nh auto insurance requirements: 1 Essential Guide

Why NH Auto Insurance Requirements Are Different From Every Other State

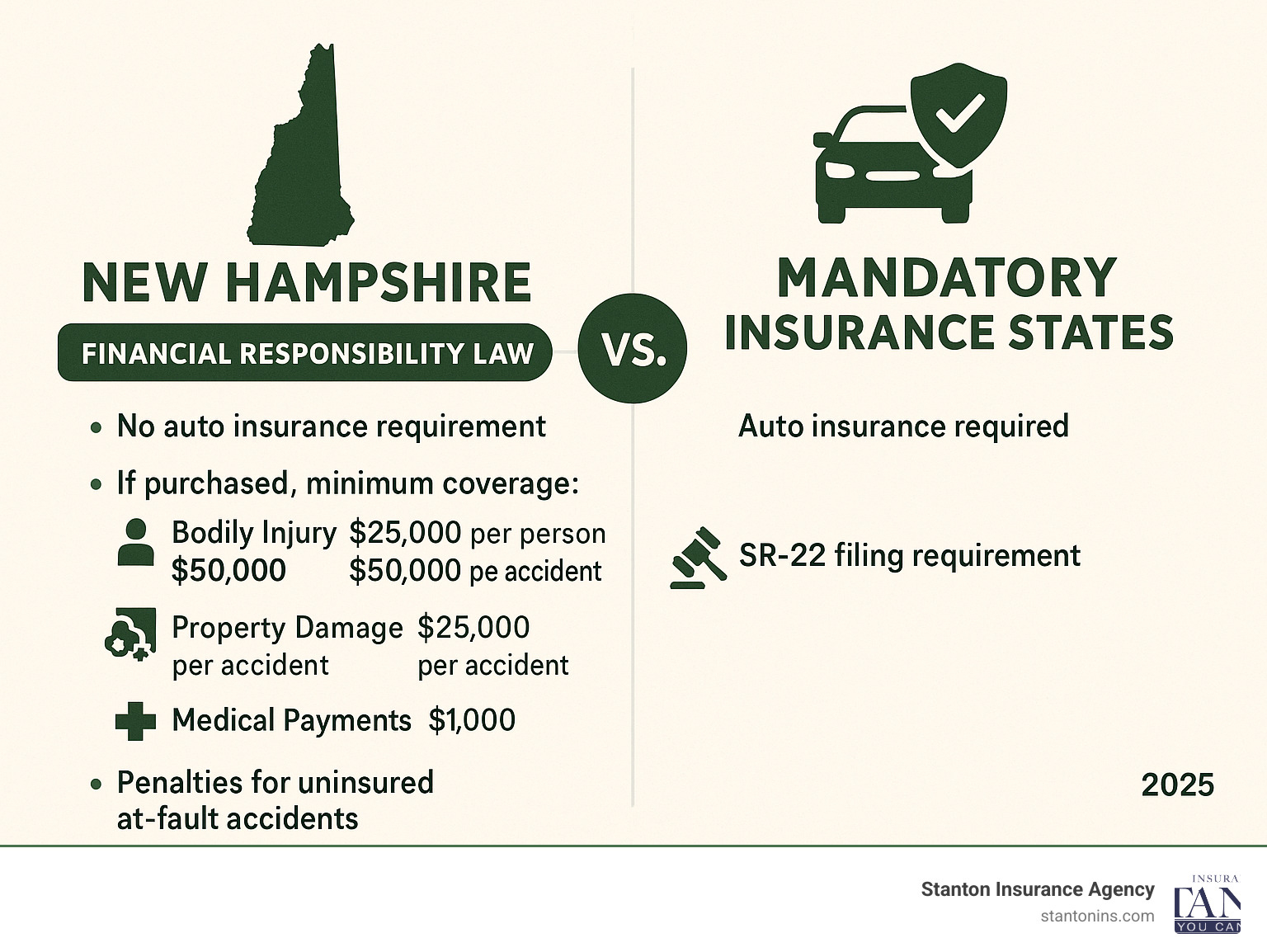

NH auto insurance requirements stand apart from the rest of the United States in a unique way. While 49 states mandate that drivers carry auto insurance, New Hampshire operates under a “financial responsibility law” instead. This means you’re not required to buy insurance – but you must prove you can pay for damages if you cause an accident.

Quick Answer: NH Auto Insurance Requirements

- No mandatory insurance requirement for most drivers

- If you buy insurance, minimum limits are:

- Bodily Injury: $25,000 per person / $50,000 per accident

- Property Damage: $25,000 per accident

- Medical Payments: $1,000 per person

- Uninsured Motorist: $25,000 per person / $50,000 per accident

- Insurance becomes mandatory if convicted of DWI, at-fault accidents while uninsured, or other serious violations (SR-22 required)

This “Live Free or Die” approach means roughly 7.8% of New Hampshire drivers choose to go without coverage – a risky decision that can lead to devastating financial consequences. If you cause an accident without insurance, you’re personally liable for all damages, medical bills, and legal costs.

The state’s at-fault system means the responsible party pays for injuries and property damage. Unlike no-fault states, you can sue for pain and suffering, but you’re also fully exposed to lawsuits if you’re at fault.

I’m Geoff Stanton, President of Stanton Insurance Agency, and I’ve helped countless New Hampshire families steer these nh auto insurance requirements for over two decades. My experience has shown me that while insurance isn’t always legally required in the Granite State, it’s absolutely essential for protecting your financial future.

New Hampshire’s Unique Stance: The Financial Responsibility Law

New Hampshire is the only state that doesn’t mandate auto insurance for all drivers. True to the “Live Free or Die” motto, the state gives you a choice. However, this freedom comes with a major catch: you are still financially responsible for any damage you cause.

This approach is based on New Hampshire’s Motor Vehicle Financial Responsibility Law (Chapter 264). The law requires owners of registered vehicles to prove they can pay for personal injuries or property damage from an accident. While you could deposit a large sum with the state treasurer, auto insurance is the most practical way to meet these nh auto insurance requirements.

As an at-fault state, New Hampshire holds the driver who caused the accident responsible for all damages. This makes proving financial responsibility critical, as you could be liable for medical bills, vehicle repairs, and more. Most drivers find that insurance provides essential peace of mind, a topic we cover in our guide on Why Auto Insurance is Important: Protecting Yourself and Others on the Road.

What Happens If You Don’t Have Insurance?

Driving uninsured is a massive financial gamble. If you cause an accident, you are personally liable for all resulting costs, which can include:

- Six-figure medical bills for serious injuries

- Lost wages for the injured party

- Vehicle repair or replacement costs

- Your own legal defense fees and any court-awarded damages

If you cannot pay, New Hampshire will suspend your driver’s license and vehicle registration until you settle the debt. To restore your driving privileges, you must also file proof of future financial responsibility (an SR-22 certificate) and maintain it for at least three years. A choice to save on premiums can quickly become a long-term financial disaster.

Is New Hampshire a No-Fault State?

No, New Hampshire is an at-fault state, also known as a “tort” system. This is a critical distinction.

- In an at-fault system (NH): The driver who causes the accident pays for all damages, including medical bills, property damage, and pain and suffering. Injured parties can sue the at-fault driver for full compensation.

- In a no-fault system: Drivers file claims with their own insurance for their injuries, regardless of fault, through Personal Injury Protection (PIP) coverage. Lawsuits are restricted.

Because New Hampshire is an at-fault state, PIP coverage is not available. The system emphasizes the responsible party’s ability to pay, making adequate liability coverage essential to protect yourself from lawsuits. For more details, see our article Do You Need Car Insurance in NH?.

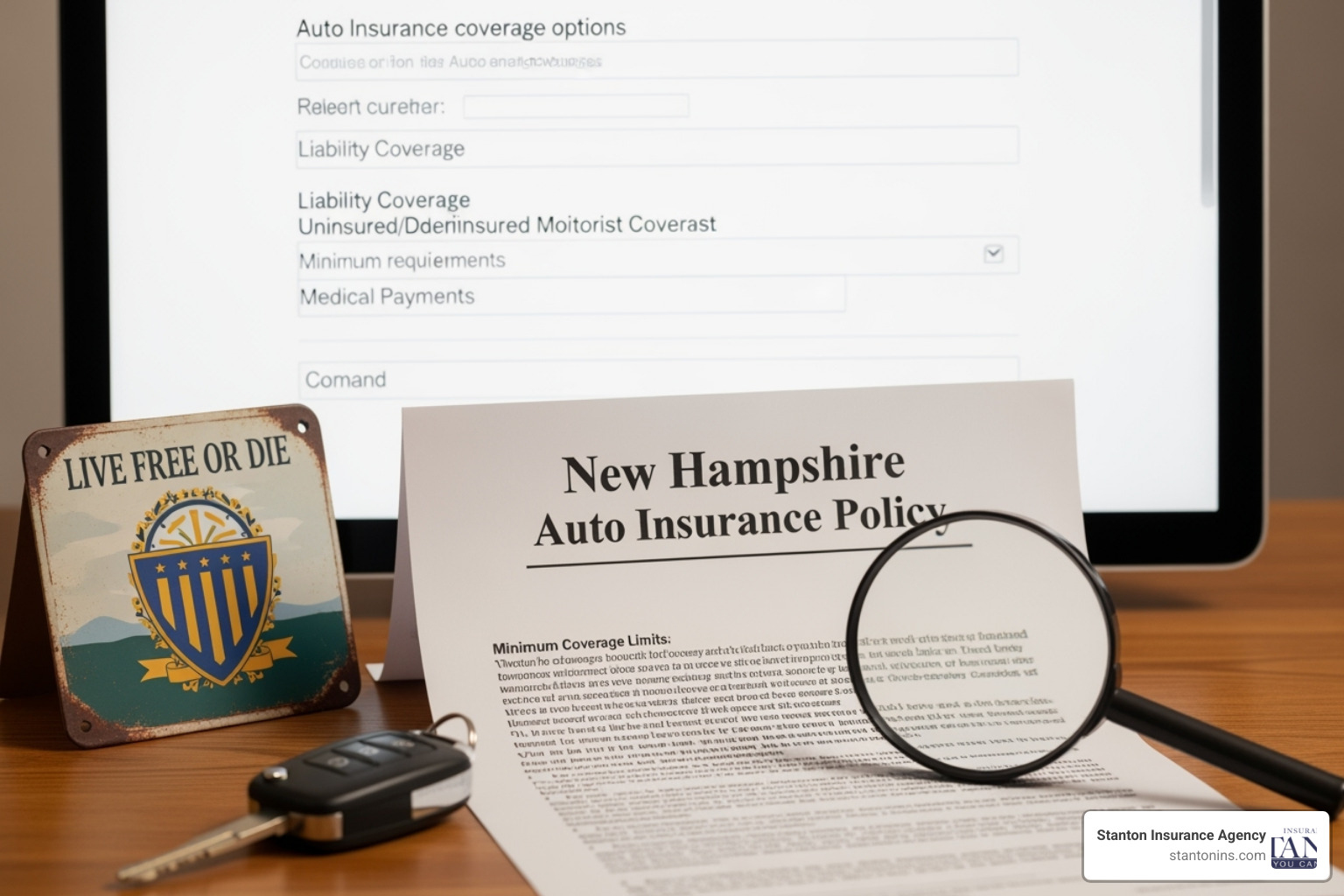

Understanding the Minimum NH Auto Insurance Requirements

While New Hampshire doesn’t mandate auto insurance, if you do purchase a policy, it must meet specific minimum coverage levels. These legal minimums are designed to satisfy the state’s Financial Responsibility Law and ensure you have a basic level of protection.

These minimums represent the state’s balance between personal freedom and public safety. For comprehensive details on what your policy should include, visit our NH Auto Insurance page.

Minimum Coverage Limits If You Buy a Policy

Any auto insurance policy in New Hampshire must meet these minimums:

- Bodily Injury Liability (BI): $25,000 per person / $50,000 per accident. This protects others when you’re at fault.

- Property Damage Liability (PD): $25,000 per accident. This covers damage to other people’s property, like their car or a fence.

- Medical Payments (MedPay): $1,000 per person. This covers medical bills for you and your passengers, regardless of fault.

- Uninsured/Underinsured Motorist (UM/UIM): $25,000 per person / $50,000 per accident. This protects you if you’re hit by a driver with little or no insurance.

Here’s how these minimums compare to what we often recommend for better protection:

| Coverage Type | NH Minimum Limits | Recommended Higher Option |

|---|---|---|

| Bodily Injury Liability (BI) | $25,000 / $50,000 | $100,000 / $300,000 |

| Property Damage Liability (PD) | $25,000 | $50,000 or $100,000 |

| Medical Payments (MedPay) | $1,000 | $5,000 or $10,000 |

| Uninsured/Underinsured Motorist | $25,000 / $50,000 | $100,000 / $300,000 |

These minimum nh auto insurance requirements often fall short of covering costs in a serious accident. As noted in Your Guide to Understanding Auto Insurance in the Granite State, higher limits are a wise choice for financial security.

What These Required Coverages Actually Protect

Understanding your policy is key. Here’s a quick breakdown:

-

Bodily Injury Liability: This is your financial shield if you injure someone. It covers their medical bills, lost wages, pain and suffering, and your legal defense fees if you’re sued. It typically extends to family members and others who drive your car with permission.

-

Property Damage Liability: This pays to repair or replace property you damage in an at-fault accident, including other vehicles, buildings, or fences.

-

Medical Payments (MedPay): This provides immediate coverage for medical bills for you and your passengers, no matter who is at fault. In NH, this coverage can be used for up to three years after the injury.

-

Uninsured/Underinsured Motorist (UM/UIM): This is crucial protection, as nearly 8% of NH drivers are uninsured. It covers your medical costs, lost income, and pain and suffering if you’re hit by an uninsured driver or in a hit-and-run.

These four coverages form the foundation of your policy. Learn more about them in our guide on New Hampshire Auto Insurance Requirements.

When Insurance Becomes Mandatory: The SR-22 Requirement

While most New Hampshire drivers can choose whether to carry insurance, certain violations remove that choice. If you are deemed a high-risk driver, the state makes insurance mandatory through an SR-22 requirement.

An SR-22 is not insurance itself; it’s a certificate your insurer files with the NH Division of Motor Vehicles to prove you have coverage. This filing is required to restore suspended driving privileges. You cannot legally drive or register a vehicle without it. For official details, see the NH DMV’s guide on Insurance Requirements / SR-22.

Offenses That Trigger an SR-22 Filing

An SR-22 is typically required for serious offenses that demonstrate irresponsible or dangerous driving. Common triggers include:

- Driving While Intoxicated (DWI)

- At-fault accidents while uninsured

- Leaving the scene of an accident (hit-and-run)

- A subsequent reckless operation conviction

- Certain repeat moving violations that show a pattern of unsafe driving

These violations signal to the state that you must be monitored to ensure you meet your financial responsibility obligations.

Understanding Your SR-22 Obligations

An SR-22 mandate comes with strict rules. Filings can be for an Owner SR-22 (to own and operate a vehicle) or an Operator SR-22 (to drive someone else’s car).

The filing period is typically three years, and it can be extended if you have additional violations. The most critical rule is maintaining continuous insurance coverage. If your policy lapses for even one day, your insurer must notify the DMV, leading to an automatic license and registration suspension, plus new fines and reinstatement fees.

There is no grace period. A lapse means starting the process over with more severe penalties. Navigating nh auto insurance requirements with an SR-22 is complex, which is why working with an experienced agency is vital. We can help you find the right policy and ensure it stays active. Explore your options on our Car Insurance Quotes NH page.

Beyond the Minimums: Optional Coverage and Saving Money

While meeting New Hampshire’s minimum nh auto insurance requirements is a start, basic coverage can leave you financially vulnerable. Rising medical and vehicle repair costs mean that state minimums are often not enough. Optional coverages provide the robust protection you need in the real world.

At Stanton Insurance Agency, we help you find the Best Car Insurance in NH that matches your needs and budget, protecting you from unexpected financial hardship.

Recommended Optional Coverages for NH Drivers

- Collision Coverage: Pays to repair or replace your car after a collision with another vehicle or object. It’s essential for financed or leased vehicles and valuable for paid-off cars.

- Comprehensive Coverage: Covers damage from non-collision events like theft, vandalism, hail, or hitting an animal. This is your protection against the unexpected.

- Higher Liability Limits: The state minimums can be exhausted quickly in a serious accident. Increasing your limits to $100,000/$300,000 for bodily injury and $100,000 for property damage offers far better protection.

- Gap Insurance: If your car is totaled, this covers the difference between the insurance payout and what you still owe on your loan.

- Rental Reimbursement: Keeps you on the road by covering the cost of a rental car while yours is being repaired after a covered claim.

- Towing and Labor: Covers roadside assistance costs, like a tow or a jump-start, which is especially useful in NH’s rural areas and harsh winters.

- Personal Umbrella Policy: For those with significant assets, this policy provides an extra layer of liability protection, often in the millions, against major lawsuits.

How to Get the Best Rates in New Hampshire

Saving money on insurance doesn’t mean sacrificing protection. Here are smart ways to lower your premiums:

- Bundle Your Policies: Combining your auto and home insurance with one company often yields significant discounts.

- Ask About Discounts: You may qualify for savings as a safe driver, a good student, or for having anti-theft devices. Low-mileage discounts are also common.

- Pay in Full: Paying your annual premium upfront can save you money on the total cost and eliminate monthly installment fees.

- Adjust Your Deductibles: Choosing a higher deductible for collision and comprehensive coverage (e.g., $1,000 instead of $500) will lower your premium. Just be sure you can afford the out-of-pocket cost.

- Shop Smart: When comparing quotes, ensure you’re looking at identical coverage levels and deductibles to make a fair comparison.

- Review Your Policy Annually: Life changes like paying off a car loan or moving can impact your rates. An annual review with your agent ensures your coverage and discounts are up to date.

Working with an experienced agent can help you balance protection and price. For more on what influences your rates, visit our Auto Insurance Costs page.

Frequently Asked Questions about NH Auto Insurance Requirements

These are the questions I hear most often from New Hampshire drivers trying to understand our unique insurance landscape. Let me walk you through the answers that matter most to your wallet and your peace of mind.

What are the penalties for driving without insurance in New Hampshire if I’m in an at-fault accident?

This is where New Hampshire’s “Live Free or Die” philosophy can become “Live Free or Pay Dearly.” If you cause an accident without insurance, you become personally liable for every penny of damage you cause. We’re talking about potentially hundreds of thousands of dollars in medical bills, lost wages, vehicle repairs, and legal fees coming straight out of your pocket.

But the financial pain doesn’t stop there. The state will immediately suspend both your driver’s license and vehicle registration until you can prove you’ve paid for all the damages. And here’s the kicker – even after you’ve paid everything, you’ll still need to file proof of future financial responsibility, typically through an SR-22 certificate, for a minimum of three years.

Think of it this way: that “free” choice to skip insurance can end up costing you far more than any premium ever would. I’ve seen families lose their homes and retirement savings because they thought they were saving money by going uninsured.

What is the statute of limitations for a car accident lawsuit in New Hampshire?

In New Hampshire, you have exactly three years from the date of the accident to file a lawsuit for personal injury or property damage, as outlined in N.H. Rev. Stat. § 508:4.I. This might seem like a long time, but it can fly by faster than you’d expect.

Here’s what’s important to understand: if someone is injured in an accident you caused, they have three full years to decide whether to sue you. That’s three years of potential financial uncertainty hanging over your head. Medical complications can develop over time, and what initially seemed like a minor injury might turn into something much more serious – and expensive.

This is another compelling reason why carrying adequate liability coverage is so crucial, even when it’s not legally required. Your insurance company will handle the legal defense and any settlements within your policy limits, protecting you from that three-year window of vulnerability.

How much does car insurance cost in New Hampshire?

The honest answer? It depends on a lot of factors, but I can give you some helpful benchmarks. Recent statistics show that a state-minimum liability policy in New Hampshire averages around $435 per year, while full coverage typically runs about $1,265 annually.

However, your actual cost could be significantly higher or lower based on several key factors: your driving record (the biggest factor), your age and experience, where you live in New Hampshire, what kind of vehicle you drive, and even your credit score. A 22-year-old with a sports car and a speeding ticket will pay dramatically more than a 45-year-old with a clean record driving a minivan.

The beauty of our nh auto insurance requirements system is that you have choices. You can opt for just the minimum coverage to satisfy the Financial Responsibility Law, or you can invest in more comprehensive protection. My advice? Don’t shop on price alone. The cheapest policy might leave you financially exposed when you need coverage most.

The best way to know your exact cost is to get personalized New Hampshire Car Insurance Quotes that reflect your specific situation. Every driver’s circumstances are unique, and your premium should reflect that reality.

Conclusion

New Hampshire’s nh auto insurance requirements might seem straightforward on the surface, but as we’ve explored together, there’s quite a bit more beneath the hood. The Granite State’s unique approach – letting you choose whether to carry insurance while holding you fully accountable for any damages you cause – reflects our independent spirit. But with that freedom comes serious responsibility.

Here’s the bottom line: while you can drive without insurance in New Hampshire, the financial risks are enormous. A single accident could wipe out your savings, damage your credit, and leave you facing lawsuits that follow you for years. The state minimums of $25,000/$50,000 for bodily injury and $25,000 for property damage provide basic protection, but in today’s world of rising medical costs and expensive vehicles, even these amounts can disappear quickly.

The smart move? Carry more than the minimums. Consider higher liability limits, add collision and comprehensive coverage if you have a newer vehicle, and don’t forget about uninsured motorist protection – especially important when nearly 8% of our neighbors are driving without coverage.

If you’ve been required to file an SR-22, maintaining continuous coverage isn’t just recommended – it’s mandatory. Let your policy lapse, and you’ll find yourself right back at square one with suspended licenses and hefty reinstatement fees.

At Stanton Insurance Agency, we’ve spent over two decades helping New Hampshire families steer these waters. We understand that every driver’s situation is different – whether you’re a new driver trying to save money, a family looking for comprehensive protection, or someone working through SR-22 requirements.

The good news is that with the right approach, you can find excellent coverage at competitive rates. Bundle your policies, maintain a clean driving record, and review your coverage annually. Most importantly, work with an agent who understands New Hampshire’s unique insurance landscape and can guide you toward the coverage that makes sense for your specific situation.

Your peace of mind is worth the investment. Don’t gamble with your financial future – let us help you find the right protection. Contact us today to explore your options for Auto Insurance in New Hampshire.