How much does liability only car insurance cost: 2025 Savings

Why Liability-Only Car Insurance Costs Matter for Your Budget

How much does liability only car insurance cost is one of the most common questions drivers ask when looking to reduce their insurance expenses. The answer depends on several factors, but here’s what you need to know:

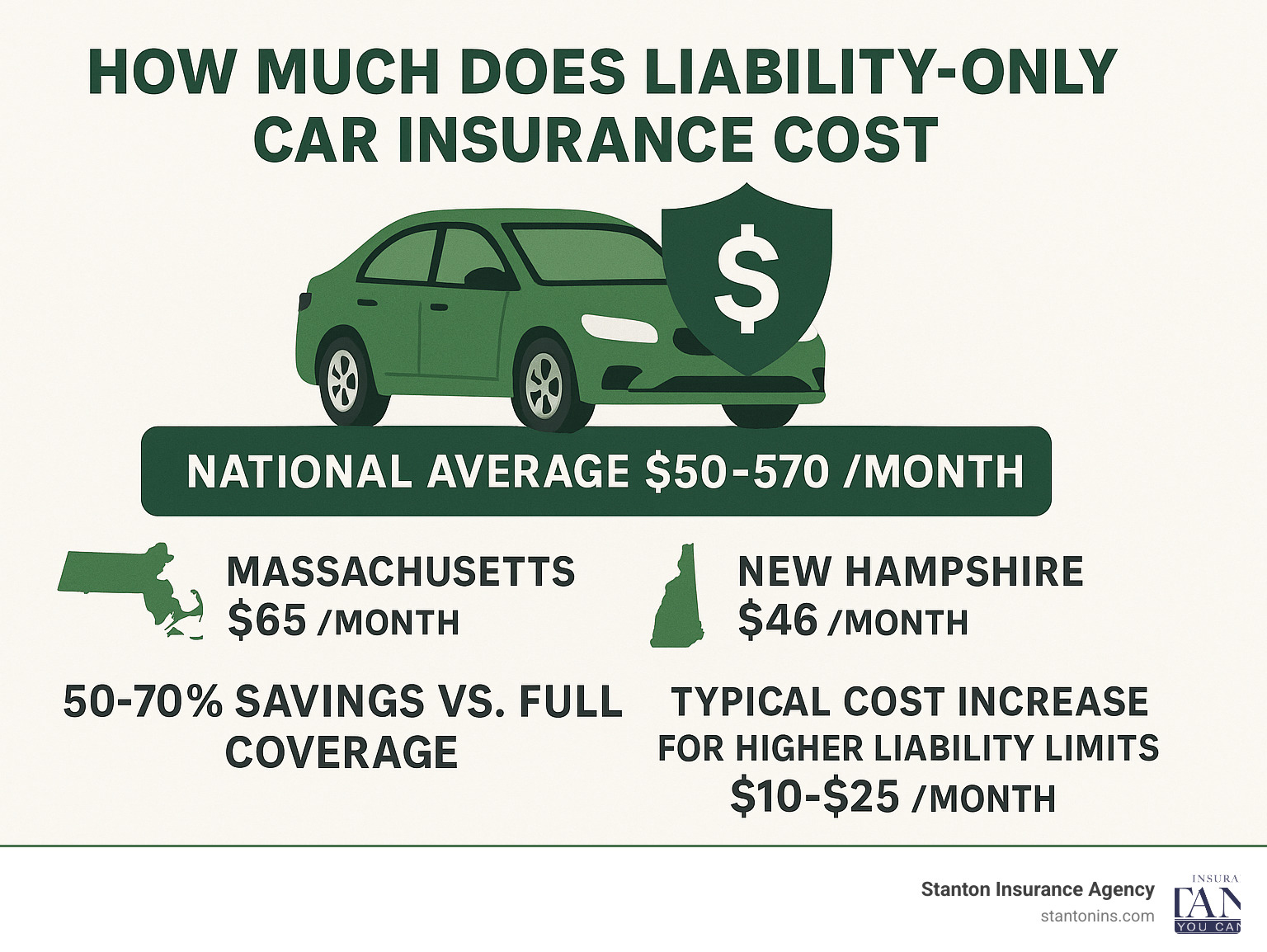

Quick Cost Overview:

- National average: $50-$70 per month

- Massachusetts average: Around $65 per month

- New Hampshire average: Around $46 per month

- Savings vs. full coverage: 50-70% less expensive

- Cost increase for higher limits: Often just $10-25 more per month

Liability-only insurance represents the most affordable way to meet legal driving requirements, but understanding its true cost means looking beyond the monthly premium. As one insurance professional noted, “The cost to increase your liability coverage is small in most cases, and most coverage options cost a similar price to one another.”

This type of coverage protects others when you’re at fault in an accident, covering their medical bills and property damage – but it won’t pay a penny toward fixing your own vehicle. For drivers with older, paid-off cars, this trade-off can result in significant savings. However, choosing inadequate coverage limits to save a few dollars can expose you to devastating financial risk.

I’m Geoff Stanton, President of Stanton Insurance Agency in Waltham, Massachusetts, and I’ve spent over two decades helping drivers steer questions about how much does liability only car insurance cost and whether it’s the right choice for their situation. Through my experience in both claims and coverage counseling, I’ve seen how the right liability limits can protect families from financial hardship, while inadequate coverage can lead to serious consequences.

Understanding Liability-Only Car Insurance

When you’re wondering how much does liability only car insurance cost, it helps to first understand what you’re actually buying. Think of liability-only insurance as your financial shield when things go wrong on the road – but here’s the catch: it only protects everyone else, not you.

This most basic form of auto insurance is required to legally drive in most states, and it’s designed with one clear purpose in mind. If you cause an accident, liability coverage steps in to handle the financial fallout for the other party. Your own vehicle damage and medical bills? You’re on your own.

This fundamental difference between protecting others versus protecting yourself is exactly why liability-only policies cost so much less than full coverage. When an insurance company doesn’t have to worry about fixing your car after an accident, they can offer much lower premiums.

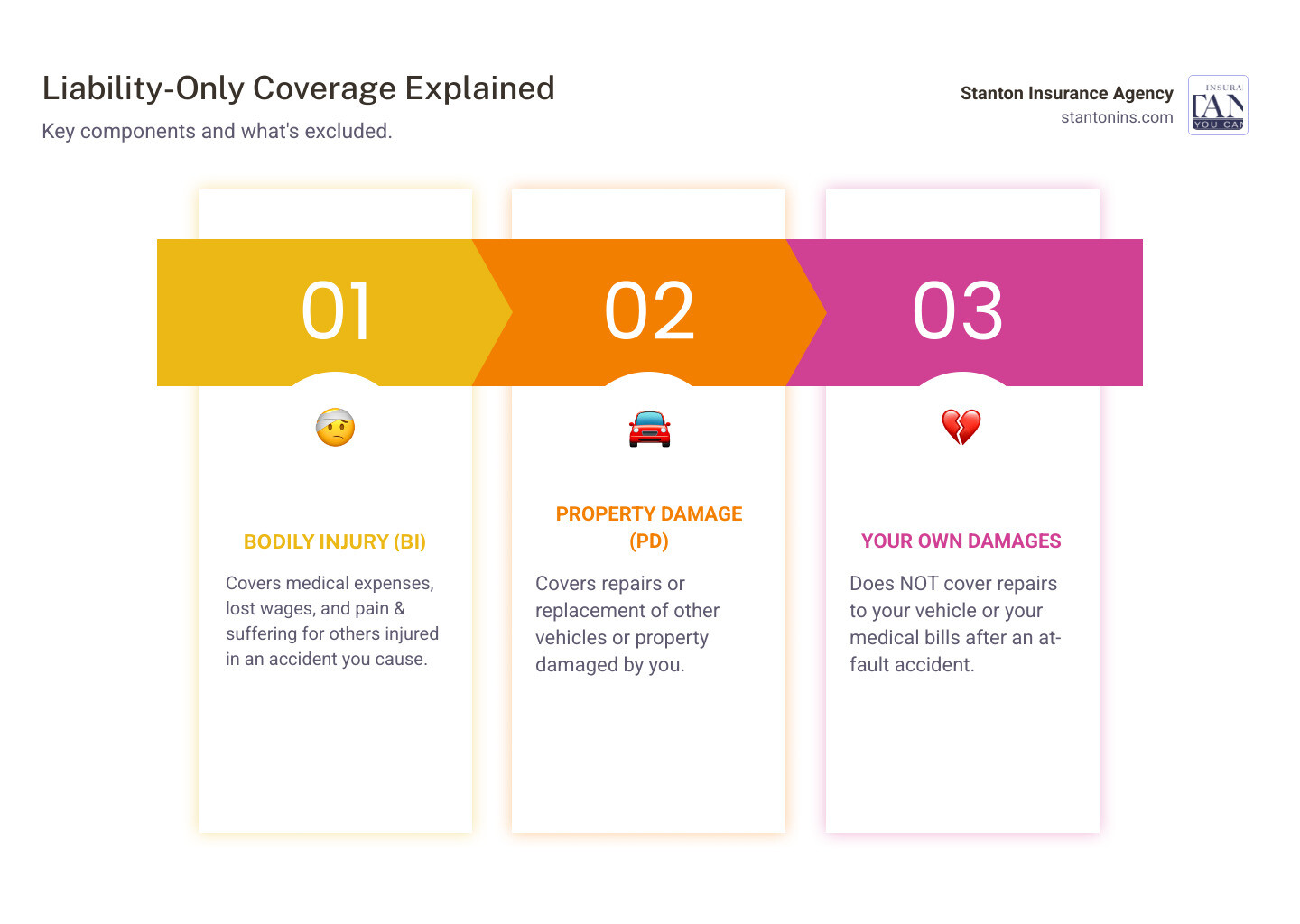

What Does Liability-Only Car Insurance Cover?

Liability coverage has two main jobs, and it takes both seriously. Bodily Injury Liability handles the human cost when you’re at fault in an accident. This means medical bills for the other driver and passengers, their lost wages while they recover, and even pain and suffering compensation if the situation warrants it.

The second component, Property Damage Liability, takes care of everything else you might accidentally damage. Most people think of car repairs, but this coverage goes further. Hit a fence? Knock over a mailbox? Slide into someone’s garage door? Property damage liability has you covered.

Here’s something many drivers don’t realize: your liability coverage also includes legal defense costs. If someone decides to sue you after an accident, your insurance company will handle the legal fees. This protection alone can be worth thousands of dollars, making even basic liability coverage a smart financial decision.

What’s particularly valuable is how liability insurance handles third-party expenses – all those costs that come from someone else’s claim against you. Without this coverage, a single serious accident could wipe out your savings and put your future earnings at risk.

For a deeper dive into how this essential coverage works, check out our comprehensive guide on what liability car insurance is.

State Minimum Requirements in Massachusetts & New Hampshire

Here’s where things get interesting for local drivers. Massachusetts requires insurance to register your car, while New Hampshire takes a “prove you can pay” approach instead. Both states set minimum coverage levels, but these legal requirements often fall short of providing adequate protection in serious accidents.

In Massachusetts, you’ll need $20,000 per person and $40,000 per accident for bodily injury liability, plus $5,000 for property damage. The state also requires $8,000 in Personal Injury Protection and $20,000/$40,000 in Uninsured Motorist coverage.

New Hampshire sets slightly higher minimums: $25,000 per person and $50,000 per accident for bodily injury, $25,000 for property damage, $1,000 in Medical Payments coverage, and $25,000/$50,000 in Uninsured Motorist protection.

The reality is that these state minimums often provide insufficient protection when accidents involve serious injuries or expensive vehicles. A single trip to the emergency room can easily exceed $20,000, and luxury cars or commercial vehicles can cost far more than $5,000 to repair.

New Hampshire’s unique approach doesn’t require insurance upfront, but mandates financial responsibility after an accident occurs. For most drivers, carrying insurance is the wisest and most practical choice to meet this requirement.

If you’re registering a car in Massachusetts, understanding these requirements is crucial. Our detailed guide Do You Need Insurance to Register a Car in Massachusetts? walks you through the process, while our Massachusetts Car Insurance Guide 2025 gives you the complete picture of your coverage options.

How Much Does Liability-Only Car Insurance Cost in Massachusetts and New Hampshire?

When drivers ask how much does liability only car insurance cost, the answer isn’t straightforward. While the U.S. average is $50 to $70 per month, your actual premium in Massachusetts or New Hampshire will depend on your unique situation.

In our local market, New Hampshire drivers typically see liability-only premiums around $46 per month, while Massachusetts residents average closer to $65. Interestingly, the price difference between state minimums and much more protective coverage is often surprisingly small—sometimes just a few extra dollars a month for double or even triple the protection.

Car insurance pricing is complex, with your personal profile creating a unique risk assessment that directly impacts your premium.

Key Factors That Influence How Much Liability-Only Car Insurance Costs

Insurance companies analyze dozens of data points to predict how likely you are to file a claim. Understanding these factors helps explain why how much does liability only car insurance cost varies so dramatically from person to person.

Your driving record is the single most powerful factor. A spotless driving history—no accidents, tickets, or DUIs—is your ticket to lower premiums. Conversely, even one speeding ticket can bump your rates by 20% to 30%, while a DUI conviction might increase them by 40% or more.

Your ZIP code carries more weight than many people realize. Living in downtown Boston versus a quiet New Hampshire town can mean dramatically different premiums. Urban areas with heavy traffic, higher accident rates, and more vehicle theft naturally cost more to insure.

Your age and gender play significant roles. Young drivers, especially teenagers, face the steepest rates because statistics show they’re involved in more accidents. Rates typically drop significantly after age 25, and again after 40-50, assuming you maintain a clean record. Gender also factors in, with males often paying slightly more due to historical accident data.

The vehicle you drive might seem irrelevant for liability coverage, but insurers still consider it. Some vehicles are associated with certain driver demographics or might cause more expensive damage in accidents. Safer vehicles with good safety ratings help keep premiums lower.

How much you drive annually directly correlates to your accident risk. A long daily commute means more exposure to potential accidents than only driving on weekends. Most insurers offer discounts for low-mileage drivers.

Your credit-based insurance score can significantly impact your rates in New Hampshire (though Massachusetts prohibits its use). A strong credit score often translates to savings of 20% to 45% on your liability premiums, as insurers have found correlations between credit and driving responsibility.

Finally, your chosen coverage limits directly affect your premium. Choosing state minimums versus more robust limits like 100/300/100 will impact your monthly cost, though often less than you’d expect.

For a deeper dive into understanding these cost factors, explore our comprehensive guide on Auto Insurance Costs.

Average Liability-Only Costs vs. Full Coverage

The financial appeal of liability-only coverage becomes clear when you compare it to full coverage. Drivers who choose liability-only typically save more than 50%. A Massachusetts driver paying $65 monthly for liability-only might face upwards of $130 per month for full coverage—that’s over $750 in annual savings.

This dramatic cost savings comes from a simple trade-off: you’re accepting financial responsibility for your own vehicle in exchange for lower premiums. Full coverage includes collision coverage, which pays for your car’s damage after an accident regardless of fault, plus comprehensive coverage, protecting against theft, vandalism, fire, and other non-collision events.

The reason liability-only costs so much less is that you’re telling the insurance company, “I’ll handle my own car; just protect me from lawsuits and claims from other people.” This can mean substantial monthly savings, but it also means potentially massive out-of-pocket expenses if your car is damaged or destroyed.

If your 2015 Honda Civic gets totaled in an accident you caused, your liability coverage will pay for the other driver’s medical bills and car repairs, but you’ll receive $0 toward replacing your own vehicle. For some drivers with older, paid-off cars, this trade-off makes perfect financial sense. For others, the peace of mind from full protection is worth every extra dollar.

To help you decide which approach works best for your situation, check out our detailed comparison in Full Coverage vs. Liability Car Insurance.

Is Liability-Only Insurance the Right Choice for You?

Choosing between liability-only and full coverage is a financial decision that hinges on your vehicle’s value and your personal financial situation. The primary risk of liability-only insurance is that you are entirely responsible for the cost of repairing or replacing your own car after an at-fault accident. If your car is totaled, you get no payout from your insurer.

This means you must be prepared to cover those costs out-of-pocket. If you have an older car that’s not worth much, this might be a manageable risk. But if you’re still making payments on your vehicle, or if replacing it would be a significant financial hardship, then liability-only might not be the best fit.

When to Consider Liability-Only Coverage

While it might sound risky, liability-only coverage can be a smart financial move for certain drivers. Here are scenarios where it often makes sense:

- Your car is older (over 8-10 years): As cars age, their market value depreciates. At some point, the cost of full coverage premiums can start to outweigh the car’s actual worth. If your car is 10 years old and worth less than $5,000, paying over $1,000 a year for full coverage might not be economically sound.

- Your car’s value is low (less than $5,000): If the car’s market value is very low, the potential payout from a full coverage policy after a total loss might not justify the premiums you’ve been paying.

- You have paid off your car loan: Lenders almost certainly require you to carry full coverage. Once the loan is paid off, you have the freedom to drop collision and comprehensive coverage if you choose.

- You have enough savings to repair or replace your car: This is the most crucial point. If you have an emergency fund that could cover replacing your vehicle out-of-pocket after an accident, then liability-only becomes a much less risky proposition. You’re essentially self-insuring for your own vehicle’s damage.

For more insights into making this decision, refer to our article on When to get liability-only car insurance?.

Recommended Liability Limits Beyond the Minimum

Insurance professionals almost universally recommend carrying liability limits far higher than the state minimums. A common recommendation is 100/300/100 ($100,000 for bodily injury per person, $300,000 per accident, and $100,000 for property damage). The cost to increase your limits is often minimal—potentially $10-$25 more per month—but can save you from financial ruin in a major accident.

Why is this important? Because state minimums, while legal, are rarely enough to cover the true costs of a serious accident. Medical bills from a severe injury can easily run into hundreds of thousands of dollars, and property damage claims can exceed a low $5,000 limit. If damages exceed your policy limits, you are personally responsible for the difference, putting your personal assets—your home, savings, and future earnings—at risk.

Higher limits provide crucial financial protection and asset protection. They act as a stronger shield against potential lawsuits and large claims, ensuring you’re not left with a massive bill. As the National Association of Insurance Commissioners (NAIC) advises, it’s wise to understand what’s at stake. You can learn more about protecting yourself in their A Consumers Guide to Auto Insurance. Don’t let a desire to save a few dollars now lead to financial devastation later.

How to Find Affordable Liability-Only Car Insurance

Finding the best rate for how much does liability only car insurance cost requires a bit of smart shopping and knowing where to look. The truth is, every insurance company has its own secret recipe for calculating rates. They all weigh risk factors differently, which means the company that offers your neighbor the cheapest rate might not be the best deal for you.

Think of it like shopping for groceries – one store might have great prices on produce while another excels at dairy deals. The key is knowing how to shop around effectively and make the most of every opportunity to save.

Even for basic liability-only policies, prices can swing dramatically between providers. One insurer might specialize in offering great rates for drivers with spotless records, while another focuses on being competitive for people with older vehicles. Some companies are fantastic for young drivers, while others cater to more experienced motorists.

How to Find the Cheapest Rates for How Much Liability-Only Car Insurance Costs

The most powerful tool in your money-saving arsenal is comparison shopping. Don’t settle for the first quote you receive – that’s like buying the first car you test drive! We always recommend getting at least three to five quotes from different companies. Online comparison tools can make this process surprisingly quick, or you can work with an independent agency that can shop multiple carriers for you in one go.

Asking about discounts is your next secret weapon, and it’s amazing how many people skip this step. Insurance companies offer more discounts than you might expect, but they won’t always volunteer this information upfront. Common money-savers include good student discounts for young drivers maintaining solid grades, bundling discounts when you combine auto insurance with home or renters coverage, and pay-in-full discounts that can knock 5% to 10% off your premium if you pay the entire six-month or annual amount upfront.

Many insurers also offer multi-car discounts if you’re insuring more than one vehicle, safe driver programs that use apps or devices to monitor your driving habits and reward good behavior with lower rates, and defensive driving course discounts for completing approved safety programs. If you don’t drive much, ask about low mileage discounts too.

Maintaining a clean driving record remains your most valuable long-term strategy. Every accident-free year and every period without tickets strengthens your position when it comes to securing the best rates. It’s like building credit – consistency over time pays off in a big way.

For drivers in New Hampshire, improving your credit score can lead to significant savings since the state allows credit-based insurance scoring. Pay bills on time, work on reducing debt, and keep an eye on your credit report. This strategy won’t help Massachusetts drivers since the state doesn’t allow credit scoring for insurance, but it’s still good financial advice overall.

If you decide to add optional coverages later (like comprehensive or collision), choosing a higher deductible on those coverages can help keep your overall premium manageable. Just make sure you can comfortably afford to pay that deductible out-of-pocket if you need to file a claim.

For Massachusetts residents specifically, we’ve put together detailed resources to help with your search, including our guide to finding the Cheapest Car Insurance in Massachusetts and a comprehensive overview of Car Insurance Companies in Massachusetts to give you a head start on your comparison shopping.

Frequently Asked Questions about Liability-Only Car Insurance Costs

When it comes to how much does liability only car insurance cost, we hear the same concerns from drivers almost every day. Let me address the questions that keep coming up in our conversations with Massachusetts and New Hampshire drivers.

What is the biggest risk of having only liability coverage?

The biggest risk is financial exposure for your own property. If you cause an accident, liability-only insurance will not pay to repair or replace your vehicle. You would have to cover those costs entirely out-of-pocket, which could be thousands of dollars.

Picture this scenario: you’re running late for work on a rainy morning, and you rear-end the car in front of you at a red light. Your liability coverage takes care of the other driver’s bumper repair and any medical bills they might have. But when you look at your own crumpled hood and broken headlight, that’s coming straight out of your wallet.

This is exactly why liability-only coverage works best when you have a solid emergency fund. If the thought of writing a $5,000 check for car repairs would cause serious financial stress, then the savings from liability-only coverage might not be worth the risk.

Does liability-only insurance get cheaper as my car gets older?

Your premium isn’t directly tied to your car’s age in the same way as full coverage. However, the decision to carry liability-only becomes more financially sound as your car’s value depreciates. The potential insurance payout from a full coverage policy may no longer justify the higher premium once the car is worth only a few thousand dollars.

Here’s what actually happens: the liability portion of your premium stays relatively stable based on your driving record and other personal factors. But as your 2015 Honda Civic becomes worth $4,000 instead of $15,000, paying an extra $600 per year for collision and comprehensive coverage starts to feel like throwing money away.

That’s when many smart drivers make the switch. They’re not necessarily paying less for liability coverage, but they’re eliminating coverage that no longer makes financial sense.

Can I get liability-only insurance if I have a car loan?

Almost never. If you are financing or leasing a vehicle, your lender or leasing company will require you to maintain both collision and comprehensive (full) coverage. This is to protect their financial interest in the vehicle until the loan is fully paid off.

Think about it from the bank’s perspective: they’ve loaned you $25,000 for a car, and they want to make sure their investment is protected. If you total that car and only have liability coverage, they’re still owed $25,000 but the collateral for their loan just got hauled away on a tow truck.

Your loan agreement almost certainly includes language requiring full coverage, and your lender will be listed on your insurance policy as a “lienholder.” If you try to drop your coverage, your insurance company is required to notify the lender, and they can actually purchase coverage on your behalf and add the cost to your loan balance.

The freedom to choose liability-only coverage is one of the perks of owning your car outright. Until then, full coverage is simply part of the cost of financing a vehicle.

Get the Right Coverage for Your Budget

Understanding how much liability-only car insurance costs is the first step toward making a smart decision for your financial protection. It offers an affordable way to meet legal driving requirements, but it’s crucial to weigh the savings against the potential risks. For drivers with older, paid-off vehicles and a solid financial cushion, it can be an excellent choice. For others, the peace of mind that comes with full coverage is worth the extra cost.

The decision ultimately comes down to your personal financial situation and risk tolerance. If you’re driving a 12-year-old sedan that’s worth $3,000, paying $80 a month for full coverage might not make sense when liability-only costs $40. But if that same car is your only means of transportation to work, and you don’t have savings to replace it, then the extra $40 might be the best investment you make each month.

At Stanton Insurance Agency, we understand that every driver’s situation is unique. Some of our clients are retirees with paid-off vehicles and healthy savings accounts who benefit greatly from liability-only coverage. Others are young professionals just starting out who need the security of full coverage despite the higher cost. There’s no one-size-fits-all answer, and that’s exactly why personalized guidance matters so much.

Our approach is simple: we listen to your needs, explain your options clearly, and help you find coverage that protects what matters most without breaking your budget. We’ve seen too many drivers make decisions based solely on price, only to face financial hardship later when they realize what they gave up. Whether you choose liability-only or full coverage, we want to make sure you understand exactly what you’re getting – and what you’re not.

Expert advice makes all the difference when you’re trying to balance cost with protection. We can help you steer these options and find a policy that fits your life and budget. Don’t leave your financial future to chance – let us help you find the peace of mind you deserve.

Contact us today to get a personalized quote and ensure you’re properly protected on the road. Get a Car Insurance Quote and find how the right coverage can give you confidence every time you get behind the wheel.