Unstacked Uninsured Motorist Coverage: 1 Crucial Choice

Why Understanding Unstacked Coverage Matters

Unstacked uninsured motorist coverage provides a single coverage limit that applies to each accident, regardless of how many vehicles you own. Unlike stacked coverage, unstacked limits cannot be combined across multiple vehicles on your policy.

Key Features of Unstacked UM Coverage:

- Single limit per accident – Your coverage amount stays the same whether you own one car or five.

- Lower premiums – Costs less than stacked coverage since the insurance company’s risk is limited.

- Standard option – The default choice in many states, including Massachusetts.

- Per-vehicle basis – Coverage applies only to the specific vehicle involved in the accident.

While Massachusetts (3.5%) and New Hampshire (6.1%) have some of the lowest rates of uninsured drivers in the nation, choosing the right uninsured motorist coverage is critical for your financial protection. When an uninsured driver causes an accident, your UM coverage pays for medical bills and lost wages, but the amount you receive depends on whether you chose stacked or unstacked limits.

The decision between stacked and unstacked coverage can mean the difference between adequate protection and facing thousands in out-of-pocket expenses after a serious accident.

I’m Geoff Stanton, President of Stanton Insurance in Waltham, Massachusetts. For over two decades, I’ve helped families understand the trade-offs between cost and protection for unstacked uninsured motorist coverage, ensuring they make the right choice for their financial security.

Essential unstacked uninsured motorist coverage terms:

Understanding Uninsured Motorist Coverage and Stacking

Imagine you’re in a car crash caused by a driver who has no insurance. This difficult scenario is precisely why Uninsured Motorist coverage exists.

Uninsured Motorist (UM) coverage is your financial lifeline when you’re hit by a driver with no auto insurance. It also applies to hit-and-run accidents.

Underinsured Motorist (UIM) coverage handles cases where the at-fault driver has insurance, but their coverage is too low to cover your damages. If they carry the state minimum of $20,000 but your hospital bills are $40,000, UIM steps in to cover the gap.

Both types of coverage protect you in two key ways. Bodily Injury coverage takes care of medical bills, lost wages, and pain and suffering for you and your passengers. This is the part that can often be “stacked.” Property Damage coverage might help repair your vehicle, though stacking usually doesn’t apply here.

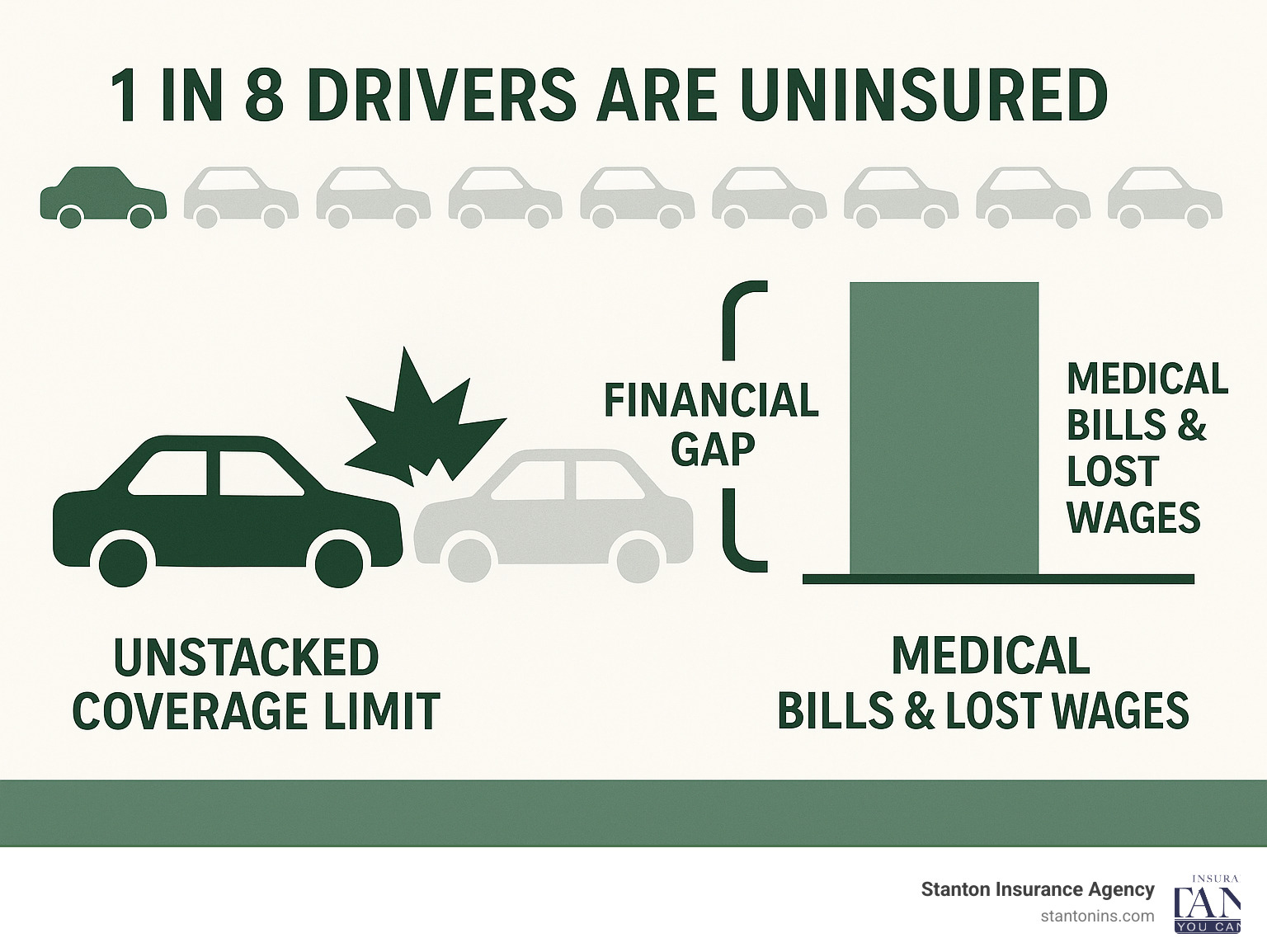

Understanding what is Uninsured Motorist Coverage? is crucial when you realize that, according to the Insurance Research Council, about 1 in 8 drivers are uninsured.

This is where “stacking” comes in. Stacking combines policy limits from multiple vehicles to create a larger safety net. Unstacked coverage is the opposite—your limits are fixed per accident, no matter how many cars you own.

What is Unstacked Car Insurance?

Unstacked car insurance is the standard option in many states, including Massachusetts. It’s a straightforward policy where your coverage limit is a fixed amount per accident.

With unstacked uninsured motorist coverage, if you have $50,000 per person and $100,000 per accident in UM coverage, your insurance will pay a maximum of $50,000 for one person’s injuries and no more than $100,000 total for everyone hurt in that accident.

Crucially, these limits stay the same whether you have one car or five on your policy. Insuring three vehicles doesn’t triple your coverage; it operates on a per-accident basis without combining limits.

For single-vehicle owners, unstacked is the only option, as there’s nothing to stack it with. It meets state requirements while keeping premiums manageable.

What is Stacked Car Insurance?

Stacked car insurance lets you combine your uninsured and underinsured motorist bodily injury limits, multiplying your protection.

If you have multiple vehicles on one policy, you can multiply your UM/UIM limits by the number of cars. Two cars with $50,000 UM coverage each could be stacked for $100,000 in total protection. You might also stack coverage across separate policies you own.

The benefit of stacked coverage is most apparent with serious injuries and large medical bills. Higher potential payouts provide better protection against the financial devastation of a major accident, safeguarding your family’s financial security.

This increased protection comes with higher premiums, but for many families with multiple vehicles, the extra peace of mind is worth the cost.

Stacked vs. Unstacked UM Coverage: A Detailed Comparison

Weighing stacked versus unstacked uninsured motorist coverage requires understanding key differences that can save you money and future heartache. Let’s break down what matters.

According to the Insurance Research Council, the rate of uninsured drivers is much lower in our area than the national average. Massachusetts has the nation’s lowest rate at 3.5%, while New Hampshire’s is 6.1%. Despite these low numbers, the risk of a costly accident with an uninsured driver makes your coverage choice critical for financial protection.

Unstacked coverage provides a single, fixed limit per accident, such as $50,000 per person and $100,000 per accident. This limit applies whether you own one car or five, keeping your premiums lower.

Stacked coverage multiplies your protection by the number of vehicles you insure. With two cars and $50,000/$100,000 limits, stacking would give you $100,000 per person and $200,000 per accident, offering a larger financial cushion.

Cost Comparison

Unstacked uninsured motorist coverage costs less because the insurance company’s risk is capped at a single policy limit, regardless of how many cars you drive.

Stacked coverage has higher premiums because you are buying more potential protection. The question is whether the extra cost is worth the significantly higher protection if an accident occurs.

For drivers in our area, it’s smart to compare Auto Insurance Rates in Massachusetts and Auto Insurance Rates in New Hampshire to see how these choices affect your budget.

Coverage for Bodily Injury vs. Property Damage

An important distinction is that stacking typically applies only to the bodily injury portion of your uninsured motorist coverage. It boosts protection for medical bills, lost wages, and pain and suffering, but not for vehicle repairs.

To fix your car after an uninsured driver hits you, you’ll rely on your collision coverage or Uninsured Motorist Property Damage (UMPD) coverage, if available. These property damage limits usually cannot be stacked.

Understanding Bodily Injury Liability helps clarify how these coverages work together. This distinction matters because serious accidents involve both medical expenses and vehicle damage. Ensuring adequate coverage for both—through the right mix of UM/UIM bodily injury limits and collision coverage—provides comprehensive protection.

The Pros and Cons of Unstacked Uninsured Motorist Coverage

Choosing unstacked uninsured motorist coverage involves trade-offs between immediate savings and long-term financial risk. Let’s review both sides to help you make an informed choice.

Advantages of Unstacked Coverage

The primary advantage of unstacked coverage is cost savings. Because the insurer’s maximum payout is capped at your policy limit, they pass those savings to you through lower premiums.

For families on a budget, this can make a real difference. The savings can go toward other priorities, like an emergency fund or more breathing room in your monthly budget.

For single-vehicle owners, unstacked coverage is the only option, as there is nothing to “stack.” You get the benefit of lower premiums without giving up any potential coverage.

Another plus is meeting state requirements. In Massachusetts, unstacked coverage satisfies the legal minimums for uninsured motorist protection, keeping you compliant while managing costs.

Disadvantages of Unstacked Coverage

The savings from unstacked uninsured motorist coverage come with significant limitations.

Lower protection limits are the main concern. With two cars on your policy, each with $50,000 in UM coverage, stacking provides $100,000 for a serious accident. With unstacked, you’re still capped at $50,000.

This creates potential for high out-of-pocket costs. If you’re badly injured by an uninsured driver and your medical bills hit $120,000, an unstacked $50,000 policy leaves you responsible for the $70,000 gap.

Unstacked coverage often falls short with severe injuries. A serious accident can generate hundreds of thousands in medical costs and lost wages, far exceeding a fixed limit.

The financial vulnerability is real. Unstacked coverage shifts risk to you. In a worst-case scenario, your savings, home equity, or future earnings could be at stake to cover costs beyond your policy limit. Unstacked coverage is like a small umbrella: fine for a drizzle, but insufficient in a downpour.

Making Your Choice: Policy and Accident Scenarios

Understanding how unstacked uninsured motorist coverage works in real-life scenarios is key to making the right decision. Let’s explore how the coverage applies and when it might be the right choice for you.

How Does Unstacked Uninsured Motorist Coverage Work in an Accident?

Imagine another driver runs a red light and hits your car, but they don’t have insurance. This is when your Uninsured Motorist coverage becomes your financial lifeline.

With unstacked uninsured motorist coverage, your policy limit is your maximum payout. It doesn’t matter if you have one car or five on your policy—that single limit is what you get.

For example, with $50,000 in unstacked UM coverage, if your total damages are $55,000, your policy would pay its $50,000 maximum. You would be responsible for the remaining $5,000.

If your injuries were more severe, with expenses reaching $150,000, your unstacked policy would still only pay $50,000. This would leave a $100,000 gap for you to cover, highlighting Why Auto Insurance is Important for protecting your financial future.

When is Unstacked Uninsured Motorist Coverage a Good Choice?

Despite its limitations, unstacked uninsured motorist coverage can be a smart choice for many drivers, depending on their circumstances and risk tolerance.

- Single-car households: The decision is made for you. You can’t stack coverage with only one vehicle.

- Drivers with excellent health insurance: If you have comprehensive health coverage, it can act as your primary safety net for medical bills, with UM coverage as a backup.

- Budget-conscious consumers: Unstacked coverage keeps premiums manageable. Some UM protection is better than none, but it’s key to understand the limitations.

- Low-risk drivers: Those who drive infrequently or in low-traffic areas may feel comfortable with unstacked limits.

It’s about understanding the trade-offs. Unstacked coverage is best for those who accept a fixed payout limit for lower premiums.

Can You Switch Between Stacked and Unstacked Coverage?

Your insurance can change as your needs do. In most states where both options are available, you can switch between stacked and unstacked uninsured motorist coverage.

The easiest time to switch is during your policy renewal period. However, mid-term policy changes are often possible. Contact your agent to discuss your options.

In some states, choosing to unstack coverage requires signing written rejection forms. This ensures you understand you are opting out of broader protection.

Contacting your insurance agent is the best first step. We can explain how changes affect your premiums and protection, helping you make the right choice. Understanding Auto Insurance Coverage is easier with an experienced agent’s guidance.

Stacking Laws in Massachusetts and New Hampshire

Your options for unstacked uninsured motorist coverage depend on state rules. As we serve both Massachusetts and New Hampshire, it’s important to understand their different approaches to stacking. Crossing the state line can dramatically change your insurance options. Let’s break down what this means for your coverage.

Massachusetts Stacking Rules

Massachusetts is an anti-stacking state, meaning the law generally prohibits combining Uninsured and Underinsured Motorist bodily injury limits, even with multiple vehicles on your policy.

When you choose unstacked uninsured motorist coverage in Massachusetts, it’s typically your only option. If you have three cars with $50,000 UM/UIM limits each, your maximum payout remains $50,000 per accident.

While rare and complex exceptions exist, unstacked is the default and the reality for most Massachusetts drivers. This makes your initial choice of coverage limits even more important, as you cannot boost them through stacking. Understanding Massachusetts Auto Insurance Requirements is crucial, as the UM/UIM limit you select is what you’ll receive.

New Hampshire Stacking Rules

In New Hampshire, the rules are different. The state gives you the freedom to choose whether to stack your Uninsured and Underinsured Motorist coverage.

This flexibility can significantly increase your protection. If you have two vehicles with $50,000 UM/UIM limits each, you can stack them for a combined $100,000 in coverage.

New Hampshire allows both vertical stacking (combining limits on the same policy) and potentially horizontal stacking (combining limits from different policies). This gives you real choices about your protection level.

Of course, greater protection comes with higher premiums. However, many New Hampshire families find the extra cost worthwhile. When reviewing your New Hampshire Auto Insurance Requirements, the stacking decision is one of the most important choices you’ll make.

Frequently Asked Questions about Unstacked UM Coverage

Here are answers to the most common questions we hear about unstacked uninsured motorist coverage from families in Massachusetts and New Hampshire.

What is the main difference between stacked and unstacked car insurance?

The primary difference is how coverage limits are applied. Unstacked uninsured motorist coverage provides a single, fixed coverage limit per accident, regardless of how many vehicles you own. Stacked insurance allows you to combine, or “stack,” the Uninsured/Underinsured Motorist (UM/UIM) Bodily Injury limits for each vehicle on your policy, creating a much higher total coverage amount.

Is unstacked insurance cheaper than stacked insurance?

Yes, unstacked uninsured motorist coverage is cheaper. Because the insurance company’s maximum potential payout is lower with an unstacked policy, the premium is less expensive. From the insurer’s perspective, a lower maximum payout means less risk, which translates to lower premiums for you. The exact savings vary, but the difference is often noticeable.

Do I need stacked insurance if I only have one car?

If you only have one car, you cannot stack coverage, as there is no other vehicle’s limit to combine. Your policy is automatically unstacked. Unstacked uninsured motorist coverage is the only option and makes the most sense for single-car households. The real decision is simply choosing the right coverage amount, not whether to stack it.

Conclusion

Choosing the right unstacked uninsured motorist coverage should be straightforward. At Stanton Insurance Agency, we aim for clarity in all insurance decisions.

The decision comes down to balancing affordability with protection. With unstacked coverage, you get lower premiums but accept a fixed payout limit if an uninsured driver hits you. Stacked coverage costs more but offers potentially higher payouts, acting as a larger financial safety net.

Your personal situation is key. Unstacked may work if you have excellent health insurance or own a single car. If you have multiple vehicles and want maximum protection, the extra cost of stacked coverage might be worth it.

Where you live also makes a huge difference. In Massachusetts, unstacked uninsured motorist coverage is the default, while New Hampshire offers the flexibility to choose stacking.

The most important thing is making a choice that helps you sleep well at night. Whether that means saving money with unstacked coverage or investing in extra protection with stacked coverage, we’re here to help you understand what you’re getting.

With some of the nation’s lowest rates of uninsured drivers in Massachusetts and New Hampshire, it can be tempting to overlook this coverage. However, having uninsured motorist protection is essential for your family’s financial future.

Ready to find the coverage that fits your life? Get a personalized car insurance quote today and let’s work together to give you the peace of mind you deserve.