Motorcycle Insurance Price: Conquer 5 Challenges

Why Motorcycle Insurance Price Matters to Every Rider

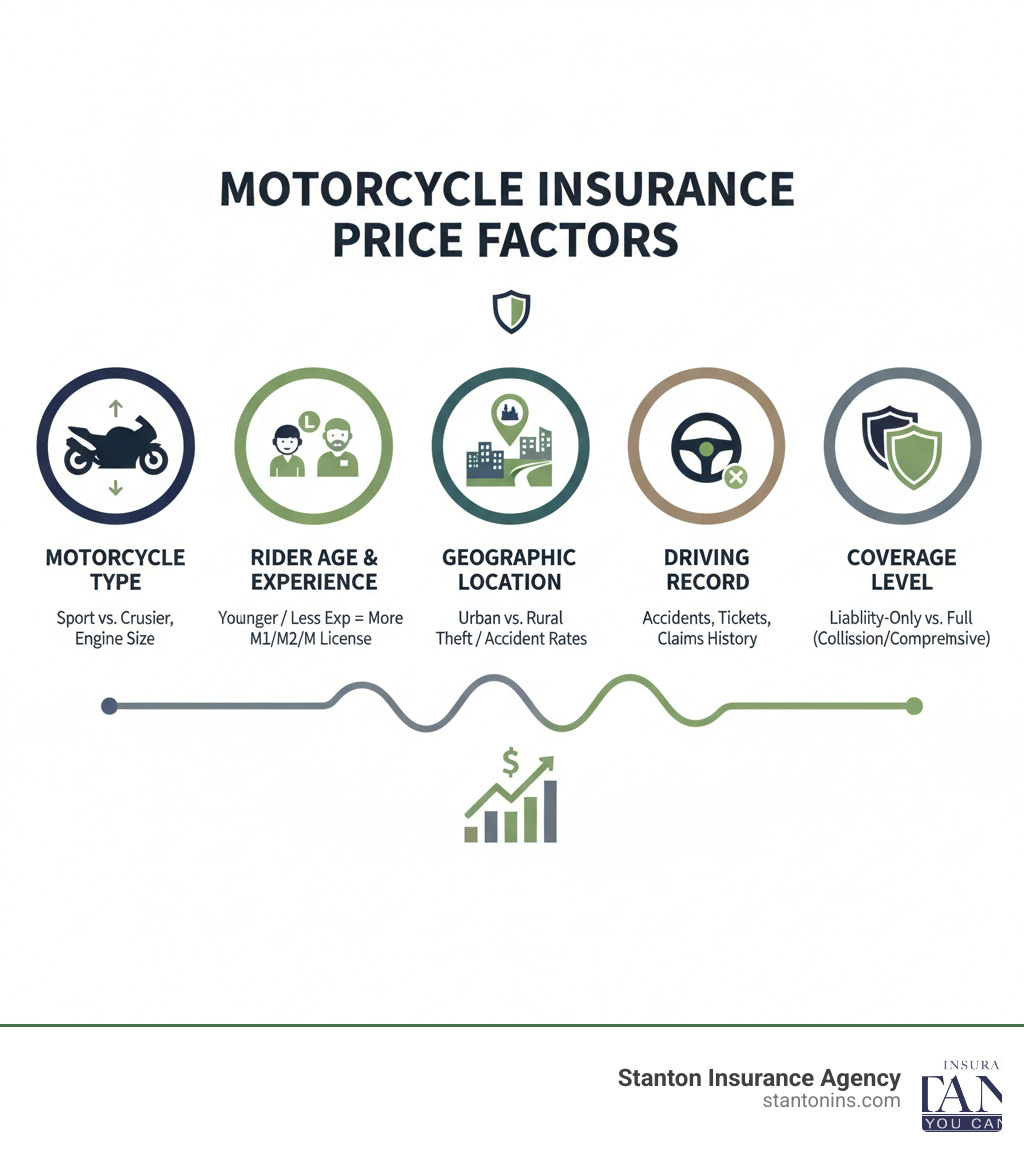

Motorcycle Insurance Price in Massachusetts and New Hampshire can range from $400 to over $1,200 per year on average, but your actual cost depends on several key factors:

- Rider Profile: Age, experience level, and driving record

- Motorcycle Type: Sport bikes can cost much more to insure than cruisers

- Location: Urban areas like Boston have higher rates than rural regions

- Coverage Level: Liability-only vs. full coverage with collision and comprehensive

- Discounts Available: Safety courses, bundling policies, anti-theft devices

Nothing compares to the freedom of cruising New England’s scenic highways on two wheels. But before you hit the open road, understanding what you’ll pay for motorcycle insurance is essential. The price you see advertised isn’t always the price you’ll pay—and that’s because insurers calculate your premium based on dozens of personal risk factors.

Many riders are surprised by how much their insurance costs can vary. A sport bike rider in Boston might pay over $1,000 annually, while a cruiser owner in a small New Hampshire town could pay just $400 for similar coverage. The good news? Once you understand how insurers calculate your rate, you can take concrete steps to lower your premium without sacrificing protection.

I’m Geoff Stanton, President at Stanton Insurance Agency, and I’ve spent over two decades helping Massachusetts and New Hampshire riders steer Motorcycle Insurance Price challenges to find affordable, comprehensive coverage. My experience gives me unique insight into the factors that drive your rates and the strategies that deliver real savings.

Understanding Motorcycle Insurance Costs and Coverage in MA & NH

This section breaks down the typical costs riders can expect and explains the essential and optional coverages that form a policy. Understanding these components is the first step to managing your insurance expenses effectively.

What is the Average Motorcycle Insurance Price in MA & NH?

When riders ask about Motorcycle Insurance Price, they’re usually looking for a ballpark figure. Most riders in Massachusetts and New Hampshire pay somewhere between $400 and $1,200 annually. However, this is a wide range for a good reason.

Your actual premium is uniquely yours, shaped by everything from the bike you ride to where you park it. A basic liability-only policy that meets state minimums will cost less than a comprehensive package that protects your bike from theft and collision. The difference can be substantial. Think of these averages as a starting point. A sport bike will likely push you toward the higher end, while a modest cruiser with an experienced rider could land you at the lower end.

The best way to know what you’ll pay is to get a personalized quote. For a deeper dive, check out our guide on How Much Is Motorcycle Insurance.

Mandatory Coverage: The Non-Negotiables

In Massachusetts, motorcycle insurance is the law. You cannot legally ride on a public road without it. A standard MA policy includes four key coverages:

- Bodily Injury to Others: Protects you if you cause an accident that injures someone else.

- Personal Injury Protection (PIP): Covers medical expenses and lost wages for you and your passengers, regardless of who is at fault.

- Bodily Injury Caused by an Uninsured Motorist: Protects you if you’re hit by a driver who has no insurance.

- Damage to Someone Else’s Property: Pays for damage you cause to another person’s vehicle or property.

New Hampshire is unique—it doesn’t legally require every rider to buy insurance. However, you must prove you can meet the state’s financial responsibility requirements if you cause an accident. Because the potential costs are so high, nearly all riders choose to buy insurance. If you do, a policy must meet minimum liability limits for bodily injury and property damage.

For more details on requirements, see our page on Do You Need Motorcycle Insurance.

Optional Coverage: Tailoring Your Protection

Mandatory coverages handle the basics, but optional coverages let you customize your protection. While they affect your overall Motorcycle Insurance Price, they provide crucial peace of mind.

- Collision Coverage: Pays to repair your own bike after an accident, whether you hit another vehicle or an object. If your bike is new or financed, this is essential.

- Comprehensive Coverage: Protects against non-collision events like theft, vandalism, fire, or hail. Since motorcycles are attractive targets for thieves, this coverage is highly valuable. Learn more in our article Does Motorcycle Insurance Cover Theft.

- Higher Liability Limits: The state minimums are often not enough to cover costs in a serious accident. Increasing your liability limits is a smart and affordable way to protect your assets.

- Roadside Assistance: Provides help for flat tires, dead batteries, or towing if you’re stranded.

- Replacement Cost Coverage: For new bikes, this ensures you get a new motorcycle if yours is totaled, rather than just its depreciated value.

Key Factors That Drive Your Motorcycle Insurance Premiums

Your final insurance premium is a unique calculation based on risk. Insurers assess several key factors related to you, your bike, and where you ride to determine your rate.

How Your Choice of Motorcycle Affects Your Rate

The motorcycle you ride has a massive impact on your Motorcycle Insurance Price. It’s not just about the bike’s price tag—it’s about its risk profile.

Sport bikes are the most expensive to insure. These high-performance machines are associated with higher speeds, which translates to higher accident rates. They are also prime targets for thieves and have expensive parts, driving up repair costs.

Cruisers sit at the opposite end of the spectrum. These bikes are associated with more relaxed riding styles, leading to fewer accidents and lower premiums. Insurers reward this lower-risk approach with better rates.

Touring bikes fall in the middle. They can be expensive, but their riders typically prioritize comfort and safety for long-distance trips, making them cheaper to insure than sport bikes.

Engine size (CCs) also matters. A bike with a 1000cc engine will cost more to insure than one with a 250cc engine. The bike’s value, including custom parts, also affects the premium, as it determines the potential replacement cost.

| Motorcycle Type | Typical Risk Profile | Average Insurance Cost Impact |

|---|---|---|

| Sport Bike | High (speed, theft) | High |

| Cruiser | Low (moderate use) | Low |

| Touring Bike | Medium-Low (cautious) | Medium-Low |

| Standard/Scooter | Very Low | Very Low |

The Rider Profile: Age, License, and Record

Who you are as a rider matters just as much as what you ride. Insurers look at your personal history to predict your likelihood of filing a claim.

Age and experience are huge factors. A younger rider will almost always pay more than a 35-year-old with a clean record. It’s not personal—it’s based on statistics showing younger riders are involved in more accidents. As you gain experience and maintain a clean record, your premiums will decrease.

Your license status also plays a role. A rider with a learner’s permit is considered less experienced and will pay higher rates than someone with a full, unrestricted motorcycle license (Class M in Massachusetts). Earning your full license signals to insurers that you’ve developed your skills.

Your driving record is the most important factor you control. A clean record—no at-fault accidents or speeding tickets—is the best way to keep your insurance costs down. Most violations impact your rate for several years. If you’ve been labeled a high-risk rider due to multiple incidents, finding affordable coverage can be challenging, but demonstrating safer habits over time can help rebuild your standing.

Location, Location, Location: The Impact of Your Postal Code

Where you live and park your bike significantly influences your Motorcycle Insurance Price. Insurers use postal code data to assess local risks.

Urban riders, especially in cities like Boston or Manchester, typically face higher premiums than their rural counterparts. This is due to higher traffic density, which increases the chance of an accident. Unfortunately, theft and vandalism rates also tend to be higher in cities.

Rural riders benefit from quieter roads, less traffic, and lower crime rates, all of which translate to lower insurance costs. Your location isn’t easy to change, but understanding its impact helps complete the picture of what drives your premium.

Smart Strategies to Lower Your Motorcycle Insurance Price

While some rating factors are fixed, you have more control over your premiums than you might think. Proactive steps and smart choices can lead to significant savings.

A Rider’s Guide to Common Insurance Discounts

You have the power to reduce your Motorcycle Insurance Price. Insurance providers reward safe riders and loyal customers, and taking advantage of discounts can save you hundreds.

One of the best ways to save is by completing a rider training course. Finishing a state-approved motorcycle safety program can slash your premiums, often by 10-15%. These courses are available through the Massachusetts Rider Education Program (MREP) and the New Hampshire Division of Motor Vehicles.

Bundling your policies is another huge opportunity. If you have home or auto insurance, adding your motorcycle policy with the same company can open up a multi-policy discount. We’ve seen riders achieve significant savings by consolidating their coverage.

Other common discounts include:

- Multi-Motorcycle Policy: Insure more than one bike with the same company.

- Claims-Free History: Maintaining a clean record for several years proves you’re a low-risk rider.

- Anti-Theft Device: Approved alarms, GPS trackers, or immobilizers can lower your comprehensive premium.

- Loyalty & Membership: Staying with the same provider or belonging to certain motorcycle clubs or associations can earn you a discount.

The Winter Dilemma: Managing Off-Season Insurance

What should you do with your insurance when New England’s weather turns cold? Canceling your policy is a risky move. Theft, fire, flooding, and vandalism can happen any time of year. If you cancel your policy to save a few dollars, you could face a total loss with no protection. Furthermore, a gap in coverage can lead to higher rates when you reinstate your policy in the spring.

The smart approach is to reduce your coverage, not eliminate it. By removing collision and liability coverage while keeping comprehensive-only protection, you stay insured against theft and other non-riding incidents. Your premium drops significantly for the winter months, but your investment remains protected. When spring arrives, you simply adjust your policy back to full coverage. For more strategies, see our guide to Affordable Motorcycle Insurance.

How to Compare Quotes for the Best Motorcycle Insurance Price

Shopping for the best Motorcycle Insurance Price is about finding the best value. Start by gathering your personal, license, and motorcycle information. When you request quotes, ensure you are comparing identical coverage. A low price may hide high deductibles or low liability limits.

This is where working with an insurance broker is invaluable. As an independent agency serving Massachusetts and New Hampshire, we work for you, not a single insurance company. We shop your coverage across multiple providers to find the best match of price and protection.

We also help you understand deductibles—the amount you pay out-of-pocket on a claim. A higher deductible lowers your premium, but you need to be comfortable paying that amount if you file a claim. We help you find the right balance. Our goal is to find you the Best Insurance for Motorcycles, which means robust protection at a fair price.

A Step-by-Step Guide to Filing a Claim

Knowing what to do after an accident or theft can make a stressful situation more manageable. Follow these steps to ensure a smooth claims process.

Steps to Filing a Motorcycle Insurance Claim

No one wants to think about accidents, but being prepared makes all the difference. Filing a claim follows a straightforward process.

-

Ensure Safety First: Your first priority is your well-being. Move to a safe location if possible and call 911 if anyone is injured.

-

Document the Scene: Use your phone to take photos of the damage to all vehicles, the surrounding area, road conditions, and any relevant signs. This evidence is crucial.

-

Collect Information: Exchange names, contact details, and insurance information with everyone involved. Get contact info from any witnesses. If police respond, get the report number.

-

Contact Your Insurance Provider Promptly: Call us at Stanton Insurance Agency as soon as possible. The sooner you report the incident, the faster we can start your claim. We’ll give you a claim number and explain the next steps.

-

Work with the Claims Adjuster: An adjuster will be assigned to investigate the incident, review the evidence, and determine what’s covered under your policy. Cooperate fully to ensure a smooth process.

-

Complete the Repair and Settlement: Once the investigation is complete, the adjuster will calculate your settlement. You can typically choose your own repair shop. If the bike is a total loss, the settlement will be based on its value as defined in your policy.

Throughout this process, we’re on your team. Our goal is to make a difficult situation as manageable as possible so you can get back on the road.

Frequently Asked Questions about Motorcycle Insurance Prices

Is motorcycle insurance mandatory in Massachusetts and New Hampshire?

In Massachusetts, yes, it is mandatory. You must have a policy with minimum liability and personal injury protection to legally ride on public roads. Riding uninsured can lead to significant fines, license suspension, and other penalties.

In New Hampshire, it’s more complicated. The state does not legally require you to buy insurance, but you must be able to prove you have enough money to cover damages if you cause an accident (financial responsibility). Because the potential costs are so high, most riders find that buying an insurance policy is the most practical and secure option.

Can I lower my rates by taking a rider safety course?

Absolutely. Completing a state-approved motorcycle safety course is one of the best ways to lower your Motorcycle Insurance Price. Insurers see it as proof of your commitment to safety and often reward it with a discount of 10% or more.

These courses teach defensive riding techniques and hazard avoidance, making you a safer, more confident rider. You can find approved courses through the Massachusetts Rider Education Program (MREP) and the New Hampshire DMV.

Why is my motorcycle insurance sometimes more expensive than my car insurance?

This often surprises riders, but it comes down to risk. Motorcyclists are far more vulnerable to serious injury in an accident than car drivers. The potential for higher medical claim costs is a major factor that drives up insurance rates.

Additionally, certain motorcycles, especially sport bikes, have much higher theft rates than most cars. The risk of theft and the cost of replacing specialized parts also contribute to the premium. Insurers price policies based on decades of claims data, which shows that riding a motorcycle is inherently riskier than driving a car, even for the safest riders.

Find the Right Coverage at the Right Price

You’ve made it to the finish line. Now you know that conquering Motorcycle Insurance Price challenges is about being informed and proactive. When you understand what drives your rates, what coverage you need, and which discounts you qualify for, you can hit the open road with confidence.

Your best rate comes from a policy that’s custom-built for your unique profile—your bike, your experience, and your riding habits. There’s no one-size-fits-all solution, which means there’s always room to find coverage that fits both your needs and your budget.

Our team at Stanton Insurance Agency has spent over two decades serving riders in Massachusetts and New Hampshire. We are dedicated to helping you steer the complexities of motorcycle insurance with clarity. We’ll work with you to explore all your options, compare quotes, and find that perfect balance between robust protection and a fair price.

Whether you’re a seasoned rider or just getting your permit, we’re here to ensure you’re covered for every mile. The road ahead should be about freedom and adventure, not insurance anxiety.

Ready to find your best rate? Explore your options for Motorcycle Insurance today, and let’s get you the coverage you deserve at a price that makes sense.