How to get car insurance in Massachusetts 2025: Easy Guide

Your First Steps: Navigating Car Insurance in Massachusetts

If you’re looking for how to get car insurance in Massachusetts, you’ve come to the right place. Getting the right coverage might seem complex. But it’s essential for protecting your car, your finances, and yourself.

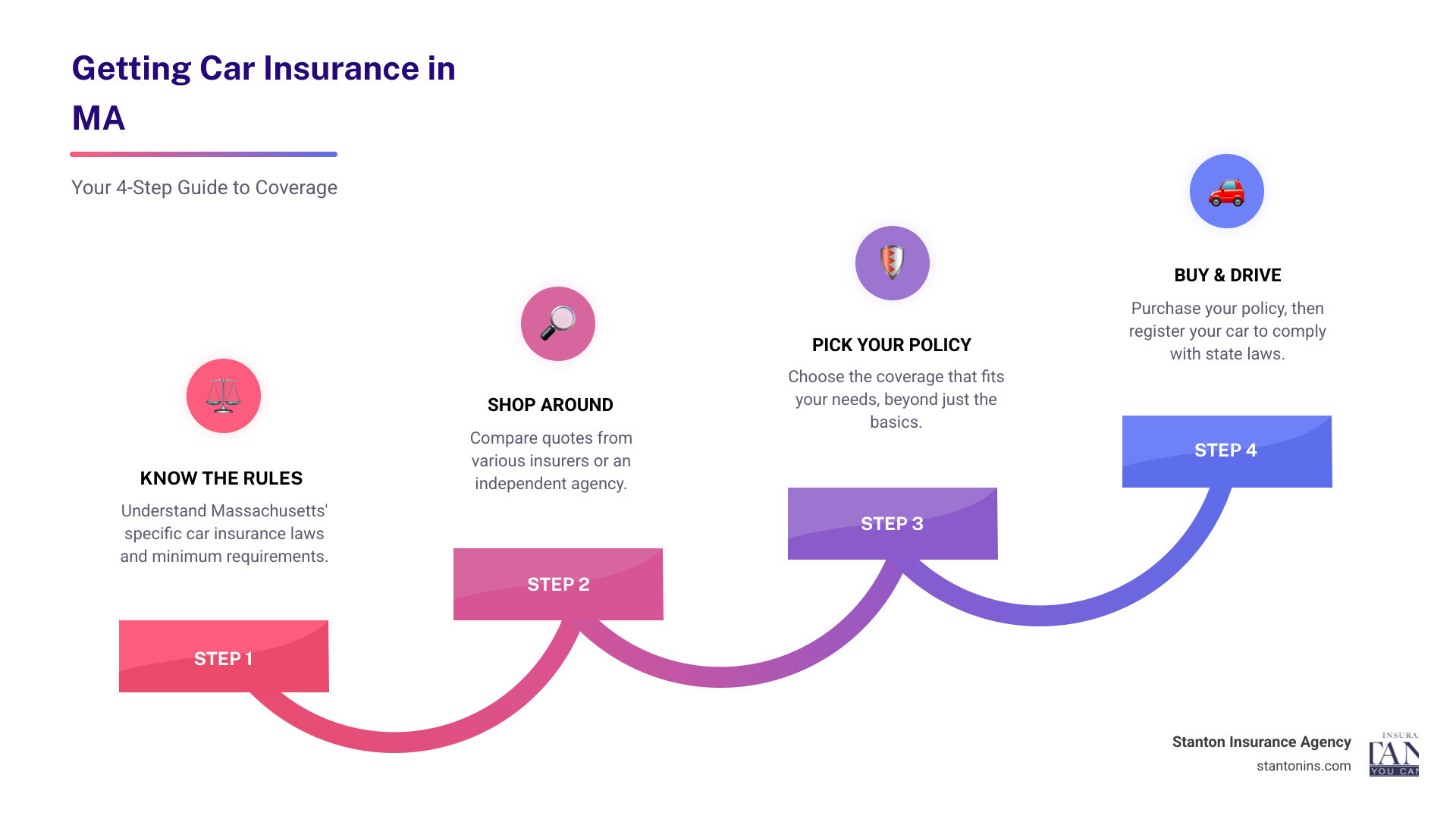

Here’s the quick rundown on how to get started:

- Know the Rules: Massachusetts has specific car insurance laws. You need to meet these minimums.

- Shop Around: Don’t pick the first option. Get quotes from different insurers or an independent agency.

- Pick Your Policy: Choose the coverage that fits your needs. This means looking beyond just the basics.

- Buy and Drive: Once you decide, purchase your policy. Then, register your car.

Massachusetts requires all drivers to carry auto insurance. This protects everyone on the road. It also keeps you safe from unexpected costs after an accident.

I’m Geoff Stanton, President at Stanton Insurance. Having joined the claims department in 1999 and now a 4th-generation owner, I’ve spent my career helping folks steer how to get car insurance in Massachusetts and protect what matters most.

Key terms for how to get car insurance in massachusetts:

- do you need insurance to register a car in massachusetts

- car insurance companies in massachusetts

- what is the minimum car insurance coverage in massachusetts

Understanding Massachusetts Car Insurance Requirements

Just like putting on a seatbelt, car insurance isn’t just a good idea in Massachusetts – it’s the law! When you’re learning how to get car insurance in Massachusetts, understanding these requirements is step one. We’re talking about mandatory coverage, which means every driver needs to meet certain minimum limits. This allows you to legally operate a vehicle in the Bay State.

Think of these as the foundational layers of your financial protection. Without them, you can’t register your car. More importantly, you’d be wide open to significant financial risk if an accident happened. These aren’t just rules; they’re safeguards for you and everyone else on the road.

Here’s a breakdown of the mandatory coverages you’ll need:

Bodily Injury to Others

This coverage is for when you cause an accident that hurts another person. It helps pay for their medical bills, lost wages, and even things like pain and suffering. In Massachusetts, the minimum required limits are $20,000 per person injured in an accident. There’s also a total of $40,000 per accident. This means if more than one person is hurt, your policy will pay up to $40,000 in total. But it won’t pay more than $20,000 to any single person. It’s like a safety net for everyone else, making sure they get the care they need if you’re found to be at fault.

Personal Injury Protection (PIP)

PIP is a truly wonderful part of Massachusetts car insurance! It’s “no-fault” coverage. This means it pays for your medical expenses and lost wages (up to 75% of your average weekly wage) if you’re injured in an accident. And it pays no matter who caused the crash! It also covers your passengers and household members who don’t have their own PIP. The minimum required coverage is $8,000 per person, per accident. PIP is designed to get you and your loved ones immediate medical attention. You don’t have to wait for someone to figure out who was at fault. It’s a real peace of mind to know that getting care comes first.

Bodily Injury Caused by an Uninsured Auto

Imagine getting hit by a driver who doesn’t have insurance – or worse, a hit-and-run! This coverage steps in to protect you. It pays for your medical expenses, lost wages, and pain and suffering if you or your passengers are injured by an uninsured or hit-and-run driver. The minimum limits are $20,000 per person and $40,000 per accident. While we all hope everyone plays by the rules, this coverage is your shield against those who don’t. It’s vital protection against the unexpected.

Damage to Someone Else’s Property

This one is pretty straightforward! If you cause an accident and damage someone else’s car, fence, mailbox, or any other property, this coverage helps pay for the repairs or replacement. The minimum required limit is $5,000 per accident. It’s crucial for protecting your own savings. You wouldn’t want to pay out of pocket if you ding someone’s bumper or, heaven forbid, take out their prize-winning rose bush!

These four coverages are the non-negotiables when you’re figuring out how to get car insurance in Massachusetts. Meeting these legal requirements is the first, most important step towards driving legally and responsibly in our state.

How to Get Car Insurance in Massachusetts

Alright, we’ve talked about why car insurance is so important in Massachusetts. Now, let’s get to the good stuff: how to get car insurance in Massachusetts! This isn’t just a chore; it’s about making smart choices to protect yourself, your loved ones, and your wallet. We’re here to make it easy and empowering. So, let’s walk through it, step by step.

Compare Quotes

Okay, first up: shopping around! This is probably the most powerful step you can take. Think of it like buying anything else important – you wouldn’t just grab the first option, right? Car insurance prices can be wildly different from one company to the next, even for the exact same coverage. So, get those quotes!

You can reach out to independent brokers, like us here at Stanton Insurance Agency. We work with lots of different insurance companies, which means we can shop for you to find the best rates and coverage that fit you just right. It’s kind of like having a personal insurance shopper, but for free! Of course, you can also use online comparison tools, but those often miss the personal touch and expert advice an agent can give. We’re truly here to understand your unique situation and help you steer all those options.

Choose Coverage

Now for the fun part: choosing your perfect coverage! Remember those mandatory minimums we talked about? They’re a great start, but often, they’re just that – a start. To truly protect yourself and your assets, you’ll want to think about adding more. This is where you get to customize your policy to fit your life. We’ll dive deeper into these options later, but here’s a quick peek at what you’ll typically consider:

First, there’s Liability Coverage. While Massachusetts has its minimums, trust us (and most other experts!), going higher is almost always a good idea. Why? Because if you’re involved in a serious accident, the costs can easily rocket past those basic limits, leaving your personal savings and future earnings at risk. Think of it as putting a stronger shield around your finances.

Then, you’ve got Comprehensive Coverage. This is your go-to for situations not involving a collision. Picture this: your car gets stolen, or maybe a tree branch falls on it during a storm, or you hit a deer. Comprehensive coverage steps in to help with repairs or replacement.

And don’t forget Collision Coverage. This is crucial for protecting your own ride. If you accidentally hit another car, a pole, or even a runaway shopping cart, collision coverage helps pay for the damages to your vehicle, no matter whose fault it was.

Finding the right balance between what you pay and how much protection you get is key. Don’t worry, we’re here to help you understand all the ins and outs and make the best choice for you!

Purchase Policy

Finally, once you’ve done your homework and found the perfect fit, it’s time to purchase your policy! You might be able to buy directly online from an insurance company. But often, and we think it’s usually the smarter way to go, you can purchase through an agent. Why an agent? Well, it means you have a real person – a dedicated point of contact – who’s there for you. They can answer all your questions, handle all that pesky paperwork, and most importantly, they’ll be in your corner, advocating for you if you ever need to file a claim. It’s like having a trusted advisor by your side.

This step is super important: you absolutely need to have your car insurance policy in place before you can register your vehicle here in Massachusetts. It’s a key part of how to get car insurance in Massachusetts and ensures you’re all set to drive legally and confidently.

Want to dive deeper into these details? We’ve got you covered:

- Curious about registering your car? Check out our insights on do you need insurance to register a car in massachusetts.

- Looking for more choices? Explore different car insurance companies in massachusetts.

- And if you need a quick refresher on the bare minimums, here’s what is the minimum car insurance coverage in massachusetts.

Costs and Discounts

Let’s be honest – when you’re figuring out how to get car insurance in Massachusetts, one of the first questions on your mind is probably “How much is this going to cost me?” I totally get it. Insurance is one of those necessary expenses that can feel like a mystery, but it doesn’t have to be. Let me break down what you can expect to pay and, more importantly, how you can save some serious money.

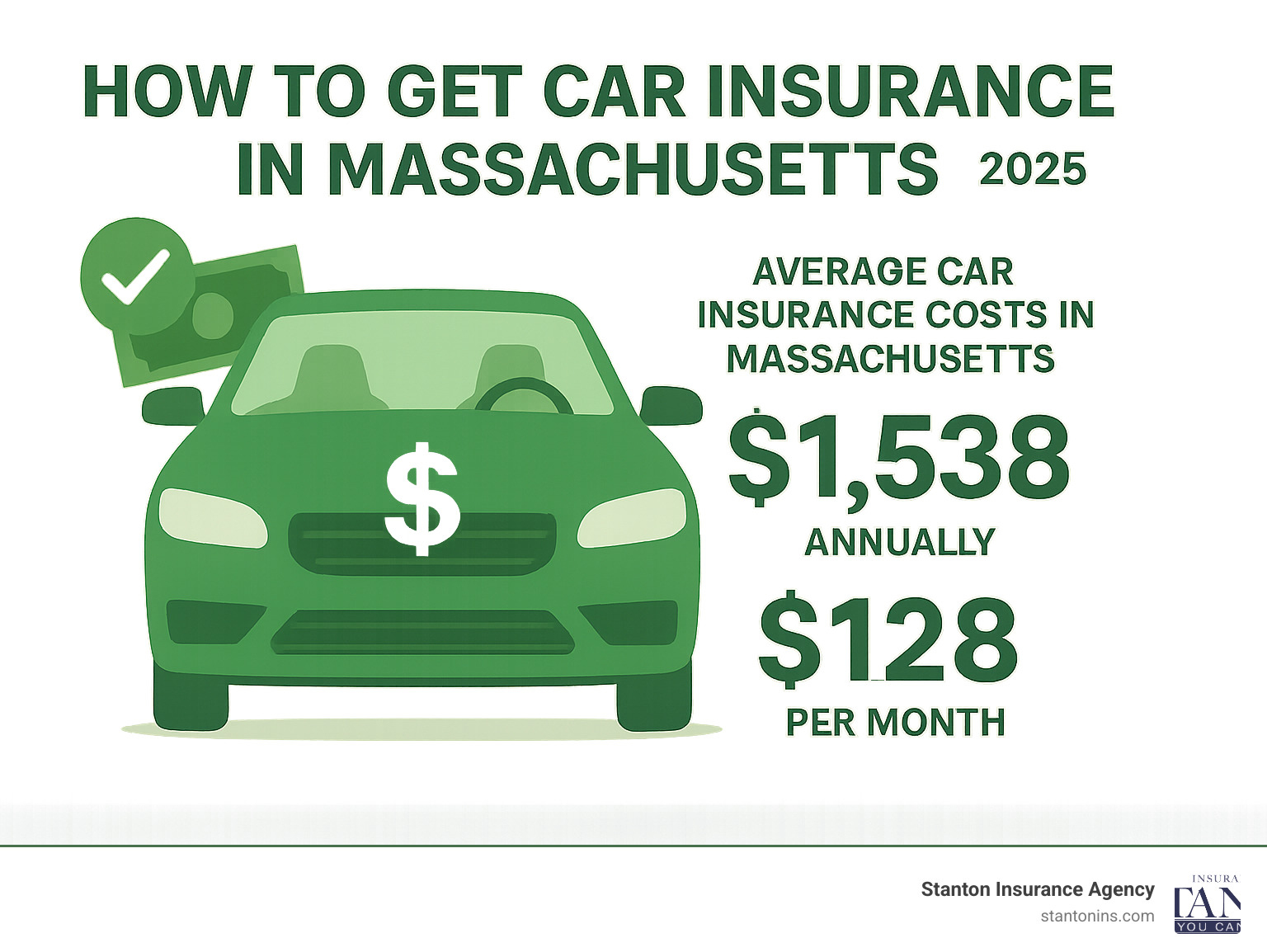

Average Cost of Car Insurance in Massachusetts

Here’s the reality: car insurance costs in Massachusetts can vary quite a bit from person to person. Your driving record, the car you drive, where you live, your age, and even your credit score (though Massachusetts limits how much insurers can use this) all play a role in determining your premium.

The good news? We can give you a solid starting point. On average, Massachusetts drivers pay about $1,538 annually for their car insurance, which works out to roughly $128 per month. Now, before you start budgeting that exact amount, this is just an average. Your actual rate could be higher or lower depending on your unique situation.

What I love about working with families and individuals on their insurance is helping them understand that this number isn’t set in stone. There are so many ways to influence your premium, and that’s where discounts come into play.

Available Discounts

This is where things get exciting! Insurance companies actually want to reward good behavior and smart choices. When we sit down to review your options, I’m always looking for every possible way to reduce your premium without compromising your protection.

The biggest money-saver? A clean driving record. If you’ve managed to stay accident-free and ticket-free for several years, you’re golden. This discount can make a real difference in your monthly payment, and it’s entirely within your control.

For families with students, the good student discount is fantastic. If your teen maintains a B average or 3.0 GPA, many insurers will cut you some slack on those higher young driver premiums. It’s a great incentive for kids to keep their grades up!

Here’s where we really shine at Stanton Insurance Agency: bundling policies. When you combine your auto insurance with your home or renters insurance, both policies typically get discounted. It’s not just about saving money (though that’s great) – it’s about simplifying your life with one trusted agent handling all your coverage needs.

Got more than one car in the family? The multi-car discount can add up quickly. And if your vehicle has modern safety features like anti-lock brakes, airbags, or anti-theft systems, you might qualify for additional safety feature discounts.

Don’t drive much? Some insurers offer low mileage discounts for people who keep their annual mileage low. And if you’re willing to take a defensive driving course, that effort often translates into premium savings too.

The key is asking about every discount you might qualify for. At Stanton Insurance Agency, we make it our business to know all the ways to save you money while ensuring you get comprehensive protection for what matters most to you.

Optional Coverages and Add-Ons

Alright, so we’ve talked about the must-haves for car insurance in Massachusetts. But imagine your car insurance policy like a cozy sweater – the basics keep you warm, but the optional coverages? Those are the extra pockets, the comfy lining, the perfect fit that makes it truly yours. They offer peace of mind far beyond the basics. When you’re figuring out how to get car insurance in Massachusetts, these are the valuable additions we love to chat about.

Comprehensive Coverage

First up is Comprehensive Coverage. Think of this as your car’s superhero cape against all those unexpected things that aren’t car crashes. Did a tree branch fall on your car during a storm? Did a rogue deer decide to play chicken with your bumper? Or, heaven forbid, was your car stolen? This coverage steps in to help pay for damages to your vehicle from things like theft, vandalism, fire, floods, hail, or hitting an animal. It’s super helpful, especially if your car is new or if you live in an area where rough weather or theft is a bigger concern.

Collision Coverage

Next, we have Collision Coverage. As the name suggests, this one is all about accidents! If you accidentally hit another car, a pole, a tree, or even if your car somehow rolls over, this coverage helps pay to fix your car. And here’s the kicker: it helps, no matter who was at fault in the accident. If you’re leasing your car or still paying off a car loan, your lender will almost certainly require you to have this. For most folks, especially with newer or more valuable vehicles, collision coverage is truly a must-have for peace of mind on the road.

Medical Payments Coverage

Finally, let’s talk about Medical Payments Coverage, often called MedPay. This is a fantastic extra layer of protection for your health. If you or your passengers are injured in a car accident, MedPay helps cover those medical bills – things like ambulance rides, doctor visits, and hospital stays. The great part? It kicks in no matter who caused the accident. While your Personal Injury Protection (PIP) already covers some medical costs, MedPay can step in to cover expenses that go beyond PIP’s limits, or for services that PIP might not fully cover. It’s truly about making sure you and your loved ones get the care you need, without added financial stress, after an unexpected incident.

These optional coverages aren’t just fancy extras; they’re vital tools for truly comprehensive protection. At Stanton Insurance Agency, we’re here to help you figure out which of these make the most sense for your life and your specific situation. We’ll make sure your policy feels like that perfectly fitted, cozy sweater we talked about!

Frequently Asked Questions about Car Insurance in Massachusetts

We get a lot of great questions from folks trying to understand how to get car insurance in Massachusetts. It’s totally normal to have them! We’re here to clear up some of the most common confusions and help you feel confident about your coverage. Here are some of the most common questions we hear, along with our expert answers.

What is needed to insure a car in Massachusetts?

Getting your car insured in Massachusetts is pretty straightforward once you know what details you’ll need to gather. Think of it like putting together a puzzle; each piece helps us build your perfect policy. You’ll generally need a few key bits of information.

First up, we’ll need all the vehicle information. This includes your car’s unique Vehicle Identification Number (VIN), its make, model, and year, and its current mileage. Then, we’ll need driver information for everyone who will be regularly driving the car. This means their names, dates of birth, driver’s license numbers, and a peek at their driving history (any accidents or tickets). Your Massachusetts address is also super important, as it helps determine your rates and proves your proof of residency. If you’re thinking of switching insurance companies, having your existing insurance information handy can be really helpful too. And finally, you’ll need your preferred payment information to get your policy set up.

Once we have all this, we’ll help you choose the right coverage types—starting with those mandatory ones we talked about, plus any optional coverages that give you extra peace of mind. After you decide on your policy and purchase it, your insurer will give you a special “stamp” or a form (often an RMV-1 form). This form is your official proof of insurance, and you’ll need it to register your car at the Registry of Motor Vehicles (RMV). It’s the final step to getting you on the road legally!

Does insurance follow the car or driver in Massachusetts?

This is a fantastic question and one that often causes a bit of head-scratching! In Massachusetts, car insurance generally follows the car first, but it also extends to the drivers listed on your policy. Let’s break down what that means for you.

Imagine you lend your car to a friend who has your permission to drive it. If they happen to get into an accident, your car insurance policy is typically the primary coverage that will step in to help with damages and injuries. So, yes, your policy is mainly tied to your vehicle.

Now, what about when you’re driving someone else’s car? Your policy also covers you (the named insured) when you drive other people’s cars, but usually as secondary coverage. For example, if you borrow a friend’s car and have an accident, their policy would typically pay first. Then, if the damages are really high and exceed their limits, your policy might kick in to cover the rest.

To make sure everyone in your household is fully covered, it’s always best to list all regular drivers on your policy. If you often lend your car out, or if you frequently borrow others’ vehicles, it’s a wise move to chat with your agent. We can help you understand all the specifics for your unique situation and ensure there are no surprises down the road.

What happens if you can’t get insurance in Massachusetts?

While it’s not super common, sometimes a driver might find it tough to get coverage from standard insurance companies. This could be due to a really challenging driving record, several past accidents, or other factors that make them seem a bit riskier to insure. But here’s the good news: Massachusetts has a helpful safety net designed just for this!

This safety net is called the Massachusetts Automobile Insurance Plan (MAIP). It’s designed to make sure that every licensed driver in our state can get the mandatory minimum liability insurance coverage they need. If you’ve tried to get quotes from a few different insurers and have been denied, you can apply for insurance through MAIP. What happens next is that MAIP will assign you to an insurance company that is required to provide you with a policy.

Now, policies obtained through MAIP might be a bit more expensive than those you’d find in the regular market. But the important thing is that they ensure you can legally drive and meet all of Massachusetts’ requirements. If you ever find yourself in this situation, don’t worry – we can definitely help guide you through the MAIP process and get you on the road legally and safely.

Conclusion

Phew! We’ve covered a lot, haven’t we? Understanding how to get car insurance in Massachusetts might have seemed a bit overwhelming at first glance. But, as we’ve walked through it together, you’ve seen that it’s a clear, step-by-step journey. We started with the absolute must-haves, like your Bodily Injury to Others and PIP coverage, ensuring you meet those crucial legal requirements. Then, we explored how to actually get your policy, from comparing quotes to choosing the right level of protection.

We even dug into the nitty-gritty of costs, helping you understand average prices and, more importantly, all the clever ways to save money with those fantastic discounts. And let’s not forget the optional coverages, like Comprehensive and Collision, which are there to give you that extra layer of peace of mind.

Our ultimate goal at Stanton Insurance Agency is simple: we want to make sure you have trusted protection for your valuable assets – whether that’s your trusty car, your cozy home, or your thriving business. We’re not just another agency; we’re a local business deeply rooted in the communities of Massachusetts (and our friends in New Hampshire and Maine!). We truly believe in going above and beyond, offering personalized advice and support that truly exceeds expectations.

We’re here to be your friendly, trusted advisors, helping you make smart choices that safeguard what matters most to you and your family. If you’re ready to get started on securing your car insurance, or if you simply have more questions swirling in your head, please don’t hesitate to reach out to us. We’re here to make the process as simple and straightforward as possible, so you can drive with confidence.