Stacked Uninsured Motorist Coverage: Secure Your 2025

Why Understanding Stacked Coverage Could Save You Thousands

Stacked uninsured motorist coverage allows you to combine the coverage limits from multiple vehicles on your policy, potentially doubling or tripling your protection after an accident with an uninsured driver. Here’s what you need to know:

Key Features:

- Higher Coverage Limits: Combine UM limits from all your vehicles

- Better Protection: More financial security than unstacked coverage

- Broader Coverage: Protects you in more situations

- Modest Cost Increase: Usually 20-30% more than unstacked coverage

According to the Insurance Research Council, about 12.6% of American drivers are uninsured. In some states like Florida, that number jumps to 1 in 4 drivers. When you’re hit by one of these uninsured motorists, having adequate protection becomes critical.

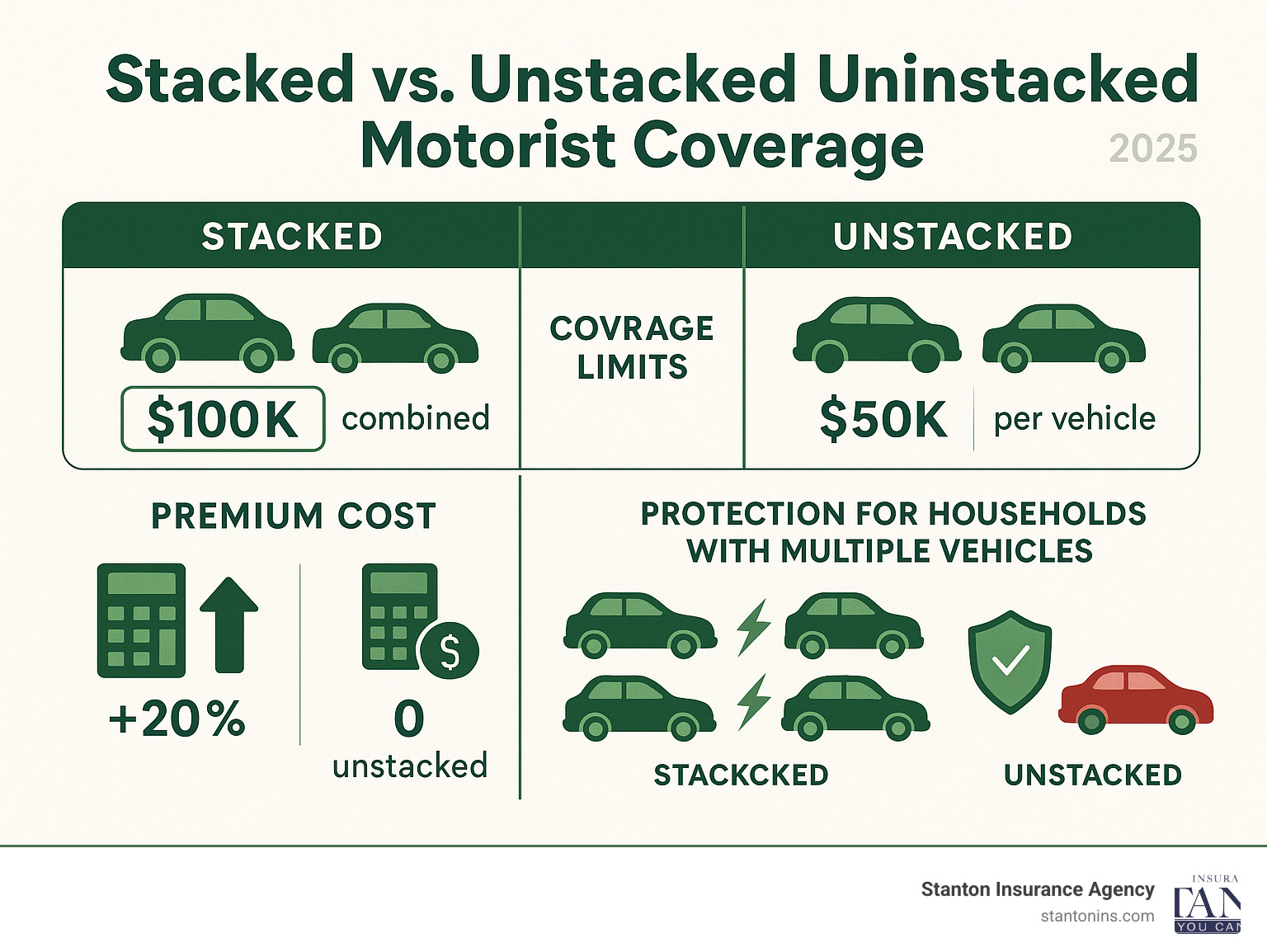

Consider this scenario: You have two cars with $50,000 in uninsured motorist coverage each. With unstacked coverage, you’re limited to $50,000 total. With stacked coverage, you have $100,000 in protection – potentially covering medical bills that unstacked coverage would leave you paying out of pocket.

I’m Geoff Stanton, and I’ve spent over two decades helping families in Massachusetts and New Hampshire understand their insurance options, including the complexities of stacked uninsured motorist coverage. As a 4th generation owner at Stanton Insurance Agency, I’ve seen how the right coverage choices can make the difference between financial security and devastating out-of-pocket costs after an accident.

Understanding the Basics: Uninsured and Underinsured Motorist (UM/UIM) Coverage

Every time you get behind the wheel, you’re essentially making a bet that everyone else on the road is playing by the same rules. Unfortunately, that’s not always the case. Uninsured and underinsured motorist coverage (UM/UIM) acts as your financial safety net when you encounter drivers who either have no insurance or not enough coverage to pay for the damage they cause.

Here’s a sobering statistic: according to the Insurance Research Council, about 1 in 8 drivers in the U.S. is uninsured. That’s roughly 13% of everyone sharing the road with you! In some states, the numbers are even more alarming, with nearly one in four drivers lacking proper coverage.

When an uninsured driver causes an accident that leaves you with injuries, medical bills, and lost wages, their empty pockets won’t help you recover. That’s exactly when UM/UIM coverage becomes invaluable. This protection steps in to cover your bodily injury, medical bills, lost wages, and pain and suffering when the at-fault driver can’t or won’t pay.

Hit-and-run accidents are another frustrating scenario where this coverage proves its worth. When the responsible party flees the scene and can’t be identified, your UM coverage treats the situation as if you were hit by an uninsured driver.

UM/UIM coverage works alongside other protections you might already have. Your Personal Injury Protection (PIP) or Medical Payments (MedPay) coverage typically handles immediate medical expenses first, regardless of who caused the accident. Once those limits are exhausted, your UM/UIM coverage provides additional protection, creating a comprehensive safety net for you and your family.

Learn more: What is Uninsured Motorist Coverage?

Is Uninsured Motorist Coverage Mandatory?

State requirements vary significantly, so understanding your local laws is crucial for proper protection.

In Massachusetts, UM coverage is required by law. It’s not optional – every auto insurance policy must include this protection, ensuring that all drivers have a baseline level of coverage when they encounter uninsured motorists.

New Hampshire takes a different approach. Since auto insurance itself isn’t mandatory in the “Live Free or Die” state, UM coverage is optional but highly recommended. Think about it this way: if you’re hit by someone who chose not to carry insurance, you’ll be left covering your own medical bills and other expenses without UM protection.

Even when not mandatory, carrying UM/UIM coverage protects your assets and provides peace of mind. This protection becomes especially important in areas with higher rates of uninsured drivers, where your financial risk increases significantly.

Learn more: Understanding Auto Insurance Coverage

What is the Difference Between Uninsured and Underinsured Motorist Coverage?

While these two coverages are often bundled together, they address different scenarios that could leave you financially vulnerable.

Uninsured Motorist (UM) coverage protects you when the at-fault driver has no insurance whatsoever. This could happen because they let their policy lapse, never bought insurance in the first place, or simply chose to ignore the law. Hit-and-run accidents also fall under UM coverage since the fleeing driver essentially becomes “uninsured” from your perspective.

Underinsured Motorist (UIM) coverage applies when the at-fault driver does have insurance, but their limits are too low to cover your damages fully. Picture this: you’re seriously injured in an accident, facing $75,000 in medical bills, but the other driver only carries the state minimum of $25,000 in liability coverage. Your UIM coverage would step in to help cover that $50,000 gap, preventing you from paying those costs out of your own pocket.

Both coverages are crucial for comprehensive protection, ensuring you’re covered whether the other driver has no insurance or simply not enough to make you whole after an accident.

Stacked vs. Unstacked UM Coverage: A Head-to-Head Comparison

When you’re reviewing your auto insurance policy, you’ll likely encounter two options for your uninsured motorist coverage: stacked and unstacked. While the terminology might sound confusing at first, understanding this distinction could be one of the most important decisions you make about your coverage. Stacked uninsured motorist coverage offers significantly higher protection limits, though it does come with a slightly higher premium.

Think of it this way: unstacked coverage is like having a single safety net, while stacked coverage is like having multiple safety nets woven together for extra strength. Both will catch you if you fall, but one provides much more security.

What is Unstacked UM Coverage?

Unstacked coverage is the straightforward option. With this type of coverage, you get exactly what’s listed on your policy for each vehicle – no more, no less. If you have one car with $50,000 in UM coverage, that’s your limit regardless of any other vehicles you might own.

Let’s say you own two cars, each with $50,000 in unstacked UM coverage. If you’re injured in an accident with an uninsured driver, you can only access $50,000 in benefits, even though you’ve been paying premiums on both vehicles. The coverage doesn’t combine or multiply – it stays tied to that single vehicle limit.

This option appeals to many drivers because it typically comes with lower premiums. If keeping your insurance costs down is your primary concern, unstacked coverage might seem like the obvious choice. However, the trade-off is that you’re accepting more limited protection when you might need it most.

How Does Stacked Uninsured Motorist Coverage Work?

Here’s where things get exciting – and much more protective for you and your family. Stacked uninsured motorist coverage allows you to combine the UM limits from multiple vehicles or policies, creating a much larger pool of protection when disaster strikes.

There are two ways stacking can work, and both can significantly boost your coverage. Vertical stacking happens when you have multiple vehicles on the same policy. Using our earlier example, if you have two cars each with $50,000 in UM coverage, vertical stacking gives you $100,000 in total protection. Add a third vehicle, and you’re up to $150,000. It’s like having a financial multiplier effect working in your favor.

Horizontal stacking comes into play when you have multiple policies within your household. Maybe you and your spouse each maintain separate auto insurance policies with $50,000 in UM coverage. With horizontal stacking, you can combine these limits for $100,000 in total protection, giving either of you access to this larger safety net.

But stacked coverage offers more than just higher dollar amounts – it provides broader protection in situations where unstacked coverage might leave you hanging. If you’re injured as a passenger in a friend’s car, or even while walking down the street and hit by an uninsured driver, your stacked uninsured motorist coverage often still protects you. It follows you around, not just your vehicle.

Even if you only own one car, choosing stacked coverage can still benefit you. It often removes certain exclusions that apply to unstacked policies, giving you protection in more scenarios. You might be covered while riding a motorcycle or occupying a vehicle you own but don’t have listed on your policy.

When comparing your options, the choice often comes down to cost versus coverage. Stacked coverage typically costs about 20-30% more than unstacked, but it can provide double, triple, or even more protection. For most families, especially those with multiple vehicles, this modest increase in premium delivers tremendous value. After all, medical bills from a serious accident don’t care whether you chose the cheaper coverage option – they need to be paid regardless.

| Feature | Stacked UM Coverage | Unstacked UM Coverage |

|---|---|---|

| Coverage Limit | Combined across vehicles | Single vehicle limit |

| Premium Cost | Slightly higher | Lower |

| Scope of Coverage | Broader, more scenarios | Limited |

| Ideal Candidate | Multi-vehicle households | Single-vehicle owners |

The Pros and Cons of Stacked Uninsured Motorist Coverage

When it comes to choosing stacked uninsured motorist coverage, you’re essentially making a bet on your future safety. It’s a decision that involves balancing your monthly budget against the potential financial catastrophe that could follow a serious accident. Over the years, I’ve helped countless families steer this choice, and I’ve seen how the right decision can mean the difference between financial recovery and overwhelming debt.

Key Benefits of Choosing Stacked Uninsured Motorist Coverage

The most compelling reason to choose stacked uninsured motorist coverage is the dramatically higher coverage limits it provides. Think about it this way: if you’re severely injured in an accident and face $200,000 in medical bills, but your unstacked coverage only offers $50,000, you’re suddenly responsible for $150,000 out of your own pocket. That’s enough to wipe out most families’ savings and then some.

What many people don’t realize is that stacked coverage offers much broader protection than just combining vehicle limits. Your coverage actually follows you around, protecting you even when you’re walking across a parking lot or riding your bike through the neighborhood. If an uninsured driver hits you while you’re out for your morning jog, your stacked UM coverage can still come to your rescue.

This protection extends to your entire household too. Your spouse and children living at home are covered under your stacked policy, even if they’re injured as passengers in someone else’s car or while walking. It’s like having a safety net that travels with your whole family.

The value becomes even clearer in areas with high rates of uninsured drivers. While Massachusetts tends to have better compliance than some states, we still see plenty of cases where responsible drivers get hit by someone without insurance. The peace of mind that comes from knowing you’re prepared for these situations is honestly priceless.

Even if you only own one vehicle, choosing the stacked option can eliminate certain exclusions that unstacked policies often include. This means if you buy a second car and haven’t added it to your policy yet, or if you’re injured while using a motorcycle or RV that’s separately insured, your stacked coverage might still protect you when unstacked coverage would leave you hanging.

Learn more: Auto Insurance Costs

Potential Downsides and Costs

Let’s be honest about the main drawback: stacked coverage costs more. Typically, you’re looking at about 20-30% higher premiums compared to unstacked coverage. For a family already watching their budget, this increase can feel significant. I get it – nobody wants to pay more for insurance if they can avoid it.

Not every state allows stacking, so depending on where you live or travel, you might not even have this option. Fortunately, both Massachusetts and New Hampshire permit stacking, so our clients can take advantage of this improved protection.

In Massachusetts, since stacking is often the default option, you might need to actively reject it in writing if you prefer the lower-cost unstacked coverage. This requirement exists to make sure you understand what you’re giving up when you choose the cheaper option.

The real question becomes whether the extra cost is worth the additional protection. This depends on your personal situation. If you have excellent health insurance with low deductibles, you might feel comfortable with less UM coverage. But if you’re carrying a high-deductible health plan, frequently drive with passengers, or live in an area where you encounter more questionable drivers, the extra protection often pays for itself when you need it most.

The way I see it, you’re already paying for insurance – why not make sure it actually protects you when disaster strikes? The difference in premium is usually much smaller than the difference in protection, and that math tends to work in your favor when you need it most.

Stacking Laws: What Drivers in Massachusetts and New Hampshire Need to Know

When it comes to insurance laws, each state has its own personality. What’s perfectly legal in one state might be prohibited in another, and what’s optional here could be mandatory there. For those of us living and driving in Massachusetts and New Hampshire, understanding these local rules isn’t just helpful – it’s essential for making smart decisions about our coverage.

The good news? Both Massachusetts and New Hampshire are friendly when it comes to stacked uninsured motorist coverage. But the details matter, and knowing exactly how these laws work in your state can help you maximize your protection.

Stacking UM Coverage in Massachusetts

Massachusetts drivers are in luck when it comes to stacking options. The Bay State not only allows stacked uninsured motorist coverage, but it’s actually the default choice for most policies. This means when you get a quote, you’re likely seeing stacked coverage unless you specifically ask for something different.

There’s a good reason Massachusetts law permits combining limits – the state wants to ensure residents have robust protection. Given the dense traffic patterns around Boston and throughout the state, accidents happen, and having maximum coverage available just makes sense.

Here’s something important to know: if you decide you’d rather have unstacked coverage to save money, you can’t just check a box and move on. You must submit a written rejection of the stacked coverage. This isn’t Massachusetts being difficult – it’s the state making sure you truly understand what you’re giving up. Think of it as a friendly reminder that you’re choosing less protection.

For families with multiple vehicles navigating Massachusetts roads, this default stacked approach provides peace of mind. Whether you’re dealing with the infamous Boston traffic or cruising the scenic routes in the Berkshires, knowing you have maximum coverage available can make all the difference after an accident.

Learn more: Massachusetts Auto Insurance Requirements

Stacking UM Coverage in New Hampshire

New Hampshire presents a unique situation that makes stacked uninsured motorist coverage even more valuable. While the state allows stacking just like Massachusetts, there’s a crucial difference: New Hampshire doesn’t require drivers to carry auto insurance at all.

This “Live Free or Die” approach to insurance requirements means you’re sharing the roads with drivers who may have chosen to skip insurance entirely. When nearly every other state requires at least basic coverage, New Hampshire’s optional approach creates a higher risk environment for encounters with uninsured motorists.

Stacking becomes your financial shield in this scenario. If you have two vehicles with $50,000 each in UM coverage, stacking gives you $100,000 in protection instead of just $50,000. When you’re hit by someone with no insurance at all, that extra coverage could mean the difference between financial recovery and devastating out-of-pocket expenses.

The beauty of New Hampshire’s stacking laws is their flexibility. You can combine coverage from multiple vehicles on one policy, or even stack coverage across different policies within your household. This creates multiple layers of protection in a state where you really need them.

New Hampshire Auto Insurance Requirements

Frequently Asked Questions about Stacked UM Coverage

We know that insurance can sometimes feel overwhelming – like trying to decode a foreign language while juggling flaming torches. That’s perfectly normal! Over my years helping families understand their coverage, I’ve noticed the same thoughtful questions come up again and again about stacked uninsured motorist coverage. Let me share the answers that have helped countless clients make confident decisions about their protection.

Can I get stacked UM coverage if I only have one car?

This question always makes me smile because it’s so logical. After all, if you only have one car, what exactly are you “stacking,” right? Here’s where it gets interesting – and where many people find they’ve been missing out on valuable protection.

Even with just one vehicle, choosing the “stacked” option can provide significantly broader coverage than unstacked. The magic isn’t in combining multiple car limits (since you only have one), but in removing exclusions that typically plague unstacked policies.

Think about it this way: unstacked coverage is like having a very particular friend who only helps under very specific circumstances. Stacked coverage is more like having a generous friend who’s got your back in all sorts of situations. For instance, if you’re injured while occupying a vehicle you own but don’t have insured on that policy – maybe a motorcycle, an RV, or even a newly purchased car you haven’t added yet – your stacked UM coverage could still protect you. Unstacked coverage would likely leave you hanging in these scenarios.

So yes, you absolutely can get stacked coverage with one car, and it often makes perfect sense. It’s about securing broader protection that follows you around, not just your vehicle.

Does stacked UM coverage apply to property damage?

This is where I need to set the record straight on a common misconception. Stacked uninsured motorist coverage applies only to bodily injury protection – things like medical bills, lost wages, and pain and suffering when you’re hurt by an uninsured driver.

Your car’s bumper, however beautiful it may be, falls under completely different coverage. For vehicle repairs after an accident with an uninsured driver, you’ll need Collision coverage or Uninsured Motorist Property Damage (UMPD) coverage if your state offers it. Think of it this way: stacked UM takes care of you and your passengers, while other coverages take care of your car. They’re teammates, but they play different positions on your insurance team.

How do I know if I have stacked or unstacked coverage?

The answer is hiding in plain sight on your auto insurance policy’s declarations page – that summary document your insurance company sends you that often gets filed away and forgotten.

Look for the section that lists your Uninsured Motorist (UM) and Underinsured Motorist (UIM) coverage. Right there, next to your coverage limits, it should clearly state whether your coverage is “Stacked” or “Unstacked” (sometimes called “Non-stacked”). It’s usually pretty straightforward once you know where to look.

If you’re staring at your declarations page and still scratching your head, don’t worry – insurance documents aren’t exactly known for their clarity. Give us a call, and we’ll walk through it together. Understanding your coverage is too important to leave to guesswork, and we’re always happy to help decode the insurance speak.

Get the Right Protection for Your Peace of Mind

Making the choice between stacked and unstacked coverage isn’t just about checking boxes on an insurance form—it’s about protecting your family’s financial future when you need it most. While unstacked coverage might look appealing with its lower price tag, the comprehensive protection offered by stacked uninsured motorist coverage often proves invaluable when reality hits. That modest increase in premium? It’s usually a small price to pay for potentially avoiding thousands in out-of-pocket expenses.

This decision becomes even more crucial here in Massachusetts and New Hampshire, where we’ve seen how quickly an accident with an uninsured driver can turn someone’s world upside down. In Massachusetts, with its busy highways and dense traffic, the risk is ever-present. In New Hampshire, where auto insurance isn’t even mandatory, that risk multiplies significantly.

Over my two decades in this business, I’ve watched families breathe sighs of relief because they chose adequate coverage, and I’ve also seen the stress that comes when coverage falls short. The difference often comes down to understanding these options before you need them, not after an accident when it’s too late to make changes.

An experienced agent can help you look at your specific situation—your daily commute, the number of vehicles in your household, your health insurance deductibles, and your overall financial picture—to determine what makes the most sense for you. We’re not here to sell you the most expensive policy; we’re here to help you find the right balance of protection and affordability that lets you sleep well at night.

At Stanton Insurance Agency, we believe insurance conversations should be straightforward, not confusing. Our team takes the time to walk through your options, answer your questions in plain English, and help you build a policy that truly fits your needs. Because at the end of the day, insurance is about more than just meeting legal requirements—it’s about protecting what matters most to you.

Ready to review your coverage and make sure you’re properly protected? Explore our Auto Insurance solutions today. We’re here to provide the trusted protection your family deserves and the peace of mind that comes with knowing you’re covered, no matter what the road throws your way.