MA Vehicle Insurance: 2025 Essential Guide

Why MA Vehicle Insurance Matters for Every Driver

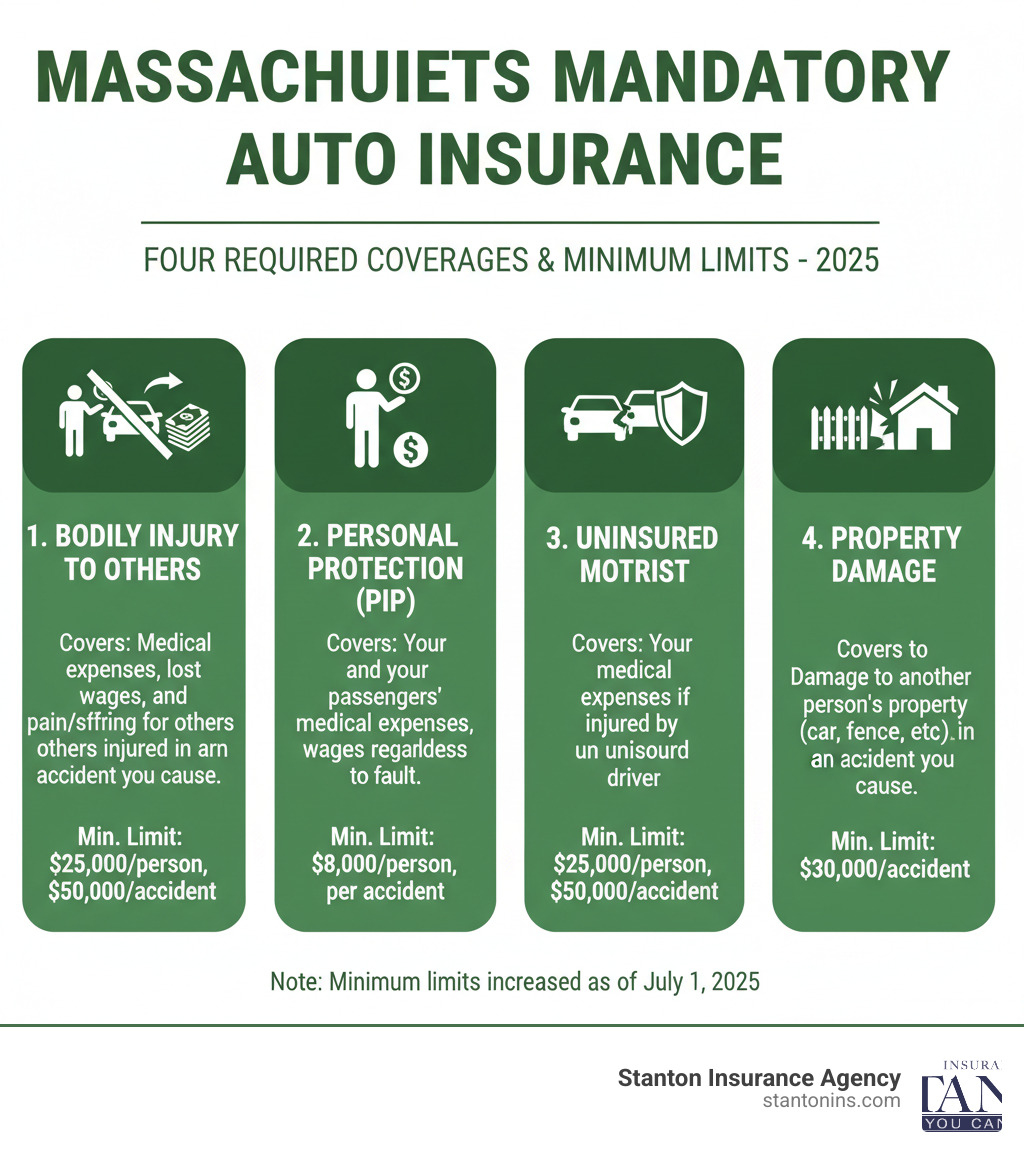

MA vehicle insurance is a legal requirement for every driver in the Commonwealth. You cannot register or operate a vehicle without carrying four mandatory types of coverage designed to protect you, your passengers, and others from financial hardship after an accident.

Massachusetts Mandatory Auto Insurance Requirements:

| Coverage Type | Minimum Limit |

|---|---|

| Bodily Injury to Others | $25,000 per person / $50,000 per accident |

| Personal Injury Protection (PIP) | $8,000 per person, per accident |

| Bodily Injury Caused by Uninsured Auto | $25,000 per person / $50,000 per accident |

| Damage to Someone Else’s Property | $30,000 per accident |

Note: These minimums increased as of January 1, 2025.

The state won’t let you register your car without proof of coverage. Driving uninsured can lead to fines from $500 to $5,000, jail time, and license suspension. Proper coverage protects your assets and provides peace of mind.

I’m Geoff Stanton, President of Stanton Insurance Agency. Since 1999, my team and I have helped Massachusetts drivers find MA vehicle insurance that meets state requirements and their personal needs. As a Certified Insurance Counselor, I’ve guided countless clients in securing the right protection.

Massachusetts Compulsory Auto Insurance Explained

In Massachusetts, MA vehicle insurance is required by state law. You cannot register a vehicle or drive legally without it. The Commonwealth mandates coverage to protect everyone on the road. As a “no-fault” state, your own insurance pays for your initial medical bills after a crash, regardless of who is at fault. This system ensures injured people get prompt medical care.

Compulsory insurance is the foundation of responsible vehicle ownership, safeguarding your finances and protecting others from the costs of accidents you may cause.

The Four Mandatory MA Vehicle Insurance Coverages

Every private passenger vehicle must carry these four coverages:

1. Bodily Injury to Others: Protects you if you’re legally responsible for injuring someone in an accident in Massachusetts. It covers their medical bills, lost wages, and pain and suffering. This mandatory coverage only applies within MA.

2. Personal Injury Protection (PIP): This is the “no-fault” component. It pays for your medical expenses (up to $8,000), 75% of lost wages, and replacement services, regardless of who caused the accident. It covers you, your passengers, and household members. PIP generally does not cover motorcycle accidents.

3. Bodily Injury Caused by an Uninsured Auto: Protects you if you’re injured by an uninsured or hit-and-run driver. It covers medical expenses and lost wages that your health insurance might not.

4. Damage to Someone Else’s Property: Pays for damages you cause to another person’s car, fence, or other property if you are at fault.

For official definitions, the Commonwealth provides details at their Understanding Auto Insurance page.

Minimum Coverage Limits in Massachusetts

Massachusetts sets minimum limits for each required coverage. As of January 1, 2025, these minimums were increased to reflect rising costs.

- Bodily Injury to Others: $25,000 per person / $50,000 per accident.

- Personal Injury Protection (PIP): $8,000 per person, per accident.

- Bodily Injury Caused by an Uninsured Auto: $25,000 per person / $50,000 per accident.

- Damage to Someone Else’s Property: $30,000 per accident.

These are just the minimums. Medical and repair costs can easily exceed these limits in a serious accident, leaving you personally responsible for the difference. Many drivers choose higher limits for better protection. At Stanton Insurance Agency, we help clients evaluate their needs. For personalized guidance, check out our car insurance services.

Beyond the Basics: Optional MA Vehicle Insurance

Mandatory coverages keep you legal, but they are just the starting point. What if a tree branch shatters your windshield, or medical bills from a serious accident exceed your $8,000 PIP limit? This is where optional coverages become crucial.

Adding optional protections to your MA vehicle insurance policy is a smart decision to protect your assets and financial future. These coverages can mean the difference between a manageable inconvenience and a financial crisis.

At Stanton Insurance Agency, we tailor coverage to your specific situation. Explore our car insurance services to see how we can help.

Optional MA Vehicle Insurance for Greater Protection

Consider these important optional coverages:

- Optional Bodily Injury to Others: This is critical. It extends your liability protection when you drive out of state and allows you to increase your limits well beyond the state minimums (e.g., to $250,000/$500,000). Higher limits protect your savings and home from lawsuits after a serious accident.

- Medical Payments (MedPay): Supplements your PIP coverage for medical expenses that exceed the $8,000 limit. It covers you and your passengers regardless of fault and is especially important for motorcyclists, as PIP generally doesn’t apply to them.

- Collision Coverage: Pays to repair or replace your vehicle after an accident, regardless of fault. Lenders usually require it for financed cars, but it’s wise even for owned vehicles you couldn’t afford to replace. You select a deductible (e.g., $500 or $1,000) that you pay out-of-pocket.

- Comprehensive Coverage: Protects your car from non-collision events like theft, vandalism, falling objects, or hitting a deer. Like collision, it has a deductible and is often required by lenders.

- Underinsured Motorist Coverage: Helps pay your expenses if you’re hit by a driver who has insurance, but their liability limits are too low to cover your medical bills and lost wages.

Standard vs. Limited Collision Coverage

Massachusetts offers two types of collision coverage:

- Standard Collision: Covers damage to your vehicle in any collision, regardless of who is at fault.

- Limited Collision: Only pays for repairs if you are found 50% or less at fault for the accident. If you are more than 50% at fault, you receive no payment for your car’s damages.

While limited collision has a lower premium, the risk is significant. We typically recommend standard collision for the much broader protection it provides.

Other Valuable Endorsements

You can further improve your MA vehicle insurance policy with these add-ons:

- Substitute Transportation (Rental Reimbursement): Covers the cost of a rental car while your vehicle is being repaired after a covered claim.

- Towing and Labor: Pays for towing and roadside assistance services like jump-starts or tire changes.

- Accident Forgiveness: Prevents your premium from increasing after your first at-fault accident.

- Auto Loan/Lease (Gap) Coverage: If your financed car is totaled, this pays the difference between the car’s value and the amount you still owe on your loan.

Understanding Your MA Vehicle Insurance Premium

Ever wonder how your MA vehicle insurance premium is calculated? Insurers use several factors to assess risk and determine your rate. Understanding these can help you make smarter choices and potentially save money.

How Premiums Are Calculated

Your premium is based on a sophisticated assessment of how likely you are to file a claim. Key factors include:

- Driving record: A clean record with no accidents or violations is the biggest factor in lowering your premium. MA uses a Merit Rating Plan that adds surcharges for infractions.

- Vehicle: The make, model, and year of your car affect costs. Newer, more expensive cars cost more to insure, while vehicles with advanced safety features may earn discounts.

- Garaging location: Your zip code matters. Areas with higher rates of theft, vandalism, or accidents typically have higher premiums.

- Annual mileage: The less you drive, the lower your risk. A short commute or working from home may qualify you for a low-mileage discount.

- Driving experience: Newer drivers, especially those under 25, face higher rates due to statistical risk. Premiums generally decrease with age and experience.

Importantly, Massachusetts law (MGL c. 175, § 4E) prohibits insurers from using your credit score, gender, marital status, occupation, or education level to set rates.

Common Car Insurance Discounts for MA Drivers

Most carriers offer discounts that can significantly lower your costs. Be sure to ask about:

- Bundling: Combining auto with home, renters, or umbrella insurance.

- Good Student: For full-time students with a B average or better.

- Paid-in-Full: Paying your annual premium upfront.

- Low Mileage: For driving under a certain annual threshold (e.g., 7,500 miles).

- Advanced Driver Training: For completing an approved defensive driving course.

- Multi-Car: Insuring more than one vehicle on the same policy.

- Safety Features: For vehicles with airbags, anti-lock brakes, and anti-theft systems.

Special Considerations: Teen Drivers

Adding a teen driver to your policy will increase your premium, but it’s a manageable process. Massachusetts has strict Junior Operator License (JOL) restrictions for drivers under 18, including passenger and nighttime driving limits. Driver’s education is also mandatory.

While teen drivers are higher risk, keeping them on your family policy is more affordable than a separate one. You can also mitigate the cost increase with good student and driver’s education discounts. This is a great opportunity to teach young drivers about the responsibilities and costs associated with driving.

For more information about protecting your family and valuable assets, visit our personal insurance page.

The MAIP, Registration, and Your Driving Record

Navigating MA vehicle insurance involves understanding the state’s systems for high-risk drivers, vehicle registration, and challenging decisions that affect your rates.

The Massachusetts Auto Insurance Plan (MAIP)

If you’ve been turned down by standard insurance companies due to a challenging driving record or other risk factors, the Massachusetts Auto Insurance Plan (MAIP) ensures you can still get coverage. MAIP is a state-mandated system, not an insurer, that assigns high-risk drivers to an insurance company.

While MAIP premiums are typically higher, the coverage is comparable to standard policies. The best way to leave MAIP is to maintain a clean driving record, which will make you eligible for the voluntary market again. For more details, visit the official Massachusetts Auto Insurance Plan (MAIP) page.

Registering a Vehicle in Massachusetts

You cannot register a vehicle in Massachusetts without active MA vehicle insurance. Before heading to the RMV, you must secure a policy. Your agent will provide a stamped RMV-1 form as proof of insurance. Along with the RMV-1, you’ll need the vehicle’s title and payment for sales tax and fees to complete the registration. The Massachusetts Registry of Motor Vehicles website has detailed guidance for all registration scenarios.

Appealing Surcharges and At-Fault Accidents

Your driving record directly impacts your insurance premiums through the state’s Merit Rating Plan. At-fault accidents and traffic violations are “surchargeable incidents” that can increase your costs. However, you have the right to appeal these decisions.

If your insurer finds you more than 50% at fault for an accident, you have 30 days to file an appeal with the Board of Appeal for a $50 fee. If you win, any surcharge paid will be refunded. Similarly, you can contest traffic citations in court. A successful appeal prevents the violation from affecting your insurance rates. This appeal process is a crucial consumer right. Learn more about protecting your assets on our home insurance page.

Frequently Asked Questions about MA Vehicle Insurance

Here are answers to some of the most common questions we hear about MA vehicle insurance.

Does insurance follow the car or the driver in Massachusetts?

In Massachusetts, MA vehicle insurance primarily follows the vehicle. If you lend your car to a friend and they have an accident, your insurance policy is the primary source of coverage. This is why it’s crucial to list all regular operators of your vehicle on your policy. Failure to do so could lead to a denied claim.

What happens if I’m caught driving without insurance in Massachusetts?

Driving uninsured in Massachusetts is a serious offense. Penalties for a first offense include fines from $500 to $5,000, up to one year in jail, and a mandatory 60-day license suspension. A coverage lapse also makes it harder and more expensive to get insurance in the future, potentially forcing you into the higher-cost Massachusetts Auto Insurance Plan (MAIP).

Is Massachusetts a “no-fault” state?

Yes, Massachusetts is a “no-fault” state, which applies to the Personal Injury Protection (PIP) part of your policy. This means your own PIP coverage pays for your first $8,000 in medical expenses and lost wages after an accident, regardless of who was at fault. This system ensures you get prompt medical care without waiting for a fault determination. For severe injuries, you can still pursue a claim against the at-fault driver for damages beyond what PIP covers.

Your Trusted Partner for Massachusetts Auto Insurance

This guide has covered the essentials of MA vehicle insurance, from mandatory requirements to optional protections that safeguard your assets. Mandatory coverage keeps you legal, but optional coverage keeps you truly protected. State minimums are just a starting point; your driving record, vehicle, and smart choices about limits and discounts all shape your policy.

At Stanton Insurance Agency, we’ve guided Massachusetts drivers since 1999. As a local agency and Certified Insurance Counselor, I know that insurance isn’t one-size-fits-all. Your needs are unique, whether you’re adding a teen driver, commuting into Boston, or insuring a new vehicle.

We take the time to understand your situation, explain options in plain English, and find the right coverage by working with multiple carriers. You’re not just a policy number to us; you’re our neighbor. We’re here to help you steer everything from your first policy to filing a claim.

Ready to build a policy that provides real protection, not just a piece of paper for the RMV? Let’s talk about your MA vehicle insurance needs.