Insurance Agencies Massachusetts: 7 Top-Rated Picks 2025

Why Finding the Right Insurance Agency Matters in Massachusetts

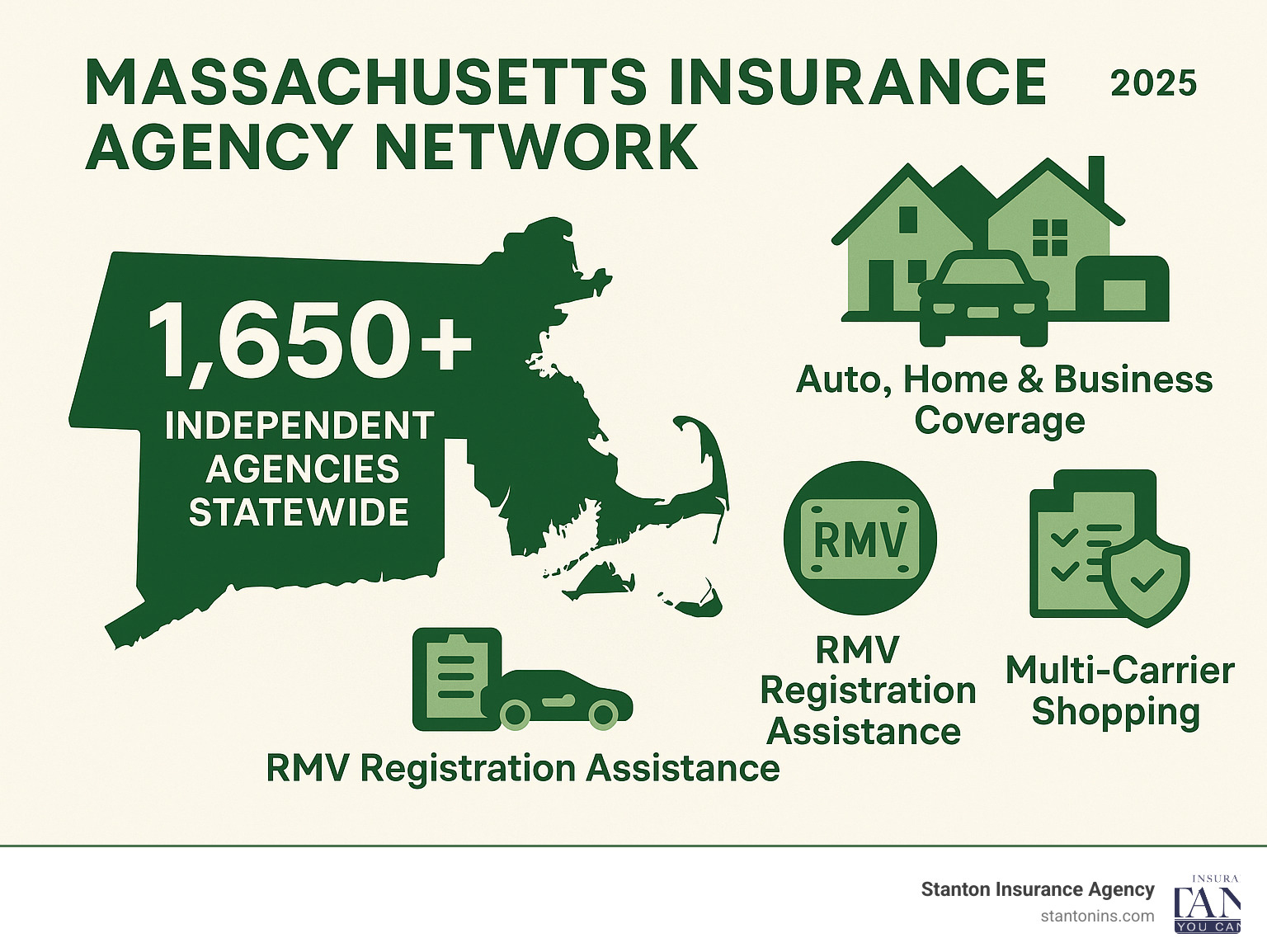

Insurance Agencies Massachusetts provide essential protection for your home, car, and business through personalized coverage and local expertise. With roughly 1,650 independent agencies across the Commonwealth, residents enjoy one of the most robust insurance markets in New England.

Quick Answer for Massachusetts Insurance Seekers:

- 1,650+ independent agencies statewide offer multiple carrier options

- Common services: Auto, home, business, life insurance, and RMV registration help

- How to find one: Use carrier websites’ agent locators or city directories

- Key benefit: Independent agents shop several carriers to secure your best rate

Massachusetts agencies shine because they understand local risks03coastal storms, strict RMV requirements, and the state’s unique insurance regulations. The Massachusetts Association of Insurance Agents (MAIA) represents nearly 1,000 agencies employing over 9,000 professionals who deliver the personal service online-only insurers can’t match.

Whether you’re a first0time homebuyer in Boston or a small0business owner in Worcester, partnering with a local agency means having an advocate who knows Massachusetts law and will guide you through claims when disasters strike.

I’m Geoff Stanton, President of Stanton Insurance in Waltham and a fourth0generation owner with 25+ years of experience helping families and businesses steer Insurance Agencies Massachusetts options. Our specialized Commercial Property & Liability programs—and deep community roots—give us a front0row seat to what makes agencies truly valuable for Bay State residents.

Insurance Agencies Massachusetts basics:

Massachusetts Insurance Landscape at a Glance

Massachusetts has built one of the most consumer-friendly insurance markets in the country, and it shows. The Massachusetts Division of Insurance keeps a watchful eye on every company that wants to do business here, making sure they meet tough financial and service standards before they can sell you a policy.

You can check out the complete list of Massachusetts Licensed or Approved Companies to see exactly who’s approved to operate in the Bay State. It’s pretty impressive – and reassuring – to know that level of oversight exists.

Nearly 1,650 independent agencies call Massachusetts home, stretching from the rolling Berkshires all the way to the sandy shores of Cape Cod. These agencies employ over 9,000 insurance professionals who genuinely understand what it’s like to live here. They know about those brutal nor’easters that can turn your peaceful neighborhood into a winter wonderland of downed power lines and damaged roofs.

The beauty of Massachusetts agencies lies in their specialization based on location and community needs. Agencies near the coast become experts in marine insurance and flood coverage because they’ve seen what storm surge can do to waterfront properties. Meanwhile, agencies in Boston’s tech corridor develop deep knowledge of cyber liability and professional services coverage because they understand the unique risks their neighbors face.

Insurance Agencies Massachusetts serve both personal and commercial clients, but what really sets them apart is their genuine community involvement. Your local agent isn’t just someone who sells you a policy and disappears. They’re at town meetings, sponsoring the local Little League team, and participating in chamber of commerce events. This community connection translates into something invaluable – better service when you need it most during a claim.

What Sets Insurance Agencies Massachusetts Apart?

Insurance Agencies Massachusetts benefit from having one of the densest agency networks in New England. Boston alone hosts 52 agencies, Worcester has 48, and even Quincy boasts 32 agencies. This concentration means you have exceptional choice and the competitive pricing that comes with it.

The state’s strict RMV requirements create a unique advantage for local agencies. Many agencies offer Electronic Vehicle Registration (EVR) services right in their office. Need to transfer license plates, renew your registration, or handle other RMV paperwork? You can knock it out while discussing your insurance needs. It’s the kind of convenience that makes Massachusetts agencies particularly valuable for busy families and business owners.

Coastal storm risks also distinguish Massachusetts agencies from their counterparts in other states. Local agents have lived through hurricanes and nor’easters. They understand why proper windstorm coverage matters, when you need flood insurance through the National Flood Insurance Program, and how business interruption coverage can save coastal businesses after a major storm.

Bundling discounts become especially important in Massachusetts, where the cost of living can stretch family budgets. Local agents work hard to find multi-policy discounts that can save families hundreds of dollars annually. Independent agents can compare bundling options across multiple carriers to find the perfect combination of coverage and savings that fits your specific situation.

Independent vs. Captive: Choosing Your Best Match

When you’re comparing Insurance Agencies Massachusetts, start by deciding whether an independent or captive agent fits you better.

Independent agents represent many companies—think of them like a marketplace. They earn commissions from several carriers but work for you, not any single insurer. Result: broader options, competitive pricing, and genuinely unbiased advice.

Captive agents represent just one carrier. They know that company’s products inside and out and often have direct access to its underwriters, which can speed up policy issuance. The trade-off? They can’t move you elsewhere if rates rise or coverage changes.

| Feature | Independent Agencies | Captive Agencies |

|---|---|---|

| Carrier Options | Multiple | Single company |

| Shopping Ability | Compare rates across carriers | One set of rates |

| Loyalty | To the client | Split between client & company |

| Product Knowledge | Broad | Deep on one brand |

| Claims Advocacy | Independent advocate | Company representative |

| Flexibility | High | Limited |

Why Independent Insurance Agencies Massachusetts Often Win

- Multi-carrier shopping – Agents can pull 10–20 quotes, often saving clients 20–40%.

- Unbiased guidance – No pressure to meet a single-company quota.

- Local claims help – Your agent advocates for you, not the insurer.

- Periodic reviews – Coverage is adjusted as your life or business changes.

- Cost savings – Bundling and niche discounts from several carriers add up.

When Captive Agencies Make Sense

Captive agencies can be a strong fit if you:

- Prefer keeping everything in one brand ecosystem.

- Want access to proprietary programs such as accident forgiveness or new-car replacement that a particular carrier offers.

- Value quicker underwriting decisions for straightforward risks.

The choice boils down to flexibility versus brand loyalty. Independent agencies maximize your options; captive agencies maximize familiarity with one insurer. Evaluate which feels more comfortable for your budget, risk tolerance, and need for advocacy.

Top Insurance Agencies Massachusetts: 7 Qualities Winners Share

After spending over 25 years helping Massachusetts families and businesses steer their insurance needs, I’ve learned what separates truly exceptional agencies from the rest. The best Insurance Agencies Massachusetts has to offer share seven distinct qualities that make them stand out in our competitive market.

Service reputation built over decades forms the foundation of great agencies. When an agency has weathered economic downturns, regulatory changes, and countless claims over multiple decades, they’ve proven their staying power. These agencies understand that insurance isn’t just about selling policies – it’s about being there when disaster strikes and your world turns upside down.

Comprehensive coverage expertise means the best agencies don’t just sell auto insurance or only handle homeowners policies. They understand how your auto, home, business, and life insurance work together like pieces of a puzzle. When your agency knows your complete insurance picture, they can spot coverage gaps before they become expensive problems and find bundling opportunities that save you money.

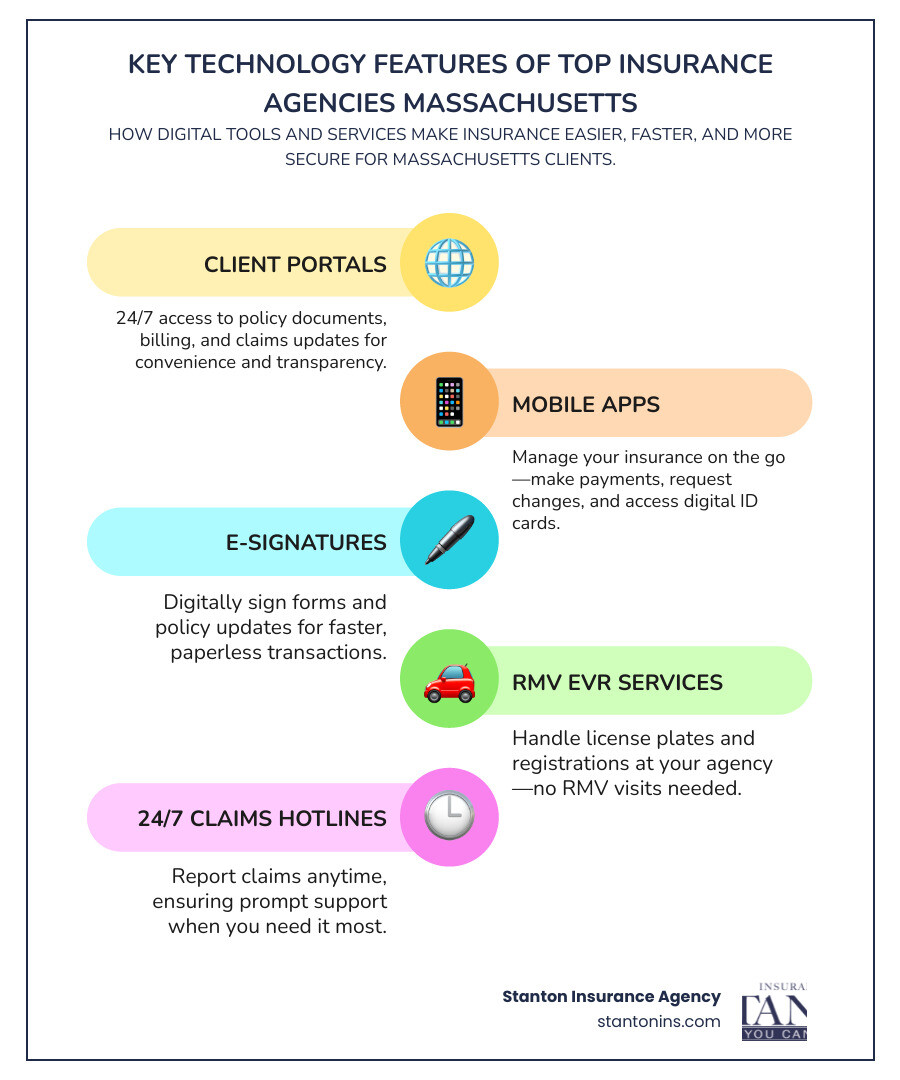

24/7 support and claims assistance becomes your lifeline when accidents happen at 2 AM or storms hit on weekends. Top agencies understand that emergencies don’t follow business hours. They provide round-the-clock claims reporting and have systems in place to help you immediately, not next Monday morning.

Modern digital tools balanced with personal service give you the best of both worlds. The leading agencies offer online portals where you can view your policies, make payments, and request changes, plus mobile apps that put your insurance cards right on your phone. But they never forget that complex coverage decisions and claims support require human expertise and empathy.

RMV registration services make exceptional agencies even more valuable in Massachusetts. Many top agencies are approved Electronic Vehicle Registration locations, which means you can handle license plate transfers, renewals, and registrations right in their office. This saves you those dreaded trips to the RMV and streamlines your insurance and registration process.

Multilingual staff reflects Massachusetts’ diverse communities. The best agencies recognize that insurance conversations involve complex terms and important decisions that require clear communication. Whether you’re more comfortable speaking Spanish, Portuguese, or another language, top agencies ensure you fully understand your coverage options.

Community involvement shows an agency’s commitment extends beyond selling policies. When agencies sponsor local youth sports teams, participate in charity drives, or volunteer at community events, they’re investing in the neighborhoods they serve. This community connection often translates into better service because they truly care about their neighbors’ wellbeing.

Finding Insurance Agencies Massachusetts Near You

Insurance Agencies Massachusetts are easier to find than you might think, thanks to several smart search strategies that can help you locate the perfect agency for your needs.

Interactive maps and geolocation tools have revolutionized how we find local agencies. Most insurance company websites now feature map-based search tools that show agency locations, contact information, and even customer ratings. You can simply enter your zip code and see all nearby options at a glance.

City directories reveal the concentration of agencies in major population centers. Boston leads with 52 agencies, Worcester follows with 48, and Quincy hosts 32 agencies. While these numbers might seem overwhelming, having multiple options means you can find an agency that specializes in your specific needs, whether that’s young driver coverage, coastal property protection, or small business insurance.

Neighborhood reviews on Google, Yelp, and social media platforms provide valuable insights into how agencies actually treat their clients. Look for consistent positive feedback about claims handling, responsiveness, and overall customer service. Pay special attention to reviews that mention how agencies handled difficult claims or helped clients during stressful situations.

Red Flags to Avoid

While most Massachusetts insurance agencies provide excellent service, knowing what warning signs to watch for can save you from frustration and potential coverage problems down the road.

Poor communication often signals deeper service issues. If an agency takes days to return calls, doesn’t explain coverage options clearly, or seems rushed during your initial consultation, they’re probably not going to provide the attention you deserve when you need to file a claim.

Missing licenses represent a serious red flag that could leave you without valid coverage. Always verify that agencies and individual agents are properly licensed in Massachusetts through the Division of Insurance website. Licensed agents have met education requirements and maintain continuing education to stay current with changing regulations.

One-size-fits-all quotes suggest an agency that’s more interested in quick sales than proper coverage. Quality agencies ask detailed questions about your specific situation, property characteristics, and risk factors. They should want to understand your needs before recommending coverage options.

No claims assistance leaves you to steer the claims process alone during what’s often the most stressful time in your relationship with your insurance company. The best agencies serve as your advocate, helping ensure claims are handled fairly and promptly while explaining the process every step of the way.

Hidden fees for routine services like policy changes, payment processing, or certificate requests can add up quickly. While some fees are reasonable, excessive charges for basic services that should be covered by the agency’s commission structure often indicate an agency more focused on profits than client service.

How to Vet and Compare Agencies Like a Pro

Finding the right Insurance Agencies Massachusetts isn’t just about price. Follow this shortened, five-step checklist to assess any agency quickly:

- Define your coverage list. Auto, home, umbrella, life, business—note required limits and must-have endorsements.

- Request identical quotes. Provide the same driver info, property details, and prior claims to each agency so comparisons are apples-to-apples.

- Verify licensing & reviews. Confirm the agency is licensed on the Division of Insurance website, then scan Google and BBB ratings for patterns of praise—or trouble.

- Compare deductibles & discounts. Ask how a $500 vs. $1,000 deductible affects premium, and check eligibility for multi-policy, safe-driver, home-security, or professional-group discounts.

- Gauge claims support. Does the agency offer 24/7 reporting, local adjuster contacts, and help negotiating settlements? If support feels vague, move on.

Rapid Quote Roadmap

Gather driver’s licenses, vehicle registrations, your current declarations pages, and (if you own a business) recent financial statements. Submit them via the agency’s secure online form or schedule a quick call. Within hours you should receive:

- Side-by-side premium comparison

- Coverage limits and deductibles

- Highlighted discounts you qualified for

- Required next steps to bind coverage (often via e-signature)

Tech & Claims Support Matter

Top agencies blend digital convenience with hands-on help:

- Client portals & mobile apps for ID cards, payments, and policy docs 24/7.

- E-signatures to bind coverage instantly.

- RMV EVR services so you can register vehicles without an extra trip.

- Round-the-clock claims lines for immediate assistance.

The tech should streamline routine tasks, freeing real humans to guide you through bigger insurance decisions.

Frequently Asked Questions about Massachusetts Insurance Agencies

How many independent agencies operate in Massachusetts?

Massachusetts boasts nearly 1,650 independent insurance agencies operating statewide, making it one of the most agency-dense states in New England. This impressive network creates a competitive marketplace that benefits consumers through better service and pricing options.

The Massachusetts Association of Insurance Agents (MAIA) represents nearly 1,000 of these agencies, which collectively employ over 9,000 insurance professionals. These aren’t just numbers on a page – they represent thousands of local experts who understand Massachusetts insurance law, weather patterns, and community needs.

This extensive network means you’ll have exceptional choice when selecting an Insurance Agencies Massachusetts option. Major cities offer numerous options – Boston hosts 52 agencies, Worcester has 48, and Quincy features 32. Even smaller communities typically have at least one local agency providing that personal touch you won’t get from online-only insurers.

What types of insurance can I buy through an agency?

Massachusetts insurance agencies offer comprehensive coverage that protects virtually every aspect of your life and business. Think of them as your one-stop shop for protection – much more convenient than dealing with multiple companies for different needs.

Personal protection starts with the basics like auto insurance (including that crucial uninsured motorist coverage Massachusetts requires) and homeowners insurance. But agencies go deeper, offering renters insurance for apartment dwellers, personal umbrella liability for extra protection, and life insurance for family security.

Specialty personal coverage includes boat and watercraft insurance (important in a state with so much coastline), motorcycle coverage, and valuable items protection for jewelry, art, or collectibles. Many agencies also handle recreational vehicle insurance and vacation home coverage.

Business insurance is where agencies really shine with their expertise. They understand commercial property insurance, general liability, workers’ compensation, and commercial auto coverage. Professional liability, cyber liability, and business interruption insurance help protect modern businesses from evolving risks.

Contractor and trade-specific insurance represents a specialty area where local knowledge matters. Agencies understand the unique risks facing electricians, plumbers, landscapers, and other skilled trades operating in Massachusetts.

The beauty of working with local agencies is their ability to coordinate all these coverages, find bundling discounts, and ensure there are no gaps in your protection. They see the big picture of your insurance needs, not just individual policies.

How do agents help during the claims process?

This is where the value of Insurance Agencies Massachusetts really becomes clear. When disaster strikes – whether it’s a car accident, house fire, or business interruption – your agent becomes your advocate and guide through what can be a confusing and stressful process.

Immediate support starts the moment you call. Your agent helps you report the claim properly, ensuring all necessary information reaches the insurance company quickly. They know exactly what documentation is needed and can walk you through those crucial first steps when you’re dealing with the shock of a loss.

Claims advocacy becomes invaluable when disputes arise or claims seem to drag on. Your agent understands policy language and can argue for proper coverage interpretation. They’re not employees of the insurance company – they work for you and will fight to ensure you receive fair treatment.

Process navigation helps you understand what to expect throughout the claims process. Agents explain adjuster reports, help you understand your rights and options, and keep you informed about timelines and next steps. This guidance is especially valuable for major losses where the stakes are high.

Settlement assistance ensures you receive fair compensation. Agents review settlement offers to identify when additional coverage might apply or when settlements seem inadequate. They can spot issues you might miss and help negotiate better outcomes.

The peace of mind that comes from having a knowledgeable advocate in your corner during difficult times is worth its weight in gold. This is what separates local agencies from online-only insurers – when you need help most, there’s a real person who knows your situation and cares about the outcome.

Conclusion

Choosing the right Insurance Agencies Massachusetts comes down to finding that perfect balance between local expertise and comprehensive service. With nearly 1,650 independent agencies across the Bay State, you have incredible options – but that also means you need to be smart about your selection.

The best agencies understand what makes Massachusetts unique. They know how coastal storms can devastate properties from Cape Cod to the North Shore. They’re familiar with the RMV’s strict requirements and can help you handle registrations right in their office. Most importantly, they understand that insurance isn’t just about policies – it’s about protecting what matters most to you and your family.

Smart comparison shopping means looking beyond just price quotes. You want an agency with decades of experience, comprehensive coverage options, and the kind of claims support that makes a real difference when disaster strikes. Look for agencies that are deeply involved in their communities, offer modern digital tools, and provide 24/7 support when you need it most.

Local relationships matter more than you might think. When you’re dealing with a claim at 2 AM after a tree falls on your roof, you want an agent who knows you personally and will fight for your interests. That’s something online-only insurers simply can’t provide.

As a Best Independent Insurance Agency serving Massachusetts families and businesses for four generations, we’ve seen how the right agency makes all the difference. Our specialized expertise in Commercial Property & Liability, combined with our deep roots in the community, helps us provide the kind of personalized service that builds lasting relationships.

The peace of mind that comes from proper insurance protection is priceless, but it requires working with an agency that truly understands your needs. Whether you’re protecting your first home in Boston, your growing business in Worcester, or your family’s future anywhere in Massachusetts, the right agency becomes your trusted partner for life.

Ready to experience what local expertise and personal service can do for your insurance needs? We’d love to show you how the right agency can provide better coverage, competitive pricing, and the confidence that comes from knowing you’re truly protected. Contact us today to start your quote and find the Stanton Insurance difference.

Like us on Facebook!