Insurance for Landlords: Essential Guide 2025

Why Landlord Insurance is Essential for Property Owners

Being a landlord is a rewarding investment, but it comes with unique risks that a standard homeowners policy won’t cover. Insurance for Landlords provides essential protection that standard homeowners policies simply can’t match. If you own rental property, this specialized coverage is the critical financial safety net that protects your property, your income, and your liability.

Your rental property is a business asset. Whether it’s a single-family home, a condo, or a multi-unit building, it requires professional-grade protection. With a significant portion of Americans renting their homes, understanding this essential coverage has never been more important for protecting your investment from the unexpected.

Most mortgage lenders require this coverage for financed rental properties, making it both a practical necessity and a contractual requirement in many cases. This guide will walk you through everything you need to know about securing your investment.

Understanding the Essentials of Landlord Insurance

While a homeowners policy is suitable for a property you live in, a rental property is an income-generating business that requires the professional protection of Insurance for Landlords. This specialized coverage recognizes that your property is a business asset with unique risks, from different liability exposures to a more complex financial stake.

What is Landlord Insurance and Why is it Important?

Landlord insurance, also known as rental property or dwelling fire insurance, is a policy designed for the realities of renting to others. It is important for several key reasons:

- Financial Protection: Your rental property is a significant investment. A single fire, storm, or act of vandalism could be financially devastating. Landlord insurance covers the cost of repairs or rebuilding, protecting your investment from catastrophic loss.

- Liability Shield: As a landlord, you can be held responsible for injuries to tenants or guests on your property. This coverage handles legal defense costs and potential settlements from lawsuits, protecting your personal assets.

- Business Continuity: If a covered event makes your property unlivable, you lose rental income. Loss of rent coverage reimburses you for this lost income during the repair period, ensuring your investment continues to provide cash flow.

This coverage provides the peace of mind that comes from knowing your investment is secure.

What Types of Properties Are Covered?

Landlord insurance is flexible and can be custom to various property types:

- Single-family homes are the most common type of rental and are well-suited for standard landlord policies.

- Multi-family properties like duplexes and triplexes require coverage that accounts for multiple units and tenants.

- Apartment buildings need comprehensive policies to handle the increased complexity and liability of many units.

- Condo units require landlord coverage, as the condo association’s master policy does not protect your individual unit or your liability as a landlord.

- Short-term rentals (like those found on home-sharing websites) typically require special endorsements or separate commercial policies due to the high turnover of guests.

Is Landlord Insurance Legally Required?

While most states don’t have a law mandating landlord insurance, it is a practical necessity.

If you have a mortgage on your rental property, your lender will almost certainly require you to carry landlord insurance to protect their financial interest. This is a contractual obligation within your mortgage agreement. Failing to maintain the required insurance can lead to your lender purchasing a costly “forced-place” policy and billing you for it, or could even put you in breach of your mortgage terms.

A Deep Dive into Insurance for Landlords: What’s Covered (and What’s Not)

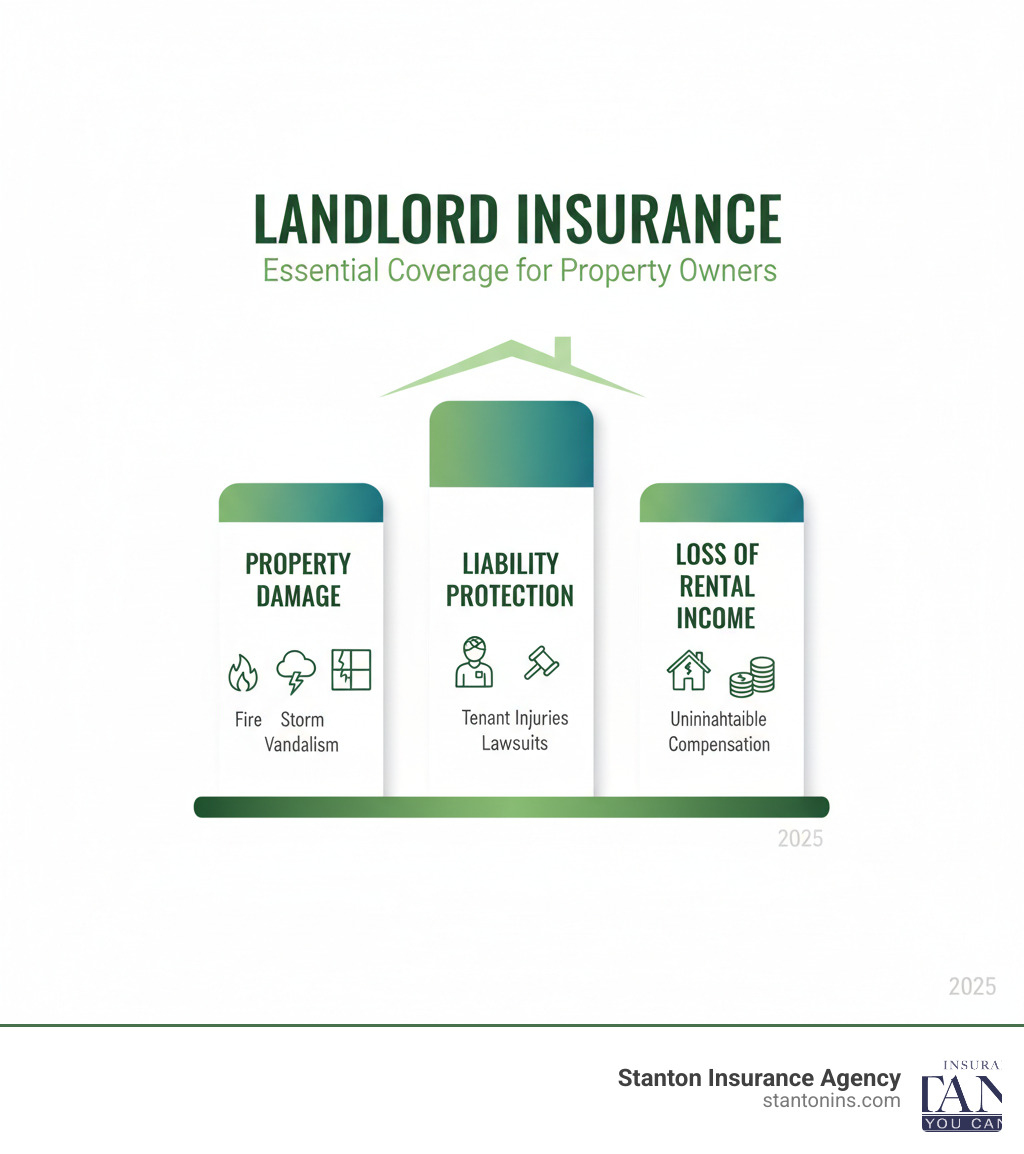

A standard Insurance for Landlords policy, often a Dwelling Fire Policy (DP-3), is built on three core protections. Understanding these components, along with optional coverages and key exclusions, is vital to protecting your investment.

Property Damage Protection

This is the foundation of your policy, protecting the physical structure of your property. It typically includes:

- Dwelling Coverage: Protects the main building against damage from covered events like fire, windstorms, hail, and vandalism. Understanding the risks of structural damage highlights the importance of this coverage.

- Other Structures: Covers detached structures like garages, sheds, and fences.

- Landlord’s Personal Property: Protects items you own that are used to service the rental, such as appliances and lawnmowers left for tenant use.

Liability Protection

This coverage is your financial shield if you are found legally responsible for accidents on your property. It covers:

- Tenant and Guest Injuries: Protects you from lawsuits arising from injuries, such as slips and falls, that occur on your property.

- Legal Defense Costs: Pays for your legal fees to defend against a liability claim, even if the suit is baseless.

- Medical Payments: Covers minor medical expenses for injured parties, regardless of fault, which can help prevent small incidents from becoming large lawsuits. Learn more about what personal liability in home insurance means for your protection.

Loss of Rent (Fair Rental Value)

If a covered event like a fire makes your property uninhabitable, this coverage reimburses you for the lost rental income during the repair period. It ensures your cash flow continues, providing a critical financial buffer when you need it most.

Common Optional Coverages for Landlords

- Vandalism Coverage: Provides broader protection against intentional damage, which can be important for vacant properties.

- Building Code Upgrade Coverage: Helps pay for the extra cost to bring a damaged property up to current building codes during repair.

- Flood Insurance: A crucial, separate policy for properties in flood-prone areas, as flood damage is not covered by standard policies.

- Ordinance or Law Coverage: Similar to building code coverage, this helps with costs associated with new regulations.

What is Typically NOT Covered?

- Tenant’s Personal Property: Your policy does not cover your tenants’ belongings. They need their own renters insurance.

- Normal Wear and Tear: Gradual deterioration, like worn carpets or faded paint, is a maintenance cost, not an insurable loss.

- Maintenance Issues: Damage resulting from neglected upkeep, such as an ignored leaky roof, is generally not covered.

- Earthquakes and Floods: These natural disasters typically require separate, specialized policies.

- Intentional Damage by Tenants: Malicious acts by a tenant are often excluded, though some vandalism endorsements may apply.

- Eviction Costs: The legal fees for evicting a tenant are not covered by standard policies.

Landlord vs. Homeowners vs. Renters Insurance: Key Differences

It’s a common point of confusion, but these three policies are designed for very different purposes and are not interchangeable. Using a homeowners policy for a rental property can lead to a denied claim, leaving you completely exposed.

| Feature | Landlord Insurance | Homeowners Insurance | Renters Insurance |

|---|---|---|---|

| Who it’s for | Property owners renting to others | Owner-occupants | Tenants |

| Dwelling Coverage | Yes | Yes | No |

| Personal Property | Limited (landlord’s property only) | Yes (owner’s property) | Yes (tenant’s property) |

| Liability | Yes (landlord’s liability) | Yes (owner’s liability) | Yes (tenant’s liability) |

| Loss of Use/Rent | Yes (loss of rent) | Yes (additional living expenses) | Yes (additional living expenses) |

Why Your Homeowners Policy Isn’t Enough

Many new landlords mistakenly assume their homeowners policy will cover a rental property. This is a critical error. Insurance companies view owner-occupied and non-owner-occupied properties as having entirely different risk profiles.

Most homeowners policies contain a business use exclusion. Since renting your property generates income, it’s considered a business, and any claims related to this activity will likely be denied. A rental property has different risks, including less oversight and tenants who may not report issues as promptly as an owner would. If you live in one unit of a multi-family home and rent out others, you’ll need a specialized policy. Our guide on Homeowners Insurance for Multi-Family properties explains these hybrid options.

The Role of Renters Insurance

Your landlord policy protects your building and your liability, not your tenant’s. This is where renters insurance is essential.

- Covers Tenant’s Belongings: If a fire or theft occurs, renters insurance covers the tenant’s furniture, electronics, and other personal items. Your policy does not.

- Provides Tenant Liability: If your tenant’s negligence causes damage (e.g., an overflowing bathtub) or if their guest is injured in their unit, the tenant’s liability coverage responds first.

- Pays for Additional Living Expenses: If the property becomes uninhabitable, renters insurance helps the tenant pay for temporary housing.

Many smart landlords require tenants to carry renters insurance in the lease. This reduces the likelihood of disputes and ensures tenants have a way to recover from a loss. Explaining what is personal liability insurance for renters can help tenants understand its value.

Explaining the Cost of Landlord Insurance

Insurance for Landlords typically costs 15-25% more than a standard homeowners policy because rental properties present higher risks to insurers. Tenants may not spot or report issues as quickly as a resident owner, leading to a higher frequency of claims.

The actual cost varies significantly. For example, property owners in New Hampshire might pay around $1,341 per year on average, while Massachusetts averages closer to $1,200 per year. These figures reflect local factors like weather risks, crime rates, and construction costs.

Factors That Influence Your Premium

Your premium is based on a risk assessment. Key factors include:

- Property Location and Age: Coastal properties face hurricane risks, while older properties may have aging systems more prone to failure.

- Construction Type: Fire-resistant materials like brick can result in lower premiums than wood-frame construction.

- Updated Utilities: A new roof or updated electrical and plumbing systems reduce the risk of claims and can lower your cost.

- Number of Rental Units: More units mean more tenants and a higher potential for claims.

- Claims History: A clean claims record can lead to lower premiums.

- Coverage Limits and Deductibles: Higher coverage limits increase the premium, while a higher deductible (your out-of-pocket share of a claim) can lower it.

- Security Features: Burglar alarms, smoke detectors, and sprinkler systems often qualify for discounts.

For more detailed cost information on larger properties, see our guide on Apartment Building Insurance Cost.

Are There Discounts Available for Landlord Insurance Policies?

Yes, and it’s always worth asking about them. Common discounts include:

- Multi-Policy Bundles: Insuring your rental property, primary home, and auto with the same company can lead to significant savings.

- Claims-Free History: Insurers reward responsible landlords who have not filed claims for several years.

- Protective Devices: Discounts are often available for professionally monitored fire and security systems.

- Updated Utilities: Inform your agent about recent upgrades to your roof, plumbing, or electrical systems.

- Paying in Full: Paying your premium annually instead of in monthly installments can eliminate processing fees.

How to Secure Your Policy and Handle Special Cases

Getting the right Insurance for Landlords is a straightforward process when you know what to look for. It involves assessing your needs, gathering property information, and working with an insurance professional to compare quotes and customize your coverage.

The Process for Obtaining Insurance

- Assess Your Needs: Consider the property type, its risks, and your financial comfort level with potential losses.

- Gather Property Details: Collect key information, including the property’s address, age, square footage, construction type, and number of units. Note any safety features or recent updates.

- Work with an Agent: Contact an independent agent who understands the rental market. An agent can shop multiple carriers to find the best combination of coverage and price for you.

- Compare Quotes: Look beyond the lowest price. Compare coverage limits, deductibles, and exclusions to ensure you’re getting true value and not just a cheap, inadequate policy.

- Review and Finalize: Review the policy terms with your agent to ensure you understand what is and isn’t covered before finalizing your policy.

Special Considerations for Short-Term Rentals

If you list your property on short-term rental or home-sharing platforms, your standard landlord policy may not be sufficient. The constant turnover of guests creates a different, often higher, liability risk that many standard policies are not designed to cover.

For frequent short-term rental activity, you may need a commercial policy or a specialized home-sharing endorsement. Be upfront with your insurance agent about your rental plans to ensure you are properly covered from the start. An incorrect policy could lead to a denied claim.

State-Specific Requirements and Recommendations

Local conditions and regulations impact your insurance needs. In our region, it’s important to consider:

- New Hampshire: With an average landlord insurance cost of about $1,341 per year and a competitive rental market, having robust Loss of Rent coverage is particularly valuable. While the state is generally landlord-friendly, it has strict rules about security deposits that can create liability exposures.

- Massachusetts: The state’s dense urban areas and strong tenant-protection laws increase liability risks for landlords. Understanding local housing codes and tenant rights is critical to managing your risk and ensuring your insurance is adequate.

It’s crucial to understand local laws regarding landlord liability, as these can significantly impact your risk exposure. We stay current on Massachusetts and New Hampshire regulations to help you build coverage that protects against both property damage and legal complexities.

Frequently Asked Questions about Insurance for Landlords

We understand that Insurance for Landlords can feel complex. Here are straightforward answers to the questions we hear most often.

Does landlord insurance cover damage caused by tenants?

It depends on the type of damage. Policies typically cover accidental damage caused by a tenant, such as an accidental kitchen fire. However, intentional damage, like a tenant punching holes in walls, is usually excluded. Similarly, normal wear and tear, such as worn-out carpet, is considered a cost of doing business and is not covered. For concerns about intentional damage, a specific vandalism endorsement may be available.

What is the difference between Actual Cash Value (ACV) and Replacement Cost coverage?

This is a critical distinction that affects your claim payout.

-

Replacement Cost Value (RCV) pays to repair or rebuild your property with new materials of similar kind and quality, without a deduction for depreciation. If a storm destroys your 10-year-old roof, RCV pays for a brand-new roof.

-

Actual Cash Value (ACV) pays the replacement cost minus depreciation. For that same 10-year-old roof, ACV would only pay what the used roof was worth at the time of the loss, leaving you to cover the difference for a new one.

We almost always recommend RCV for the structure, as it provides the most complete financial protection and prevents large, unexpected out-of-pocket expenses during a claim.

Should I get an umbrella policy as a landlord?

Yes, we strongly recommend it. As a landlord, you face significant liability risks from tenant injuries, guest accidents, and other claims that can easily exceed the liability limits of a standard landlord policy.

A personal umbrella policy provides an extra layer of liability coverage—typically $1 million or more—that sits on top of your primary policy. If a major lawsuit results in a judgment that exceeds your landlord policy’s limit, the umbrella policy kicks in to cover the difference.

This affordable coverage is essential for safeguarding your personal assets, such as your home, savings, and future income, from being seized to satisfy a large judgment. It is a cornerstone of sound financial protection for any property owner.

Protect Your Investment with the Right Coverage

Insurance for Landlords isn’t just another expense—it’s the foundation of a successful real estate investment strategy. It’s the safety net that protects your financial future from a single catastrophic event, changing a potentially devastating loss into a manageable insurance claim.

A comprehensive policy safeguards your physical asset from damage, shields you from ruinous liability claims, and ensures your rental income continues even when your property is vacant due to a covered loss. Every property is unique, and the right insurance strategy can mean the difference between a minor setback and a financial catastrophe.

Don’t let the complexity of insurance options overwhelm you. Stanton Insurance Agency’s independent insurance agents have spent decades helping property owners in Massachusetts and New Hampshire steer these waters. We work with multiple carriers to find the most comprehensive and cost-effective protection for your rental properties.

Your investment deserves professional protection. Contact us today to discuss your rental property insurance needs and get a personalized quote.