MA Homeowner Insurance: 6 Key Protections

Why MA Homeowner Insurance is Essential for Bay State Homeowners

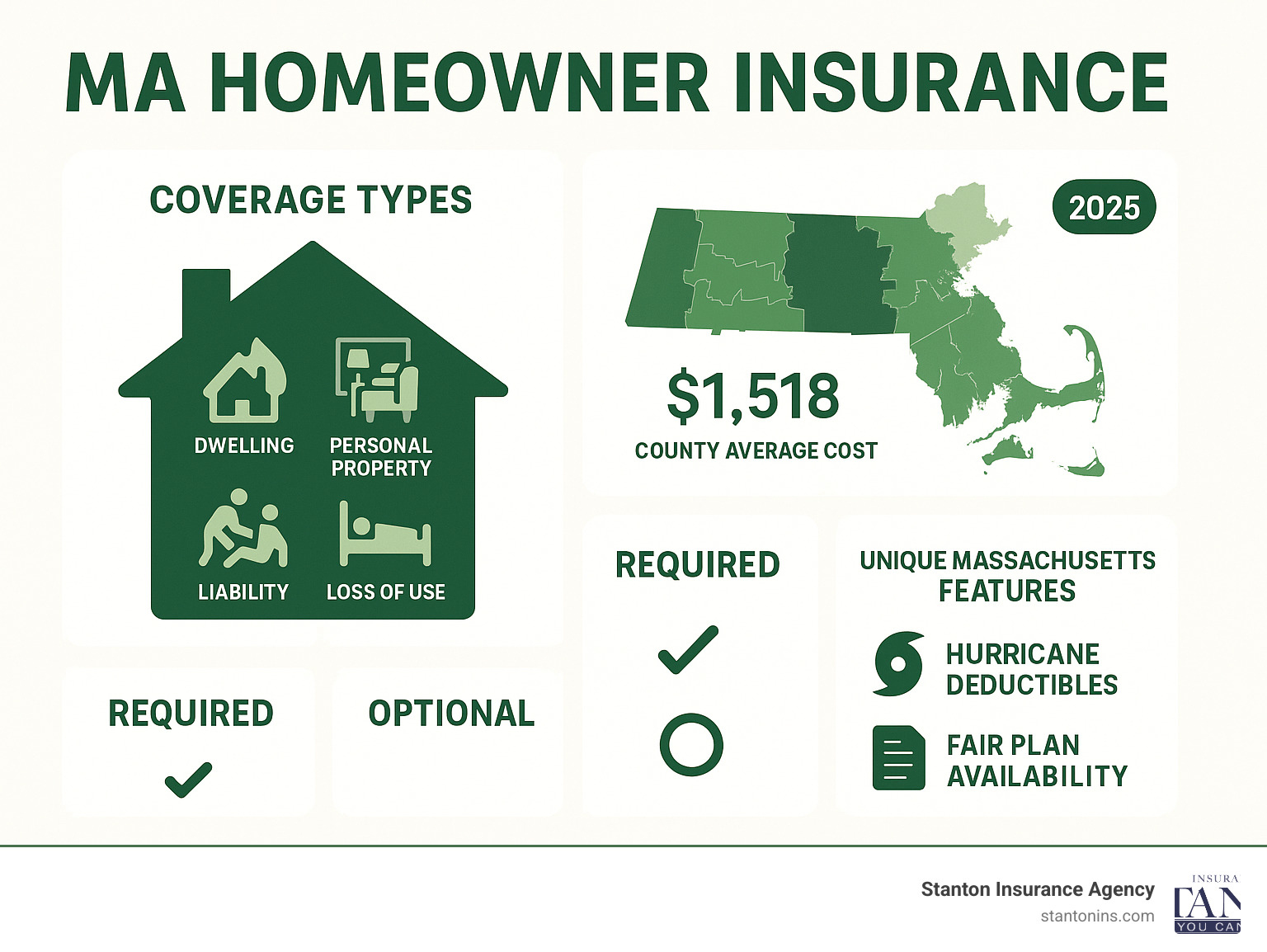

MA Homeowner Insurance provides crucial financial protection for your home and belongings against unexpected events like fires, storms, and liability claims. In Massachusetts, where coastal storms and harsh winters pose unique risks, having proper coverage isn’t just smart—it’s essential for protecting your most valuable asset.

Key MA Homeowner Insurance Essentials:

- Average Cost: $1,518 annually for $300,000 dwelling coverage

- Required Coverage: Dwelling, personal property, liability, and additional living expenses

- Unique Features: Hurricane deductibles (1-5% of dwelling coverage) and FAIR Plan availability

- Legal Requirement: Not mandated by state law, but required by mortgage lenders

- Special Considerations: Flood insurance sold separately, wind/storm coverage varies by location

Massachusetts homeowners face specific challenges that make insurance particularly important. The state’s coastal location means exposure to hurricanes and nor’easters, while inland areas deal with ice storms and heavy snow loads. Property values are higher than the national average, and 25% of homeowners recently reported fewer insurance options available to them.

Your policy typically includes six main coverage areas: dwelling protection for your home’s structure, coverage for detached structures like garages, personal property protection for your belongings, additional living expenses if you’re displaced, personal liability coverage, and medical payments for injured guests. Understanding these components helps ensure you’re properly protected.

I’m Geoff Stanton, a 4th generation owner of Stanton Insurance Agency and Certified Insurance Counselor with over 20 years of experience helping Massachusetts families steer MA Homeowner Insurance decisions. My expertise in Commercial Property & Liability and personal lines insurance helps homeowners find the right coverage to protect their homes, families, and financial security.

Deconstructing Your Policy: What MA Homeowner Insurance Covers

A Massachusetts homeowners policy (usually an HO-3 form) is really six smaller coverages bundled together. Knowing what each part does helps you spot gaps before a claim, not after.

Core Coverage Components

- Dwelling (Coverage A) – Pays to rebuild the structure of your home at today’s construction costs after a covered peril like fire, wind or hail. This isn’t your home’s market value; it’s the cost of labor and materials to make you whole again, which is crucial given fluctuating building costs.

- Other Structures (Coverage B) – Detached garage, shed, fence, pool, etc. The standard limit is 10% of Coverage A, but if you have a large, custom-built garage or an elaborate pool house, you should consider increasing this limit.

- Personal Property (Coverage C) – Furniture, electronics, clothes and everything else that isn’t bolted down. This is typically 50–70% of Coverage A. An updated home inventory is vital to keep this accurate. Be aware that standard policies have sub-limits for items like jewelry, cash, and firearms, so high-value items may need extra coverage.

- Loss of Use (Coverage D) – Covers hotel bills, restaurant meals, laundry services, pet boarding, and other extra costs if you can’t live at home after a covered loss. It’s designed to maintain your normal standard of living while your home is being repaired.

- Personal Liability (Coverage E) – Legal defense and judgments if you’re sued for injuries or property damage. Most clients choose at least $300,000, but with the potential for high legal awards, many opt for $500,000 or more.

- Medical Payments (Coverage F) – $1,000–$5,000 for minor injuries to guests, paid without having to prove fault. This can be a goodwill gesture to prevent a small accident from becoming a large lawsuit.

Actual Cash Value vs. Replacement Cost

| Feature | Actual Cash Value (ACV) | Replacement Cost (RCV) |

|---|---|---|

| Definition | Pays today’s value minus depreciation | Pays the full cost to replace with new, like-kind materials |

| 10-yr-old roof example | $20,000 roof − 10 yrs wear ≈ $10,000 payout | Full $20,000 payout |

| Best for | Lower premiums, higher out-of-pocket risk | Maximum protection, minimal surprise costs |

Most MA insurers automatically give RCV on the dwelling, but personal property is ACV unless you add the RCV endorsement. This is one of the most important and affordable upgrades you can make to your policy.

Must-Have Endorsements in Massachusetts

- Water Backup & Sump Overflow – Covers basement damage from backed-up sewers or failed sump pumps. With aging municipal infrastructure and intense rainstorms, this is a frequent and costly claim that is normally excluded.

- Flood Insurance – Standard policies never cover flood; buy through the NFIP or a private carrier. Even if you’re not in a high-risk zone, 25% of all flood claims occur in low-to-moderate risk areas.

- Scheduled Personal Property – Extra limits and broader, “all-risk” protection for jewelry, art, collectibles and similar high-value items, often with no deductible.

- Personal Umbrella – Adds $1 million or more in liability protection that sits on top of both home and auto policies. It also covers claims not included in standard policies, such as libel, slander, and false arrest.

Adding the right riders turns a good policy into great protection without breaking the bank.

Decoding the Cost of Your MA Homeowner Insurance

Navigating Unique Massachusetts Insurance Scenarios

Hurricane & Windstorm Deductibles

Many MA policies, especially in coastal counties, carry a separate 1–5% hurricane or windstorm deductible. This deductible is triggered when damage is caused by a “named storm” as declared by the National Weather Service or National Hurricane Center. For a home insured for $400,000, a 2% deductible means you are responsible for the first $8,000 of damage from that storm, which is significantly higher than a standard $1,000 flat deductible. It’s crucial to know your specific percentage and how it’s triggered before a storm is on the horizon.

The Massachusetts FAIR Plan (MPIUA)

If private insurers decline coverage—often for high-risk coastal homes or properties with multiple claims—the Massachusetts Property Insurance Underwriting Association, or MPIUA, serves as the insurer of last resort. FAIR Plan policies are often more expensive and provide more limited, “bare-bones” coverage, typically for perils like fire, wind, and vandalism. They often do not include personal liability or theft coverage, requiring you to purchase a separate “wrap-around” policy from a private insurer to fill those gaps. While not ideal, the FAIR Plan ensures you can meet mortgage requirements and protect your property while working to improve its insurability and return to the standard market.

How to Find and Secure the Best Policy

- Size up your needs – Calculate rebuild cost (not market price) and total the value of your belongings.

- Collect 3–5 quotes – Same limits, same deductible, same endorsements; otherwise you’re comparing apples to oranges.

- Check carrier strength & reviews – AM Best ratings and complaint ratios hint at future claims service.

- Lean on an independent agent – We shop multiple carriers at once and explain the fine print. See our tips on how to pick a good homeowners insurance agency.

Legal Requirement?

Massachusetts law doesn’t force you to buy homeowners insurance, but lenders do. Skip it and you’ll end up with costly force-placed coverage—far pricier and less generous than a policy you choose yourself.

Frequently Asked Questions about MA Homeowner Insurance

Which perils are not covered by a standard policy?

Flood, earthquake, sinkhole, war, nuclear hazard, wear & tear, and neglect. Damage from pests (like termites) and mold (unless caused by a covered peril) are also typically excluded. Flood and earthquake require separate policies; the rest are generally considered uninsurable maintenance or catastrophic events.

Does my policy cover damage from snow and ice?

Yes, a standard MA homeowner policy covers damage from the weight of ice and snow. This includes issues like a roof collapse or structural damage. It also typically covers interior water damage from ice dams, which form on the edge of a roof and prevent melting snow from draining properly. However, the policy does not cover the cost of removing snow or ice to prevent a loss from occurring.

How often should I review my policy?

At least once a year with your agent. You should also schedule a review immediately after major life or property changes, such as a major renovation that increases your home’s value, acquiring valuable new possessions (art, jewelry), starting a home-based business, getting a swimming pool or trampoline, or adding new safety and security devices.

What if I can’t find coverage?

Start with an independent agent who can access multiple standard and specialty markets. If every private carrier says no, the MA FAIR Plan guarantees a basic policy so your home never goes uninsured, satisfying your mortgage lender and providing essential protection.

Conclusion: Partnering for Peace of Mind

From hurricane deductibles to flood exclusions, Massachusetts coverage can be tricky. The right policy turns uncertainty into confidence. Stanton Insurance Agency has helped New England families safeguard their homes for four generations. Ready for a second opinion or a brand-new quote? Contact our local team today and find how straightforward truly comprehensive MA Homeowner Insurance can be.