Sailboat Insurance: Smooth Sailing 2025

Why Every Sailboat Owner Needs Insurance Protection

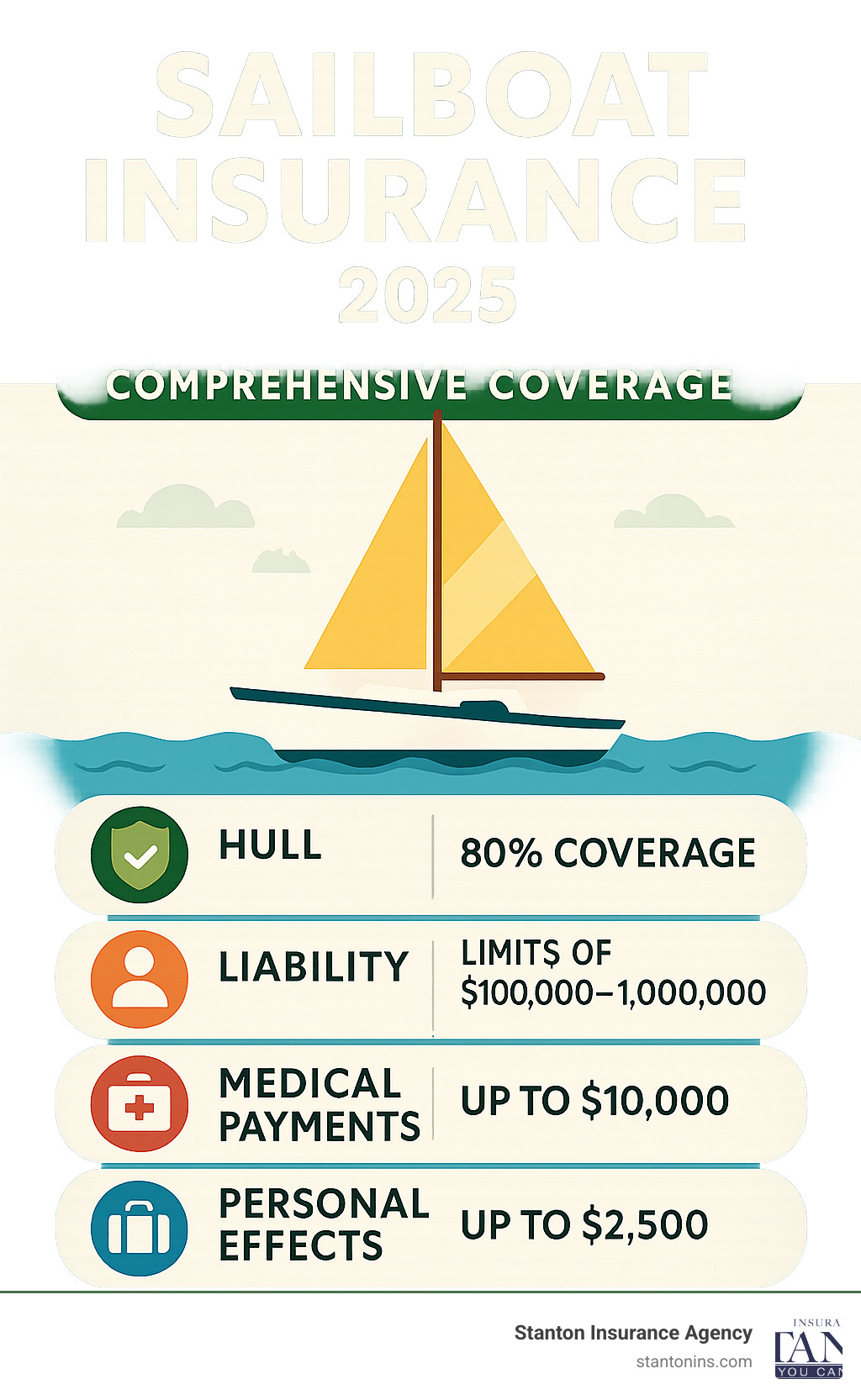

Sailboat insurance protects your vessel and finances from unexpected risks on the water, safeguarding your investment and providing peace of mind. Key coverages include protection for physical damage to your boat (hull coverage), liability for injuries or property damage you cause, medical payments for you and your passengers, personal property on board, and emergency towing.

While not legally required in Massachusetts or New Hampshire, most marinas and lenders mandate coverage. For an average annual cost of $300-$600—or about 1.5% of your boat’s value—insurance protects you from costly repairs, liability claims, and total loss from storms, theft, or accidents. The peace of mind knowing you’re protected makes it a smart investment for any sailor.

I’m Geoff Stanton, President of Stanton Insurance Agency. For decades, we’ve helped Massachusetts and New Hampshire boat owners protect their vessels. Our team specializes in sailboat insurance and understands the unique risks of sailing in New England waters.

Sailboat insurance word guide:

- https://stantonins.com/do-i-need-boat-insurance/

- https://stantonins.com/how-much-does-boat-insurance-cost/

- https://stantonins.com/insurance-for-boats/

Why Sailboat Insurance is Essential for Every Captain

Sailboat insurance is your financial lifeline when things go wrong on the water. Even the most experienced captains can’t control sudden storms, the actions of other boaters, or theft. Beyond these unpredictable risks, insurance is a practical necessity. Most marinas and lenders require proof of coverage before you can dock or finance your vessel, making it essential for accessing key services.

The liability and asset protection alone makes insurance worthwhile. If your sailboat causes damage to another vessel, a dock, or injures someone, you could face devastating lawsuits. We typically recommend liability coverage from $100,000 to $1,000,000 or more, as costs can add up frighteningly fast. This coverage, along with protection against storms, theft, and vandalism, is why our Massachusetts and New Hampshire boat insurance expertise is so valuable for local sailors.

Is Sailboat Insurance Legally Required in MA or NH?

No, sailboat insurance isn’t legally mandated by state law in Massachusetts or New Hampshire. However, as the Massachusetts government website notes, “not legally required” doesn’t mean “not necessary.”

In practice, you’ll find it nearly impossible to operate without it. Marinas and yacht clubs almost universally require liability insurance as a condition for docking. Similarly, if you financed your sailboat, your lender will require comprehensive coverage to protect their investment. While the state won’t fine you, the marine community and financial institutions make insurance a de facto requirement.

Protecting Your Investment and Yourself

Your sailboat is a significant investment. Insurance protects it from the scenarios that keep owners awake at night. This includes collisions with other vessels or docks, which can happen even to careful sailors. It also covers injuries to passengers or other boaters, with medical payments for your guests and liability coverage if you’re at fault.

Two often-overlooked but critical protections are wreckage removal and fuel spill liability. If your boat sinks, you are often legally required to pay for its removal, a surprisingly costly endeavor. Likewise, fuel spills can trigger significant environmental cleanup costs and fines. A good policy also includes uninsured boater coverage, which protects you if an accident is caused by a boater who lacks their own insurance.

Understanding Your Sailboat Insurance Coverage Options

Choosing the right sailboat insurance means customizing a policy for your vessel and sailing habits. At Stanton Insurance Agency, we help you steer the options to select the best protection.

A good policy is built on several key components:

- Hull and Machinery Coverage: This is the foundation, protecting the physical structure of your boat, including the mast, rigging, sails, and engine.

- Liability Limits: Ranging from $100,000 to $1,000,000+, this covers you when you’re responsible for injuries to others or damage to their property.

- Medical Payments: Covers reasonable medical expenses for you or your guests injured on your boat, regardless of fault.

- Personal Effects Coverage: An important add-on that covers belongings not permanently attached to your boat, like fishing gear, laptops, and clothing.

- Towing and Assistance: Reimburses you for emergency towing or on-water assistance if you break down or run aground.

It’s also important to understand common exclusions, which typically include normal wear and tear, manufacturer defects, and damage from marine life.

Agreed Value vs. Actual Cash Value: What’s the Difference?

This choice critically impacts your payout in the event of a total loss. An Agreed Value policy is the gold standard, paying a pre-agreed amount without depreciation, making it ideal for new or classic boats. An Actual Cash Value (ACV) policy costs less but pays out the boat’s market value at the time of loss, which includes depreciation.

| Feature | Agreed Value Policy | Actual Cash Value (ACV) Policy |

|---|---|---|

| Payout at Total Loss | Full agreed value, no depreciation | Current market value, minus depreciation |

| Premium Cost | Higher | Lower |

| Best For | New, high-value, or classic boats | Older boats, cost-conscious owners |

| Depreciation Handling | No depreciation on total loss | Depreciation applied to claims |

What Does a Standard Sailboat Insurance Policy Cover?

A comprehensive sailboat insurance policy covers specific events, known as named perils. Most standard policies protect you from:

- Storm damage, including from high winds, heavy seas, and hurricanes.

- Sinking, though not from gradual leaks due to poor maintenance.

- Fire and lightning, including electrical damage from surges.

- Theft of your vessel or its components.

- Collision with other boats, docks, or submerged objects.

- Vandalism or other malicious damage.

Your sails, rigging, electronics, and auxiliary engine are typically covered under the hull and machinery portion of your policy, protecting your most valuable equipment.

Learn more about how we can tailor your coverage: Marine Insurance with Stanton Insurance

Key Factors That Determine Your Sailboat Insurance Cost

The cost of sailboat insurance is not one-size-fits-all. Insurers consider several key factors to calculate your premium. While rates can be as low as $100 for a basic policy, the average cost is about 1.5% of your boat’s total value annually, with most boaters paying between $300-$600 per year for comprehensive coverage.

Key factors influencing your premium include:

- Boat’s Value, Age, and Size: Higher value, older age, and greater length generally increase the cost.

- Hull Material: Modern fiberglass is preferred by insurers, while wooden or steel hulls may see higher rates.

- Location: Where you sail and moor your boat is critical. Hurricane-prone areas and saltwater use typically increase costs.

For a deeper dive into cost factors, check out: How Much is Boat Insurance?

How Your Boat’s Use and Type Affect Premiums

How you use your sailboat significantly influences your insurance costs:

- Private Pleasure Use: The most common and least expensive category for recreational sailing.

- Racing: Standard policies often exclude racing. A racing coverage endorsement is needed for competitive events.

- Chartering/Commercial Use: Requires specialized, more expensive coverage for business activities.

- Liveaboard Status: Insuring your boat as a primary residence costs more due to increased daily-use risks.

- Boat Type: Catamarans and high-performance sailboats may face higher premiums due to design complexity and risk.

Special Considerations for Classic and Vintage Sailboat Insurance

Insuring a classic or vintage boat requires special attention. Insurers will look at:

- Age and Classification: Boats are often classified as Historic, Antique, or Classic, per the Antique and Classic Boat Society.

- Hull Material: Wooden or steel hulls common in classic boats may require a specialty insurer.

- Valuation: An agreed value policy based on a recent marine survey is almost always required to properly value the vessel.

- Maintenance History: Documented restoration and professional care can help secure better rates.

How Your Experience and Cruising Plans Impact Rates

Your personal profile and sailing plans also affect your premium:

- Boating History: A long, safe record with few or no claims leads to lower premiums.

- Operator Experience: Mature, experienced operators and those who have completed boater safety courses often receive better rates.

- Navigational Limits: Your policy will specify your covered cruising range. Coastal cruising is less risky and cheaper to insure than offshore voyages. Sailing outside your limits can void coverage.

- Hurricane Zone Travel: Sailing in hurricane-prone regions during storm season (June 1st to November 1st) will increase costs.

How to Get a Quote and Lower Your Premiums

Getting a sailboat insurance quote is a straightforward process. You can use our online quote forms or speak directly with an agent who understands the needs of sailors. To speed up the process, it helps to have key information ready.

Information You’ll Need to Provide for a Quote

To find the right policy, we’ll need to know the story of you and your boat:

- Personal Information: Your name, address, date of birth, and any prior boating or driving claims.

- Boat Details: The year, make, model, length, Hull Identification Number (HIN), engine details, and hull material.

- Usage Information: Your primary mooring location, typical cruising area, and intended use (e.g., private pleasure, racing).

- Desired Coverage: The liability limits, deductible, and policy type (Agreed Value vs. Actual Cash Value) you prefer.

Qualifying for Discounts on Your Policy

We love helping clients save money while maintaining excellent protection. You may qualify for several discounts:

- Bundling: Combine your sailboat insurance with your auto or home policy for significant savings.

- Boater Safety Course: Completing an approved course from an organization like the U.S. Power Squadron or Coast Guard Auxiliary can earn a 5-10% discount. BoatUS offers excellent free courses.

- Good Driving Record: A clean record on land can lower your rates on the water.

- Safety Equipment: GPS, radar, alarms, and other safety devices can earn you credits. A diesel engine is also often cheaper to insure than gasoline.

- Lay-Up Discount: If you store your boat for the winter, you can get reduced rates during this lay-up period.

For more ideas, check out our boating safety tips. Safety and savings often go hand in hand.

What to Do If You Need to File a Claim

If the unexpected happens, knowing how to handle a sailboat insurance claim can make a stressful situation more manageable. At Stanton Insurance Agency, we guide you through the process.

First, ensure everyone is safe. Once secure, follow these steps:

- Document the Damage: Take clear photos and videos of all damage from multiple angles. This visual record is invaluable for your claim.

- Contact Your Insurer Promptly: Report the incident as soon as possible so we can begin processing your claim.

- Prevent Further Damage: Take reasonable steps to protect your boat from additional harm, such as covering holes or moving to a safer location. Keep receipts for any emergency repairs, as they are often reimbursable.

- File Official Reports: For theft, vandalism, or serious collisions, file a report with the local police, Coast Guard, or harbor master. This provides crucial documentation.

- Get Repair Estimates: Obtain detailed estimates from reputable marine service providers to establish the scope of repair costs.

Throughout this process, we are your advocate. Our team will help you understand your coverage, manage documentation, and communicate with the claims adjuster to ensure a fair and timely settlement.

Frequently Asked Questions about Sailboat Insurance

Here are answers to some of the most common questions we hear from sailors in Massachusetts and New Hampshire about sailboat insurance.

Does my policy cover my sailboat if it sinks during a hurricane?

Yes, most comprehensive policies cover storm damage, including sinking from a hurricane. However, policies for coastal areas like New England often include a separate and higher “named storm” or “hurricane” deductible, which may be a percentage of your boat’s insured value (e.g., 2-5%). Your policy may also require you to follow a “named storm plan,” such as hauling the boat out of the water, to maintain coverage when a hurricane is approaching.

Will my sailboat insurance cover me if I want to race my boat?

Standard policies typically exclude coverage for damage that occurs while racing due to the higher risk. However, you can add a racing coverage endorsement to your policy for an additional premium. This add-on provides protection for club-level racing and local regattas. It is crucial to declare your intent to race when setting up your policy to ensure you are properly covered.

Are my personal belongings like fishing gear or laptops covered?

Your standard hull policy covers the boat and its permanently installed equipment, but not your personal belongings. Items like clothing, fishing gear, and portable electronics (laptops, cameras) are not automatically included. To protect these items, you can add personal effects coverage as an endorsement to your sailboat insurance policy. This provides coverage up to a specified limit and ensures you won’t have to replace these valuables out of pocket.

Get the Right Protection for Your Voyage

Setting sail with proper sailboat insurance is about one simple thing: protecting what matters most. Your sailboat represents a significant investment and countless hours of joy. The right policy ensures that unexpected storms—both literal and financial—won’t sink your sailing dreams.

Think of insurance as your maritime safety net. The peace of mind that comes from knowing you’re protected against collisions, storms, theft, and liability is invaluable, letting you focus on the freedom of being on the water.

At Stanton Insurance Agency, we’ve spent decades helping Massachusetts and New Hampshire sailors find the right protection. We understand that a weekend warrior has different needs than a long-distance cruiser. We take the time to understand your unique situation and tailor a policy that fits.

Getting started is easy. Our team will walk you through every step, from understanding coverage options to finding discounts. We speak sailor, not just insurance jargon. With the right policy in place, you can accept the freedom that drew you to sailing in the first place.

Get Your Boat Insurance Quote Today

- Expert guidance from agents who understand New England waters.

- Customized policies for your vessel, habits, and budget.

- Trusted protection for Massachusetts and New Hampshire sailors.