NH Renters Insurance: 7 Powerful Reasons to Protect Yourself 2025

Why NH Renters Insurance Is Your Financial Safety Net

If you’re searching for information about NH renters insurance, here’s what you need to know:

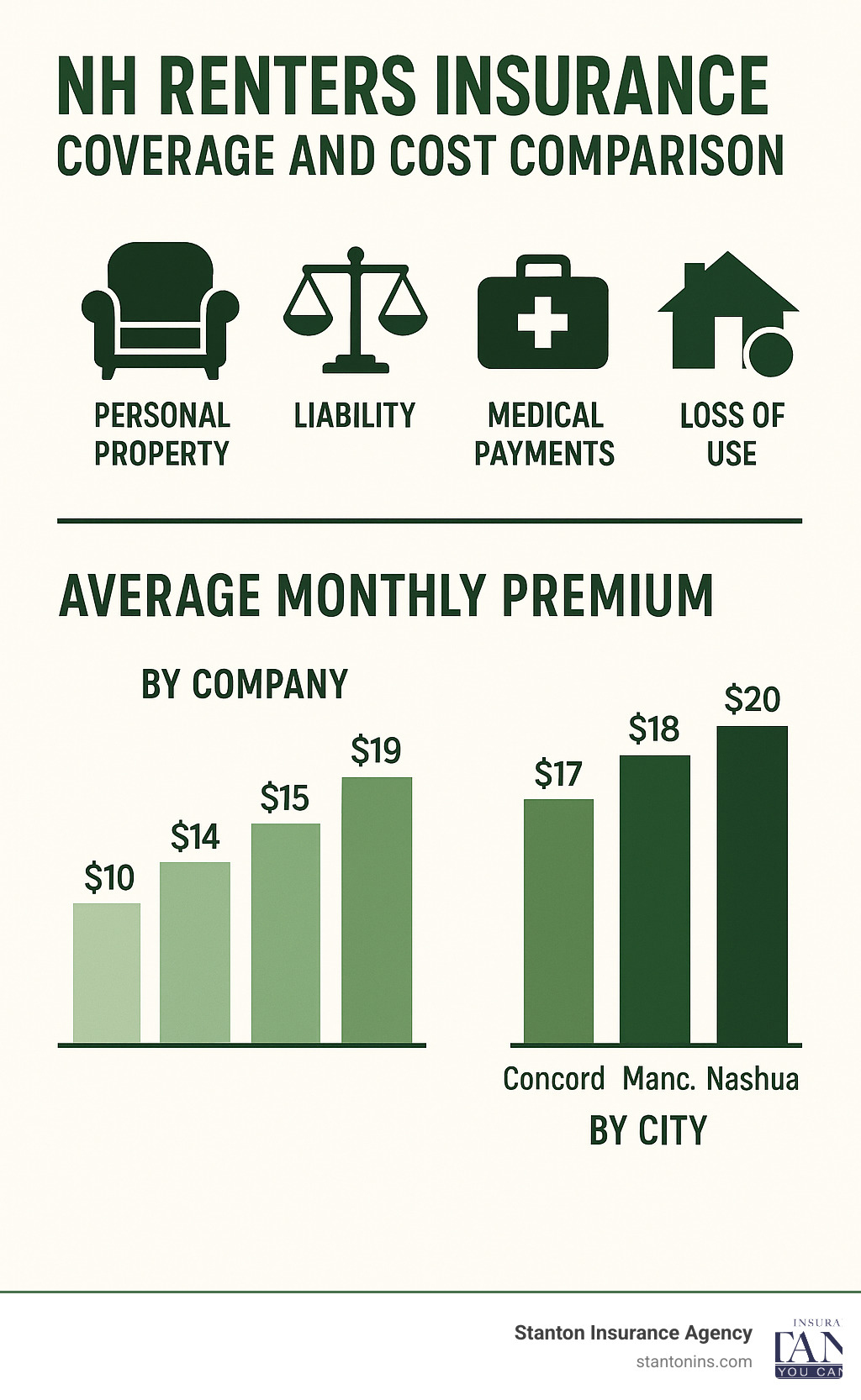

- Average Cost: $17 per month or about $206 per year in New Hampshire

- Cheapest Option: State Farm at approximately $10 per month

- Coverage Includes: Personal property, liability protection, and temporary living expenses

- Not Required: No state law requires it, but many landlords do

- Discounts Available: Bundling with auto insurance can save up to 17%

NH renters insurance provides essential protection for your belongings and financial security that many tenants overlook. While your landlord’s insurance covers the building structure, it doesn’t protect any of your personal possessions or shield you from liability claims. For less than the cost of a streaming service subscription, you can safeguard everything from your furniture and electronics to your clothing and kitchenware against perils like fire, theft, wind damage, and more.

Many renters in the Granite State mistakenly assume their belongings aren’t valuable enough to insure or that coverage would be too expensive. The reality? The average NH renters insurance policy costs about $17 per month – significantly less than what it would cost to replace even a fraction of your possessions after a disaster. Plus, New Hampshire residents enjoy rates approximately $5 below the national average, making the state the seventh-cheapest for renters insurance nationwide.

I’m Geoff Stanton, President of Stanton Insurance and a Certified Insurance Counselor with over two decades of experience helping New Hampshire residents find the right coverage for their needs, including affordable NH renters insurance policies custom to protect against the unique risks Granite Staters face.

Important NH renters insurance terms:

What Is Renters Insurance & Why Granite Staters Need It

Picture this: You come home after a long day to find water pouring through your ceiling from the apartment above. Your furniture is soaked, electronics ruined, and clothes water-damaged. Without NH renters insurance, you’d be facing thousands in replacement costs all on your own.

Renters insurance is your financial safety net when you’re leasing your home rather than owning it. Think of it as three powerful protections rolled into one affordable package:

- Personal Property Coverage: Shields your belongings—from your cozy couch to your morning coffee maker—against perils like fire, theft, vandalism, and certain water damage

- Liability Protection: Has your back if someone slips in your kitchen and sues, or if you accidentally damage someone else’s property

- Loss of Use Coverage: Keeps a roof over your head by covering hotel stays and extra expenses if a disaster makes your rental unlivable

One of the most overlooked benefits of NH renters insurance is that it follows you everywhere. That smartphone stolen during your vacation in Florida? Covered. The bicycle taken from your storage unit? Protected. Your policy safeguards your possessions virtually worldwide, not just within your apartment walls.

NH renters insurance and state laws

While New Hampshire doesn’t legally require you to carry NH renters insurance, don’t be surprised when your landlord does. Across the Granite State, property owners increasingly include insurance requirements in lease agreements—and yes, this practice is completely legal.

Even the New Hampshire Insurance Department recognizes the importance of this protection, regularly issuing consumer advisories about renters insurance. This is especially true for college students heading back to campus housing. If you’re unsure about your landlord’s insurance requirements or have questions about your rights, the NH Insurance Department’s Consumer Services Division is just a call away at (800) 852-3416 or via email at consumerservices@ins.nh.gov.

College students, before shopping for your own policy, check with your parents first. Many homeowners policies extend some coverage to dependents living in dorms, though typically limited to about 10% of the parents’ personal property coverage. This could be enough for a minimalist dorm setup but probably won’t cover everything in an off-campus apartment.

Why your landlord’s policy isn’t enough

“My landlord has insurance, so I’m covered too, right?” Unfortunately, this common misconception leaves many renters financially vulnerable. Your landlord’s policy is like a protective bubble around the building itself—the walls, roof, plumbing, and any appliances they own. Everything inside that bubble that belongs to you? Not protected at all.

When disaster strikes, your landlord’s insurance won’t replace your grandmother’s antique lamp, your collection of books, or the laptop you need for work. It won’t cover your living expenses if you need to stay in a hotel while repairs are made. And if a guest slips on your area rug and breaks their arm, your landlord’s liability coverage won’t help with the resulting lawsuit.

Consider what happened to one of our clients in Manchester last winter: A pipe froze and burst in the apartment above, sending water cascading through her ceiling. While the landlord’s insurance covered repairs to the building, her NH renters insurance replaced her water-damaged furniture, electronics, and clothing—over $12,000 worth of possessions—minus only her $500 deductible. Without coverage, that financial burden would have fallen entirely on her shoulders.

According to FEMA research on disaster losses, the average renter loses over $30,000 in personal property after a significant disaster like a fire. For most Granite Staters, that’s simply too much to risk for the sake of saving $17 a month on insurance.

Coverage Basics & Common Perils in NH

When it comes to protecting your belongings in the Granite State, understanding what NH renters insurance actually covers can save you from costly surprises down the road. New Hampshire’s unique climate and geography create specific risks that renters should be particularly aware of.

Standard protections under an NH renters insurance policy

Your typical NH renters insurance policy works as a safety net against life’s unexpected moments. If a kitchen fire damages your apartment, or someone breaks in and steals your laptop, or a winter storm causes a tree to crash through your window – your policy has you covered.

The backbone of your NH renters insurance includes four essential protections. First, personal property coverage reimburses you when your belongings are damaged or stolen. Second, liability protection steps in if someone gets injured in your apartment or you accidentally damage someone else’s property (like if your bathtub overflows and damages the apartment below). Third, additional living expenses coverage pays for hotel stays and extra food costs if a covered disaster makes your rental uninhabitable. Finally, medical payments coverage handles smaller medical bills for guests injured in your home, regardless of who was at fault.

New Hampshire’s seasonal challenges make certain coverages particularly valuable. During our brutal winters, protection against frozen pipes that burst, snow and ice damage to your belongings, and heating-related fire risks become especially important. Meanwhile, coastal residents particularly benefit from wind damage coverage during nor’easters, while all renters appreciate protection against theft, vandalism, and accidental water damage from things like burst pipes.

What NH renters insurance does NOT cover

Just as important as knowing what’s covered is understanding what’s not. Your NH renters insurance policy has some significant gaps you should be aware of.

Flooding is perhaps the most significant exclusion. If the Merrimack River overflows or coastal storm surge enters your rental, standard policies won’t cover the damage. For this, you’d need separate flood insurance through the National Flood Insurance Program – especially important if you’re renting near water.

Earthquakes, while rare in New Hampshire, aren’t covered either. Neither is damage from unwelcome guests like mice, bed bugs, or other pests. And while your policy covers your stuff, it doesn’t extend to your roommate’s belongings unless they’re specifically listed on your policy.

Many renters are surprised to learn about coverage limits for valuable items. Most policies cap payouts at $1,000-$2,500 for categories like jewelry, art, or collectibles. So that engagement ring or vintage guitar collection might not be fully protected without additional coverage. Equipment you use for business purposes typically has limited coverage as well.

For a deeper dive into what’s covered and what’s not, check out our comprehensive guide on What Does Renters Insurance Cover?

Optional endorsements worth considering

Think of your basic NH renters insurance policy as a good starting point – but for many Granite Staters, a few affordable add-ons can provide much better protection.

Replacement cost coverage is perhaps the most valuable upgrade. Instead of receiving what your five-year-old laptop is worth today (actual cash value), you’ll get enough to buy a new comparable model. While this typically adds 10-15% to your premium, the difference in payout can be substantial.

For those special items that exceed standard limits – like your grandmother’s diamond ring or that expensive camera equipment – scheduled personal property coverage provides itemized protection. This requires an appraisal or receipt, but offers peace of mind for your most treasured possessions.

Water backup coverage is particularly valuable in older New Hampshire properties, where backed-up sewers or drains can cause messy, expensive damage that standard policies won’t cover. And in our increasingly digital world, add-ons like identity theft protection and home cyber protection can be lifesavers, covering costs associated with restoring your identity or recovering from online fraud.

Even earthquake coverage, while seemingly unnecessary in New Hampshire, is surprisingly affordable and provides additional peace of mind for the “what if” scenarios life sometimes throws our way.

Cost, Discounts & How Much Coverage You Need

Good news for Granite State renters! NH renters insurance is surprisingly affordable, with average costs around $17 per month or $206 annually. That’s about $5 less than what folks pay nationwide, making New Hampshire the seventh-most affordable state for protecting your rental home.

When clients visit our office at Stanton Insurance, they’re often shocked to learn how budget-friendly this essential coverage really is. Think about it—for less than the cost of a pizza dinner each month, you can protect everything you own.

Of course, what you’ll actually pay depends on several factors. Location matters quite a bit in our state. If you’re renting in Concord, you might pay around $16 monthly, while coastal Hampton residents typically see rates closer to $24 due to increased storm risks along the seacoast.

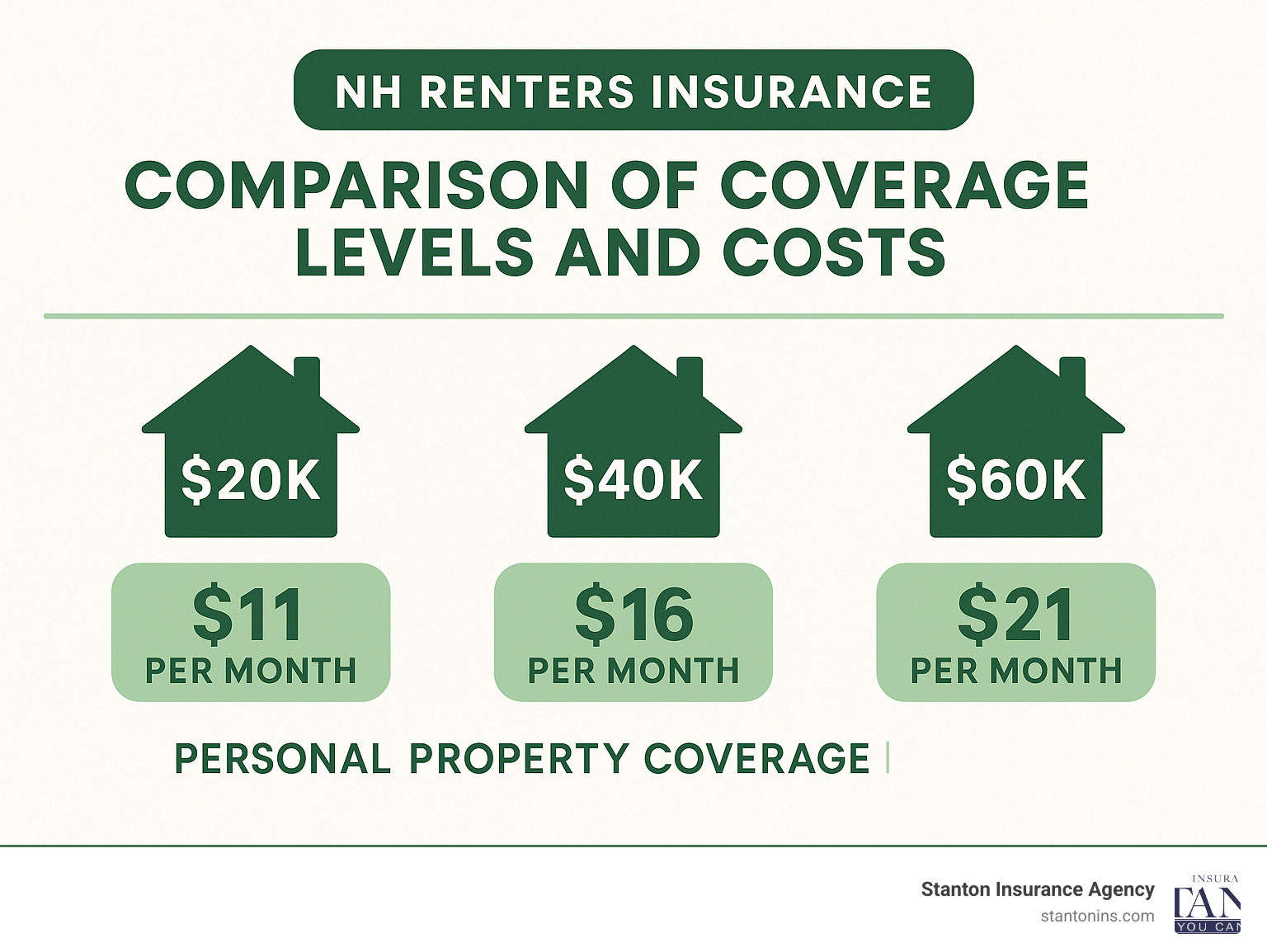

Your coverage amount significantly impacts your premium too. Bumping up from $20,000 to $40,000 in personal property protection typically raises your annual premium from about $118 to $155—a small price increase for double the protection. Meanwhile, some insurance providers currently offer rates as low as $10 monthly, though rates vary between carriers.

Other factors affecting your NH renters insurance cost include your deductible choice, credit history (yes, insurers in New Hampshire can use this), and whether you’ve filed claims previously.

How to calculate your ideal personal property limit

One of the biggest mistakes I see renters make is underestimating how much their stuff is actually worth. Most people are genuinely surprised when they add it all up!

Creating a home inventory is your first step toward proper NH renters insurance coverage. Walk through your rental room by room, listing everything you own. Don’t forget those storage closets, under-bed containers, and even items you keep in your car regularly. For each item, research replacement costs—not what you paid, but what you’d need to spend to buy it new today.

When you total everything up, most renters find their belongings are worth $20,000-$40,000 or more. Even a modest one-bedroom apartment typically contains at least $20,000 in personal property when you account for furniture, clothing, electronics, kitchen items, and other possessions.

Remember to identify any valuables that exceed standard sub-limits, like jewelry or musical instruments, as these may need additional scheduled coverage. And don’t forget to add a small buffer for items you might purchase during your policy period.

For an even deeper dive into costs and coverage options, check out our comprehensive guide on How Much is Renters Insurance?

Deductibles, limits, and their effect on NH renters insurance premiums

Your deductible—the amount you’ll pay out-of-pocket before insurance kicks in—plays a significant role in your premium. With NH renters insurance, deductibles typically range from $250 to $2,500.

Opting for a higher deductible will lower your monthly premium, but means more out-of-pocket expense if disaster strikes. For example, a policy with a $500 deductible might cost around $17 monthly ($204 annually), while raising your deductible to $1,000 could drop that to $15 monthly ($180 annually). Push it to $2,000, and you might pay just $13 monthly ($156 annually).

The right deductible balances affordability now against potential costs later. Ask yourself: How much could I comfortably pay after a loss? Is saving $2-4 per month worth an extra $500-$1,500 out-of-pocket if something happens?

Discounts every Granite State renter should ask for

Here at Stanton Insurance, we love helping clients save money on their NH renters insurance. Always ask about these discounts—they can make an already affordable policy even more budget-friendly:

The multi-policy discount is the big one—bundling your renters and auto insurance with the same company typically saves up to 17%. Some insurers offer bundle discounts up to 22%! Security system discounts are another easy win—smoke detectors, burglar alarms, or sprinkler systems can knock 5-15% off your premium.

If you haven’t filed claims in the past 3-5 years, be sure to mention it, as most insurers offer a claims-free discount. Going paperless with electronic billing and documents usually saves a few dollars, while setting up automatic payments can trim another 2-5% off your premium.

Other money-savers include the pay-in-full discount (save 5-10% by paying annually instead of monthly), the advanced quote discount (shop 7+ days before your current policy expires), and discounts for living in a secured community or building. Loyalty discounts reward customers who stay with the same insurer for multiple years, while maintaining good credit can significantly lower your rates in New Hampshire.

Every dollar saved on insurance is a dollar you can spend enjoying everything the beautiful Granite State has to offer!

Buying & Managing NH Renters Insurance

Shopping for NH renters insurance doesn’t have to be complicated. With a little knowledge and the right approach, you can find excellent coverage that fits your budget and protects everything you value.

Comparing NH renters insurance quotes like a pro

When I help New Hampshire renters find the right policy, I always recommend getting quotes from at least 3-4 different insurance companies. Several quality insurance providers consistently offer competitive rates for Granite State residents, making them good starting points for your search.

But here’s the secret to making meaningful comparisons: make sure you’re looking at the same coverage levels across all quotes. It’s like comparing apples to oranges if one quote includes replacement cost coverage while another offers actual cash value. When requesting quotes, specify the same personal property limit, liability amount (I recommend at least $300,000), and deductible for each company.

The cheapest policy isn’t always the best value. Look beyond the premium to factors that matter when you actually need your insurance. The NAIC Complaint Index is particularly revealing—companies scoring below 1.00 receive fewer complaints than average. J.D. Power ratings can also help you gauge overall customer satisfaction.

Don’t forget to ask about the claims process. Is there a local claims adjuster who understands New Hampshire’s unique challenges? Can you file claims online? These conveniences matter when you’re dealing with a stressful situation like theft or damage to your home.

For more comprehensive information about policy options, check out our detailed guide on Renters Insurance.

Roommates, students, and special situations

Sharing your rental with roommates? You have options, but they each come with trade-offs. While you can save money by splitting the cost of a single NH renters insurance policy, I usually recommend separate policies for non-related roommates. Here’s why: when you share a policy, you also share the claims history. One roommate’s stolen laptop affects everyone’s insurance record. Plus, if someone moves out, you’ll need to rewrite the policy, which can be a hassle.

College students have unique considerations. If you’re living in a dorm at UNH, Dartmouth, or another New Hampshire college, you might already have some protection under your parents’ homeowners policy—typically up to 10% of their personal property coverage. But once you move to off-campus housing, you’ll likely need your own policy. Student-friendly options are available in college towns like Durham, Hanover, and Keene, often at very affordable rates.

Some situations require special attention. If you run a business from your rental, standard NH renters insurance probably won’t fully cover your business equipment or liability. Short-term rentals might need different coverage altogether. And if you’re renting a luxury apartment with high-end furnishings or collectibles, you’ll want to ensure your coverage limits reflect the true value of your possessions.

How to file and win a claim in New Hampshire

Despite our best efforts, sometimes things go wrong. When they do, knowing how to steer the claims process can make all the difference. If you need to file a claim on your NH renters insurance policy, start by documenting everything. Take photos and videos of damaged items before moving anything—this visual evidence is invaluable.

Contact your insurance company promptly—most have 24/7 claims reporting by phone or online. Be prepared to complete a proof of loss form detailing all damaged or stolen items, their approximate age, and estimated replacement cost. Having a home inventory already prepared can make this step much easier.

Your insurance company will assign an adjuster to assess the damage and determine the payout amount. If you’re displaced from your rental, keep all receipts for temporary housing, meals, and other expenses that exceed your normal costs—these may be reimbursable under your policy’s loss of use coverage.

If you disagree with the adjuster’s assessment, don’t be afraid to speak up. Provide additional documentation to support your claim and be persistent but professional. The New Hampshire Insurance Department’s Consumer Services Division can be a valuable resource if you encounter difficulties—they’re there to help with questions and assist with claim disputes.

The best claim is one you never have to file. Taking preventive measures like installing smoke detectors and security systems not only keeps you safer but often qualifies you for discounts on your NH renters insurance premium.

Frequently Asked Questions about NH Renters Insurance

Is NH renters insurance required by law?

No, NH renters insurance isn’t mandated by state law, but don’t be surprised if your landlord requires it anyway. This practice has become increasingly common throughout the Granite State, and yes—it’s completely legal for landlords to include this requirement in your lease agreement.

If your lease does require insurance coverage, make sure you maintain it continuously to avoid potential lease violations. Your landlord might specify minimum coverage amounts they expect you to carry, particularly for the liability portion which protects them as much as it protects you. When in doubt, check your lease or ask your property manager directly about their specific requirements.

How much does NH renters insurance cost on average?

The good news? NH renters insurance is remarkably affordable, averaging about $17 per month or $206 annually—roughly $5 less per month than what renters pay nationwide.

That said, what you’ll actually pay can vary quite a bit depending on several factors. Some insurance providers offer rates as low as $10 monthly for qualified applicants. Location matters too—if you’re enjoying coastal living in Hampton, expect to pay around $24 monthly, while Concord residents typically pay around $16.

Coverage amounts make a difference as well. Bumping up from basic $20,000 coverage to a more comprehensive $40,000 policy typically raises your annual premium from $118 to $155—a small price for double the protection. With discounts factored in, many Granite Staters end up paying less than $150 annually for solid coverage, making it one of the most affordable insurance products available.

What’s the difference between actual cash value and replacement cost?

This distinction might seem like insurance jargon, but it makes a world of difference when you’re filing a claim for your NH renters insurance:

Actual Cash Value (ACV) coverage pays what your belongings are worth today, not what you paid for them. That five-year-old laptop you bought for $1,000? It might only be valued at $200-$300 after depreciation is factored in. ACV is standard in most basic policies and results in lower premiums—but also significantly lower claim payments when you need them most.

Replacement Cost Coverage, on the other hand, pays what it actually costs to replace your belongings with new items of similar kind and quality. That same five-year-old laptop would be replaced with a brand-new comparable model. While this coverage typically costs 10-15% more (often just $20-30 extra per year), the improved protection can save you thousands if disaster strikes.

We strongly recommend replacement cost coverage for most renters. When you consider that the difference often amounts to less than the cost of a pizza dinner annually, the improved protection is well worth it—especially for electronics, furniture, and other items that depreciate quickly but remain expensive to replace.

Conclusion

When it comes to protecting your personal belongings and financial security, NH renters insurance is truly one of the smartest investments you can make. I’ve seen how this simple coverage has saved countless New Hampshire renters from financial devastation after unexpected events – from kitchen fires and burst pipes to theft and liability claims.

For about the price of a pizza each month (just $17 on average across New Hampshire), you gain comprehensive protection that extends far beyond what most renters realize. Your coverage doesn’t just protect your laptop and furniture in your apartment – it follows your belongings virtually anywhere in the world. That mountain bike stolen during your vacation? Your renters policy likely covers it. The coffee you accidentally spilled on your friend’s expensive laptop? Your liability coverage has your back.

What I find most concerning is that many Granite State renters still believe their belongings “aren’t worth insuring” – until they face the daunting prospect of replacing everything they own after a disaster. Even a modest apartment typically contains $20,000-$40,000 in personal possessions when you add it all up. Imagine having to replace all your clothing, furniture, kitchenware, and electronics at once, out of pocket!

As a local agency with deep New Hampshire roots, we at Stanton Insurance Agency understand the unique challenges renters face here – from coastal flooding concerns to frozen pipe risks during our harsh winters. We’re not just selling policies; we’re your neighbors helping you steer the specific protection needs of living in the Granite State.

Don’t wait for a disaster to find the true value of renters insurance. Your future self will thank you for taking this simple step to protect what you’ve worked so hard to acquire. Reach out today to learn more about our personal insurance services and let us help you find NH renters insurance coverage perfectly custom to your unique situation and budget.

After all, peace of mind shouldn’t be a luxury – it should be as essential as the roof over your head.