Personal Liability Insurance Cost: Smart 2025 Guide

Understanding Personal Liability Insurance Costs in Massachusetts and New Hampshire

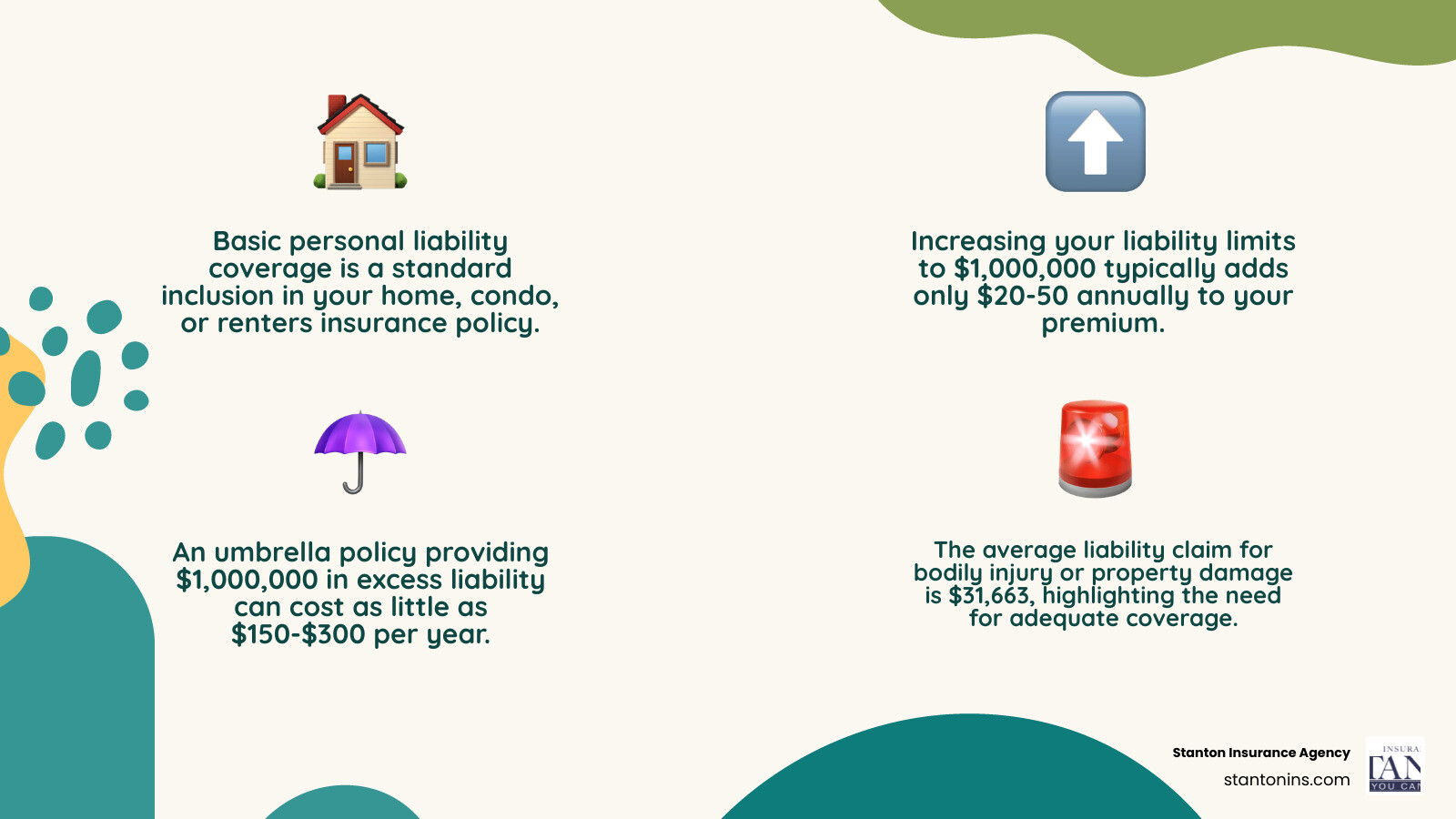

Personal liability insurance cost varies, but the good news is that basic protection is already part of your home, condo, or renters insurance. Here’s what you need to know about pricing:

Quick Cost Overview:

- Base Coverage: Already included in your home/renters policy premium

- Higher Limits: Adding $1M coverage typically costs $20-50 more annually

- Umbrella Policies: $1M in additional coverage runs $150-300 per year

- Average Claims: Liability claims average $31,663 for bodily injury/property damage

Most Massachusetts and New Hampshire homeowners have $100,000 to $500,000 in personal liability coverage built into their home insurance. However, experts recommend increasing this to at least $1,000,000, especially since 1 in every 1,670 insured homeowners file a liability claim each year.

The real question isn’t if you can afford this insurance, but if you can afford to go without it. A single lawsuit from a slip-and-fall or dog bite could exceed your limits, leaving you responsible for the difference.

As President of Stanton Insurance Agency, I’ve seen how a small investment in adequate liability coverage can save families from financial devastation. For over 25 years, I’ve helped Massachusetts families make smart personal liability insurance cost decisions when accidents happen.

What is Personal Liability Insurance and Why Do You Need It?

Imagine your neighbor slips on your deck during a barbecue, or your dog nips the mail carrier. These common scenarios can lead to expensive lawsuits that threaten your financial security.

Personal liability insurance is your financial safety net in these situations. It’s designed to protect you and your family when you’re found legally responsible for accidentally injuring someone or damaging their property. It’s a protective shield for your assets—your savings, home, and future earnings.

This valuable coverage handles legal defense costs, medical payments, and settlements when someone is hurt on your property or you damage their belongings. Without it, you’d pay these fast-growing expenses out-of-pocket.

Here’s some good news: you probably already have some personal liability protection. It’s automatically included in your Home Insurance, Renters Insurance, and Condo Insurance policies. However, the standard coverage limits might not be enough to fully protect your assets.

The beauty of personal liability insurance extends beyond your property. Whether you’re at home in Massachusetts, visiting family in New Hampshire, or vacationing across the country, your coverage typically follows you. This worldwide coverage protects you when accidents happen away from home.

If you want to dive deeper into how this protection works, check out our detailed guide: What is Personal Liability Insurance?.

What’s Covered vs. What’s Not

Understanding what your personal liability insurance covers – and what it doesn’t – helps you make informed decisions about your protection level.

Your coverage typically handles bodily injury claims if someone gets hurt on your property, including medical bills, lost wages, and pain and suffering. It also covers property damage when you accidentally harm someone else’s belongings, like your child’s baseball breaking a neighbor’s window.

A key benefit is legal defense costs. Your policy typically covers these expenses, even for frivolous lawsuits, regardless of the outcome. Your coverage also includes medical payments to others for minor injuries, which can help resolve situations quickly before they escalate.

Your policy may even extend to libel and slander situations, protecting you from personal injury claims related to things you say or write. This worldwide protection means you’re covered whether the incident happens in your backyard or during a vacation.

However, there are important boundaries. Your policy won’t cover intentional acts – insurance protects against accidents, not deliberate harm. Business activities conducted from your home require commercial insurance. Auto-related accidents are handled by your car insurance. And remember, this coverage protects others from harm you cause; it doesn’t cover damage to your own property.

Real-World Claim Scenarios

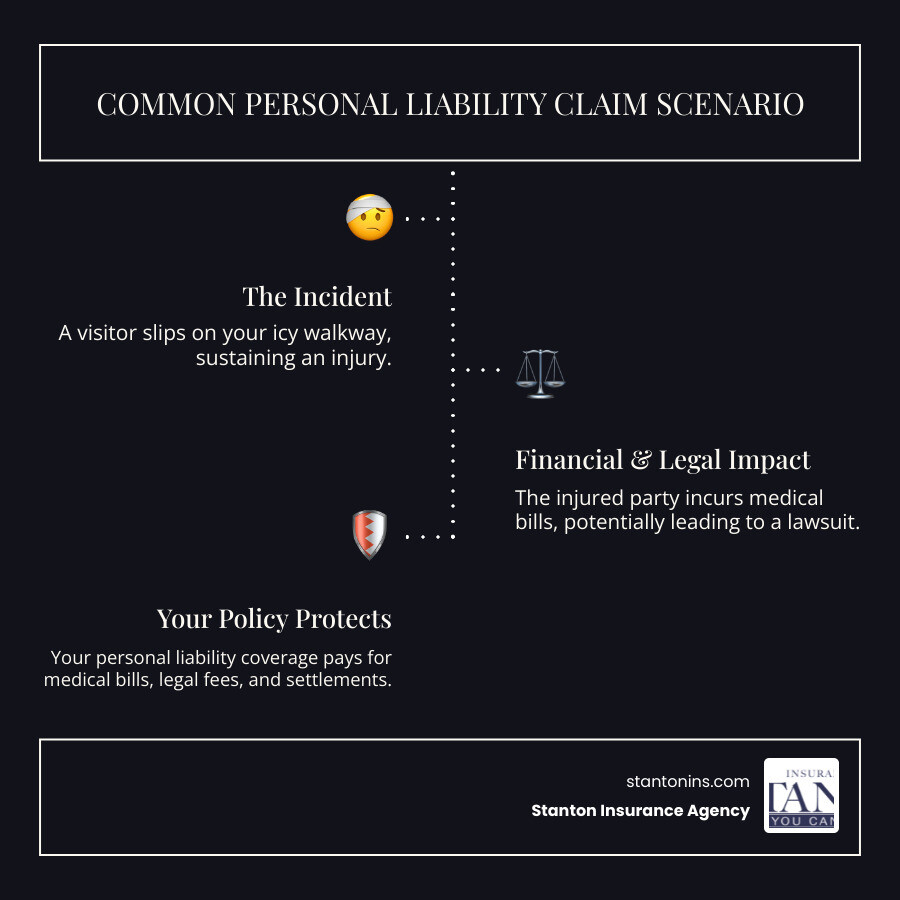

Liability claims often arise from ordinary situations. Everyday mishaps, not just dramatic accidents, can lead to expensive lawsuits.

In a classic slip-and-fall scenario, a delivery driver breaks their leg on your icy steps. You’re facing medical bills, lost wages, and a potential lawsuit. Your liability coverage handles these costs, protecting your savings.

Dog bite incidents are another common claim. Even friendly pets can have an off day, and dog bites are consistently among the top homeowner’s insurance claims. Your coverage would help with medical treatment and legal expenses.

Children’s activities can also lead to claims. Whether your child accidentally breaks a valuable antique at a friend’s house or injures a playmate, your personal liability coverage can handle the financial consequences.

Weather-related incidents like falling tree branches that damage a neighbor’s property also fall under your coverage. Swimming pool accidents or injuries from trampolines can result in significant claims, as these are considered attractive nuisances.

The financial impact of these scenarios can be substantial. According to the Insurance Information Institute, the average liability claim for bodily injury or property damage was $31,663 between 2017 and 2021. Factoring in legal fees, the total cost can easily exceed $50,000. This is why understanding your personal liability insurance cost and ensuring adequate coverage is crucial.

How Much Does Personal Liability Insurance Cost?

Personal liability insurance cost is one of the smartest financial decisions you can make, yet you’ll never see it as a separate line item. That’s because it comes bundled into your home, condo, or renters insurance policy, making it affordable for the massive protection it provides.

The real beauty lies in upgrading your coverage. While your base policy might include $100,000 to $500,000 in liability protection, boosting that to $1 million typically costs just $20 to $50 more per year. That’s less than your monthly coffee budget for protection that could save your entire financial future.

While not a standalone policy, increasing your liability limits is an affordable way to gain significant protection.

Understanding the Average Personal Liability Insurance Cost

Your home insurance premium in Massachusetts or New Hampshire, typically $1,000 to $2,000 annually, already includes personal liability coverage. Renters and condo insurance also include this protection at a lower premium. You’re not paying extra for this essential coverage.

Most standard policies start with liability limits between $100,000 and $500,000. While that sounds substantial, a serious accident can blow through those limits. Medical bills for a severe injury can easily reach six figures, and that’s before legal fees enter the picture.

Insurance experts consistently recommend bumping your coverage to at least $1,000,000 to $2,000,000. Here’s where the math gets really interesting: increasing coverage limits might add $20 to $50 annually to your base policy premium, offering a substantial increase in protection for a minimal cost.

Let’s put that in perspective. For about $4 a month, you could increase your liability coverage from $300,000 to $1 million. That’s an extra $700,000 in protection for less than the cost of a fancy coffee. It’s hard to find better value anywhere in the insurance world.

Factors That Influence Your Personal Liability Insurance Cost

Several factors can nudge your overall premium up or down, which affects how much you’ll pay for that liability protection. Understanding these can help you make smart decisions about your coverage.

Property characteristics play a big role. That backyard swimming pool or trampoline might be great for fun, but insurers see them as “attractive nuisances” that increase your liability risk. These features can bump up your premium slightly.

Your furry family members matter too, especially dogs. Some breeds are considered higher risk by insurers, and any history of bites can impact your rates.

Your claims history follows you. Previous liability claims signal to insurers that you might be a higher risk, potentially leading to increased premiums. A clean record can help keep your costs down.

Location matters. Rates can vary between different areas of Massachusetts and New Hampshire based on local claim frequencies and population density.

Your credit history surprisingly affects your personal liability insurance cost. Insurance companies use credit-based scores to predict future claims, so good credit can lower your premiums.

The coverage limits you choose obviously impact your premium, but as we’ve seen, the increase is usually minimal compared to the extra protection you receive. It’s one of those rare situations where spending a little more gives you dramatically better value.

Personal Liability vs. Umbrella Insurance: What’s the Difference?

When researching personal liability insurance cost, you’ve likely heard of umbrella insurance. Both offer liability coverage, but they work together to build your overall protection strategy.

Think of personal liability insurance as your foundation. It’s the first layer of protection included in your Home Insurance, Renters Insurance, and Condo Insurance policies. This coverage kicks in first, typically providing $100,000 to $500,000 in protection (though we recommend increasing this to $1,000,000 or more).

Umbrella insurance is a separate, standalone policy providing “excess liability” coverage on top of your home and auto policies. When your base policy limits are exhausted, your umbrella policy takes over with much higher limits—often starting at $1,000,000 and going up to $10,000,000 or more.

Here’s a simple way to picture it: Your home and auto policies are like smaller umbrellas, each protecting you from specific risks up to a certain point. An Umbrella Insurance policy is like a giant umbrella that extends over both of those smaller ones, providing extra protection once their limits are reached. It can even cover situations your primary policies don’t, such as libel and slander claims, false imprisonment, or worldwide incidents.

The key difference is that personal liability insurance is bundled, while umbrella insurance stands alone. You’ll typically need minimum underlying liability limits on your home and auto policies before an insurer will issue an umbrella policy.

| Feature | Personal Liability Insurance | Umbrella Insurance |

|---|---|---|

| Typical Coverage Limits | $100,000 – $500,000 (often increased to $1M-$2M) | $1,000,000 – $10,000,000+ |

| Cost | Included in home/renters/condo premium; increasing limits adds $20-$50/year for $1M extra | Standalone policy; $1M typically costs $150-$300/year |

| How It’s Purchased | Part of your home, condo, or renters insurance policy | Separate policy requiring minimum underlying limits |

| Scope of Coverage | Covers bodily injury and property damage from personal actions | Extends over home and auto limits; broader coverage including libel, slander, worldwide incidents |

When to Consider an Umbrella Policy

While everyone benefits from solid personal liability coverage, umbrella insurance becomes a financial necessity for some.

High net worth individuals and families with significant assets should seriously consider umbrella coverage. If your total assets—including your home, savings, investments, and future earnings—exceed your current liability limits, a major lawsuit could wipe you out. Umbrella insurance can prevent that.

Landlords face increased liability risks from tenants and visitors. People with high-risk hobbies or professions—perhaps you volunteer, serve on nonprofit boards, or work in a profession that might make you a target for lawsuits—benefit greatly from that extra protection.

If you have teenage drivers, you know the statistics. An umbrella policy provides crucial additional coverage if your teen is involved in a severe car accident where damages exceed your auto policy’s limits.

Attractive nuisances like swimming pools, trampolines, or certain dog breeds also significantly increase your liability exposure, making umbrella coverage a smart move.

Here’s what might surprise you: A $1 million umbrella policy can cost as little as $150 to $300 per year, providing a massive boost to your financial safety net. Additional millions of coverage typically cost just $50 to $75 more per year.

When you consider that the average liability claim exceeds $31,000—and severe claims can reach millions—this small annual investment makes tremendous financial sense.

For a deeper dive into whether umbrella coverage is right for you, check out our detailed guide: Do you know the importance of Umbrella Insurance?.

How Much Personal Liability Coverage Do You Need?

While most insurers recommend a minimum of $1,000,000 in personal liability coverage, the right amount for your family depends on your assets and risks. It’s about creating a financial shield that covers your specific situation, not just picking a big number.

If someone successfully sues you, they can come after everything you own: your savings, home equity, investments, and even future paychecks. That’s why you should calculate your total assets to determine the right amount for your situation.

Your net worth is your starting point. Add up everything you own—your home’s equity, savings accounts, retirement funds, and investments. Then subtract what you owe. The result is the minimum you need to protect.

But you’re not just protecting current assets, you’re also protecting your future earning potential. If you’re 35 with a good career, a major lawsuit could result in wage garnishment for decades, derailing your financial plans.

Your lifestyle and risk factors matter too. Do you host parties where someone could fall? Own a dog? Have a swimming pool? Serve on a local board or coach a team? Each of these activities increases your exposure to potential liability claims.

For most Massachusetts and New Hampshire families, bumping up their personal liability coverage to $1,000,000 or $2,000,000 within their existing policy makes perfect sense. This upgrade typically costs just $20 to $50 more per year—less than a dollar per week for hundreds of thousands in additional protection.

If your net worth exceeds these amounts, or if you have significant future earnings to protect, an umbrella policy becomes essential. It’s the difference between adequate protection and bulletproof financial security.

The goal isn’t to buy the most coverage possible—it’s to buy the right amount. Too little, and you’re gambling with your family’s future. Too much, and you’re overpaying. Getting it just right is where we can help.

Frequently Asked Questions about Personal Liability Insurance

Insurance talk can be confusing, and we get that! Here are the answers to the most common questions we hear from Massachusetts and New Hampshire families.

Is personal liability insurance included in my home insurance policy?

Yes, personal liability coverage is a standard component automatically included in all home, condo, and renters insurance policies. You don’t need to purchase it separately.

The main variable is the coverage limit, which you control. Your policy might default to $100,000 or $300,000 in liability coverage, but you can (and probably should) increase this amount.

We always recommend reviewing these limits. Ask yourself: “If someone got seriously hurt on my property, would my current coverage protect everything I’ve worked for?” If the answer is no, it’s time to bump up those limits.

Does personal liability cover incidents that happen away from my home?

Yes, your coverage typically extends worldwide, protecting you and your family members wherever you are. For example, if you’re on vacation and accidentally damage property, or your child causes an injury, your personal liability coverage can step in. This portable protection is incredibly valuable, covering you whether you’re at the local farmers market or traveling abroad.

What is the difference between personal liability and third-party liability on my auto insurance?

While both types of coverage protect you when others make claims against you, they are designed for different situations.

Personal liability from your home, condo, or renters policy handles the non-driving parts of your life. This includes someone getting hurt on your property, your dog causing trouble, or accidentally damaging someone’s belongings away from home. Think of it as your “life outside the car” protection.

Third-party liability on your auto insurance is all about what happens when you’re behind the wheel. If you cause a car accident, this coverage pays for the other driver’s medical bills and vehicle repairs. It’s your “driving responsibility” coverage.

The key thing to remember is that these two policies don’t overlap—they cover entirely different risks. Your home policy won’t help if you rear-end someone, and your auto policy won’t cover a guest slipping on your icy steps. That’s why having adequate limits on both is so important.

The good news about personal liability insurance cost is that boosting your limits on both policies is typically very affordable, giving you comprehensive coverage for all of life’s unexpected moments.

Secure Your Financial Future Today

You wouldn’t drive without auto insurance, so why leave yourself vulnerable to a lawsuit that could wipe out your assets? Protecting your financial future from unexpected lawsuits doesn’t have to be complicated or expensive; it’s one of the smartest moves you can make.

The truth about personal liability insurance cost is that for pocket change each month, you can gain massive financial security. Adding millions in protection for the cost of a few cups of coffee delivers a monumental increase in your peace of mind.

The numbers speak for themselves. The average liability claim runs over $31,000, but severe incidents can easily reach six or seven figures. A single accident could potentially cost you your home, savings, and future earnings. With proper coverage, you can sleep soundly knowing you’re protected.

By understanding your risks and options, you can build a protective shield around your family’s future. You’re ensuring that one unfortunate accident won’t jeopardize everything you’ve worked so hard to build. It’s not just about having insurance; it’s about having the right amount of insurance.

At Stanton Insurance Agency, we’ve helped countless Massachusetts and New Hampshire families steer these crucial decisions. Our expert team understands that every family’s situation is unique, and we’re committed to helping you find the perfect balance between comprehensive coverage and cost-effectiveness.

The cost of robust personal liability coverage is a small price to pay for financial security and the peace of mind that comes with knowing you’re properly protected. Don’t leave your financial future to chance—especially when protection is so affordable.

Ready to take action? Reach out to us today to discuss your personal liability needs, or consider taking the next step to add that crucial extra layer of protection. Explore Umbrella Insurance options with us to fortify your defenses against life’s unpredictable moments. Because when it comes to protecting your family’s future, you deserve nothing less than complete confidence.