Why Every Massachusetts Renter Needs to Know This Number

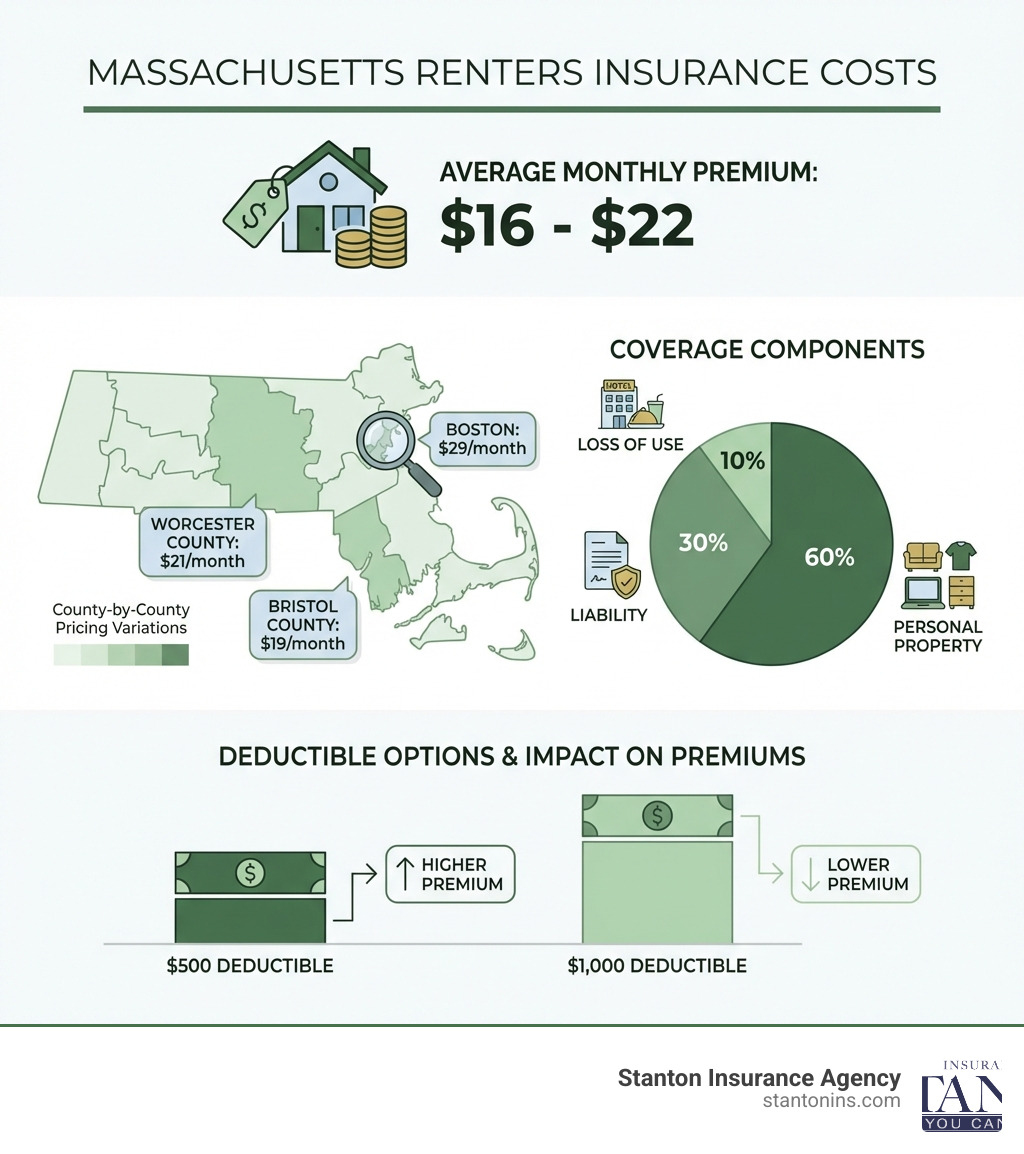

How much is renters insurance in ma? On average, Massachusetts renters pay between $16 and $22 per month (about $194 to $265 per year) for a standard policy. Here’s what you typically get for that price:

| Coverage Type | Typical Amount | Average Monthly Cost |

|---|---|---|

| Personal Property | $30,000 – $40,000 | $16 – $22 |

| Liability Protection | $100,000 – $300,000 | Included |

| Loss of Use | Varies by policy | Included |

Key factors that affect your cost:

- Location – Boston averages $29/month, while smaller cities average $18/month

- Coverage amount – More protection costs more

- Deductible – Higher deductibles mean lower premiums

- Insurance company – Prices vary by up to 300% between carriers

If you’re like most renters, you probably think your landlord’s insurance covers your stuff. It doesn’t. Your landlord’s policy protects the building, but your laptop, furniture, clothes, and everything else you own? That’s on you. The good news is that protecting all of it costs less than your monthly streaming subscriptions combined.

I’m Geoff Stanton, a fourth-generation insurance professional and Certified Insurance Counselor who has helped hundreds of Massachusetts renters find affordable coverage. Understanding how much is renters insurance in ma and what drives those costs is the first step to making a smart buying decision.

Basic how much is renters insurance in ma glossary:

So, How Much is Renters Insurance in MA, Really?

On average, the cost of renters insurance massachusetts is between $18 and $22 per month, or about $215 to $265 per year. Some sources even report averages as low as $16 per month. This is a small price for significant peace of mind. For a typical policy providing around $30,000 to $40,000 in personal property coverage and $100,000 in liability, Massachusetts’ rates are very close to the national average.

However, this is just a starting point. Your final premium depends on several factors, especially where you live within the state.

How much is renters insurance in MA by location?

Your ZIP code plays a major role in determining your premium. Insurers assess risk based on local factors like crime statistics and weather patterns. For example, living in a dense urban area like Boston often costs more than living in a quieter suburban or rural town. Massachusetts has some of the lowest rates of property crime in the country, which helps keep rates down, but costs still vary.

Here’s a look at average annual costs in different Massachusetts counties:

- Boston (Suffolk County): ~$347/year (or about $29/month) for $40,000 in personal property, $300,000 in liability, and a $1,000 deductible. This is notably higher than the state average.

- Middlesex County: ~$252/year (or about $21/month)

- Worcester County: ~$247/year (or about $21/month)

- Bristol County: ~$233/year (or about $19/month)

As you can see, rates can differ by over $100 per year just based on your county. For instance, some of the most affordable ZIP codes, like Framingham (1701), average around $213 annually, while some Boston ZIP codes (like 2203) can reach $380 annually. This difference highlights the impact of local risk factors on your premium.

What Factors Influence Your MA Renters Insurance Premium?

The price you pay for renters insurance isn’t random. Insurance companies calculate your premium based on risk. The higher the risk of you filing a claim, the higher your rate will be. Here are the key factors that will move your price up or down.

How much is renters insurance in MA based on your coverage?

This is the biggest driver of your cost. The more protection you buy, the more your policy will cost.

- Personal Property Coverage: This covers the cost to replace your belongings. A renter with $20,000 worth of possessions will pay less than someone with $60,000. It’s crucial to create a home inventory to accurately estimate the value of your stuff. For example, increasing your personal property coverage from $20,000 to $40,000 can raise your annual premium by about $89. Going up to $60,000 might add another $96 annually.

- Liability Coverage: What is personal liability insurance for renters? It protects you if you’re sued for injuring someone or damaging their property, whether it happens in your apartment or elsewhere. Standard policies often start at $100,000, but increasing it to $300,000 or $500,000 often costs only a few extra dollars per month and provides substantially more protection. It’s a small price to pay for significant peace of mind against potential lawsuits.

- Deductible: This is the amount you pay out-of-pocket on a claim before your insurance kicks in. A higher deductible (e.g., $1,000) will lower your monthly premium, while a lower deductible (e.g., $500) will increase it. For instance, increasing your deductible from $500 to $1,000 could save you around $25 annually. Just make sure the deductible amount is something you can comfortably afford in an emergency.

- Your Claims History: If you’ve filed previous renters insurance claims, insurers might view you as a higher risk, potentially leading to higher premiums. A theft claim on your record, for example, could increase your premium by about 18%.

- Credit-Based Insurance Score: In Massachusetts, you have a key protection: insurers are not allowed to use credit scores to set renters, condo, or mobile home insurance prices. This means your credit history won’t directly impact your rate. This is not the case everywhere; in neighboring New Hampshire, for example, a credit-based insurance score can be a factor in determining your premium.

- Type of Building: The age, construction, and safety features of your rental unit can also play a role. A newer building with modern fire suppression systems might lead to lower rates than an older structure.

Replacement Cost vs. Actual Cash Value

When choosing your renters insurance coverage, you’ll encounter two important terms:

- Actual Cash Value (ACV): This pays for the depreciated value of your items. If your five-year-old laptop is stolen, ACV pays you what a five-year-old laptop is worth today, not the cost of a new one. Imagine a 10-year-old kitchen table. With ACV, we’d pay you what that worn-out table is worth today.

- Replacement Cost Value (RCV): This pays the full cost to replace your stolen or damaged item with a new, similar one. It costs slightly more, but it provides far better financial protection. Most experts recommend RCV because it allows you to truly replace what you’ve lost without significant out-of-pocket expenses. Upgrading to RCV typically raises premiums by about 11%.

Understanding Your Massachusetts Renters Insurance Coverage

A standard renters insurance ma policy, often called an HO-4 policy, is a package of coverages designed to protect you, your belongings, and your finances. It’s a vital part of any renter’s financial plan, often costing less than your daily coffee habit.

What’s Typically Included?

According to the Massachusetts state government, a typical policy includes three core protections:

- Personal Property Coverage: This is the heart of your policy, protecting your belongings (furniture, electronics, clothes, and even that vintage vinyl collection) from damage or loss due to “named perils.” These usually include fire, theft, vandalism, lightning, wind, hail, explosions, falling objects, and the weight of snow or ice. If a thief walks off with your laptop, this coverage helps you buy a new one.

- Personal Liability Coverage: This protects your financial well-being if you’re found legally responsible for injuring someone or damaging their property. This could be if a guest trips over your rug and breaks an arm, or if you accidentally cause a small fire that damages a neighbor’s unit. It covers medical bills, property repair costs, and even legal expenses if you’re sued.

- Additional Living Expenses (Loss of Use): Imagine a pipe bursts in your apartment, making it uninhabitable for a few weeks. This coverage helps pay for temporary housing (like a hotel), meals, and other essential costs that are above your normal living expenses while your rental unit is being repaired.

Common Exclusions and Add-Ons

Standard policies don’t cover everything. It’s crucial to be aware of what’s typically left out so you can consider additional protection if needed:

- Flooding: Damage from natural floods (e.g., storm surge, overflowing rivers) is almost always excluded from standard renters insurance. If you live in a flood-prone area, you’ll need to purchase a separate flood insurance policy, often through the National Flood Insurance Program.

- Earthquakes: This is also excluded and requires a separate policy or endorsement. While less common in Massachusetts, it’s something to consider for complete protection.

- Roommates’ Property: Your policy only covers your own belongings, not your roommate’s. Each adult tenant should have their own policy to protect their possessions.

- High-Value Items: Standard personal property limits might not fully cover very expensive items like fine jewelry, rare art, or high-end cameras.

You can also add endorsements (or “riders”) for extra protection, such as:

- Scheduled Personal Property: This allows you to specifically list and insure high-value items for their full appraised value, providing broader coverage than standard personal property limits.

- Water Backup: Covers damage from backed-up sewers, drains, or sump pump overflow, which is often excluded from standard policies. Given Massachusetts’ sometimes harsh winters and older infrastructure, this can be a very valuable add-on.

- Home Cyber Coverage: In our digital age, this add-on protects against identity theft, cyber-attacks, and data restoration costs.

- Pet Damage Coverage: While liability usually covers pet-related injuries to others, this can offer broader protection for damage your pet might cause to the rental unit itself.

- Increased Liability Limits: As mentioned, you can often increase your liability coverage beyond the standard $100,000 for a minimal cost.

How to Find Cheap Renters Insurance in Massachusetts

While how much is renters insurance is a key question, the better question is how to get the best value. You can take several steps to lower your premium without sacrificing crucial protection. We’re all about smart savings!

Here are common renters insurance discounts and strategies:

- Bundling Discount: The most significant discount usually comes from bundling your renters and auto insurance with the same company. Many carriers offer substantial savings when you combine policies. We often help clients find significant savings this way!

- Protective Devices Discount: Having safety features like smoke detectors, fire extinguishers, a burglar alarm, or a sprinkler system in your home can often lower your rates. Even living near a fire station can sometimes net you a discount!

- Claims-Free Discount: If you haven’t filed any claims for a certain number of years, many insurers will reward you with a discount. Maintaining a good claims history is always beneficial.

- Pay-in-Full Discount: Paying your annual premium upfront instead of in monthly installments can often save you money. It reduces administrative costs for the insurer, and they pass those savings on to you.

- Autopay/Paperless Discount: Many insurers offer small discounts for enrolling in automatic payments and receiving your policy documents electronically. It’s a win-win for convenience and savings.

- Higher Deductible: As discussed, choosing a higher deductible means you take on more initial risk, but your premium will be lower.

- Review Your Coverage Regularly: Ensure you’re not over-insured or under-insured. If you’ve sold valuable items or acquired new ones, update your policy.

The single best way to find cheap renters insurance massachusetts is to compare renters insurance quotes massachusetts from multiple carriers. Working with an independent insurance agency like ours allows you to see prices and coverage options from many different companies at once, ensuring you find the perfect fit for your budget and needs. We do the shopping for you, saving you time and money.

Is Renters Insurance Required in Massachusetts?

This is a common point of confusion. There is no state law in either Massachusetts or New Hampshire that requires you to have renters insurance. However, landlords in both states can legally require it.

Most landlords and property management companies include a clause in the lease agreement mandating that tenants carry a renters insurance policy, usually with a minimum liability limit of $100,000. They do this to protect themselves from liability if a tenant’s negligence causes damage to the building or injures another resident. For example, if you accidentally leave a faucet running and cause water damage to the unit below, your landlord wants assurance that their property (and their other tenants) are protected.

Always check your lease to see if a renters insurance policy is required for your specific unit. Even if your landlord doesn’t require it, we strongly recommend it. The minimal cost provides invaluable protection for your belongings and financial peace of mind. Without it, replacing all your possessions after a fire or theft could be financially devastating.

Frequently Asked Questions about MA Renters Insurance Costs

What does renters insurance cover in Massachusetts and New Hampshire?

A standard policy covers your personal belongings against perils like fire, theft, and vandalism; provides personal liability protection if you’re sued for injury or property damage; and covers additional living expenses if your rental becomes uninhabitable due to a covered event. It does not cover the physical building (that’s your landlord’s responsibility) or damage from natural floods or earthquakes (which require separate policies). For a full breakdown, check out our guide on what does renters insurance cover.

How much personal property coverage do I need?

The best way to determine this is to create a home inventory. Go room by room and list your major possessions (furniture, electronics, appliances, clothing, etc.) and estimate their value. Don’t forget items in storage or on your balcony! Most people are surprised to find their belongings are worth between $20,000 and $50,000. It’s better to slightly overestimate than to be underinsured and face significant out-of-pocket costs if disaster strikes. Consider using a digital inventory tool or simply taking photos and videos of your possessions.

Does renters insurance cover my dog biting someone?

Yes, in most cases. The personal liability portion of your renters insurance policy typically covers injuries or property damage caused by your pet. So, if your furry friend gets a little too enthusiastic and nips a guest, or causes damage to someone else’s property, your policy can help. However, some insurance companies have breed restrictions and may not cover certain dog breeds deemed “high-risk.” It’s essential to disclose that you have a pet when getting a quote to ensure you have the proper coverage. If you’re concerned about specific breeds, we can help you find a carrier that offers the coverage you need.

How do renters insurance rates in Massachusetts and New Hampshire compare to the national average?

Renters insurance costs in Massachusetts are generally in line with, or slightly above, the national average. While the national average might hover around $13-$15 per month, Massachusetts typically sees averages of $16-$22 per month. This is due to factors like higher property values and cost of living. In contrast, New Hampshire’s average rates are often slightly below the national average, making it one of the most affordable states for renters insurance.

What are common renters insurance claims in Massachusetts and New Hampshire?

While theft is always a concern, especially in urban areas, renters in both states also frequently file claims for water damage (from burst pipes, leaks, or appliance malfunctions) and damage from freezing temperatures during our often-harsh winters. Wind and hail damage from severe storms can also lead to claims. Having a policy that covers these common perils is essential.

Get the Right Renters Protection in Massachusetts

Renters insurance is one of the most affordable and effective ways to protect your financial well-being. For a small monthly cost, you get a powerful safety net that shields your belongings from disaster and protects your assets from liability lawsuits. The key is finding a policy that balances comprehensive coverage with a price that fits your budget.

As one of the trusted insurance agencies in massachusetts, our team at Stanton Insurance Agency is here to help. We work with multiple top-rated carriers to find you the best coverage at the most competitive price. Don’t leave your financial future to chance. Contact Stanton Insurance Agency today for a free, no-obligation quote and see how affordable peace of mind can be. We’re proud to serve Massachusetts and New Hampshire, providing trusted protection for your valuable assets.