Does liability car insurance cover legal costs – 1 Key?

Why Understanding Legal Cost Coverage Matters for Your Financial Protection

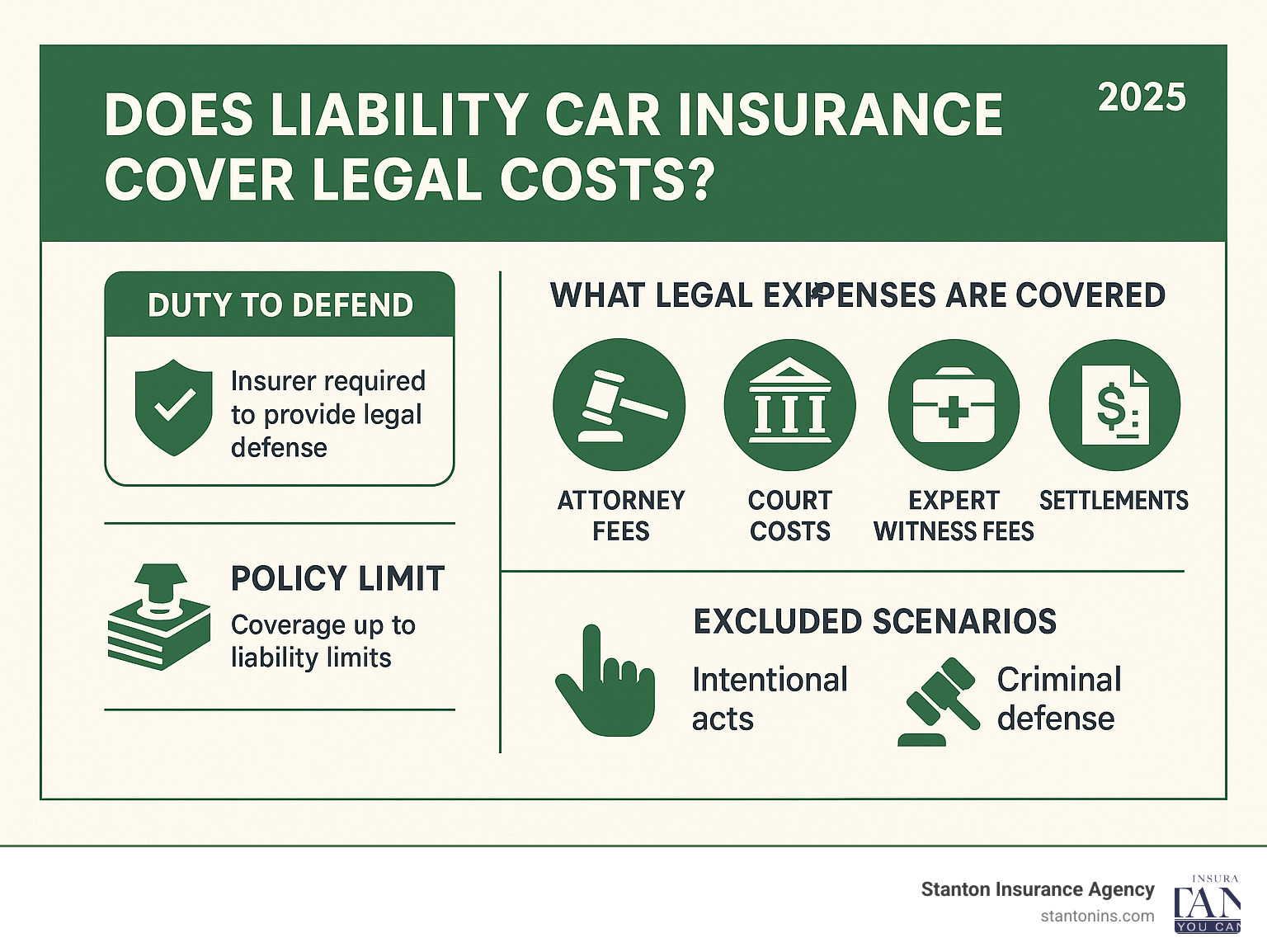

Does liability car insurance cover legal costs? Yes, liability car insurance typically covers legal costs through your insurer’s “duty to defend,” which includes attorney fees, court costs, expert witness fees, and settlements up to your policy limits when you’re sued for a covered incident.

Quick Answer: What Legal Costs Are Covered

- Attorney fees for your defense lawyer

- Court filing fees and administrative costs

- Expert witness fees for accident reconstruction or medical testimony

- Settlements and judgments up to your policy limits

- Defense costs are usually paid in addition to your liability limits

When you’re behind the wheel, you’re one accident away from a potential lawsuit that could cost hundreds of thousands in legal fees alone. Even if you’re a careful driver, you can still face a lawsuit from another party claiming you caused their injuries or property damage. The financial reality is stark – without proper coverage, these legal costs could drain your savings and put your assets at risk.

Your auto insurance policy contains powerful legal protections that many drivers don’t fully understand. The “duty to defend” clause means your insurer must hire and pay for attorneys to represent you in covered lawsuits, providing a critical financial shield when you need it most.

I’m Geoff Stanton, President of Stanton Insurance Agency, and I’ve spent over 20 years helping Massachusetts and New Hampshire residents understand complex insurance topics, including does liability car insurance cover legal costs. My experience in the claims department has shown me how proper liability coverage can make the difference between financial security and financial ruin when legal issues arise.

The Core Protection: Your Insurer’s “Duty to Defend”

Picture this: you’re involved in an accident, and while you’re still dealing with the stress of vehicle damage and potential injuries, you receive something that makes your heart sink—a lawsuit. This is where your auto insurance transforms from a simple expense into your financial lifeline, thanks to a powerful provision called the “duty to defend.”

This isn’t just insurance jargon—it’s a legal promise that could save you thousands of dollars. When you’re sued for an incident covered by your policy, your insurance company doesn’t just write you a check and wish you luck. Instead, they roll up their sleeves and fight for you. They hire qualified attorneys, pay all the legal bills, and provide the expert representation you need to protect your assets.

Think of it as having a legal team on standby, ready to spring into action the moment trouble arrives. Does liability car insurance cover legal costs? Absolutely, and this duty to defend is the cornerstone of that protection. It’s particularly important here in Massachusetts and New Hampshire, where liability insurance requirements ensure drivers have this crucial safety net.

The beauty of this protection is that it kicks in regardless of whether you’re actually at fault. Even if the other party is making unreasonable claims or trying to blame you unfairly, your insurer still has to defend you. This means you won’t lose sleep worrying about mounting legal bills while trying to prove your innocence.

What Triggers the Duty to Defend?

The duty to defend doesn’t wait around—it springs into action the moment someone files a lawsuit against you. But there’s a key requirement: the lawsuit must allege damages that could potentially fall under your Bodily Injury or Property Damage liability coverage.

Here’s how it works in practice. Once you receive those intimidating legal documents and notify your insurance company, they don’t waste time. Their claims team immediately investigates to determine if the incident falls within your policy’s coverage. This isn’t about whether you’re guilty or innocent—it’s simply about whether the alleged damages are the type your policy is designed to cover.

After confirming coverage, your insurer assigns experienced legal counsel to handle your case. These aren’t just any attorneys—they’re specialists who understand insurance law and have extensive experience defending similar cases. From that moment forward, you have professional advocates working to protect your interests, whether that means negotiating a settlement or taking the case all the way to trial.

The process is designed to be seamless for you. While your legal team handles depositions, court filings, and negotiations, you can focus on getting your life back to normal. This immediate response and professional handling is what makes the duty to defend such a valuable part of your coverage.

What Specific Legal Expenses Does Liability Car Insurance Cover?

When your insurer steps in to defend you, you might be surprised at just how comprehensive their coverage really is. It’s not simply a matter of having someone show up to court on your behalf—though that’s certainly part of it. The financial protection runs much deeper, covering virtually every expense that comes with mounting a proper legal defense.

Attorney fees represent the biggest expense in most lawsuits, and thankfully, your liability coverage handles this entirely. From the moment your lawyer takes your case through every consultation, investigation, deposition, and courtroom appearance, these professional fees are covered. Given that attorney fees can easily reach six figures in serious cases, this protection alone makes your policy invaluable.

Then there are all those court costs that people don’t think about until they’re facing them. Filing fees, jury costs, subpoena expenses—these administrative charges pile up quickly during litigation. Your insurer takes care of these too, so you won’t be hit with surprise bills every time your case moves forward.

Expert witness fees often make or break a case, especially in car accident lawsuits. When you need an accident reconstruction specialist to prove what really happened, or a medical expert to testify about injuries, these professionals don’t come cheap. Your liability insurance covers these specialized witness fees, ensuring your defense has access to the expertise needed to protect you.

Finally, there’s the big one: settlements and judgments. Whether your case is resolved through negotiation or goes all the way to a court verdict, your liability insurance covers these payouts up to your policy limits. This is often where the real financial relief comes in, as settlements can reach hundreds of thousands of dollars.

The question “does liability car insurance cover legal costs” gets a resounding yes across all these categories. It’s comprehensive protection that shields you from the potentially devastating financial impact of a lawsuit.

Does liability car insurance cover legal costs for both injury and property claims?

Absolutely, and this is where many people underestimate their coverage. Your insurer’s duty to defend kicks in whether someone is claiming you hurt them physically or damaged their property.

If you’re facing a lawsuit over injuries—whether it’s the other driver, their passengers, or a pedestrian—your Bodily Injury Liability coverage handles every aspect of your legal defense. Medical bills, lost wages, pain and suffering claims—when these lead to a lawsuit, your insurer is there with full legal support.

Property damage lawsuits get the same treatment through your Property Damage Liability coverage. Whether someone claims you damaged their car, knocked down their fence, or caused any other property damage, your insurer will manage the entire legal defense process.

This dual protection means you’re covered regardless of what type of damage leads to a lawsuit. It’s one less thing to worry about when you’re already dealing with the stress of a legal case.

Understanding Coverage Limits for Legal and Settlement Costs

Here’s where things get really interesting, and frankly, where many people get pleasantly surprised. When it comes to does liability car insurance cover legal costs, the structure of how these costs are handled is actually quite generous to policyholders.

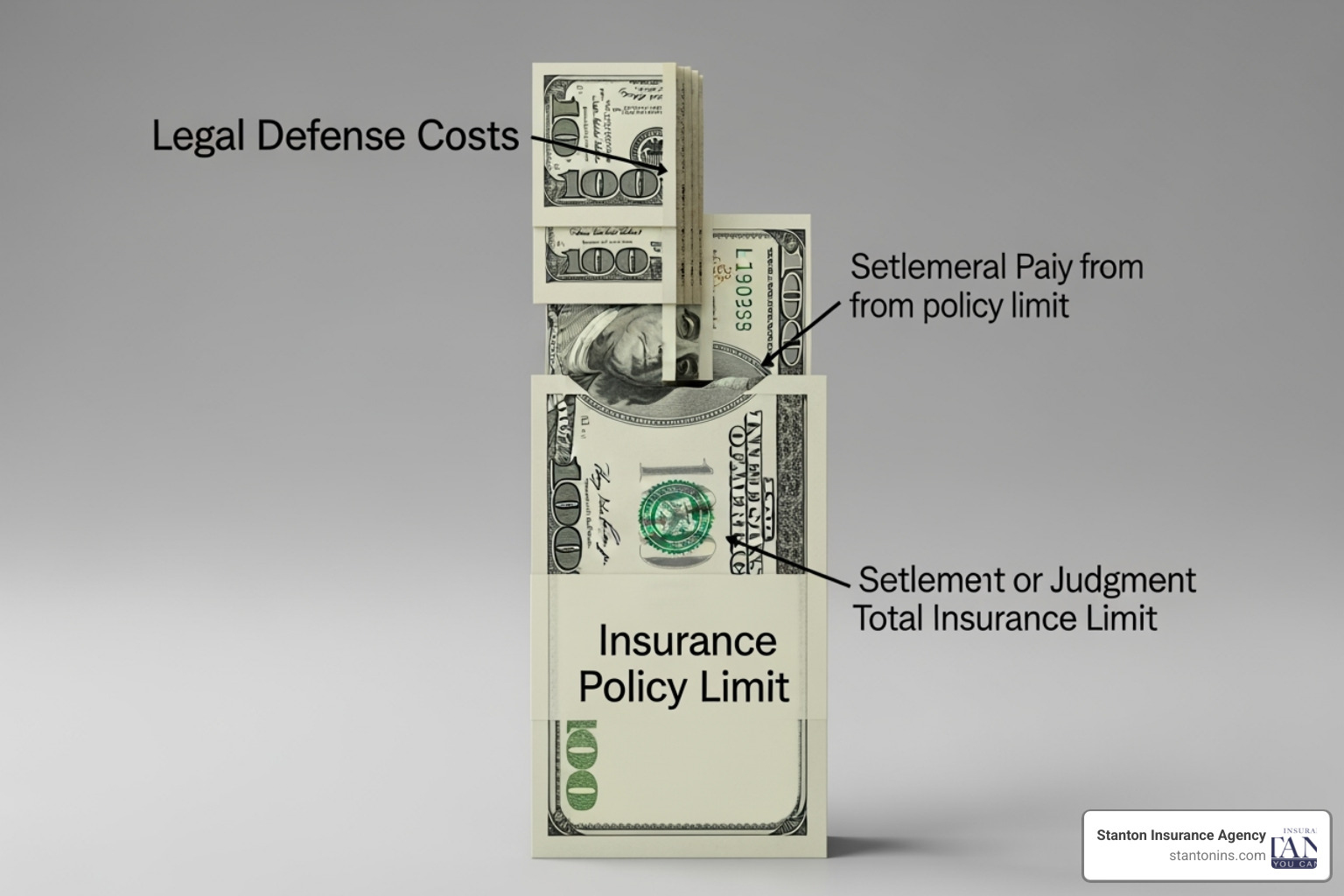

In most standard auto policies, defense costs are treated as what insurers call “supplementary payments.” This is insurance speak for something pretty wonderful – these costs are paid in addition to your liability limits, not subtracted from them. Let me paint you a picture of how this works.

Imagine you have a $100,000 liability limit on your policy. A lawsuit is filed against you, and your defense attorney’s fees end up totaling $50,000. Here’s the good news: that $50,000 is typically paid by your insurer on top of your $100,000 limit. Your actual coverage amount for settling the claim remains completely intact at the full $100,000.

This structure is incredibly valuable because it means that even an expensive legal defense won’t eat away at the money available to pay a settlement or judgment to the injured party. Your Liability Car Insurance Coverage is designed to keep these two financial buckets separate, which protects both you and the person making the claim.

However, there’s an important flip side to understand. While defense costs get this special treatment, the actual settlement or judgment itself is paid from your liability limits. So if that same $100,000 policy faces a court judgment of $150,000, your insurer will cover their portion up to $100,000, but you’d be personally responsible for that remaining $50,000.

This scenario isn’t meant to scare you, but rather to highlight why understanding your coverage limits is so crucial. The legal defense is handled beautifully by your policy, but the financial exposure from a large judgment can still be significant if you’re underinsured.

How to Ensure Your Liability Coverage Adequately Addresses Potential Legal Costs

Let’s be honest about something that might surprise you: state minimum liability limits are rarely enough to protect you from a serious lawsuit. In Massachusetts, the minimum bodily injury liability is just $20,000 per person and $40,000 per accident, with only $5,000 for property damage. New Hampshire requires $25,000 per person, $50,000 per accident, and $25,000 for property damage. These amounts might have seemed adequate decades ago, but today’s medical costs and vehicle values can easily exceed these minimums in even moderate accidents.

The smart approach is to regularly review your coverage with your personal assets in mind. A practical rule of thumb is to carry enough liability insurance to cover your total net worth. This includes your savings, investments, home equity, retirement accounts, and any other valuable assets you’ve worked hard to accumulate. If you’re sued and a judgment exceeds your policy limits, those personal assets could potentially be at risk.

For those with significant assets or higher risk exposure, a Personal Umbrella Insurance policy can be a game-changer. These policies typically provide an additional $1 million or more in liability coverage that kicks in when your underlying auto liability limits are exhausted. Think of it as an extra safety net that provides tremendous peace of mind for a relatively modest premium.

The key question to ask yourself is “How Much Liability Insurance Do I Need For My Car?” At Stanton Insurance Agency, we help our clients assess their unique situations – looking at their assets, lifestyle, and potential risks – to recommend coverage levels that provide real protection, not just the bare minimum required by law.

Common Scenarios: When Legal Cost Coverage Comes into Play

The true value of understanding does liability car insurance cover legal costs becomes crystal clear when you find yourself in unexpected legal situations. Let me walk you through some real-world scenarios where this coverage becomes your financial lifeline.

Disputed fault cases are surprisingly common and can be incredibly stressful. Picture this: you’re driving through an intersection when another car runs a red light and hits you. You know you weren’t at fault, but the other driver claims you were speeding. Even though you firmly believe you were not at fault for the accident, the other driver can still sue you for their injuries and vehicle damage.

Here’s the good news: your insurer is still obligated to defend you in these situations. They will assign experienced attorneys who will work diligently to prove your non-liability. These legal professionals will gather evidence, interview witnesses, review traffic camera footage, and present your case effectively. All of this defense work is covered by your policy, protecting you from potentially devastating legal fees associated with proving your innocence.

Another scenario that catches many people off guard involves passengers in your own vehicle. Your Bodily Injury Liability coverage also applies if a passenger in your own car is injured and decides to sue you for damages. While we certainly hope this never happens, it’s a very real possibility, especially if a friend or family member sustains serious injuries in an accident you caused. Your insurer would provide complete legal defense and coverage for their medical expenses and other damages up to your policy limits.

Business versus personal use creates another important distinction that many drivers overlook. If you use your personal vehicle for work-related activities—such as making deliveries, visiting clients, or transporting goods for your employer—your personal auto policy may not cover accidents that occur during these activities. This gap in coverage necessitates separate Business Liability Insurance or a commercial auto policy. Without the correct commercial coverage, your personal policy might deny both legal defense and claims payment if an accident happens while you’re working, leaving you personally vulnerable to significant legal costs.

It’s worth noting that while liability car insurance coverage for legal costs follows similar patterns nationwide, each state has its own specific requirements and nuances. These variations are detailed in the Automobile Financial Responsibility Laws By State. Understanding these state-specific regulations helps ensure you meet all legal obligations and maintain the continuous, adequate coverage that protects your assets when legal challenges arise.

What Legal Costs Are NOT Covered by Standard Liability Insurance?

While your liability insurance provides robust protection, it’s important to understand where that coverage ends. Think of it like a strong umbrella—it protects you from most storms, but it won’t help in every situation. Your policy is specifically designed to cover accidental damages and injuries you cause to others, but it’s not an unlimited legal defense fund.

The most significant exclusion involves intentional acts. If you deliberately cause an accident or injury—perhaps during a road rage incident where you purposefully collide with another vehicle—your insurer will walk away from the situation entirely. They won’t defend you, and they won’t pay any claims. This makes sense when you think about it: insurance exists to protect you from unexpected accidents, not from the consequences of deliberate harmful actions.

Criminal defense is another major gap in coverage that surprises many drivers. When does liability car insurance cover legal costs comes up in criminal situations, the answer is a firm no. If you’re charged with a DUI, reckless driving, or vehicular manslaughter following an accident, you’ll need to hire and pay for your own criminal defense attorney. Your liability coverage only handles civil lawsuits related to bodily injury or property damage—it doesn’t extend to defending you against criminal charges, even if they stem from the same incident.

Punitive damages present another financial risk that your policy likely won’t cover. These damages aren’t meant to compensate the injured party but rather to punish you for particularly egregious behavior and send a message to others. If a court decides your actions were so reckless or malicious that punishment is warranted, you’ll typically be on your own for these additional costs. Many insurance policies specifically exclude punitive damages, meaning they could come directly out of your pocket.

Finally, liability insurance is purely defensive. If you decide to initiate a lawsuit against someone else—perhaps to recover damages for your own injuries or vehicle repairs—your liability coverage won’t help with those legal costs. You’d need to rely on other parts of your insurance policy or pay for legal representation yourself.

Understanding these boundaries helps you set realistic expectations and plan for situations that fall outside your policy’s protective umbrella.

Frequently Asked Questions about Liability Insurance and Legal Costs

We often hear similar questions from our clients about how liability insurance works, especially when it comes to legal costs. These concerns are completely understandable – facing a lawsuit can feel overwhelming, and knowing what to expect from your coverage brings peace of mind.

What should I do if I’m sued after a car accident?

The moment you receive legal papers, take a deep breath and remember that this is exactly why you have insurance. Your first call should be to your insurance agent or company – don’t wait even a day. This immediate notification is absolutely crucial because does liability car insurance cover legal costs depends on you following proper procedures from the start.

Here’s what you should not do: Don’t speak to the other party’s attorney or their insurance company. Don’t sign any documents or make any statements about the accident. These well-meaning actions can actually hurt your case later on.

Instead, gather all the legal documents you received, including the summons and complaint, and get them to your insurer right away. Your insurance company needs this information to activate their “duty to defend” and assign a qualified attorney to represent you. The sooner they know about the lawsuit, the better they can protect your interests.

Does my liability insurance cover legal costs if I’m in a rental car?

This is a great question, especially since many people rent cars for vacations or business trips. The good news is that your personal auto liability coverage typically travels with you when you’re driving a rental car for personal use.

If you cause an accident in a rental vehicle and someone sues you, your liability insurance should provide the same legal defense it would for your own car. This means attorney fees, court costs, and settlements are all covered up to your policy limits, just like they would be at home.

However, rental car coverage can have some nuances, so it’s always smart to double-check with your insurance provider before you pick up those rental keys. Some policies might have specific restrictions or requirements. For a deeper dive into this topic, check out our comprehensive guide: Does Liability Insurance Cover Rental Car?.

Are legal costs covered differently in no-fault states like Massachusetts?

Living in a no-fault state like Massachusetts does add some complexity, but the core protection remains strong. Here’s how it works:

Initially, your Personal Injury Protection (PIP) coverage handles medical bills and lost wages for you and your passengers, regardless of who caused the accident. This system helps minor injuries get resolved quickly without lawyers getting involved.

But here’s the important part – if injuries are serious or meet certain dollar thresholds set by state law, the injured party can still sue you for additional damages. When that happens, your Bodily Injury liability coverage and its legal defense provisions kick in just like they would anywhere else.

So while Massachusetts’ no-fault system might handle the initial aftermath differently, you still need robust liability coverage for serious accidents. The question does liability car insurance cover legal costs has the same answer whether you’re in Massachusetts or New Hampshire – yes, when you’re sued for covered incidents, your insurer will defend you.

The key takeaway is that no-fault insurance doesn’t eliminate the possibility of lawsuits – it just changes when they can happen. Having adequate liability coverage remains essential for protecting your assets and financial future.

Conclusion

Your liability insurance is much more than a simple way to pay for another driver’s car repairs—it’s actually a critical legal shield that stands between you and potential financial devastation. When someone asks does liability car insurance cover legal costs, the answer is absolutely yes, and understanding this protection could save your financial future.

Think about it this way: even a seemingly minor accident can spiral into a lawsuit with legal costs that reach tens or hundreds of thousands of dollars. Attorney fees alone can be staggering, and that’s before you factor in court costs, expert witnesses, and potential settlements. Without proper insurance protection, these expenses could wipe out your savings, force you to sell your home, or even garnish your future wages.

But here’s the reassuring part—the “duty to defend” clause in your policy ensures you won’t have to face these overwhelming costs alone. Your insurance company becomes your legal guardian, hiring qualified attorneys, covering court expenses, and handling every aspect of your defense. It’s like having a powerful legal team on standby, ready to protect you when life takes an unexpected turn.

The cost of carrying adequate liability coverage, especially when you consider adding an umbrella policy for extra protection, is remarkably small compared to the potentially devastating expense of a major lawsuit. We’ve seen too many people learn this lesson the hard way, which is why we’re passionate about helping our clients understand these protections before they need them.

At Stanton Insurance Agency, we believe knowledge is your best defense. Our experienced team has spent years helping Massachusetts and New Hampshire residents steer these complex coverage decisions, and we’re committed to providing you with trusted protection that exceeds your expectations.

Don’t wait until you’re facing a lawsuit to find gaps in your coverage. Take a proactive approach and review your Car Insurance Liability coverage today to ensure your assets are properly protected. We’re here to help you drive with confidence, knowing you have the right protection in place for whatever the road ahead might bring.