Understanding Auto Repair Liability Business Insurance Cost: What You Need to Know

Auto repair liability business insurance cost is a critical investment for protecting your Massachusetts or New Hampshire shop from financial ruin. Whether you’re worried about a customer injury, damage to a client’s vehicle, or an employee accident, the right insurance coverage shields your business from devastating lawsuits and claims that could cost hundreds of thousands of dollars.

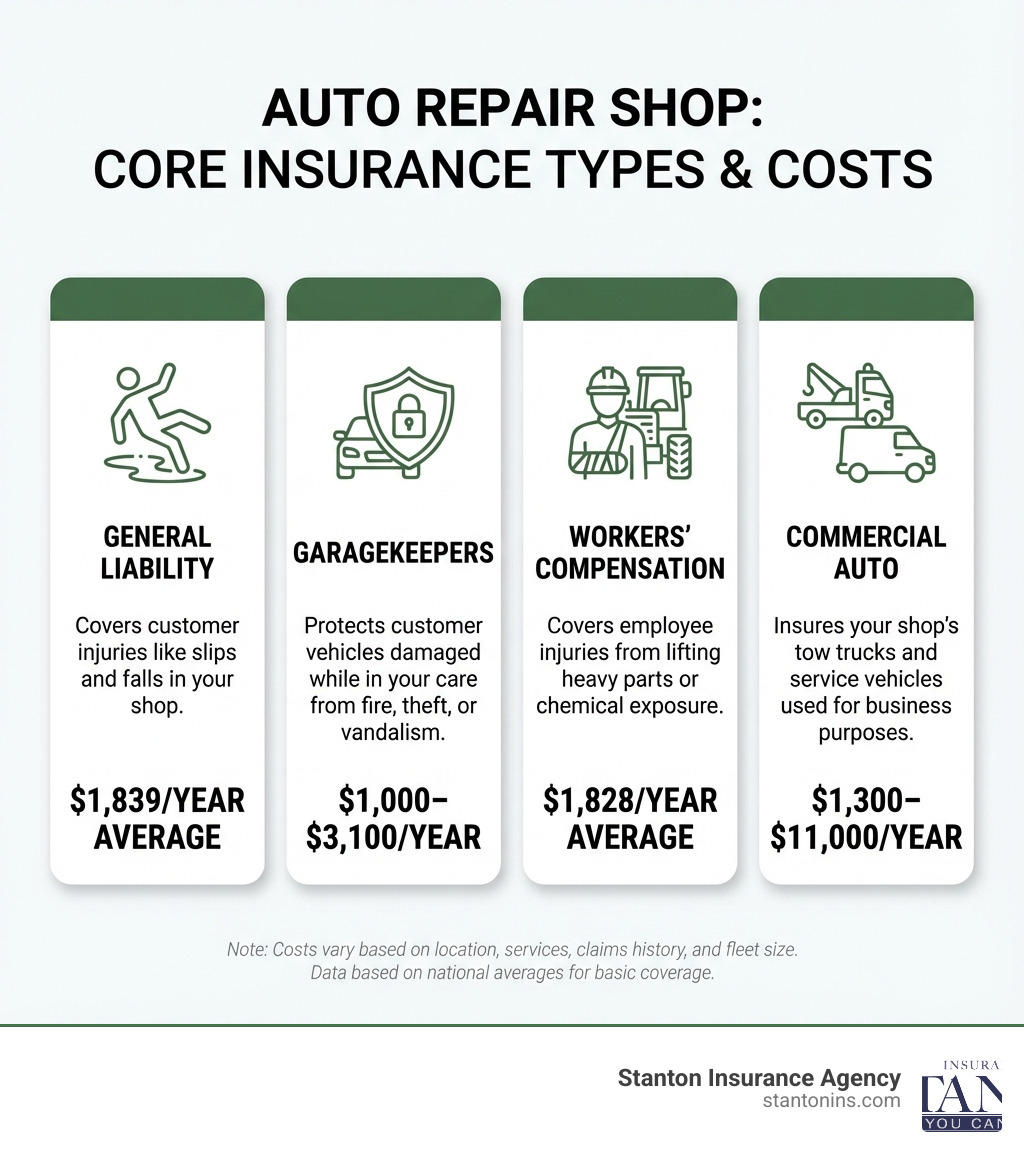

Quick Answer: Average Auto Repair Insurance Costs

- Business Owner’s Policy (BOP): $1,700–$2,700 annually ($145–$238/month)

- Garage Liability Insurance: $1,300–$2,500 annually

- Garagekeepers Insurance: $1,000–$3,100 annually

- Workers’ Compensation: $1,800–$1,950 annually ($152–$159/month)

- Comprehensive Bundle (BOP + Workers’ Comp + Professional Liability): $450–$550/month or $5,400–$6,600/year

Running an auto repair shop in Massachusetts or New Hampshire is a demanding business that requires skill, precision, and a significant investment in tools and talent. But the biggest risks often aren’t under the hood—they’re the financial liabilities that can arise from a simple accident. Protecting your hard-earned business from lawsuits, property damage claims, and employee injuries is non-negotiable.

The cost of auto repair liability business insurance varies widely based on your location, the services you offer, your claims history, and the coverage limits you choose. National averages show that most shops pay between $1,571 and $3,162 annually for basic coverage, though comprehensive protection typically runs higher.

Why costs vary so much:

- Your location matters: Shops in Massachusetts average $160/month for general liability, while New Hampshire shops pay closer to $152/month

- Your services matter: Collision repair and frame straightening carry higher premiums than routine oil changes

- Your employees matter: More mechanics mean higher workers’ comp costs

- Your equipment matters: Expensive diagnostic tools and lifts increase your property coverage needs

I’m Geoff Stanton, President of Stanton Insurance Agency in Waltham, Massachusetts, and I’ve spent over two decades helping local businesses steer the complexities of commercial insurance, including finding the right balance between comprehensive coverage and manageable auto repair liability business insurance cost. This guide breaks down the essential details of auto repair liability insurance, helping you understand the costs and secure the right protection for your shop.

Simple auto repair liability business insurance cost glossary:

Why Your Auto Repair Shop Can’t Afford to Skip Liability Insurance

Running an auto repair shop in Massachusetts or New Hampshire comes with inherent risks. We’re dealing with heavy machinery, flammable liquids, and customer vehicles that can be worth tens or even hundreds of thousands of dollars. A single mishap—a customer slipping on a stray wrench, a mechanic accidentally damaging a client’s high-end vehicle, or an employee getting injured on the job—can quickly escalate into a lawsuit that could financially cripple or even close your business.

Adequate insurance isn’t just a safety net; it’s a fundamental business tool. It’s the shield that covers legal fees, settlements, and medical costs, ensuring your shop’s survival and demonstrating professionalism to your clientele. Without it, you personally assume all the risk, putting your business assets and personal finances in jeopardy. Beyond financial protection, having the right coverage is often a legal requirement to operate in Massachusetts and New Hampshire, and it builds customer confidence, showing them you’re a responsible business owner who takes their safety and property seriously.

What Does Auto Repair Business Insurance Cover?

Auto repair business insurance is a comprehensive term that encompasses several types of policies designed to protect your shop from a wide array of potential liabilities. Here’s a breakdown of what these policies typically cover:

- Bodily Injury: This is perhaps the most common liability concern. If a customer, vendor, or other third party is injured on your premises or as a direct result of your operations, your insurance can cover their medical expenses, rehabilitation, and even lost wages.

- Property Damage: Should your business operations cause damage to a third party’s property (e.g., you accidentally spray paint a neighboring building, or a faulty repair causes damage to a customer’s property), this coverage steps in.

- Faulty Work Claims (Professional Liability/Errors & Omissions): Sometimes, even with the best intentions, a repair might go wrong, or a diagnostic error could lead to further issues. This coverage protects you if a customer claims financial loss due to your professional negligence or errors in service.

- Employee Injuries (Workers’ Compensation): Your team works hard, often in physically demanding and sometimes hazardous conditions. If an employee gets hurt or falls ill due to their job, workers’ compensation covers their medical treatment, lost wages, and rehabilitation.

- Vehicle Theft or Damage (Garagekeepers Legal Liability): This specialized coverage is crucial for auto repair shops, as it protects your customers’ vehicles while they are under your care, custody, and control.

Here are some real-world scenarios where these coverages would come into play:

- A customer slips on an oil patch in your garage and breaks their arm. Your General Liability policy would typically cover their medical bills and any legal defense costs.

- A mechanic test-driving a customer’s car gets into an accident, damaging the customer’s vehicle and another car. Your Garagekeepers Legal Liability and Garage Liability policies would activate.

- A fire in the shop (perhaps from a faulty electrical system) damages several customers’ vehicles left overnight. Garagekeepers Legal Liability would cover the damage to those vehicles.

- An employee injures their back while lifting a heavy engine part. Workers’ Compensation would cover their medical care and lost income.

- A mechanic installs an incorrect part, and the customer’s car breaks down a week later, causing further damage. Professional Liability (Errors & Omissions) might cover the costs associated with the faulty repair.

Understanding the Average Auto Repair Liability Business Insurance Cost

The cost of insurance for an auto repair business isn’t a one-size-fits-all number. National averages provide a baseline, but your final premium will depend on your specific operations, location, and the types of services you provide. On average, a comprehensive insurance bundle for an auto repair shop can range from $450 to $550 per month, or roughly $5,400 to $6,600 annually. This bundle typically includes a Business Owner’s Policy (BOP), Workers’ Compensation, and Professional Liability. Let’s break down the average costs for the most common policies in our region, Massachusetts and New Hampshire.

Business Owner’s Policy (BOP)

A Business Owner’s Policy, or BOP, is often a smart and cost-effective choice for many auto repair shops. It bundles essential coverages like General Liability insurance and Commercial Property insurance into a single, convenient policy, usually at a lower premium than purchasing them separately.

For auto repair shops in Massachusetts, a BOP averages around $238 per month, while in New Hampshire, it’s closer to $223 per month. This policy is designed to cover a broad range of risks:

- General Liability: Protects against claims of bodily injury (like a customer slip-and-fall) or property damage to others that occur on your premises or as a result of your business operations. The average General Liability price for auto repair shops is $153 monthly or $1,839 annually nationwide. Specifically, in Massachusetts, general liability is around $160 monthly, and in New Hampshire, it’s $152 monthly.

- Commercial Property: Safeguards your physical assets, including your shop’s building (if you own it), tools, equipment (such as diagnostic scanners, lifts, air compressors), inventory, and business interruption coverage, which can help replace lost income if your business has to temporarily close due to a covered event.

A BOP is particularly valuable because it streamlines your insurance needs, offering robust protection against common risks without requiring you to manage multiple separate policies. For more information on protecting your business, explore our business insurance options.

Garage Liability & Garagekeepers Insurance

These two policies are absolutely vital for any auto repair shop. They specifically address the unique risks associated with working on and around customer vehicles.

- Garage Liability: This coverage is essential for the daily operations of your auto repair shop. It protects your business against claims of bodily injury or property damage to third parties arising from your garage operations. This typically includes incidents like a customer tripping over equipment in your waiting area, or a mechanic’s faulty repair leading to an accident that damages another person’s car or injures its driver. The annual garage liability insurance cost typically ranges from $1,300 to $2,500.

- Garagekeepers Legal Liability: This is the specific coverage that protects your customers’ vehicles while they are in your care, custody, or control. This means if a customer’s car is damaged by fire, theft, vandalism, extreme weather, or even a collision while it’s parked in your lot, being worked on in a bay, or during a test drive, this policy would cover the cost of repairs or replacement. Garagekeepers coverage typically costs between $1,000 and $3,100 annually.

Workers’ Compensation

If your auto repair shop has employees, Workers’ Compensation insurance isn’t just a good idea—it’s legally required in both Massachusetts and New Hampshire. This crucial policy provides medical benefits and wage replacement for employees who suffer injuries or illnesses directly related to their job duties. Mechanics face numerous risks, from burns and crush injuries to chemical exposure, making this coverage indispensable.

The average Workers’ Compensation price for auto repair shops nationwide is $152 per month or $1,828 per year. However, these costs can vary by state due to different regulations and claims histories. In Massachusetts, we see average rates around $159 per month, with New Hampshire slightly lower at $152 per month. This coverage ensures that your employees are taken care of, and it protects your business from costly lawsuits related to workplace injuries.

Garage Liability vs. Garagekeepers: A Critical Distinction

Understanding the difference between Garage Liability and Garagekeepers Legal Liability insurance is crucial for auto repair shop owners in Massachusetts and New Hampshire. While they both sound like they cover your garage, they protect against fundamentally different risks. Confusing the two can leave a significant gap in your protection, potentially exposing your business to ruinous costs.

Garage Liability is like a specialized form of General Liability for auto service businesses. It covers your business’s legal liability for bodily injury or property damage to third parties arising from your business operations. Think of incidents that happen because you run a garage, but not necessarily to a customer’s car that’s in your care.

Garagekeepers Legal Liability, on the other hand, is specifically designed to cover damage or theft to your customers’ vehicles while they are under your care, custody, or control. This is the policy that truly protects the valuable assets your customers entrust to you.

Here’s a clearer comparison:

| Feature | Garage Liability Insurance | Garagekeepers Legal Liability Insurance |

|---|---|---|

| Primary Focus | Your business’s legal liability for its operations. | Damage to customers’ vehicles in your care. |

| Covers | Bodily injury to a third party (e.g., customer slip-and-fall in your waiting room), property damage caused by your business operations (e.g., a mechanic’s faulty brake repair leads to an accident on the road), or advertising injury. | Damage to a customer’s vehicle from fire, theft, vandalism, extreme weather, or collision while on your premises, in a parking lot, or during a test drive. |

| Example | A mechanic’s faulty brake repair leads to an accident after the car leaves your shop. This policy covers damage to the other car and injuries to its driver. Or, a customer trips over a loose mat and breaks their wrist. | A fire in your shop damages a customer’s classic car being restored. This policy covers the repair or replacement cost of that car. Or, a customer’s car is stolen from your lot overnight. |

Without Garagekeepers Legal Liability, if a customer’s car is damaged while sitting in your bay due to a fire or gets stolen from your lot, you could be personally responsible for the full cost of that vehicle. This distinction is paramount for comprehensive protection.

Key Factors That Drive Your Insurance Premiums

When we evaluate the auto repair liability business insurance cost for your shop in Massachusetts or New Hampshire, we consider a variety of factors. Insurers look at your specific operations to determine your unique risk profile. Understanding these elements can help you anticipate your costs and identify areas for potential savings.

Key Factors That Influence Your Auto Repair Liability Business Insurance Cost

- Location: This is a big one for shops in Massachusetts and New Hampshire. A shop in a busy urban area like Boston, with higher traffic, more foot traffic, and potentially higher crime rates, might face higher premiums than a shop in a quieter, rural part of New Hampshire. Densely populated areas often see more claims and higher jury verdicts in personal injury lawsuits, which insurers factor into pricing. For instance, General Liability in Massachusetts averages $160 monthly, while New Hampshire is $152 monthly.

- Services Offered: The type of work you do directly impacts your risk. A shop specializing in high-performance exotic cars, heavy-duty trucks, or complex collision repair and frame straightening will have higher premiums than one focused primarily on oil changes, tire rotations, and basic maintenance. Handling higher-value inventory and performing more intricate, potentially dangerous, or safety-critical work increases the likelihood of a high-cost claim.

- Business Size and Revenue: Larger shops with more bays, higher annual revenue, and more customer throughput generally face higher premiums. More activity means more exposure to potential incidents.

- Employee Count and Payroll: The number of employees you have is a direct factor in your Workers’ Compensation costs. More employees mean a greater chance of workplace injuries. Your total payroll also plays a role, as Workers’ Comp premiums are often calculated based on payroll.

- Claims History: A history of frequent or severe claims tells insurers that your business might be a higher risk. A clean claims record, on the other hand, can help keep your premiums lower.

- Coverage Limits: The maximum amount an insurer will pay out for a covered claim. Higher limits provide more protection but naturally lead to higher premiums.

- Deductibles: The amount you pay out-of-pocket before your insurance coverage kicks in. A higher deductible typically results in a lower premium.

- Equipment Value: The amount and value of equipment in your garage, including lifts, diagnostic tools, and specialized machinery, impacts your Commercial Property insurance component of a BOP. Collision centers with frame machines and paint booths, for example, have significantly higher equipment investments.

- Certifications and Training: Shops with certified technicians (e.g., ASE, I-CAR Gold Class) and those that invest in ongoing employee training often demonstrate a commitment to quality and safety, which can lead to discounts.

How Coverage Limits and Deductibles Affect Your Premium

Understanding the interplay between coverage limits and deductibles is key to managing your auto repair liability business insurance cost.

- Coverage Limits: This is the maximum amount your insurer will pay for a covered loss. If you choose higher coverage limits (e.g., $2 million in General Liability coverage instead of $1 million), you’re asking the insurer to take on more potential financial risk. Consequently, your annual premium will be higher. While a higher limit costs more, it provides a more robust safety net against catastrophic claims that could otherwise devastate your business. It’s especially important for auto repair shops given the high value of vehicles and potential for serious accidents.

- Deductibles: This is the amount you agree to pay out of your own pocket before your insurance coverage begins to pay for a claim. If you opt for a higher deductible (e.g., $2,500 instead of $500), you are taking on more initial risk yourself. In return, the insurance company will typically offer you a lower annual premium. This can be a good strategy for businesses with a strong financial cushion that can comfortably cover a higher deductible if a claim arises. For example, increasing Garagekeepers deductibles to $1,000-$2,500 can reduce premiums by 19%-27%. However, it’s crucial to choose a deductible you can comfortably afford, as you’ll need to pay it for each covered claim.

Smart Strategies to Get Affordable Coverage

Securing affordable auto repair liability business insurance cost doesn’t mean compromising on crucial protection. We believe that proactive risk management and smart shopping are your best tools. Insurers reward businesses that demonstrate a commitment to safety, professionalism, and operational excellence. Here are some strategies we recommend to our clients in Massachusetts and New Hampshire.

Strategies to Lower Your Auto Repair Liability Business Insurance Cost

- Bundling Policies: One of the most effective ways to reduce your overall insurance cost is to bundle multiple policies together. A Business Owner’s Policy (BOP), for instance, combines General Liability and Commercial Property insurance, often at a reduced rate compared to buying them separately. Combining a BOP with Workers’ Compensation and Professional Liability can lead to significant savings, sometimes between 18% to 26% compared to purchasing individual policies.

- Increase Deductibles: As we discussed, opting for a higher deductible means you’ll pay more out-of-pocket if a claim occurs, but it will lower your annual premium. This strategy is best if your business has healthy cash reserves to cover that initial expense.

- Annual Payments: Many insurers offer a discount if you pay your premium annually rather than monthly. Paying upfront can save you 5% to 10% in processing fees and often earns an additional 6% to 9% discount on the premium itself.

- Shop Around: Insurance rates can vary significantly between providers for the exact same coverage. We always recommend getting quotes from several different insurance companies. Working with an independent insurance agency like Stanton Insurance allows us to do this comparison shopping for you, finding the best value and coverage custom to your specific needs.

- Maintain a Good Safety Record: A strong safety record and a low claims history are powerful indicators to insurers that your business is less risky. Implement robust safety protocols, conduct regular safety training, and address potential hazards promptly. Fewer claims translate directly to lower premiums over time.

- Review Coverage Annually: Your business evolves, and so should your insurance. Annually review your policies with us to ensure your coverage still aligns with your current operations, employee count, services offered, and equipment value. This prevents you from paying for unnecessary coverage or, worse, having critical gaps.

The Value of Certifications and Safety

In the auto repair industry, expertise and safety are paramount. Insurers recognize this and often reward shops that demonstrate a commitment to these principles.

- ASE Certification: Technicians certified by the National Institute for Automotive Service Excellence (ASE) signify a higher level of technical competence. Shops with a high percentage of ASE-certified technicians often qualify for discounts on their auto repair liability business insurance cost, as it suggests a lower likelihood of faulty work claims.

- I-CAR Gold Class and AAA-Approved: Achieving designations like I-CAR Gold Class for collision repair or becoming an AAA-Approved Auto Repair facility signals a commitment to industry-best practices, quality, and customer service. These certifications can lead to favorable insurance rates.

- Strong Safety Programs: Beyond certifications, having documented safety protocols, regular employee training on equipment use, hazardous material handling, and emergency procedures can significantly reduce workplace accidents. Insurers look favorably on businesses that actively manage and mitigate risks.

- Financial Stability: Insurers also consider the financial stability of the businesses they cover. A well-managed business with a solid financial standing is generally seen as a lower risk. It’s worth noting that the financial strength of the insurer itself is also important. For example, insurers with an A+ (Superior) rating from AM Best are often preferred for their ability to handle claims.

By implementing these strategies and maintaining a focus on quality and safety, your auto repair shop in Massachusetts or New Hampshire can significantly reduce its auto repair liability business insurance cost without compromising on the protection it needs to thrive.

Frequently Asked Questions about Auto Repair Insurance Costs

Navigating auto repair insurance can bring up a lot of questions. Here, we address some of the most common inquiries we receive from shop owners in Massachusetts and New Hampshire.

What is the most critical liability coverage for an auto repair shop?

While all coverages are important, the combination of Garage Liability and Garagekeepers Legal Liability is arguably the most critical for an auto repair shop. This duo protects you from both operational mishaps (like a customer injury from a slip-and-fall) and, crucially, damage to the very expensive property you’re entrusted with—your customers’ vehicles. Without Garagekeepers, a fire, theft, or even an accidental dent to a customer’s car while it’s in your care could lead to massive out-of-pocket expenses for your business.

Will a past claim make my insurance unaffordable?

A single, isolated claim, especially a minor one, is unlikely to make your insurance completely unaffordable. However, a history of frequent or severe claims will definitely increase your premiums. Insurers view past claims as an indicator of future risk, and higher risk translates to higher auto repair liability business insurance cost. This is why implementing a strong safety program, maintaining meticulous records, and actively working to prevent incidents are vital to keeping costs down in the long term. A commitment to improving safety can also demonstrate to insurers that you’re proactively addressing risks.

Do I need commercial auto insurance if I have garage liability?

Yes, if you own vehicles titled in your business’s name. Garage Liability covers the use of non-owned vehicles (like customer cars during test drives or while being moved around your lot). However, it does not cover accidents involving your own business-owned vehicles, such as your tow truck, parts runner van, mobile repair unit, or even a company car. For those, you absolutely need a separate Commercial Auto Insurance policy. This ensures that your business vehicles are covered for liability, collision, comprehensive, and other risks while being used for business purposes.

Secure Your Shop’s Future Today

Protecting your auto repair business is a complex task, but you don’t have to do it alone. Understanding the nuances of your auto repair liability business insurance cost is the first step toward securing robust, affordable coverage. By partnering with a knowledgeable expert, you can ensure there are no gaps in your policy and that you’re not paying for coverage you don’t need.

The automotive industry in Massachusetts and New Hampshire is dynamic, and your insurance needs are unique. At Stanton Insurance Agency, we pride ourselves on helping local businesses steer these complexities. Our team is here to help you steer your options, compare policies from multiple reputable carriers, and build a policy that truly protects your investment. Don’t let uncertainty put your hard work at risk.

Contact Stanton Insurance Agency for a personalized quote and drive your business forward with confidence.