Liability Car Insurance Cost: Maximize Savings 2025

Understanding Your Liability Car Insurance Cost: What Every Driver Needs to Know

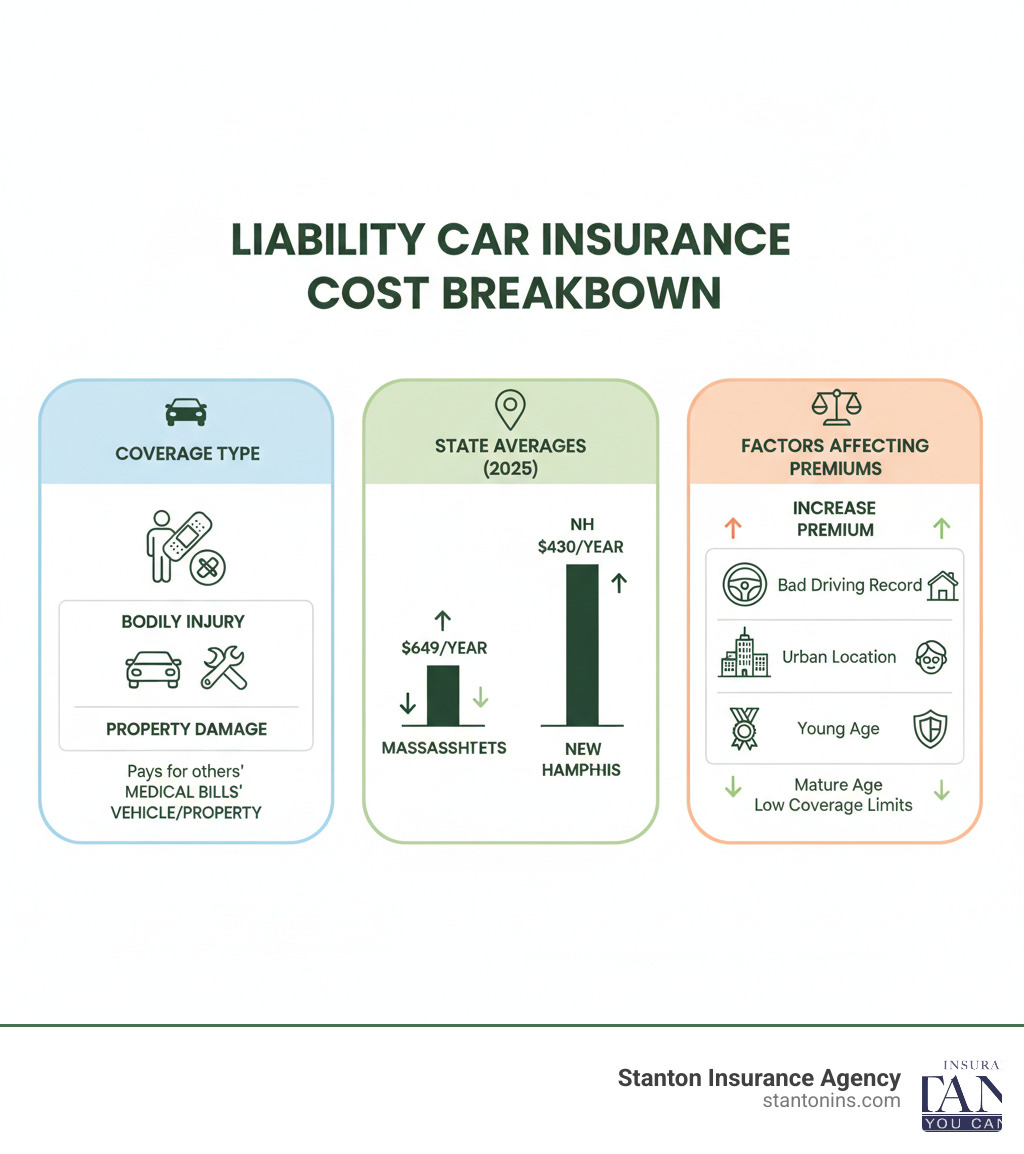

Liability car insurance cost is a top consideration for drivers. This mandatory coverage protects you financially if you’re at fault in an accident by paying for others’ medical bills and property damage. Here’s what you need to know:

Quick Cost Overview:

- National Average: $736 per year ($61 per month)

- Massachusetts Average: $649 annually

- New Hampshire Average: $430 annually

- Range: From $304 (North Dakota) to $979 (Louisiana)

- Savings vs. Full Coverage: 61% less expensive on average

The cost of liability insurance varies dramatically based on your state, driving record, and coverage limits. While some drivers pay as little as $37 per month, others might pay over $150 depending on their risk factors.

As one of our Massachusetts clients shared, “I slid on black ice into a luxury SUV. The damage was over $45,000, but my 100/300/50 liability policy covered it all. I’m so glad I didn’t just go with the state minimum.”

I’m Geoff Stanton, a Certified Insurance Counselor at Stanton Insurance Agency. Since 1999, I’ve helped Massachusetts and New Hampshire drivers find affordable liability coverage that protects their families from financial disaster. My experience has shown me how the right coverage can keep premiums affordable while preventing financial ruin.

What is Liability Car Insurance and What Does It Cover?

Imagine you accidentally back into your neighbor’s car. That sinking feeling about repair costs is exactly what liability insurance is for. It’s your financial shield when you’re responsible for an accident.

Liability car insurance pays for the other party’s injuries and property damage, but it’s crucial to remember: it doesn’t cover your own vehicle or injuries. It protects others from your mistakes and shields your finances from devastating bills.

This coverage is legally required in almost every state. Without it, a single accident could leave you facing tens of thousands of dollars in bills. Understanding what liability insurance covers is crucial for every driver. For a comprehensive overview, check out our guide on What is Liability Car Insurance?.

Bodily Injury (BI) Liability

When someone is hurt in an accident you cause, Bodily Injury Liability is your financial lifeline. It covers medical expenses, lost wages if the injured person can’t work, and pain and suffering compensation. It also covers your legal fees if you face a lawsuit.

Bodily Injury coverage is written as two figures, like $25,000/$50,000. The first number is the maximum paid for one person’s injuries. The second is the total maximum for everyone injured in that same accident.

For example, a client ran a red light, and the resulting medical bills for three passengers totaled $85,000. Because they had chosen higher limits than the state minimum, their policy covered the costs, saving them from financial ruin. Learn more about this vital protection at our Bodily Injury Liability page.

Property Damage (PD) Liability

Property Damage Liability covers the cost of fixing or replacing things you damage in an accident. This usually means repairs to other vehicles, but can also include fences, buildings, and mailboxes. We’ve seen it cover everything from a damaged garden shed to expensive vehicle repairs.

This coverage is the third number in your policy limits, such as /$25,000. That’s the maximum your insurance will pay for all property damage in one accident. Modern vehicles are expensive to repair, and even a minor accident can easily cost $15,000 or more. For detailed information, visit our Property Damage Liability resource.

Liability-Only vs. Minimum Coverage

It’s easy to confuse liability-only and minimum coverage. Liability-only means your policy includes just Bodily Injury and Property Damage coverage. However, minimum coverage is what your state legally requires, which often includes more than just liability.

In Massachusetts, for example, the state minimum includes Personal Injury Protection (PIP) to cover your own medical expenses, regardless of fault. Some states also require Uninsured Motorist (UM) coverage. So while liability-only might seem cheapest, it may not be legal in your state.

Liability insurance does not cover your vehicle or your injuries in an at-fault accident. If you’re wondering Does Liability Insurance Cover My Car If I Hit Someone?, the answer is no—you need Collision coverage for that. To understand local requirements, see our guide on What is the Minimum Car Insurance Coverage in Massachusetts?.

The Average Liability Car Insurance Cost in 2025

Understanding the Liability Car Insurance Cost landscape is key to making smart financial decisions. There’s no universal price; your cost depends heavily on your location and insurer.

The U.S. average for liability-only coverage is $736 annually ($61/month). This is 61% less than full coverage on average, a significant saving that makes it an attractive option for drivers with older vehicles. The savings can be substantial, but you’re also taking on more personal risk. For a detailed breakdown, our Full Coverage vs Liability Car Insurance guide walks you through the pros and cons.

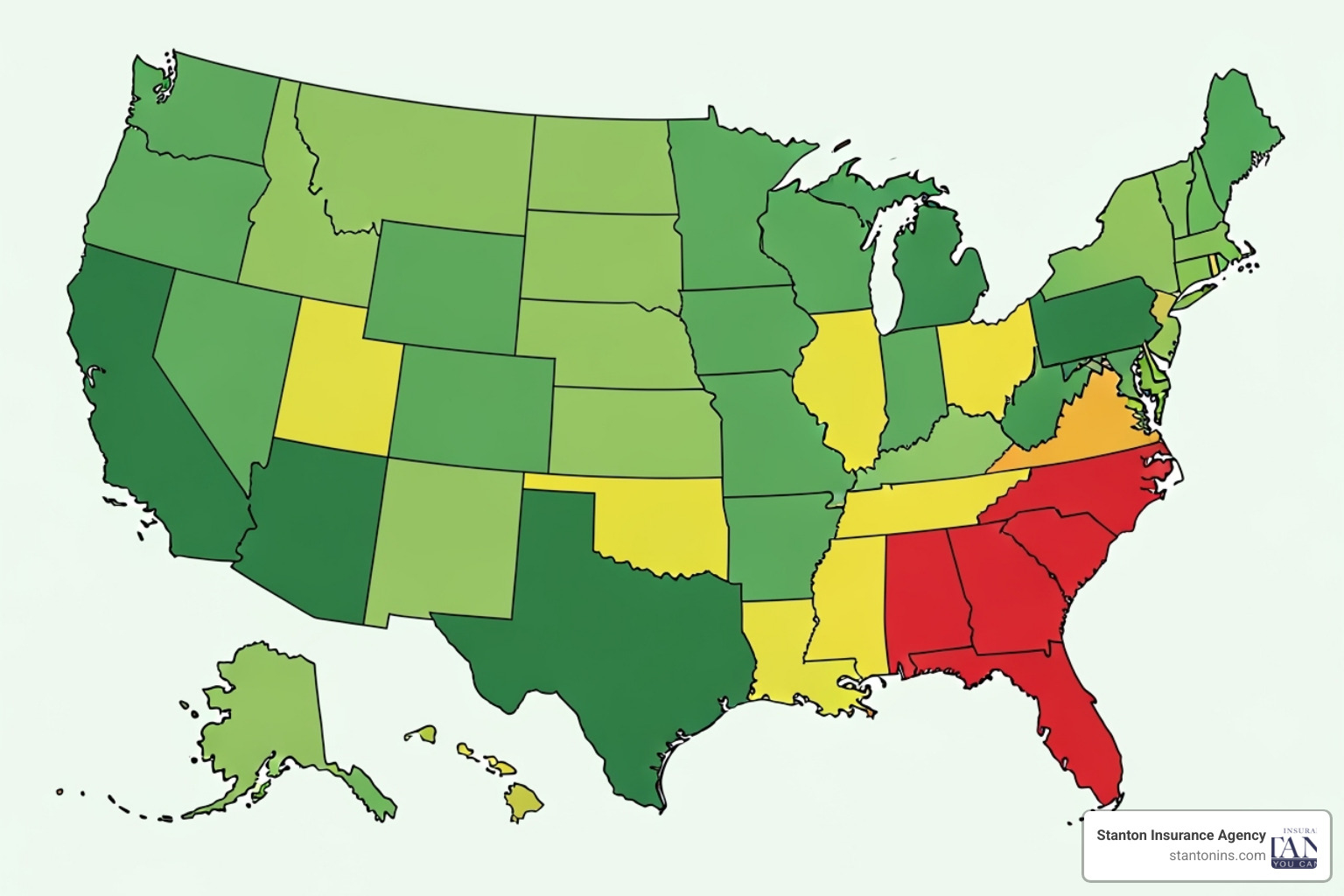

Average Liability Car Insurance Cost by State

Your ZIP code is one of the biggest factors in your Liability Car Insurance Cost. State regulations, local accident rates, and population density all shape what you’ll pay.

Here in New England, we have relatively reasonable rates. Let’s see how our local states stack up:

| State | Average Annual Liability Cost | Average Monthly Liability Cost |

|---|---|---|

| National Average | $736 | $61 |

| Massachusetts | $649 | $54 |

| New Hampshire | $430 | $36 |

Massachusetts drivers save about $87 annually compared to the national average, while New Hampshire residents enjoy savings of roughly $306. New Hampshire’s lower rates are partly due to its unique laws, where insurance isn’t mandatory, but drivers must still prove financial responsibility after an accident.

By contrast, drivers in the nation’s cheapest states often pay under $350 per year, while residents of the most expensive states can face bills exceeding $900 annually. These variations are driven by factors like population density, medical costs, and legal environments. For a complete breakdown of requirements, the Insurance Information Institute maintains a helpful resource: View state-by-state minimums from the Insurance Information Institute.

Liability vs. Full Coverage Cost Comparison

Understanding the price gap between liability-only and full coverage is essential. Liability-only is the most affordable option, but you give up protection for your own vehicle.

Full coverage adds Collision and Comprehensive insurance to your liability policy. Collision covers repairs to your car from an accident, regardless of fault. Comprehensive covers non-collision incidents like theft, vandalism, fire, or hitting a deer.

This additional protection comes with a significant price increase, with the cost difference often exceeding $1,300 annually. For many drivers with newer vehicles, this extra cost is worthwhile. But if you’re driving an older, paid-off car and have savings to replace it, liability-only might make perfect financial sense.

Key Factors That Influence Your Liability Car Insurance Cost

Your Liability Car Insurance Cost isn’t random. Insurers use a complex formula, analyzing data about you and your driving habits to assess your risk. This is why your rate can differ significantly from your neighbor’s. Many of these factors are within your control, allowing you to influence your premium. For a comprehensive look at what affects your rates, visit our Auto Insurance Costs page.

Driving Record and History

Your driving record is the most important factor in determining your Liability Car Insurance Cost. Past behavior is the best predictor of future claims.

- At-fault accidents can increase rates by 25% or more, with the impact lasting three to five years.

- A DUI conviction is the most severe violation, often increasing rates by over 40% and potentially leading to non-renewal of your policy.

- Speeding tickets and moving violations also add up, potentially costing you hundreds more in increased premiums over several years.

On the other hand, a clean driving record is your golden ticket to lower rates and good driver discounts.

Personal and Geographic Factors

Who you are and where you live also play significant roles in your premium.

- Age and driving experience are major factors. Drivers under 25 face higher rates due to statistically higher accident involvement, but costs typically decrease as they gain experience.

- Your ZIP code has a major impact. Urban areas like Boston have higher rates than rural New Hampshire due to more traffic, accidents, and theft.

- Credit history is a major factor in most states, but Massachusetts prohibits its use in setting auto insurance rates. New Hampshire allows credit scoring, so residents there should be aware of its potential impact. You can learn more on our Car Insurance Rates Massachusetts and Auto Insurance Rates in New Hampshire pages.

Vehicle and Coverage Choices

The car you drive and the coverage you select also influence your premium.

- The type of car you drive matters. A high-performance sports car suggests more aggressive driving, while a vehicle with advanced safety features may earn you a discount.

- How much you drive annually directly correlates with risk. Driving less can lead to premium reductions.

- Your chosen coverage limits significantly impact your premium. While state minimums are cheapest, they often provide inadequate protection. The small extra cost for higher limits like 100/300/100 provides significant peace of mind and financial security. To learn more, read our guide: How Much Liability Insurance Do I Need For My Car?.

How to Find the Cheapest Liability-Only Car Insurance

Finding affordable coverage requires a proactive approach. Don’t just auto-renew your policy; shopping around annually can save you hundreds. Rates are always changing, so last year’s best deal may not be this year’s. Our page on Cheapest Liability Auto Insurance provides more money-saving strategies.

Compare Quotes from Multiple Providers

Rates for identical coverage can vary by hundreds of dollars between insurers. One company might quote $1,200 while another offers the same policy for $750. This is because each insurer uses its own formula to calculate risk.

The key is getting quotes from at least three to five different providers. You can do this online, over the phone, or by working with an independent insurance agency like ours. An independent agency saves you time, as we can shop multiple carriers for you at once to find the best rate. For insights on choosing the right company, check out Comparing Car Insurance Companies: Which One Is Right For You?.

Ask About Available Discounts

Many drivers leave money on the table by not asking about discounts. Be sure to ask for every discount you might qualify for.

- Multi-policy bundling is often the biggest saver. Combining auto with home or renters insurance can yield discounts from 5% to 25%.

- Good student discounts reward young drivers who maintain a B average or better.

- Safe driver and telematics programs monitor your driving habits and can earn you discounts up to 40%.

- Other common discounts include multi-car, vehicle safety features, paying in full, and paperless billing.

When is Liability-Only a Smart Choice?

While liability-only offers the lowest Liability Car Insurance Cost, it’s not for everyone. It makes the most sense in specific situations.

The most common scenario is when your car is older and has a low market value. A helpful guideline is the “10% rule”: if your annual premium for full coverage is more than 10% of your car’s value, liability-only may be more cost-effective. For example, if your car is worth $4,500 but full coverage costs an extra $1,200 per year, the math suggests liability-only is a smarter choice.

It can also be a good option if your car is paid off and you have savings to cover repairs or replacement. You are essentially self-insuring your vehicle while meeting your legal obligations.

However, if losing your car would create a financial hardship or if you have an auto loan (which requires full coverage), then liability-only is not the right choice. Our guide When to Get Liability Only Car Insurance can help you make this decision.

Frequently Asked Questions about Liability Car Insurance Cost

Having helped thousands of drivers in Massachusetts and New Hampshire, I’ve found the same questions about Liability Car Insurance Cost come up often. Here are the answers to the most common ones.

What is the difference between liability-only and minimum coverage?

This is a common point of confusion. Liability-only insurance includes just Bodily Injury and Property Damage coverage. Minimum coverage is the legal requirement in your state, which often includes liability plus other coverages. For example, Massachusetts requires Personal Injury Protection (PIP) in addition to liability, so true “liability-only” isn’t an option.

Does liability insurance cover damage to my own vehicle if I’m at fault?

No. Liability insurance only pays for damages and injuries you cause to others. If you are at fault, it will not cover your own vehicle’s repairs. To protect your own car, you need to add Collision and Comprehensive coverage to your policy.

How much liability coverage do I really need?

While state minimums keep you legal, they are rarely enough to cover the costs of a serious accident. Medical bills and vehicle repair costs can quickly exceed minimum limits, leaving you personally responsible for the difference.

Our recommendation? Aim for at least 100/300/100 coverage—that’s $100,000 per person for injuries, $300,000 per accident, and $100,000 for property damage. The extra premium is typically small compared to the massive increase in financial protection. A good rule of thumb is to carry liability limits that at least equal your net worth to protect your assets. The peace of mind that comes with proper coverage is worth far more than the small additional cost in your Liability Car Insurance Cost.

Protect Yourself with the Right Coverage

Understanding your Liability Car Insurance Cost is the first step, but the goal is to balance affordability with solid protection. Liability insurance is the foundation of your financial safety net on the road. Relying on state minimums is risky, as they often fail to cover the high costs of modern vehicle repairs and medical care, leaving you exposed to significant personal expense.

Smart coverage is about protecting your assets, not just finding the lowest price. Always compare quotes, ask for every available discount (like bundling, good student, or safe driver), and choose coverage limits that truly protect you. Consider what you have to lose in a serious accident—your savings, your home, and your future earnings are all at risk if your coverage falls short. The difference in premium between state minimums and robust coverage like 100/300/100 is often surprisingly small for the peace of mind it provides.

At Stanton Insurance Agency, we help Massachusetts and New Hampshire drivers find the right balance for their unique needs and budget. Our job isn’t to sell you the most expensive policy—it’s to help you find the right one for your circumstances.

The bottom line is that Liability Car Insurance Cost shouldn’t be your only consideration. The goal is driving with confidence, knowing you’re prepared for the unexpected. For personalized advice and a free quote that compares multiple carriers, explore our Car Insurance Liability services today. Because when it comes to protecting what matters most, you deserve coverage that truly fits your life.