Why Finding the Best Car Insurance Price Matters More Than Ever

Find cheapest car insurance options by following these essential steps:

- Compare quotes from at least 3-5 different insurers – Rates can vary by hundreds of dollars annually for identical coverage

- Bundle your policies – Combine auto with home or renters insurance to save up to 25%

- Understand your coverage needs – Liability-only starts around $41/month nationally, while full coverage averages $143/month

- Maintain a clean driving record – A single speeding ticket can increase your premium by over 25%

- Ask about all available discounts – Safe driver, good student, low mileage, and vehicle safety features can significantly reduce costs

- Review your policy annually – Your needs and rates change, and loyalty doesn’t always pay

Car insurance costs have surged dramatically in recent years. According to the consumer price index, motor vehicle insurance costs have increased by approximately 52% between 2020 and 2024. For Massachusetts and New Hampshire drivers, this means the difference between a smart shopping strategy and simply renewing your current policy could mean saving over $1,100 annually.

The good news? You have more control over your car insurance costs than you might think. While factors like your age and location influence your rate, understanding how insurers calculate premiums and knowing where to look for savings can dramatically reduce what you pay.

I’m Geoff Stanton, President of Stanton Insurance Agency in Waltham, Massachusetts, and I’ve spent over two decades helping local families and individuals find cheapest car insurance options without sacrificing the protection they need. As an independent agent, I work with multiple carriers to ensure my clients get the best value for their specific situation.

Understanding Your Coverage: Liability vs. Full Coverage

Here’s the truth: before you can find cheapest car insurance, you need to know exactly what you’re shopping for. It’s like walking into a grocery store hungry without a list—you’ll either grab too much or miss what you actually need.

The choice between liability-only and full coverage isn’t just about price. It’s about matching your protection to your situation. Let’s break down what each option really means for your wallet and your peace of mind.

What is Liability-Only Insurance?

Liability-only insurance is the bare minimum required in most states, and yes, that includes New Hampshire. Think of it as the “cover the other guy” policy. If you cause an accident, it pays for the damage and injuries to others—but stops right there.

Bodily injury liability covers medical expenses, lost wages, and other costs for people you injure in an accident. Property damage liability takes care of repairs to other vehicles, fences, buildings, or anything else you might hit.

Here’s the catch: your own car? That’s on you. If you total your vehicle in an at-fault accident, liability coverage won’t pay a dime toward replacing it. Your medical bills? Also not covered under this basic plan.

This is why liability-only is the cheapest option—around $41 per month nationally. It meets state minimums and keeps you legal, but it leaves you financially exposed if your car needs repairs or replacement. For drivers with older vehicles worth less than a few thousand dollars, this trade-off might make sense. For everyone else, it’s worth thinking twice.

What is Full Coverage Insurance?

Despite what the name suggests, “full coverage” isn’t actually a single policy. It’s insurance industry shorthand for combining liability, collision, and comprehensive insurance into one protective package.

Collision coverage is your safety net when accidents happen. Whether you slide into a guardrail on an icy Massachusetts morning or get rear-ended at a stoplight, collision pays to repair or replace your vehicle—regardless of who’s at fault.

Comprehensive coverage protects you from everything else life throws at your car. A tree branch falls during a storm? Covered. Someone breaks your window to steal your laptop? Covered. A deer decides to test your reflexes on a New Hampshire back road? That’s covered too. Fire, theft, vandalism, hail damage—comprehensive handles the unexpected events that have nothing to do with driving.

If you’re financing or leasing your vehicle, your lender will require full coverage. They want to protect their investment, and honestly, you should too. Even if you own your car outright, full coverage makes sense for newer vehicles or any car you couldn’t afford to replace out of pocket.

Yes, full coverage costs more—averaging around $143 per month nationally. But here’s what I’ve seen in my 20 years at Stanton Insurance Agency: families who stuck with minimum coverage to save a few bucks often end up in serious financial trouble after one bad accident. The money you save each month can disappear in an instant when you’re facing a $15,000 repair bill.

Ready to explore your options? Learn more about your car insurance choices and what makes sense for your specific situation.

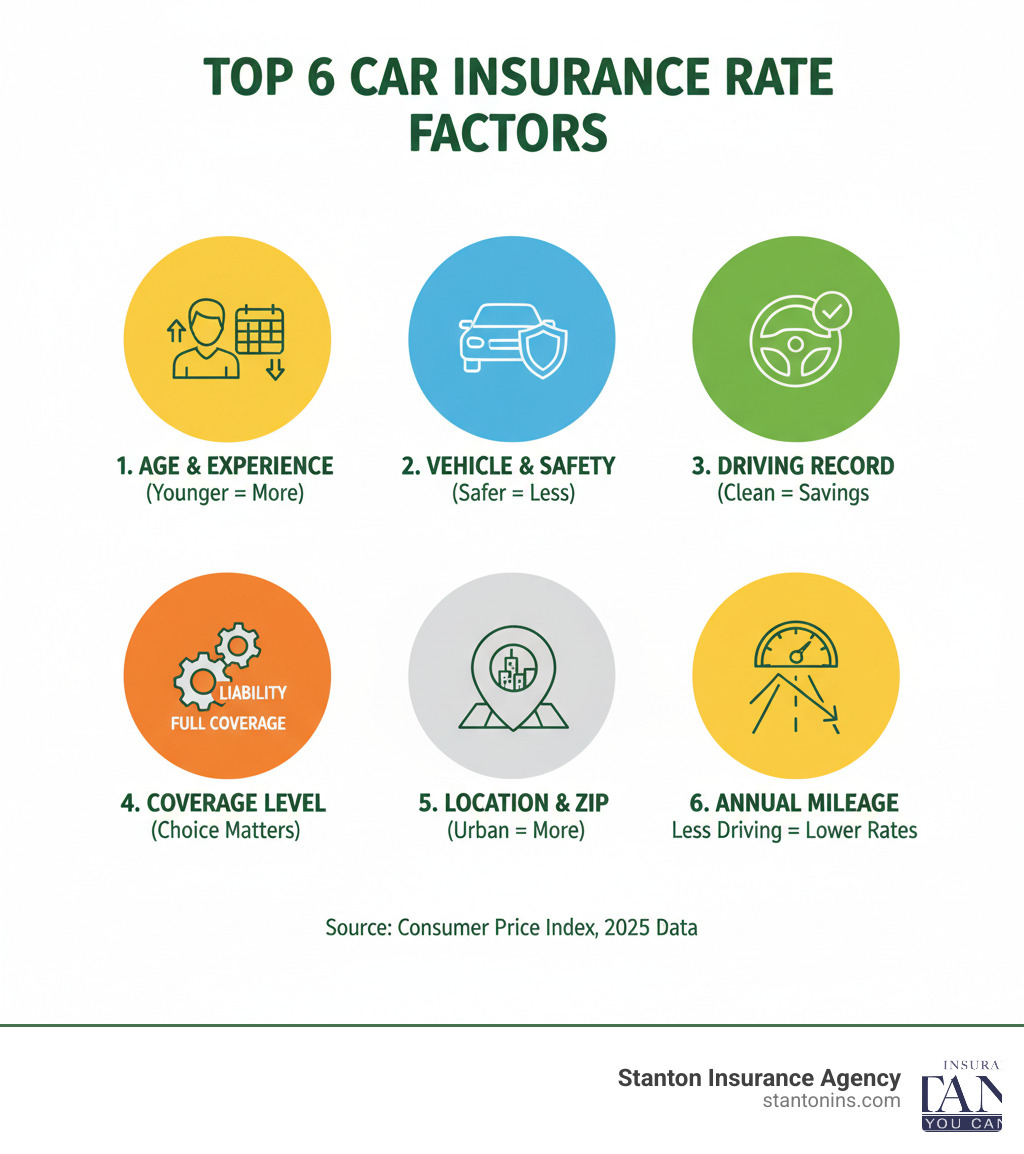

Key Factors That Determine Your Car Insurance Rate

When you find cheapest car insurance, you’re really finding an insurer who views your specific risk profile favorably. Insurers use a complex algorithm to set your premium, weighing dozens of factors to predict how likely you are to file a claim. While some factors are beyond your control, understanding them helps you identify where you can make changes to lower your costs.

The price you pay isn’t random. It’s calculated based on real data about accident rates, claim frequencies, and repair costs for people who look a lot like you on paper. The good news? Once you understand what insurers are looking at, you can often find ways to present yourself as a lower risk.

Personal and Geographic Factors

Your personal details and where you live play a significant role in your premium. Age is one of the biggest factors—teen drivers pay dramatically more than middle-aged drivers because statistics show they’re involved in more accidents. Marital status also matters; married drivers tend to get lower rates because data shows they file fewer claims.

Your ZIP code can be just as important as your driving record. Urban areas with higher traffic density and theft rates often have higher premiums than rural areas. In New Hampshire and Massachusetts, your specific town can impact your rate by hundreds of dollars annually due to varying accident rates, claims frequencies, and local repair costs. A driver in downtown Boston might pay significantly more than someone in a quiet New Hampshire suburb, even with identical driving records.

It’s worth noting that Massachusetts law prohibits insurers from using gender or credit scores to set auto insurance rates, which makes the state unique in how premiums are calculated.

Vehicle and Usage Factors

The car you drive is a major rating factor, and it’s one area where you have real control. Vehicles that are cheaper to repair, have high safety ratings, and are less likely to be stolen generally cost less to insure. A practical sedan with advanced safety features will almost always cost less to insure than a high-performance sports car or luxury vehicle.

Think about it from the insurer’s perspective: if your car is expensive to fix, they’ll pay more when you file a claim. Cars with good safety ratings protect you better in a crash, which means lower medical costs. And if your car isn’t a popular target for thieves, it’s less likely to be stolen.

Your annual mileage matters too. The less you drive, the lower your risk of being in an accident, which can lead to lower premiums. If you have a long commute or use your car for business, your rates might be higher than someone who only drives occasionally. Many insurers offer low-mileage discounts, so it’s worth asking about if you work from home or use public transportation regularly.

How to Find the Cheapest Car Insurance for Your Profile

Finding the “cheapest” company isn’t a one-size-fits-all answer. The best provider for a teen driver is often different from the best for a senior. Rates are highly personalized, but data shows clear trends for different groups. We’ve seen that while some insurers are consistently competitive, the absolute cheapest can vary based on your unique profile.

How to Find the Cheapest Car Insurance by Age Group

Car insurance rates are highest for teen drivers and typically decrease around age 25. This is because insurers view younger, less experienced drivers as having a higher risk of accidents. As you gain experience, you are more likely to find cheaper insurance quotes. Rates often remain stable through middle age, generally paying the lowest rates around age 55 (around $60/month for minimum coverage and $184/month for full coverage), before ticking up again for drivers over 70.

For example, for young drivers aged 16-19, some providers offer minimum coverage as low as $39 per month. For 20-year-olds seeking full coverage, rates can still be high, averaging around $307 per month with certain insurers. However, for 40-year-old drivers, a leading insurer offers full coverage for around $136 per month. This trend continues for 50-year-old drivers, who might find full coverage rates as low as $127 per month with the same provider. Even 70-year-old drivers can find competitive full coverage rates around $137 per month.

How Driving Record and Credit Score Impact Your Rates

A clean driving record is your best tool for low rates. A single speeding ticket can increase full coverage premiums significantly, with some drivers seeing rates jump to around $184 per month from a baseline of $143 per month, representing an increase of over 25%. An at-fault accident can push full coverage rates to around $201 per month for a full-coverage policy. More serious violations like DUIs have an even greater impact, potentially causing full coverage rates to average around $240 per month, and these violations can affect your rates for up to 10 years.

Similarly, your credit score can significantly influence insurance rates in most states. A poor credit score can lead to significantly higher rates, with some drivers with poor credit paying an average of $233 per month for full coverage, compared to $143 per month for those with good credit. This represents an increase of 67%. However, it’s important to note that Massachusetts law prohibits insurers from using credit scores to set auto insurance rates, which is a significant protection for drivers in our state. In New Hampshire, credit score can be a factor, so maintaining good credit is beneficial.

Find the Cheapest Car Insurance for Different Coverage Levels

The type of coverage you choose directly impacts your premium. Minimum-liability policies are always the cheapest option, but they offer less protection. Here’s a national snapshot of what we see for average monthly costs for different driver profiles, which can give you an idea of potential savings:

- Cheapest Liability-Only (National Average): Around $41/month (a leading insurer)

- Cheapest Full Coverage (National Average): Around $143/month (a competitive provider)

- Driver with one speeding ticket (Full Coverage): Around $184/month (a specific insurer)

- Driver with poor credit (Full Coverage): Around $233/month (a certain provider)

These are national averages. Your specific rates in Massachusetts or New Hampshire will vary based on all the factors we’ve discussed.

The Smart Shopper’s Strategy: Comparing Quotes and Lowering Premiums

The most effective way to ensure you’re not overpaying is to actively manage your policy and comparison shop. Don’t just set it and forget it! Insurance rates are constantly changing, and staying loyal to one carrier might actually cost you more over time as insurers regularly adjust premiums based on claims data and market conditions.

How to Effectively Compare Quotes

When comparing quotes, the most important rule is to ensure you’re looking at identical coverage limits and deductibles for an apples-to-apples comparison. It’s like comparing two cars—you wouldn’t compare a base model to a fully loaded one and expect the same price! We always recommend gathering quotes from at least three different providers to get a true sense of the market.

This is where working with an independent agent can be invaluable. Unlike captive agents who represent just one company, independent agents like us can shop multiple carriers on your behalf to find cheapest car insurance options that actually fit your unique needs. We can also help you understand complex insurance terms, so you’re not left guessing what you’re actually buying. The goal is to shop with confidence, not confusion.

If you’re in our service area, explore options for car insurance in New Hampshire to see how rates vary between states and how we can help you steer the choices.

Actionable Ways to Lower Your Premium Today

Here’s the good news: there are many ways you could get cheaper car insurance, even with your existing policy. Some require just a phone call, while others might take a bit more planning.

Bundling your policies is one of the easiest wins. When you combine your auto insurance with home or renters insurance, most insurers reward you with a multi-policy discount. Some drivers save up to 25% simply by bringing all their coverage under one roof.

Don’t be shy about asking for discounts. Many insurers offer savings for good students, safe drivers with clean records, low-mileage drivers, and vehicles equipped with safety features like anti-theft devices or automatic braking systems. You might also qualify for membership or professional organization discounts. The key is to ask—these discounts aren’t always automatically applied.

Consider raising your deductible from $500 to $1,000 on your comprehensive and collision coverage. This simple change can lower your premium noticeably. Just make sure you have enough in your emergency fund to comfortably cover the higher out-of-pocket cost if you need to file a claim.

For drivers in New Hampshire and other states where it’s a factor, improving your credit score can lead to substantial savings over time. Insurers view those with better credit as less risky. It’s worth noting that Massachusetts law prohibits insurers from using credit scores to set auto insurance rates, so this strategy doesn’t apply to our Bay State neighbors.

Review your coverage annually. Your life changes, and your insurance needs should change with it. Getting married, moving to a new town, driving less, or paying off your car loan are all reasons to reassess your policy. You might find you’re paying for coverage you no longer need, or that you’re missing out on new discounts that have become available.

Maintaining a clean driving record remains one of the most powerful tools for keeping your rates low. Avoid speeding tickets, accidents, and other violations, and your insurer will reward you with better rates year after year.

Finally, if you can afford it, paying your annual premium all at once instead of monthly often earns you a discount. Many insurers add small administrative fees to each monthly payment, so paying in full eliminates those extra costs—typically saving you 5-10% on your total premium.

The bottom line? A little effort goes a long way. Taking the time to compare quotes, ask questions, and actively manage your policy can lead to hundreds of dollars in annual savings without sacrificing the protection you need.

Frequently Asked Questions about Finding Cheap Car Insurance

What is the cheapest type of car insurance?

Liability-only insurance is the cheapest type of car insurance you can buy, and there’s a simple reason why: it provides the most basic level of coverage. This coverage only pays for damages and injuries you cause to others in an accident—it doesn’t cover repairs to your own vehicle or your own medical expenses if you’re at fault.

While liability-only meets the legal minimum requirements in states like New Hampshire, it’s important to understand what you’re giving up. If your car is damaged in an accident where you’re at fault, you’ll pay for repairs entirely out of pocket. If your car is totaled, you’ll need to replace it yourself. It’s essentially a trade-off between saving money each month and accepting significant financial risk if something goes wrong.

For drivers with older vehicles that aren’t worth much, liability-only can make sense. But if your car has substantial value—or if you couldn’t easily afford to replace it—the monthly savings might not be worth the potential financial exposure.

At what age does car insurance get cheaper?

The magic number most drivers look forward to is 25 years old. That’s when car insurance rates typically start to decrease noticeably. Insurers view drivers with more experience behind the wheel as less risky, and the statistics back this up—younger drivers simply have more accidents.

From age 25 through middle age, your rates generally continue to fall or stabilize, with many drivers enjoying their lowest rates around age 55. However, rates may start to tick up again for drivers around age 70, as accident rates tend to increase slightly in older age groups.

The good news? A clean driving record and good driving habits can help keep your rates lower regardless of your age. I’ve seen 70-year-old drivers with spotless records pay less than 30-year-olds with a couple of tickets on their record. Your age matters, but it’s not the only factor that counts.

Is it better to pay for car insurance monthly or all at once?

If you can swing it financially, paying your entire premium upfront for a six- or twelve-month term is almost always the smarter choice. Here’s why: many insurance companies add small administrative or service fees to each monthly payment—typically $3 to $10 per month. Those seemingly minor fees add up quickly over a year.

By paying in full, you avoid these fees entirely. Most insurers also offer a “paid-in-full discount” of around 5-10% on your total premium as a thank-you for reducing their administrative work. On a $1,200 annual premium, that could mean saving $60 to $120 just by paying upfront.

Of course, not everyone has the cash flow to pay a large bill all at once, and that’s perfectly okay. Monthly payments exist for a reason. But if you do have the financial means to pay annually, it’s one of the simplest ways to find cheapest car insurance rates without changing your coverage at all. You’re getting the exact same protection—you’re just paying less for it.

Conclusion

Finding affordable car insurance doesn’t have to feel like solving a complex puzzle. With the right approach and a little time invested, you can take control of your premiums and potentially save hundreds of dollars every year.

The key takeaways? Understand what coverage you actually need, not just what sounds good. Know which factors are driving your rate up and which ones you can influence. Most importantly, don’t settle for the first quote you receive. The insurance market is competitive, and rates can vary dramatically between carriers for the exact same coverage.

I’ve seen countless clients find they were overpaying simply because they’d been renewing the same policy year after year without shopping around. Insurance companies count on this loyalty, but it rarely benefits you financially. The good news is that comparing quotes and asking about discounts takes far less time than you might think, and the savings can be substantial.

Remember to review your policy annually, especially after major life changes like buying a new car, moving to a new town, or even improving your credit score. Your needs evolve, and your insurance should evolve with them. Don’t be afraid to ask questions—there’s no such thing as a silly question when it comes to protecting your financial well-being.

As a local, independent agency, Stanton Insurance Agency is dedicated to helping our neighbors in Massachusetts and New Hampshire steer their options and find trusted protection that fits their budget. Unlike captive agents who work for a single insurer, we can shop multiple carriers on your behalf to find the best combination of coverage and price for your unique situation.

We know the local market, understand the specific requirements in both states, and genuinely care about helping you make the smartest decision for your family and your wallet. Contact us today to see how we can help you find the cheapest car insurance that still provides the car insurance protection you need. A conversation costs nothing, but it could save you hundreds.