What happens if my car insurance is cancelled in Massachusetts: 3!

Understanding Massachusetts Car Insurance Cancellation Consequences

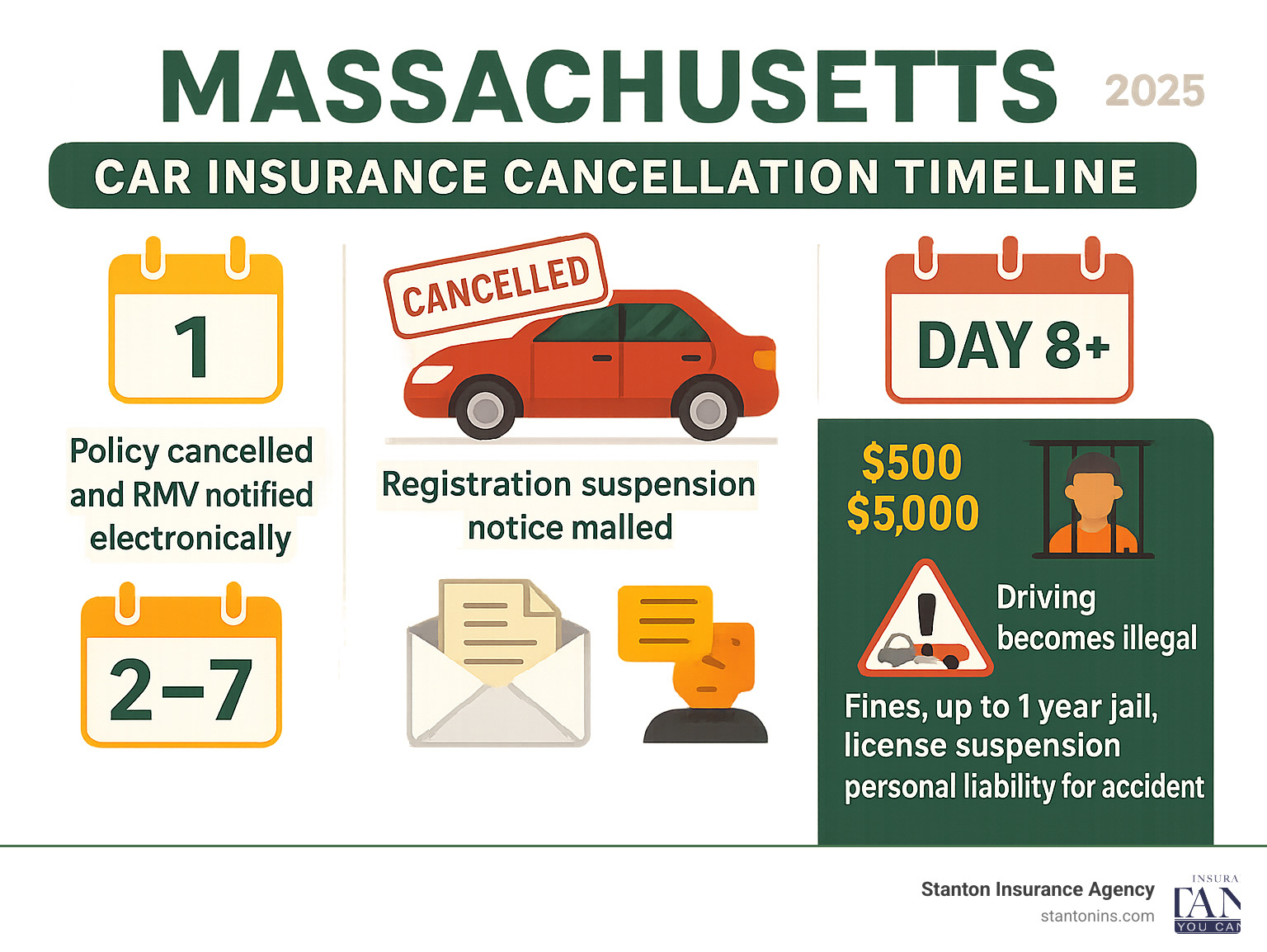

What happens if my car insurance is cancelled in massachusetts can be summarized in these immediate consequences:

- Legal penalties: Fines up to $5,000, potential jail time up to one year, and license suspension.

- Registration issues: The Massachusetts RMV automatically suspends your vehicle registration.

- Financial liability: You become personally responsible for all damages in any accident.

- Future insurance problems: A cancellation stays on your record for about five years, making coverage harder to find and more expensive.

- Immediate driving ban: It becomes illegal to operate your vehicle on Massachusetts roads.

In Massachusetts, driving without insurance is illegal and carries severe consequences. The moment your coverage ends, the state’s electronic system notifies the Registry of Motor Vehicles (RMV), triggering a chain of legal and financial penalties. If your policy has been active for over 60 days, insurers can only cancel it for specific reasons like non-payment, fraud, or serious driving violations. Understanding these consequences is crucial for any Bay State driver.

I’m Geoff Stanton, President of Stanton Insurance Agency. For over two decades, I’ve helped Massachusetts residents steer complex insurance situations, including policy cancellations. As a fourth-generation insurance professional, I’ve guided countless clients through restoring their coverage and protecting their driving privileges.

Why Car Insurance Policies Are Cancelled in Massachusetts

Understanding why a policy is cancelled is the first step to resolving the issue. In Massachusetts, insurers cannot cancel a policy that has been active for over 60 days without a valid reason, as the law provides strong consumer protections.

Reasons an Insurer Might Cancel Your Policy

- Non-payment of premium: This is the most common reason. Insurers provide a grace period (usually 10-20 days) to make a payment, but if the deadline is missed, cancellation follows.

- Fraud or material misrepresentation: Providing false information, such as an incorrect garaging address, hiding a driver, or lying about your driving record, can lead to cancellation.

- Suspended or revoked driver’s license: If you are no longer legally allowed to drive, an insurer will cancel your policy. This includes registration suspensions from unpaid tickets.

- Major traffic violations: A pattern of serious violations, like reckless driving or multiple at-fault accidents, can make you too high-risk for a standard insurer.

- DUI conviction: An OUI (Operating Under the Influence) conviction signals a significant increase in risk that most insurers will not accept.

In Massachusetts, if your policy has been active for more than 60 days, insurers can only cancel it for failure to pay your premium, fraud or serious misrepresentations on your application, a suspended or revoked license, or serious driving history issues.

Reasons You Might Cancel Your Own Policy

- Selling your vehicle: If you no longer own the car, you no longer need the insurance. Ensure coverage remains active until the sale is final.

- Moving out of state: You will need a new policy that complies with your new state’s laws and coverage minimums.

- Switching to a new insurance provider: To get better rates or coverage, you might switch insurers. Always activate the new policy before cancelling the old one to avoid a coverage gap.

- Storing your vehicle long-term: If you plan to store your car, you must cancel your registration with the RMV before you can cancel your insurance.

For guidance on how to properly cancel your car insurance in Massachusetts, visit: https://stantonins.com/how-to-cancel-car-insurance-in-massachusetts/

What Happens If My Car Insurance Is Cancelled in Massachusetts? The Legal and Financial Fallout

The moment your policy is cancelled, the state’s electronic system notifies the Registry of Motor Vehicles (RMV) almost immediately, triggering significant repercussions.

Immediate Legal Consequences of Driving Uninsured

Your insurer is legally required to alert the RMV when your coverage ends. This electronic notification leads to swift action:

- Vehicle Registration Suspension: The RMV will suspend your vehicle’s registration, as insurance is a prerequisite for it.

- License Plate Confiscation: Law enforcement can confiscate your plates if they find your registration is suspended for lack of insurance.

- Fines and Penalties: If caught driving uninsured, you face fines from $500 to $5,000, imprisonment for up to one year, and a driver’s license suspension for up to one year.

Do you need insurance to register a car in Massachusetts? Find out here: https://stantonins.com/do-you-need-insurance-to-register-a-car-in-massachusetts/

Financial Risks and Long-Term Record Impact

Beyond legal troubles, the financial fallout can be devastating.

- Personal Liability: If you cause an accident while uninsured, you are personally responsible for all damages and injuries. This can include medical bills, property damage, and lost wages, potentially amounting to hundreds of thousands of dollars.

- Difficulty Securing New Insurance: A cancellation marks you as high-risk, making it difficult to find coverage. Many standard insurers may decline to offer you a policy.

- Higher Premiums: When you do find coverage, expect to pay significantly more. A cancellation history suggests higher risk, leading to higher rates, sometimes double or triple your previous premium.

- Long-Term Record: A cancelled policy stays on your record for about five years, affecting your rates and options for the entire period.

What is the minimum car insurance coverage in Massachusetts? https://stantonins.com/what-is-the-minimum-car-insurance-coverage-in-massachusetts/

What happens if my car insurance is cancelled in Massachusetts due to non-payment?

This is a common scenario with specific outcomes. A policy lapse occurs the moment your payment deadline passes. Acting quickly may allow for reinstatement, though this isn’t guaranteed and often requires paying the full overdue balance plus late fees. You will likely need to sign a no-loss statement, confirming no accidents occurred during the lapse. If your car is financed, your lender may purchase expensive force-placed insurance to protect their investment and add the cost to your loan.

How to Get Back on the Road After a Cancellation

If you receive a cancellation notice, you must act quickly to restore your coverage and legal driving status. Delaying only increases your risk and makes finding new insurance more difficult.

Step 1: Contact Your Previous Insurer

Your first call should be to your former insurance company. Time is critical.

- Inquire about reinstatement: If the cancellation was for non-payment, you may be able to reinstate the policy by paying the outstanding balance and any late fees. This is often the fastest and cheapest solution.

- Understand the reason: Get a clear explanation for the cancellation. This information is vital for preventing future issues and for explaining your situation to new insurers.

- Ask about grace periods: Massachusetts grace periods for payment are typically 10-20 days, but this varies. Knowing your insurer’s policy helps you understand your options.

Step 2: Shop for a New Policy Immediately

If reinstatement isn’t an option, you must find new coverage without delay.

- Work with an independent insurance agent: An independent agent can shop multiple carriers on your behalf, which is especially valuable when you’re considered high-risk. They can find options you might not find on your own.

- Look for high-risk insurers: Some companies specialize in covering drivers with cancellations or violations on their record. Their rates may be higher, but they provide a legal path back to driving.

- Consider the MAIP: If you’re denied coverage through standard channels, you may be eligible for the Massachusetts Automobile Insurance Plan (MAIP). This state-mandated program is an insurer of last resort, though rates are typically higher.

How to get car insurance in Massachusetts: https://stantonins.com/how-to-get-car-insurance-in-massachusetts/

Future Impact of a Cancellation

A policy cancellation has long-term effects on your insurance record.

- Higher future premiums: Insurers will view you as a higher risk, leading to more expensive premiums for several years.

- High-risk driver classification: This status can make you ineligible for certain discounts and preferred rates.

- Potential SR-22 requirement: If your license was suspended, you might need to file an SR-22 form, a certificate of financial responsibility that proves you have coverage. This can increase costs and limit insurer choices.

- Fewer carrier options: Many standard insurers may be unwilling to cover drivers with a cancellation history, reducing your choices.

Understanding Your Rights: Cancellation vs. Non-Renewal and the Appeals Process

It’s crucial to understand the difference between a policy “cancellation” and a “non-renewal,” as well as your right to challenge an insurer’s decision in Massachusetts.

The Difference Between Cancellation and Non-Renewal

A cancellation is a mid-term termination of your policy for serious reasons, while a non-renewal happens at the end of your policy term. A cancellation carries a much heavier stigma and has a more severe impact on your ability to get insurance in the future.

| Feature | Cancellation | Non-Renewal |

|---|---|---|

| Timing | Occurs mid-term | Occurs at the end of the policy term |

| Reason | Specific, severe reasons (e.g., non-payment, fraud, license suspension) | Broader reasons (e.g., too many claims, insurer changes business strategy) |

| Notice | Shorter notice (10-20 days for non-payment) | Longer notice (typically 45 days in MA) |

| Impact | Severe impact on future insurability, higher rates, fewer choices | Less severe, but still requires finding new coverage |

How to Appeal a Cancellation in Massachusetts

If you believe your policy was cancelled unfairly, Massachusetts law gives you the right to appeal the decision. The Board of Appeal on Motor Vehicle Liability Policies and Bonds exists to protect drivers from unjust cancellations.

To appeal, you must file a complaint with the Board. Timing is critical: if you file your appeal before the cancellation date, your coverage remains active during the appeals process. This prevents a lapse in coverage while you await a decision. You can still file up to 10 days after the cancellation date, but you will be uninsured during the review.

The process involves submitting a Cancellation Complaint form (with no fee) and attending a virtual hearing where both you and the insurer present your cases. This is a valuable option if the cancellation was based on incorrect information or improper procedure.

Learn more about the appeals process: https://www.mass.gov/how-to/appeal-an-auto-insurance-cancellation

Massachusetts General Laws on Cancellation Appeals: https://malegislature.gov/Laws/GeneralLaws/PartI/TitleXXII/Chapter175/Section113d

What to Do If You Can’t Afford Your Car Insurance

If you’re struggling to afford your car insurance, don’t let the policy lapse. A cancellation creates a much bigger problem. Instead, be proactive and explore ways to lower your costs while staying legally insured.

Review and Adjust Your Coverage

- Increase your deductible: Raising your deductible (e.g., from $500 to $1,000) is one of the fastest ways to lower your premium. Ensure you can afford the higher out-of-pocket cost in case of a claim.

- Lower coverage limits: You can reduce your liability limits, but be sure to stay above Massachusetts’ legal minimums. Lower limits offer less financial protection in a major accident.

- Remove optional coverages: For older, less valuable cars, removing collision or comprehensive coverage might be cost-effective. You would be responsible for repair or replacement costs from damage or theft.

Seek Out Discounts and Compare Rates

- Ask about discounts: Inquire about all available discounts, such as those for low mileage, good students, bundling auto with home or renters insurance, or completing a defensive driving course.

- Shop around: Rates for the same coverage can vary significantly between insurers. An independent agent can compare quotes from multiple carriers to find you the best price.

Being proactive about affordability is always better than facing the consequences of a cancellation.

Why is car insurance so expensive in Massachusetts? https://stantonins.com/why-is-car-insurance-so-expensive-in-massachusetts/

Frequently Asked Questions about Massachusetts Car Insurance Cancellation

Here are answers to common questions about car insurance cancellation in Massachusetts.

How long does a car insurance cancellation stay on your record in Massachusetts?

A canceled insurance policy typically stays on your driving and insurance history record for three to five years. During this period, insurers will view you as a higher risk, which will likely result in higher premiums. After this time, the impact on your rates will diminish.

Can I just cancel my registration if I’m not driving my car?

Yes, but you must cancel your registration first. To legally cancel your insurance for a car you aren’t driving, you must first cancel the vehicle’s registration with the Massachusetts RMV. This involves returning the license plates. Once the registration is cancelled, you can then cancel the insurance policy without penalty. Cancelling insurance while the car is still registered will lead to fines.

What is the Massachusetts Automobile Insurance Plan (MAIP)?

The Massachusetts Automobile Insurance Plan (MAIP) is the state’s assigned-risk pool, serving as an insurer of last resort. If you are unable to find coverage in the standard market due to being a high-risk driver, the MAIP will assign you to an insurance company that is required to offer you a policy. This guarantees you can get the legally required coverage, but the premiums are typically much higher than standard policies.

Don’t Steer a Cancellation Alone

Facing a car insurance cancellation in Massachusetts is a serious matter with significant legal and financial consequences. The key to minimizing the damage is to act immediately. Every day you wait increases your legal risk and makes it harder to get back on the road.

Navigating the insurance market after a cancellation can be challenging. As an independent insurance agency, we have experience helping high-risk drivers. We work with multiple carriers and know how to find coverage for drivers with cancellations on their record.

Don’t let a cancellation derail your life. Our team at Stanton Insurance Agency understands that life happens. We can help you explore your options and find the right coverage to get you back on the road safely and legally. What matters now is taking the right steps to protect yourself, your assets, and your driving privileges.

Contact us today to learn more about our Massachusetts car insurance solutions: https://stantonins.com/massachusetts-car-insurance/