If I have full coverage do I need uninsured motorist 1 Yes

The “Full Coverage” Misconception That Could Cost You Thousands

If I have full coverage do I need uninsured motorist coverage? The short answer is yes. Here’s what you need to know:

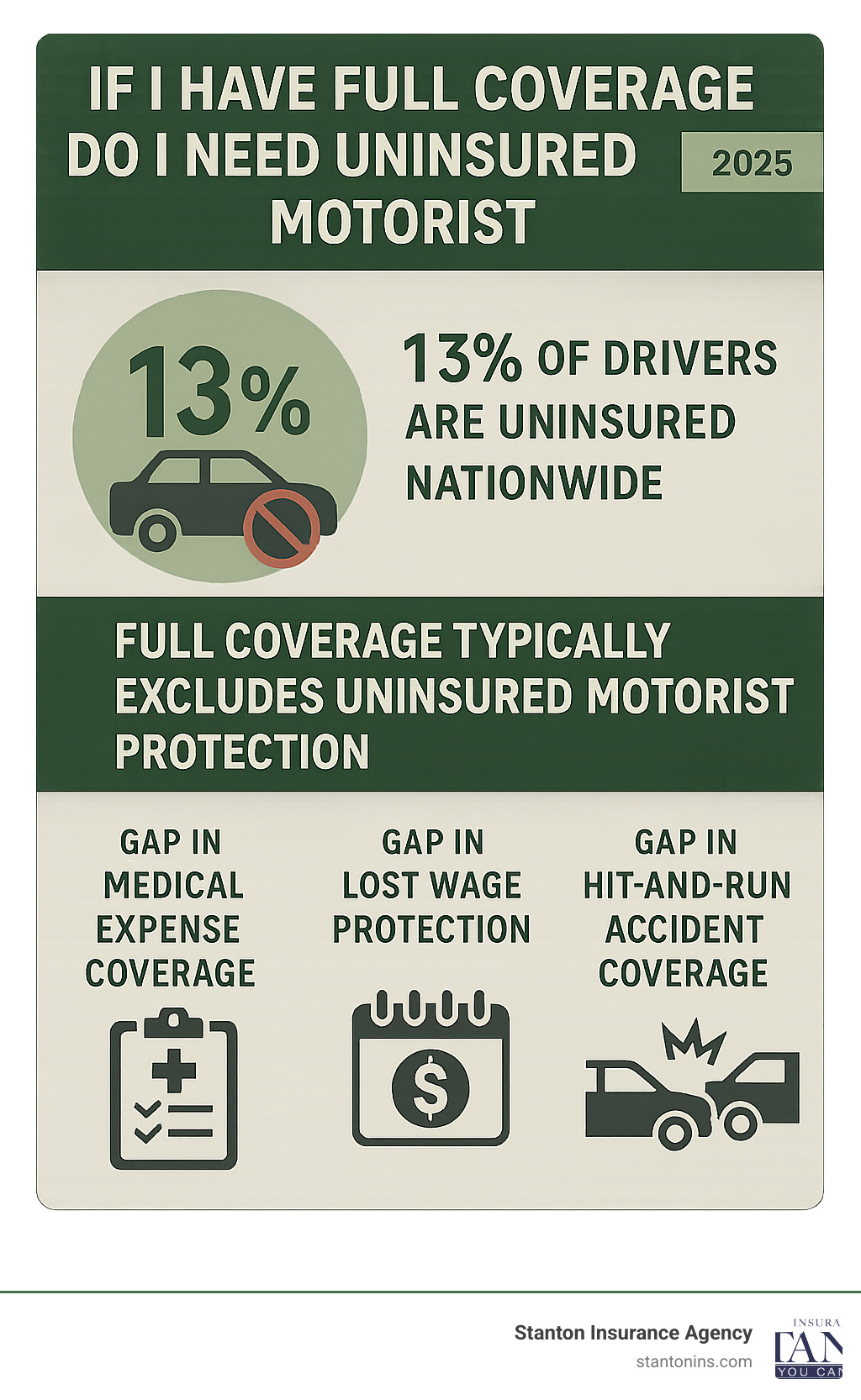

- “Full coverage” doesn’t include everything – It typically means liability + collision + comprehensive, but often excludes Uninsured Motorist (UM) coverage

- 13% of drivers are uninsured nationwide – That’s roughly 1 in 8 drivers on the road without insurance

- Your medical bills won’t be covered – Collision covers your car, not your injuries from an uninsured driver

- UMBI fills the gap – Uninsured Motorist Bodily Injury covers medical costs, lost wages, and pain/suffering

- UMPD can save money – May have lower deductibles than collision coverage

During our free consultations with new car accident clients, we routinely ask our clients what type of insurance they have and their response is often “I have full coverage.” This common phrase creates a dangerous misconception that leaves many drivers financially exposed.

The reality? “Full coverage” is misleading marketing language, not an official insurance term. While it sounds comprehensive, it typically only includes state-required liability insurance plus collision and comprehensive coverage. What it often doesn’t include is Uninsured Motorist coverage – the very protection you need when an uninsured driver causes an accident.

With over 682,000 hit-and-run accidents occurring annually in the United States and roughly 13% of drivers operating without insurance, the financial risk is too significant to ignore. Your collision coverage will fix your car, but it won’t pay a single dollar toward your medical bills, lost wages, or pain and suffering.

I’m Geoff Stanton, President of Stanton Insurance Agency, and in my 25 years in the insurance industry, I’ve seen countless clients find gaps in their “full coverage” policies after accidents with uninsured drivers. My expertise in helping Massachusetts and New Hampshire residents understand if I have full coverage do I need uninsured motorist protection has shown me how critical this often-overlooked coverage truly is.

What “Full Coverage” Really Means (And What It’s Missing)

Here’s the truth about “full coverage” – it’s not an official insurance term. It’s marketing language that sounds comprehensive but actually refers to a basic bundle of coverages. When most people say they have full coverage, they mean their policy combines state-mandated liability insurance with Comprehensive and Collision Coverage.

But here’s what might surprise you: this bundle doesn’t automatically include Uninsured Motorist (UM) coverage. That’s a critical gap that could leave you financially exposed when you least expect it.

Let’s break down what “full coverage” actually includes. Liability insurance is the foundation – it’s legally required in Massachusetts and New Hampshire and covers damages you cause to others in an at-fault accident. Think of it as protection for your wallet when you’re responsible for someone else’s medical bills or car repairs.

Collision insurance steps in when your car gets damaged in any collision, whether you hit another car, a tree, or someone hits you. It doesn’t matter who’s at fault – collision coverage helps repair or replace your vehicle.

Comprehensive insurance handles the unexpected stuff that has nothing to do with collisions. If your car gets stolen, vandalized, damaged by hail, or you hit a deer, comprehensive coverage has you covered.

While these three coverages form a solid foundation, they create a dangerous coverage gap. None of them protect you when an uninsured driver causes an accident and injures you. Your collision coverage will fix your car, but it won’t pay a penny toward your medical bills, lost wages, or pain and suffering.

In Massachusetts and New Hampshire, the rules around Uninsured Motorist coverage vary significantly. Understanding what is the minimum car insurance coverage in Massachusetts? is important, but minimums rarely provide adequate protection for real-world scenarios.

Does ‘Full Coverage’ Automatically Include Uninsured Motorist Coverage?

No, it absolutely does not. This is one of the most dangerous misconceptions in car insurance. Even if you’ve carefully selected what you believe is comprehensive protection, Uninsured Motorist coverage is typically a separate decision you need to make.

Massachusetts requires Uninsured Motorist Bodily Injury (UMBI) coverage, but you still choose the limits. The state minimums might not be enough to cover your actual expenses if you’re seriously injured. New Hampshire takes a different approach – insurers must offer UM coverage, but you can reject it in writing. Many drivers unknowingly do exactly that, thinking their “full coverage” protects them.

The bottom line? Don’t assume anything about your policy. Look for specific sections labeled “Uninsured Motorist Bodily Injury” and “Uninsured Motorist Property Damage” in your policy documents. If you can’t find them, or if the limits seem low, it’s time for a policy review.

We’ve seen too many clients find these gaps after an accident when it’s too late to fix them. If I have full coverage do I need uninsured motorist protection? The answer is always yes, because “full coverage” isn’t actually full without it.

Uninsured Motorist Property Damage (UMPD) vs. Collision Coverage

Both Collision Insurance and Uninsured Motorist Property Damage (UMPD) can fix your car after an accident with an uninsured driver, but they work very differently. Understanding these differences could save you hundreds of dollars out of pocket.

Collision coverage is the workhorse of vehicle protection. It covers damage from any collision regardless of who’s at fault, but you’ll pay a deductible – often $500 or $1,000. UMPD coverage, on the other hand, specifically targets damage caused by at-fault uninsured drivers and often comes with a much lower deductible, sometimes none at all.

Here’s where it gets interesting: collision coverage handles hit-and-run accidents reliably, while UMPD coverage varies by state and insurer for hit-and-run scenarios. However, when an uninsured driver is clearly at fault, UMPD often provides the more affordable path to getting your car repaired.

| Feature | UMPD | Collision Coverage |

|---|---|---|

| Deductible | Often lower or no deductible | Typically $500-$1,000+ deductible |

| Fault Requirement | Covers damage from at-fault uninsured drivers | Covers damage regardless of fault |

| Hit-and-run Coverage | Varies by state and policy | Generally covers hit-and-run damage |

| Cost | Generally less expensive | More expensive due to broader coverage |

| Availability | Required in some states, optional in others | Optional but often required by lenders |

If you’re wondering what is Uninsured Motorist Coverage vs Collision?, think of UMPD as specialized protection for a specific growing problem, while collision coverage is broad protection for any collision scenario. Both have their place in a well-designed insurance policy.

If I have full coverage do I need uninsured motorist coverage in Massachusetts and New Hampshire?

Yes, absolutely. The high number of uninsured drivers on the road makes this coverage essential. According to the Insurance Research Council, one in eight drivers is uninsured. If one of them hits you, your “full coverage” policy won’t cover your medical bills or lost wages. That’s where Uninsured Motorist Bodily Injury (UMBI) coverage becomes your primary financial safeguard.

Let me paint you a picture that might sound familiar. You’re driving home from work on a Tuesday evening, following all the traffic laws, when suddenly another driver runs a red light and slams into your car. The good news? You have “full coverage.” The bad news? The other driver doesn’t have insurance at all.

Your collision coverage will take care of your car repairs (minus your deductible), but what about the ambulance ride? The emergency room visit? The three weeks you can’t work because of your injured back? Unfortunately, your collision and comprehensive coverage won’t pay a penny toward any of these costs.

This scenario isn’t as rare as you might think. If I have full coverage do I need uninsured motorist protection becomes a very real question when you’re facing thousands in medical bills from someone else’s mistake.

Here’s where Uninsured Motorist Bodily Injury (UMBI) coverage steps in like a financial superhero. It’s specifically designed to protect you when the at-fault driver can’t or won’t pay for the damage they’ve caused. Medical expenses from emergency room visits to months of physical therapy are covered. Lost wages during your recovery period are replaced. Even pain and suffering compensation is included – something your health insurance will never provide.

The coverage also extends to your passengers, which means if your family members or friends are injured in your car, they’re protected too. This is especially important if they don’t have robust health insurance of their own.

Uninsured Motorist Bodily Injury (UMBI) vs. Health Insurance

While you might think your health insurance has you covered, UMBI is critically different. Health insurance pays for medical treatments but comes with deductibles, copays, and network limitations. Crucially, it does not cover lost income if you can’t work, or compensation for pain and suffering. UMBI is designed to cover these exact gaps left by an at-fault, uninsured driver.

Think of health insurance and UMBI as teammates, not competitors. Your health insurance is great at covering medical treatments, but it comes with some significant limitations that UMBI fills perfectly.

First, let’s talk about deductibles and copays. Your health insurance probably requires you to pay a deductible before coverage kicks in, plus ongoing copays for doctor visits and procedures. UMBI typically has no deductible for bodily injury claims, putting more money back in your pocket when you need it most.

But here’s the bigger issue: health insurance is designed to get you medically stable, not financially whole. It won’t replace the lost income from missing work during your recovery. If you’re the primary breadwinner in your family, those missed paychecks can create a financial crisis that medical treatment alone won’t solve.

Pain and suffering compensation is another crucial difference. Health insurance will never pay you for the emotional trauma, physical discomfort, or long-term impact an accident has on your life. UMBI recognizes that being injured by someone else’s negligence affects more than just your medical needs.

For serious injuries requiring long-term care, health insurance plans often have coverage limits or restrictions on certain types of therapy. UMBI helps ensure these critical needs are met without forcing you to fight with your health insurer over what’s “medically necessary.”

There’s also the issue of subrogation to consider. After your health insurance pays your bills, they often have the right to seek reimbursement from the at-fault party. When that party is uninsured, your health insurer might come after you for repayment if you receive money from any other source. UMBI helps avoid this complicated situation entirely.

Calculating your risk: if I have full coverage do I need uninsured motorist coverage for property damage?

How you cover property damage from an uninsured driver differs between Massachusetts and New Hampshire, but in both cases, having the right protection can save you hundreds of dollars out-of-pocket.

In Massachusetts, the key is the Collision Deductible Waiver. Massachusetts does not offer Uninsured Motorist Property Damage (UMPD). Instead, if you carry collision coverage and are hit by an at-fault, identified uninsured driver, your collision deductible is waived. This means you pay nothing to get your car repaired, saving you from paying a $500 or $1,000 deductible yourself. However, this waiver does not apply to hit-and-run accidents where the driver is not found.

In New Hampshire, you can purchase Uninsured Motorist Property Damage (UMPD) coverage. This is a smart choice because it typically comes with a much lower deductible than your standard collision coverage (e.g., $250 for UMPD vs. $1,000 for collision). When an at-fault uninsured driver damages your car, you can use your UMPD coverage and pay the lower deductible, saving you a significant amount of money.

The cost-benefit analysis is clear: In Massachusetts, having collision coverage is crucial for the deductible waiver benefit. In New Hampshire, adding affordable UMPD coverage is a cost-effective way to protect yourself from the financial carelessness of others.

The High Cost of Skipping UM: Real Financial Risks

When clients ask me “if I have full coverage do I need uninsured motorist” protection, I often share real stories from our claim files. The financial devastation from skipping UM coverage isn’t theoretical—it’s happening to responsible drivers every single day.

Picture this: You’re driving home from work when an uninsured driver runs a red light and T-bones your car. The ambulance ride alone costs $1,200. Your three-day hospital stay? $18,000. Physical therapy for your back injury? Another $8,000. Lost wages while you recover? $6,000. Your “full coverage” collision insurance fixes your car, but leaves you holding a $33,200 bill for everything else.

With 13% of drivers nationwide being uninsured, this scenario is far from rare. That’s roughly 32 million drivers on American roads without insurance to cover the damage they cause.

Medical debt becomes the first domino to fall. Even with health insurance, you’ll face deductibles, copays, and out-of-network charges. A serious accident can easily generate six-figure medical bills. Without UMBI coverage, these costs land squarely on your shoulders, potentially following you for decades.

Lost income creates immediate financial pressure. Your mortgage payment doesn’t pause because you’re injured. Neither do your car payments, utility bills, or grocery expenses. If your injuries prevent you from working for weeks or months, UMBI coverage replaces that lost income. Without it, your family’s financial stability crumbles quickly.

Vehicle repair costs add insult to injury. Your collision coverage will fix your car—after you pay your deductible, which is often $500 or $1,000. In New Hampshire, optional Uninsured Motorist Property Damage (UMPD) coverage can cover this with a much lower deductible. In Massachusetts, if the uninsured driver is identified and you are not at fault, your collision deductible is waived entirely, saving you that out-of-pocket cost.

Hit-and-run accidents compound the problem. With over 682,000 hit-and-run crashes annually, there’s often no one to hold accountable. The driver disappears, leaving you with all the financial consequences of their reckless behavior.

I’ve watched clients attempt to sue uninsured drivers personally, hoping to recover their losses through legal action. It’s usually a painful lesson in reality—you can’t collect money from someone who doesn’t have any. These legal battles drain more money from already-stretched budgets while providing little hope of actual recovery.

The harsh truth? Financial ruin from a single accident is entirely preventable. UM coverage costs pennies compared to the protection it provides, yet too many drivers skip it because they believe their “full coverage” has them protected.

How Much Uninsured Motorist Coverage Should I Get?

Here’s my simple rule that’s served our clients well for 25 years: match your Uninsured Motorist limits to your Bodily Injury liability limits. If you carry $100,000/$300,000 in liability coverage to protect others, you should have the same limits protecting yourself and your family.

Think about the logic here. You’re responsible enough to carry high liability limits in case you accidentally hurt someone else. Why wouldn’t you want that same level of protection when someone hurts you?

Your income level matters tremendously. If you earn $60,000 annually and suffer injuries that keep you out of work for six months, that’s $30,000 in lost wages alone—before we even talk about medical bills. Higher-income families need correspondingly higher UM limits to maintain their standard of living during recovery.

Consider your health insurance gaps carefully. That $5,000 health insurance deductible suddenly feels manageable when your UMBI coverage helps pay it. Your health insurance also won’t cover lost wages, pain and suffering, or the extra expenses that come with serious injuries—things like modified vehicles, home accessibility improvements, or childcare while you recover.

Protecting passengers extends your responsibility. Your UMBI coverage doesn’t just protect you—it covers your spouse, children, and anyone riding in your car. If your teenager’s friend gets seriously injured in an accident with an uninsured driver, your UM coverage becomes their financial lifeline.

When choosing your limits, honestly assess your current savings and emergency funds, your monthly income and expenses, your health insurance deductible and out-of-pocket maximums, and the value of your vehicles. These factors should guide your coverage decisions far more than simply choosing the cheapest option available.

The small difference in premium between minimum UM coverage and robust protection often amounts to less than a monthly coffee shop habit. Yet that difference can mean the distinction between financial recovery and financial ruin after a serious accident.

Frequently Asked Questions about Uninsured Motorist Coverage

When clients visit our office asking if I have full coverage do I need uninsured motorist protection, these are the most common questions that come up. Let me share the answers I give them every day.

Does uninsured motorist coverage apply in a hit-and-run accident?

Yes, for bodily injuries it does, and this is one of the most valuable benefits of the coverage. When someone hits you and flees the scene, your Uninsured Motorist Bodily Injury (UMBI) coverage will step in to cover your medical bills, lost wages, and pain and suffering in both Massachusetts and New Hampshire.

However, property damage from a hit-and-run is handled differently:

- In Massachusetts: Your property damage is covered by your Collision coverage (minus the deductible). The state’s Collision Deductible Waiver, which saves you from paying the deductible, does not apply in a hit-and-run because the at-fault driver cannot be identified.

- In New Hampshire: Whether your Uninsured Motorist Property Damage (UMPD) covers a hit-and-run depends on your specific policy language. If it doesn’t, you would rely on your Collision coverage and have to pay the deductible.

This is a key reason to review your policy’s specific terms.

Is uninsured motorist coverage expensive?

Absolutely not – and this might surprise you. Uninsured Motorist coverage is typically one of the most affordable components of your entire auto insurance policy. We’re talking about roughly $50-$75 annually for both bodily injury and property damage coverage in most cases.

To put that in perspective, that’s about 5% of your total annual premium for protection that could cover tens or hundreds of thousands of dollars in medical bills and lost wages. I tell my clients it’s like buying a lottery ticket, except this one actually pays out when you need it most.

Think about it this way: you probably spend more on coffee in a month than you’d spend on UM coverage for an entire year. Yet this coverage could literally save you from financial ruin if an uninsured driver causes a serious accident.

The reason it’s so affordable is that insurance companies spread the risk across many drivers, but the coverage only kicks in for that specific scenario – accidents with uninsured drivers. It’s targeted protection at a bargain price.

If I have collision and comprehensive, why is UM still necessary?

This is probably the question I hear most often, and it reveals a crucial misunderstanding about what different coverages actually protect. Collision and comprehensive cover your car, not your body.

Let me break this down simply: Comprehensive Insurance handles non-accident events like theft, vandalism, or hail damage to your vehicle. Collision coverage repairs your car after an accident, regardless of who’s at fault, but you’ll pay a deductible and it offers zero help with medical bills, lost wages, or pain and suffering.

Uninsured Motorist Bodily Injury (UMBI) is the only coverage that protects you personally from the financial devastation of an accident with an uninsured driver. Your collision coverage might get your car fixed, but what happens when you’re in the hospital for weeks and can’t work? What about the physical therapy? The ongoing pain management?

Think of it this way: collision and comprehensive are like having a great mechanic for your car. UMBI is like having excellent health insurance specifically designed for car accidents. You need both to be truly protected, because cars can be replaced – but your health and financial stability cannot.

This is why I always tell clients that asking if I have full coverage do I need uninsured motorist protection is really asking whether you want to protect just your car or yourself and your family too.

Secure Your Peace of Mind with the Right Coverage

Don’t let the phrase “full coverage” lull you into a false sense of security. As we’ve explored throughout this article, if I have full coverage do I need uninsured motorist coverage is a question with a resounding yes. True financial protection means building a policy that shields you from every angle, especially from the growing risk of accidents with uninsured drivers.

Here’s what we’ve learned: that comfortable “full coverage” term typically covers your car beautifully – collision repairs it after accidents, comprehensive handles theft and weather damage, and liability protects others when you’re at fault. But what about you? What happens to your medical bills, lost wages, and pain and suffering when an uninsured driver turns your world upside down?

Understanding the distinct and vital role of Uninsured Motorist coverage is the key to safeguarding your financial future. UMBI (Uninsured Motorist Bodily Injury) steps in where your health insurance falls short, covering not just medical expenses but also lost income and compensation for pain and suffering. Protection for your vehicle’s damage—through New Hampshire’s UMPD or Massachusetts’ Collision Deductible Waiver—can save you hundreds or even thousands of dollars in deductibles when an uninsured driver is at fault.

The statistics are sobering – with 13% of drivers operating without insurance, you’re not just protecting against a remote possibility. You’re preparing for a genuine risk that affects millions of drivers every year. The relatively small cost of UM coverage (often just $50-$75 annually) pales in comparison to the potentially devastating financial consequences of going without it.

At Stanton Insurance Agency, we’ve spent 25 years helping Massachusetts and New Hampshire drivers steer these crucial coverage decisions. We’ve seen too many clients find gaps in their “full coverage” policies only after an accident occurs. The team at Stanton Insurance Agency is dedicated to ensuring you have the right protection without any gaps.

Your peace of mind shouldn’t depend on hoping every other driver carries adequate insurance. It should rest on knowing you’ve built a comprehensive safety net that protects you and your family, regardless of what others choose to do.

Ready to move beyond the “full coverage” misconception? To review your policy and ensure you’re truly covered, explore our Car Insurance options today. Let’s work together to build protection that actually covers everything that matters to you.