Why Understanding a Private Car Insurance Broker Matters

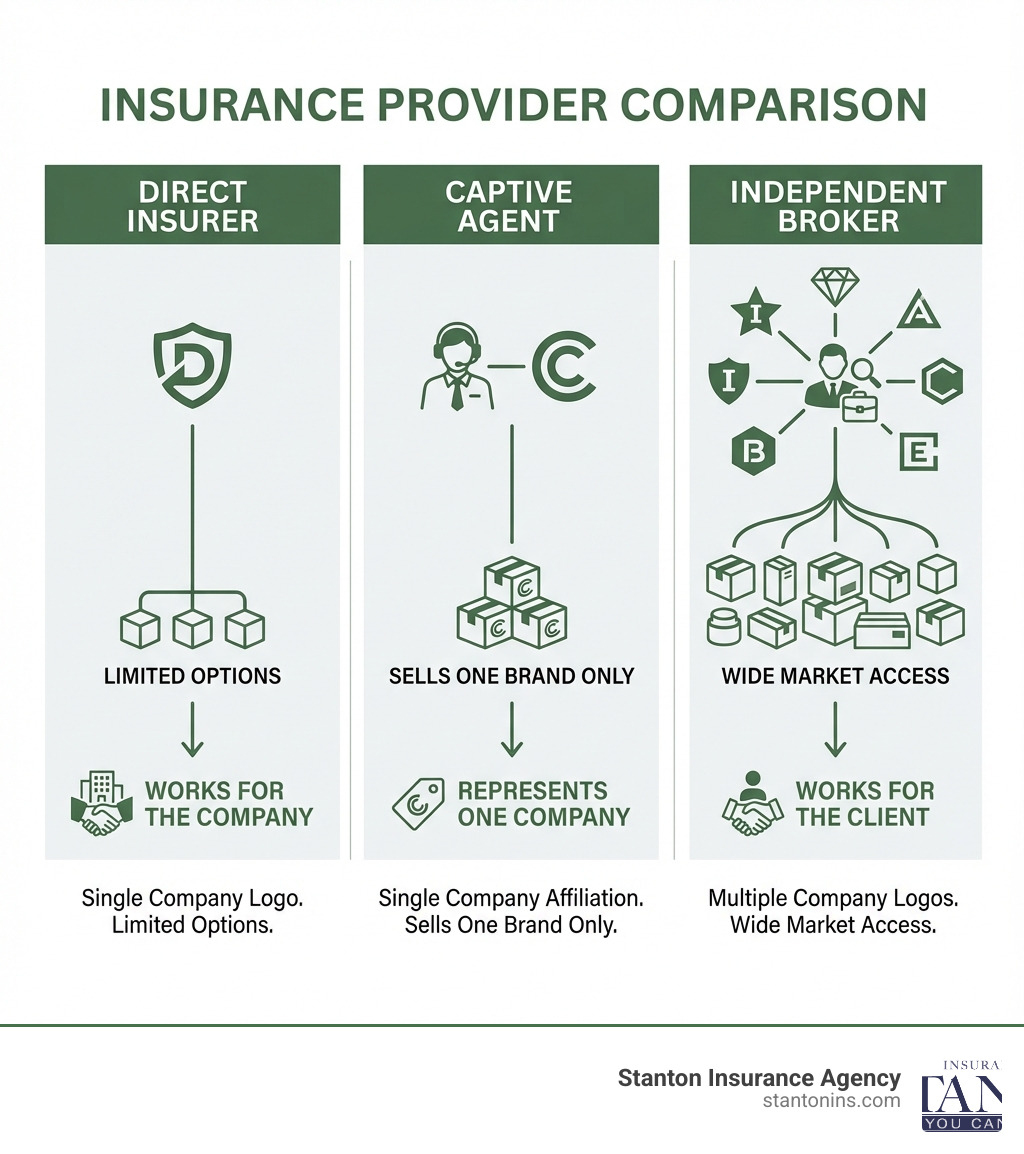

A private car insurance broker is a licensed professional who works for you, not an insurance company, to shop the market and find you the best coverage and price from multiple insurers. Unlike direct insurers or captive agents who represent one company, brokers compare dozens of options to match your specific needs and budget.

Key Differences:

- Independent Broker: Represents you; compares 20-100+ companies; finds best fit for your needs

- Captive Agent: Represents one insurance company; limited product selection

- Direct Insurer: Sells only their own policies through call centers or websites

Shopping for car insurance can feel like navigating a maze blindfolded. With countless companies promising the lowest rates and best coverage, how do you know which one truly fits your needs? The research shows that drivers who switch report average savings of $700 or more, but finding those savings requires knowing where to look across a marketplace where over 90% of insurers may not advertise directly to you.

I’m Geoff Stanton, President at Stanton Insurance, where I’ve specialized in helping Massachusetts and New Hampshire drivers find personalized car insurance solutions as a private car insurance broker for over two decades. This guide will show you how an independent broker simplifies your search, uncovers hidden savings, and serves as your advocate from quote to claim.

What is a Private Car Insurance Broker and How Do They Differ?

A private car insurance broker is a licensed professional who acts as your personal insurance advisor. Unlike insurance agents who might work for a specific company, we, as brokers, are independent. Our primary duty is to represent your best interests, not those of an insurance carrier. We take the time to understand your unique driving habits, vehicle type, and coverage preferences, then carefully search the market to find the best possible coverage and price. We are licensed professionals dedicated to simplifying what can often feel like a complex and overwhelming process. Think of us as your personal shopper for insurance, but with expert knowledge of the entire insurance landscape. You can learn more about our approach at our Independent Insurance Agency.

Broker vs. Direct Insurer vs. Captive Agent

Understanding the key players in the insurance world is crucial for making an informed decision about how to purchase your car insurance.

- Direct Insurers: These are companies that sell their policies directly to consumers, often through online platforms, phone calls, or their own dedicated offices. When you go directly to a direct insurer, you are only getting a quote from that one company. This can be fast, but it limits your options significantly.

- Captive Agents: A captive agent works exclusively for one insurance company. While they can offer personalized service and in-depth knowledge of their company’s products, their offerings are restricted to that single insurer. This means they cannot compare rates or coverages from other companies on your behalf.

- Private Car Insurance Brokers: This is where we come in. As independent brokers, we don’t work for any single insurance company. Instead, we partner with a wide array of insurers. This allows us to compare policies, rates, and coverage options from many different providers to find the one that best suits your needs. We are essentially your advocate, using our market access to provide you with choice and flexibility that direct insurers or captive agents simply cannot. Our goal is to find you the most comprehensive coverage at the most competitive price, leveraging our relationships with various Insurance Agencies.

Here’s a quick comparison:

| Feature | Private Car Insurance Broker | Captive Agent | Direct Insurer |

|---|---|---|---|

| Number of Companies | Many (often 20-100+) | One | One (their own products) |

| Allegiance | Client | Insurance Company | Insurance Company |

| Range of Options | Wide range of policies, prices, and coverage types | Limited to one company’s offerings | Limited to their own products |

| Personalized Advice | High | High | Varies (often less personalized) |

| Claims Advocacy | Yes | Varies | No (you deal directly with company) |

How Does a Private Car Insurance Broker Get Paid?

We believe in transparency, especially when it comes to compensation. As private car insurance brokers, we are typically compensated via a commission. This commission is paid to us by the insurance company after you purchase a policy. This cost is already built into the insurance premium, regardless of whether you go through a broker or directly to an insurer.

This means you do not pay us a direct fee for our services. In fact, our ability to shop the market and compare rates from numerous carriers often results in significant net savings for you, even with the commission built into the premium. Our motivation is to find you the best deal because that’s how we earn your business and our commission. We save you time and hassle, and often money, all without an additional out-of-pocket cost to you.

The Core Services and Benefits of Using a Broker

Working with a private car insurance broker goes far beyond just getting a quote. We provide a comprehensive suite of services designed to save you time and money, all while ensuring you are properly protected on the roads of Massachusetts and New Hampshire. We aim to be your long-term insurance partner, not just a one-time transaction.

Our expertise allows us to offer personalized advice and in-depth review of your needs. For a broader understanding of car insurance, you can also check out What you need to know about auto insurance.

Typical Services Offered

From your initial consultation to ongoing support throughout your policy’s life, we are here for you. Here are some of the typical services we offer:

- Needs Assessment: We start by thoroughly understanding your specific situation, including your vehicle, driving history, daily commute, and financial considerations. This includes a detailed risk analysis to identify potential gaps in coverage.

- Market Comparison: We shop around on your behalf, comparing policies from dozens of insurance carriers to find the best match for your needs and budget. This saves you the tedious work of contacting multiple companies yourself.

- Policy Explanation: Insurance policies can be filled with jargon. We break down complex terms, explain different coverage options (like liability, comprehensive, and collision), and ensure you understand exactly what you’re buying.

- Coverage Customization: We don’t believe in one-size-fits-all. We help you tailor your policy with the right limits and deductibles, and identify additional coverages like roadside assistance or rental reimbursement that might benefit you.

- Discount Identification: We actively look for every possible discount you qualify for, such as multi-car, bundling, good student, or low-mileage discounts. For our Massachusetts clients, we also specialize in navigating the Safe Driver Insurance Plan (SDIP) to ensure you receive all applicable credits.

- Application Assistance: We guide you through the application process, ensuring all information is accurate and submitted correctly, helping to prevent delays or issues.

- Annual Policy Reviews: Your life changes, and so should your insurance. We proactively review your policy at renewal time to ensure it still meets your needs and to re-shop the market for new, more competitive rates.

- Claims Support: Should you ever need to file a claim, we are your first point of contact and advocate, guiding you through the process and liaising with the insurance company on your behalf.

Key Benefits for Consumers

The “broker advantage” translates into tangible benefits that directly impact your peace of mind and wallet:

- Access to More Choices: We shop hundreds of companies to find the best match for you! This broad market access means you’re not limited to the offerings of just one insurer. You get to choose from a diverse range of policies, ensuring you find coverage that truly fits.

- Expert Guidance: Our deep understanding of insurance products, market trends, and state-specific regulations in Massachusetts and New Hampshire means you receive informed advice. We help you steer complex decisions and understand the nuances of different policies.

- One-Stop Shopping: Instead of spending hours calling different companies or filling out multiple online forms, you come to us once. We do all the legwork, presenting you with curated options saving you valuable time.

- Long-Term Relationship: We aim to build lasting relationships with our clients. We’re not just here for the initial sale; we’re here to provide ongoing support, answer questions, and adjust your policy as your life changes.

- Advocacy on Your Behalf: Whether it’s negotiating with an insurer for a better rate or assisting during a claims process, we act as your advocate, ensuring your interests are always prioritized.

- Potential Savings of Hundreds of Dollars: By comparing rates across many carriers, we often uncover significant savings. Drivers who switch insurers commonly report saving hundreds of dollars annually. While specific figures can vary, the potential to save up to $700 or more by switching is a powerful incentive, as seen in various industry reports. We are committed to finding you the most cost-effective solution without compromising on quality coverage.

How to Find and Choose the Best Private Car Insurance Broker

Selecting the right private car insurance broker is a crucial decision that can impact both your coverage and your finances. You need a partner who is knowledgeable, trustworthy, and genuinely dedicated to your best interests. This is especially true in local markets like Massachusetts and New Hampshire, where local expertise can make a significant difference.

What to Look for in a Private Car Insurance Broker

When searching for a broker, consider these key factors:

- State Licensing: Always verify that the broker is properly licensed to sell insurance in Massachusetts and New Hampshire. This ensures they meet regulatory standards and possess the necessary qualifications.

- Years of Experience: Experience matters. A broker with a long track record, especially in your local area, will have a deeper understanding of regional insurance challenges, reputable carriers, and effective strategies for finding you the best deals.

- Carrier Appointments: A good broker will have appointments with a wide range of insurance companies. The more carriers they represent, the more options they can provide you. Ask them about the number of companies they work with. We pride ourselves on working with numerous top-rated carriers to ensure comprehensive choice.

- Positive Reviews and Reputation: Look for brokers with strong positive reviews and a solid reputation in the community. What do other clients say about their service, their ability to find good rates, and their responsiveness? This insight can be invaluable. You can see why we are considered a Best Independent Insurance Agency by many.

- Communication Style: Choose a broker whose communication style aligns with your preferences. Do they explain things clearly? Are they responsive to your questions? A good broker should make you feel comfortable and informed, never rushed or confused.

Potential Drawbacks and Limitations

While the advantages of using a private car insurance broker are numerous, it’s also important to be aware of potential limitations:

- May Not Represent Every Single Insurer: While brokers work with a wide network of carriers, it’s important to note that no single broker represents every insurance company on the market. Some niche or very small insurers might not be in their portfolio. However, the sheer breadth of options they do offer typically covers the vast majority of competitive choices.

- Commission Structure Could Be a Concern (Though Regulated): As mentioned, brokers are compensated by commission from the insurance company. While this is a standard practice and regulated, some consumers might worry it could bias recommendations. However, a reputable broker’s long-term success relies on client satisfaction and trust, which means finding you the best deal, not just the highest commission.

- Smaller Local Brokers May Have Fewer Carrier Options than Large National Ones: While smaller local agencies like ours offer personalized service and deep community roots, a very small broker might have a slightly more limited selection of carriers compared to a massive national brokerage. However, we at Stanton Insurance Agency maintain robust relationships with a broad spectrum of top carriers to ensure our clients in Massachusetts and New Hampshire always have excellent choices.

A Broker’s Role in Securing Coverage and Managing Claims

A private car insurance broker truly shines when it comes to securing the right policy and, crucially, helping you steer the often-stressful claims process. When you need us most, we’re there. Understanding the intricacies of Auto Insurance Costs is just one part of our expertise.

How a Broker Finds the Best Coverage and Price

We leverage our expertise and industry access to match your unique driver profile and needs with the insurer best suited for you. We look beyond just the advertised price to ensure you get value and comprehensive protection. Here’s how:

- Comparing Quotes Systematically: We don’t just get one quote; we get many. We shop with numerous insurance companies, often over a hundred, to find you competitive rates. While some online comparison sites can give you quick quotes, they often lack the personalized advice and in-depth understanding of your specific situation that a broker provides.

- Bundling Discounts: We are experts at identifying opportunities to bundle your car insurance with other policies, such as home or renters insurance, which can lead to significant savings. Many insurers offer substantial discounts for clients who consolidate multiple policies with them.

- Identifying Applicable Credits: Beyond standard discounts, we know how to uncover specific credits you might qualify for based on your vehicle’s safety features, your driving history, professional affiliations, or even participation in telematics programs (where available and beneficial).

- Understanding Insurer Niches: Different insurance companies have different target markets. Some specialize in drivers with perfect records, while others are more competitive for younger drivers, drivers with minor infractions, or those with unique vehicles. We know which insurers are likely to offer the best rates for your specific profile. This personalized approach often leads to substantial savings. For instance, while specific figures vary by state and insurer, drivers often report saving hundreds of dollars (e.g., up to $700 or more) when a broker helps them switch to a better-suited policy. Our Auto Insurance Quotes MA Complete Guide further elaborates on how we secure favorable terms for our Massachusetts clients. Both states also provide helpful consumer resources, including the Massachusetts guide to shopping for auto insurance and the New Hampshire Insurance Department’s auto insurance page.

- Advantageous in Specific Situations: Using a private car insurance broker is particularly advantageous if you have complex insurance needs, such as insuring a classic car, a highly customized vehicle, or if you have a less-than-perfect driving record. We know which carriers are willing to offer coverage and at what rates, saving you the frustration of multiple rejections. This also applies to drivers looking for specific types of coverage not easily found through standard channels.

How a Private Car Insurance Broker Helps with Claims

In the stressful event of an accident or other covered incident, your private car insurance broker is your most valuable ally. We act as your first point of contact and your dedicated advocate, guiding you through the process and liaising with the insurance company to ensure a fair and timely settlement. Our commitment extends across our entire Auto Insurance Service Area.

- Claims Process Guidance: The paperwork and procedures involved in filing a claim can be overwhelming. We explain each step, what information you need to provide, and what to expect from the insurance adjuster.

- Advocate for You: We stand by your side throughout the claims process. If there are disputes or delays, we intervene on your behalf, using our knowledge and relationships to push for a fair resolution. We ensure your voice is heard and your rights are protected.

- Communication with Adjuster: Dealing with an insurance adjuster can be intimidating. We can facilitate communication, ensuring that all necessary details are conveyed accurately and that you understand any requests or offers made by the adjuster.

- Policy Interpretation: Sometimes, the language in a policy can be ambiguous. We interpret your policy’s terms and conditions, ensuring you understand what is covered and what isn’t, and that the insurer is adhering to the terms of your agreement. This support can be invaluable, turning a potentially frustrating experience into a manageable one.

Frequently Asked Questions about Car Insurance Brokers

Is it more expensive to use a car insurance broker?

This is a common misconception. No, it is generally not more expensive to use a private car insurance broker. As we discussed, brokers are paid a commission directly by the insurance company, and this cost is already factored into the premium regardless of how you purchase your policy. In fact, because we have access to policies from many different carriers, we can often find you a better rate than you might find on your own by comparing options and identifying specific discounts. This means our service often leads to overall savings for you.

Can a broker help if I have a bad driving record or unique vehicle?

Absolutely. This is precisely one of the specific situations where using a private car insurance broker is particularly advantageous. If you have a few dings on your driving record, or if you own a classic, custom, or high-performance vehicle, finding affordable and comprehensive coverage can be a challenge. We know which insurance companies specialize in insuring high-risk drivers or unique vehicles and can steer those markets to find coverage where you might otherwise be denied or quoted exorbitant rates. We leverage our relationships to connect you with the right insurer for your specific needs.

How is a broker different from an online comparison website?

While both brokers and online comparison websites aim to provide quotes from multiple companies, the service and value they offer are fundamentally different. Online comparison sites are excellent for speed and initial price comparison. However, they are largely automated and transactional.

A private car insurance broker, on the other hand, provides a personalized, human touch. We offer:

- Personalized Advice: We help you understand the nuances of coverage, not just the price. We assess your needs, explain policy details, and ensure you’re not underinsured or overpaying for unnecessary coverage.

- Advocacy: We act as your advocate, assisting with policy changes, renewals, and most importantly, guiding and supporting you through the claims process. Automated websites cannot offer this level of support.

- Long-Term Relationship: We aim to be your trusted advisor for years, adapting your insurance as your life and needs evolve. This ongoing partnership is something no algorithm can replicate.

Essentially, a comparison website gives you data; a broker gives you expert, custom advice and ongoing support.

Your Trusted Partner for Car Insurance

Choosing the right car insurance is a critical decision that protects you, your loved ones, and your valuable assets. A private car insurance broker demystifies this process, offering personalized expertise, unparalleled choice, and dedicated advocacy. We work for you, ensuring you get the best combination of coverage, service, and price for your vehicle in Massachusetts and New Hampshire. By partnering with a trusted local agency like ours, you gain a long-term ally committed to protecting what matters most. The team at Stanton Insurance Agency has been providing this level of service to the community for years, building relationships based on trust and exceptional service.

Ready to experience the broker advantage and drive with confidence? Let us do the shopping for you and open up personalized car insurance deals that fit your life. Contact us today for a personalized auto insurance review!