Massachusetts Car Insurance: Best 2025 Guide

Your Essential Guide to Massachusetts Car Insurance

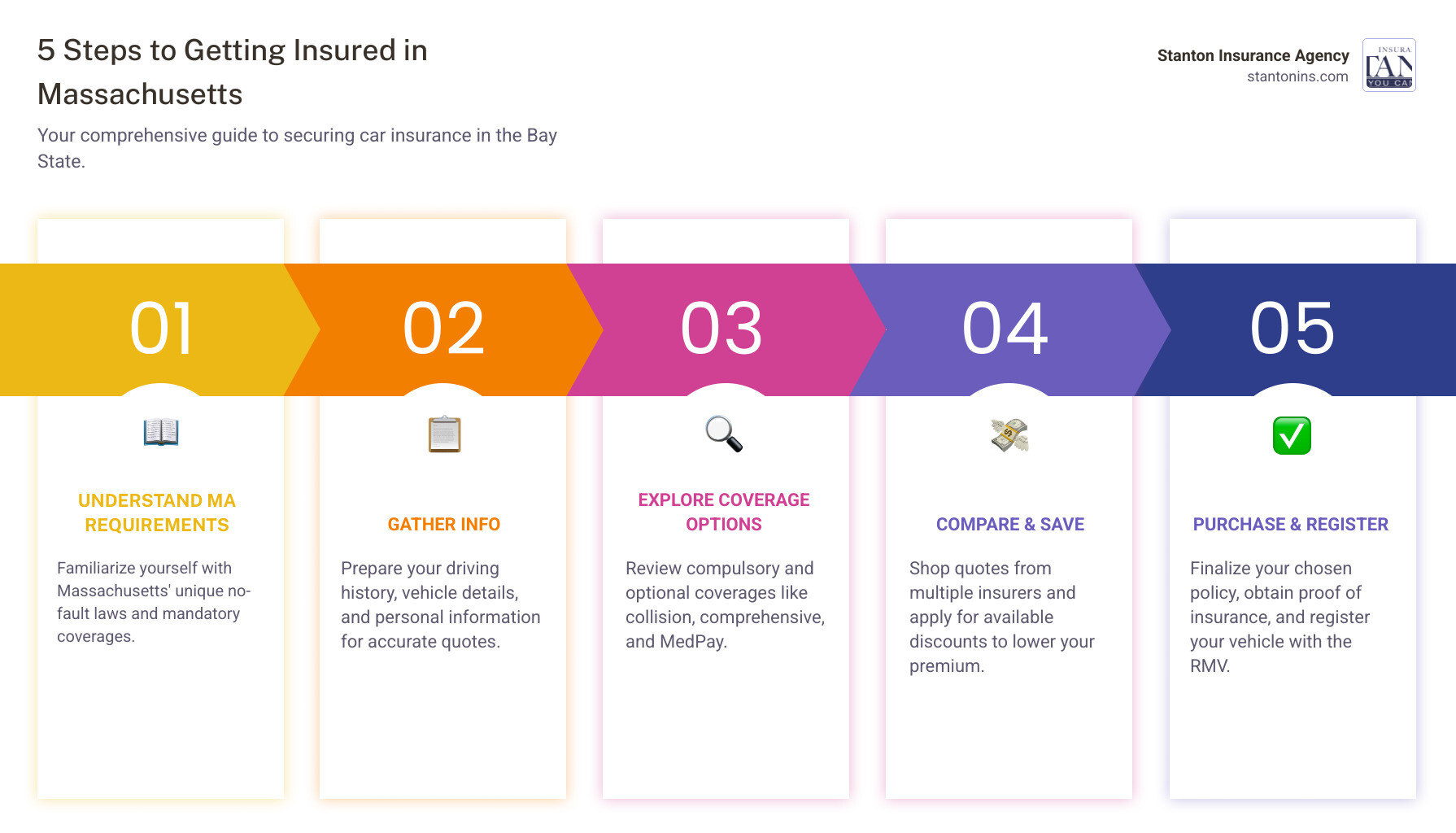

Navigating Massachusetts car insurance can seem complicated. Here’s a quick overview of what you need to know:

- Minimum Required Coverage in Massachusetts:

- Bodily Injury Liability: $20,000 per person / $40,000 per accident

- Property Damage Liability: $5,000 per accident

- Personal Injury Protection (PIP): $8,000 per person

- Uninsured Motorist Bodily Injury: $20,000 per person / $40,000 per accident

- Average Full Coverage Cost in Massachusetts: Approximately $1,726 annually (about $144 monthly)

Navigating the roads of the Bay State, from Boston’s busy streets to the serene byways of the Berkshires, requires more than just a driver’s license—it requires the right protection. Massachusetts has a unique set of auto insurance laws, including its status as a no-fault state, which can make finding the right policy seem complex. This guide will simplify the process, breaking down everything you need to know to secure the best coverage for your needs and budget.

As President of Stanton Insurance and a lifelong Waltham resident, I, Geoff Stanton, have helped Massachusetts families with their car insurance needs for over two decades. My experience in claims and as a Certified Insurance Counselor allows me to provide expert guidance for protecting your vehicles and other valuables.

Massachusetts car insurance terms to learn:

- car insurance rates massachusetts

- how to get car insurance in massachusetts

- what is the minimum car insurance coverage in massachusetts

Understanding Massachusetts’ Mandatory Car Insurance Requirements

In Massachusetts, every driver needs a minimum amount of Massachusetts car insurance to legally register and operate a vehicle. The state uses a “no-fault” system, which means your own Personal Injury Protection (PIP) coverage is the first source of payment for medical bills and lost wages after an accident, regardless of who was at fault. This system is designed to ensure medical expenses are covered quickly, streamlining the claims process and getting accident victims the care they need without unnecessary delays.

Curious about the exact numbers? You can find out more about what is the minimum car insurance coverage in Massachusetts?.

For a deeper dive into the legal framework of auto insurance in the Bay State, you can explore more details on state requirements. Understanding these foundational elements is crucial before we explore the specifics of each required coverage.

The Four Compulsory Coverages in MA

To legally drive in Massachusetts, your car insurance policy must include these four fundamental coverages. Think of them as the protective foundation that keeps you compliant and covered in essential situations.

Bodily Injury to Others. This coverage is your financial shield if you’re found responsible for causing bodily injury or death to someone else in an accident, including pedestrians, people in other cars, and non-family passengers. The current minimums are $20,000 per person and $40,000 per accident, increasing to $25,000/$50,000 on July 1, 2025. We often suggest considering higher limits to protect your assets, as serious injuries can quickly exceed these amounts.

Personal Injury Protection (PIP). This vital coverage provides up to $8,000 for medical expenses, lost wages (up to 75%), and replacement services for you, your household members, and passengers in your vehicle. It kicks in regardless of who caused the accident, ensuring swift payment for injuries so you can get medical treatment right away. It’s a crucial part of the no-fault system.

Bodily Injury Caused by an Uninsured Auto. This coverage protects you and your household members if you’re injured by an uninsured or hit-and-run driver. It covers your medical expenses and lost wages up to your policy limits. The minimums are $20,000 per person and $40,000 per accident. With many drivers lacking insurance, this coverage is incredibly important for your financial peace of mind.

Damage to Someone Else’s Property. If you’re at fault for damaging another person’s property (their car, a fence, etc.), this coverage pays for repairs or replacement. The current minimum is $5,000 per accident, increasing to $30,000 on July 1, 2025. Since modern vehicle repair costs can easily surpass the current minimum, this limit can be quickly exhausted, leaving you personally responsible for the rest.

Exploring Optional Coverage for Complete Protection

Meeting Massachusetts’ minimum requirements is just the starting point. State minimums often fall short in real-world accidents, where repair bills can easily top $8,000 and medical costs can exceed $20,000. If you cause an accident with costs beyond your coverage limits, you are personally responsible for the difference. For example, with the $20,000 minimum bodily injury limit, a $50,000 medical bill would leave you owing $30,000 out-of-pocket.

That’s why we help clients build policies that truly protect their financial future, not just meet legal minimums. After two decades in the insurance industry, I’ve seen how the right coverage can be the difference between a manageable event and a financial disaster.

Collision vs. Comprehensive: What’s the Difference?

Think of collision and comprehensive coverage as the dynamic duo that protects your actual vehicle. While Massachusetts doesn’t require them by law, your lender certainly will if you’re financing or leasing your car—and for good reason.

Collision coverage steps in when your car meets another object, whether that’s another vehicle, a guardrail, or that concrete pillar that seemed to jump out of nowhere in the parking garage. It doesn’t matter who’s at fault—if your car is damaged in a collision, this coverage helps pay for repairs or replacement. Massachusetts offers both standard collision (covers you regardless of fault) and limited collision (only applies when you’re less than 50% at fault), giving you options based on your budget and risk tolerance.

Comprehensive coverage handles everything else that can damage your car. We’re talking about the unpredictable stuff—hail storms that turn your hood into a golf ball, vandals with questionable artistic skills, or that deer that decided your morning commute needed more excitement. It also covers theft, fire, and flood damage. Basically, if it’s not a collision but your car still needs fixing, comprehensive has you covered.

For a deeper dive into these coverages, check out our detailed guide on collision vs comprehensive.

Other Valuable Add-Ons for Your Policy

Beyond protecting your vehicle, several other optional coverages can fill important gaps in your financial protection. Medical Payments (MedPay) extends your medical coverage beyond the $8,000 PIP limit, which can be a lifesaver if you have high health insurance deductibles or need extensive treatment after an accident.

Underinsured Motorist Coverage protects you from a frustrating scenario: being hit by someone who has insurance, but not nearly enough. If the at-fault driver only carries the state minimums but your medical bills are $60,000, this coverage fills that gap so you’re not left scrambling to cover the difference.

If you’re financing or leasing your vehicle, Gap Insurance is often essential. Cars depreciate quickly, and if yours is totaled six months after you bought it, you might owe more on the loan than the car is worth. Gap insurance covers that difference, preventing you from making payments on a car that’s sitting in a junkyard. Learn more about this crucial protection in our guide on what is gap insurance.

Rental Reimbursement keeps you mobile while your car is being repaired after a covered claim. There’s nothing worse than being without transportation for two weeks while waiting for parts to arrive. Towing and Labor coverage handles roadside emergencies—dead batteries, flat tires, or those moments when your car simply decides it’s done for the day.

These additional coverages create a comprehensive safety net that goes far beyond the basics. They’re designed to keep your life running smoothly when the unexpected happens, because let’s face it—accidents never occur at convenient times.

How Your Massachusetts Car Insurance Premium is Calculated

How do insurance companies determine your Massachusetts car insurance premium? It’s a calculated process based on your unique risk profile. Insurers assess several factors about you, your vehicle, and your driving habits to determine the price of your policy.

Key Factors That Influence Your Rates

When an insurer calculates your Massachusetts car insurance premium, they consider several important elements. Understanding these can help you see why your rates are what they are and identify ways to save.

One of the biggest factors is your Age and Driving Experience. Teen drivers (aged 16-19) often face the highest rates, sometimes over $5,000 a year for full coverage, because statistically, they have more accidents. As you gain experience, rates usually drop, with drivers between 30 and 60 typically seeing the lowest rates. Even drivers over 65 usually pay less than teens.

Here’s a quick look at how age can influence average full coverage premiums in Massachusetts:

| Age Group | Average Annual Full Coverage Premium in MA |

|---|---|

| Teen Drivers (16-19) | $5,299 |

| Drivers (20-25) | $2,529 |

| Drivers (30-60) | $1,700 |

| Drivers (65+) | $1,509 |

The Vehicle Make and Model you drive also plays a big role. Cars that are expensive to repair, high-performance, or frequently stolen will likely have higher insurance costs. Conversely, vehicles known for safety features or lower repair costs (like many Subarus, Hyundais, Hondas, and Mazdas) can often lead to lower bills.

Your Location (ZIP Code) matters too! Living in a busy urban area with more traffic and higher accident or crime rates often means higher premiums. For example, drivers in Roxbury might pay nearly $3,000 annually, while those in Northfield could pay closer to $1,300.

Finally, your Coverage Limits and Deductibles directly impact your premium. Higher coverage limits mean more protection and a higher premium. A lower deductible (what you pay out-of-pocket) means a higher premium, while a higher deductible lowers your premium. It’s about balancing your budget with your comfort for risk.

It’s also interesting to note that Massachusetts is one of the few states that doesn’t let insurance companies check your credit score when setting your rates. This is a unique protection for consumers here in the Bay State!

The Impact of Your Driving Record on Massachusetts Car Insurance Costs

Your driving history is one of the most significant factors impacting your Massachusetts car insurance rates. A clean record helps keep your costs low, as insurers view you as a lower risk. Conversely, a history of accidents or tickets will increase your premiums.

Let’s look at how specific incidents can affect your wallet:

- At-fault accidents: If you’re found responsible for an accident, your rates will almost certainly jump. In Massachusetts, an at-fault accident can cause your premium to increase by up to 53%! The state’s Merit Rating Board (MRB) keeps track of these incidents.

- Speeding tickets: Even a single speeding ticket can make a difference. It could raise your car insurance rates by up to 26% and stay on your record, affecting your premium, for up to three years.

- DUI convictions: Driving under the influence (called OUI, or Operating Under the Influence, in Massachusetts) is a very serious offense with the biggest impact on your insurance. A DUI conviction can lead to a staggering 78% increase in your premiums, on top of hefty fines, possible jail time, and license suspension.

The Massachusetts Merit Rating Board (MRB), part of MassDOT, manages the driving records insurers use. While incidents older than 6 years can’t be used to determine your merit rating, any premium increases from accidents or violations can’t last for more than 5 years. If you believe an at-fault determination is wrong, you can appeal it to the Board of Appeal within 30 days.

For some simple tips on how to appeal a driving surcharge, you can visit Simple tips appeal driving surcharge.

What is the Average Cost of Car Insurance in MA?

So, after all that, what’s the typical cost for Massachusetts car insurance?

On average, drivers in Massachusetts pay around $1,726 annually for a full coverage car insurance policy. This works out to about $144 per month. The good news is that this is about 12% lower than the national average, making car insurance in the Bay State relatively affordable compared to many other places.

Though, that these are just averages. Your actual cost will depend on all the personal factors we’ve discussed: your age, your driving record, the car you drive, where you live, and the specific coverages and deductibles you choose. For a deeper dive into the average cost of car insurance in MA, including breakdowns by city and other details, be sure to check out our resource: Average cost of car insurance in MA.

How to Save Money and Register Your Vehicle

Beyond securing the right policy, you can manage auto-related expenses by leveraging discounts and understanding the vehicle registration process. A little knowledge can save you significant time and money.

Top Discounts to Lower Your Premium

Insurance companies offer various discounts, and it’s always worth asking your agent about every one you might qualify for, as they can add up to significant savings on your Massachusetts car insurance.

Multi-Policy Discount (Bundling). Purchasing multiple policies, like auto and renters insurance, from the same provider can lead to significant savings on both premiums and simplifies your insurance management.

Good Student Discount. Teen drivers who maintain good grades (usually a B average or higher) may qualify for a discount, helping to offset the higher premiums for young drivers.

Safe Driver/Accident-Free Discount. A clean driving record for a set period (e.g., 3-5 years) can earn you a discount. Ask about the Massachusetts Safe Driver Insurance Plan (SDIP), as many carriers participate.

Low Mileage Discount. Driving fewer miles annually reduces your accident risk and can lead to lower premiums.

Anti-Theft Device Discount. Vehicles equipped with security features like car alarms or tracking systems are less attractive to thieves, which can earn you a discount.

Paid-in-Full Discount. If you’re able to pay your entire annual or six-month premium upfront, many companies offer a discount compared to paying in monthly installments.

Don’t hesitate to discuss all possible discounts with your insurance professional to ensure you’re getting every penny of savings you deserve!

Registering Your Car with the Massachusetts RMV

Once you have your Massachusetts car insurance in place, the next crucial step is to register your vehicle with the Registry of Motor Vehicles (RMV). You cannot register a car in Massachusetts without first having an active insurance policy.

Here’s a simplified overview of the process:

First, you must Obtain Insurance First. This is non-negotiable. Your policy must meet the state’s compulsory minimum requirements. Your insurance company will provide a stamp or electronic verification on your RMV-1 form, certifying your coverage.

Next, you’ll need to Complete the RMV-1 Form. This is the official Application for Registration & Title. Your insurance agent will often assist you in completing and signing sections of this form, which details your vehicle, ownership, and insurance information.

If you’ve just purchased a vehicle, you’ll also need to Pay Title and Sales Tax. These fees are typically handled at the RMV when you register your car. Finally, with your completed and insurance-stamped RMV-1 form, proof of ownership, and identification, you’ll Visit an RMV Service Center. Here, you’ll submit your paperwork, pay the necessary fees, and receive your new license plates and registration sticker. For more detailed information on vehicle registration, you can visit the official Massachusetts Registry of Motor Vehicles website.

Frequently Asked Questions about Massachusetts Car Insurance

At Stanton Insurance, we believe clarity is key when it comes to your coverage. We often hear similar questions from our clients about Massachusetts car insurance, and we’re always happy to clear up any confusion. Let’s tackle some of the most common inquiries you might have.

Is Massachusetts a no-fault car insurance state?

Yes, Massachusetts is indeed a no-fault state, and this is a really important distinction! What does that mean for you? Well, if you’re involved in an accident, your own Personal Injury Protection (PIP) coverage is the primary source for paying medical bills and lost wages for you and your passengers. This applies up to the $8,000 limit, regardless of who caused the accident.

This “no-fault” system is designed to streamline the process, getting you and your loved ones the care you need quickly, without waiting for a lengthy investigation into who was at fault. It helps reduce litigation and ensures immediate medical attention, which is a huge benefit in a stressful situation.

Do I need insurance to register a car in Massachusetts?

Absolutely, and this is non-negotiable! Proof of active Massachusetts car insurance is a mandatory prerequisite for registering any vehicle with the Massachusetts Registry of Motor Vehicles (RMV). You simply cannot get your license plates or legally drive your car in the Bay State without a valid insurance policy that meets the state’s compulsory coverage requirements.

Think of it as the very first and most critical step in legally putting your car on the road. Your insurance agent will even help you complete the necessary forms to ensure everything is in order for the RMV.

How does a driving record from another state affect my insurance in Massachusetts?

That’s a great question, and the answer is that your entire driving history follows you! When Massachusetts insurers calculate your premium, they’ll consider your complete driving record, including any violations or accidents that occurred in other states.

The state’s Merit Rating Board (MRB) plays a role here, using all this data to assess your risk profile. So, if you have a less-than-perfect record from another state, it will likely lead to higher Massachusetts car insurance rates here in the Bay State. On the flip side, if you’ve maintained a clean driving record elsewhere, that’s a big advantage that can help you secure more favorable premiums in Massachusetts. Insurers simply want a full picture of your driving habits, no matter where they occurred.

Find the Right Policy for Your Drive

Choosing the right Massachusetts car insurance requires balancing legal requirements, personal risk, and your budget. By understanding the coverages, rate factors, and available discounts, you can select a policy that provides true peace of mind.

While meeting state minimums is the first step, the right policy should reflect your lifestyle, protect your assets, and fit your budget. All the information in this guide—from PIP coverage to RMV registration—is most valuable when applied to your unique situation. Your commute, your family’s drivers, and your financial goals all shape your insurance needs.

Navigating these options is easier with an expert by your side. A local, independent agency like Stanton Insurance Agency provides personalized advice and shops multiple carriers to find the best fit for you. We aren’t tied to one company, so we can compare options to find the sweet spot between comprehensive coverage and affordable premiums. We understand the unique aspects of Massachusetts car insurance, from the Merit Rating Board to upcoming changes in coverage limits.

We pride ourselves on providing trusted protection for your valuable assets in Massachusetts, New Hampshire, and Maine. Let us be your guide through insurance.

Ready to get started? Contact us today for a personalized car insurance quote! Let’s work together to find a policy that gives you confidence every time you get behind the wheel.