New Hampshire Car Insurance: Ultimate Guide 2025

Why New Hampshire Car Insurance Is Different from Every Other State

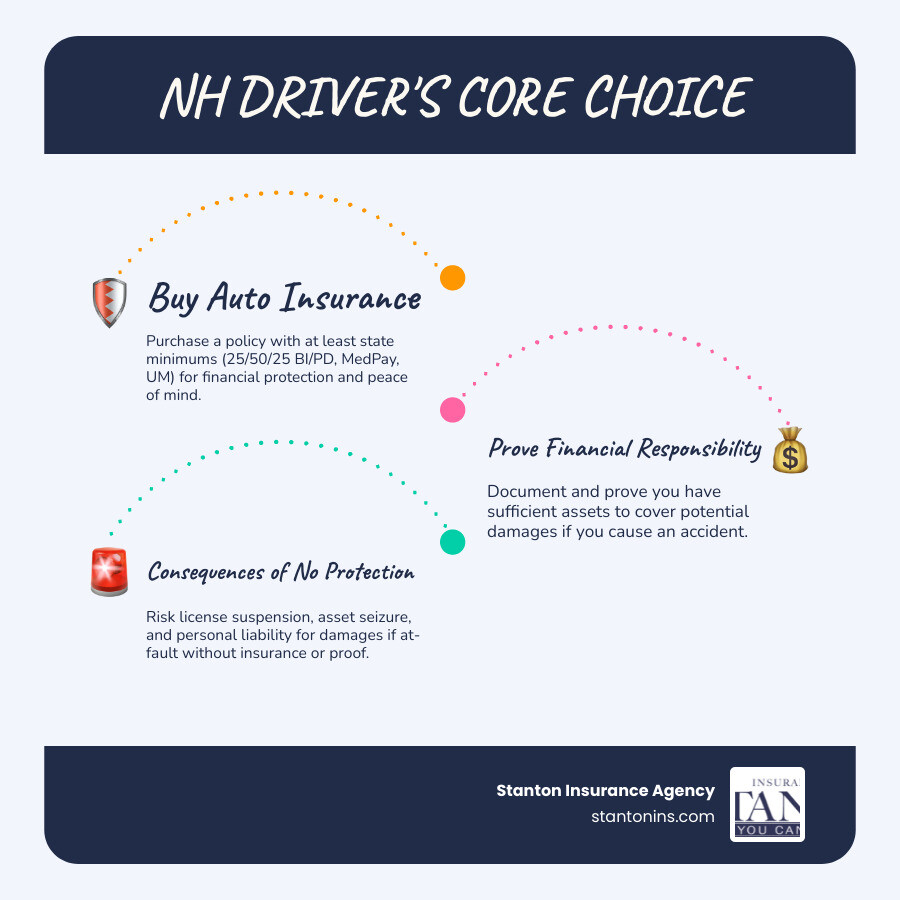

New Hampshire car insurance operates under unique rules that set it apart from nearly every other state. It’s one of only two states that doesn’t legally require drivers to carry auto insurance—but that doesn’t mean you can drive without financial consequences.

Here’s what you need to know about New Hampshire car insurance:

- No mandatory insurance law: You are not required to buy car insurance to register or drive a vehicle.

- Financial responsibility is mandatory: You must prove you can pay for damages if you cause an accident.

- Minimum coverage (if you buy a policy): 25/50/25 liability, $1,000 medical payments, and matching uninsured motorist coverage.

- At-fault state: The driver who causes an accident is responsible for paying all damages.

- License suspension risk: If you cause an accident and can’t pay, you will lose your license and face serious penalties.

- Average cost: NH drivers pay around $999 annually, about 35% lower than the national average.

This “Live Free or Die” approach puts your personal assets and driving privileges at serious risk if you’re in an accident. Most New Hampshire residents choose to carry insurance because the financial protection far outweighs the cost.

I’m Geoff Stanton, President at Stanton Insurance. For over two decades, I’ve helped New England families—including many in New Hampshire—steer these unique requirements. This guide will walk you through everything you need to know about auto insurance in the Granite State.

New Hampshire’s Unique “Live Free or Die” Insurance Laws

New Hampshire lives up to its “Live Free or Die” motto with its auto insurance laws. The Granite State is one of only two states where you can legally register and drive a car without an insurance policy.

However, this freedom comes with a major catch: financial responsibility. New Hampshire is an at-fault state, meaning the driver who causes an accident is legally responsible for all resulting damages. If you cause a crash, you are personally liable for medical bills, lost wages, and property repairs—costs that can easily reach tens or hundreds of thousands of dollars.

If you can’t pay, the consequences are severe. The New Hampshire Department of Motor Vehicles will suspend your driver’s license and vehicle registration. To get them back, you’ll have to prove you can meet the state’s financial responsibility requirements, which often means buying insurance and filing an SR-22 certificate. This can lead to significantly higher premiums for years.

That’s why most New Hampshire residents choose to carry New Hampshire car insurance. The protection and peace of mind are worth far more than the premiums. For more details, visit our page: Are You Required to Have Auto Insurance in New Hampshire?

Is Car Insurance Mandatory in New Hampshire?

No, car insurance is not mandatory in New Hampshire. You can legally drive without a policy. However, you must be able to prove you can cover all damages if you cause an accident. This means having enough cash, a bond, or other assets to pay for injuries and property damage out-of-pocket.

If you’re in an at-fault accident and can’t pay, your license and registration will be suspended immediately. Reinstatement requires purchasing insurance and filing an SR-22, often at much higher rates. For most drivers, the risk of financial ruin from a single accident makes carrying insurance the only logical choice.

What Are the Financial Responsibility Requirements?

If you opt out of insurance, you must be prepared to prove you can cover the same minimums required by an insurance policy:

- Bodily Injury Liability: $25,000 per person and $50,000 per accident.

- Property Damage Liability: $25,000 per accident.

- Medical Payments: $1,000 per person.

- Uninsured Motorist: $25,000 per person and $50,000 per accident.

After an accident, the DMV will investigate your ability to meet these obligations. If you can’t provide proof through bank statements or other documentation, your license is suspended. Essentially, driving uninsured means you are self-insuring against a catastrophic financial loss—a gamble most people aren’t willing to take.

Understanding Your New Hampshire Car Insurance Coverage

While New Hampshire doesn’t mandate auto insurance, most drivers carry it as the simplest way to meet financial responsibility laws and protect their assets. When you buy a policy, it’s crucial to understand the different coverages and what they protect.

A New Hampshire car insurance policy is a bundle of different coverages. Some protect others if you’re at fault, while others protect you, your passengers, and your vehicle. Beyond the basics, optional coverages can provide a much broader safety net.

For a comprehensive overview, explore our NH Auto Insurance Complete Guide.

Minimum Required Coverages (If You Buy a Policy)

If you purchase New Hampshire car insurance, your policy must include four specific coverages to provide meaningful protection.

- Bodily Injury Liability (25/50): Pays for injuries to others if you cause an accident. The minimum limits are $25,000 per person and $50,000 per accident.

- Property Damage Liability (25): Covers repairs to other people’s property, like their car or a fence. The minimum limit is $25,000 per accident. Together, these are often written as 25/50/25.

- Medical Payments (MedPay): Pays for medical expenses for you and your passengers, regardless of fault. New Hampshire requires at least $1,000 in coverage.

- Uninsured/Underinsured Motorist (UM/UIM): This is critical in New Hampshire. It pays for your injuries if you’re hit by a driver with no insurance or not enough insurance. State law requires your UM/UIM limits to match your Bodily Injury limits.

These minimums are a legal floor, not a recommended ceiling. A serious accident can easily exceed these limits, leaving you personally responsible for the rest. For more details, see the Official NHID Auto Insurance Guide.

Optional Coverages for Greater Protection

For truly comprehensive protection, we recommend considering optional coverages that protect your own vehicle and finances.

- Collision: Pays for damage to your car from a collision with another object or vehicle, regardless of fault. Lenders typically require this for financed or leased cars.

- Comprehensive: Covers damage from non-collision events like theft, vandalism, fire, hail, or hitting a deer. This is also usually required for car loans or leases.

- Rental Reimbursement: Helps pay for a rental car while your vehicle is being repaired after a covered claim.

- Towing and Labor: Provides roadside assistance for things like a tow, a jump-start, or a flat tire.

- Gap Insurance: If your car is totaled, this covers the difference between the car’s value and what you still owe on your loan or lease. This is especially useful for new cars.

- Higher MedPay Limits: You can increase your Medical Payments coverage beyond the $1,000 minimum for more extensive protection for you and your passengers.

Factors Influencing Your New Hampshire Car Insurance Rates

While New Hampshire car insurance is generally affordable, your specific premium is highly personalized. Insurers use a variety of factors to assess your risk and determine your rate.

Factors like your age, location, driving history, and vehicle type all play a role. Understanding these influences can help you identify opportunities to save money. For a deeper dive, explore our page on Auto Insurance Rates in New Hampshire.

What is the Average Cost of Car Insurance in New Hampshire?

Granite State drivers benefit from rates significantly lower than the national average. The average annual premium in New Hampshire is around $999, which is about 35% less than what most Americans pay.

Of course, this is just an average. Your personal quote will depend on your unique circumstances. The New Hampshire Insurance Department’s Comparison of New Hampshire Personal Auto Insurance Premiums shows how much rates can vary between carriers for the same coverage, highlighting the importance of shopping around.

Insurers use underwriting to evaluate your risk based on demographics, driving record, vehicle type, location, annual mileage, and chosen coverage limits. Many insurers also consider your credit history, as permitted by the state, so good credit can often lead to lower premiums.

How Your Location and Driving History Impact Premiums

Two of the most significant factors in your New Hampshire car insurance premium are where you live and how you drive.

Where You Live Makes a Difference

Insurance companies analyze local data on accident rates, theft, and claims frequency. This is why rates differ by zip code.

- Urban areas like Manchester and Nashua typically have higher premiums due to more traffic, which increases the risk of accidents, theft, and vandalism.

- Rural areas generally have lower rates because of less traffic congestion and fewer claims per capita.

Your Driving Record Tells Your Story

Your driving record is a primary indicator of your risk level. A clean record is the best way to secure lower premiums.

- At-fault accidents and traffic violations (speeding, DUIs) will increase your rates, often for three to five years.

- Years of driving experience also matter. New drivers, especially teens, face higher rates due to statistical risk, though good student and driver training discounts can help.

- A clean driving record maintained over several years often earns safe driver discounts, proving that responsible driving pays off.

How to Find Affordable Rates and Save Money

Finding affordable New Hampshire car insurance is achievable. While average costs are already low, smart strategies can help you trim your premium without sacrificing protection. Insurance companies offer numerous discounts, and there are practical steps you can take to lower your costs.

Let’s walk through some proven ways to lower your premium and get the best value when you compare quotes. For more personalized strategies, visit our Affordable Car Insurance NH page.

Actionable Tips for Lowering Your Premium

Small changes can lead to significant savings on your New Hampshire car insurance. Here are the most effective strategies:

- Maintain a clean driving record. This is the most powerful way to lower your premium over time. Insurers reward safe drivers with discounts.

- Consider a higher deductible. Increasing your deductible (the amount you pay out-of-pocket on a claim) from $500 to $1,000 will lower your premium. Just be sure you can afford the higher amount.

- Pay your premium in full. Many companies offer a discount for paying your entire six- or twelve-month premium upfront.

- Ask about all available discounts. You may qualify for savings by bundling home and auto policies, having a good student, using a telematics/safe driver program, insuring multiple cars, being a homeowner, or having low annual mileage.

- Review your coverage annually. As your car ages, you might consider dropping collision or comprehensive coverage if its value no longer justifies the cost.

- Choose your vehicle wisely. Cars with high safety ratings and lower repair costs are cheaper to insure than high-performance or luxury models.

Comparing New Hampshire Car Insurance Quotes

Shopping around is essential for getting the best deal, as premiums vary dramatically between carriers for identical coverage. You can save hundreds annually by comparing.

You can work with an independent agent like us at Stanton Insurance or contact direct carriers yourself. An independent agent shops multiple providers for you, saving time and helping you understand the differences between policies.

When comparing, ensure it’s an apples-to-apples comparison. A cheaper quote might have lower liability limits or higher deductibles, offering less protection. Verify that every quote has the same coverage types, limits, and deductibles.

Understanding your coverage limits and deductibles is key. Low liability limits can expose your personal assets, while your deductible impacts both your premium and out-of-pocket costs. Sometimes paying a bit more for higher limits is a wise investment.

While online tools are fast, talking with an experienced agent provides insights that algorithms miss. We can identify discounts, explain coverage options, and build a policy that fits your life and budget. The lowest price isn’t always the best value; focus on a balance of affordability, quality coverage, and reliable claims service.

Ready to see your options? Get personalized Car Insurance Quotes NH and let’s find the best value for your needs.

Frequently Asked Questions about NH Auto Insurance

The unique nature of New Hampshire car insurance laws leads to some common and important questions. Here are the answers to the ones we hear most often.

What happens if an uninsured driver hits me in New Hampshire?

If an uninsured driver hits you, your own Uninsured Motorist (UM) coverage becomes your financial safety net. This coverage pays for your bodily injuries, including medical bills, lost wages, and pain and suffering, up to your policy limits. This is why we recommend robust UM coverage.

If you don’t have UM coverage or your damages exceed its limits, your only recourse may be to sue the at-fault driver personally. This can be a long, expensive process with no guarantee you will be able to collect any money, even if you win.

Is New Hampshire a “no-fault” state?

No, New Hampshire is a traditional “at-fault” (or tort) state. This means the driver found legally responsible for an accident is required to pay for the resulting damages and injuries. Their liability insurance—or personal assets, if uninsured—covers the other party’s costs. This differs from no-fault states, where your own insurance covers your initial medical bills regardless of who caused the crash.

Do I need to add my teenager to my policy once they get their license?

Yes, absolutely. Once your teenager is licensed, they must be added to your New Hampshire car insurance policy. Insurers require all licensed drivers in a household to be listed because they have access to your vehicles and represent a potential risk.

Failing to add a licensed teen can have severe consequences. If they have an accident, your insurer could deny the claim entirely, leaving you personally responsible for all costs. They might even cancel your policy. While adding a teen will increase your premium, you can often offset the cost with good student discounts or by having them complete a driver’s education course.

Conclusion

You now understand what makes New Hampshire car insurance unique. While the freedom to drive without mandatory insurance is appealing, financial responsibility is the law. For most drivers, carrying a solid insurance policy is the smartest and safest choice.

New Hampshire trusts you to make the right decision, but it will hold you accountable if you cause an accident and can’t pay. That’s a risk that could cost you your license and your savings. A comprehensive New Hampshire car insurance policy protects you from that worst-case scenario.

We’ve covered the at-fault system, minimum requirements, optional coverages, and how factors like your location and driving history affect your rates. We’ve also shown you how to find affordable coverage through discounts and smart shopping.

At Stanton Insurance Agency, we’ve spent over two decades helping New England families steer these decisions. Our goal is to provide clear answers and help you find a policy that protects what matters most without breaking your budget. We believe in trusted protection for your valuable assets.

Don’t leave your financial future to chance. Whether you’re a new driver, a longtime resident looking to save, or someone reconsidering driving uninsured, we’re here to help.