Is vandalism covered by commercial property insurance 1

Protecting Your Business from Vandalism

It’s a scenario no business owner wants to face: arriving at your property to find shattered glass, spray-painted walls, or other senseless destruction. When this happens, a key question arises: is vandalism covered by commercial property insurance?

Here’s a quick answer:

- Yes, in most cases, commercial property insurance does cover vandalism.

- This coverage is often included as “vandalism and malicious mischief coverage.”

- However, specific policy terms, exclusions (like vacant properties), and endorsements always apply.

Vandalism is more than just an eyesore; it’s a direct attack on your investment. It can disrupt operations, deter customers, and lead to significant financial loss. For business owners in Massachusetts and New Hampshire, understanding your financial safeguards is critical. This guide breaks down everything you need to know about protecting your business.

Geoff Stanton is President at Stanton Insurance. With over 20 years in the industry, including a Certified Insurance Counselor (CIC) designation, Geoff specializes in Commercial Property & Liability, especially understanding is vandalism covered by commercial property insurance for small and medium-sized businesses.

Basic is vandalism covered by commercial property insurance vocab:

- Commercial Property Insurance

- commercial property insurance rates

- is collapse covered by commercial property insurance

Understanding Vandalism and Malicious Mischief Coverage

When reviewing your commercial property insurance, you’ll often see the terms “vandalism” and “malicious mischief.” While they sound similar, understanding the distinction is key to knowing if is vandalism covered by commercial property insurance for your business.

What is ‘Vandalism and Malicious Mischief’?

Vandalism is the willful, intentional destruction or defacement of property, like spray-painting a wall or smashing a window. Malicious mischief is a broader term that includes reckless acts causing damage, even without the specific intent to destroy. In insurance, these terms are usually bundled together as vandalism and malicious mischief coverage. This combined coverage is designed to help pay for the repairs or replacement of your property when it’s damaged by these kinds of acts. It’s a fundamental safeguard for businesses, especially if you’re in an area where such incidents are a concern.

How is Vandalism Coverage Included in a Policy?

Vandalism is considered a “peril,” or a cause of loss. How your policy handles this peril depends on the type of Commercial Property Insurance you have. At Stanton Insurance Agency, we help business owners in Massachusetts, New Hampshire, and Maine steer these policy types to ensure you have the right protection.

There are two main ways commercial property policies offer this protection:

-

All-Risk (Open Peril) Policies: These offer the broadest protection, covering all direct physical losses unless a cause is specifically excluded. Vandalism is almost always included in an all-risk policy, providing comprehensive peace of mind.

-

Named Peril Policies: These policies are more selective, only covering perils explicitly listed in the policy. To be covered, “vandalism and malicious mischief” must be named. While potentially more affordable, they require careful review to ensure you’re protected against the risks you face.

Most standard commercial property insurance policies today include vandalism and malicious mischief coverage as a basic component. However, it can also be added as a specific policy endorsement or rider. This is especially important for landlords or businesses that might be unoccupied for certain periods. Our team at Stanton Insurance always recommends taking a close look at your policy language to confirm the specifics of your coverage.

What’s Covered vs. What’s Excluded

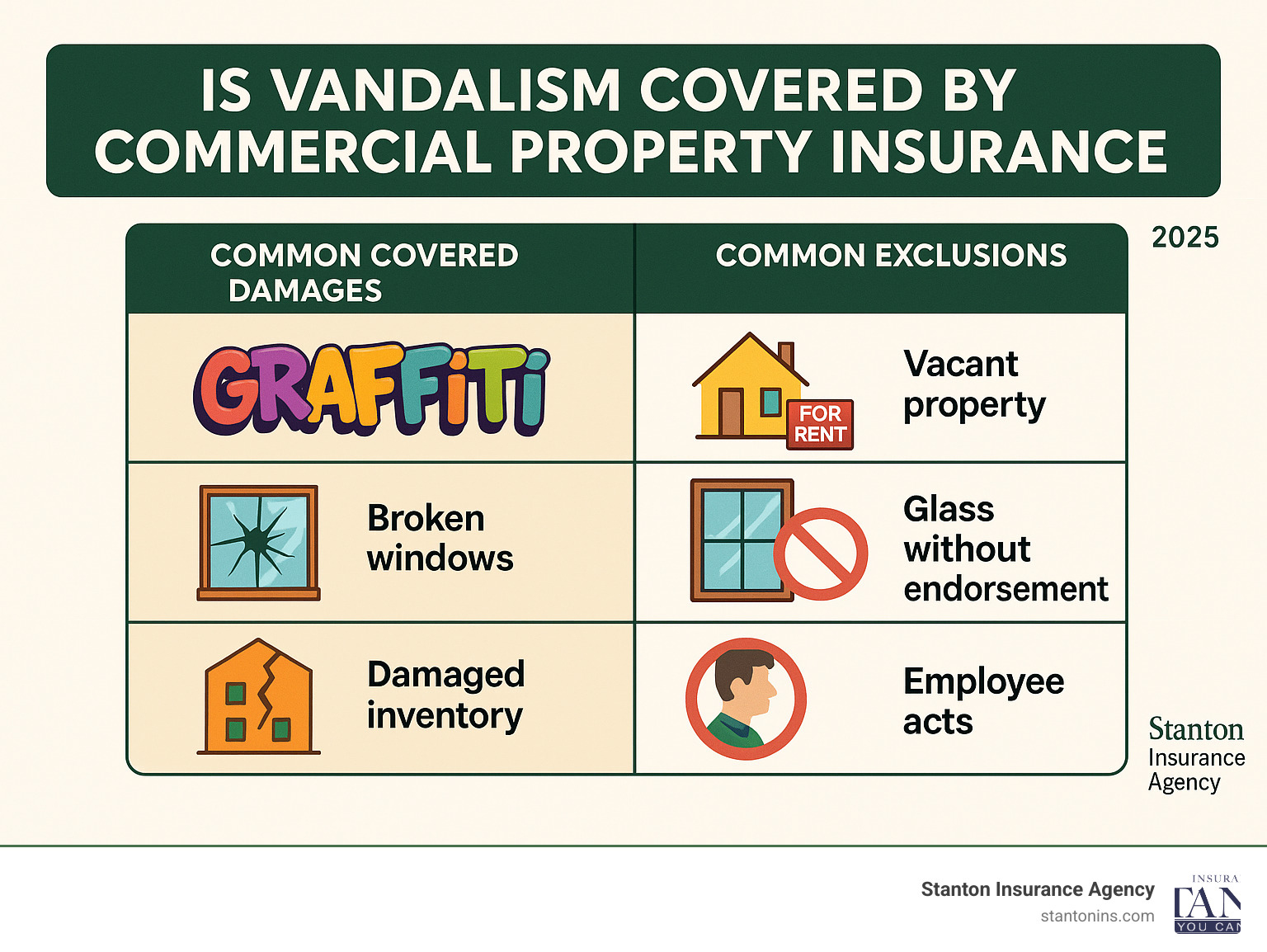

When considering is vandalism covered by commercial property insurance, it’s crucial to understand that while coverage is generally broad, it’s not without its limits. Knowing what is and isn’t covered is key to avoiding surprises.

What specific damage is covered if vandalism is covered by commercial property insurance?

When vandalism is a covered peril, your policy can help pay for a wide range of damages to get your business back to normal quickly. This includes:

- Structural Damage: Covers repairs to broken windows, doors, locks, and walls.

- Exterior Defacement: Pays for graffiti removal, pressure washing, and repainting.

- Damaged Business Property: Covers vandalized furniture, equipment, computers, and inventory inside your building.

- Debris Removal: Pays for the cleanup of broken glass, damaged fixtures, and other messes left behind.

- Business Interruption: If vandalism forces a temporary closure, this helps replace lost income and cover ongoing expenses like payroll and rent. You can learn more in our guide on what is business owners insurance and when do you need it.

For the latest updates on protecting your business, check out our Business Insurance News.

What Common Exclusions Might Prevent Coverage?

Even with a robust policy, certain situations can lead to a denied claim. At Stanton Insurance Agency, we help Massachusetts and New Hampshire business owners steer these potential pitfalls. It’s vital to know these common exclusions:

- The Vacancy Clause: Most policies exclude vandalism if the property has been vacant for over 60 consecutive days. Insurers view empty buildings as a much higher risk.

- Glass Breakage Limitations: Large plate glass or specialty windows might require a separate glass endorsement for full coverage.

- Acts by Insured Parties: Vandalism committed by the business owner, a partner, or an employee is not covered. Insurance protects against external, not internal, threats.

- Theft-Related Distinctions: Damage from a break-in (like a broken door) is covered as vandalism, but the stolen items fall under your policy’s theft provision, which may have different limits and deductibles.

Is Vandalism Covered by Commercial Property Insurance? A Guide to Filing a Claim

So, you’ve arrived at your business in Massachusetts or New Hampshire, and the unfortunate has happened: vandalism. It’s a gut-wrenching feeling, but your immediate response is crucial for a smooth recovery and insurance claim process. Knowing if is vandalism covered by commercial property insurance is the first step; acting correctly is key.

What Steps Should I Take Immediately After Vandalism?

Finding your property vandalized is upsetting, but your actions in the first few hours are critical for safety, securing your property, and ensuring your insurance claim succeeds. Follow this roadmap:

-

Call the Police: This is your first step. An official police report is essential evidence that a crime occurred and is almost always required by insurers for a vandalism claim.

-

Document Everything: Before cleaning up, take extensive photos and videos of all damage from multiple angles. Make a detailed list of every damaged or destroyed item, and gather receipts if possible. This documentation is your primary evidence for the insurer.

-

Mitigate Further Damage: Take reasonable steps to secure your property and prevent more loss, such as boarding up a broken window. This shows the insurer you acted responsibly.

-

Contact Your Insurance Agent: Report the claim to us at Stanton Insurance Agency as soon as possible. We will guide you through the claims process and explain your policy’s terms.

Proper documentation and prompt reporting are the cornerstones of a successful claim. For a broader understanding of how to protect your business, we encourage you to explore The Definitive Guide to Finding Suitable Business Insurance Coverage.

Why might a claim be denied even if vandalism is covered by commercial property insurance?

Even if your policy covers vandalism, a claim can still be denied. Insurers may deny a claim if the policyholder fails to provide adequate proof or meet specific policy conditions. Here are the most common reasons for denial:

- Lack of a Police Report: Without an official report, insurers may question the legitimacy of the incident.

- Insufficient Documentation: Failure to provide proof (photos, receipts) of the existence and value of damaged property can lead to denial or a lower settlement.

- Vacancy Clause: If the property was unoccupied for more than 60 consecutive days (as defined by the policy), the claim will likely be denied.

- Failure to Mitigate: If you don’t take reasonable steps to prevent further damage after the incident (e.g., leaving a broken window open to the elements), the insurer may deny coverage for the subsequent damage.

- Specific Policy Exclusions: The damage may fall under an exclusion, such as for certain types of glass not covered by a special endorsement.

- Vandalism by an Insured: Damage caused by the policyholder, an employee, or anyone connected to the policy is not covered.

Prevention and Other Related Coverages

While knowing that is vandalism covered by commercial property insurance provides a crucial safety net, prevention is always the best strategy. Minimizing the chances of vandalism can save you headaches, downtime, and potential premium increases.

How Can I Help Prevent Vandalism?

You can’t eliminate the risk entirely, but you can make your property a less attractive target. Insurers also look favorably on proactive measures, as they demonstrate your commitment to risk management.

- Improve Lighting: A well-lit property is a major deterrent. Install bright exterior lighting around entrances, windows, and alleys to make it harder for vandals to go unnoticed.

- Install Security Cameras: Visible surveillance cameras discourage vandals and provide valuable footage for police reports and insurance claims if an incident occurs.

- Secure Your Perimeter: Use strong locks on all doors and windows. Consider secure fencing and strategic landscaping, like thorny bushes, to deter access. Keep outdoor areas tidy to eliminate hiding spots.

- Maintain Your Property: A well-kept property signals active occupancy. Remove any graffiti immediately, as prompt removal discourages repeat offenses.

What Other Insurance Covers Vandalism?

While your Commercial Property Insurance covers your building and its contents, vandalism can affect other valuable business assets. Other specialized coverages provide comprehensive protection for small businesses in Massachusetts or New Hampshire.

-

Commercial Auto Insurance: If a company vehicle is vandalized (e.g., spray-painted, tires slashed), the damage is covered under the comprehensive portion of your commercial auto policy, not your property policy.

-

Inland Marine Insurance: This policy, also known as a tools and equipment floater, is crucial for businesses with mobile equipment. It covers tools and equipment that are vandalized while in transit, at a job site, or stored away from your main business premises.

By understanding these additional coverages, you can ensure that all facets of your business are protected against the unexpected as part of a robust Small Business Insurance strategy.

Frequently Asked Questions about Vandalism and Insurance

We often get asked similar questions by business owners in Massachusetts, New Hampshire, and Maine when they’re trying to understand their vandalism coverage. Let’s clear up some of the most common concerns.

Does filing a vandalism claim raise my insurance rates?

Filing any claim has the potential to affect future premiums, as your claims history is a key factor in determining risk. However, a single, isolated vandalism claim is less likely to cause a significant rate hike than multiple claims or those resulting from negligence. Insurers consider your overall claims history, business location, and existing security measures. Often, the cost of repairs far outweighs any potential premium increase.

Do I need a police report to file a vandalism claim?

Yes, a police report is practically a necessity. Most insurers require it as official, third-party evidence that a crime occurred. It validates the incident and provides crucial details that speed up the claims process. Without a police report, your claim is far more likely to be delayed, questioned, or denied for lack of verifiable proof.

How is the cost of commercial property insurance with vandalism coverage determined?

The cost of your commercial property insurance, and how is vandalism covered by commercial property insurance impacts it, is based on several key risk factors:

- Location: Businesses in areas with higher crime rates typically have higher premiums.

- Property Value: The value of your building and its contents directly impacts the potential payout and, therefore, the premium.

- Construction & Industry: A modern, fire-resistant building may have lower premiums. Your industry type also matters, as a retail store has different risks than a manufacturing plant.

- Claims History: A history of frequent claims can lead to higher rates.

- Security Measures: Proactive measures like security cameras, lighting, and alarms can often lead to discounts.

- Policy Limits & Deductible: Higher coverage limits increase the premium, while a higher deductible can lower it.

By evaluating these factors, we can work with you to tailor a policy that provides the right protection at a competitive price.

Protect Your Business from the Unexpected

Vandalism is a frustrating and costly threat, but it doesn’t have to be a financial disaster. A well-structured Business Insurance plan is your most important recovery tool. By understanding your policy, knowing the exclusions, and taking proactive steps to secure your property, you can reduce your risk and ensure a smoother recovery.

The answer to is vandalism covered by commercial property insurance is typically “yes” for most comprehensive policies. However, true peace of mind comes from understanding the details of your coverage. At Stanton Insurance Agency, we help business owners across Massachusetts, New Hampshire, and Maine steer these complexities.

Don’t let uncertainty be a risk. If you’re unsure about your current coverage or want to ensure your business is protected against vandalism and other perils, our team is here to help. We’ll review your policy, identify any gaps, and find the right protection for your assets.

Ready to secure your peace of mind? Contact us today for a comprehensive review of your Commercial Property Insurance policy.