What is loss assessment coverage: Crucial 2025 Protection

Why Condo Owners Need to Understand Shared Financial Risks

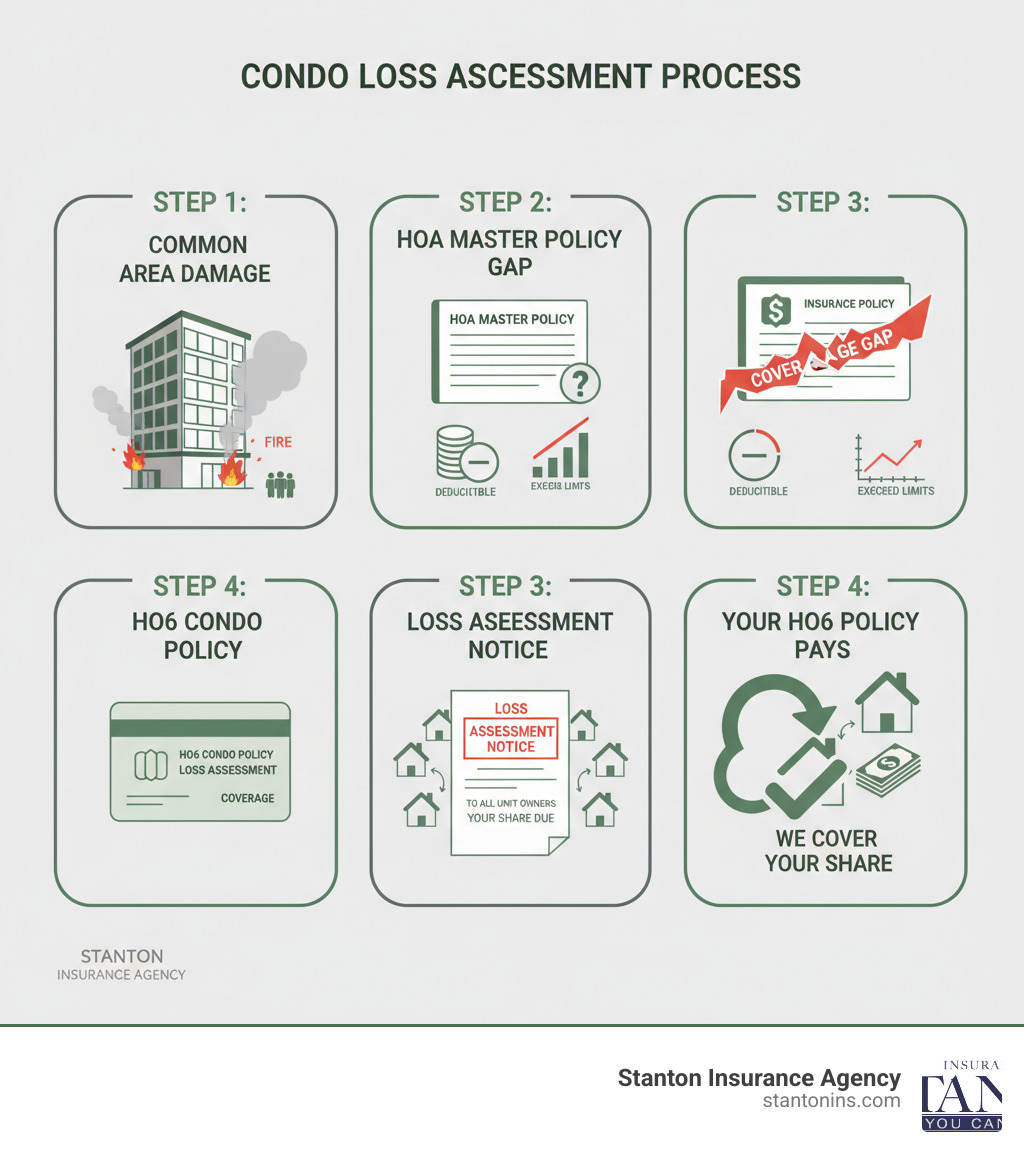

What is loss assessment coverage? It’s an optional add-on to your condo insurance policy (HO6) that pays your share of costs when damage to common areas exceeds your homeowners association’s (HOA) master policy. Here’s what you need to know:

- It’s a financial safety net – Protects you from unexpected bills when the HOA assesses all unit owners for a covered loss.

- Standard coverage is too low – Most basic policies include only $1,000, but assessments can easily reach five figures.

- It covers gaps in the master policy – Helps pay for claims that exceed your association’s insurance limits or deductible.

- It’s affordable – Boosting coverage to $50,000 or more may cost only tens of dollars more per year.

- Not for routine expenses – Only covers sudden, accidental losses, not maintenance or building improvements.

While condo living offers benefits like shared amenities and no exterior maintenance, it also comes with shared financial responsibility. Your condo association’s master insurance policy covers common areas, but what happens when that policy isn’t enough?

If damage exceeds the master policy’s limit or the association has a large deductible, your HOA will issue a special assessment, dividing the uncovered costs among all unit owners. A $100,000 shortfall split between 50 owners means a surprise $2,000 bill for you.

For example, when a severe windstorm led to a $10,000 loss assessment for one condo owner, her coverage paid the full amount, saving her from significant financial hardship. This is where loss assessment coverage becomes crucial. It protects you from these unexpected bills and provides peace of mind.

I’m Geoff Stanton, President of Stanton Insurance Agency. For over two decades, I’ve helped condo owners understand what is loss assessment coverage and how this affordable endorsement can prevent devastating out-of-pocket expenses.

What is loss assessment coverage and how does it work?

Loss assessment coverage is an optional add-on to your personal condo insurance (HO6) policy. It acts as your financial backup plan, protecting you from surprise bills for damage to shared spaces in your building.

Your condo community shares responsibility for common areas like the lobby, roof, and pool, which are covered by your homeowners association’s (HOA) master insurance policy. When a major incident like a fire or storm causes damage exceeding the master policy’s limits, a coverage gap occurs. To fill this gap, the HOA issues a special assessment fee, billing each unit owner for their share of the uncovered costs. A $50,000 shortfall could mean a bill for thousands of dollars per unit, due immediately.

Loss assessment coverage is your shield, paying your portion of that special assessment up to your policy limit. These gaps typically occur when repair costs exceed the master policy’s coverage limits or when the association assesses owners to cover its high deductible (often $25,000 or more).

For a deeper look at what your standard condo policy typically protects, visit our guide on what condo insurance covers.

How it interacts with your condo association’s master policy

The master policy is the primary insurance for your building and common areas, but it has limits and deductibles that can leave gaps. For example, a fire causes $500,000 in damage to your building’s lobby, but the master policy has a limit of $400,000. That leaves a $100,000 shortfall. If your building has 50 units, each owner would be assessed $2,000. With loss assessment coverage, your HO6 policy would pay your $2,000 share.

Your HO6 policy protects your unit’s interior, personal belongings, and provides liability coverage. Loss assessment coverage specifically addresses the unique risk of shared claims that exceed the master policy, ensuring you aren’t left with an unexpected bill for thousands.

The difference between a loss assessment and a deductible

It’s easy to confuse a loss assessment with your policy deductible, but they are very different. Your policy deductible is the predictable amount you pay on your own claims before your insurance kicks in. A loss assessment is an unpredictable fee from your HOA to cover shortfalls in the master policy. The amount is determined by the association and can vary wildly.

Here’s a comparison that makes the differences clear:

| Feature | Loss Assessment | Your Policy Deductible |

|---|---|---|

| What is it? | A fee from your HOA to cover gaps in the master policy | The amount you pay before your insurance covers a claim |

| Who issues it? | Your condo association or HOA | Set by you when you choose your insurance policy |

| When do you pay it? | After damage to common areas exceeds the master policy limits or deductible | When you file a claim on your personal condo policy |

| Typical Amount | Can range from hundreds to tens of thousands of dollars | Usually $500 to $2,500, chosen when you buy your policy |

The key takeaway is that your deductible applies to your personal claims, while a loss assessment applies to shared property damage and is often much larger and less predictable. That’s why having adequate loss assessment coverage is so important.

What’s Covered (and Not Covered) by a Loss Assessment Endorsement?

What is loss assessment coverage designed to cover? It’s a safety net for unexpected costs from your condo association, stemming from sudden and accidental events (covered perils) affecting common areas.

Generally, loss assessment coverage kicks in for:

- Property damage assessments: When a covered peril like a fire or storm damages shared property and the master policy’s limits are exhausted or its deductible is assessed to owners.

- Liability claims: If someone is injured in a common area and sues the association, your coverage can help pay your portion of an assessment for a settlement or legal fees that exceed the master liability policy.

What specific situations does what is loss assessment coverage typically cover?

Your loss assessment coverage would come to the rescue in several common scenarios:

- Damage to shared property: A severe winter storm in Massachusetts causes $750,000 in damage to your building’s roof, but the master policy limit is only $600,000. The $150,000 shortfall is assessed to all owners. If there are 25 units, your loss assessment coverage would help pay your $6,000 share.

- Common area liability: A visitor is injured on an icy walkway at your New Hampshire condo, and the resulting lawsuit settlement of $500,000 exceeds the association’s $300,000 liability limit. Your coverage would pay your portion of the $200,000 assessment.

- Master policy deductible: A fire causes damage, and your association assesses each owner their share of the master policy’s $25,000 deductible. Your loss assessment coverage can pay this for you.

What is NOT covered by loss assessment coverage?

It’s also important to know the limitations of what is loss assessment coverage. It is not a blank check for any fee from your HOA; it only covers assessments from insured property or liability losses.

Here’s what loss assessment coverage typically does not cover:

- Routine maintenance: Assessments for painting, cleaning, or landscaping are not covered. These are operational costs funded by regular HOA fees.

- Property improvements or upgrades: Assessments for building a new fitness center or repaving the parking lot are considered capital improvements and are not covered.

- Assessments due to financial mismanagement: If the association has a shortfall due to poor financial planning or failure to collect dues, your coverage will not apply.

- Damage from excluded perils: Assessments for damage from perils like floods or earthquakes are not covered unless you have specific, separate coverage for those events.

- Fines for bylaw violations: Your policy will not pay for personal fines from the HOA.

- Pre-existing conditions: Damage or issues that existed before your policy’s effective date are not covered.

How Much Coverage Do You Need and What Does It Cost?

Many condo owners are surprised to learn their basic HO6 policy includes only $1,000 of loss assessment coverage. A single incident can easily lead to assessments of $5,000, $10,000, or more per unit, making this standard amount inadequate.

We typically recommend at least $50,000 in loss assessment coverage. You can usually purchase limits from $10,000 to $100,000. The right amount depends on your building and financial situation, so it’s crucial to evaluate your needs instead of accepting the standard low limit.

For more context on condo insurance basics, you might find this helpful: More info on if you need home insurance for a condo.

Steps to determine your coverage needs

Determining your coverage needs requires some research into your condo association’s master policy. Here are the key steps:

- Review your condo association’s bylaws to understand how assessments work.

- Obtain and examine the master insurance policy. This is the most important document for understanding your risk. Your HOA is required to provide it.

- Note the master policy’s coverage limits and deductible. A large gap between the building’s value and the policy limit, or a high deductible (e.g., $50,000), indicates a higher risk of a large assessment.

- Consider the number of units in your association. A $100,000 assessment is $1,000 per owner in a 100-unit building, but $10,000 per owner in a 10-unit building. Fewer units mean higher individual risk.

- Consult with an insurance professional who can review the master policy and help you select the right coverage amount.

How much does what is loss assessment coverage typically cost?

Here’s the good news: what is loss assessment coverage is remarkably affordable. Increasing your limit from the standard $1,000 to $50,000 or even $100,000 often costs just tens of dollars more per year.

The exact cost depends on your insurer and coverage amount. Factors influencing your premium include your unit’s size, the building’s age and condition (especially for historic buildings in MA and NH), location, and your choice of insurance company. An independent agency can shop multiple insurers for the best value.

Most condo owners in our area pay between $400 and $600 per year for a comprehensive policy that includes adequate loss assessment coverage. Considering a single assessment could cost you thousands, the small additional premium is a wise investment.

Why Loss Assessment Coverage is Crucial for Condo Owners

Imagine receiving an unexpected bill for $15,000 for damage to your building’s common area. This is the reality many condo owners face without proper loss assessment coverage. For condo owners in Massachusetts and New Hampshire, what is loss assessment coverage is your protection against these financial shocks.

Loss assessment coverage is your financial safety net. It pays your share of a special assessment, so you don’t have to drain savings or take on debt. An unexpected $10,000 bill can cause real financial hardship, and this coverage prevents that. The peace of mind is invaluable, allowing you to enjoy your condo knowing you’re protected from the collective risks of shared ownership.

Over the past decade, large claims affecting condo associations have become more frequent and severe. Due to intense weather and rising construction costs, a major repair can be twice as expensive as it was ten years ago. In response, many associations are raising their master policy deductibles to $25,000, $50,000, or more. This shifts the financial risk to unit owners, who must pay their share of the deductible when a claim occurs. Without loss assessment coverage, this comes out of your pocket.

The International Risk Management Institute defines a loss assessment as “A property owner’s share of a loss to property owned in common by all members of a property owners association.” That simple definition captures the heart of the issue: you’re financially connected to everyone else in your building. An expert definition of loss assessment provides additional context on this shared responsibility.

Think of loss assessment coverage as protecting your investment and your personal finances from collective risks. For a modest annual cost, you’re buying protection that could save you thousands. It’s about being prepared and ensuring a problem affecting the whole building doesn’t become your personal financial crisis.

Frequently Asked Questions about Loss Assessment Coverage

After learning about what is loss assessment coverage is, condo owners in Massachusetts and New Hampshire often have the same questions. Here are the answers.

Is loss assessment coverage automatically included in my condo insurance?

Not in a meaningful way. Most basic HO6 policies include a small amount of coverage—typically just $1,000—which is rarely enough. A single assessment can easily cost you $5,000 or more. That’s why you must add an endorsement to increase your limit. We recommend a minimum of $50,000. The good news is that this increase is very affordable, often costing just tens of dollars more per year.

Can loss assessment coverage pay for my HOA’s master policy deductible?

Yes, this is one of its most common uses. Condo master policies often have high deductibles ($25,000, $50,000, or more). When a claim is filed, the association often assesses owners to cover this deductible, and your loss assessment coverage is designed to pay your share. Be aware that some policies have a specific sub-limit for deductible assessments, so it’s important to review your policy with an agent.

Does loss assessment coverage apply to special assessments for building improvements?

No. This coverage is for assessments resulting from a sudden and accidental loss, like a fire or storm. It does not cover assessments for planned capital improvements (like building a new clubhouse or repaving the parking lot) or routine maintenance. Those costs must be paid out of pocket, as they are not considered insured losses.

Secure Your Finances with the Right Condo Coverage

As a condo owner in Massachusetts or New Hampshire, understanding what is loss assessment coverage is key to protecting your investment. You don’t want to be blindsided by a massive bill for damage to a shared area or a lawsuit against your association.

The value is simple: a small annual premium can prevent a large, unexpected bill. For just tens of dollars a year, you can protect yourself from assessments of $10,000 or more. It’s one of the smartest financial decisions a condo owner can make.

Think of it as an insurance policy for your insurance policy. Your association’s master policy provides the first layer of protection, but when that protection falls short, you need your own safety net.

At Stanton Insurance Agency, we’ve spent over two decades helping condo owners in Massachusetts and New Hampshire protect their investments and their peace of mind. We know the local market, understand the unique challenges facing condo associations in our region, and are committed to making sure you have the right coverage at the right price.

We take the time to review your association’s master policy, help you understand potential gaps, and recommend the appropriate loss assessment limits for your specific situation. We’re here to answer your questions and be your advocate when you need us most.

Don’t wait until your association issues a special assessment to realize you’re underinsured. Take action today to protect your finances and your future. Contact us for a comprehensive review of your condo insurance needs, and let’s build the right protection together.