Kawasaki Ninja 300 insurance cost: Unlock 2025 Savings

Why Understanding Kawasaki Ninja 300 Insurance Cost Matters

Kawasaki Ninja 300 insurance cost ranges dramatically—from as low as $120 per year for basic liability coverage to over $2,000 annually for full coverage in high-risk areas. Here’s what you need to know:

Quick Answer: Average Kawasaki Ninja 300 Insurance Costs

| Coverage Type | Annual Cost Range | What’s Included |

|---|---|---|

| Liability Only | $120 – $320/year | Minimum legal coverage; no bike protection |

| Full Coverage | $400 – $1,200/year | Comprehensive + Collision + Liability |

| High-Risk Riders | $1,200 – $2,000+/year | Young riders, urban areas, poor driving record |

The Kawasaki Ninja 300 is a legendary entry-level sportbike, praised for its nimble handling and exciting performance. But before you hit the open road, there’s a crucial question every rider must answer: What will it actually cost to insure?

The answer isn’t simple. A 40-year-old rider in rural New Hampshire with a clean record might pay just $180 per year for full coverage. Meanwhile, a 22-year-old in Boston could face quotes exceeding $1,200 for the same bike and coverage. Some riders have even reported paying as little as $93 per year when bundling with other policies, while others have been shocked by quotes topping $2,000.

Why such a massive difference? Insurance companies evaluate dozens of factors—your age, riding experience, location, driving record, credit score, and even the specific Ninja 300 model year you own. Whether your bike has ABS can affect your rate. So can your zip code, your choice of deductible, and how much coverage you select.

This guide cuts through the confusion. We’ll break down the real costs based on data from actual Ninja 300 owners, explain exactly what drives your premium up or down, and show you proven strategies to lower your rate without sacrificing protection.

I’m Geoff Stanton, President of Stanton Insurance Agency. For over two decades, I’ve helped riders in Massachusetts and New Hampshire find the right coverage for their bikes. Let’s unmask the mystery behind your motorcycle insurance premium and get you riding with confidence.

What is the Average Insurance Cost for a Kawasaki Ninja 300?

The Kawasaki Ninja 300 insurance cost varies dramatically based on the level of protection you choose and your personal situation. Think of it as a sliding scale rather than a single number.

For basic liability-only coverage—the bare minimum required to ride legally in most states—you’re looking at $120 to $200 per year on average. Some riders have even reported rates as low as $75 annually. This covers damage you cause to others, but it won’t pay a penny if your own bike is stolen or damaged.

Now, if you want to actually protect your investment, you’ll need full coverage, which adds comprehensive and collision to your policy. This is where costs climb, but for good reason. Full coverage protects your Ninja 300 from theft, vandalism, weather damage, and repair costs after an accident. Annual premiums for full coverage typically range from $400 to over $1,200, though some riders pay even more.

Real-world examples tell the story. One rider with a 2016 Ninja 300 ABS secured full coverage with a $500 deductible for just $320 per year. Another managed an incredible $180 annually for full coverage with $100 deductibles, proving affordable full coverage exists.

On the flip side, a 29-year-old rider received a quote of $1,200 for full coverage, while a 22-year-old in a major city faced a shocking $2,000 annual premium. The difference? Age, location, and driving history all played major roles.

Some of the most impressive deals come from bundling policies. One rider paid just $93 per year for full coverage by bundling with their car insurance and choosing a $1,000 deductible. Another with multiple bikes paid around $39 annually for liability on their Ninja 300 when part of a multi-vehicle policy.

Your actual premium will depend on dozens of factors, but understanding this range helps you set realistic expectations and recognize a good deal. The key is shopping around and comparing quotes, because the difference between providers can be hundreds or even thousands of dollars annually.

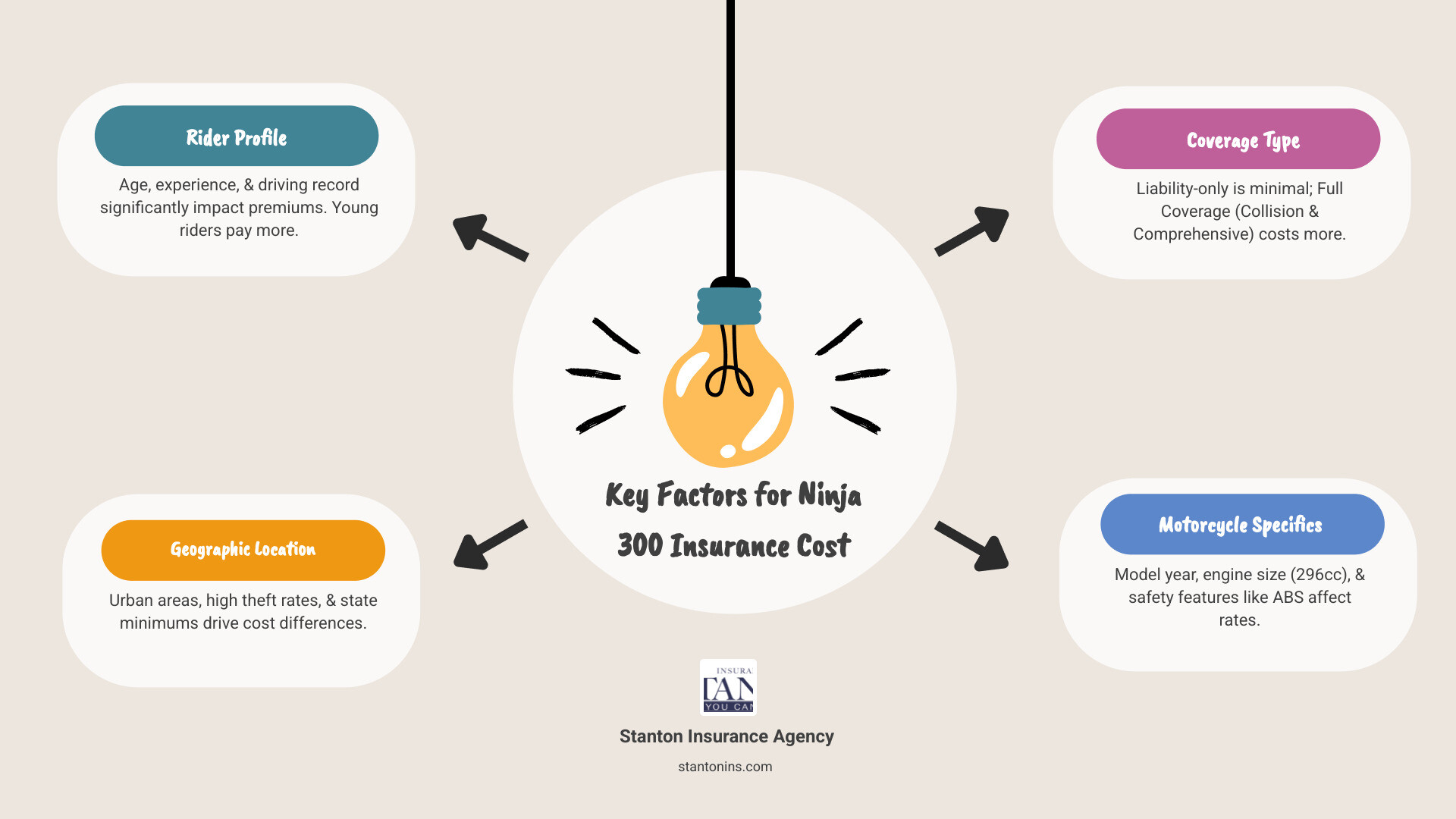

Key Factors That Influence Your Kawasaki Ninja 300 Insurance Cost

The final price on your policy isn’t pulled from thin air. It’s a unique calculation based on risk, where insurers assess a combination of your personal details and information about your motorcycle to determine your premium. Think of it as a financial portrait of you as a rider. Understanding these elements is the first step to managing your costs and finding opportunities to save.

Your Rider Profile: Age, Experience, and Record

Your personal profile is one of the most significant determinants of your Kawasaki Ninja 300 insurance cost. Statistically, younger, less experienced riders are involved in more accidents. A 22-year-old new rider will almost always pay more than a 40-year-old with a decade of riding experience, even with a spotless record.

Your driving record carries enormous weight in this equation. A history dotted with speeding tickets or at-fault accidents will significantly increase your rates. Multiple violations or a major offense like a DUI will cause a dramatic and lasting increase in your Kawasaki Ninja 300 insurance cost. Conversely, maintaining a clean driving record for several years is one of the most powerful tools for keeping rates low.

In most states, your credit score also influences your premiums. Insurers often use credit-based insurance scores as a predictor of future claims. A good credit score can signal responsibility and lead to lower premiums, while a poor score might suggest higher risk, driving your costs up. It’s worth keeping an eye on your credit as part of your overall financial health.

Your Location: Why Where You Live Matters

Your zip code has a major impact on what you’ll pay to insure your Ninja 300. Densely populated urban areas—like Boston in Massachusetts—typically have higher rates of accidents, traffic congestion, and motorcycle theft. These factors lead to more expensive premiums compared to rural locations in New Hampshire, where the risks of such incidents are considerably lower. Insurers analyze local claim data, including the frequency of accidents and theft rates, to price policies for specific geographic areas.

Local weather patterns and riding season length also play a part. States with long winters and shorter riding seasons, like Massachusetts and New Hampshire, may have slightly lower rates than states where you can ride year-round because fewer months on the road means less risk. However, other factors like population density and state regulations can outweigh this.

Furthermore, each state has its own minimum insurance requirements, which directly impact your base premium. These legal minimums vary considerably. Massachusetts requires Bodily Injury to Others ($20,000/$40,000), Property Damage ($5,000), and Personal Injury Protection (PIP) ($8,000). New Hampshire, on the other hand, requires Bodily Injury ($25,000/$50,000), Property Damage ($25,000), and Uninsured Motorist Coverage. The cost of meeting these different state requirements will vary, affecting your bottom line from the start.

The Bike Itself: Understanding the Kawasaki Ninja 300 insurance cost profile

Specific characteristics of your Kawasaki Ninja 300 contribute to its insurance risk profile. The Ninja 300 was first introduced in 2012, succeeding the popular Ninja 250R. Its 296cc engine, delivering nearly 40 horsepower, places it in a more affordable insurance category than its larger, more powerful siblings like those in the Ninja® ZX™ series. High-performance models with larger engines and higher top speeds consistently carry the highest insurance costs.

However, despite its smaller engine size, the Ninja 300 is still classified as a “sportbike” due to its aggressive styling and performance-oriented design. Sportbikes are generally considered higher risk by insurers compared to cruisers or touring bikes, often leading to slightly higher premiums within the same engine size class. This is because sportbikes are statistically more often involved in accidents and are more frequently targeted for theft.

A key factor that can positively affect your Kawasaki Ninja 300 insurance cost is the presence of Anti-lock Brakes (ABS). Many Ninja 300 models, especially from 2013 onwards, were available with optional ABS. Motorcycles equipped with ABS are statistically safer, as they significantly reduce the risk of skidding and losing control during emergency braking. Insurers recognize this safety feature and often offer a discount on your premium for ABS-equipped bikes. For example, a 2016 Ninja 300 ABS with full coverage was quoted at $320 per year, showcasing the tangible benefit of this safety technology.

The model year of your Ninja 300 also matters. Newer bikes with the latest safety features and technology may qualify for better rates, while older models might be seen as slightly higher risk due to wear and tear or outdated safety equipment. It’s all part of the risk assessment puzzle that determines your final premium.

Understanding Your Coverage Options

A motorcycle insurance policy is not one-size-fits-all. It’s a package of different coverages designed to protect you financially. Choosing the right ones is essential for your peace of mind and legal compliance.

State-Mandated Minimums in Massachusetts & New Hampshire

Before we even consider protecting your bike, we must meet the legal requirements to ride. Both Massachusetts and New Hampshire have specific minimum insurance requirements that all motorcyclists must adhere to. These are the absolute bare minimums to ride legally, but they typically only cover damages or injuries you cause to others—not to yourself or your own motorcycle.

In Massachusetts, you’re required to carry Bodily Injury to Others coverage of at least $20,000 per person and $40,000 per accident, which pays for injuries you cause to other people. You’ll also need Property Damage coverage of $5,000 per accident to cover damage to another person’s vehicle or property. Additionally, Massachusetts mandates Personal Injury Protection (PIP) of $8,000 per person, which covers your own medical expenses and lost wages, regardless of who caused the accident.

New Hampshire takes a slightly different approach. The state requires Bodily Injury Liability of $25,000 per person and $50,000 per accident, and Property Damage Liability of $25,000 per accident. Uniquely, New Hampshire also mandates Uninsured Motorist Coverage, including $25,000 per person and $50,000 per accident for bodily injury, plus $25,000 for property damage (with a $500 deductible). This protects you if you’re hit by a driver who doesn’t have insurance or doesn’t have enough coverage.

While these minimums let you ride legally, they offer no protection for your own Ninja 300. If your bike is stolen, vandalized, or damaged in an at-fault accident, you’re on your own financially. We always recommend going beyond the minimums for better protection.

Protecting Your Investment: Collision and Comprehensive

If your Ninja 300 is financed, your lender will almost certainly require you to carry full coverage, which includes both collision and comprehensive. Even if you own your bike outright, these coverages are crucial for protecting its value and your financial well-being.

Collision coverage pays for damages to your Kawasaki Ninja 300 if it collides with another vehicle or object, or if it overturns. This is the coverage that kicks in if you have an accident, regardless of who is at fault. Whether you slide out on a wet corner or get rear-ended at a stoplight, collision coverage handles the repair costs.

Comprehensive coverage protects your bike against non-collision events—essentially everything else that could damage your motorcycle. This includes theft, which is unfortunately common with sportbikes. It also covers vandalism, fire, natural disasters like hail or floods, and even hitting an animal on a rural road. If your bike is stolen, comprehensive coverage pays out its fair market value, minus your deductible.

Without these coverages, any damage to your bike from an accident, theft, or other event comes directly out of your pocket. This protection is a smart investment that can save you thousands in repair or replacement costs.

Optional Coverages to Consider for your Kawasaki Ninja 300 insurance cost

Depending on your needs and how you use your Ninja 300, you may want to add extra protection beyond the basics. These optional coverages can provide an additional layer of financial security and peace of mind.

Medical Payments (MedPay) helps pay for medical expenses for you and your passengers if you’re injured in an accident, regardless of fault. It’s useful for covering health insurance deductibles or co-pays.

If you’ve invested in aftermarket parts, custom paint, or other modifications for your Ninja 300, standard comprehensive and collision coverage might not fully cover their value. Accessory/Custom Parts Coverage ensures your expensive upgrades—like that custom exhaust or upgraded seat—are properly protected. Many insurers include some basic accessory coverage (often up to $3,000) with full coverage, but you can usually purchase additional coverage if needed.

Roadside Assistance coverage can be a lifesaver if you break down on a remote road in New Hampshire or experience a mechanical issue far from home. This coverage typically handles towing, fuel delivery, or battery jump-starts, getting you back on the road faster.

For relatively new bikes, Total Loss Coverage can pay out the full manufacturer’s suggested retail price (MSRP) for a brand-new replacement if your Ninja 300 is declared a total loss within its first one or two model years, rather than just the depreciated actual cash value.

While New Hampshire mandates Uninsured/Underinsured Motorist (UM/UIM) coverage, it’s highly recommended even where not required. This protects you if you’re involved in an accident with a driver who doesn’t have insurance or whose insurance isn’t enough to cover your damages and injuries. Unfortunately, there are many uninsured drivers on the road, making this a critical protection for any rider.

Finally, if you often ride with a passenger who isn’t a family member, Guest Passenger Liability coverage can pay for their injuries if you are at fault in an accident.

We can help you tailor a policy that perfectly fits your riding habits and budget, ensuring your Kawasaki Ninja 300 insurance cost provides the best value for your protection.

How to Lower Your Ninja 300 Insurance Premiums

While some factors like your age are out of your control, there are many proactive steps you can take to secure a lower rate on your Kawasaki Ninja 300 insurance cost. We believe in empowering our clients to save money without sacrificing essential coverage. The good news is that with the right approach, you can often reduce your premium by hundreds of dollars per year.

One of the smartest investments you can make is completing a certified motorcycle safety course from an organization like the Motorcycle Safety Foundation (MSF). These courses teach life-saving riding skills, defensive techniques, and emergency maneuvers. You’ll become a safer, more confident rider and typically earn a 10-15% discount from your insurer. It’s a win-win.

Bundling your policies is one of the easiest ways to open up significant savings. Insuring your motorcycle with the same company that provides your auto or home insurance can often save you 25% or more through multi-policy discounts. Bundling also simplifies your life with one company and one agent for all your policies.

The most powerful long-term strategy for keeping your Kawasaki Ninja 300 insurance cost low is to maintain a spotless driving record. Every ticket you avoid, every accident you prevent through defensive riding, directly translates to lower premiums. A single speeding ticket can increase your rates by 10-20% for three to five years. Ride safely, follow traffic laws, and your insurance company will reward your responsibility.

Adjusting your deductible can have an immediate impact on your premium. By choosing a higher deductible—say $1,000 instead of $250—you’re telling the insurer you’re willing to cover more of the initial cost if something happens. This reduces their risk and lowers your annual payment. Just make sure you have enough savings set aside to comfortably cover that deductible if you ever need to file a claim.

Don’t leave money on the table by failing to ask about every available discount. Beyond the safety course and bundling discounts we’ve mentioned, you might qualify for a good student discount if you’re maintaining a GPA of 3.0 or higher, a mature rider discount for experienced riders over a certain age, or a low annual mileage discount if your Ninja 300 is more of a weekend toy than a daily commuter. Some insurers offer discounts for anti-theft devices like alarms or GPS trackers, and many will reduce your rate if you pay your entire premium upfront rather than in monthly installments.

Perhaps the most important step is to shop around and compare quotes from multiple insurers. The exact same coverage for the same rider and bike can vary by hundreds of dollars between companies. What one insurer considers high risk, another might view more favorably based on their unique underwriting criteria. This is where working with an independent agency like Stanton Insurance Agency really pays off. We can compare rates from various providers on your behalf, saving you the time and hassle of contacting multiple companies yourself while ensuring you get the best possible rate for your Kawasaki Ninja 300 insurance cost.

Frequently Asked Questions about Kawasaki Ninja 300 Insurance Cost

Is the Ninja 300 expensive to insure compared to other beginner bikes?

Generally, no. The Ninja 300’s smaller engine (296cc) makes it more affordable to insure than larger sportbikes. You won’t face the sky-high premiums that come with a 600cc or 1000cc superbike. That smaller displacement is a real advantage when it comes to your Kawasaki Ninja 300 insurance cost.

However, there’s a catch. Because the Ninja 300 is classified as a “sportbike” due to its aggressive styling and performance-oriented design, it can be slightly more expensive to insure than a standard or cruiser-style motorcycle with a similar engine size. A 300cc cruiser might get you a lower premium than a 300cc sportbike, simply because insurers view sportbikes as higher risk. The good news is that the Ninja 300’s insurance cost is often comparable to its direct rivals in the 300cc sportbike class. Many riders find their premiums quite manageable, especially with a clean record and a few years of riding experience under their belts.

Does full coverage make sense for an older Ninja 300?

It depends on the bike’s value and your financial situation. If your Ninja 300 is still worth several thousand dollars, full coverage is usually a wise investment to protect against theft or a total loss.

Compare the annual cost of full coverage to the bike’s current market value. If your Ninja 300 is worth $2,500 and full coverage costs $800 a year with a $500 deductible, your insurer would only pay out $2,000 for a total loss. In this case, the premium may not be worthwhile. However, if the premium is a small fraction of the bike’s value—say, $300 per year on a bike worth $3,500—it’s likely worth keeping the protection.

Your personal risk tolerance matters too. If you could easily replace the bike out-of-pocket and you’re comfortable with that risk, switching to liability-only might make sense. But if losing the bike would be a significant financial hit, maintaining full coverage provides peace of mind.

How much does a speeding ticket affect my motorcycle insurance?

A single speeding ticket can increase your premium by 10-20% or more, depending on the severity and your insurer. Insurers view speeding tickets as a red flag, signaling increased risk. After all, speed is often a contributing factor in motorcycle accidents.

The surcharge typically stays on your policy for three to five years, gradually decreasing as the violation ages. During this period, you’ll be paying a higher rate. Multiple violations within a short timeframe will cause a much more dramatic increase. A major offense like reckless driving or a DUI will send your Kawasaki Ninja 300 insurance cost soaring, potentially leading to policy cancellation or difficulty finding affordable coverage at all.

The best strategy? Keep your record clean. Riding defensively and obeying traffic laws is the most effective long-term approach to keeping your insurance costs low. Every year without a violation helps demonstrate to insurers that you’re a responsible rider, which directly translates to lower premiums.

Secure the Right Protection for Your Ride

Now you understand that the Kawasaki Ninja 300 insurance cost isn’t a random number—it’s a personalized calculation reflecting your situation, habits, and chosen protection. We’ve seen rates swing from $120 per year for basic liability to over $2,000 for full coverage in high-risk scenarios. The good news is you now have the knowledge to secure a lower rate.

By understanding what drives your premium—your age and experience, your location in Massachusetts or New Hampshire, your driving record, and even whether your bike has ABS—you’re already ahead of the game. You know that choosing the right coverages, whether that’s meeting your state’s minimum requirements or investing in comprehensive and collision to protect your bike’s value, is about finding the balance between cost and peace of mind.

And you’ve learned the practical strategies that actually work: taking a certified safety course through the Motorcycle Safety Foundation, bundling your motorcycle policy with your home insurance, maintaining that spotless driving record, and most importantly, shopping around for quotes. These aren’t just tips—they’re proven ways to save real money without sacrificing the protection you need.

No two riders pay the same rate. What one insurer considers high-risk, another may not. That’s why working with an independent agency makes a difference. We don’t represent just one carrier; we work with multiple top-rated insurers to compare options and find coverage that fits your needs and budget.

At Stanton Insurance Agency, we’ve spent years helping riders across Massachusetts and New Hampshire steer these exact decisions. We understand the local roads, the state requirements, and the unique challenges that come with insuring a sportbike in New England. More than that, we genuinely care about getting you the right protection at a fair price, so you can focus on what matters: enjoying every twist and turn on your Kawasaki Ninja 300.

Ready to see what your actual Kawasaki Ninja 300 insurance cost could be? Let’s find out together. Get a personalized motorcycle insurance quote today and find how affordable the right coverage can be. Your ride is waiting.