BI): This covers medical expenses, lost wages, and pain and suffering for others injured in an accident you cause. It also covers legal fees if you’re sued. In Massachusetts, this also applies to injuries that those listed on your policy, or another authorized driver, cause to someone else. You and family members on the policy are also covered when driving someone else’s car with their permission.

- Property Damage Liability (PD): This covers damage you (or someone driving your vehicle with your permission) cause to someone else’s property, including other cars, fences, buildings, or mailboxes.

While Massachusetts mandates minimums, we recommend higher liability limits. If damages from a serious accident exceed your policy limits, you are personally responsible for the difference, putting your assets at risk.

For a more detailed look at this crucial coverage, explore our guide on More on Car Insurance Liability.

Collision Coverage: Protecting Your Car in a Crash

Collision coverage answers what does car insurance cover for your own vehicle. It pays for damage to your car from a collision with another vehicle or object (like a fence or pole), damage from potholes, or if your car rolls over.

Collision coverage is sold with a deductible, the amount you pay out-of-pocket before your insurance pays. For example, with a $500 deductible, if your car sustains $3,000 in damage, you’d pay $500, and your insurer would cover the remaining $2,500.

While not legally required, lenders will almost certainly require collision coverage for a leased or financed car to protect their investment. It’s a smart choice for most drivers, as repairs can be incredibly expensive.

To understand all the nuances, read our article Learn more about what collision insurance covers.

Comprehensive Coverage: Protection Beyond the Crash

If collision coverage is for when you hit something, comprehensive is for almost everything else. It’s your shield against non-collision incidents, often beyond your control. This includes damage from:

- Theft or vandalism

- Fire

- Flooding, hail, or other weather-related events

- Falling objects (like tree branches)

- Hitting an animal (deer, moose, etc.)

- Glass damage (windshield, windows)

Like collision, comprehensive coverage usually has a deductible. You pay this amount before your insurer covers the rest of the repair or replacement costs. In Massachusetts, for example, the deductible for windshield repair is typically waived if you have comprehensive coverage, though a deductible may still apply for a full replacement.

If a tree branch smashes your windshield or your car is stolen, comprehensive coverage helps. It’s a crucial part of what many call “full coverage.”

To help clarify the differences between these two vital coverages, here’s a quick comparison:

| Feature | Collision Coverage | Comprehensive Coverage |

|---|---|---|

| What it covers | Damage to your car from hitting another car or object, or rolling over. | Damage to your car from non-collision events (theft, fire, vandalism, weather, animals, falling objects). |

| When it applies | You hit something (or something hits you and it’s another car/object). | Something other than a collision damages your car. |

| Deductible | Yes, typically $250 to $1,000. | Yes, typically $100 to $300 (sometimes no deductible for glass). |

| Requirement | Not state-mandated in MA/NH, but often required by lenders for financed/leased cars. | Not state-mandated in MA/NH, but often required by lenders for financed/leased cars. |

For a more in-depth comparison, check out our guide on Explore the details of Comprehensive vs Collision.

Essential Add-Ons: Expanding Your Policy’s Protection

Beyond the core coverages, the answer to what does car insurance cover includes essential add-ons. These options address specific needs like medical bills, lost wages, or protection from uninsured drivers, allowing for a customized policy that provides a safety net for your unique circumstances.

What does car insurance cover for medical expenses? (MedPay & PIP)

Accidents can be painful, both physically and financially, which is why medical expense coverages are so important.

- Medical Payments (MedPay): This helps pay for your and your passengers’ medical and funeral expenses after an accident, regardless of who is at fault. It can supplement your health insurance or act as primary coverage for smaller bills.

- Personal Injury Protection (PIP): Often called “no-fault insurance,” PIP is similar to MedPay but offers broader benefits. In addition to medical bills, PIP can also cover lost wages, essential services (like childcare if you’re unable to perform them), and funeral expenses.

Massachusetts is a no-fault state, meaning PIP is compulsory. This ensures you and your passengers get immediate medical treatment and other benefits without waiting for fault to be determined. For more details, refer to Is Massachusetts a no-fault car insurance state?.

Uninsured/Underinsured Motorist (UM/UIM) Coverage

If you’re hit by a driver with little or no insurance, you could face significant medical and repair bills. Uninsured/Underinsured Motorist (UM/UIM) coverage protects you in this scenario.

- Uninsured Motorist (UM): This steps in when the at-fault driver has no insurance or in a hit-and-run. It can pay for your medical bills, lost wages, and property damage.

- Underinsured Motorist (UIM): This applies when the at-fault driver’s insurance limits aren’t high enough to cover all your expenses. Your UIM coverage pays the difference, up to your policy’s limits.

UM/UIM is vital in Massachusetts and New Hampshire, where you risk encountering uninsured or underinsured drivers. It can even protect you as a pedestrian. For more information, read Do you need uninsured motorist coverage?.

Specialized Optional Coverages

Several other valuable coverages can improve your policy and answer more specific questions about what does car insurance cover:

- Gap Insurance: If your car is totaled or stolen, your policy pays its actual cash value. If you owe more on your loan or lease than the car is worth, gap insurance pays the “gap.” It’s a lifesaver for many with new vehicles. To learn more, visit What is Gap Insurance?.

- Rental Reimbursement: Helps pay for a rental car while yours is being repaired or replaced after a covered incident.

- Roadside Assistance: Provides help for flat tires, dead batteries, lockouts, or towing.

- Loan/Lease Payoff Coverage: Similar to gap insurance, this may cover the difference if you owe more on your vehicle than it’s worth.

- Accident Forgiveness: Protects you from a rate increase after your first at-fault accident.

Choosing these optional coverages allows us to tailor your car insurance to your lifestyle, vehicle, and financial situation.

Navigating Your Policy: Key Concepts and Exclusions

Understanding your policy requires grasping a few key concepts: deductibles, limits, and premiums. It’s also vital to know what your car insurance typically doesn’t cover.

How Deductibles, Limits, and Premiums Work

These three terms are fundamental to any insurance policy:

- Deductible: The amount you pay out-of-pocket for a claim before your insurance pays. For example, with a $500 deductible on a $2,000 repair, you pay $500, and your insurer pays $1,500. A higher deductible usually means a lower premium.

- Premium: The amount you pay your insurance company for coverage, typically monthly or annually. It’s based on your driving record, location, vehicle, and the coverages you choose.

- Policy Limit: The maximum amount your insurer will pay for a covered loss. If your limit is $50,000 for an injury and the bills are $75,000, you’re responsible for the remaining $25,000. This is why we often recommend higher limits.

When your car is totaled, the insurer pays its Actual Cash Value (ACV)—the replacement cost minus depreciation, not what you originally paid.

We help clients balance affordable premiums with adequate protection. For guidance on rates, check out our Get a guide on Car Insurance Quotes in Massachusetts.

What does car insurance typically NOT cover?

Knowing what does car insurance cover also means understanding its exclusions to prevent unexpected costs:

- General Maintenance/Mechanical Repairs: Insurance isn’t a warranty; it won’t cover oil changes, new brakes, or engine trouble unless caused by a covered accident.

- Wear and Tear: Damage from normal use, aging, or rust is not covered.

- Personal Items Stolen from Your Car: Items like laptops or phones stolen from your car are usually covered by homeowners or renters insurance, not your auto policy.

- Intentional Damage: Your insurance won’t cover damage you cause to your own car on purpose.

- Commercial Use (without specific coverage): A personal policy likely won’t cover you if you use your vehicle for business, like ridesharing or deliveries. You’ll need a commercial policy or endorsement.

- Unlisted Drivers: If someone who regularly drives your car isn’t on your policy, a claim could be denied. Always list all regular drivers.

If your business uses vehicles, learn more about Commercial Auto Insurance to ensure proper protection.

The Claims Process

Knowing how to steer the claims process is crucial. Here’s a general overview:

- Safety First: After an accident, ensure everyone is safe and call for help if needed.

- Gather Information: Exchange contact and insurance details with other parties. Take photos of the scene and damage.

- Report the Incident: Notify your insurance company as soon as possible.

- Adjuster Investigation: An adjuster will investigate the accident, review damages, and determine fault.

- Settlement: Your insurer may approve repairs, replacement, or, if the car is a “total loss,” pay you its actual cash value (ACV) minus your deductible.

Be thorough when explaining the accident and cooperate with the adjuster. You have the right to negotiate a settlement offer you disagree with. For a comprehensive guide, refer to our A complete guide to Auto Insurance Claims.

State-Specific Spotlight: Insurance Rules in MA & NH

Car insurance requirements can vary significantly from state to state. While we’ve discussed general coverages, it’s crucial for drivers in Massachusetts and New Hampshire to understand their local laws. Driving without proper insurance can lead to severe penalties, including fines, license suspension, and even vehicle impoundment.

Massachusetts Car Insurance Requirements

Massachusetts has specific compulsory coverages that drivers must carry, reflecting its status as a no-fault state. This means certain coverages are required by law for all vehicles registered in the Commonwealth. So, what does car insurance cover by law in MA?

- Bodily Injury to Others: Pays for legal liability for injuries to others caused by your vehicle, up to $20,000 per person and $40,000 per accident.

- Personal Injury Protection (PIP): As a no-fault state, Massachusetts requires PIP coverage, which pays up to $8,000 for medical expenses, lost wages, and replacement services for you or your passengers, regardless of who caused the accident. This ensures quick access to care.

- Bodily Injury Caused by Uninsured Auto: Pays for injuries to you or your passengers if caused by an uninsured motorist, up to $20,000 per person and $40,000 per accident.

- Damage to Someone Else’s Property: Covers damage to other people’s property (like their car or home) if you are at fault, with a minimum limit of $5,000.

While these are the minimums, we always recommend considering higher limits and additional optional coverages like collision and comprehensive to adequately protect your assets. For a full breakdown of the essentials, see What is the minimum car insurance coverage in Massachusetts?.

New Hampshire Car Insurance Laws

New Hampshire is famous for its “Live Free or Die” motto, and its auto insurance laws reflect a unique approach. Unlike almost every other state, New Hampshire does not legally mandate that drivers carry car insurance. However, this doesn’t mean you’re off the hook financially.

New Hampshire still has financial responsibility laws. If you’re involved in an accident and are found at fault, you are personally responsible for any damages or injuries you cause. If you don’t have insurance, you’ll have to prove you can cover these costs out-of-pocket. If you can’t, your driving privileges and vehicle registration can be suspended, and you may even be required to file an SR-22 (a certificate of financial responsibility) for a period of time.

So, while not required, having car insurance in New Hampshire is highly recommended. Without it, the consequences of an accident can be financially devastating. We advise New Hampshire drivers to carry at least:

- Bodily Injury Liability: $25,000 per person / $50,000 per accident

- Property Damage Liability: $25,000 per accident

- Uninsured Motorist Bodily Injury: $25,000 per person / $50,000 per accident

- Medical Payments: $1,000

These recommended coverages provide a basic level of protection that can save you from significant financial hardship. To understand more about the specifics in the Granite State, visit Are you required to have auto insurance in New Hampshire?.

Frequently Asked Questions about Car Insurance Coverage

Here are answers to common questions we receive about what does car insurance cover.

Does car insurance cover the person or the car?

Generally, insurance follows the car. If you lend your car to someone with your permission (“permissive use”) and they have an accident, your policy is typically the primary source of coverage. However, your own liability coverage often extends to you when driving someone else’s car, acting as secondary coverage. In Massachusetts, if someone else drives your car and has an accident, your insurance helps cover the claims. It’s crucial to list all regular drivers on your policy. For a deeper dive, read Does Insurance Follow the Car or Driver in Massachusetts?.

Does my car insurance cover rental cars?

Your personal auto policy may extend some coverages, like liability, to a rental car. However, collision and comprehensive might not fully transfer, and your deductible would still apply. Before renting, it’s wise to:

- Check Your Personal Policy: Review your documents to see what’s covered.

- Check Your Credit Card Benefits: Many cards offer rental car insurance if you use them to pay.

- Consider the Rental Company’s Offer: Weigh their options against your existing coverage.

For more details on how your liability coverage specifically interacts with rental cars, check out Does liability insurance cover rental cars?.

How long does it take to get car insurance?

Getting car insurance can be very fast. You can often get quotes online or over the phone in minutes. Once you choose a policy and make the initial payment, your coverage can typically start the same day. We can provide immediate proof of insurance so you can drive legally and with peace of mind.

Conclusion

Understanding what does car insurance cover is more than just a theoretical exercise; it’s about protecting your financial future and ensuring peace of mind on the road. We’ve explored the core components of liability, collision, and comprehensive coverage, digd into essential add-ons like MedPay, PIP, and UM/UIM, and highlighted state-specific requirements for Massachusetts and New Hampshire.

Every driver’s situation is unique, and so should their insurance policy be. Customizing your coverage to fit your lifestyle, vehicle, and assets is key to balancing cost and protection effectively. Don’t settle for minimums if your assets are at risk, and don’t pay for coverages you don’t need.

At Stanton Insurance Agency, we pride ourselves on providing trusted advice and helping our Massachusetts and New Hampshire clients steer the complexities of auto insurance. We’re here to help you understand your options, compare policies, and find the right coverage that meets your needs without breaking the bank.

Contact us today to review your Car Insurance options and get a personalized quote!