Why Your Belongings Need Protection (Even When You Rent)

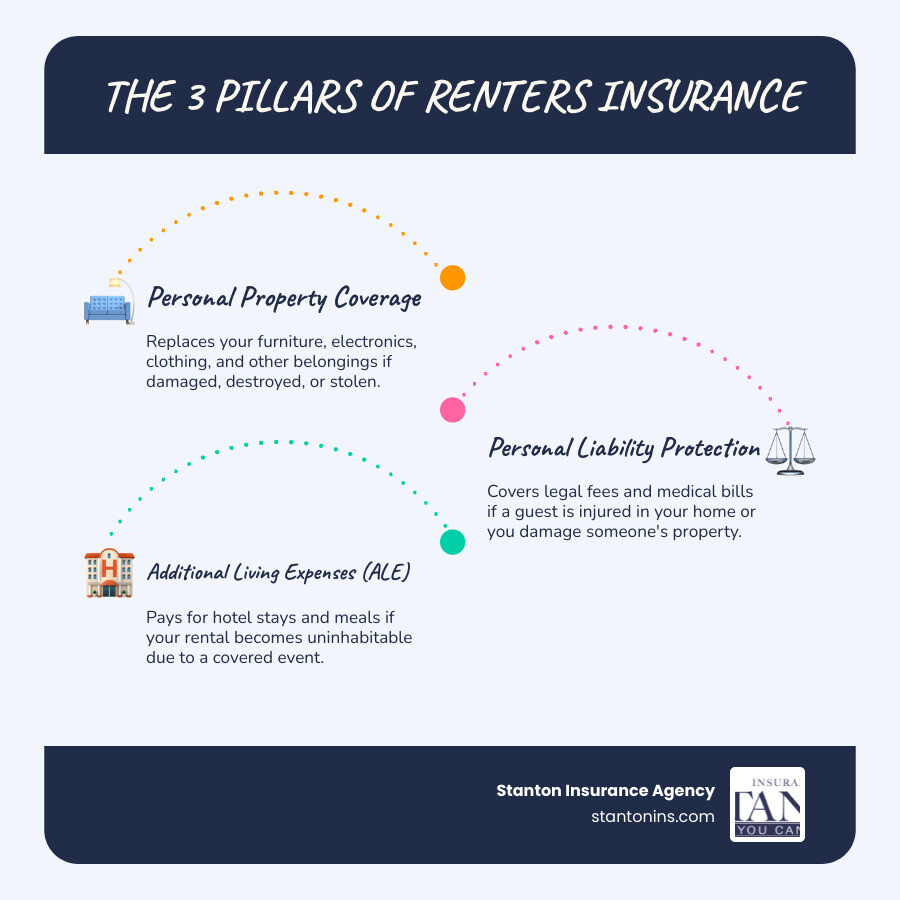

Best renters insurance coverage protects your personal belongings, shields you from liability, and covers temporary housing costs if disaster strikes. Here’s what the best policies include:

- Personal Property Coverage – Replaces your furniture, electronics, clothing, and other belongings if they’re damaged, destroyed, or stolen.

- Personal Liability Protection – Covers legal fees and medical bills if a guest is injured in your home or you accidentally damage someone else’s property.

- Additional Living Expenses (ALE) – Pays for hotel stays and meals if your rental becomes uninhabitable due to a covered event like fire or water damage.

- Optional Add-Ons – Flood insurance, earthquake coverage, and scheduled personal property riders for high-value items like jewelry or art.

Many renters assume their landlord’s insurance will cover their personal belongings if something goes wrong. It won’t. Your landlord’s policy protects the building itself, not your laptop, couch, or clothes. According to recent data, less than 50% of renters in Canada actually have tenant insurance in place, even though the average cost of replacing all belongings for the average renter could easily exceed $35,000. In the United States, only about 57 percent of renters say they have renters insurance. That leaves millions of people financially exposed.

Renters insurance is surprisingly affordable—typically between $15 and $30 per month—yet it provides a critical safety net. Whether you’re renting a studio apartment in Boston or a house in Manchester, the right policy ensures you’re not left scrambling to replace everything after a fire, theft, or other covered disaster. It also protects you from potentially devastating lawsuits if someone is injured in your home.

I’m Geoff Stanton, President at Stanton Insurance Agency in Waltham, Massachusetts, and I’ve spent over two decades helping individuals and families secure the best renters insurance coverage to protect their homes and belongings. Whether you’re a first-time renter or simply looking to ensure your policy is up to par, I’ll walk you through everything you need to know to make a smart, informed decision.

What Standard Renters Insurance Covers

When you choose to rent a home, apartment, or condo in Massachusetts or New Hampshire, you’re not just getting a roof over your head; you’re also creating a space filled with your memories and possessions. Yet, many people overlook a crucial step in protecting that space: obtaining renters insurance. We often hear the misconception that a landlord’s insurance policy covers a tenant’s personal property. This couldn’t be further from the truth! Your landlord’s insurance is designed to protect the physical building and their own liability, not your couch, computer, or clothing. Without your own policy, you’re on the hook for replacing everything if a fire, theft, or other unexpected event occurs.

Renters insurance acts as your personal financial safety net, providing peace of mind that your investments are protected. It’s a vital tool for any tenant, helping you recover from unforeseen circumstances without facing significant financial hardship. To truly understand its importance, let’s explore the three main types of coverage included in a standard renters insurance policy. For a deeper dive into what’s covered, check out our guide on What Does Renters Insurance Cover?.

Personal Property Coverage

Think about everything you own: your furniture, electronics, clothes, kitchenware, and even your toothbrush! All these items represent a significant financial investment. Personal property coverage is the core of your renters insurance, designed to reimburse you for the cost of repairing or replacing your belongings if they’re damaged, destroyed, or stolen due to a covered peril. Covered perils typically include fire, smoke, lightning, vandalism, theft, explosions, windstorms, and water damage from internal sources (like a burst pipe).

What’s more, this coverage isn’t just for items inside your rental unit. Most policies also offer “off-premises coverage,” meaning your belongings are protected even when they’re not at home. If your laptop is stolen from your car while you’re at a coffee shop in Boston, or your luggage goes missing during a trip, your renters insurance may still cover the loss, up to specified limits.

To ensure you have adequate coverage, we always recommend creating a detailed home inventory. This involves listing all your possessions, along with their estimated value, purchase dates, and even photos or receipts. This inventory will be invaluable if you ever need to file a claim, helping you remember everything you lost and speeding up the claims process. For more details on protecting your belongings, visit our page on Renters Insurance Coverage.

Personal Liability Protection

Accidents happen. What if a friend slips and falls in your kitchen, injuring themselves badly? Or what if you accidentally leave a faucet running, causing water damage to the apartment below you? Without personal liability protection, you could be held financially responsible for their medical bills, property repairs, and even legal fees if they decide to sue.

This coverage is a lifesaver, protecting you from potentially devastating financial consequences. It typically covers:

- Bodily injury: If a guest is injured in your home and you are found legally responsible.

- Property damage: If you accidentally damage someone else’s property, whether it’s your neighbor’s unit or a friend’s borrowed item.

- Legal defense costs: If you’re sued, this coverage can help pay for your legal defense, regardless of whether you’re found at fault.

Most experts recommend carrying at least $100,000 to $300,000 in liability coverage, though some suggest even higher, especially if you have significant assets to protect. It’s truly an invaluable safeguard against the unexpected. Learn more about this crucial protection on our What is Personal Liability Insurance for Renters? page.

Additional Living Expenses (ALE) / Loss of Use

Imagine a pipe bursts in your building, or a fire makes your apartment uninhabitable. Where would you go? How would you pay for a hotel, meals, or other necessities while your place is being repaired? That’s where Additional Living Expenses (ALE) coverage, also known as Loss of Use coverage, comes in.

This part of your policy covers the extra costs you incur if a covered peril forces you to temporarily move out of your rental. It doesn’t pay for expenses you would normally have (like your regular grocery bill), but it covers the difference in cost. So, if your rent is still due, but you’re also paying for a hotel room, ALE coverage helps bridge that gap. This can include hotel stays, temporary rental costs, restaurant meals, and even pet boarding fees. It’s designed to help you maintain your normal standard of living as much as possible during a stressful time, ensuring you’re not left without a place to stay or food to eat.

What’s NOT Covered (And How to Add It)

While standard renters insurance provides a broad safety net, it’s crucial to understand its limitations. No policy covers everything, and certain perils or types of property might be excluded or subject to specific policy limits. Knowing these exclusions allows you to decide if you need additional coverage, often through endorsements or “riders,” to fully protect your valuable items like jewelry, fine art, or collectibles.

Common Exclusions: Floods, Earthquakes, and Pests

Some of the most significant exclusions in standard renters insurance policies involve natural disasters and specific types of damage:

- Floods: This is a big one. Standard renters insurance policies typically do not cover flood damage. Flood damage is generally defined as water that comes from outside or underground sources, like overflowing rivers, heavy rainfall, or storm surges. This is distinct from water damage caused by internal sources, such as a burst pipe or overflowing toilet, which is usually covered. If your rental property is in a flood-prone area in Massachusetts or New Hampshire, we highly recommend considering a separate flood insurance policy. This is often available through the National Flood Insurance Program or select private insurers.

- Earthquakes: Similar to floods, damage from earthquakes is almost always excluded from standard renters insurance. If you live in an area with seismic activity (though less common in MA/NH, it’s still a consideration for some), you might want to purchase earthquake coverage as an endorsement or a separate policy.

- Bedbugs and Other Pests: Unfortunately, infestations from bedbugs, rodents, or other pests are generally not covered by renters insurance. Insurers typically classify these as maintenance issues or problems that develop over time due to neglect, rather than sudden, accidental perils. While some niche policies might offer limited coverage, it’s rare in a standard policy.

Adding Coverage for High-Value Items

Your standard personal property coverage comes with certain limits. For everyday items, these limits are usually sufficient. However, for particularly valuable possessions, such as engagement rings, antique watches, fine art, rare coin collections, or expensive electronics, the standard limits might not cover their full replacement cost. For instance, a policy might only cover up to $1,500 for jewelry lost due to theft, even if your diamond ring is worth $10,000.

To ensure these treasures are fully protected, you can add “scheduled personal property” coverage, often called a “floater” or “endorsement,” to your policy. This allows you to list specific high-value items individually and insure them for their appraised value. This often comes with broader coverage, sometimes even covering “mysterious disappearance,” which isn’t typically included in standard policies. We can help you determine if your high-value items exceed standard limits and guide you through the process of obtaining an appraisal and scheduling them on your policy. For comprehensive protection of all your assets, explore our Personal Insurance options.

Finding the Best Renters Insurance Coverage for Your Budget

One of the most appealing aspects of renters insurance is its affordability. As we mentioned, the typical premium ranges from $15 to $30 per month, according to the National Association of Insurance Commissioners. This means for roughly the cost of a few cups of coffee, you can secure tens of thousands of dollars in protection for your belongings and hundreds of thousands in liability coverage. The best renters insurance coverage doesn’t have to break the bank; it’s about finding the right balance of protection and price. Let’s explore how we can help you find that sweet spot. For more insights on finding affordable options, check out our guide on Cheap Renters Insurance.

Key Factors That Influence Your Premium

The cost of your renters insurance isn’t arbitrary; it’s determined by several factors unique to you and your living situation in Massachusetts or New Hampshire:

- Location: Where you live plays a significant role. Premiums can vary based on the zip code, local crime rates, proximity to fire hydrants and fire stations, and even the history of claims in your area.

- Property Type: The type of building you live in (apartment complex, multi-family home, single-family rental) and its construction materials can affect your rate.

- Coverage Limits: The amount of personal property and liability coverage you choose directly impacts your premium. Higher limits mean higher costs, but also greater protection.

- Deductible Amount: This is the amount you pay out-of-pocket before your insurance kicks in. Choosing a higher deductible (e.g., $1,000 instead of $500) will generally lower your premium, but make sure it’s an amount you can comfortably afford if you need to file a claim.

- Claims History: A history of previous insurance claims, whether for renters or other types of insurance, can lead to higher premiums.

- Credit Score: In many states, including Massachusetts and New Hampshire, insurers may use a credit-based insurance score as one factor in determining your premium. A higher score often indicates a lower risk and can lead to better rates.

- Safety Features: Your building’s safety features, such as smoke detectors, carbon monoxide detectors, sprinkler systems, and security alarms, can positively influence your premium.

How to Find the Best Renters Insurance Coverage and Save Money

Finding the best renters insurance coverage means not just getting adequate protection, but also doing so at a price that fits your budget. Here are our top strategies for finding affordable renters insurance in Massachusetts and New Hampshire:

- Compare Quotes: This is perhaps the most important step. Don’t settle for the first quote you receive. We work with multiple top-rated insurance carriers, allowing us to compare various policies and prices to find the best fit for your needs.

- Bundle Auto and Home Policies: Many insurance companies offer significant discounts when you purchase multiple policies (like renters and auto insurance) from them. This is often one of the easiest ways to save.

- Increase Your Deductible: As mentioned, opting for a higher deductible will lower your monthly or annual premium. Just be sure you have enough in savings to cover that deductible if a claim arises.

- Install Safety Devices: If your rental unit has smoke alarms, carbon monoxide detectors, fire extinguishers, or a monitored security system, let us know! These features can qualify you for discounts.

- Ask About Discounts: Always inquire about any available discounts. These can include discounts for being claim-free, paying your premium in full annually, being a non-smoker, or even professional affiliations.

- Pay Annually: If possible, paying your entire premium upfront for the year can sometimes be cheaper than making monthly installments, as it reduces administrative costs for the insurer.

For personalized quotes and expert advice custom to your specific situation, visit our Renters Insurance Quotes Massachusetts page.

The Nuts and Bolts: Quotes, Claims, and Key Terms

Understanding the process of obtaining and utilizing your renters insurance policy is just as important as knowing what it covers. From getting an initial quote to navigating a claim, being informed helps you feel confident in your protection. At Stanton Insurance Agency, we believe in making this process as transparent and straightforward as possible, whether you’re in Massachusetts or New Hampshire. For specific information about coverage in your state, check out our dedicated pages: Renters Insurance MA and NH Renters Insurance.

Getting a Quote and Filing a Claim

Getting a renters insurance quote is a quick and easy process. To provide you with the most accurate pricing, we’ll typically need some basic information:

- Your Address: The location of your rental unit in MA or NH.

- Type of Residence: Is it an apartment, condo, or single-family home?

- Value of Your Belongings: An estimate of the total replacement cost of all your personal property. This is where your home inventory comes in handy!

- Who Lives With You: The number of occupants in your household.

- Building Information: Details about the building’s construction year and any recent updates.

Once you have a policy, understanding how to file a claim is paramount. If disaster strikes, here’s a general overview of the claims process:

- Ensure Safety: Your first priority is always safety. If there’s a fire or other emergency, evacuate and call 911.

- Report to Landlord (if applicable): If the incident affects the building structure, notify your landlord immediately.

- File a Police Report: For theft or vandalism, file a police report as soon as possible. This is often a requirement for your insurance claim.

- Document Losses: Take photos and videos of all damaged or stolen items. Refer to your home inventory to list everything lost or damaged.

- Contact Your Insurer: Reach out to us at Stanton Insurance Agency or your insurance provider directly. Most insurance companies expect you to file your claim promptly, generally within 48 to 72 hours. We’ll guide you through the next steps, including providing you with the necessary claim forms.

A key term you’ll encounter during the claims process is the deductible. This is the amount you agree to pay out-of-pocket towards a covered loss before your insurance company starts paying. For example, if you have a $500 deductible and experience $2,000 in covered personal property damage, you’d pay the first $500, and your insurer would cover the remaining $1,500.

Replacement Cost (RCV) vs. Actual Cash Value (ACV)

When it comes to personal property coverage, you’ll typically have a choice between two settlement methods: Replacement Cost Value (RCV) and Actual Cash Value (ACV). The difference between these two can significantly impact your payout after a claim.

| Feature | Replacement Cost Value (RCV) | Actual Cash Value (ACV) |

|---|---|---|

| Payout Basis | Cost to buy a brand-new, similar item today. | The item’s current worth, factoring in age and wear (depreciation). |

| Example | Your 5-year-old TV is destroyed. You get enough money to buy a new, comparable model. | Your 5-year-old TV is destroyed. You get what a 5-year-old TV is worth today. |

| Premium Cost | Higher | Lower |

| Best For | Renters who want to fully replace their items without extra out-of-pocket costs. | Renters looking for the lowest possible premium. |

We generally recommend opting for Replacement Cost Value (RCV) coverage. While it comes with a slightly higher premium (typically about 10% more than ACV), it ensures you can replace your damaged or stolen items with new ones, without having to pay the difference out of your own pocket due to depreciation. It’s often the best renters insurance coverage option for true peace of mind.

Frequently Asked Questions about Renters Insurance

Is renters insurance mandatory in Massachusetts or New Hampshire?

No, renters insurance is not required by state law in either Massachusetts or New Hampshire. However, a landlord has the legal right to require you to purchase and maintain a policy as a condition of your lease agreement. This is a very common practice to ensure tenants can cover accidental damage they might cause to the property. Always check your lease to see if it’s a requirement. More info on landlord requirements in MA.

Can my roommate and I share one renters insurance policy?

While some insurance companies allow it, it’s generally not recommended. Sharing a policy means you also share your coverage limits and your claims history. If your roommate files a claim, it goes on your shared insurance record and could raise your rates in the future. Furthermore, if you part ways, untangling the policy can be complicated. The simplest and safest approach is for each roommate to have their own separate policy.

How do I update my policy if I move or buy something expensive?

Updating your policy is simple. If you move, contact your insurance agent before your move date with your new address. Your premium may be adjusted based on the new location. If you acquire a high-value item like an engagement ring or expensive artwork, contact your agent to see if it exceeds your policy’s sub-limits. You may need to “schedule” the item with an endorsement to ensure it’s fully covered. It’s a good practice to review your coverage annually to make sure it still meets your needs.

Protect Your World with the Right Coverage

Your rented space is more than just four walls—it’s your home, filled with things you’ve worked hard for. The best renters insurance coverage provides a crucial financial backstop against the unexpected, from theft and fire to liability lawsuits. By understanding what a policy covers, what it costs, and how to tailor it to your needs, you can secure robust protection without breaking the bank. Don’t leave your financial future to chance.

Ready to find the perfect policy to protect your belongings? Contact the experts at Stanton Insurance Agency to get a personalized renters insurance quote today.