Why Building Owners Insurance Is Essential for Protecting Your Property Investment

Building owners insurance is specialized commercial property insurance for owners of rental properties. It protects the physical structure, provides liability coverage for accidents on your premises, and can cover lost rental income if a covered event makes the property uninhabitable. It’s designed for commercial, multi-unit residential, and mixed-use buildings, covering the structure, fixtures, outdoor signs, and fencing.

Key coverages typically include:

- Property damage protection: Fire, vandalism, theft, and windstorms

- General liability: Bodily injury and property damage claims (e.g., slip-and-fall accidents)

- Business interruption: Lost rental income during repairs

- Additional options: Equipment breakdown, sewer backup, and ordinance or law coverage

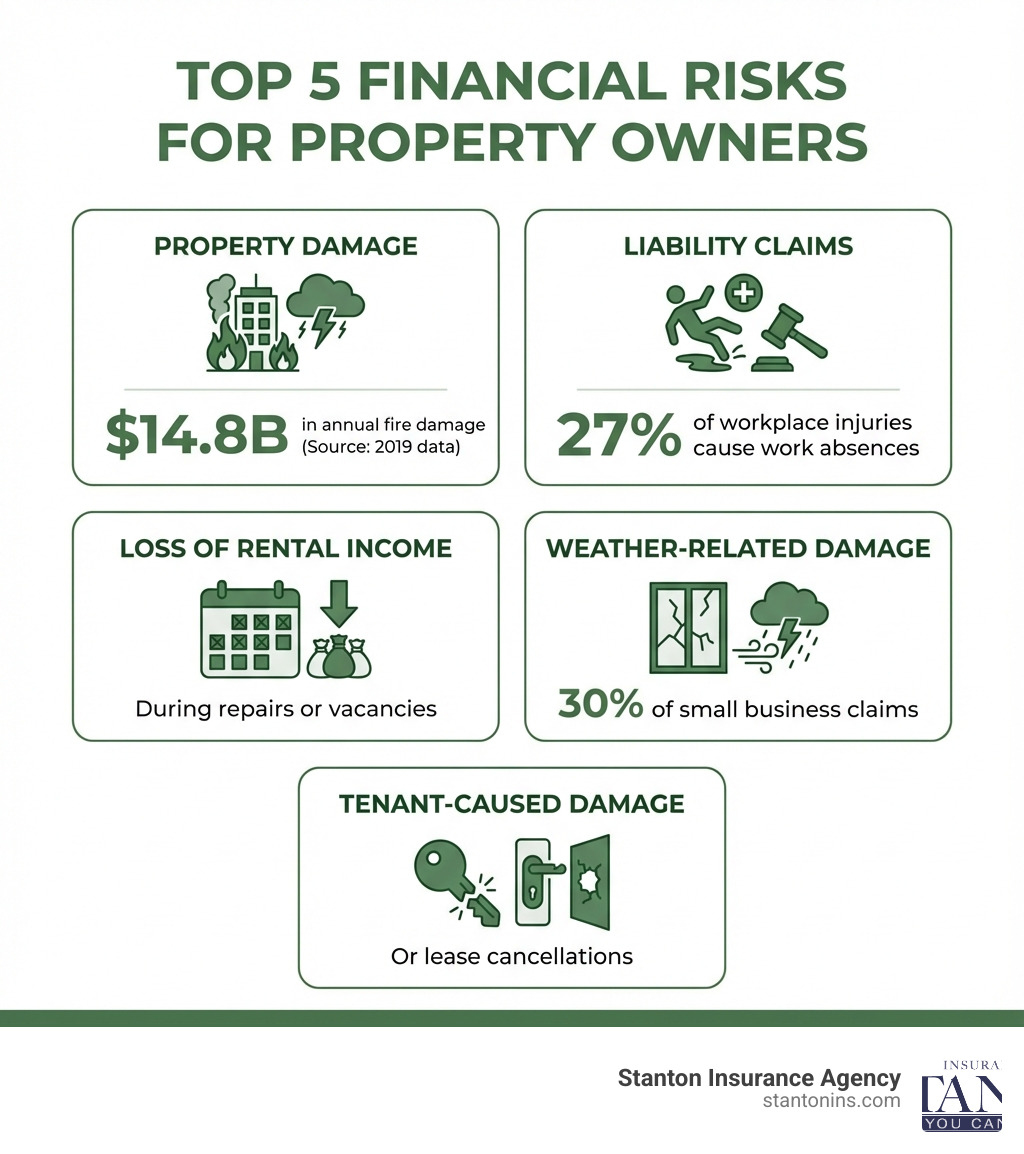

As a property owner, you face significant financial exposure. In 2022 alone, U.S. fire departments responded to an estimated 1.5 million fires, causing $18 billion in property damage. Beyond fire, weather damage accounts for 30% of small business claims, and tenant or visitor injuries can lead to costly lawsuits. Without proper coverage, a single incidenta tenant injury, major storm, or firecould devastate your investment.

Many landlords assume a standard homeowner’s or basic commercial property policy is enough, but building owners insurance addresses the unique risks of rental properties. It covers the structure, your liability as a landlord, and your loss of rental income if the building becomes uninhabitable.

I’m Geoff Stanton, President of Stanton Insurance Agency. For over two decades, I’ve helped property owners in Massachusetts and New Hampshire steer building owners insurance. Whether you own a small multi-family home or a portfolio of commercial properties, this guide will walk you through what you need to know to safeguard your investment.

Simple guide to building owners insurance:

- How Much Does It Cost to Insure an Apartment Building?

- Does Apartment Building Insurance Cover Dog Bites?

What Is Building Owners Insurance and What Does It Cover?

Building owners insurance is a comprehensive policy for owners of commercial or multi-unit residential properties rented to tenants. Unlike a standard homeowner’s policy, it addresses the unique risks of operating a rental property, such as higher foot traffic, tenant-related issues, and the need to protect rental income.

Your investment extends beyond the physical structure to the income it generates and your responsibilities to tenants. Without it, a single incident could lead to significant financial strain. For instance, U.S. fire departments responded to an estimated 1.5 million fires in 2022, causing $18 billion in property damage. Additionally, about 30% of small business claims result from weather damage. These statistics highlight the real and costly threats properties face. 10 Most Common and Costliest Small Business Claims

Building owners insurance typically covers properties leased to commercial or multiple residential tenants, including:

- Commercial and retail plazas

- Office buildings

- Multi-unit residential buildings (apartment complexes, townhouses)

- Industrial buildings and plazas

- Mixed-use properties

Key Components of a Building Owners Insurance Policy

A robust building owners insurance policy is structured around several core components for holistic protection.

- Commercial Property Coverage: This is the bedrock of your policy, protecting the physical assets. It covers:

- Building structure: The main framework, walls, roof, and foundation.

- Permanently installed fixtures: HVAC systems, built-in shelving, lighting, and plumbing.

- Outdoor signs and fencing: Protection for exterior elements.

- Other structures: Detached garages, sheds, or other buildings on the premises.

- Business Personal Property (BPP): Your property inside the building, such as maintenance equipment or office furniture.

- General Liability Coverage: This protects you from claims of bodily injury or property damage that occur on your premises. This is vital for landlords due to higher liability risks.

- Bodily injury: Covers medical expenses and legal fees if a tenant or visitor is injured on your property (e.g., a slip and fall on an icy walkway, a common hazard in Massachusetts and New Hampshire).

- Property damage: Covers costs if you or your property accidentally damage someone else’s property.

- Slips and falls: A classic liability risk, especially in high-traffic areas or during inclement weather.

Common Perils and Exclusions

Understanding what your building owners insurance covers and excludes is crucial.

Common covered perils include:

- Fire and smoke

- Vandalism and theft

- Windstorms (including hurricanes)

- Burst pipes and water damage from plumbing

- Lightning and explosions

Common exclusions often require separate policies or endorsements:

- Floods: Damage from rising water requires a separate flood insurance policy, which is essential for many properties in Massachusetts and New Hampshire.

- Earthquakes: Damage from seismic activity usually requires a specific endorsement.

- Wear and tear: Gradual deterioration is not covered; insurance is for sudden, accidental losses.

- Pest infestation: Damage from insects or rodents.

- Intentional damage by the owner.

- Pollution cleanup and employee dishonesty.

Always review your policy to understand your exact coverage.

Building Owners vs. Landlord vs. Commercial Property Insurance

The terms “building owners insurance,” “landlord insurance,” and “commercial property insurance” are often used interchangeably, but they have important distinctions. Understanding the focus of each helps you choose the right protection.

| Feature | Building Owners Insurance | Landlord Insurance | Commercial Property Insurance |

|---|---|---|---|

| Primary Focus | Protection for the physical structure of commercial/multi-unit residential buildings rented to others, and associated liabilities. | Protection for residential rental properties (single-family, duplexes, small apartments). | Protection for owned business property (building, contents) used for your own business operations. |

| Typical Properties | Office buildings, retail plazas, industrial parks, large apartment complexes (e.g., 5+ units). | Single-family homes, duplexes, triplexes, vacation rentals. | Office buildings, warehouses, retail stores, manufacturing plants (occupied by the owner’s business). |

| Liability Scope | Broad commercial general liability for public and tenant injuries/property damage on premises. | General liability for tenant/visitor injuries and property damage at residential rental. | General liability for customers/visitors and property damage at your business location. |

| Contents Coverage | Primarily covers the building structure and permanently installed fixtures. May cover owner’s business personal property (e.g., maintenance equipment) if applicable. | Covers landlord’s personal property used for the rental (e.g., appliances, lawnmowers). Does NOT cover tenant’s belongings. | Covers your business’s contents (inventory, equipment, furniture, computers). |

| Business Interruption | Covers lost rental income if a covered peril makes the building uninhabitable. | Covers lost rental income if a covered peril makes the residential property uninhabitable. | Covers lost business income if your operations are interrupted by a covered peril. |

| Target Audience | Real estate investors, property management companies, owners of large commercial portfolios. | Individual property owners, landlords of residential units. | Business owners operating from a physical location. |

In Massachusetts and New Hampshire, building owners insurance typically refers to the comprehensive package for larger commercial or multi-unit residential properties. Landlord insurance is usually for smaller residential rentals, while commercial property insurance is for businesses that own and occupy their building.

Customizing Your Coverage: Endorsements and Valuation

No two properties are alike, so your building owners insurance shouldn’t be either. Customizing your policy with endorsements and understanding valuation methods are key to filling coverage gaps. We work with clients to tailor policies to their unique needs, not a one-size-fits-all approach.

Business Interruption and Loss of Rental Income

If a fire or severe storm damages your Boston apartment complex or Nashua commercial plaza, your rental income could stop. Business interruption insurance, also known as “loss of rental income” coverage, is your financial lifesaver in this scenario.

This coverage is designed to:

- Cover lost rent: It replaces the rental income you would have earned if the covered event hadn’t occurred.

- Pay for ongoing expenses: It helps cover mortgage payments, property taxes, and insurance premiums while your property is being repaired.

- Cover additional expenses: It can also cover costs to minimize the suspension of operations, such as temporary relocation for tenants.

Coverage is triggered when a direct physical loss from a covered peril makes the premises uninhabitable. It does not cover income lost from tenant vacancies or economic downturns. For more on how this protects your income, see our business insurance solutions.

Actual Cash Value (ACV) vs. Replacement Cost (RCV)

How much your insurance pays depends on whether your policy uses Actual Cash Value (ACV) or Replacement Cost (RCV).

- Actual Cash Value (ACV): This is the cost to replace damaged property minus depreciation. For example, if your 10-year-old roof is damaged, ACV pays the value of a 10-year-old roof, not a new one. ACV premiums are lower, but the payout may not cover the full cost to repair or rebuild.

- Replacement Cost (RCV): This covers the cost to repair or replace damaged property with new materials of like kind and quality, without deducting for depreciation. If your 10-year-old roof is damaged, RCV pays for a new one. RCV policies offer more comprehensive protection but have higher premiums.

For building owners in Massachusetts and New Hampshire, we generally recommend Replacement Cost coverage. It ensures you can fully restore your property and income stream without facing a shortfall in rebuilding costs.

Popular Additional Coverages

Specific endorsements can be added to your building owners insurance policy to address unique risks.

- Ordinance or Law Coverage: Crucial for older New England properties. If your building is damaged, local codes in Massachusetts or New Hampshire may require costly upgrades to meet current standards (e.g., installing a sprinkler system after a fire). This endorsement covers those increased costs.

- Equipment Breakdown: Standard policies often exclude damage from mechanical or electrical breakdown. This endorsement covers the repair or replacement of essential systems like HVAC units, boilers, elevators, and electrical panels.

- Sewer and Drain Backup: This covers property damage from water that backs up through sewers or drains, which is often excluded from standard policies. This is a common concern given the variable weather in MA/NH.

- Flood Coverage: Standard policies exclude flood damage. If your property is in a flood-prone area, a separate flood insurance policy is essential.

The Financials: Premiums, Costs, and Savings

The cost of your building owners insurance is an investment in risk management. Like maintenance, it’s a fundamental part of responsible property ownership. Policy costs vary widely, but knowing what influences them helps you make informed decisions.

Factors That Influence Your Insurance Premium

Many elements affect your building owners insurance premium as insurers assess risk.

- Property location: Areas with higher crime rates, natural disaster risks (e.g., coastal flood zones in MA/NH), or higher construction costs will have higher premiums.

- Construction materials: Fire-resistant buildings (steel, concrete) often get lower rates than wood-frame structures.

- Age of building: Older buildings may be more expensive to insure due to outdated systems and potentially higher repair costs.

- Occupancy type: A building with a restaurant carries higher risks and premiums than one with professional offices.

- Claims history: A history of frequent or large claims will lead to higher premiums.

- Fire and security systems: Properties with sprinkler systems, central station alarms, and security cameras often qualify for discounts.

- Proximity to fire services: Properties closer to fire hydrants and fire departments often have lower premiums due to faster emergency response times.

- Deductible amount: A higher deductible lowers your premium but increases your out-of-pocket cost for a claim.

For more insights on protecting commercial property, Stanton Insurance Agency offers additional resources and guidance through our business insurance solutions.

How to Manage Risk and Potentially Lower Costs

While some factors are beyond your control, you can take proactive steps to manage risk and potentially reduce your building owners insurance costs.

- Install sprinkler systems: These are highly effective in mitigating fire damage and can lead to significant premium reductions.

- Use central station alarms: Connecting fire and security alarms to a monitoring station can reduce risk.

- Perform regular property maintenance: Keeping your property well-maintained (roofs, plumbing, electrical, drainage) prevents common claims.

- Upgrade electrical and plumbing: Modernizing these systems in older buildings reduces the risk of fire and water damage.

- Enforce safety rules for tenants: Clear rules on fire safety and common area use can reduce liability risks.

- Implement robust security: Good lighting, secure locks, and surveillance cameras deter theft and vandalism.

- Increase your deductible: If you have a healthy emergency fund, a higher deductible can reduce your annual premium.

- Maintain a clean claims history: Fewer claims generally mean lower premiums over time.

We can help you identify improvements that may qualify you for discounts with insurers in Massachusetts and New Hampshire.

Navigating the Process: From Purchase to Claim

Getting the right building owners insurance and knowing what to do after a loss are critical for safeguarding your investment. The process is best steerd with a trusted partner.

Who Specifically Needs Building Owners Insurance?

If you own real estate that generates rental income, you likely need building owners insurance. This policy is for:

- Commercial landlords: Owners of office buildings, retail spaces, and industrial warehouses in Massachusetts and New Hampshire.

- Owners of multi-unit residential buildings: This includes apartment complexes, townhouses, and condominium buildings with rental units.

- Property management firms: These firms often ensure adequate coverage is in place for the properties they oversee.

- Real estate investors: Anyone with a portfolio of rental properties needs this insurance to protect their investments.

- Condo associations: Associations need coverage for common areas, the building structure, and liability.

Essentially, if you collect rent, you have a landlord’s liability and a business interest to protect.

The Role of an Insurance Broker

Navigating building owners insurance can be complex. An experienced insurance broker is your indispensable guide.

- Needs assessment: We listen to understand your property, risks, and goals to identify the coverages you need.

- Market access: We work with multiple carriers to shop on your behalf, comparing policies and pricing to find the best value for your MA or NH property.

- Comparing quotes: We provide clear comparisons of different options so you can make an informed decision.

- Policy explanation: We walk you through the fine print in plain language so you fully understand your protection.

- Advocacy during claims: If you have a loss, we act as your advocate, guiding you through the claims process to ensure a fair and timely settlement.

- Finding the right fit: Our role is to find the right coverage to protect your assets and give you peace of mind.

Understanding the Claims Process

Losses can happen even with the best preparation. Knowing the claims process makes a stressful situation smoother.

- Immediate steps after a loss:

- Ensure Safety: Prioritize the safety of tenants and visitors. Address immediate hazards and call emergency services if needed.

- Prevent Further Damage: Take reasonable steps to mitigate more damage (e.g., turn off water, board up windows). Keep receipts for temporary repairs.

- Document Everything: Take photos and videos of the damage. Make a list of all damaged items.

- Contact your broker: Call us as soon as it’s safe. We’ll help you initiate the claim with your carrier and guide you on the next steps.

- The role of the claims adjuster: The insurance company assigns an adjuster to assess the damage based on your policy. Cooperate fully and provide all requested information.

- Settlement and repairs: The adjuster will provide a settlement offer. We can help you review it to ensure it aligns with your policy. Once agreed, you can proceed with permanent repairs.

Frequently Asked Questions about Building Owners Insurance

Does building owners insurance cover my tenants’ personal property?

No, this insurance covers the building structure and your liability as the owner. Tenants are responsible for their own belongings and should be encouraged to purchase renters insurance.

Is building owners insurance legally required in Massachusetts or New Hampshire?

While not always mandated by state law, mortgage lenders in Massachusetts or New Hampshire almost universally require building owners insurance to protect their investment. Furthermore, adequate liability coverage is a business necessity to protect your assets from lawsuits, making it a practical requirement.

What if my building is vacant or under construction?

Standard policies may have exclusions for vacant properties (often after 30-60 days) or buildings undergoing major renovations, as these pose higher risks. If your property in Massachusetts or New Hampshire will be vacant or under construction, you may need a specialized policy, such as Builder’s Risk Insurance or a Vacant Building Policy. Always inform us of any changes to your property’s status to avoid coverage gaps.

Protect Your Real Estate Investment with the Right Coverage

Owning rental property in Massachusetts and New Hampshire is rewarding but comes with risks. Your real estate is a significant asset, and building owners insurance is the essential shield that safeguards your property, income, and peace of mind.

From fire and wind protection to liability and business interruption coverage, a custom policy ensures you’re prepared. Proactive risk management, combined with the right insurance, forms the bedrock of a secure real estate portfolio.

Don’t leave your investment vulnerable. Partner with a trusted advisor who understands the local landscape. For a comprehensive review of your property’s insurance needs and to ensure your investment is fully protected, explore our apartment building insurance solutions. We are here to help you build a solid foundation for your future.