Personal liability umbrella insurance cost: 1M Safeguard

Why Personal Liability Umbrella Insurance Cost Matters

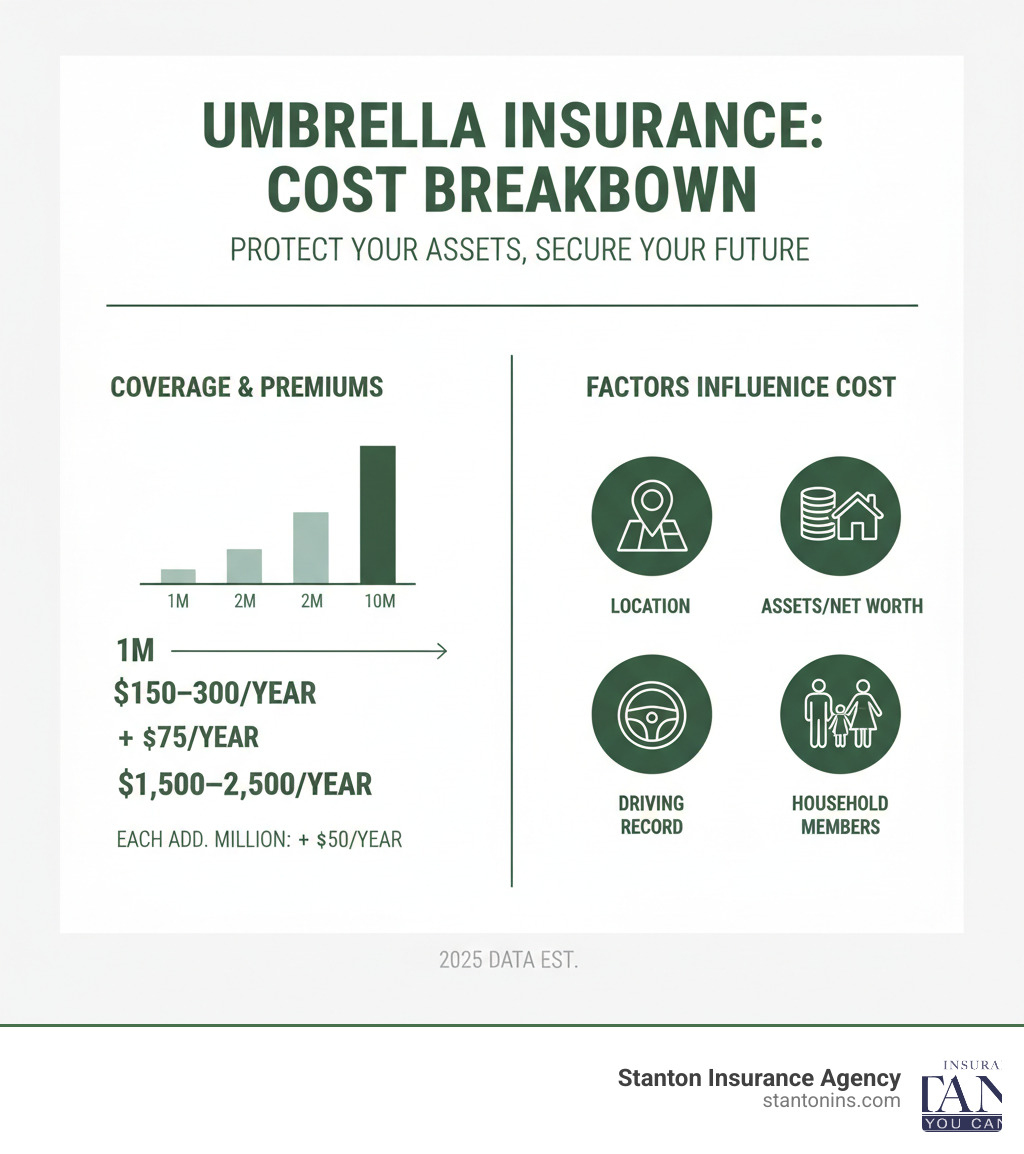

Personal liability umbrella insurance cost typically ranges from $150 to $300 per year for $1 million in coverage, making it one of the most affordable ways to protect your assets from catastrophic lawsuits.

Quick Cost Breakdown:

- $1 million coverage: $150-$300 annually

- $2 million coverage: Add ~$75 more per year

- Each additional million: Add ~$50 per year

- $10 million coverage: $1,500-$2,500 annually

Sometimes life throws you a curveball. A guest slips on your icy driveway. Your teenager causes a multi-car accident. Someone claims you damaged their reputation online. Any of these situations could result in a lawsuit with damages that far exceed your standard home or auto insurance limits.

This is where umbrella insurance becomes your financial safety net. It’s an extra layer of liability protection that kicks in when your primary insurance policies aren’t enough to cover the full cost of a claim. Think of it as affordable insurance for your insurance – protecting everything you’ve worked hard to build.

The reality is stark: 13% of personal injury awards exceed $1 million, yet many people with substantial assets remain unprotected. A single lawsuit could wipe out your savings, home equity, and future earnings without proper coverage.

I’m Geoff Stanton, President of Stanton Insurance Agency, and I’ve spent over two decades helping Massachusetts and New Hampshire families understand personal liability umbrella insurance cost and coverage options. Through my experience in claims and as a Certified Insurance Counselor, I’ve seen how affordable umbrella protection can save families from financial devastation.

Understanding How Umbrella Insurance Works

Think of umbrella insurance like having a backup generator for your home. You hope you’ll never need it, but when the power goes out, you’ll be incredibly grateful it’s there. Personal liability umbrella insurance works the same way—it’s not your first line of defense, but it’s your powerful safety net when everything else falls short.

Your umbrella policy functions as a secondary policy that springs into action only after your primary insurance policies—like your homeowners insurance or auto insurance—have reached their limits. Here’s how it works in real life: imagine you’re driving home from work and cause an accident that results in $800,000 in damages and medical bills. If your auto policy has a $300,000 liability limit, your car insurance covers the first $300,000. Your umbrella policy then steps in to cover the remaining $500,000, protecting you from financial ruin.

This “over the top” coverage is exactly why it’s called an umbrella—it provides that extra layer of protection, shielding your personal assets from large claims that could otherwise wipe out everything you’ve worked for. Without it, you’d be personally responsible for that $500,000 difference, which could mean losing your home, draining your retirement savings, or having your wages garnished for years to come.

What Umbrella Insurance Covers (and What It Doesn’t)

Understanding what your umbrella policy covers is crucial for making smart decisions about your personal liability umbrella insurance cost. The good news? Umbrella insurance offers remarkably broad protection that extends far beyond your standard policies.

Bodily injury liability forms the foundation of umbrella coverage. This protects you when someone gets hurt and you’re legally responsible—whether it’s a guest slipping on your icy walkway, a neighbor’s child getting injured on your trampoline, or someone hurt in a car accident you caused. The policy covers their medical bills, lost wages, pain and suffering, and even funeral expenses in worst-case scenarios.

Property damage liability kicks in when you’re responsible for damaging someone else’s belongings. Picture your teenager accidentally backing into your neighbor’s brand-new luxury car, or your dog somehow damaging expensive landscaping. These situations can get costly quickly, but your umbrella policy has you covered.

For property owners, landlord liability protection is invaluable. If you rent out a property and a tenant gets injured due to faulty stairs or a broken railing, you could face significant liability. Your umbrella policy provides that extra layer of protection that basic landlord insurance might not fully cover.

Here’s where umbrella insurance really shines: personal injury offenses. Unlike standard policies, umbrella coverage often includes protection against libel, slander, defamation of character, false arrest, and invasion of privacy claims. A heated social media comment or negative online review could potentially lead to a defamation lawsuit. Your umbrella policy can help protect you from these modern risks.

Legal defense costs represent another huge benefit. Even if a lawsuit against you is completely groundless, you’ll still need legal representation. Attorney fees can easily reach tens of thousands of dollars, but your umbrella policy typically covers these costs, often even when the underlying claim isn’t covered.

Many umbrella policies also provide worldwide protection, covering you when you’re traveling internationally—something your standard home and auto policies might not offer.

Of course, umbrella insurance isn’t a magic shield that covers everything. Your own injuries fall under your health insurance, not your liability policy. Damage to your own property is covered by your homeowners or auto insurance property coverage, not your umbrella policy.

Business-related activities require separate coverage. If you run even a small home-based business, you’ll need commercial insurance for business liability. Intentional or criminal acts are never covered—insurance protects against accidents, not deliberate wrongdoing.

Contractual liability that you assume under signed agreements typically isn’t covered either. And certain high-risk activities that weren’t disclosed during underwriting may have exclusions or limitations.

Umbrella Insurance vs. Excess Liability Insurance

Many people confuse umbrella insurance with excess liability insurance, but they’re actually quite different—and understanding the distinction could save you from costly coverage gaps.

Excess liability insurance is like adding more fuel to one specific tank. It simply increases the dollar limit of a single existing policy while following that policy’s exact terms and conditions. If your auto policy covers certain risks up to $300,000, excess liability might bump that up to $1 million—but only for those same specific risks your auto policy already covered.

Umbrella insurance is much broader. It’s like having an entirely new, larger tank that can fuel multiple parts of your financial protection system. An umbrella policy can apply to multiple underlying policies—your home, auto, and boat insurance—all at once. Even better, it often covers risks that your underlying policies don’t include at all, like those personal injury offenses we mentioned earlier.

The coverage scope differs significantly too. While excess liability “follows form” (meaning it only covers what your underlying policy already covers), umbrella insurance provides broader protection, often including risks not covered by any of your underlying policies.

There’s also a difference in how deductibles work. Excess liability has no separate deductible—it simply kicks in once your primary policy limit is reached. Umbrella insurance may require what’s called a Self-Insured Retention (SIR) for claims not covered by an underlying policy, typically ranging from $250 to $10,000.

For most families, the broader protection of an umbrella policy offers superior value, especially when you consider the minimal difference in personal liability umbrella insurance cost between the two options.

The Real Personal Liability Umbrella Insurance Cost

Here’s the surprising truth about personal liability umbrella insurance cost: it’s remarkably affordable for the massive protection it provides. We’re talking about roughly the cost of your morning coffee habit to protect millions of dollars in assets.

According to the Insurance Information Institute, a $1 million umbrella policy typically runs between $150 and $300 per year. That breaks down to less than a dollar a day for $1 million in extra protection. When you consider that a single severe accident could result in a judgment that wipes out your life savings, this cost becomes one of the best bargains in insurance.

The pricing gets even better as you add coverage. Need $2 million in protection? You’ll typically pay about $75 more than the base $1 million policy. Each additional million after that usually adds approximately $50 to your annual premium. So a $5 million policy might cost around $500-600 annually, while $10 million in coverage could run between $1,500 and $2,500 per year.

Key Factors That Influence Your Personal Liability Umbrella Insurance Cost

Your personal liability umbrella insurance cost isn’t pulled from thin air. Insurance companies look at your specific situation to determine your risk level, and several factors can bump your premium up or down.

Coverage amount is the most obvious factor—more protection costs more money. But location plays a bigger role than many people realize. Living in Massachusetts versus New Hampshire can affect your rates due to different legal environments and population densities.

Your driving record matters tremendously. A clean record for everyone in your household keeps costs low, while accidents or tickets can increase your premium. The same goes for the number of vehicles you own—more cars mean more opportunities for accidents.

Property ownership affects pricing too. Multiple homes or rental properties increase your liability exposure. Speaking of properties, certain features can significantly impact your rates. A swimming pool, hot tub, or trampoline on your property raises red flags for insurers because they’re considered “attractive nuisances” that increase injury risk.

Household members also factor into the equation, especially if you have teenage drivers. Statistically, teens are more accident-prone, which translates to higher potential claims and increased premiums.

Your claims history tells insurers a lot about your risk level. Previous liability claims on your home or auto policies suggest you might file claims in the future. Some insurers even consider your credit history as an indicator of financial responsibility.

Here’s some good news: bundling your umbrella policy with your existing home and auto insurance often leads to significant discounts. Many insurers require this anyway, but it usually works in your favor financially.

For more insights on how these factors relate to your overall insurance strategy, check out our personal insurance resources.

How Much Coverage Do You Really Need?

The golden rule is simple: protect your total net worth. Add up your home equity, investments, savings, and valuable possessions. That’s your baseline coverage amount. If you’re worth $2 million, start with a $2 million umbrella policy.

But don’t stop there. Your future earning potential matters too, since wages can be garnished to satisfy court judgments. A successful professional in their 40s might have $500,000 in current assets but could earn another $2 million before retirement. That future income is at risk in a major lawsuit.

Higher-risk situations call for higher coverage limits. Landlords face increased exposure, especially if rental properties aren’t held in separate LLCs. Owners of boats, RVs, or other recreational vehicles should consider more coverage. Parents of teenage drivers definitely need to think bigger—teen accidents can result in catastrophic claims.

Most financial experts recommend at least $1 million to $5 million in coverage, even if your net worth is lower. Why? Because lawsuit judgments can be unpredictable and devastating. A severe accident involving multiple victims can easily result in multi-million dollar awards.

The good news is that even high coverage amounts remain affordable. While some extreme cases result in judgments exceeding $10 million, most personal injury awards stay below that threshold. For high-net-worth individuals, policies can extend up to $100 million with certain providers.

At Stanton Insurance Agency, we help you find that sweet spot—comprehensive protection without overpaying. Every family’s situation is unique, and we’re here to assess your specific risks and recommend coverage that gives you peace of mind without breaking your budget.

Is Umbrella Insurance a Worthwhile Investment?

For most people in Massachusetts and New Hampshire, the answer is absolutely yes. When you consider that personal liability umbrella insurance cost averages just $150-$300 per year for a million dollars of protection, it’s hard to find a better deal in the insurance world. That’s less than what many people spend on their monthly coffee habit, yet it could save your entire life savings.

Think about it this way: a single serious accident could result in a judgment of $2 million or more. Without umbrella coverage, you’d be personally responsible for everything above your standard policy limits. Your home, your savings, your retirement accounts, even your future wages could all be at risk. For the price of a nice dinner out each month, you can protect everything you’ve worked so hard to build.

I’ve seen too many families face financial ruin because they thought “it won’t happen to me.” The truth is, lawsuits don’t discriminate. They can happen to anyone, anywhere, at any time. A moment of distraction while driving, a guest slipping on your front steps, or even an innocent social media post that someone takes the wrong way—any of these could trigger a lawsuit that changes your life forever.

The Pros and Cons of Umbrella Coverage

Let’s be honest about what you’re getting with umbrella insurance. On the positive side, you’re getting millions in extra liability coverage for an incredibly affordable price. Unlike your standard policies, umbrella insurance also protects against claims like slander and defamation—risks that are becoming more common in our digital age.

The coverage follows you anywhere in the world, which is fantastic if you travel. And perhaps most importantly, it covers your legal defense costs even if a lawsuit against you turns out to be completely groundless. Legal fees alone can easily reach six figures, even when you win.

The downsides are minimal but worth noting. You’ll need to maintain underlying home and auto policies with specific minimum liability limits—typically around $250,000 per person for auto and $300,000 for homeowners. Most insurers will also want you to bundle your umbrella policy with your other coverage, though this often leads to discounts that actually save you money overall.

Who Should Seriously Consider Umbrella Insurance?

While anyone can benefit from umbrella coverage, certain people have higher risk exposure. If you’re someone with a net worth over $500,000, you’re essentially walking around with a target on your back from a legal standpoint. Your assets make you an attractive defendant in any lawsuit.

Parents of teenage drivers should definitely consider umbrella coverage. Teen drivers are statistically much more likely to cause serious accidents, and the resulting claims can be devastating. Similarly, if you’re a landlord or own rental properties, your liability exposure multiplies with each property you own.

Do you have a swimming pool, trampoline, or hot tub? These are what insurance companies call “attractive nuisances”—things that draw people in but create significant liability risks. Even if you’re careful about safety, accidents happen, and the results can be expensive.

Pet owners, especially those with certain dog breeds, face unique liability risks. Dog bite claims average over $50,000, and some can be much higher. If you serve on a nonprofit board or have a visible online presence through blogging or social media, you’re also at higher risk for personal injury claims like defamation.

Boat owners and recreational vehicle enthusiasts face additional liability exposures beyond what their standard policies cover. The good news is that umbrella insurance can provide that extra layer of protection across all these different risk areas for one low annual premium.

The bottom line is simple: if you have assets worth protecting or income that could be garnished, umbrella insurance is one of the smartest financial moves you can make. At Stanton Insurance Agency, we’ve helped countless Massachusetts and New Hampshire families secure this vital protection, and we’re here to help you determine if it’s right for your situation.

Frequently Asked Questions about Umbrella Insurance

Over my decades in the insurance industry, I’ve found that people have genuine concerns about umbrella insurance. They want to understand exactly what they’re buying and whether it makes sense for their situation. Let me address the most common questions I hear from families in Massachusetts and New Hampshire.

Do I need to have home and auto insurance to get an umbrella policy?

Yes, absolutely. Insurers universally require you to have primary liability policies in place before they will issue an umbrella policy. Think of it this way – you can’t have an umbrella without something underneath it to protect!

Furthermore, insurers will mandate minimum liability limits on those underlying policies. In Massachusetts and New Hampshire, this typically means around $250,000 per person/$500,000 per accident for auto insurance liability and $300,000 for homeowners insurance liability.

These minimums aren’t arbitrary. They ensure that your umbrella policy truly acts as an excess layer, kicking in only after a substantial portion of the claim has been covered by your primary policies. This structure keeps the personal liability umbrella insurance cost affordable while providing meaningful protection.

Does umbrella insurance cover my business activities?

Generally, no – and this is a crucial distinction that can save you from a nasty surprise down the road. A personal umbrella policy is designed exclusively to cover your personal, non-business-related activities.

If you own a business, even a small home-based one like freelance consulting or selling crafts online, you will need a separate commercial insurance policy and potentially a commercial umbrella policy to cover business-related liability.

I’ve seen too many people assume their personal umbrella will cover everything. Attempting to use a personal umbrella policy for business claims is a common mistake that can lead to a denied claim and significant financial hardship. The line between personal and business activities isn’t always clear, so when in doubt, ask us. We’d rather clarify upfront than see you face coverage gaps later.

Can I get a standalone umbrella policy?

While technically possible, it’s uncommon and often more expensive. Most major insurers prefer – or even require – you to have your underlying home or auto policy with them to add an umbrella policy.

This practice, known as bundling, actually works in your favor. It often leads to significant discounts on your overall insurance premiums, sometimes saving you more than the umbrella policy costs! Insurers like this arrangement because it gives them a complete picture of your risk profile, which helps them price your coverage more accurately.

While a few specialized providers might offer standalone policies, you’ll generally find better rates and much simpler management by bundling your coverage with one trusted provider. Having all your policies with one company means one phone call, one renewal date, and one relationship to manage. It’s insurance made simple.

The bottom line? Personal liability umbrella insurance cost becomes even more attractive when you factor in the bundling discounts. Most of our clients find that adding an umbrella policy to their existing home and auto coverage costs less than they expected, especially when those multi-policy discounts kick in.

These are the questions I hear most often, but every family’s situation is unique. If you have specific concerns about how umbrella insurance might work for your circumstances, I encourage you to reach out. We’re here to provide clear, honest answers that help you make the best decision for your family’s financial security.

Secure Your Financial Future Today

Life has a way of throwing unexpected curveballs when you least expect them. One moment you’re enjoying a peaceful evening at home, and the next you could be facing a lawsuit that threatens everything you’ve worked so hard to build. But here’s the good news: you don’t have to face these risks alone or unprotected.

A personal liability umbrella policy is one of the smartest financial decisions you can make. For less than a dollar a day, you can add $1 million in liability protection that shields your assets, savings, and future earnings from the devastating impact of a major lawsuit. When you consider that the average personal liability umbrella insurance cost is just $150-$300 annually, it’s an incredibly small price to pay for such enormous peace of mind.

Think about it this way: you probably spend more on your monthly coffee habit than you would on umbrella insurance for an entire year. Yet that coffee only lasts a few minutes, while umbrella insurance protects your family’s financial security 24/7, 365 days a year.

The peace of mind that comes from knowing you’re protected is truly priceless. No more lying awake at night wondering “what if” something happens. No more worrying that a single accident could wipe out your children’s college fund or force you to sell your home. With proper umbrella coverage in place, you can focus on living your life instead of constantly worrying about potential financial disasters.

At Stanton Insurance Agency, we understand that every family’s situation is unique. Maybe you’re a young professional just starting to build wealth, or perhaps you’re nearing retirement with substantial assets to protect. Either way, we have the expertise to help you assess your specific risks and find the right level of coverage that fits both your needs and your budget.

Our team has been serving families throughout Massachusetts and New Hampshire for years, and we’ve seen how umbrella insurance can be a financial lifesaver. We’re not just here to sell you a policy – we’re here to be your trusted partner in protecting what matters most to your family.

Don’t wait until it’s too late. The best time to get umbrella insurance is before you need it. Once an accident happens, it’s too late to add coverage. But right now, today, you can take this simple step to secure your family’s financial future.

Get your personalized umbrella insurance quote from Stanton Insurance Agency today!