Insurance Companies in Keene NH: 7 Top-Rated Picks 2025

Finding the Right Insurance Protection in the Monadnock Region

Insurance companies in Keene NH offer everything from basic auto coverage to specialized business protection, but choosing the right one doesn’t have to feel overwhelming. Here are the top local options at a glance—described without brand names so you can focus on what each type of agency brings to the table:

Independent Agencies:

– Family-owned offices with 30-plus years serving the Monadnock region, providing full-service personal and business coverage

– Regional firms that offer access to 40+ carriers, giving clients a wide range of commercial and personal lines

– Multi-generation agencies that have protected the area since the 1800s, now expanding into emerging products like pet insurance

– Specialists focused on commercial and human-services insurance for nonprofits, healthcare practices, and social-service organizations

National Carriers with Local Agents:

– Local storefronts representing larger companies and earning 5-star reviews for personal and business insurance support

– New England–based regional carriers that combine online quote tools with in-office service when you need face-to-face help

Several national and regional insurers also maintain service, underwriting, or claims centers in Cheshire County—bringing additional resources and jobs to the local economy.

“We understand the immense responsibility we have to protect what you’ve worked your whole life to build,” says Geoff Stanton, President of Stanton Insurance Agency, capturing the personal approach that defines many Keene-area agencies.

I’m Geoff Stanton, and I’ve spent over two decades helping New England families and businesses steer insurance decisions just like the ones insurance companies in Keene NH handle daily. My experience working with independent agencies and national carriers gives me insight into what makes each option work best for different situations.

Basic insurance companies in keene nh vocab:

– NH Auto Insurance

– NH renters insurance

– NH Insurance Agencies

Why Work With a Local Agency in Keene

When you choose insurance companies in Keene NH, you’re not just buying a policy—you’re joining a community that understands your life. There’s something reassuring about walking into an office where they remember your name and know your family’s history. Some agencies have watched local families grow for more than three decades, while others have been woven into the community fabric since the 19th century.

That deep community connection shows up when you need it most. When a storm hits the Monadnock region, your local agent doesn’t just process claims—they understand exactly what you’re going through because they’re dealing with the same weather. They know which roads flood first, which contractors do quality work, and how to get your claim moving quickly.

Face-to-face service still means something in today’s digital world. Need to add your teenager to your auto policy? Want to discuss whether your business coverage is adequate? You can walk down Court Street or Main Street and sit across from someone who actually knows your situation. No phone trees, no explaining your story three times—just straightforward help from a familiar voice.

The claims process becomes so much simpler when you have a local advocate in your corner. Instead of navigating a maze of automated systems, you can call someone who will personally follow up with adjusters and keep you informed. Local offices earn high ratings by being there when clients need help most.

More info about personal insurance options

Unique Benefits for Home & Auto Owners

Living in the Monadnock region brings unique joys—and unique risks that cookie-cutter policies don’t always handle well. Local agents understand that your 1800s farmhouse needs different protection than a new subdivision home. They’ve seen how spring snowmelt affects different neighborhoods and know which areas see more storm damage.

Storm response experience makes all the difference when Mother Nature strikes. Local agents have weathered decades of ice storms, nor’easters, and heavy snow loads. They know which adjusters work efficiently in our area and which contractors deliver quality repairs. When your roof caves in from snow load, you want someone who’s handled that exact situation before.

Your home’s replacement cost often surprises people in today’s market. That cozy 1,200-square-foot house might cost $300,000 to rebuild even if it’s worth $250,000 on paper. Local agents understand these realities and make sure your coverage keeps up with construction costs. They’ll also ensure you’re covered for bringing older homes up to current building codes—a costly surprise many homeowners face after a loss.

New Hampshire’s auto insurance laws can trip up even long-time residents. While we’re technically a “no-fault” state that doesn’t require insurance, you still need to prove financial responsibility. Local agents help you steer these nuances without falling into expensive traps.

Auto Insurance Requirements in New Hampshire

Unique Benefits for Business Owners

Running a business in Keene means dealing with industry-specific risks that generic policies miss entirely. Whether you’re operating a downtown restaurant, managing an elder-care facility, or running a contracting business, local agents understand the liability exposures that keep you up at night.

OSHA compliance training becomes much more accessible through local connections. Local agencies offer OSHA 10-Hour seminars right here in the community, helping you protect employees and prevent claims before they happen. This kind of hands-on support simply doesn’t exist with online-only insurers.

When you need a certificate of insurance for a new contract, timing matters. Local agents can often turn these around in hours rather than days because they understand that business moves fast. A delayed certificate can cost you a valuable opportunity—something your local agent will never let happen.

Compliance support goes far beyond basic coverage requirements. Local agents stay current on New Hampshire employment laws, safety regulations, and industry-specific requirements. They can connect you with resources and training that help your business thrive while staying protected.

Top Insurance Companies in Keene NH at a Glance

When you’re looking at insurance companies in Keene NH, you’ll find three main types of service models, each with its own personality and approach. Think of it like choosing between a local diner with a varied menu, a specialty restaurant that does one thing really well, or a fast-food chain where you order through an app.

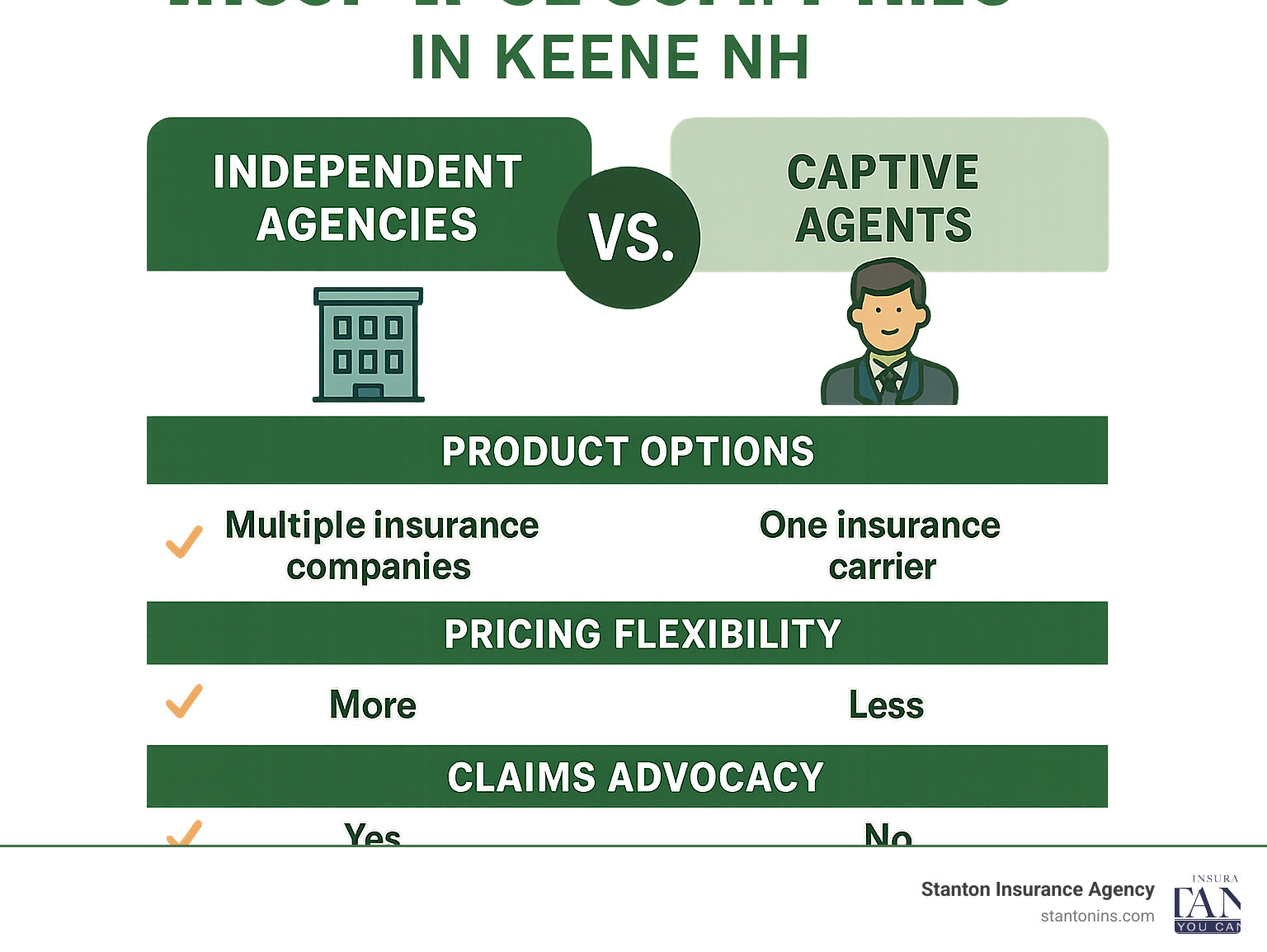

Independent agencies work with multiple insurance carriers, giving them the flexibility to shop around on your behalf. They’re like having a personal shopper who knows all the best stores in town. Captive agents focus exclusively on one company’s products, becoming true experts in everything that carrier offers. Direct writers cut out the middleman entirely, often saving you money but requiring you to handle everything yourself online or over the phone.

The choice really comes down to what matters most to you: maximum flexibility and personalized service, deep expertise with one trusted carrier, or the convenience and potential savings of going direct.

Most people in the Keene area find that the personal touch still matters, especially when life gets complicated. A fender-bender in a snowstorm or a tree through your roof isn’t the time to be navigating automated phone systems.

| Service Model | Product Breadth | Personal Service | Price Flexibility | Claims Advocacy |

|---|---|---|---|---|

| Independent | 20-40+ carriers | High | Very High | Strong |

| Captive | Single carrier | Moderate | Limited | Moderate |

| Direct | Single carrier | Low | Fixed | Self-service |

Independent Insurance Companies in Keene NH

Independent agencies have deep roots in the Keene community, and there’s a reason they’ve thrived here for decades. When you work with an independent agent, you’re getting someone who can compare options from 20 to 40 different carriers without you having to make a dozen phone calls or fill out endless online forms.

The real magic happens at renewal time. Instead of getting that dreaded notice that your rates are going up 20%, your independent agent can shop your coverage with their entire network of carriers. If your current company decides to get greedy, your agent can often find you better coverage at a lower price without you having to start over with a new relationship.

Custom coverage becomes possible when your agent isn’t locked into one company’s approach. Maybe one carrier offers the best auto rates while another excels at homeowners coverage. Your independent agent can mix and match to create the perfect combination for your specific situation.

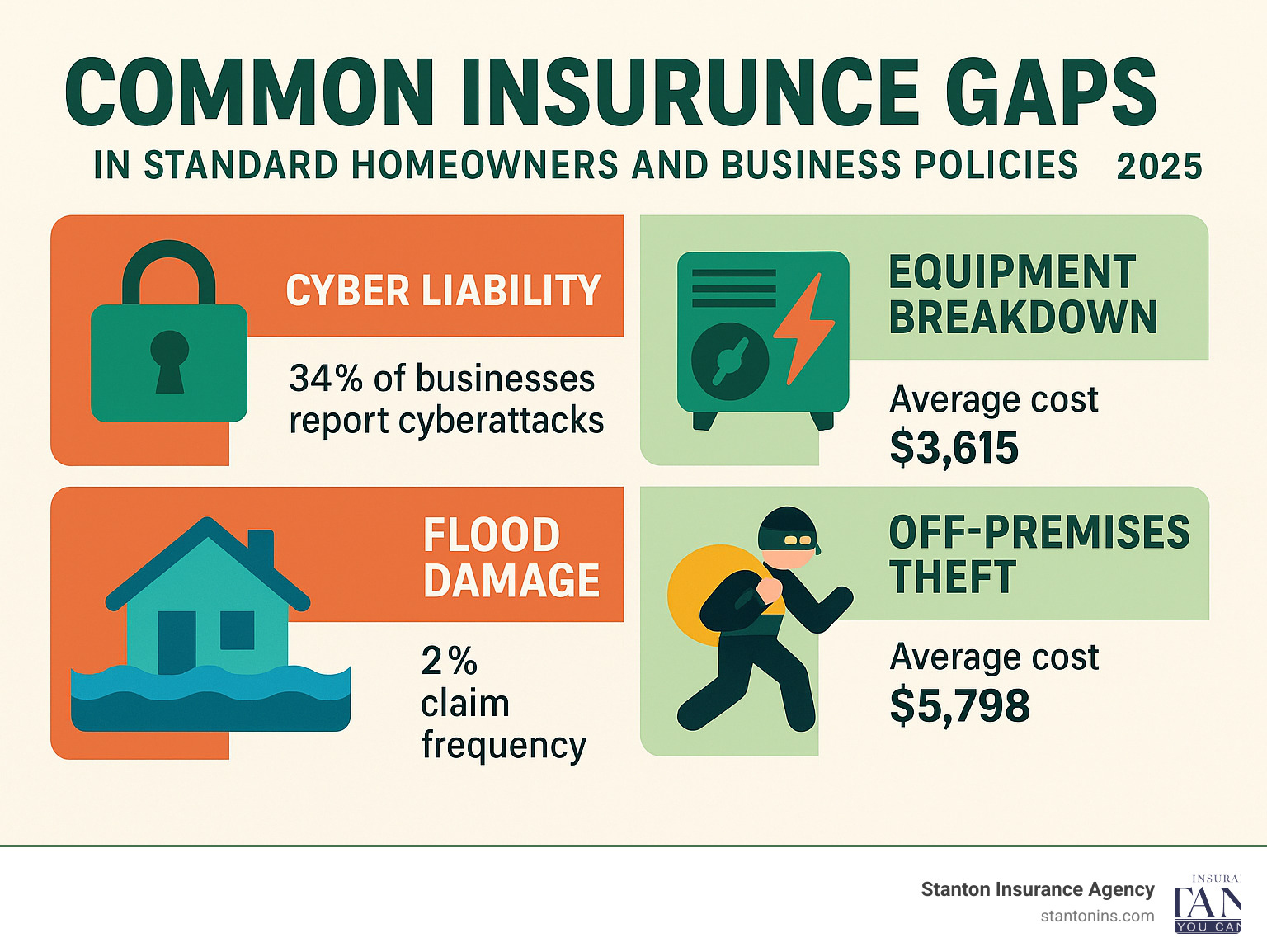

Risk gap analysis might sound fancy, but it’s really just your agent playing detective with your coverage. They’ll look for holes that could leave you exposed – like finding your business policy doesn’t cover that expensive computer equipment, or realizing your homeowners policy won’t help if the Ashuelot River decides to visit your basement.

Modern independent agencies offer 24/7 online portals and mobile apps that rival anything the big direct writers provide. You get the convenience of digital service when you want it, plus a real person who knows your name when you need actual help.

Captive & Direct Insurance Companies in Keene NH

Single-carrier focus allows captive agents to become true specialists in their company’s products and services. They know every discount, every coverage option, and every claims procedure inside and out. When you call with a question, you’re talking to someone who lives and breathes that one company’s way of doing business.

App-based quoting has gotten impressively sophisticated. Many carriers now offer tools that can import your current policy information automatically, making it easier than ever to get accurate quotes without spending your Saturday afternoon on paperwork.

National resources provide real advantages if you travel frequently or own property in multiple states. When you’re dealing with a claim while on vacation in Florida, having access to a nationwide network of agents and adjusters can make all the difference.

Loyalty discounts reward customers who stick around, often providing significant savings for bundling multiple policies or maintaining a clean driving record. These programs recognize that your best customers deserve your best rates.

The trade-off with captive and direct options is flexibility. If that one company doesn’t fit your needs perfectly, or if they decide to raise rates significantly, your options become more limited. But for straightforward coverage needs and customers who value simplicity, this focused approach often works beautifully.

Specialized Insurance Programs for the Monadnock Region

The Monadnock region’s unique character creates insurance needs that go far beyond standard coverage. From elder-care facilities serving our aging population to artisan contractors crafting custom furniture, the diverse businesses and lifestyles here require specialized protection that understands local risks.

Elder care facilities represent a cornerstone of Keene’s economy, but they face complex challenges that standard business policies simply don’t address. These facilities must protect against resident falls, medication errors, and evolving regulatory requirements that can result in significant liability exposure. The specialized nature of this industry means that insurance companies in Keene NH need deep expertise to properly assess and cover these unique risks.

Artisan contractors and specialty tradespeople bring character to our community, but their work creates exposures that generic contractor policies miss entirely. A custom furniture maker faces different risks than someone pouring concrete foundations. Their specialized tools, unique materials, and one-of-a-kind creations require coverage that understands the value and liability associated with true craftsmanship.

The high-net-worth homes scattered throughout Keene’s historic districts tell stories of generations past, but they also present modern insurance challenges. Standard homeowners policies typically cap coverage for jewelry, art, wine collections, and antiques at levels that barely scratch the surface of their actual value. When your grandmother’s china collection or your husband’s vintage guitar collection represents real financial value, you need coverage that recognizes that importance.

Farm and rural property owners find quickly that standard homeowners policies exclude most agricultural activities. Whether you keep horses as a hobby, operate a small farm stand, or rent pasture land to neighbors, these activities can void your basic coverage entirely. Rural properties also face unique exposures from outbuildings, equipment, and the simple reality of being farther from fire departments and emergency services.

Coverage You Didn’t Know You Needed

The digital age has created entirely new categories of risk that most people never consider until it’s too late. Cyber liability protection isn’t just for Fortune 500 companies anymore. When a local restaurant’s point-of-sale system gets hacked or a contractor’s customer database is compromised, the costs can be devastating. Even families face cyber risks through home networks, online banking, and social media accounts.

Inland marine coverage sounds like something you’d only need if you owned a boat, but it actually protects valuable items that travel with you or don’t fit standard policy categories. A photographer’s camera equipment, a musician’s instruments, or even that expensive engagement ring all benefit from coverage that follows the item wherever it goes.

Equipment breakdown coverage becomes more critical as everything becomes computerized. When your restaurant’s refrigeration system fails due to electrical issues, or your home’s smart HVAC system crashes, standard property policies often leave you stranded. This coverage bridges the gap between property damage and the increasing complexity of modern equipment.

Pet medical insurance might seem like a luxury until you’re facing a $5,000 emergency veterinary bill. As veterinary care becomes more sophisticated and expensive, many families find that pet insurance provides peace of mind and financial protection for their four-legged family members.

The most common homeowners claim involves water damage, but standard policies contain surprising gaps. Sewer backup, sump pump failure, and gradual leaks often require specific endorsements to be covered properly. In New Hampshire’s climate, these water-related risks are particularly relevant during spring thaw and heavy storm seasons.

How to Get Quotes & Personalized Advice (Fast)

Getting insurance quotes doesn’t have to mean waiting days for callbacks or scheduling lengthy office visits. The insurance companies in Keene NH have acceptd technology while keeping the personal touch that makes local service valuable.

Most agencies now offer online quote forms that work surprisingly well. You can start a quote at 11 PM on a Sunday and have preliminary numbers in your inbox by morning. The best part? These aren’t the generic estimates you might get elsewhere – local agents can fine-tune them based on their knowledge of Keene’s specific risks and opportunities.

Phone consultations still shine when your situation gets complicated. Maybe you’re buying your first home in one of Keene’s historic neighborhoods, or you’re starting a business with unique liability exposures. A quick conversation with someone who knows the local market can save you hours of research and prevent expensive coverage gaps.

The real game-changer has been policy import technology. Instead of digging through your current policies to find coverage limits and deductibles, many agencies can pull this information directly from your current insurer’s system. It’s like having someone else do your homework – accurately and quickly.

Step-by-Step Quote Checklist

Having the right information ready speeds up everything. For vehicle quotes, you’ll need more than just make, model, and year. Safety features like automatic emergency braking can earn significant discounts, while anti-theft devices and garage storage also affect rates. Your driving record matters too, but having your license number handy eliminates delays.

Home replacement costs often surprise people, especially in Keene’s older neighborhoods. That charming 1,200-square-foot Victorian might be worth $250,000 on the market, but rebuilding it with period-appropriate materials and current code compliance could cost $350,000 or more. Local agents understand these nuances and can help you avoid being underinsured.

Business owners need accurate revenue figures since many policies use gross receipts for both coverage limits and pricing. Having recent financial statements available helps ensure you get proper coverage without overpaying for protection you don’t need.

Your claims history affects both availability and pricing, even for incidents that weren’t your fault. Gathering information about any losses in the past five years helps agents find the best options and avoid surprises during underwriting.

Making Changes & Filing Claims Without Stress

Modern insurance feels more like banking – most tasks happen digitally without sacrificing personal service. Digital ID cards mean you’ll never dig through your glove compartment looking for proof of insurance again. Most agencies provide mobile apps that store your cards and let you email them directly when needed.

Policy changes that once required office visits now happen with electronic signatures. Adding a vehicle, updating coverage limits, or adding someone to your policy can often be completed entirely online. The convenience of technology with the backup of local expertise when you need it.

Claims reporting has gotten dramatically simpler. You can often upload photos immediately after an incident, giving adjusters a head start on evaluating your claim. Instead of waiting days for someone to visit, the process begins immediately.

The real advantage shows up when claims get complicated. Local agents provide direct adjuster contact information and intervene if communication breaks down. You’re not just another claim number in a national system – you’re someone’s neighbor who deserves personal attention during a stressful time.

Frequently Asked Questions About Insurance Companies in Keene NH

How do independent agencies find the best price?

The magic behind independent agencies lies in their relationships with 20-40 different insurance carriers, each viewing risk through their own unique lens. What makes you expensive with one company might actually make you their favorite customer at another. Picture this: you have one speeding ticket from three years ago. Carrier A might bump your rates by 20%, while Carrier B doesn’t even blink until you hit your second violation.

But here’s where it gets interesting – insurance companies in Keene NH that operate as independent agencies don’t just chase the lowest premium. They’re evaluating each carrier’s claim service reputation, financial strength, coverage breadth, and discount programs. That policy saving you $100 annually becomes expensive fast if the company drags its feet on claims or leaves you hanging when you need help most.

Market access makes a huge difference too. Larger independent agencies maintain relationships that smaller shops simply can’t match. When you have a unique business risk or a challenging driving record, having access to specialized carriers can mean the difference between getting covered and getting turned away entirely.

Is New Hampshire really a “no-auto-insurance-required” state?

New Hampshire takes a different approach – they don’t require auto insurance, but they absolutely require proof of financial responsibility. This means if you cause an accident, you must be able to pay for the damage. For most of us, insurance is the most practical way to meet this requirement without risking our life savings.

If you choose to buy insurance (and most people do), you’ll need minimum coverage of $25,000 for bodily injury per person, $50,000 per accident, and $25,000 for property damage. These numbers sound reasonable until you consider that a single day in the hospital can easily exceed $25,000, and a serious accident involving multiple vehicles can quickly reach six figures.

Here’s what makes New Hampshire unique: since some drivers choose to self-insure rather than buy traditional coverage, uninsured motorist coverage becomes especially important. This protects you when someone who chose to go without insurance (or without adequate coverage) causes damage they can’t afford to pay for.

What documents should I bring to a first appointment?

Walking into your first appointment prepared makes everything smoother and helps ensure you get accurate quotes. Start with your current insurance policies – even if you’re frustrated with your current coverage, bring those declaration pages. Your agent needs to see what you have now to identify gaps, overlaps, or opportunities for improvement.

Driver’s license numbers for everyone in your household speed up the process significantly. Agents need to run motor vehicle reports to price your coverage accurately, and having this information ready eliminates back-and-forth calls. Social Security numbers are typically needed too, since most carriers use credit-based insurance scoring.

For vehicles, VIN numbers provide precise details about safety features, anti-theft systems, and other factors that affect your rates. If you lease any vehicles, bring the lease agreement – it often specifies minimum coverage requirements that might be higher than what you’d normally choose.

Homeowners should gather recent appraisals, major renovation receipts, and details about security systems, roof age, and heating systems. Business owners need financial statements, employee counts, and clear descriptions of what their business actually does day-to-day. The more complete picture you can provide, the more accurate your quotes will be.

Conclusion

Finding the right protection among insurance companies in Keene NH comes down to understanding what matters most to you and your family. After exploring the local landscape—from independent agencies with century-long community ties to national carriers with cutting-edge technology—the choice becomes clearer.

Local expertise makes a real difference when you’re dealing with New Hampshire’s unique insurance requirements, the Monadnock region’s specific weather patterns, or the challenges of insuring historic properties downtown. Agencies that have served the region for generations didn’t earn their reputations by accident—they did it by helping neighbors through countless claims and life changes.

The technology gap between independent agencies and direct writers has essentially disappeared. You can now get fast quotes, digital ID cards, and mobile claim reporting from local agents while still having someone to call when things get complicated. That’s the best of both worlds.

Price alone shouldn’t drive your decision. A policy that costs $200 less per year isn’t a bargain if the company delays your claim payments or doesn’t understand that your 1850s farmhouse needs different coverage than a modern subdivision home. The agents who have built lasting relationships in Keene understand these nuances.

Your next move is straightforward: reach out to two or three agencies that feel like good fits and have actual conversations about your specific needs. Ask about their claim service track record, how they handle policy reviews as your life changes, and what they know about the risks you face in your neighborhood or industry.

The peace of mind that comes from proper insurance protection is worth the effort of choosing wisely. Whether you’re protecting your first apartment, your growing business, or the home where you plan to retire, insurance companies in Keene NH offer the local knowledge and personal service that turns insurance from a necessary evil into a trusted partnership.

At Stanton Insurance Agency, we’ve seen how the right insurance relationship can transform a stressful situation into a manageable one. While we serve clients throughout New England, we deeply respect the value that dedicated local agencies bring to communities like Keene.

Like us on Facebook!