Why Uninsured Motorist Coverage Is Essential Protection

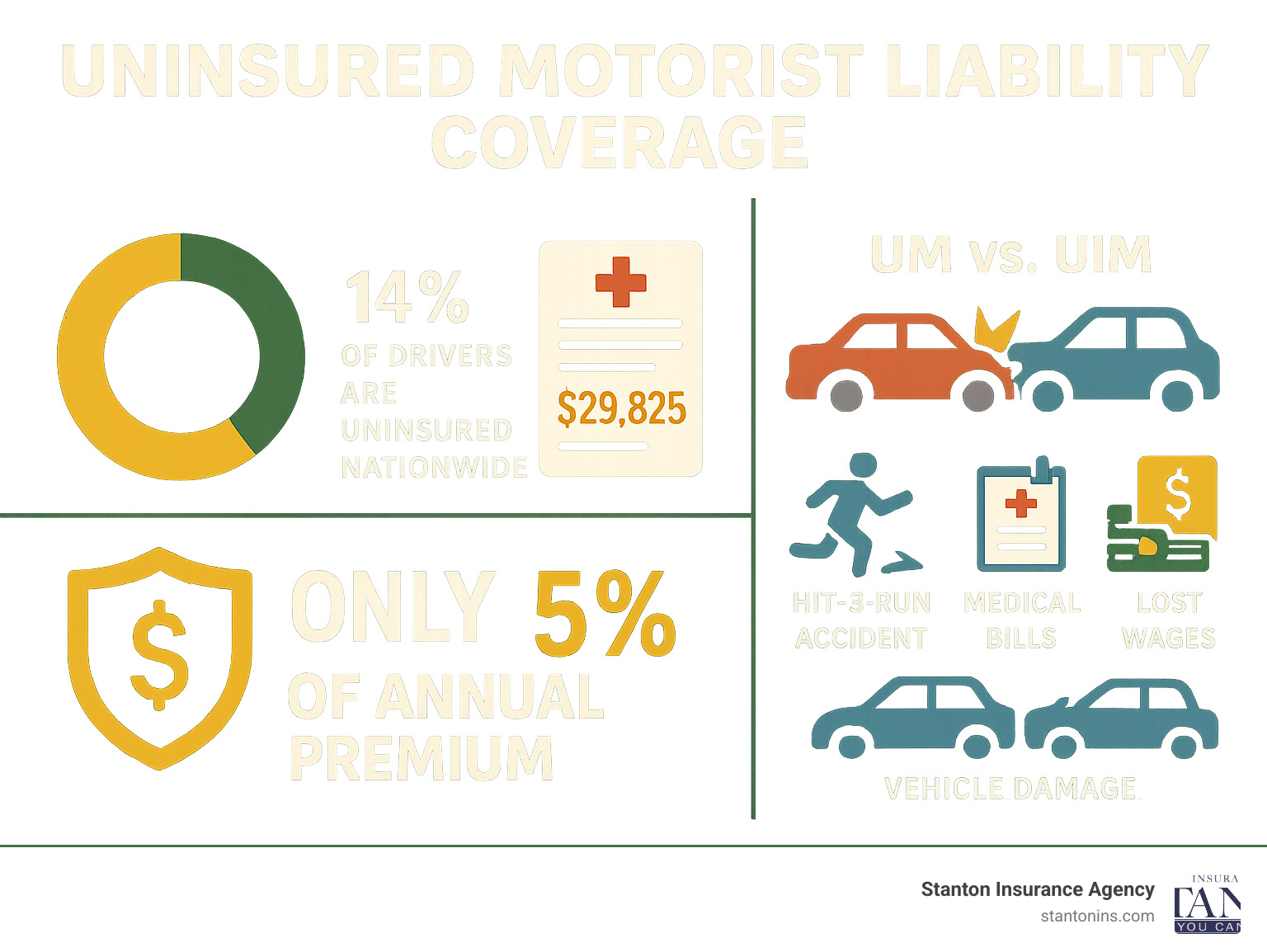

Uninsured motorist liability coverage protects you when the at-fault driver has no insurance or insufficient coverage to pay for your damages. Here’s what you need to know:

- Uninsured Motorist (UM): Covers you when hit by a driver with no insurance or in hit-and-run accidents

- Underinsured Motorist (UIM): Covers the gap when the at-fault driver’s insurance isn’t enough

- Who’s covered: You, your family, passengers, and even as pedestrians

- What’s covered: Medical bills, lost wages, pain and suffering, and sometimes vehicle damage

- Cost: Typically only 5% of your annual auto insurance premium

Picture this scenario: You’re rear-ended by a driver who flees the scene, leaving you with a totaled car and mounting medical bills. Without uninsured motorist coverage, you’d be responsible for these costs out-of-pocket. This situation isn’t rare—while the national average of uninsured drivers is an alarming 14%, the risk is still significant in our local area. In Massachusetts, about 1 in 16 drivers is uninsured, and in New Hampshire, it’s nearly 1 in 10, according to the most recent data from the Insurance Information Institute.

The financial impact can be devastating. The average claim payment for uninsured motorist injuries is $29,825, but serious accidents can result in costs far exceeding this amount. When you consider that thousands of drivers on local roads lack proper insurance, this coverage becomes not just smart—it’s essential.

I’m Geoff Stanton, President of Stanton Insurance Agency, and I’ve spent over two decades helping families protect themselves from exactly these situations. Through my experience in claims and as a Certified Insurance Counselor, I’ve seen how uninsured motorist liability coverage can mean the difference between financial recovery and devastating debt after an accident.

Easy uninsured motorist liability coverage glossary:

What Are Uninsured & Underinsured Motorist Coverages?

Think of uninsured motorist liability coverage as your backup plan when someone else’s plan falls through completely. When an at-fault driver doesn’t have the insurance they should have carried, this coverage steps in to fill that gap.

While insurance companies often bundle them together, Uninsured Motorist (UM) and Underinsured Motorist (UIM) coverages tackle two different—but equally frustrating—scenarios. Getting clear on the difference is your first step toward rock-solid protection.

Defining Uninsured vs. Underinsured Motorist Coverage

Uninsured Motorist (UM) coverage becomes your lifeline when you’re hit by a driver who has zero liability insurance. This also kicks in for those maddening hit-and-run accidents where the guilty driver vanishes into thin air. Without this coverage, you’d be stuck paying your own medical bills and repair costs—not exactly fair when you weren’t even at fault.

Underinsured Motorist (UIM) coverage handles a different headache. This applies when the at-fault driver does have insurance, but their coverage limits are laughably low compared to your actual expenses. Picture this: your medical bills hit $75,000, but the driver who rear-ended you only carries the bare-bones state minimum of $25,000. Your UIM coverage steps up to help cover that painful $50,000 gap.

Who and What Is Covered?

Here’s the good news—UM/UIM coverage casts a wide protective net over you and your loved ones. You as the policyholder are covered, naturally. But it also extends to your family members living under your roof, any passengers riding in your insured vehicle when the accident happens, and even you and your family when you’re on foot or cycling and get struck by an uninsured or underinsured driver.

The coverage itself typically splits into two essential parts. Uninsured/Underinsured Motorist Bodily Injury (UMBI/UIMBI) takes care of your medical expenses, replaces lost wages, and provides compensation for pain and suffering. Uninsured Motorist Property Damage (UMPD) handles repairs to your vehicle, though this isn’t available in every state and might come with a deductible.

The Consequences for Driving Uninsured

You might wonder why this coverage is so crucial in the first place. Well, drivers who hit the road without insurance face some pretty serious consequences. We’re talking hefty fines, suspended licenses, impounded vehicles, and in extreme cases, even jail time.

In Massachusetts, driving without insurance can slam you with fines, license suspension, and vehicle registration revocation. New Hampshire takes a different approach—while they don’t require insurance, if you choose to skip it, you’re personally on the hook for any damages you cause in an accident.

But here’s the kicker: despite these tough penalties, millions of drivers still roll the dice without coverage. While Massachusetts (6.2%) and New Hampshire (9.3%) have some of the country’s lowest uninsured driver rates, that still means thousands of drivers on local roads are operating without insurance. These rates are far better than states like Mississippi (22.2%) or the national average of 14%, but the risk of an accident with an uninsured driver remains a daily reality.

That’s exactly why having uninsured motorist liability coverage isn’t just smart—it’s essential protection for anyone who follows the rules and wants to stay financially secure on the road.

How Uninsured Motorist Liability Coverage Protects You

When you’re cruising down the highway and suddenly find yourself in an accident, uninsured motorist liability coverage becomes your financial lifeline. This coverage is your first line of defense in those frustrating scenarios where someone else’s poor choices threaten to derail your finances. It ensures that an irresponsible driver doesn’t leave you with a mountain of debt.

Let’s walk through how this protection actually works in the real world, because understanding the mechanics can make all the difference when you need it most.

Accidents with Uninsured, Underinsured, and Hit-and-Run Drivers

The beauty of uninsured motorist liability coverage is how it adapts to different nightmare scenarios. When you’re dealing with an identified uninsured driver who hits you, the process is relatively straightforward. You file a claim with your own insurance company under your UM coverage, and they step up to pay for your covered damages up to your policy limits. Your insurer might then try to recover those costs from the at-fault driver through a process called subrogation – essentially, they become the bill collector so you don’t have to.

Underinsured drivers present a slightly different challenge. Here’s where the two-step dance begins: you first collect from the at-fault driver’s insurance up to their measly policy limit. When your damages exceed that amount (and trust me, they often do), you can file a claim under your UIM coverage for the remaining balance. This ensures you’re not left holding the bag just because someone else decided to go bargain hunting with their insurance coverage.

Hit-and-run accidents are perhaps the most maddening situation of all. When a driver hits you and vanishes into the night, they’re treated as an uninsured motorist under your policy. Your UM coverage kicks in to cover your bodily injuries, and in some states, your vehicle damage through UMPD coverage. It’s your insurance company’s way of saying, “We’ve got your back when others don’t.”

What is the difference between uninsured motorist property damage (UMPD) and collision coverage?

Here’s where things get interesting, and where the rules differ significantly between Massachusetts and New Hampshire. UMPD and collision insurance are two different tools for repairing your car after an accident with an uninsured driver.

In Massachusetts, Uninsured Motorist Property Damage (UMPD) is not available. Instead, your Collision coverage is what pays for damage to your car caused by an uninsured or hit-and-run driver. If you decline collision coverage in Massachusetts, you have no way to claim vehicle damage through your own policy in these situations, leaving you to pay for repairs out-of-pocket.

In New Hampshire, you have the option to purchase UMPD. This coverage specifically handles repairs to your car if it’s damaged by an identified, uninsured driver. It often comes with a lower deductible than collision coverage, making it a valuable and targeted protection. Collision coverage in New Hampshire works as an all-purpose solution, covering damage from any collision, regardless of fault.

The right strategy depends on your state. For Massachusetts drivers, having Collision coverage is essential for this type of protection. For New Hampshire drivers, a combination of UMPD and Collision offers the most comprehensive protection. For a deeper dive, check out our guide: Uninsured Motorist Coverage vs. Collision.

How UM/UIM Interacts with Your Health Insurance

Now, let’s talk about something that surprises many people: health insurance and UMBI coverage aren’t competitors – they’re teammates. While your health insurance is absolutely vital, it shouldn’t be seen as a replacement for UMBI coverage.

Your health insurance handles the obvious stuff – medical bills and treatments. But UMBI steps up to cover the gaps that health insurance simply won’t touch. Lost wages when you can’t work? That’s UMBI territory. Pain and suffering compensation? Health insurance doesn’t even pretend to cover that. Medical costs for passengers who might not have their own health coverage? Again, that’s where UMBI shines.

Don’t forget about those annoying deductibles and co-pays from your health plan – UMBI can help with those too. It’s like having a financial safety net beneath your safety net, ensuring you get the most complete recovery possible after an accident.

The bottom line? These coverages work best when they work together, each filling in where the other leaves off.

UM/UIM Requirements and Recommended Limits

Insurance laws vary significantly by state, and it’s crucial to know the rules where you live. While some states mandate UM/UIM coverage, others make it optional. However, even where it’s optional, the risk of encountering an uninsured driver makes it a highly recommended purchase. It’s a small price to pay for significant peace of mind.

Think of it this way: you wouldn’t leave your house open uped in a neighborhood where break-ins happen, right? Well, with roughly one in seven drivers lacking proper insurance, uninsured motorist liability coverage is like having a really good security system for your financial well-being. For a broader understanding of auto insurance, check out what you need to know about auto insurance.

Uninsured Motorist Coverage in Massachusetts and New Hampshire

Your location dictates the minimum requirements for car insurance. We’re proud to serve drivers in both Massachusetts and New Hampshire, and here’s how the requirements break down in our local areas:

Massachusetts takes a protective approach to its drivers. Uninsured Motorist (UM) coverage is mandatory here, which honestly makes a lot of sense given the traffic density and accident rates. The state requires minimum limits of $20,000 per person and $40,000 per accident for bodily injury. Underinsured Motorist (UIM) coverage is optional but highly recommended – think of it as the smart upgrade that most people wish they’d gotten after they need it.

Given Massachusetts’ commitment to protecting its drivers, we strongly advise considering higher limits than the minimums. You can learn more about what is the minimum car insurance coverage in Massachusetts?. You can also find more details on Massachusetts’ insurance requirements from official sources like Mass.gov.

New Hampshire marches to the beat of its own drum – it’s unique in that it doesn’t mandate that drivers carry auto insurance at all. “Live Free or Die” extends to insurance requirements, apparently! However, if you do purchase an auto policy (which we strongly recommend), you must include Uninsured Motorist coverage with minimums of $25,000 per person and $50,000 per accident. This means if you opt for coverage, you’re automatically getting this crucial protection built right in.

Get the full details on auto insurance requirements in New Hampshire. You can also review New Hampshire’s specific statutes on Justia Law: New Hampshire Revised Statutes Section 264:15.

How much uninsured motorist liability coverage should I get?

Here’s the honest truth: the minimum required limits are often insufficient to cover serious injuries. Imagine an accident where medical bills skyrocket beyond $20,000 or $25,000 – it happens more often than you think! A simple broken bone can easily cost $15,000 to $20,000, and that’s before we even talk about physical therapy, lost wages, or more serious injuries.

A good rule of thumb is to purchase UM/UIM limits that are equal to your own bodily injury liability limits. If you have determined that you need $100,000/$300,000 in liability car insurance coverage to protect your own assets in case you cause an accident, it makes sense to have the same amount of protection for yourself if you’re hit by someone without adequate insurance.

This ensures you and your family are protected to the same level you protect others. It’s about ensuring your financial safety net is as strong for yourself as it is for others. Think of it as the Golden Rule of insurance – protect yourself as well as you’d protect someone else. While affordability is often a concern, liability car insurance cost is an investment in your security that typically adds only a small amount to your premium for significantly more peace of mind.

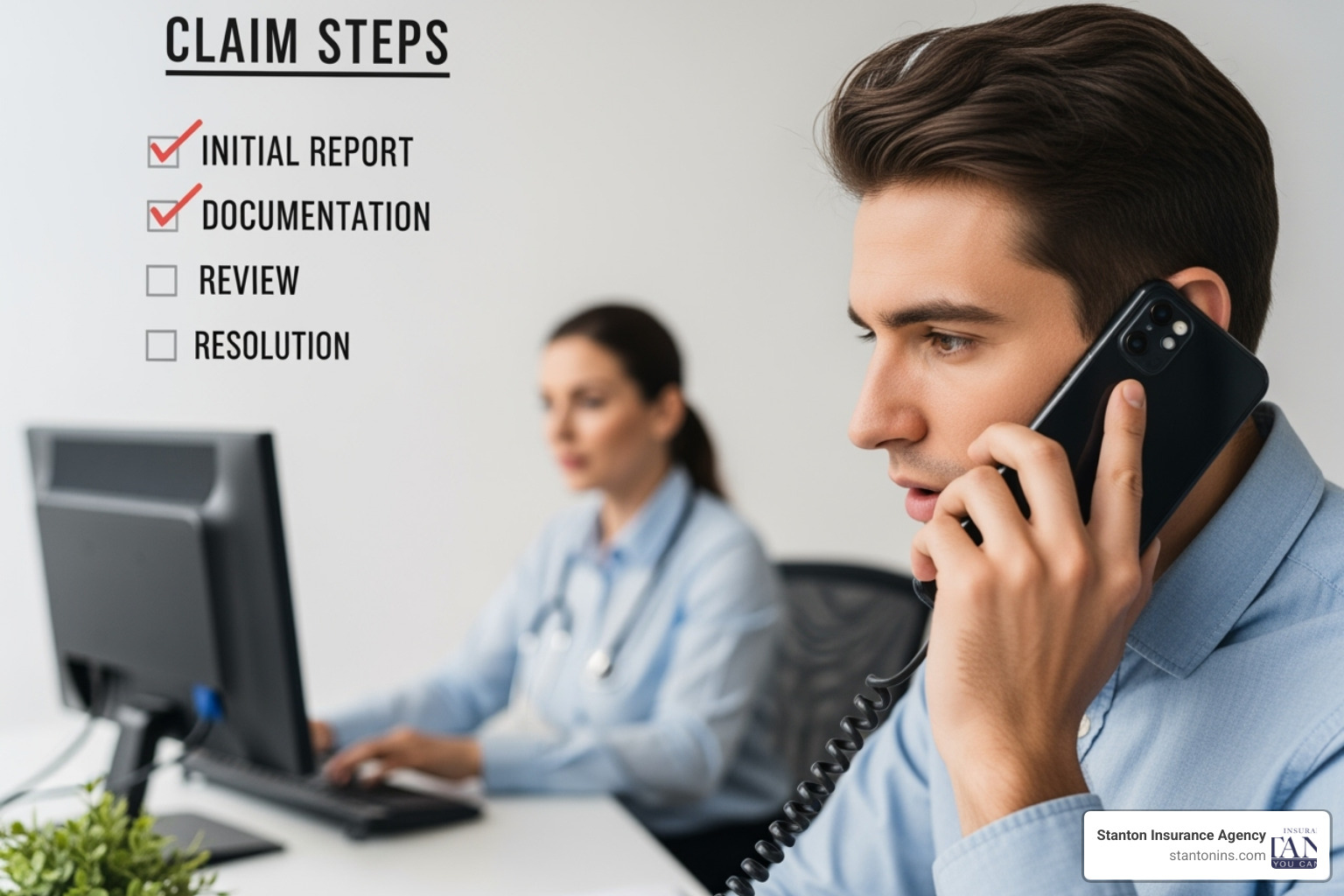

The Uninsured Motorist Claim Process

Nobody plans for an accident, but knowing what to do when you’re hit by an uninsured driver or become the victim of a hit-and-run can make all the difference. The uninsured motorist liability coverage claim process has some unique steps that differ from typical accident claims, but don’t worry—we’ll walk you through everything you need to know.

Steps to Take Immediately After the Accident

When you’re dealing with the shock and stress of an accident, having a clear action plan helps tremendously. Your safety comes first—if you can move your vehicle safely out of traffic, do so immediately. Check yourself and any passengers for injuries, even minor ones that might not be immediately obvious.

Always call the police, especially when dealing with an uninsured driver or hit-and-run situation. Some people might tell you a police report isn’t necessary for minor accidents, but when it comes to uninsured motorist claims, that report becomes your best friend. It provides official documentation of what happened and can be crucial evidence for your insurance company.

While you’re waiting for the police, become a detective. Take photos of everything—the accident scene, all vehicle damage, license plates, street signs, and any visible injuries. If the other driver is present but admits they don’t have insurance, still gather their name, contact information, and license plate number. You’d be surprised how often people aren’t completely honest about their insurance status in the heat of the moment.

Don’t forget about witnesses. In hit-and-run cases especially, witness testimony can make or break your claim. Get their names and phone numbers—most people are happy to help when they see an injustice has occurred.

Filing Your UM/UIM Claim

Here’s where things get a bit different from standard accident claims. Time is absolutely critical when filing an uninsured motorist claim. Many insurance policies require you to report hit-and-run accidents within 24 hours—not 24 business hours, but actual hours. It might seem harsh, but these strict timelines exist to prevent fraud and ensure accurate reporting.

When you call your insurance company, be prepared with all the documentation you’ve gathered. The police report number, photos, witness contact information, and any medical documentation should all be ready to share. Your insurance company becomes your advocate in these situations, which is a nice change from typical at-fault accident scenarios where you’re dealing with the other driver’s insurance company.

Your adjuster will need to verify that the other driver was indeed uninsured or, in hit-and-run cases, that the incident actually occurred as you described. This investigation process protects everyone and ensures that legitimate claims are paid promptly. We work with you every step of the way to make this process as smooth as possible—you’re dealing with enough stress already.

One important consideration: if multiple people in your vehicle were injured, your policy’s “per accident” limit represents the total amount available to cover everyone’s damages. If your injuries and damages exceed that limit, the payment will be distributed proportionally among all injured parties. This is why choosing adequate coverage limits upfront is so important—it ensures everyone gets the protection they need when it matters most.

Frequently Asked Questions about Uninsured Motorist Liability Coverage

Let’s be honest – insurance can feel complicated, and uninsured motorist liability coverage often raises questions. After helping thousands of families steer these waters, I’ve heard just about every concern you might have. Here are the answers to the most common questions that come up in our conversations.

Does an uninsured motorist claim make my rates go up?

Here’s some good news: in most cases, filing a UM/UIM claim won’t bump up your premiums. Think about it this way – you’re not at fault for getting hit by someone who chose to drive without proper insurance. You’re simply using the protection you’ve been paying for all along.

You shouldn’t be penalized for someone else’s poor choices. That said, every insurance company has its own policies, and state laws can vary. At Stanton Insurance Agency, we believe in complete transparency. We’ll always explain exactly how any claim might affect your specific situation before you file it. No surprises, no fine print gotchas.

Is there a deductible for uninsured motorist claims?

This depends on the type of damage and your state. For Uninsured Motorist Bodily Injury (UMBI), the good news is there is no deductible in either Massachusetts or New Hampshire. Your coverage for medical bills, lost wages, and pain and suffering begins from the first dollar, up to your policy limits.

For vehicle damage, the rules are different:

- In Massachusetts, where Uninsured Motorist Property Damage (UMPD) is not offered, you must use your Collision coverage. You will have to pay your collision deductible, though your insurance company may try to recover it from the at-fault driver if they are identified.

- In New Hampshire, you can purchase UMPD, which typically has a small deductible (e.g., $100) that is often lower than a collision deductible.

What’s the difference between UM/UIM and Personal Injury Protection (PIP)?

If you live in Massachusetts, you’re familiar with PIP – it’s required by law. Personal Injury Protection is like your insurance’s emergency response team. It jumps into action immediately after any accident, regardless of who caused it, covering your medical bills and lost wages without asking questions about fault.

UM/UIM coverage is more like a detective and advocate rolled into one. It only kicks in when we can establish that an uninsured or underinsured driver caused your accident. While PIP gets you immediate help, UM/UIM provides additional coverage that can extend beyond PIP limits and cover things like pain and suffering that PIP doesn’t address.

Think of them as a tag team working for your protection. PIP handles the immediate crisis, then UM/UIM steps in to ensure you’re fully covered when the dust settles. Together, they create a comprehensive safety net that protects both your immediate needs and your long-term financial recovery.

Secure Your Peace of Mind on the Road

Picture yourself driving home after a long day, when suddenly—crash—someone rear-ends you and speeds away. Your heart pounds as you realize you’re dealing with a hit-and-run driver who may never be found. This nightmare scenario becomes manageable when you have uninsured motorist liability coverage protecting you.

Navigating the aftermath of a car accident is stressful enough without wondering how you’ll pay for thousands of dollars in medical bills and car repairs. This coverage acts as your financial safety net, ensuring that someone else’s irresponsible decision doesn’t derail your family’s financial stability.

Think about it this way: you wouldn’t leave your house open uped or skip health insurance for your family. Uninsured motorist liability coverage provides that same essential protection for your financial well-being on the road. For just a few dollars more per month—typically around 5% of your total premium—you’re protecting yourself from potentially devastating costs that could reach tens of thousands of dollars.

The peace of mind this coverage provides is invaluable. You can drive knowing that if the worst happens, you won’t be left scrambling to figure out how to pay for medical treatments, lost wages, or vehicle repairs. Your coverage steps in immediately, handling the financial burden so you can focus on what matters most—your recovery and your family’s well-being.

At Stanton Insurance Agency, we’ve seen how uninsured motorist liability coverage transforms a potential financial disaster into a manageable situation. Our experienced agents understand the unique risks drivers face in Massachusetts and New Hampshire, and we’re committed to helping you build comprehensive protection that fits your budget and lifestyle.

We believe in providing trusted protection for the things you value most. Our team can review your current policy and ensure you have adequate coverage limits that truly protect your family’s financial future. Don’t leave your security to chance—let us help you create a safety net that works.

Ready to secure your peace of mind? Contact us today to explore our car insurance options and get a personalized quote that includes the right amount of uninsured motorist protection for your family. Because when it comes to protecting what matters most, you deserve coverage you can count on.