Owner builder insurance cost 2025: Ultimate Protection

Why Owner-Builder Insurance Cost Matters for Your Construction Project

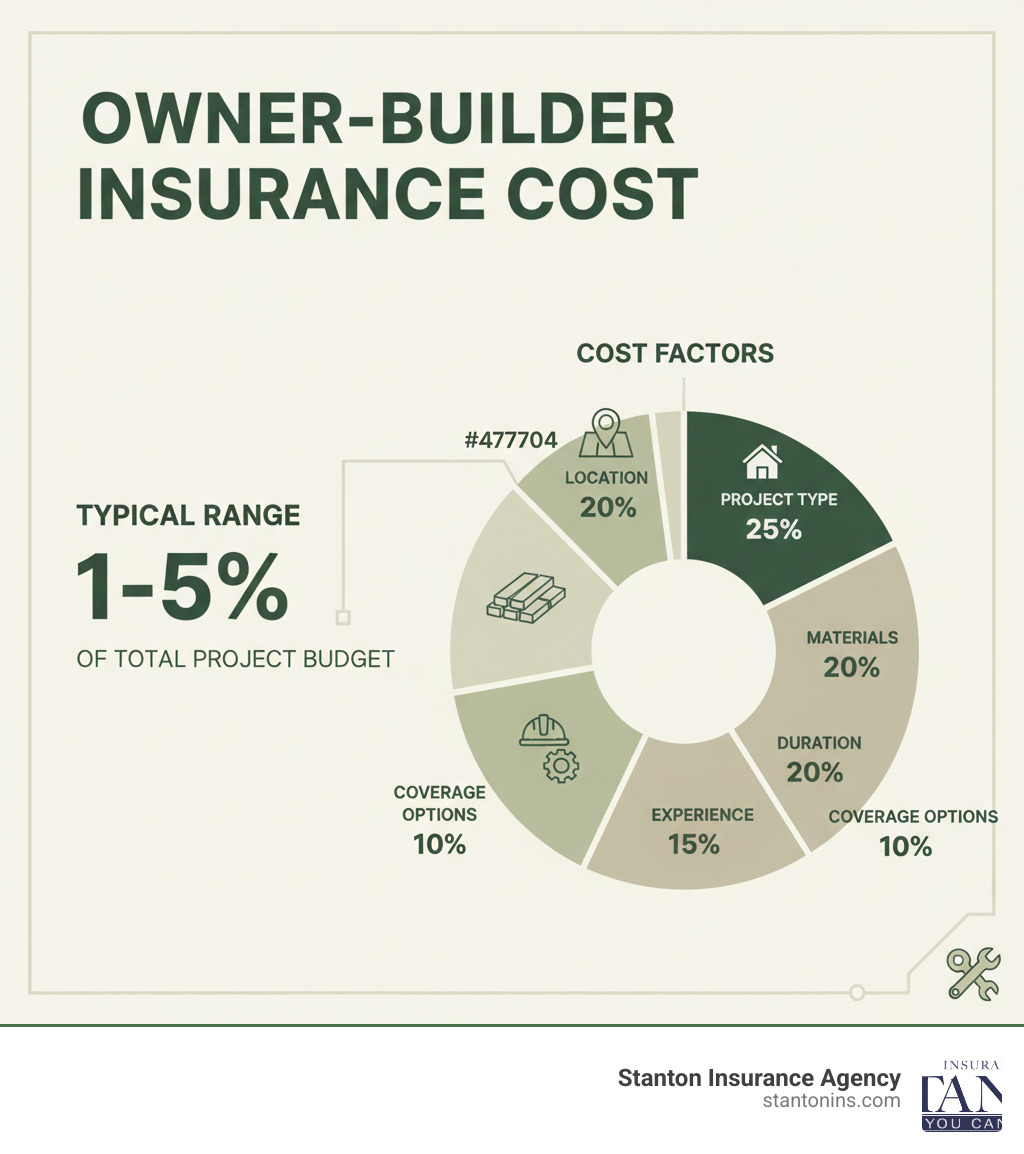

Owner builder insurance cost is a critical budget item when you act as your own general contractor. Here’s a quick overview:

Quick Answer: Owner Builder Insurance Cost

- Typical Range: 1% to 5% of the total construction budget.

- Average Premium: $1,000 to $5,000 per $100,000 of construction value.

- Key Cost Factors: Project scope, location, materials, duration, your experience, and coverage choices.

Example: A $300,000 renovation project might cost between $3,000 and $15,000 to insure for the construction period.

When you build or renovate your own home, you take on significant risks. Standard homeowners insurance will not cover your project during construction, leaving you exposed to losses from fire, theft, weather damage, and other perils.

This is where specialized owner-builder insurance is essential. It’s designed to protect your investment during the construction phase, covering materials, the structure, and other related expenses. Understanding what drives your premium helps you budget accurately and make informed choices to lower costs without sacrificing protection. Factors like building materials, project location, and your construction experience all play a role in your final premium.

I’m Geoff Stanton, a Certified Insurance Counselor at Stanton Insurance Agency. Since 1999, I’ve specialized in helping owner-builders in Massachusetts and New Hampshire steer the complexities of securing the right coverage at competitive rates for their construction projects.

Understanding Owner-Builder Insurance and Why You Need It

Taking on the role of general contractor means you also shoulder the risks of professional construction. Standard homeowners insurance won’t cover your project, creating a significant gap in protection. This is precisely where a specialized Builders Risk Insurance Policy becomes your financial safety net. This property insurance is designed to protect your structure, materials, and financial interests throughout the course of construction in Massachusetts or New Hampshire.

What is Owner-Builder Insurance?

Owner-builder insurance is a form of builders risk insurance (also called “course of construction insurance”) custom for individuals managing their own build. It provides comprehensive property protection for the physical structure as it’s being built, from the foundation to the roof. It also includes materials coverage for supplies on-site, protecting them from fire, theft, or storm damage.

Most policies also include liability protection, which is crucial for shielding your personal assets if a visitor is injured on your job site. It provides peace of mind, letting you focus on the project instead of potential disasters. For more details, see our guide on What is Builders Risk Insurance.

Why Standard Homeowners Insurance Isn’t Enough

Many owner-builders mistakenly assume their homeowners policy will cover them, but damage during construction is explicitly excluded from most standard policies. These policies are designed for occupied homes, not active construction sites, and contain specific policy exclusions that apply once major work begins. You can review a Sample homeowners insurance policy to see these limitations.

The construction phase risks—like exposed wiring, flammable materials, and heavy equipment—are far greater than what a standard policy is designed to handle. Even for additions, renovation limitations may cap coverage at a low amount or suspend it entirely. To properly protect your project, you need to understand How to Insure Builders Risk Policies for Building Additions.

When is Owner-Builder Insurance Required?

While not always mandated by state law in Massachusetts or New Hampshire, you’ll likely find it’s required by other parties:

- Lenders: If you have a construction loan, your bank will almost certainly require a builder’s risk policy to protect their investment. Properties financed with an FHA loan have strict federal mandates for this coverage.

- Municipalities: Many local building departments require proof of liability or property protection before issuing permits, as part of their local building codes.

- Contracts: Industry-standard contracts with subcontractors often include clauses requiring builder’s risk insurance.

Whether required or not, owner-builder insurance is a wise investment. Factoring the owner builder insurance cost into your budget upfront ensures you can proceed without delay when proof of coverage is requested.

Key Factors That Determine Your Owner Builder Insurance Cost

Your owner-builder insurance premium is not a flat rate; it’s calculated based on your project’s specific risk profile. Understanding these factors helps you budget realistically and make informed decisions.

What is the Typical Owner Builder Insurance Cost?

Your owner builder insurance cost will typically be 1% to 5% of your total construction budget. This percentage applies to the project’s “completed value,” which includes all materials and labor but excludes the land value. For example, a $400,000 home build in Massachusetts would likely have an insurance cost between $4,000 and $20,000 for the entire construction period. Generally, you can expect to pay between $1,000 to $5,000 per $100,000 of construction spending.

Where your project falls in that range depends on the factors below. For a deeper dive into pricing, see our guide on How Much Does Builders Risk Insurance Cost or use our Builders Risk Insurance Cost Calculator for a preliminary estimate.

Project Scope: New Build vs. Renovation

New construction projects often have a more straightforward risk profile and may receive more competitive premiums. Renovations, however, introduce unknowns like outdated wiring or hidden structural issues, which can increase the perceived risk and premium. With renovations, insurers must also cover the total completed value, which includes the existing structure plus the new work, making adequate coverage essential. Our New Construction Insurance resources offer further guidance.

Location and Environmental Risks

Your project’s location in Massachusetts or New Hampshire plays a major role. Insurers assess environmental factors like New England weather, including nor’easters and heavy snow load. Coastal properties face added risks from hurricanes. If your property is in a designated flood zone, you will need separate flood coverage, as explained in our guide Does Builders Risk Insurance Cover Flood. Other factors include proximity to fire hydrants and local crime rates, as construction sites can be targets for theft and vandalism.

Construction Materials and Methods

Your choice of materials significantly impacts your owner builder insurance cost. Wood-frame construction, common in New England, is considered more combustible and therefore riskier to insure than frame versus masonry construction. Homes built with fire-resistive materials like steel beams, concrete blocks, or brick typically qualify for lower premiums because they are less vulnerable to fire. Be prepared to provide details on your building methods and materials when requesting a quote.

How Your Experience Impacts Owner Builder Insurance Cost

Your personal background influences how insurers view your project. A first-time owner-builder may face higher premiums due to a lack of experience in managing subcontractors and job site safety. Conversely, previous construction experience or a professional background in project management, engineering, or architecture can reduce perceived risk and lead to lower costs. Your claims history also matters; a clean record suggests you are risk-aware and can help keep your premium reasonable. Be sure to highlight any relevant experience when seeking quotes.

Decoding Your Policy: Coverage, Limits, and Exclusions

Your insurance policy is a detailed contract outlining what is and isn’t protected. Understanding its components is key to ensuring you have the right coverage for your Massachusetts or New Hampshire project without overpaying on your owner builder insurance cost.

What Your Policy Typically Covers

A well-designed owner-builder policy protects your investment from a wide range of perils. Core coverages include:

- The structure itself as it is being built.

- On-site building materials, whether installed or stored.

- Foundations, scaffolding, and temporary structures like job trailers.

- Debris removal costs following a covered event like a fire or storm.

- Soft costs, which are indirect expenses from construction delays, such as extended loan interest or additional architectural fees.

Coverage generally protects against fire, wind, vandalism, and theft. Some policies also cover materials stored off-site or in transit. For a complete list, review our guide on What Does Builders Risk Cover.

Understanding Limits and Deductibles

Two key terms define your financial protection: limits and deductibles.

- Coverage Limit: This is the maximum amount the insurer will pay for a loss. It must reflect the project’s “total completed value” (all costs except land) to avoid being underinsured in a total loss.

- Deductible: This is the amount you pay out-of-pocket before insurance kicks in. Choosing a higher deductible lowers your premium, but you must be able to comfortably afford this amount if you file a claim. It’s a balance between upfront savings and potential future expenses.

Common Endorsements and Optional Coverage

Standard policies can be customized with endorsements to cover specific risks. These will affect your owner builder insurance cost but can provide vital protection.

- Flood and Earthquake Coverage: These perils are typically excluded but can be added, which is critical for many New England locations. Our guide, Does Builders Risk Insurance Cover Flood, explains this further.

- Off-Site Storage and Transit Coverage: Protects materials stored away from the job site or while being transported.

- Change Order Coverage: Covers increased project costs resulting from approved changes after a covered loss.

Explore our insights on Builders Risk Endorsement to learn more about customizing your policy.

Potential Exclusions to Watch For

Knowing what your policy doesn’t cover is equally important. Common exclusions include:

- Employee theft.

- Professional liability for design or engineering errors.

- Tools and equipment (yours or your subcontractors’).

- Landscaping, driveways, and walkways.

- Normal wear and tear.

- Damage from faulty workmanship (though resulting accidental damage may be covered).

For risks beyond a standard policy, you may need other forms of Construction Insurance.

How to Secure and Save on Your Owner-Builder Policy

Getting the right policy at the best price for your Massachusetts or New Hampshire project requires some preparation. Taking proactive steps can streamline the process and potentially lower your premium.

The Process for Getting a Quote

To get an accurate owner builder insurance cost estimate, you’ll need to provide detailed information. Being organized shows insurers you are serious and can lead to better rates. Be prepared with:

- Project plans and budget: Architectural drawings and a detailed cost breakdown.

- Construction timeline: A realistic start and completion date.

- Contractor details: Information on any subcontractors, including their own insurance.

- Site security information: Details on fencing, lighting, or surveillance.

- Your experience level: Any relevant background in construction or project management.

As our guide on Can a Homeowner Get Builders Risk Insurance explains, this coverage is designed specifically for people managing their own projects.

Tips for Saving Money on Premiums

Managing your owner builder insurance cost is crucial. Here are several ways to lower your premium without sacrificing essential coverage:

- Raise your deductible: Agreeing to a higher out-of-pocket cost per claim reduces your premium.

- Bundle policies: Combine your builder’s risk with other policies like general liability for a discount.

- Secure your site: Fencing, lighting, and cameras deter theft and can lower your rate.

- Follow safety protocols: A strong safety plan reduces the risk of accidents and claims.

- Pay your premium in full: Insurers often offer a discount for upfront payment.

- Choose fire-resistant materials: Using materials like steel or concrete can result in lower premiums.

Working With a Specialist Agent

Navigating owner-builder insurance alone can be overwhelming. A specialist independent agent at Stanton Insurance Agency works for you, not a single insurance company. This provides several key advantages:

- Market Access: We shop multiple carriers to find competitive rates.

- Policy Customization: We tailor coverage to the specific risks of your Massachusetts or New Hampshire project.

- Local Expertise: We understand New England’s unique building codes and environmental risks.

- Claims Advocacy: If something goes wrong, we guide you through the claims process.

As an owner-builder, the responsibility for securing this insurance is yours. Our article on Who Pays For Builders Risk Insurance clarifies these roles. We’re here to make the process straightforward and ensure you’re protected from day one.

Frequently Asked Questions about Owner Builder Insurance Cost

How is the cost of owner-builder insurance calculated?

The cost is typically 1% to 5% of your total project budget, excluding land value. This base rate is then adjusted for risk factors like your project’s location in Massachusetts or New Hampshire, construction materials (wood vs. masonry), project scope (new build vs. renovation), and your personal construction experience.

Does the project’s timeline affect the insurance cost?

Yes, significantly. A longer construction timeline increases the period of exposure to risks like theft, vandalism, and weather, which leads to a higher premium. Any extensions to the original timeline may also require a policy extension, adding to the overall cost.

What other insurance should an owner-builder consider?

Beyond a primary Builders Risk Insurance policy, you should consider General Liability insurance to protect against third-party claims of injury or property damage on your site. If you hire any direct employees, Workers’ Compensation insurance is legally required in Massachusetts and New Hampshire. You should also require all subcontractors to provide proof of their own liability and workers’ comp coverage.

Protect Your Project with the Right Coverage

An owner-builder project is a major investment of time and money, and the right insurance is the essential safeguard that protects your dream from becoming a financial nightmare. Understanding the factors that influence owner builder insurance cost—from your project’s location in Massachusetts to the materials you choose—empowers you to find the right balance of protection and affordability.

While the cheapest policy isn’t always the best, smart strategies like improving job site security or choosing a higher deductible can help manage your premium. The key is finding coverage that truly protects your specific project.

Working with a specialist at Stanton Insurance Agency makes the process simple. We use our local expertise in Massachusetts and New Hampshire to customize your coverage and find competitive rates from multiple carriers. If a claim occurs, we’ll be your advocate. Your dream home deserves protection as solid as its foundation.

Don’t leave your investment exposed. Get a quote for your project today, or explore our broader Business Insurance and Commercial Insurance offerings. Let’s work together to ensure your owner-builder journey is a success.