MA Car Insurance: Top 10 Essential Tips for 2025 Success

Why MA Car Insurance is Different from Other States

MA Car Insurance operates under unique no-fault laws that set it apart from most other states. Here’s what every Massachusetts driver needs to know:

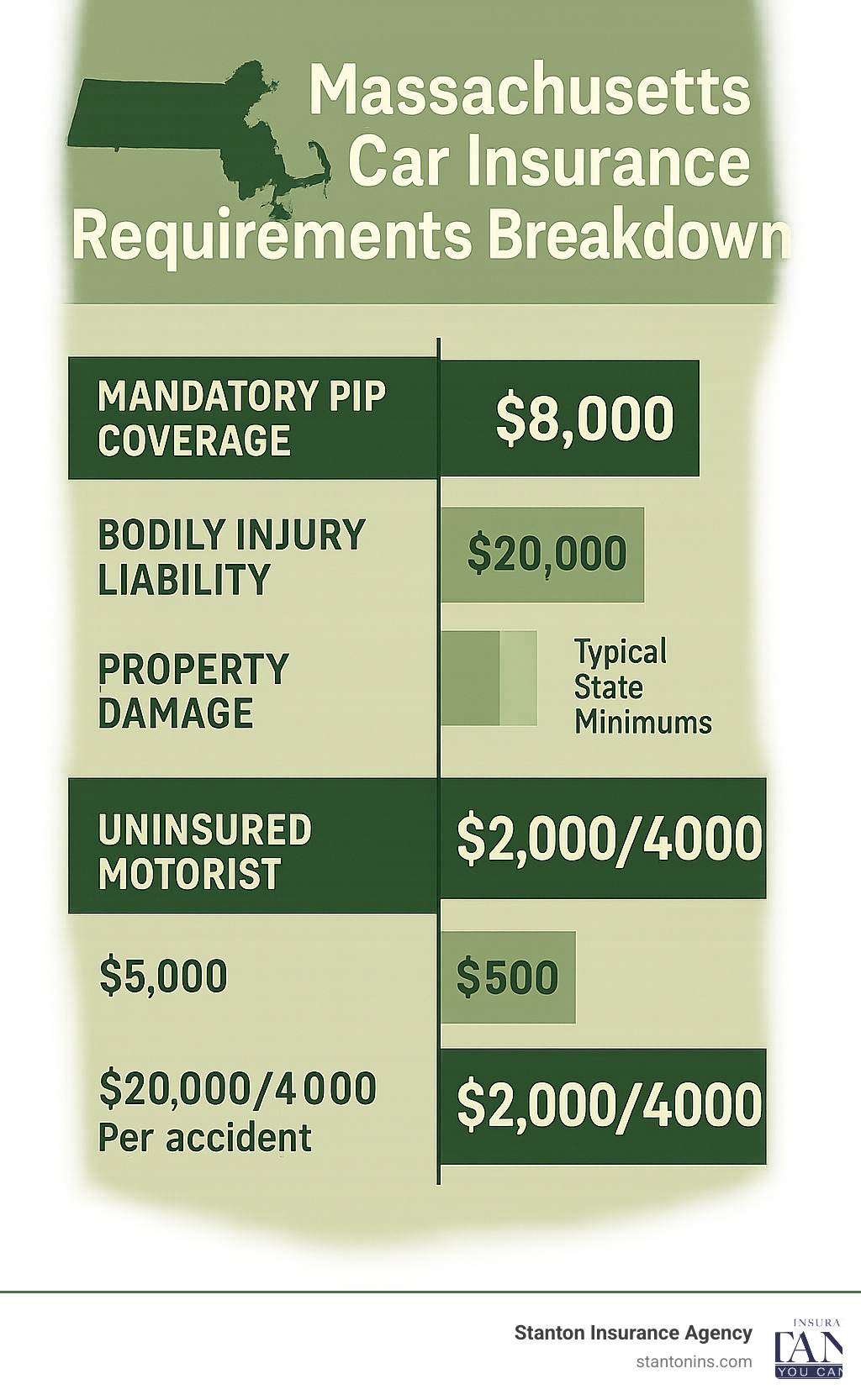

Required Coverage:

- Bodily injury liability: $20,000/$40,000

- Property damage: $5,000

- Personal Injury Protection (PIP): $8,000

- Uninsured motorist: $20,000/$40,000

Key Differences:

- No-fault system means your own insurance pays medical bills regardless of who caused the crash

- Personal Injury Protection is mandatory (covers 75% of lost wages)

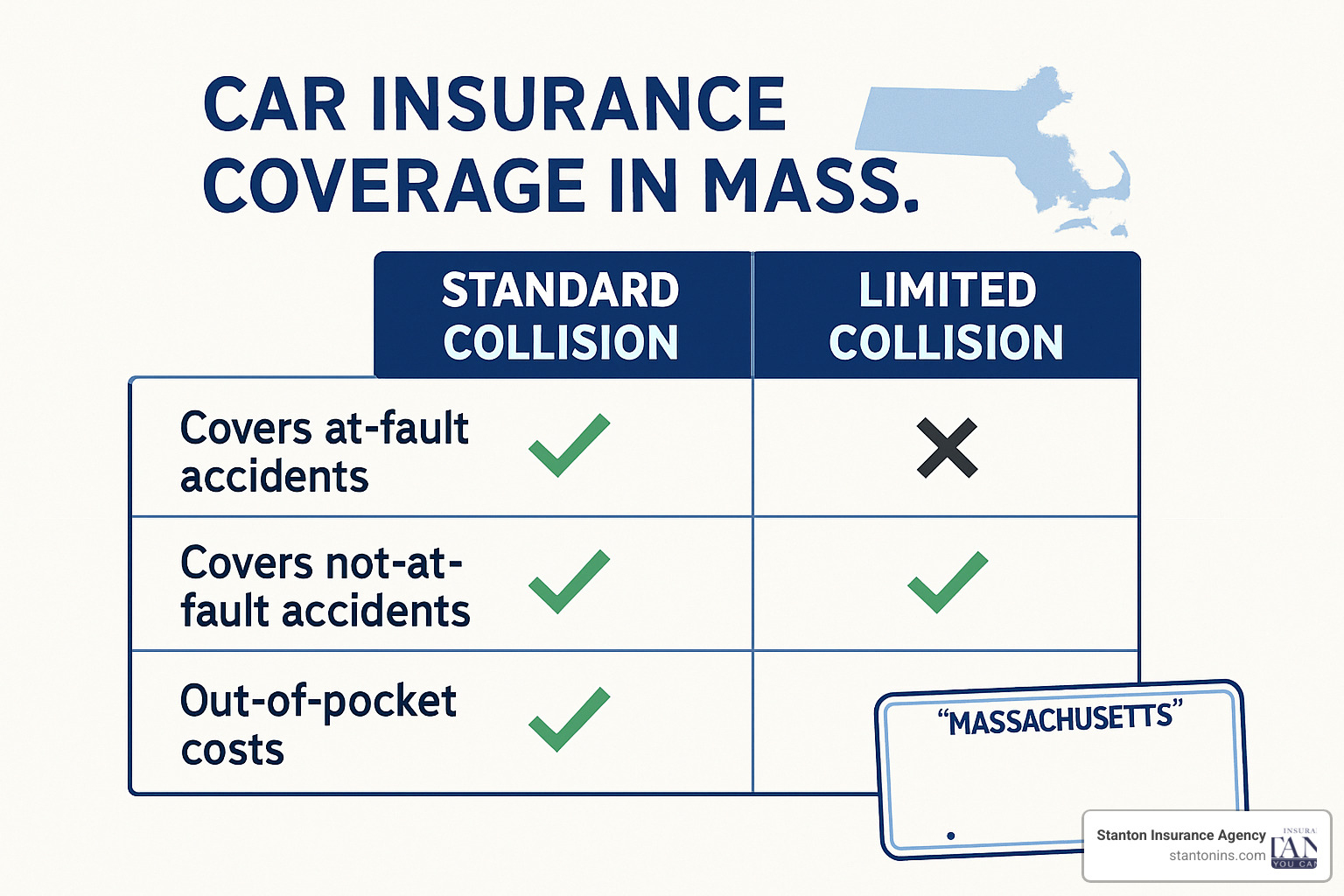

- Choice between standard collision and limited collision coverage

- Strict penalties for driving uninsured (60-day license suspension minimum)

Massachusetts drivers pay an average of $1,346 per year for car insurance – about 12% below the national average despite comprehensive coverage requirements. The state’s no-fault system and mandatory PIP coverage create both benefits and complexities that every driver should understand.

Whether you’re a new resident, adding a teen driver, or shopping for better rates, navigating Massachusetts insurance laws requires local expertise. The state prohibits using credit scores or gender in rate calculations and operates a special insurance plan for high-risk drivers.

I’m Geoff Stanton, a fourth-generation insurance professional and Certified Insurance Counselor who’s spent over two decades helping Massachusetts families protect their assets. Having grown up in Waltham and worked exclusively with MA Car Insurance requirements since 1999, I’ve guided thousands of Bay State drivers through coverage decisions, claims, and appeals processes.

Essential MA Car Insurance terms:

- does insurance follow the car or driver in massachusetts

- is massachusetts a no fault car insurance state

- what is the minimum car insurance coverage in massachusetts

Understanding MA Car Insurance Requirements

Every car on Massachusetts roads must carry four specific types of coverage – it’s not optional, it’s the law. The Commonwealth takes this seriously because these requirements form the backbone of our no-fault insurance system, designed to protect everyone from drivers to pedestrians.

What makes Massachusetts unique is how we blend traditional liability coverage with mandatory Personal Injury Protection. This creates a safety net ensuring medical bills get paid quickly, regardless of who caused the accident.

But here’s what catches many drivers off guard: MA Car Insurance isn’t just about meeting minimums. The state offers choices that can significantly impact your wallet after an accident – especially the decision between standard and limited collision coverage.

MA Car Insurance Minimum Limits

MA Car Insurance requires more comprehensive coverage than most states:

Bodily injury liability at $20,000 per person and $40,000 per accident covers medical expenses, lost wages, and pain and suffering for people you might injure. This applies to occupants of other vehicles and pedestrians, but doesn’t cover your own injuries – that’s what PIP handles.

Property damage liability of $5,000 per accident pays for damage to other people’s vehicles, guardrails, buildings, and anything else you might hit. Five thousand dollars doesn’t stretch far with today’s vehicle values, so many drivers wisely choose higher limits.

Personal Injury Protection (PIP) at $8,000 per person is where Massachusetts really differs from other states. Your PIP covers your medical expenses regardless of who caused the accident and pays 75% of lost wages up to policy limits. It also covers passengers in your vehicle and pedestrians you might injure.

Uninsured motorist coverage at $20,000 per person and $40,000 per accident protects you when someone without insurance hits you. This also covers hit-and-run accidents where the other driver can’t be identified.

The most confusing part of Massachusetts coverage? The choice between standard collision and limited collision. Limited collision only applies when you’re less than 50% at fault, while standard collision covers you regardless of fault percentage.

For more detailed information about coverage limits, visit our guide on what is the minimum car insurance coverage in massachusetts.

MA Car Insurance Optional Coverages

While Massachusetts mandates solid basic coverage, smart drivers often add extra protections:

Comprehensive coverage protects against everything that isn’t a collision – theft, vandalism, weather damage, and encounters with deer. If you have a car loan or lease, this coverage is typically required.

Standard collision coverage repairs your vehicle after accidents regardless of who’s at fault. It often includes a collision deductible waiver option when you’re less than 50% at fault.

Gap insurance becomes crucial if you owe more on your car than it’s worth. New vehicles depreciate quickly, and gap coverage pays the difference between your loan balance and the car’s actual value if it’s totaled.

Medical payments coverage supplements your PIP coverage for medical expenses, covering you and your passengers regardless of fault.

Accident forgiveness prevents your first at-fault accident from increasing your premium, but you must purchase it before you need it.

What Drives Your Premium in Massachusetts?

Understanding how insurers calculate MA Car Insurance rates helps you make informed decisions and find potential savings. Massachusetts has unique rating regulations that protect consumers from some common pricing factors used in other states.

Prohibited Rating Factors in Massachusetts:

- Credit score (banned since 2008)

- Gender

- Race

- Occupation

- Education level

Allowed Rating Factors:

- Driving history and experience

- Age (with some restrictions)

- Territory where you live and work

- Vehicle type and safety features

- Annual mileage

- Coverage selections

Territory Impact on Rates:

Your location significantly affects premiums. Drivers in Suffolk County (Boston) pay the highest average rates at $940 annually for sedans, while rural areas like the Berkshires typically see lower rates.

Age and Experience Considerations:

- Drivers under 25 pay significantly higher rates

- New drivers face surcharges regardless of age

- Rates typically decrease at ages 25, 30, and 65

- Senior drivers may see increases after age 70

Vehicle Value and Safety Features:

- Newer, more expensive vehicles cost more to insure

- Safety features like anti-lock brakes and airbags can reduce rates

- Anti-theft devices provide discounts

- Hybrid and electric vehicles often qualify for green discounts

For more information about Massachusetts’ no-fault system and how it affects your rates, check out our detailed explanation: Is Massachusetts a No-Fault State?

Discounts Every Bay Stater Should Ask For

Massachusetts insurers offer numerous discounts that can significantly reduce your MA Car Insurance premiums:

Multi-Policy Bundling:

- Combine auto and home insurance for 5-25% savings

- Add renters or umbrella policies for additional discounts

- Bundle multiple vehicles on one policy

Safe Driver Discounts:

- Accident-free records earn substantial savings

- Violation-free periods (3-5 years) provide discounts

- Defensive driving course completion

- Telematics programs that monitor safe driving habits

Vehicle-Based Discounts:

- Anti-theft devices and car alarms

- Anti-lock brakes and electronic stability control

- Hybrid and electric vehicle discounts

- Low annual mileage (under 7,500 miles)

Student and Family Discounts:

- Good student discounts for full-time students with B+ averages

- Student away at school (over 100 miles) discounts

- Multi-generational household discounts

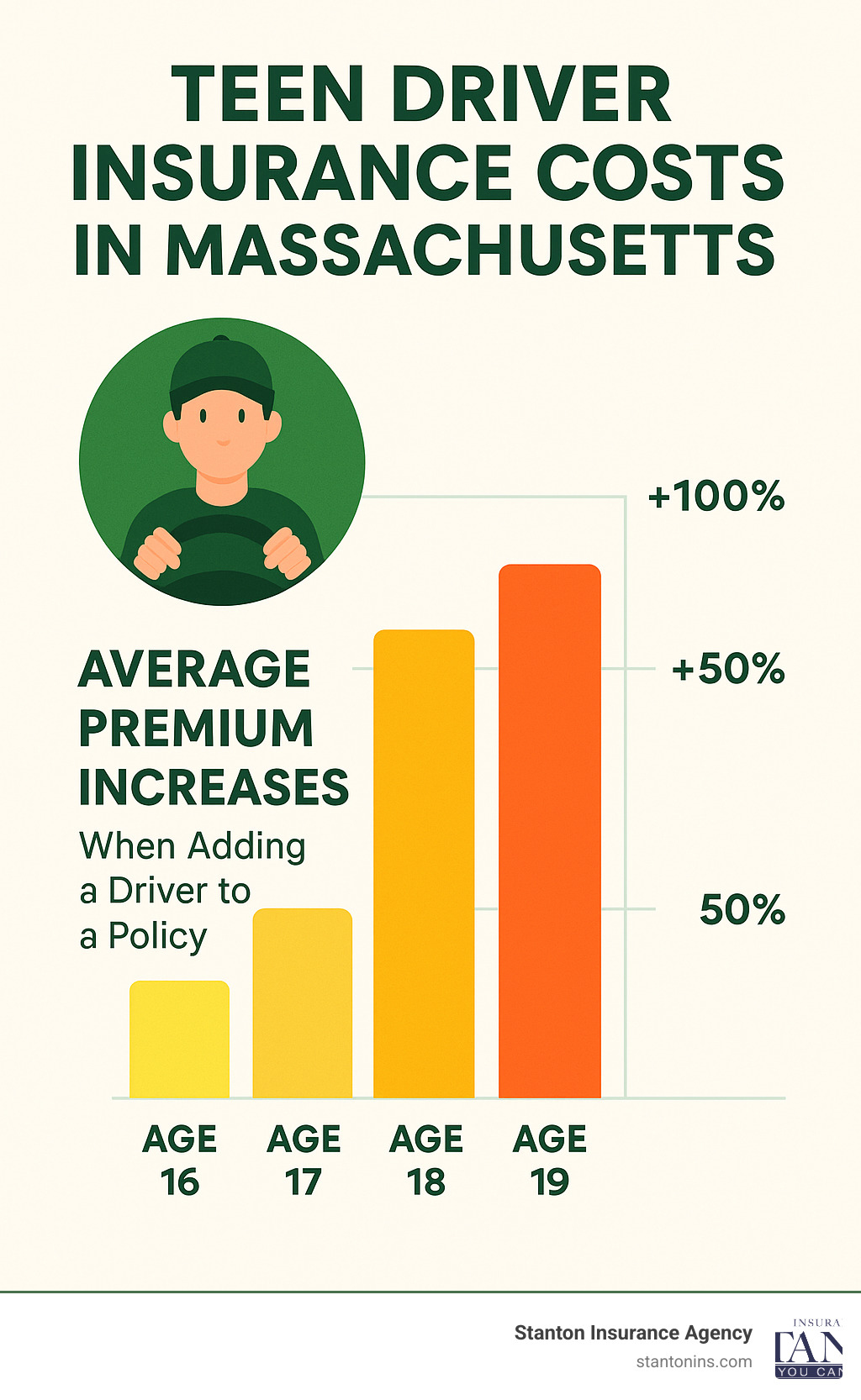

Special Considerations for Teen Drivers

Massachusetts has a comprehensive Graduated Driver’s License (GDL) system that affects both licensing and insurance costs for young drivers.

GDL Requirements:

- Learner’s Permit (Age 16): 40 hours of supervised driving required

- Junior Operator’s License (Age 16.5): Night driving restrictions (12:30 AM – 5:00 AM), passenger restrictions for first 6 months

- Unrestricted License (Age 18): Full driving privileges

Insurance Implications for Teen Drivers:

- Expect significant premium increases when adding a teen driver

- Good student discounts can offset some costs

- Driver training course completion may provide discounts

- Consider keeping teens on older, safer vehicles

Junior Operator Surcharges:

Massachusetts applies additional surcharges to drivers under 21, regardless of their driving record. These surcharges gradually decrease as young drivers gain experience.

Buying & Keeping the Right Coverage

Finding the right MA Car Insurance doesn’t have to feel overwhelming. Think of it like shopping for any major purchase – you want quality coverage at a fair price from a company that’ll be there when you need them most.

The biggest mistake I see Massachusetts drivers make? Getting caught up in price alone. Saving money matters, but the cheapest policy often leaves gaps that cost thousands when you actually need coverage. Instead, focus on comparing identical coverage levels across multiple insurers while considering their reputation for handling claims.

Start by gathering quotes from at least three different insurance companies. Make sure you’re comparing apples to apples – same coverage limits, same deductibles, same optional coverages. Ask each insurer about every discount you might qualify for.

Your driving record and claims history will heavily influence your quotes, but so will factors like your vehicle’s safety features, where you park it overnight, and how many miles you drive annually. Be honest about these details – fudging information can backfire if you need to file a claim.

Review your coverage annually, especially after major life changes like moving, getting married, or adding a teen driver.

Step-by-Step: Registering and Insuring a Car in MA

Whether you’re new to Massachusetts or just bought a vehicle, the registration process has specific timing requirements.

New residents have 30 days to get both a Massachusetts driver’s license and register their vehicle. Don’t wait – you’ll need Massachusetts insurance that meets state requirements before you can register. Your out-of-state coverage probably won’t meet our MA Car Insurance requirements, particularly the mandatory Personal Injury Protection.

Buying a new vehicle from a dealer? Many Massachusetts dealers now offer electronic registration services, handling both insurance verification and registration simultaneously.

Private purchases require more legwork. You must have insurance in place before taking possession of the vehicle, then register it within seven days.

The paperwork is straightforward. You’ll need the RMV-1 form from your insurance company (this proves you have required coverage), the vehicle title or manufacturer’s certificate, your valid driver’s license, and proof of Massachusetts residency. Registration costs $60 for two years for passenger vehicles.

Don’t forget the excise tax – this is paid to your city or town, not the RMV. You’ll also need to get your vehicle inspected within seven days of registration.

For complete forms and current requirements, visit the Massachusetts Registry of Motor Vehicles website.

High-Risk? How the Massachusetts Auto Insurance Plan Works

Nobody plans to become a high-risk driver, but life happens. The good news? Massachusetts ensures everyone can get required coverage through the Massachusetts Auto Insurance Plan (MAIP).

MAIP acts as the insurance market of last resort. If you’ve been declined by at least two private insurance companies, or if the quotes you’re getting are significantly higher than MAIP rates, you may be eligible for assignment through this state program.

Here’s how it works: eligible drivers get assigned to insurance companies through a rotating system. The assigned company must provide coverage at regulated rates that are often more reasonable than what high-risk drivers face in the voluntary market.

The assignment isn’t permanent. New drivers with no insurance history often start in MAIP simply because private insurers view them as unknown quantities. Once you establish a clean driving record, you can shop the voluntary market for potentially better rates.

Getting out of MAIP requires patience and good driving habits. Maintain a clean record, consider taking a defensive driving course, and shop the voluntary market annually.

What to Do After an Accident & Manage Surcharges

Nobody expects to be in a car accident, but when it happens in Massachusetts, knowing what to do can make all the difference. The Commonwealth’s no-fault system creates a unique claims process that protects you while ensuring everyone gets the medical care they need quickly.

Massachusetts requires accident reporting for any crash involving injury, death, or property damage over $1,000. You have five days to report to the RMV, and police reports are mandatory when injuries occur. The good news? Your MA Car Insurance Personal Injury Protection coverage kicks in immediately to cover medical expenses, regardless of who caused the accident.

Understanding fault determination becomes crucial because it affects your future rates. Massachusetts uses comparative negligence, meaning you can be partially at fault and still recover damages. For example, if you’re found 30% at fault, you can still collect 70% of your damages from the other driver’s insurance.

The state’s Merit Rating Board handles surcharge appeals, giving you a fair chance to contest fault determinations you believe are incorrect. This appeals process has helped thousands of Massachusetts drivers avoid unfair rate increases over the years.

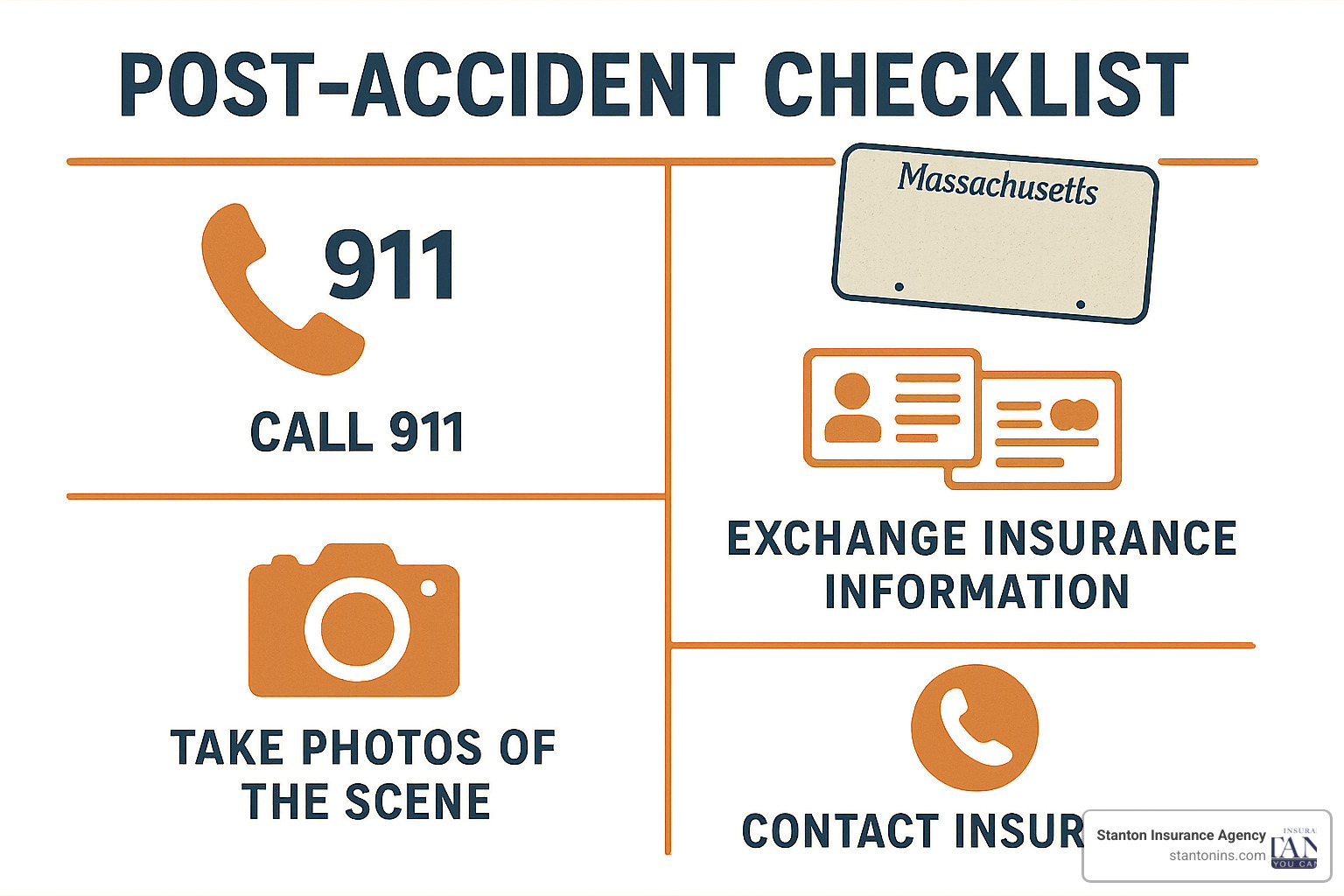

Immediate Post-Crash Checklist

The moments after an accident feel overwhelming, but following a simple checklist helps protect both your safety and your insurance interests.

Safety comes first every time. Move your vehicle out of traffic if possible, turn on hazard lights, and check everyone for injuries. Call 911 immediately if anyone appears hurt – even minor injuries can become serious problems later. Massachusetts law requires police reports for injury accidents, so don’t skip this step.

Documentation makes or breaks your claim. Take photos of all vehicle damage, license plates, street signs, and the overall accident scene. Get the other driver’s insurance information, license number, and contact details. If witnesses stop to help, collect their information too – their statements can be invaluable if fault becomes disputed.

Call your insurance company right away, even if the accident seems minor. Massachusetts insurers have 24-hour claim reporting hotlines, and prompt reporting helps ensure faster claim processing. Stick to the facts when describing what happened, avoid admitting fault, and ask about rental car coverage if your vehicle isn’t safe to drive.

Follow-up actions protect your long-term interests. Seek medical attention for any injuries, even if they seem minor – adrenaline can mask pain and symptoms. Keep detailed records of all accident-related expenses, from medical bills to lost wages. Never sign documents except for police or your own insurance company, and contact your agent if questions arise during the claims process.

Appealing a Surcharge or Claim Decision

Massachusetts gives you real power to fight unfair insurance decisions. The state’s appeals process isn’t just bureaucratic window dressing – it’s a legitimate way to protect yourself from incorrect fault determinations and unfair surcharges.

Surcharge appeals go through the Merit Rating Board, and you have 30 days from receiving your surcharge notice to file. The $50 filing fee is refunded if you win your appeal. You can present evidence that you weren’t at fault, that the accident didn’t occur as described, or that mitigating circumstances apply. Most hearings happen by phone, making the process convenient for working people.

Claim decision appeals start with your insurance company’s internal process. Work with your insurer first – many disputes get resolved at this level. If that doesn’t work, contact the Division of Insurance Consumer Service Unit at 617-521-7794. They handle complaints about unfair claim handling and can intervene on your behalf.

Fault determinations in Massachusetts follow specific standards that create predictable outcomes. Rear-end collisions typically result in the following driver being found at fault, left-turn accidents usually blame the turning driver, and backing accidents generally fault the driver in reverse. However, these are presumptions, not absolute rules – strong evidence can overcome them.

The appeals process works because Massachusetts takes consumer protection seriously. Insurance companies know their decisions face scrutiny, which encourages fair claim handling from the start. If you believe you’ve been treated unfairly, don’t hesitate to use these appeals processes.

For detailed information about the appeals process and your rights, visit the Basics of Auto Insurance appeals page on the state’s website.

Frequently Asked Questions about MA Car Insurance

When it comes to MA Car Insurance, I hear the same questions from Bay State drivers almost every day. After two decades of helping Massachusetts families steer their coverage options, these three questions top the list. Let me give you the straight answers you need.

How much does car insurance cost in Massachusetts?

The good news? MA Car Insurance costs less than you might expect, especially considering our comprehensive coverage requirements. Massachusetts drivers pay an average of $1,346 per year – that’s actually 12% below the national average despite having some of the most robust protection in the country.

But here’s what really matters: your actual cost depends on several key factors. Young drivers under 25 face the steepest rates, often paying over $3,000 annually due to inexperience and state surcharges. Once you hit 25, rates typically drop significantly, with most drivers aged 25-65 paying between $1,200-$2,000 per year for good coverage.

Location makes a huge difference in Massachusetts. If you’re parking in downtown Boston (Suffolk County), expect to pay top dollar – around $940 annually just for basic sedan coverage. But drive out to the Berkshires or other rural areas, and those same coverage levels cost considerably less.

The coverage level you choose dramatically impacts your premium. State minimum coverage starts around $38 per month, but I rarely recommend stopping there. Full coverage with reasonable limits averages about $134 monthly – a small price for protecting your assets and avoiding financial disaster.

Your driving record remains the biggest factor you can control. Clean records earn substantial discounts, while violations and accidents can double or triple your rates. That’s why I always tell clients: the best insurance investment you can make is keeping your record spotless.

Does insurance follow the car or the driver in MA?

This question trips up a lot of people, especially when lending cars to family members. In Massachusetts, insurance follows the car, not the driver. This means your policy covers anyone driving your vehicle with your permission.

When you let your college-age daughter borrow your car for the weekend, your insurance provides primary coverage if she has an accident. Her own policy (if she has one) might kick in as secondary coverage if your limits aren’t sufficient, but your policy handles the claim first.

The flip side works the same way. When you drive your friend’s car to help them move, their insurance covers you primarily. Your policy might provide backup coverage, but you’re essentially borrowing their protection along with their vehicle.

Important exceptions can leave you exposed, though. If someone is specifically excluded from your policy, they won’t be covered driving your car. Unlicensed drivers face limited or no coverage. And if someone uses your personal vehicle for business purposes, your policy might not respond.

This system actually protects everyone involved by ensuring injured parties have access to compensation. But it also means your insurance rates could be affected by claims involving other drivers using your car. That’s why I always advise clients to be thoughtful about who they allow behind the wheel.

What happens if you drive without insurance in the Commonwealth?

Massachusetts doesn’t mess around with uninsured drivers. The penalties start harsh and get worse quickly. First-time offenders face a $500-$5,000 fine plus a minimum 60-day license suspension and registration suspension. That means you can’t legally drive, and your car can’t legally be on the road.

Repeat offenders face escalating consequences: fines increase substantially, suspensions can last up to a year, and judges can impose jail time for multiple violations. The state also requires SR-22 filings for future insurance, which marks you as high-risk and drives up rates for years.

But the legal penalties are just the beginning. Driving without insurance exposes you to unlimited financial liability. A serious accident could result in hundreds of thousands of dollars in medical bills, property damage, and legal judgments that you’d be personally responsible for paying. I’ve seen uninsured drivers lose their homes and face wage garnishment for decades after a single accident.

Getting back on the road requires paying all fines and fees, obtaining proper insurance coverage, filing required paperwork with the RMV, and paying reinstatement fees. The whole process typically costs more than a year of insurance premiums – and that’s before considering the long-term impact on your rates.

The bottom line: MA Car Insurance isn’t optional in Massachusetts. It’s a legal requirement and financial necessity that protects both you and everyone else sharing the road.

Conclusion

Mastering MA Car Insurance doesn’t have to feel overwhelming. Yes, Massachusetts has unique requirements that set it apart from other states, but these rules exist for good reason – they create a safety net that protects everyone on our roads, from busy Boston commuters to families driving through the Berkshires on weekend getaways.

The beauty of Massachusetts’ no-fault system is that it takes the guesswork out of getting medical care after an accident. Your Personal Injury Protection kicks in immediately, covering medical bills and lost wages without waiting for fault determination. That peace of mind is worth understanding and protecting.

Smart Massachusetts drivers know that minimum coverage is just the starting point. While the state requires $20,000/$40,000 in bodily injury coverage, today’s medical costs and vehicle values often exceed these limits. The extra few dollars monthly for higher coverage limits could save you thousands if the unexpected happens.

Here’s what I’ve learned after helping thousands of Bay State families with their insurance needs: the best policy is one you understand completely. Whether you’re dealing with a teen driver’s first policy, comparing collision options, or appealing a surcharge, knowledge gives you confidence to make the right choices.

The financial protection goes beyond just meeting legal requirements. When you’re properly insured, you’re protecting your home, your savings, and your family’s future. A single serious accident without adequate coverage can derail years of careful financial planning.

At Stanton Insurance Agency, we’ve built our reputation on making complex insurance simple for Massachusetts families. We know which discounts you might be missing, how to steer the claims process smoothly, and when it makes sense to appeal a surcharge. More importantly, we’re here when you need us most – whether that’s at 2 AM after a fender-bender or when you’re adding your teenager to your policy.

Every Massachusetts driver deserves coverage that fits their life and budget. That might mean basic coverage for an older vehicle or comprehensive protection for a growing family. The key is working with someone who understands both the regulations and your personal situation.

Ready to make sure your MA Car Insurance is working as hard as you are? Our comprehensive guide at Car Insurance in MA covers everything from shopping tips to claims advice. Better yet, give us a call – we’re your neighbors in this business, and we genuinely care about getting you the right protection at the right price.

Good insurance isn’t an expense – it’s an investment in your peace of mind and your family’s security. Let’s make sure you have both.