Is limited collision worth it: Smart 2025 Guide

Why Limited Collision Coverage is a Crucial Decision for Massachusetts Drivers

Is limited collision worth it? Here’s the quick answer for Massachusetts drivers:

Limited collision is worth it if:

- You own an older, low-value car outright (worth less than $5,000)

- You have sufficient savings to cover major repairs or replacement

- You have a clean driving record and rarely drive in high-traffic areas

- The annual premium savings exceed 10% of your car’s actual value

Limited collision is NOT worth it if:

- Your car is financed or leased (lenders won’t accept it)

- You cannot afford unexpected repair bills of several thousand dollars

- You frequently drive in congested areas where accidents are more likely

- You want coverage for hit-and-run incidents where the driver isn’t identified

Limited collision coverage is a Massachusetts-specific option that offers lower premiums but only pays for vehicle damage when you’re 50% or less at fault in an accident. Unlike standard collision, it includes no deductible when it applies, but it leaves you completely uncovered if you cause an accident or if another driver can’t be identified.

The decision comes down to a simple cost-benefit calculation. You’re trading premium savings for the risk of paying thousands out-of-pocket if you’re at fault. For a car worth $3,000, paying $400 annually for standard collision may not make sense. But for a newer vehicle worth $15,000, that same premium could save you from financial disaster.

As Geoff Stanton, President of Stanton Insurance Agency, I’ve helped hundreds of Massachusetts drivers answer if limited collision is worth it for their specific situation. By analyzing vehicle value, driving habits, and financial capacity, we can determine the smartest coverage choice. My goal is to ensure you understand exactly what you’re getting—and what you’re giving up—before making this critical decision.

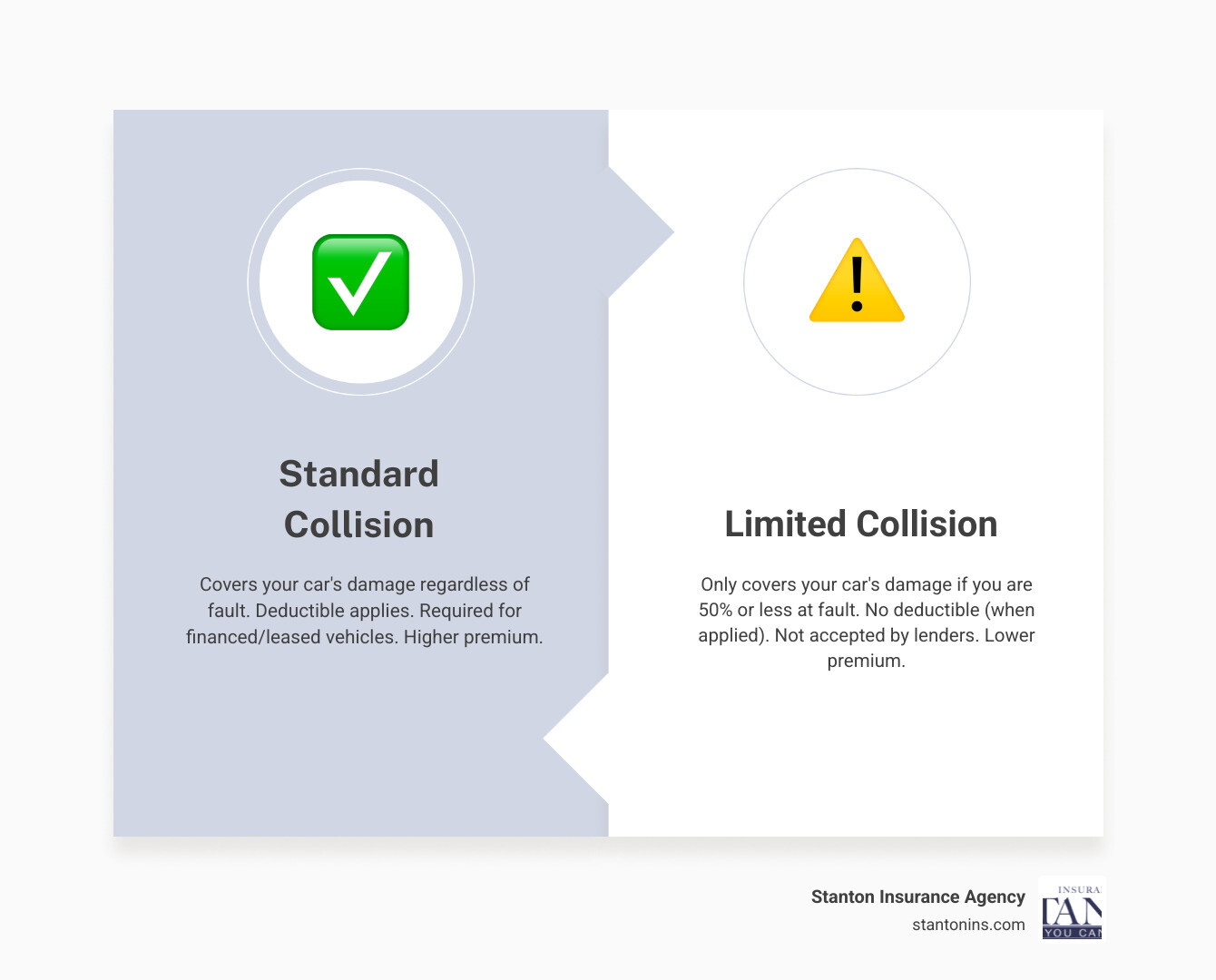

Standard vs. Limited Collision: A Head-to-Head Comparison

Understanding the fundamental differences between these two coverages is the first step. While both pay for damages to your vehicle, their application is worlds apart.

The core distinction is critical: standard collision covers your car’s damage regardless of who caused the accident, while limited collision only covers it if you’re 50% or less at fault. This single difference affects how these coverages work, what they cost, and when they’ll be there for you.

| Feature | Standard Collision | Limited Collision (MA Only) |

|---|---|---|

| Fault Requirement | Pays for damages regardless of who is at fault. | Only pays if you are 50% or less at fault for the accident. |

| Deductible | A deductible applies (e.g., $500, $1,000). | No deductible when coverage applies (i.e., you’re not at fault). |

| Premium Cost | Generally higher due to broader coverage. | Generally lower due to stricter payout conditions. |

| Hit-and-Run | Covers damage, even if the other driver isn’t found. | Requires the other driver to be identified. |

| Lender Acceptance | Typically required for financed or leased vehicles. | Not accepted by lenders for financed or leased vehicles. |

| Availability | Available in all states. | Primarily available only in Massachusetts. |

What is Standard Collision Coverage?

Standard collision coverage is your safety net for vehicle damage, no matter what happens. If you hit another car, back into a mailbox, slide into a guardrail on icy roads, or roll your vehicle, standard collision has you covered. The defining feature is simple: it pays for damages regardless of who caused the accident.

When you file a claim, you’ll pay your chosen deductible first—typically anywhere from $500 to $1,000 or more. After that, your insurance company covers the remaining repair costs up to your car’s actual cash value. Yes, you’re out-of-pocket for the deductible, but you’re protected from catastrophic repair bills that could run into the thousands.

This broader protection comes with higher premiums, but there’s a reason lenders and leasing companies almost always require it. They have a financial stake in your vehicle and need to know it’s protected no matter what. If you’re financing or leasing your car, standard collision is typically mandatory. You can learn more in our guide on What is Collision Insurance?

What is Limited Collision Coverage?

Limited collision coverage is Massachusetts’ budget-friendly alternative that comes with serious limitations. It only works under specific conditions: the coverage only pays for your vehicle’s damage if you’re determined to be 50% or less at fault for the accident.

If you rear-end someone, swerve and cause an accident, or back into a parked car, you’re likely to be found more than 50% at fault. In those scenarios, limited collision provides zero coverage, meaning you’ll pay for all repairs yourself.

The upside? When limited collision does apply, there’s no deductible to pay. If someone else causes an accident and you’re not at fault, your repairs are covered 100% without you having to pay anything out-of-pocket first. This is a genuine advantage over standard collision’s deductible requirement.

But there’s another major catch: limited collision requires the other driver to be identified. If you’re the victim of a hit-and-run, your limited collision coverage won’t help you, even if you were not at fault. The other party must be identified for your coverage to work.

Because of these stricter payout conditions, limited collision costs significantly less than standard collision. However, this also means lenders won’t accept limited collision for financed or leased vehicles. They need the comprehensive protection that standard collision provides. When you’re asking yourself is limited collision worth it, these restrictions are exactly what you need to weigh against the premium savings. For a detailed comparison, visit our page on Collision vs. Limited Collision.

Is Limited Collision Worth It? A Financial Breakdown

This is the central question for many drivers, especially those with older, paid-off vehicles. The answer depends on a careful calculation of premium savings versus potential financial risk. For some, the cost savings make perfect sense. For others, the potential financial exposure is too great. Let’s break down how to figure out which camp you fall into.

Calculating Your Potential Savings vs. Risk

Deciding is limited collision worth it means doing some honest math. You’re weighing a guaranteed smaller expense (your premium) against a potential larger one (paying for repairs yourself if you’re at fault).

Start by looking at your annual premium savings. Check your policy quotes to see the exact difference between standard and limited collision. Limited collision is cheaper because insurers know they’ll be writing far fewer checks, but that savings comes with big strings attached.

Next, you need to know your vehicle’s Actual Cash Value (ACV). This isn’t what you paid for it, but what the market says it’s worth today. You can find this number using online vehicle valuation tools. This matters because no collision coverage will pay more than your car’s ACV, no matter how much repairs cost.

Here’s where the “10% Rule” comes in handy. This guideline suggests that if your annual collision and comprehensive premiums combined exceed 10% of your vehicle’s value, you might want to rethink those coverages. For a car worth $3,000, paying $350 a year for standard collision is nearly 12% of its value. Add a $500 deductible, and your maximum possible payout is only $2,500. The math starts looking less attractive. Our guide on When to Drop Collision Insurance Coverage explores this concept in more depth.

The final piece of the puzzle is your personal savings. Could you write a check for several thousand dollars to repair or replace your car without causing serious financial stress? If not, limited collision might be too risky. The point of insurance is to protect you from expenses you can’t comfortably absorb on your own.

Who is the Ideal Candidate? When is limited collision worth it?

So who should consider limited collision? After years of helping Massachusetts drivers, I’ve noticed clear patterns in who benefits most.

The ideal candidate owns an older, low-value car outright, typically worth less than $5,000. If your car is paid off and its market value is around $2,000 or $3,000, the economics of standard collision start to fall apart.

A clean driving record matters. If you haven’t had an at-fault accident in years and you’re a cautious driver, you’re at lower risk of causing an accident. Limited collision becomes a calculated bet on your own driving skills.

The real deal-breaker is having sufficient savings to cover major repairs or replacement. This is essential. If you choose limited collision, you’re self-insuring for at-fault accidents. Your emergency fund must be robust enough to handle a check for thousands of dollars.

You also need to be comfortable with risk. Some people prefer paying more for peace of mind. Others accept more risk for lower premiums. Neither approach is wrong—it’s about knowing your comfort level. The Basics of Auto Insurance in Massachusetts provides helpful context.

The Bottom Line: When is limited collision worth it for an older car?

For older vehicles, is limited collision worth it comes down to three scenarios where it often makes sense.

If your car’s value is less than a few thousand dollars, standard collision’s benefit shrinks. A car worth $2,500 with a $500 deductible means you’d only receive a $2,000 maximum from a claim. If you’re paying $300 annually for that coverage, you’re spending 15% of the potential payout every year.

The second scenario is when the annual premium for standard collision plus the deductible approaches your car’s total value. At that point, you’re essentially pre-paying for your next car through insurance premiums.

The third scenario is the simplest: if you could easily replace the car without financial hardship, limited collision or even dropping collision coverage entirely might make sense. If losing your car wouldn’t significantly impact your finances, why pay to insure against that loss?

For many drivers with older vehicles, the goal shifts from protecting an asset to maintaining affordable transportation. If your older car gets totaled and you have the savings to buy another used car for $3,000, that might be more straightforward than years of paying collision premiums.

The Big Risks: When Limited Collision Leaves You Uncovered

While the lower premium is tempting, limited collision coverage has significant gaps that can leave you holding a very expensive bag. Before you make the switch, you need to understand exactly when this coverage will—and won’t—be there for you.

The At-Fault Accident Scenario

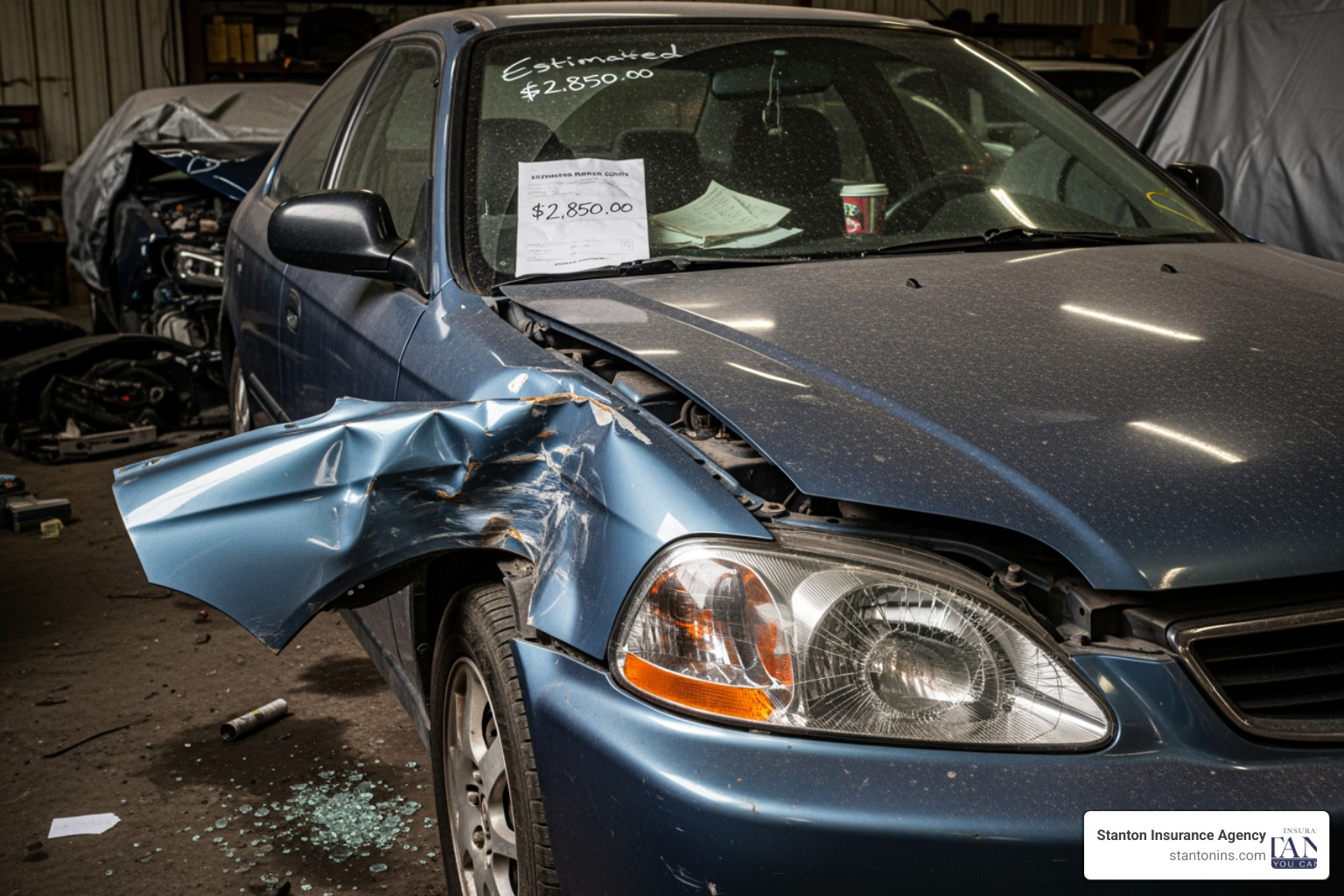

Here’s the scenario that keeps insurance agents up at night: you cause the accident. If you are determined to be more than 50% at fault for a collision, your limited collision coverage pays absolutely nothing. Zero.

Let’s make this real. You’re texting at a red light and roll forward into the car ahead. Or you misjudge a parallel parking attempt and crunch into the car behind you. Perhaps you back out of your driveway into a utility pole.

These are everyday accidents that happen to careful drivers. In these common scenarios, you would be found more than 50% at fault. Your limited collision coverage would provide zero help with a repair bill that could easily be thousands of dollars.

Think about whether limited collision is worth it when one distracted moment could cost you thousands out of pocket. Massachusetts uses the Safe Driver Insurance Plan (SDIP) to track at-fault accidents, and being at fault doesn’t just affect future premiums—with limited collision, it determines whether your car gets fixed on your insurer’s dime or yours.

The Unidentified Hit-and-Run

The second major gap is the “ghost driver” problem. Limited collision requires the at-fault driver to be identified. No identification means no coverage—it’s that simple and frustrating.

Imagine walking out of a store to find a massive dent in your door and no note. Or someone sideswipes you in traffic and speeds off before you can get their plate number. In all these situations, you have damage, you’re clearly not at fault, but you have no idea who did it.

With limited collision, you’re stuck. The coverage won’t apply because the responsible party is unidentified. You’re left to pay for all the repairs yourself.

If you had standard collision, you’d file a claim, pay your deductible, and get your car fixed. Some Massachusetts drivers also carry Uninsured Motorist Property Damage (UMPD) coverage, which can help in certain hit-and-run situations, but that’s a separate coverage. You can learn more about the Difference between Collision and Uninsured Motorist coverage to see how they complement each other.

Hit-and-run accidents are more common than you might think, especially in busy parking lots and urban areas. If you regularly park on city streets or in crowded lots, this risk becomes very real.

State-Specific Availability

Here’s something that surprises many people: limited collision is almost exclusively a Massachusetts thing. This unique coverage option is primarily available only in the Commonwealth.

If you move to another state—say, across the border to New Hampshire—you won’t find limited collision as an option. New Hampshire drivers face a simpler choice: either carry standard collision coverage or go without it entirely.

This state-specific nature is a good reminder that auto insurance isn’t one-size-fits-all. Each state has its own rules and required coverages. That’s why working with a local insurance agency that truly understands Massachusetts insurance regulations can make such a difference.

The bottom line? Limited collision’s lower premium comes with real, substantial risks. You’re gambling that you won’t cause an accident and that if someone hits you, they’ll stick around. For some drivers, that’s a bet worth taking. For many others, the peace of mind of standard collision is worth every penny.

Frequently Asked Questions about Limited Collision Coverage

Navigating auto insurance can feel like learning a new language, and we get a lot of questions about limited collision. These are the questions that come up most often when Massachusetts drivers are trying to figure out is limited collision worth it.

Is Limited Collision the same as Comprehensive Coverage?

No, they are entirely different coverages for different risks. This is a common point of confusion.

Limited collision covers damage to your car from a collision where you are 50% or less at fault. It’s all about who caused the accident.

Comprehensive coverage, on the other hand, has nothing to do with fault or collisions. It pays for non-collision events like theft, vandalism, fire, hail, falling objects, or hitting an animal. These are “acts of nature” and random events outside of your control.

So while both are optional coverages for your vehicle, they cover completely separate risks. You could have one, both, or neither.

What happens if I’m less than 50% at fault, but the other driver is uninsured or their insurance company is difficult?

This is a significant risk many drivers don’t appreciate until it’s too late.

With standard collision, the process is straightforward. If the other driver is at fault but uninsured or their insurer is difficult, you pay your deductible and your own insurer handles your repairs. Your insurance company then pursues reimbursement from the other party through a process called subrogation. This gets your car fixed faster and relieves you of the burden.

With limited collision in Massachusetts, the situation is more complicated. If the other driver is uninsured or their insurer is uncooperative, you could be stuck waiting. Your policy won’t pay if there’s no solvent insurer to recover from, even if you weren’t at fault. This means you might have to pay for repairs out-of-pocket and potentially sue the at-fault driver directly, which is a lengthy and expensive process.

This is one of the “hidden” downsides of limited collision that makes the premium savings less attractive. You’re not just giving up coverage for at-fault accidents; you’re also giving up the convenience of having your own insurer fix your car quickly.

Can I have both Standard and Limited Collision coverage?

No, you cannot have both standard and limited collision coverage on the same vehicle. When you choose collision coverage for your car in Massachusetts, it’s an either-or decision. You must select either the standard option or the limited option for each vehicle on your policy. They are mutually exclusive options.

Get the Right Protection for Your Ride

Deciding if limited collision is worth it requires a look at your car’s value, your budget, and your risk tolerance. It’s a personal decision based on your circumstances.

For drivers in Massachusetts with older, paid-off cars and a healthy emergency fund, limited collision can be a calculated way to save on premiums. If your 2008 sedan is worth $2,500 and you have savings for car emergencies, accepting the risk of paying for at-fault accidents might make financial sense. You’re essentially self-insuring for those scenarios while keeping some protection.

However, for most drivers, the peace of mind from standard collision is the safer bet. It protects you from catastrophic repair bills regardless of fault, a hit-and-run, or if the other driver is uninsured. When your car is your lifeline to work and daily life, that comprehensive protection often outweighs the premium savings.

At Stanton Insurance Agency, we understand that insurance is about people and their peace of mind. We take the time to understand your vehicle’s value, driving patterns, and financial comfort zone. For our Massachusetts clients, we’ll walk through the Collision vs. Limited Collision decision together, helping you weigh the savings against the risks. For our New Hampshire clients, we’ll focus on the right deductible and coverage strategy, as limited collision isn’t an option there.

Our goal isn’t just to sell you a policy—it’s to ensure you have trusted protection that lets you drive with confidence. As a fourth-generation, family-owned agency, we’ve been helping local drivers steer these decisions for decades. We’ve seen how the right coverage prevents financial disasters. Making the right choice ensures you don’t crash your budget when an accident happens.

Get a quote for your car insurance today!