Small business insurance MA: Essential Guide 2025

Why Massachusetts Small Businesses Need the Right Insurance Coverage

Small business insurance MA is essential protection for the over 597,000 small businesses operating in the Commonwealth. If you’re looking for coverage, here’s what you need to know:

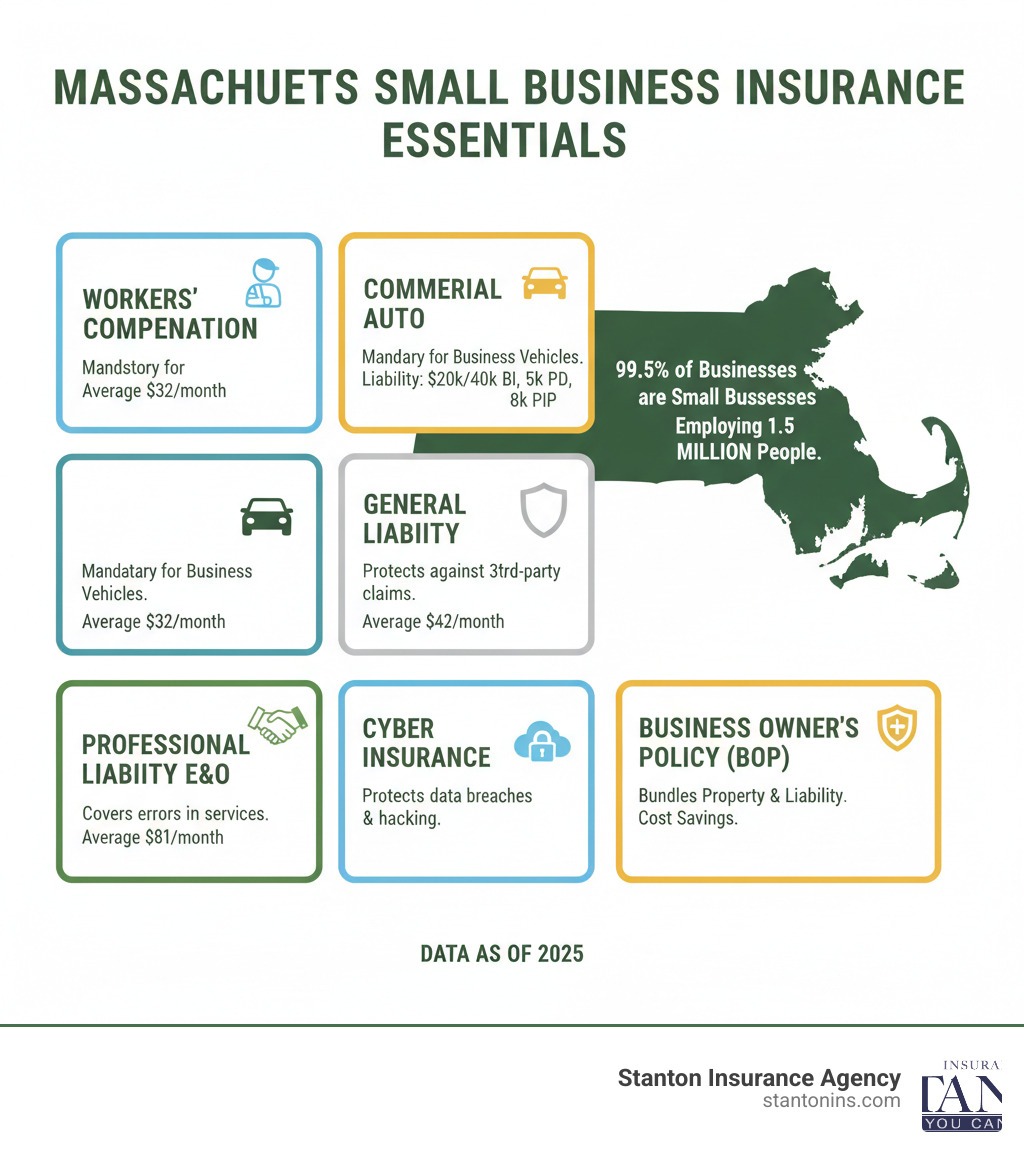

Quick Answer: Required & Essential Coverage

- Mandatory by Law: Workers’ Compensation (for all businesses with employees) and Commercial Auto (for business vehicles)

- Essential for Protection: General Liability, Professional Liability (E&O), Cyber Insurance

- Average Monthly Costs: General Liability ($42), Workers’ Comp ($32), Professional Liability ($81)

- Where to Start: Work with an independent insurance agent or use the Massachusetts Health Connector for employee health benefits

Running a business in Massachusetts involves significant risks. A single lawsuit, employee injury, or data breach can create financial hardship that threatens everything you’ve built. Many business owners delay securing proper coverage due to confusion about what’s required, what’s recommended, and how much it will cost.

Fortunately, understanding your insurance needs is manageable. Massachusetts has clear legal requirements, and beyond those mandates, a handful of essential policies provide comprehensive protection. Whether you operate a tech startup in Cambridge, a restaurant in Worcester, or a contracting business in Springfield, the right insurance acts as a financial safety net, allowing you to focus on growth.

I’m Geoff Stanton, President of Stanton Insurance Agency in Waltham, and I’ve spent over two decades helping Massachusetts businesses secure the right coverage. As a fourth-generation insurance professional and Certified Insurance Counselor (CIC), I specialize in guiding businesses to find small business insurance MA that fits their unique needs and budget.

Mandatory Business Insurance in Massachusetts

The Commonwealth of Massachusetts legally requires businesses to carry specific types of insurance. These laws are state-specific, so requirements in New Hampshire will differ. Failing to secure the coverage mandated for your business’s location can result in severe penalties, including fines and stop-work orders. Understanding these non-negotiable requirements is the first step in protecting your business.

Workers’ Compensation Insurance Explained

If your Massachusetts business has employees, workers’ compensation insurance isn’t optional—it’s the law. This coverage protects your team and your bottom line when workplace injuries or illnesses occur. It ensures employees receive medical care and compensation for lost wages, while your business avoids the potentially catastrophic cost of paying these expenses directly.

Massachusetts law is clear: all businesses with employees must carry workers’ compensation insurance, regardless of how many hours they work. The only exception is for domestic employees, who need coverage if they work at least 16 hours per week. This means even one part-time employee necessitates this coverage.

Benefits include medical expenses, rehabilitation costs, and a portion of lost wages. For business owners, it provides crucial protection against lawsuits related to workplace injuries. While sole proprietors and partners aren’t required to cover themselves, we typically recommend including all owners in your policy. A serious workplace injury without coverage can financially devastate a business.

For detailed information, the state offers resources like the Workers’ Compensation Guide and their Workers’ Comp in Massachusetts page. We’ve also created resources explaining the importance of workers’ compensation insurance, and we’re ready to provide a workers’ compensation quote for your business.

Commercial Auto Insurance Requirements

Just as workers’ comp protects your employees, commercial auto insurance is legally required for any business that operates vehicles in Massachusetts. This meets state law and ensures you’re financially responsible if a business vehicle is in an accident.

Crucially, personal auto insurance policies typically won’t cover accidents that happen during business use. If you use a personal car for work-related tasks, you could face a massive coverage gap without a commercial policy.

The state requires specific minimums: $20,000 bodily injury liability per person and $40,000 per accident, $8,000 in personal injury protection (PIP), $5,000 property damage liability per accident, and $20,000/$40,000 in uninsured motorist coverage.

Massachusetts is a no-fault state, meaning your own insurer pays for initial medical expenses and lost wages up to your PIP limit. We strongly recommend higher liability limits to protect your business from serious claims that could exceed these minimums.

If your employees use their personal vehicles for work or if you rent vehicles, you may need Hired and Non-Owned Auto Insurance (HNOA) to fill another potential coverage gap.

For more details, see the state’s guide on understanding auto insurance. You can also explore options on our commercial auto insurance and commercial vehicle insurance pages.

Essential Types of Small Business Insurance MA

Beyond legal requirements, several other insurance types are essential for safeguarding your business from common liabilities and potential lawsuits. These policies provide a comprehensive shield against financial disruption.

General Liability Insurance (GLI)

Though not always mandated by law, General Liability Insurance is the foundation of a smart business insurance portfolio. It’s your first line of defense against everyday risks that can lead to expensive lawsuits.

General liability insurance protects you from third-party claims of bodily injury, property damage, personal injury (like slander), and advertising injury. It’s the coverage that steps in when a customer slips on a wet floor, an employee damages a client’s property, or your ad campaign allegedly copies another’s idea.

Without GLI, your business would be responsible for medical bills, legal fees, and settlements. This is why most landlords and many clients require proof of general liability coverage. It signals that you operate professionally and responsibly.

GLI doesn’t cover employee injuries (workers’ comp), professional mistakes (E&O), or auto accidents (commercial auto). However, for most small business insurance MA needs, it’s non-negotiable. Learn more about business liability insurance, public liability insurance, and property damage liability.

Professional Liability (Errors & Omissions)

If your business provides advice or professional services, Professional Liability Insurance—also known as Errors & Omissions (E&O)—is essential. This coverage protects you when a client claims your professional work caused them financial harm.

Unlike general liability, which covers physical harm, professional liability covers financial losses resulting from your professional mistakes, oversights, or negligence. Examples include an accountant’s tax error that leads to client penalties or a consultant’s advice that results in a poor business outcome. E&O insurance is your financial lifeline in these scenarios.

Certain professions, like physicians and surgeons, are required by the state to carry minimum coverage. However, real estate agents, architects, engineers, accountants, and technology companies also face significant professional liability risks.

Even if you’ve done nothing wrong, a dissatisfied client can still sue. E&O insurance covers your legal defense, settlements, and judgments. For leadership risks, consider directors and officers insurance and management liability insurance.

Business Owner’s Policy (BOP)

A Business Owner’s Policy (BOP) bundles several essential coverages into one convenient and often more affordable package.

A typical BOP combines general liability, commercial property insurance, and business income insurance. This protects you from lawsuits, covers damage to your building and equipment, and provides financial support if a covered event forces a temporary closure.

BOPs are ideal for low-risk businesses with a physical location, such as retail shops, restaurants, and small offices. They streamline your coverage into a single policy, and insurers often offer them at a discount compared to buying each policy separately. Learn if a BOP is right for you in our guide to Business Owners Insurance.

Cyber Liability Insurance

Cyberattacks are a major threat, and small businesses are frequent targets. A data breach can be a financial and reputational disaster.

Cyber Liability Insurance protects your business from the high costs following a cyberattack or data breach. These costs include notifying affected individuals (as required by Massachusetts data breach laws), credit monitoring services, legal fees, forensic investigations, and public relations efforts.

If your business handles customer data, processes payments, or relies on technology, cyber insurance is critical. It’s not a question of if you’ll face a cyber threat, but when. Protect your business and your customers’ trust. Learn more about cyber insurance for small business, what is cyber liability insurance?, and why you need cyber liability insurance.

Understanding the Cost of Your MA Business Insurance

One of the most common questions from entrepreneurs is, “How much will this cost?” The price of small business insurance MA is unique to your business. There’s no one-size-fits-all answer, as your premiums depend on factors reflecting your specific operations, location, and risk profile.

A tech startup in Cambridge faces different risks than a landscaping company in Worcester, and your insurance costs will reflect that. Understanding what influences your premiums helps you make informed decisions about coverage and budgeting.

Key Factors Influencing Your Premiums

When calculating your insurance cost, we analyze several key elements to understand your business’s level of risk.

- Industry: Some businesses carry more inherent risk. A construction contractor will have higher premiums than a graphic designer, reflecting the likelihood of claims based on the work’s nature.

- Business Location: Your location within Massachusetts influences rates. A storefront in downtown Boston has different exposures (crime rates, traffic) than one in a suburban area, affecting your premium.

- Number of Employees: Your employee count and total payroll directly impact workers’ compensation costs and can affect other liability premiums. More employees generally mean more exposure to potential claims.

- Claims History: A clean claims record demonstrates strong risk management and can help keep costs down. Previous claims may signal a higher likelihood of future claims, increasing premiums.

- Coverage Limits & Deductibles: Higher coverage limits increase your premium because the insurer takes on more risk. A higher deductible (your out-of-pocket cost) can lower your premium because you share more risk.

- Business Size and Revenue: Larger businesses with higher revenues typically have more assets to protect and greater liability exposures, which influences insurance costs. The cost of specialized coverage like apartment building insurance will also differ from builders risk insurance, reflecting their distinct risks.

Average Costs for Small Business Insurance MA

While every business is unique, it helps to have a baseline understanding of typical costs. The table below shows average monthly premiums for common policies in Massachusetts. These are averages—your actual costs will vary.

| Insurance Type | Average Monthly Premium in MA |

|---|---|

| General Liability | $42 |

| Workers’ Compensation | $32 |

| Professional Liability (E&O) | $81 |

Data represents average premiums and your actual cost will vary based on your business’s specific risk factors.

These numbers provide a helpful starting point for budgeting. A retail shop might pay less than average for general liability, while a consulting firm could pay more for professional liability. Getting a personalized quote is the only way to know the true cost for your business.

How to Find the Right Insurance and Get Quotes in Massachusetts

Navigating the insurance market can be complex. Knowing where to look for reliable providers and information is key to securing the right coverage at a fair price.

Working with an Independent Insurance Agent

Working with an independent insurance agent offers a distinct advantage. We aren’t tied to one insurance carrier; we work with multiple companies, allowing us to shop on your behalf to find the best combination of coverage and price for your specific needs.

Think of an independent agent as your personal advocate. We bring expertise and choice, giving you access to a broader range of products than you’d find with a single carrier. This is vital because every business is unique.

Our role extends beyond finding a policy. We take time to understand your business, your industry risks, and the challenges of operating in Massachusetts. We offer expert advice rooted in local knowledge, helping you identify exposures and customize your policy with appropriate limits. Most importantly, we act as your advocate during the claims process, guiding you and working with the insurance company on your behalf. Learn more about independent insurance agencies, why we’re considered the best independent insurance agency, and find more about insurance agencies in Massachusetts.

Massachusetts-Specific Resources for Business Owners

Beyond an independent agent, Massachusetts offers valuable resources to help business owners understand their obligations.

The official Massachusetts Business Resources portal at Mass.gov is a central hub for state-specific guidance on regulations, licensing, and support programs.

For federal support, the U.S. Small Business Administration Massachusetts District office provides counseling, capital access assistance, and contracting information. Visit them at the SBA Massachusetts District site.

The UMass Amherst Small Business Development Center Network offers free, confidential advising from experienced business consultants. With regional centers across the state, the MSBDC provides hands-on training and resources on business planning, financing, and risk management. Learn more at the UMass Amherst Small Business Development Center Network.

These resources, combined with the expertise of an independent agent, create a comprehensive support system for securing your small business insurance MA.

Frequently Asked Questions about Small Business Insurance in MA

We understand that navigating small business insurance MA can raise questions. Here are answers to some of the most common inquiries.

What is the difference between general liability and professional liability insurance?

Understanding this distinction is crucial. General liability insurance covers physical risks, such as third-party bodily injury or property damage. For example, it would cover a customer’s medical bills if they slip and fall in your store. It’s your safety net for claims arising from your business operations, premises, or products.

Professional liability insurance, or Errors & Omissions (E&O), covers financial losses to a client due to mistakes in your professional services. For instance, if an accountant’s error leads to a client’s IRS penalty, this policy would cover the damages. In short, general liability is for physical harm, while professional liability is for financial harm caused by your expertise.

Are there specific insurance needs for different industries in Massachusetts?

Yes. Industry-specific risks require custom coverage, and legal requirements can vary by state. A construction contractor in Massachusetts will need builders risk insurance for projects under construction. A technology company needs robust cyber liability and E&O coverage to protect against data breaches and software errors. Landlords of multifamily properties need specialized policies for tenant-related risks.

State law also has specific requirements for certain professions. For example, Massachusetts requires physicians and surgeons to carry professional liability with minimum limits, and cannabis businesses must carry general liability, product liability, and a surety bond to operate legally. Requirements in neighboring states like New Hampshire will be different. An experienced agent can ensure your business is adequately protected against its unique exposures.

What happens if I don’t have the required workers’ compensation insurance in MA?

The consequences are severe. The Department of Industrial Accidents (DIA) can issue a Stop Work Order, forcing your business to cease all operations immediately. This means no revenue and potential damage to your reputation.

You can also face fines of up to $250 per day for every day you operate without coverage. These fines accumulate quickly and can cripple a small business.

Most critically, if an employee is injured while you are uninsured, you may be held personally liable for all associated costs, including medical bills, lost wages, and legal fees. These expenses can be financially devastating. The risk of non-compliance far outweighs the cost of a policy.

Your Trusted Partner for Massachusetts Business Insurance

You’ve worked hard to build your business. Don’t let an unexpected lawsuit, workplace injury, or cyber incident jeopardize it. The right insurance coverage is a critical investment in your company’s longevity and success.

From mandatory workers’ compensation and commercial auto policies to essential coverages like general liability and cyber insurance, the right protection acts as a financial shield. The key takeaway is this: small business insurance MA isn’t just about meeting legal obligations—it’s about safeguarding everything you’ve worked to create.

While costs vary, understanding the factors that influence your premiums and working with a knowledgeable expert can help you secure comprehensive coverage that fits your budget. You don’t have to steer this alone.

Don’t leave your hard work vulnerable. As a local independent insurance agency, the team at Stanton Insurance Agency has deep roots in Massachusetts and the expertise to help you steer the state’s insurance landscape. We are your partners in risk management, taking the time to understand your unique business to find a policy that provides genuine peace of mind.

Our relationships with multiple carriers mean we can shop the market on your behalf, comparing options to find the best combination of coverage and price. Whether you’re just starting out or looking to review your current protection, we’re here to help.

Contact Stanton Insurance Agency today to get a personalized quote and build a stronger, more secure future for your business. Let’s work together to protect what you’ve built.