Understanding Car Insurance Down Payments: What You Need to Know

How much is a down payment for car insurance? Typically, a car insurance down payment ranges from 10% to 30% of your annual premium, or it equals your first one or two months of coverage if you choose a monthly payment plan. For example, if your annual premium is $1,200, you might pay $120 to $300 upfront to start your policy.

Here’s what you need to know:

- Not a separate fee: The down payment is simply your first payment toward your total premium, not an extra charge

- Activates your policy: No coverage begins until this initial payment is made

- Varies by insurer: Different companies have different requirements, typically one to two months’ worth of coverage

- Influenced by your profile: Your driving record, credit score, and coverage choices affect the total premium and thus your down payment amount

You might have seen ads for “no down payment” car insurance, but here’s the reality: this doesn’t truly exist. Every reputable insurance company requires some payment upfront before your policy goes into effect. What these ads really mean is a low down payment, often just your first month’s premium.

Insurance companies require this initial payment as a financial commitment. It’s a way to ensure you’re serious about maintaining coverage and protects them from the risk of a driver getting into an accident before ever paying for their policy. Think of it this way: if you could get proof of insurance without paying anything, you could register your car or satisfy a dealership’s requirements and then never pay for the actual coverage.

The amount you’ll pay depends on several factors, including your driving history, credit score, the type of car you drive, and where you live. In Massachusetts and New Hampshire, these factors can significantly impact your total premium and, consequently, your down payment.

The good news? Since your down payment is tied to your overall premium, lowering your insurance rate automatically reduces your down payment. Strategies like bundling policies, increasing your deductible, maintaining a clean driving record, and comparing quotes from multiple insurers can all help reduce what you pay upfront.

I’m Geoff Stanton, President at Stanton Insurance Agency, and I’ve been helping Massachusetts and New Hampshire residents steer car insurance costs for over two decades. Understanding how much is a down payment for car insurance is crucial for budgeting your coverage, and I’m here to break it down in plain language. Let’s explore what goes into that first payment and how you can manage it effectively.

What Is a Car Insurance Down Payment and Why Is It Required?

A car insurance down payment is simply the first payment you make toward your total premium to activate your policy. It’s not an extra fee or a separate deposit like you’d put on an apartment. Instead, it’s a portion of your overall insurance cost paid upfront.

Insurers require a down payment as a sign of good faith. It secures the financial agreement and ensures you have a stake in the policy from day one. This practice protects the insurance company from the risk of a driver getting into an accident and filing a claim before ever making a payment.

The Role of a Down Payment in Your Policy

When you secure a car insurance policy, the down payment acts as your first payment, not an additional fee. It’s the initial installment that makes your policy valid, effectively setting your coverage in motion. This upfront payment is a critical step because, as the National Association of Insurance Commissioners states, a policy does not begin until a payment is made.

This initial payment serves several key purposes:

- Secures Coverage: Your policy isn’t active until this payment is processed. You cannot legally drive in Massachusetts or New Hampshire without proof of insurance, and that proof is contingent on your first payment.

- Mitigates Insurer Risk: Insurance is a financial agreement where the company assumes the risk of providing coverage. If an accident were to occur before any premiums were paid, the insurer would face a loss. The down payment reduces this immediate risk.

- Activates Policy: Without this payment, your policy simply won’t go into effect. It’s the green light for your insurance protection.

We understand that thinking about an upfront cost can be daunting, but it’s a standard and necessary part of the insurance process, ensuring both you and the insurer are protected from the outset.

Why Insurers Can’t Offer “Zero Down” Policies

You’ve probably seen advertisements promising “zero down” car insurance, and it’s easy to be enticed by the idea. However, from our expert perspective, true “zero down” auto insurance from reputable providers simply doesn’t exist. This isn’t a marketing gimmick; it’s a fundamental aspect of how insurance works.

Here’s why reputable insurers require an upfront payment:

- Financial Agreement: An insurance policy is a financial contract. The initial payment solidifies your commitment to this contract. If a driver could obtain proof of insurance without any payment, they might use it to register a vehicle or satisfy a dealership requirement and then fail to pay for actual coverage. This would leave the insurance company exposed to significant risk.

- Proof of Insurance: In both Massachusetts and New Hampshire, you need proof of insurance to register your car and drive legally. The down payment ensures that when you receive that proof, you’ve already initiated your coverage.

- Risk of Non-Payment: Insurers need to manage the risk of policyholders not paying their premiums. An initial payment helps validate that your payment method works and that you’re committed to the policy. Drivers perceived as higher risk, perhaps due to a poor driving record or credit history, might face a larger initial payment to offset this risk.

- Administrative Costs: There are immediate administrative costs associated with setting up a new policy, such as processing paperwork and running necessary reports. The down payment helps cover these initial expenses.

- State Regulations: While some states have specific regulations, the general principle across the country, including in Massachusetts and New Hampshire, is that insurance coverage requires an upfront payment.

So, when you see “no down payment,” it usually means a very low first payment—often equivalent to one month’s premium—which is still an initial payment. We always advise caution with any offer that sounds too good to be true, as they often come with hidden fees or higher overall costs.

How Much Is a Down Payment for Car Insurance?

The amount you’ll pay for a down payment isn’t a fixed number; it varies based on your total premium and several personal factors. Typically, a down payment is a percentage of your total policy cost, often for a six-month or annual term.

On average, you can expect your down payment to be between 10% and 30% of your total premium. For example, if your annual premium is $1,500, your down payment might range from $150 to $450. For drivers who opt for monthly installments, the down payment is often equivalent to the first one or two months’ premium.

Factors That Influence How Much a Down Payment for Car Insurance Is

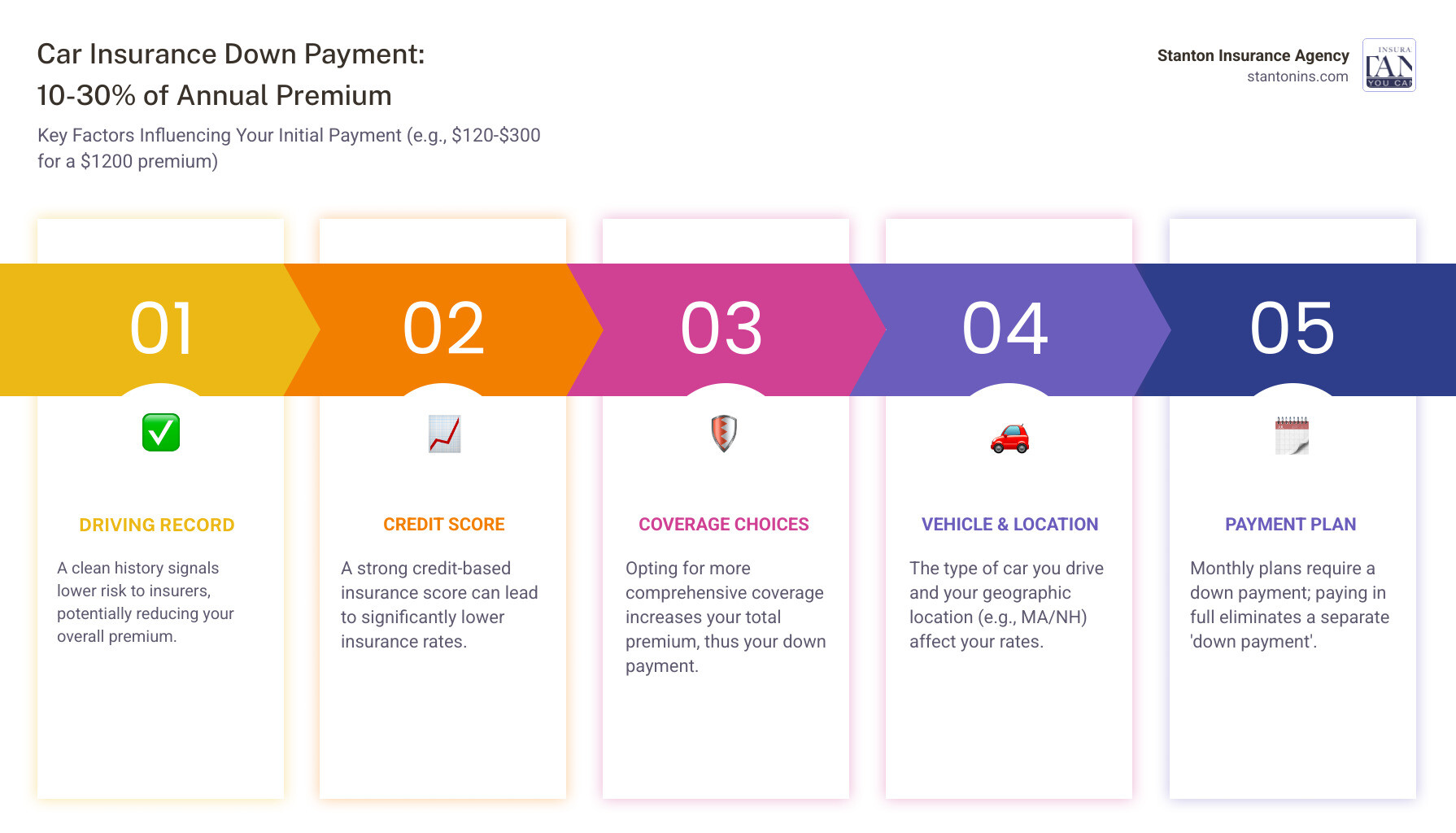

Determining how much is a down payment for car insurance involves a blend of personal circumstances and policy choices. Here are the key factors that influence this initial payment, particularly relevant for drivers in Massachusetts and New Hampshire:

- Driving record: Accidents, speeding tickets, or other violations generally increase your overall premium, which in turn raises your down payment. A clean record helps keep both lower.

- Credit-based insurance score: This factor’s impact varies significantly between our two states. In Massachusetts, the use of credit scores to determine car insurance rates is prohibited by law. However, in New Hampshire, insurers are permitted to use a credit-based insurance score to help predict the likelihood of future claims, where a stronger credit history can lead to a lower premium and a smaller down payment.

- Coverage levels: Choosing higher liability limits, plus collision and comprehensive coverage, increases your premium compared to carrying only the state minimums. More protection means a larger total cost and a higher first payment.

- Vehicle type and value: Newer, more expensive, or high-performance vehicles usually cost more to insure than older or lower-value cars, which affects the size of your down payment.

- Location (MA/NH): Where you live and park your car matters. Urban areas or regions with higher claim frequency and repair costs often come with higher premiums than more rural locations.

- Your chosen payment plan: Paying in full for six or 12 months may qualify you for discounts and eliminates installment fees. Choosing monthly payments spreads out the cost but usually starts with a down payment equal to one or two months of coverage.

- Overall auto insurance costs: Broader market factors, such as repair costs and medical expenses in your area, also influence rates. You can learn more about how these pieces fit together in our guide to auto insurance costs.

Calculating a Typical Down Payment

When we talk about how much is a down payment for car insurance, we’re generally looking at a percentage of your total premium. As a rule of thumb, this initial payment typically falls within the range of 10% to 30% of your annual or six-month premium.

Let’s illustrate with an example:

If your annual car insurance premium in Massachusetts or New Hampshire is $1,800, your down payment could be anywhere from $180 (10%) to $540 (30%).

For those who opt for monthly payment plans, the down payment is often equivalent to your first one or two months’ worth of coverage. So, if your monthly premium is $150 ($1,800 annually divided by 12 months), your down payment might be $150 or $300, depending on the insurer’s specific terms. The exact amount is set by the insurance company and depends on the factors outlined above.

Understanding Car Insurance Payment Options

When you purchase a policy, you’ll have a few choices for how to pay your premium, which directly impacts your down payment. The two most common options are paying in full or paying in monthly installments.

Paying your entire premium upfront for a six or 12-month term eliminates the need for a “down payment” in the traditional sense, as the first payment is the only payment. Many insurers offer a significant “paid-in-full” discount for this, making it the most cost-effective option if you can afford it. If you choose a monthly plan, you’ll make the initial down payment and then continue with smaller payments each month, though this option may include small installment fees.

Pay-in-Full vs. Monthly Installments

Choosing how to pay your car insurance premium is a significant decision that impacts both your upfront costs and your overall financial outlay. Drivers in Massachusetts and New Hampshire commonly compare these two options:

-

Paid-in-Full: This option involves paying your entire six-month or annual premium in one lump sum.

- Pros: Often the most cost-effective method. Many insurers offer a “paid-in-full” discount, which can range from 5% to 10% of your total premium. You also avoid potential installment fees that can be added to monthly payments. Once paid, you do not need to think about insurance payments again until renewal.

- Cons: Requires a higher upfront cost, which may not be feasible if you are managing a tight budget.

-

Monthly Installments: This is the most common payment method, allowing you to spread your premium cost over the policy term.

- Pros: Requires a lower upfront cost in the form of your down payment, making insurance more accessible. It helps manage your cash flow, as you pay smaller, regular amounts.

- Cons: Typically does not include a “paid-in-full” discount. Many insurers charge small installment fees for processing each monthly payment, which can add up over the policy term and slightly increase your overall premium cost.

The larger the down payment you make upfront, even if you are not paying in full, the lower your subsequent monthly payments will be. This can be a good middle-ground strategy for reducing your monthly financial obligations without having to pay the entire premium at once.

The Myth of “No Down Payment” Car Insurance

True “no down payment” car insurance is effectively a myth. It is often used as a marketing term to catch your attention, but in reality, every reputable car insurance company requires some form of upfront payment to activate your policy.

What these ads typically refer to is a low first payment. This could be as minimal as your first month’s premium, sometimes a relatively small amount depending on various factors. While this might feel like a “no down payment” option, it is still an initial payment.

Insurers are cautious about policyholders who appear to be seeking insurance only temporarily or simply to fulfill immediate requirements, such as registering a vehicle, without a genuine commitment to ongoing coverage. This behavior can signal higher risk, as these customers may be more prone to policy cancellation or non-payment. As a result, drivers with a poor driving record or weaker credit history may find that very low initial payment options are less available to them, or they may be required to pay a larger portion upfront.

Being open about your budget and payment preferences with your insurance agent can help you find a payment plan that is both affordable and sustainable, without relying on offers that sound too good to be true.

How Can I Lower My Car Insurance Down Payment?

Since the down payment is a percentage of your total premium, the most effective way to lower it is to reduce your overall car insurance rate. By taking steps to become a less risky driver to insure, you can secure a lower premium and, consequently, a smaller down payment.

Strategies for a Lower Premium and Down Payment

Reducing your car insurance premium directly translates to a lower down payment. Here are some actionable steps we recommend to our clients in Massachusetts and New Hampshire:

- Shop Around: This is one of the most impactful steps. Rates can vary significantly between different insurance carriers for the exact same coverage. Compare auto insurance quotes from multiple providers to find competitive rates.

- Bundle Your Policies: Many insurers offer multi-policy discounts when you combine your auto insurance with other policies, such as home insurance, renters, or umbrella coverage. Bundling can lead to substantial savings on your overall premium.

- Increase Your Deductible: The deductible is the amount you pay out of pocket before your insurance coverage applies after a claim. Choosing a higher deductible for collision and comprehensive coverage generally lowers your premium. Just be sure you can comfortably afford that amount if you need to file a claim.

- Ask for Discounts: Insurers may offer a wide array of discounts you could qualify for, including:

- Safe driver discounts for maintaining a clean driving record

- Good student discounts for young drivers with strong grades

- Vehicle safety feature discounts for anti-lock brakes, airbags, and anti-theft devices

- Low mileage discounts if you do not drive many miles each year

- Multi-car discounts when you insure more than one vehicle on the same policy

- Electronic funds transfer (EFT) or automatic payment discounts

- Paperless billing discounts

- Improve Your Credit (New Hampshire only): While Massachusetts law prohibits the use of credit in setting car insurance rates, in New Hampshire, your credit-based insurance score can influence your premium. For NH residents, strengthening your credit profile over time can help reduce premiums.

- Maintain a Clean Driving Record: Avoiding accidents and traffic violations is one of the most effective long-term strategies for keeping your premium, and therefore your down payment, as low as possible.

How Your Coverage Choices Affect Your Down Payment

The types and amounts of coverage you choose directly impact your total premium, and by extension, how much is a down payment for car insurance.

- Full Coverage vs. Liability-Only: If you opt for full coverage (typically liability plus collision and comprehensive), your premium will be higher than if you only carry the state-mandated minimum liability. A higher premium naturally leads to a larger down payment. For older vehicles, particularly if the car’s value is relatively low, you might review whether collision and comprehensive still make sense.

- State Minimums: In Massachusetts and New Hampshire, there are minimum liability requirements. Choosing only the minimum coverage will usually result in a lower premium and down payment than selecting higher liability limits. However, minimum limits may not provide enough protection in a serious accident, so it is important to balance cost with adequate coverage.

- Optional Coverages: Adding features such as roadside assistance, rental car reimbursement, or improved uninsured/underinsured motorist coverage increases your overall premium and, therefore, the amount due at the start of the policy. These options can be valuable, but it is worth reviewing which ones are essential for your situation.

By fine-tuning your coverage and applying these strategies, you can make your car insurance more affordable overall and reduce the upfront cost required to start your policy.

What Happens to My Down Payment If I Cancel My Policy?

A common question is whether the down payment is refundable. Since it’s part of your total premium and not a separate security deposit, you don’t get the “down payment” back as a distinct amount.

However, insurance is paid for in advance. If you cancel your policy before the term is over, you are generally entitled to a refund for the unused portion of the premium you’ve paid. For example, if you paid for a six-month policy in full and cancel after three months, you would typically receive a prorated refund for the remaining three months, minus any cancellation fees your provider may charge. The same principle applies if you’re on a monthly plan—your initial down payment covers the first month(s), and you’d be refunded for any paid time you don’t use.

Understanding Prorated Refunds

When you cancel your car insurance policy, whether in Massachusetts or New Hampshire, you generally will not get your initial “down payment” back as a separate line item. Instead, what you receive is a prorated refund for any unused premium you’ve paid.

Here’s how it usually works:

- Unused Premium: Insurance is paid in advance. If you’ve paid for a certain period (for example, six or 12 months) and cancel partway through, you have essentially pre-paid for the remaining time. The insurer calculates the premium for the period your policy was active and refunds the difference for the period it was not.

- Cancellation Date: The refund is calculated from the effective date of your cancellation. Until that date, you are considered covered and paying for protection.

- Policy Term: Whether you paid for a six-month or annual policy, the calculation is based on the number of days or months remaining in that term.

- Potential Cancellation Fees: Some insurance companies may charge a cancellation fee if you end your policy early. This fee is deducted from your prorated refund.

- Minimum Earned Premium: For certain policies, there may be a “minimum earned premium” (for example, a percentage of the policy) that is non-refundable once the policy is issued, even if you cancel very early. It is wise to review your policy documents or speak with your agent so you understand these terms before canceling.

If you’re considering canceling your policy in Massachusetts, you can review this guide on how to cancel car insurance in Massachusetts for more details on the process.

Does the Down Payment Affect the Overall Premium?

This is a common point of confusion. The down payment itself, in most cases, does not directly affect the overall premium amount for your car insurance policy. Instead, it’s a portion of that predetermined total premium.

Think of it this way: your total annual premium is like the price tag on a product. The down payment is just the first installment you pay to start owning that product. The price tag (your overall premium) generally doesn’t change based on whether your first payment is 10% or 20% of that total, assuming you’re still on an installment plan.

However, there are two key scenarios where your payment plan choice, which includes your down payment amount, can influence your overall cost:

- Paid-in-Full Discounts: If you choose to pay your entire premium upfront for the full policy term (for example, six months or a year), many insurers offer a “paid-in-full” discount. In this scenario, your overall premium effectively decreases because you’re rewarded for paying everything at once. This is the most significant way your payment choice impacts the total cost.

- Installment Fees: If you opt for a monthly or quarterly payment plan, your insurer might charge small installment fees for each payment processed. These fees, while often minor, can add up over the policy term and increase the total amount you pay compared to paying in full.

So, while the down payment itself does not change the base premium, your chosen payment plan can lead to discounts (paying in full) or additional costs (installment fees), which ultimately affect your total out-of-pocket expense for the policy. The larger the initial payment you make on an installment plan, the lower your subsequent monthly payments will be, but the underlying premium amount before discounts and fees usually remains the same.

Find the Right Car Insurance Plan for Your Budget

Understanding how much is a down payment for car insurance is the first step toward managing your insurance costs effectively. While you can’t avoid this initial payment, you can take steps to lower your overall premium, which in turn reduces the amount you need to pay upfront. By choosing the right coverage, asking for discounts, and maintaining a good driving record, you can find a policy that fits your budget.

The experts at Stanton Insurance Agency are here to help you understand your options and find affordable coverage for your needs in Massachusetts and New Hampshire. We focus on providing trusted protection for your valuable assets and on exceeding customer expectations.

To learn more about managing your insurance expenses, explore our guide to auto insurance costs or reach out to us for a personalized quote today.