Pet Insurance: 7 Powerful Reasons to Protect Pets in 2025

Why Pet Insurance Is Essential for Your Family’s Financial Security

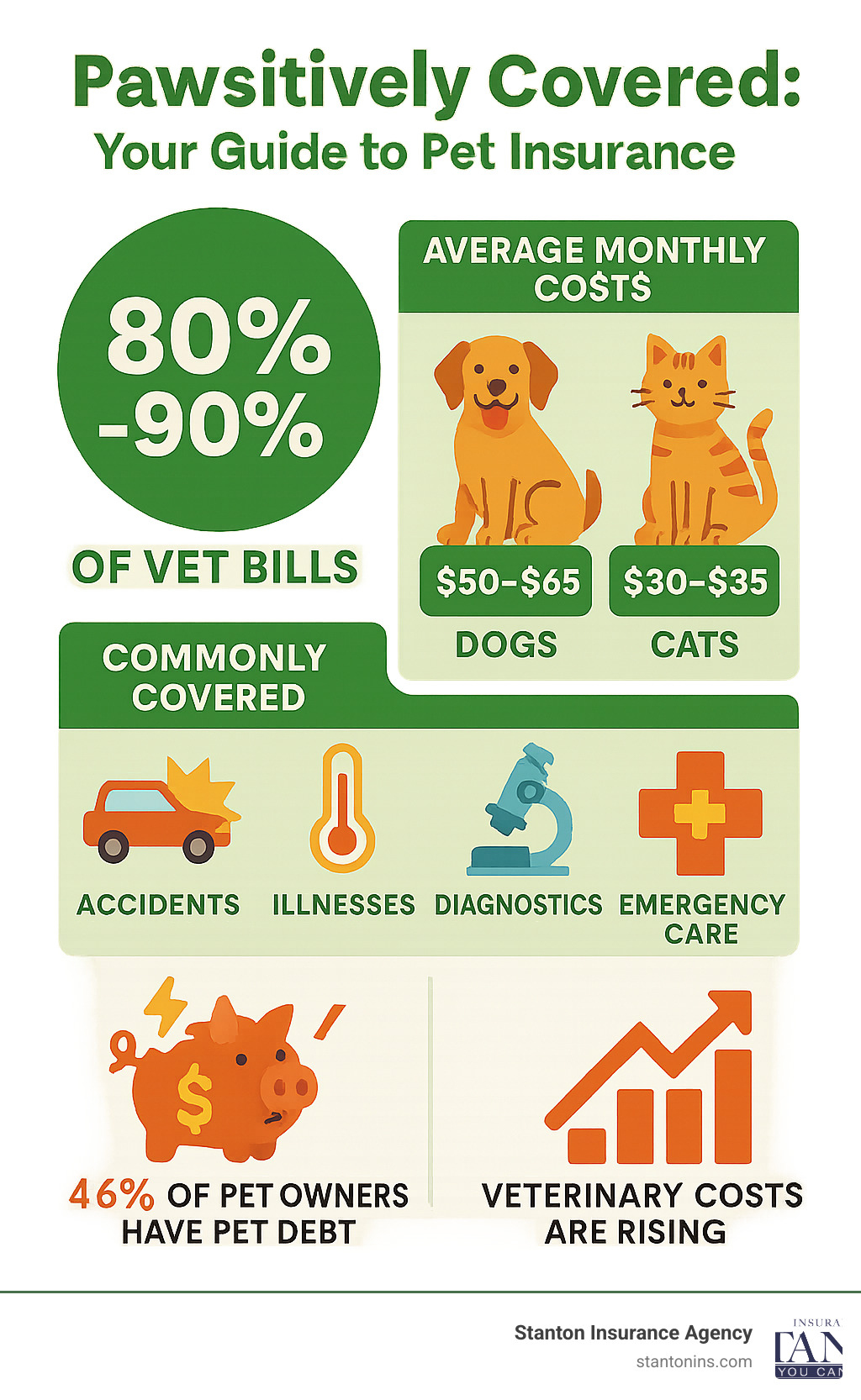

Pet insurance provides financial protection against unexpected veterinary bills by reimbursing a percentage of covered medical expenses after you pay a deductible. Here’s what you need to know:

Key Benefits:

– Coverage: 80-90% reimbursement of eligible vet bills

– Flexibility: Use any licensed veterinarian

– Peace of Mind: Avoid financial stress during pet emergencies

– Fast Claims: Most claims paid within 2-48 hours

Average Costs:

– Dogs: $50-65/month for accident & illness coverage

– Cats: $30-35/month for accident & illness coverage

– Accident-only plans: $16-20/month (dogs), $9-12/month (cats)

As pet parents, we know our furry family members deserve the best care possible. But with veterinary costs rising and emergency treatments often reaching thousands of dollars, many pet owners face difficult financial decisions when their pets need medical attention.

The numbers tell the story: nearly half of pet owners have gone into debt to pay for veterinary care, and more than 60% underestimate the true cost of pet ownership. Pet insurance can cover up to 90% of your unexpected vet bills, including exam fees and taxes, giving you the freedom to choose the best treatment without putting cost first.

Whether you’re dealing with a puppy who gets into everything or a senior cat showing signs of illness, having coverage means you can focus on your pet’s health instead of worrying about the financial burden.

I’m Geoff Stanton, President of Stanton Insurance Agency, and I’ve helped Massachusetts and New Hampshire families protect their most valuable assets for over two decades. While we specialize in home and auto insurance, I understand how pet insurance fits into your overall financial protection strategy and can help you make informed decisions about coverage options.

Related insurance topics:

– what is cobra insurance

– what is umbrella insurance

– homeowners insurance

Pet Insurance 101: How It Works

Think of pet insurance like your own health insurance, but for your furry family member. When your dog needs surgery or your cat gets sick, you’ll pay the veterinary bill upfront, then get reimbursed for most of the cost. It’s that simple.

The process is straightforward and stress-free. After your pet receives care, you submit a claim along with the vet receipts and medical records. Within a few days, you’ll receive 70-90% of your eligible expenses back through direct deposit or check.

Your monthly premiums typically range from $30-65 for comprehensive coverage, depending on your pet’s breed, age, and where you live here in Massachusetts or New Hampshire. Just like with your car insurance, you can choose higher deductibles (usually $100-500) to lower your monthly payments. Most pet parents find the sweet spot around $250 for their annual deductible.

Here’s something important to know about waiting periods: your coverage doesn’t start immediately. Most policies cover accidents after just 48 hours, but illnesses require a 14-day wait. Dental coverage might take up to 6 months to kick in. This prevents people from buying insurance only after their pet gets sick, which keeps costs fair for everyone.

Scientific research on average premiums shows that pet insurance costs have stayed reasonable over time, making it an affordable safety net for most families.

What Does Pet Insurance Cover?

Pet insurance shines when unexpected expenses hit your wallet hard. Accidents like broken bones, poisoning, or emergency surgeries are covered from day one after your waiting period ends. These situations can easily cost $3,000-5,000, but your insurance handles most of that bill.

Illnesses get comprehensive coverage too. Whether your pet develops cancer, diabetes, allergies, or chronic conditions, you’re protected. This includes all the diagnostic tests your vet needs – X-rays, blood work, CT scans, and ultrasounds that help figure out what’s wrong with your pet.

Surgery coverage is where insurance really proves its worth. From routine procedures to complex orthopedic repairs, you won’t have to choose between your pet’s health and your financial security. Many policies also include dental care, covering cleanings, extractions, and periodontal disease treatment up to $600 annually.

Wellness add-ons are optional extras that cover routine care like vaccinations, annual exams, and flea prevention. These typically add $10-25 to your monthly premium but can save money if you’re diligent about preventive care.

How Does Pet Insurance Reimburse?

Most pet insurance companies offer 80-90% reimbursement rates on eligible expenses. Let’s say your dog needs $2,500 surgery and you have 80% coverage with a $250 deductible. You’d pay $700 out of pocket and get $1,800 back – much better than paying the full amount yourself.

Some insurers now offer direct pay options for major procedures, meaning they pay your vet directly instead of making you wait for reimbursement. Claim processing is faster than you might expect. Most companies handle claims within 2-5 business days, with many offering reimbursement in just 2 days via direct deposit.

Why Pet Insurance Matters in Massachusetts & New Hampshire

Living in New England means dealing with some of the highest veterinary costs in the country. As someone who’s lived and worked in Massachusetts and New Hampshire for over two decades, I’ve seen how these regional factors can impact pet-owning families.

Regional veterinary fees in our area reflect the higher cost of living throughout New England. A routine emergency visit in Boston or Manchester can easily run $3,000 to $5,000 before any major treatment begins. I’ve had clients tell me about $6,000 ACL repair surgeries and cancer treatments reaching $15,000 or more. These aren’t rare cases – they’re becoming the norm at quality veterinary practices throughout Massachusetts and New Hampshire.

Emergency care access presents another challenge unique to our region. While we have excellent veterinary hospitals, specialized emergency care often means driving to urban centers during stressful situations. The last thing any pet parent wants is to worry about whether they can afford treatment while racing to save their furry family member.

Our New England weather creates additional risks that pet owners in warmer climates don’t face. Harsh winters bring dangers from frostbite and hypothermia to injuries from icy conditions. Spring and summer aren’t much easier – our region has some of the highest rates of Lyme disease in the country, and tick-borne illnesses can require expensive long-term treatment.

The financial impact is real and measurable. Scientific research on pet debt shows that New England pet owners are among those most likely to carry debt related to veterinary expenses. Nearly 40% of pet owners in our region have borrowed money or used credit cards to pay for unexpected vet bills.

Pet insurance becomes particularly valuable when you consider these regional factors. Instead of hoping nothing serious happens to your pet, you can have peace of mind knowing that 80-90% of those high New England veterinary costs will be covered. It’s the difference between making medical decisions based on your pet’s needs versus your bank account balance.

Coverage Types and Key Features

When you’re shopping for pet insurance, understanding your coverage options can feel overwhelming. Let me break down the different types of protection available so you can find the right fit for your furry family member.

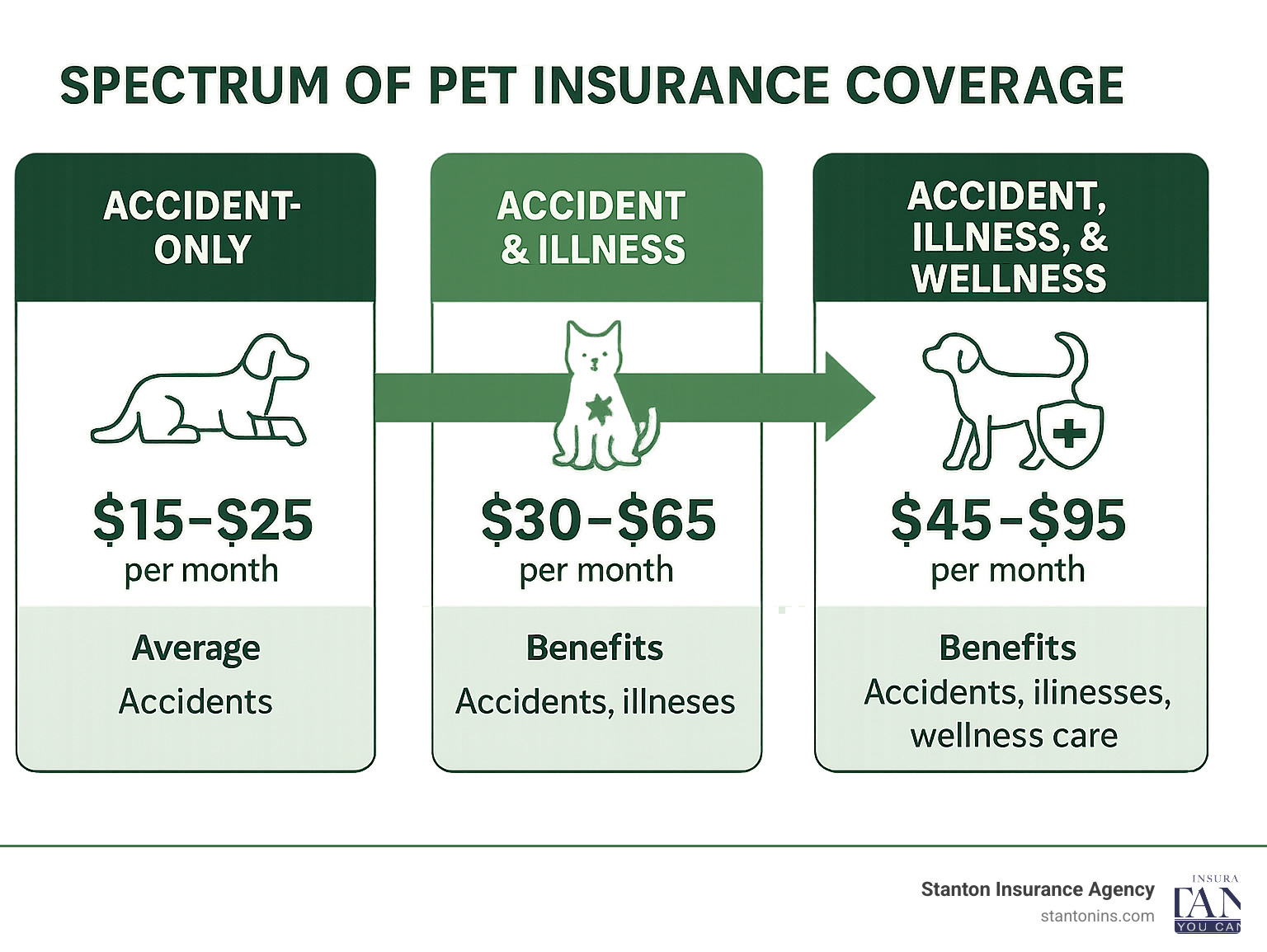

Accident-only coverage is the most budget-friendly option, typically costing $15-25 monthly. This basic protection covers injuries from unexpected events like broken bones from a fall, cuts from glass, poisoning from eating something they shouldn’t, or injuries from car accidents. While affordable, it won’t help with illnesses like cancer or diabetes.

Most pet parents choose accident and illness coverage because it provides comprehensive protection. For $30-65 monthly, you’re covered for both sudden injuries and health conditions that develop over time. This includes everything from cancer treatment and diabetes management to allergies, skin conditions, and chronic diseases that might require ongoing care.

Wellness or preventive care coverage is an optional add-on that covers routine veterinary expenses. For an additional $15-30 monthly, this coverage helps with vaccinations, annual checkups, dental cleanings, and parasite prevention.

Modern pet insurance plans often include valuable features that weren’t available years ago. Exam fee inclusion means the veterinary visit cost (typically $50-250) gets reimbursed along with treatment costs. Alternative therapy coverage helps pay for acupuncture, chiropractic care, and physical therapy when your pet needs specialized treatment.

Some plans now cover behavioral therapy for pets dealing with anxiety or aggression issues. Virtual vet services give you 24/7 access to veterinary consultations through your phone. Prescription food coverage reimburses therapeutic diets your veterinarian prescribes for specific health conditions.

Comparing Pet Insurance Coverage Limits

The structure of your pet insurance plan determines how much protection you actually have when you need it most. Understanding these limits helps you avoid surprises during stressful times.

Annual limits cap how much your insurance will pay each year, typically ranging from $5,000 to $15,000. While this might seem like plenty, serious conditions like cancer treatment or complex surgeries can easily exceed these amounts. That’s why many pet parents now choose unlimited annual coverage, which costs more monthly but provides true peace of mind.

Per-incident limits can be tricky because they restrict coverage for each individual condition or accident. If your plan has a $3,000 per-incident limit and your dog develops diabetes requiring $5,000 in annual care, you’ll pay $2,000 out of pocket every year. This is why unlimited coverage has become the gold standard of pet insurance protection.

Your deductible options typically range from $100 to $1,000 annually. Choosing a higher deductible lowers your monthly premium but means you’ll pay more before insurance kicks in. Your reimbursement percentage – usually 70%, 80%, or 90% – determines how much you’ll receive back after meeting your deductible.

Here’s a real example: If your cat needs $2,000 surgery and you have an 80% reimbursement rate with a $250 deductible, you’ll pay $250 plus 20% of the remaining $1,750, which equals $600 total out-of-pocket.

Is Wellness Worth Adding to Pet Insurance?

Adding wellness coverage to your pet insurance plan makes financial sense if you’re committed to keeping up with your pet’s routine healthcare.

A typical year of preventive care includes an annual exam costing $75-150, vaccinations running $100-200, and flea and tick prevention adding another $150-300. If your pet needs a dental cleaning (and most do), that’s $300-800. Add heartworm prevention at $100-200, and you’re looking at $725-1,650 in routine expenses annually.

Wellness coverage typically costs $200-360 per year, so you’ll save money if you use most of the benefits. The real advantage isn’t just the savings – it’s the convenience of having one plan handle all your pet’s healthcare expenses.

However, wellness coverage isn’t right for everyone. If you prefer to budget for routine expenses yourself or if you sometimes skip recommended preventive care, you might be better off sticking with basic accident and illness coverage and paying routine costs out of pocket.

Plan Costs: Premiums, Deductibles & Discounts

When shopping for pet insurance, understanding what drives premium costs helps you make smart decisions for your budget. Think of it like car insurance – your pet’s “driving record” (breed health history), age, and where you live all play a role in pricing.

Your pet’s breed has the biggest impact on premiums. That adorable Golden Retriever might steal your heart, but their tendency toward hip dysplasia and cancer means higher insurance costs. Mixed breeds often get better rates because they typically have fewer genetic health issues – one of the many perks of adopting from shelters.

Age matters more than you might think. A two-year-old dog might cost $45 monthly to insure, while that same dog at age eight could cost $100 or more. The good news? Most insurers won’t drop your pet as they age, but premiums do increase over time. Starting coverage while your pet is young locks in lower initial rates.

Living in Massachusetts or New Hampshire affects your premiums because veterinary costs here run higher than many other states. Urban areas like Boston or Manchester typically see higher premiums than rural communities, reflecting the cost of emergency veterinary care in those regions.

Your coverage choices directly impact monthly costs. Basic accident-only coverage keeps premiums low but leaves you vulnerable to illness-related expenses. Comprehensive accident and illness coverage costs more but provides real financial protection when your pet needs it most.

Many insurers offer multi-pet discounts ranging from 5-15%, making coverage more affordable if you have multiple furry family members. Some companies also provide discounts for military families, veterinary professionals, or employees of certain companies.

Deductible options give you control over your monthly costs. Choosing a $500 deductible instead of $250 can lower your premium by $10-20 monthly. Just remember – you’ll pay that higher amount out-of-pocket before insurance kicks in.

Reimbursement percentages work similarly. Choosing 70% reimbursement instead of 90% reduces your premium but increases your share of each vet bill. For most families, 80% reimbursement offers a good balance between affordable premiums and meaningful coverage.

Here’s what New England pet owners typically pay for coverage:

| Pet Type | Age | Coverage | Deductible | Reimbursement | Monthly Premium |

|---|---|---|---|---|---|

| Mixed Breed Dog | 2 years | Accident & Illness | $250 | 80% | $35-45 |

| Golden Retriever | 2 years | Accident & Illness | $250 | 80% | $55-70 |

| Domestic Cat | 2 years | Accident & Illness | $250 | 80% | $25-35 |

| Senior Dog | 8 years | Accident & Illness | $500 | 70% | $85-120 |

Pet insurance premiums can increase over time due to inflation, rising veterinary costs, and your pet’s aging. However, most insurers spread these increases across all policyholders rather than targeting individual pets, keeping rate changes reasonable and predictable.

How to Choose the Right Policy

Choosing the right pet insurance policy doesn’t have to be overwhelming. Think of it like finding the perfect fit for your family’s needs and your pet’s health requirements.

Start by considering your veterinary preferences. The good news is that most pet insurance plans let you use any licensed veterinarian, so you won’t have to switch from the vet you trust. However, it’s worth confirming this before you buy, especially if you have a specialized veterinarian or prefer a particular clinic.

Budget considerations play a huge role in your decision. You can actually control your monthly costs by adjusting your deductible and reimbursement rate. A higher deductible means lower monthly premiums, but you’ll pay more out of pocket when you file a claim.

If your pet already has health issues, understanding how pre-existing conditions are handled becomes crucial. Most insurers won’t cover conditions your pet already has, though some will cover curable conditions after a waiting period. This is why many pet parents choose to get coverage while their pets are young and healthy.

Waiting periods matter more than you might think. If you’re buying insurance for a bouncy puppy who seems invincible, a 14-day waiting period for illnesses might seem reasonable. But if you’re covering an older pet showing early signs of health changes, every day counts.

Don’t underestimate the importance of customer service and claim processing speed. When your pet is sick or injured, the last thing you want is to deal with slow claim processing or unhelpful customer service. Look for insurers with good reputations for handling claims quickly and fairly.

Pet insurance is just one piece of your family’s financial protection puzzle. At Stanton Insurance Agency, we understand how all your insurance needs work together. While we specialize in protecting your home and vehicles, we know that comprehensive coverage includes thinking about every member of your family – including the furry ones. Our personal insurance services can help you create a complete protection strategy that makes sense for your situation.

Checklist Before You Buy

Before you sign up for pet insurance, take a few minutes to go through this essential checklist. Think of it as your final quality check before making this important decision for your pet’s health and your family’s financial security.

Review the exclusions carefully – this is where you’ll find what’s not covered. Every policy has them, and they often include breed-specific conditions, behavioral issues, and cosmetic procedures. Don’t let this discourage you, but do make sure you understand what you’re getting.

Read the actual policy wording, not just the marketing brochures. Insurance companies are required to provide clear policy documents, and while they might not be the most exciting reading, they contain the real details about your coverage.

Ask your veterinarian for their insights. Your vet knows your pet’s breed, age, and health history better than anyone. They can tell you about common conditions that affect pets like yours and help you understand what coverage might be most valuable.

Plan for flexibility as your pet ages. Your puppy’s insurance needs will change as they become a senior dog. Make sure you can adjust your coverage levels, deductibles, and add-ons without switching companies entirely.

Frequently Asked Questions about Pet Insurance

When considering pet insurance for your furry family member, you probably have questions about how coverage actually works in practice. Let me address the most common concerns I hear from Massachusetts and New Hampshire pet owners.

How soon does coverage begin?

The timing of when your pet insurance kicks in depends on what type of care your pet needs. Insurance companies use waiting periods to ensure people don’t purchase coverage only after their pet gets sick – it’s similar to how you can’t buy car insurance after an accident.

Accidents typically have the shortest waiting periods, usually just 48 hours to 2 weeks. This means if your dog swallows a sock or gets hit by a car, you’ll have coverage relatively quickly.

Illnesses require a longer wait, typically 14 to 30 days. This covers everything from ear infections to cancer diagnoses. The waiting period gives the insurance company confidence that the condition wasn’t already developing when you purchased coverage.

Orthopedic conditions like hip dysplasia or torn ACLs often have much longer waiting periods of 6 to 12 months. These conditions are common in certain breeds and can be expensive to treat, so insurers want to ensure they’re not covering pre-existing problems.

Dental care usually requires the longest wait – often 6 months to a full year. Since dental disease develops gradually, this extended period helps insurers distinguish between new problems and existing dental issues.

Can I use any veterinarian?

This is one of the biggest advantages of pet insurance – you have complete freedom to choose your veterinarian. Unlike human health insurance with restricted networks, most pet insurance operates on a reimbursement model that works with any licensed veterinarian.

You can continue seeing your regular veterinarian who knows your pet’s history and personality. When emergencies happen, you can rush to the nearest emergency animal hospital without worrying about whether they’re “in network.”

If your pet needs specialized care, you can visit veterinary specialists for cardiology, oncology, or orthopedic surgery. Many pet owners also appreciate having access to university veterinary hospitals, which often provide cutting-edge treatments and clinical trials.

This flexibility extends throughout the United States and Canada, so your coverage travels with you. Whether you’re visiting family in Florida or moving to a new state, your pet insurance continues working with whatever veterinarian you choose.

Are exam fees and taxes reimbursed?

This is where pet insurance policies can vary significantly, and it’s an important detail that affects your out-of-pocket costs. Many modern pet insurance plans now include exam fees in their reimbursement, which can save you $50 to $250 per sick visit.

Some plans go even further and reimburse taxes on veterinary services. This comprehensive approach means you’re reimbursed for the total cost of covered care, not just the treatment portion. When you’re dealing with a $3,000 emergency bill, having the exam fee and taxes covered can make a meaningful difference in your final costs.

However, not all policies include these benefits. Some older or basic plans only cover the actual treatment costs, leaving you responsible for exam fees and taxes. Before purchasing coverage, make sure to ask specifically whether exam fees and taxes are included in your reimbursement calculation.

The best way to avoid surprises is to read the policy details carefully and ask your insurance representative to clarify exactly what’s included in your coverage.

Conclusion: Protect Your Best Friend Today

Your pet isn’t just an animal – they’re family. And just like you wouldn’t hesitate to protect your home or car with insurance, your furry family member deserves that same level of protection. Pet insurance gives you something priceless: the ability to make decisions about your pet’s health based on what’s best for them, not what you can afford.

Here in Massachusetts and New Hampshire, we know how quickly veterinary bills can add up. That routine check-up that turns into emergency surgery. The playful puppy who swallows something they shouldn’t. The senior cat who suddenly stops eating. These moments test both our hearts and our wallets.

Pet insurance means you can focus on what matters most – getting your pet the care they need. With coverage for 80-90% of unexpected veterinary bills, you’re protected against those financial surprises that can derail your budget. Most plans reimburse you within days, and you can use any licensed veterinarian you trust.

The math is simple, but the peace of mind is invaluable. For the cost of a nice dinner out each month, you’re protecting yourself from bills that could reach thousands of dollars. More importantly, you’re ensuring your pet gets the best possible care when they need it most.

At Stanton Insurance Agency, we’ve spent over two decades helping families protect what matters most to them. While we specialize in home and auto coverage, we understand that true protection means looking at your entire financial picture – including your pets.

The biggest mistake pet owners make? Waiting too long to get coverage. Pet insurance works best when you purchase it before problems arise. Pre-existing conditions aren’t covered, and waiting periods mean you need to plan ahead.

If you’re still wondering whether pet insurance makes sense for your situation, check out our detailed analysis: Is Pet Insurance Worth It? We break down the numbers to help you make the best decision for your family.

Your pet has given you years of unconditional love, companionship, and joy. They’ve been there through good times and bad, never asking for anything more than food, shelter, and your attention. Now it’s your turn to be there for them.

Don’t wait for an emergency to wish you had pet insurance. Take a few minutes today to research your options and get a quote. Your future self – and your pet – will thank you for it.