How to Cancel Car Insurance in Massachusetts: 4 Simple Steps

Your Guide to Canceling Car Insurance in Massachusetts

Learning how to cancel car insurance in Massachusetts can feel tricky, thanks to the state’s unique rules. Unlike many other states, Massachusetts has specific steps involving your vehicle’s registration and license plates that you must follow. Get it wrong, and you could face fines, license suspension, or continued billing for a policy you thought was canceled.

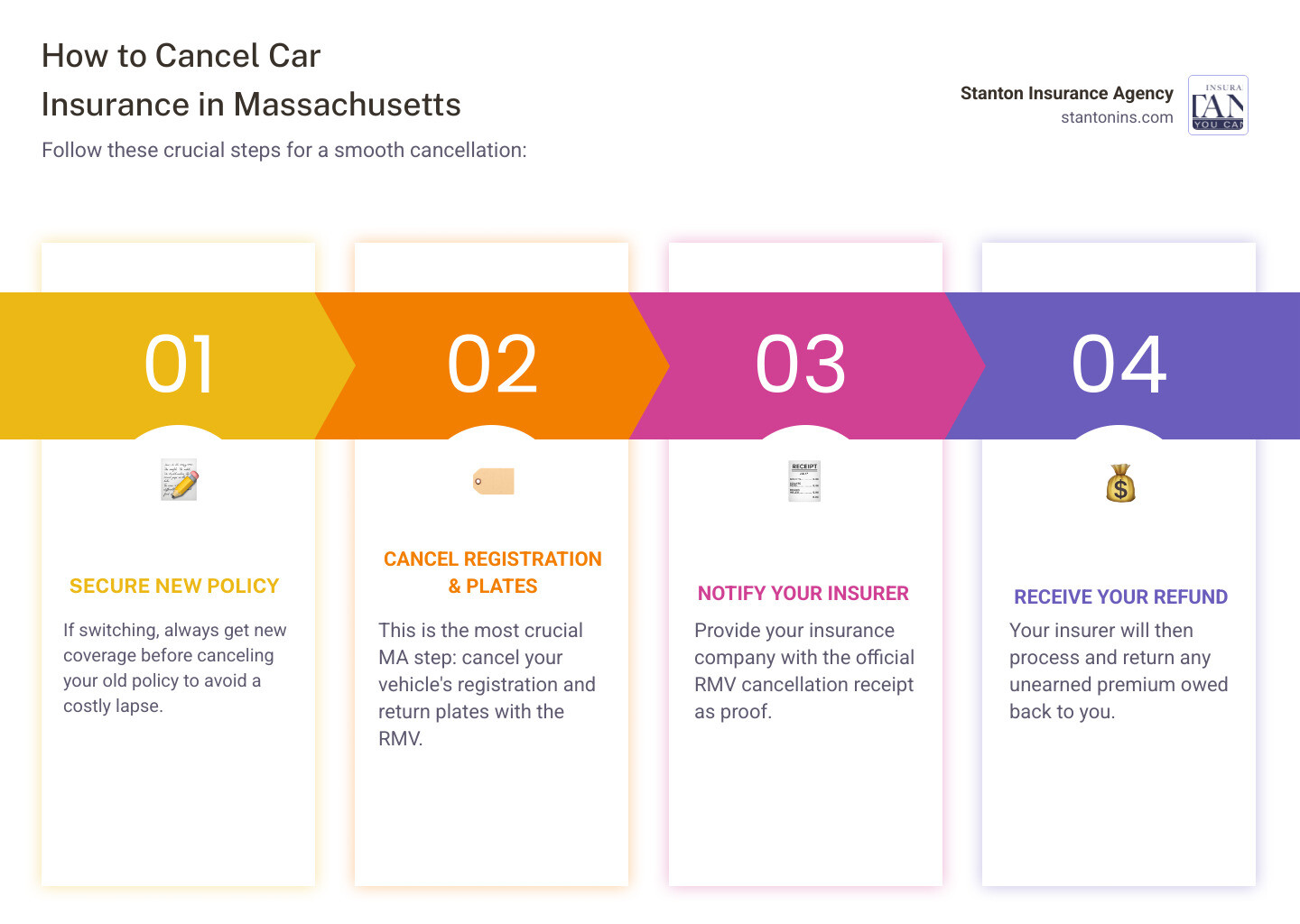

Here’s a quick look at the core steps to cancel your car insurance in Massachusetts:

- Secure New Coverage First: If you plan to keep driving, always get new insurance before canceling your old policy to avoid a costly lapse in coverage.

- Cancel Your Vehicle Registration and Plates with the RMV: This is the most crucial Massachusetts-specific step. Your insurance cannot be canceled until your vehicle’s registration and plates are handled.

- Notify Your Insurer: Provide your insurance company with proof that your vehicle’s registration has been canceled (your RMV receipt).

- Receive Your Refund: Your insurer will then process any unearned premium owed back to you.

This guide simplifies the process, drawing on decades of local expertise. I’m Geoff Stanton, President at Stanton Insurance, and my family has been helping folks like you steer insurance in Massachusetts for generations. This includes guiding clients through the precise steps for how to cancel car insurance in Massachusetts efficiently and correctly.

Quick how to cancel car insurance in massachusetts terms:

- MA Car Insurance

- do you need insurance to register a car in massachusetts

- what is the minimum car insurance coverage in massachusetts

The Official Guide on How to Cancel Car Insurance in Massachusetts

Canceling car insurance in the Bay State isn’t as simple as just stopping payments. Massachusetts has a strict, state-mandated process you must follow to avoid penalties. The most important rule to remember is: you must cancel your vehicle’s registration before you can cancel the insurance policy tied to it.

In Massachusetts, your license plate is tied to your insurance. As long as your plates are active, the state requires continuous insurance coverage. If you cancel your policy without first canceling your registration, the Registry of Motor Vehicles (RMV) is notified of an insurance lapse, which can lead to fines, license suspension, and registration revocation.

So, let’s walk through the proper steps to ensure a clean break, starting with securing new coverage if you’re switching.

Step 1: Secure New Coverage (If You’re Switching Insurers)

If you plan to continue driving, you must secure new coverage before canceling your current policy. A lapse in coverage, even for one day, has serious consequences. Driving uninsured is illegal in Massachusetts and carries penalties like fines and license suspension. Furthermore, a coverage lapse flags you as a high-risk driver, leading to much higher insurance rates for years.

To avoid this, ensure your new policy’s effective date aligns with your old policy’s cancellation date, creating a seamless transition without any gaps.

For more information on comparing options, check out our guide on Comparing Car Insurance Companies Which One Is Right For You?. And if you’re wondering about the bare minimum, we have a resource on What Is The Minimum Car Insurance Coverage In Massachusetts?.

Step 2: Cancel Your Vehicle Registration & License Plates

This is the most critical step. In Massachusetts, an insurer cannot legally process a cancellation without proof that the vehicle’s registration has been canceled. The RMV links your insurance status to your plates, so until they are officially canceled, the state requires the vehicle to be insured.

Here are the ways you can cancel your registration and plates:

- Online: This is often the fastest and most convenient method, especially for vehicles with a single owner. You can cancel your plates/vehicle registration online directly on the Mass.gov RMV portal. You’ll need your vehicle registration (license plate) number, email address, and one of your driver’s license/permit/ID number, Social Security Number (SSN), or FID number (if the vehicle is registered to a company). There is no fee to cancel your registration.

- By Mail: If the vehicle has two owners, you must use this method. Both owners will need to complete and sign the “Affidavit for Cancellation of Registration.” This form must then be mailed to the RMV.

- In-Person: You can visit any RMV service center to cancel your registration. Many insurance agencies, including ours, can also assist you with this process as a convenience.

Upon cancellation, the RMV will issue a “Registration Cancellation Receipt.” This document is essential for canceling your insurance policy. You are no longer required to return your physical plates to the RMV; you can recycle or destroy them. It is illegal to drive a vehicle with a canceled registration on any public road in Massachusetts.

Step 3: What to Do If You Can’t Physically Return Your Plates

If your license plates are lost, stolen, or otherwise unavailable (e.g., on a totaled vehicle), you can’t cancel your registration in the usual way. For these situations, Massachusetts provides the RMV-2A Form.

This form, officially known as the “Affidavit for Cancellation of Registration for Lost, Stolen, Destroyed, or Canceled Plates,” serves as a legal substitute for returning the physical plates. It is used when plates are lost, stolen, destroyed, or were not removed from a vehicle that was totaled, junked, or moved out of state.

To use the RMV-2A Form:

- Download and complete the form from the Mass.gov website, explaining why the plates are unavailable.

- Get the form notarized. This is a required step to legalize the affidavit.

- Submit the notarized form to your insurance company and the Massachusetts RMV.

- Follow up with both your insurer and the RMV to confirm your registration and policy are canceled. Keep copies for your records.

This form is legally required by MGL Chapter 175, Section 113H, which mandates that a policy cannot be canceled without either the return of the plates or this sworn affidavit. It’s a key tool for preventing fraud and uninsured driving.

Step 4: Notify Your Insurance Company

With your “Registration Cancellation Receipt” or notarized RMV-2A Form in hand, you can now notify your insurance company. You must provide them with a copy of this proof along with a formal written request to cancel. A written notice (via mail, email, or in-person) is always recommended for your records.

Your cancellation notice should include:

- Your full name and address

- Your policy number

- The desired cancellation date (which will be the date your plates were canceled by the RMV)

- A clear statement requesting cancellation

- A copy of your RMV “Registration Cancellation Receipt” or the notarized RMV-2A Form.

Sending the notice via certified mail provides proof of delivery. Per Massachusetts regulations (211 CMR 97.00), insurers require this written notice. Once they receive it, they will officially cancel your policy and process any refund you are owed.

The Financial Side of Cancellation: Refunds and Fees

When you cancel your car insurance, you may be entitled to a refund for the unused portion of your premium. This is called a return premium. The insurer keeps the “earned premium” for the time you were covered and returns the “unearned premium.” The amount you get back depends on whether the cancellation is pro-rata or short-rate.

Pro-Rata vs. Short-Rate Refunds

There are two main ways your refund is calculated:

- A pro-rata refund is a full, proportional refund for the unused time on your policy. If you paid for 12 months and cancel after 6, you get exactly half your premium back.

- A short-rate cancellation includes a small administrative penalty for an early cancellation that you initiate. The insurer retains a bit more of the premium to cover its costs for setting up the policy for a full term.

Here is when each type of refund typically applies:

You’ll typically get a pro-rata refund if:

- The insurance company cancels your policy.

- You cancel your policy within the first 30 days of it starting.

- Your vehicle is stolen or declared a total loss (and you cancel within 30 days of that incident).

- You’re entering military service.

- You’re moving from the Massachusetts “residual market” to regular insurance coverage.

You’ll usually face a short-rate cancellation if:

- You cancel your policy for other reasons (like finding a cheaper rate or selling your car) more than 30 days after the policy started.

Here’s a quick comparison to help you understand the two:

| Feature | Pro-Rata Cancellation | Short-Rate Cancellation |

|---|---|---|

| Who Initiates | Usually the insurance company. | Usually the policyholder. |

| Refund Amount | Full refund for the unused portion of the premium. | Refund for the unused portion, minus a small penalty. |

| When It Applies | Insurer cancels, or if you cancel within the first 30 days, after a total loss, or for military deployment. | You cancel for other reasons (e.g., found a cheaper rate) more than 30 days into the policy. |

These rules are set by Massachusetts law (211 CMR 97.00 and MGL 175, Section 113A) to ensure fairness for both policyholders and insurers.

How long does it take to get a refund?

According to Massachusetts regulations, once your car insurance policy is officially canceled, any money you’re owed (your return premium) must be sent to you within 30 days of the cancellation date.

When to Cancel (and When to Hold Off)

Canceling your policy isn’t always the right move. It’s important to know when it makes sense to cancel and when you should consider other options.

Good Reasons to Cancel Your MA Car Insurance

- You Sold Your Car: If you sell your vehicle and don’t plan to replace it, you can cancel your policy after canceling your plates with the RMV. Ensure the sale is complete (title transferred, bill of sale signed). By law, your policy terminates automatically 30 days after the sale unless you transfer the registration to a new vehicle.

- You’re Moving Out of Massachusetts: When moving out of state, you must first get new insurance and registration in your new state of residence. Only then should you cancel your Massachusetts registration and your MA insurance policy to avoid a coverage gap.

- The Vehicle is Totaled or Stolen: If your vehicle is declared a total loss or is stolen and not recovered, you must cancel the registration to stop the policy after the claim is settled. If you cancel within 30 days of the incident, you are entitled to a pro-rata refund without penalties.

When You Should NOT Cancel Your Policy

- You Still Own the Car (Even if You Don’t Drive It): If a vehicle is registered in Massachusetts, it must have minimum liability insurance, even if it’s not being driven (e.g., stored for the winter). To stop insuring a vehicle you own, you must first cancel its registration with the RMV.

- You’re Switching to a New Insurer: Never cancel your old policy until your new one is officially active. Confirm the start and end dates with both insurers to prevent a costly coverage gap.

- Your College Student Leaves Their Car at Home: Instead of canceling coverage for a college student who leaves their car at home, ask your insurer about a “student away at school” discount. This often provides significant savings while keeping them insured for breaks and holidays.

- You Just Paid Off Your Car Loan: Paying off your car loan removes the lender’s requirement for comprehensive and collision coverage. However, if your car still has significant value, dropping these coverages means you’ll pay for repairs or replacement out-of-pocket. Consider adjusting deductibles or reviewing our guide on When To Drop Collision Insurance Coverage before removing protection.

- You Won’t Be Driving for an Extended Period: If you won’t be driving for an extended period but the car remains registered, it still needs insurance. Talk to your agent about options. If you cancel the registration, you may be able to get a “storage” policy to protect against non-driving risks like theft or fire.

When Your Insurer Cancels on You

An insurance company can’t cancel your policy without a valid reason. Massachusetts law (211 CMR 97.00 and MGL 175, Section 113A) strictly governs how and why an insurer can end your coverage, and you have rights if you believe the cancellation is unfair. Insurers must provide a specific, legally-defined reason for the cancellation.

Valid Reasons for an Insurer to Cancel Your Policy

Your insurer must provide a specific, valid reason for cancellation. Here are the main scenarios where they have the legal right to cancel your policy:

- Non-payment of premium: This is the most common reason. If you miss a payment, your insurer can cancel your policy. The law requires them to send a notice stating the amount due and giving you a chance to pay by a specific date to avoid cancellation.

- Fraud or material misrepresentation: This includes providing false or misleading information on your application, such as your driving record, vehicle location, or household members. Accurate information is crucial for risk assessment and pricing.

- Suspension or revocation of your driver’s license or vehicle registration: An insurer can cancel your policy if the driver’s license or vehicle registration of any household member on the policy is suspended or revoked.

- A determination by the commissioner that continuing the policy would violate the law: This allows the Division of Insurance to step in if continuing your policy would breach state regulations.

Insurers are legally required to send a written Notice of Cancellation at least 20 days before the effective date. This notice must state the specific reason for cancellation and detail your right to appeal.

How to Appeal an Auto Insurance Cancellation in Massachusetts

If you believe your policy was canceled unfairly, you have the right to appeal. Appeals are handled by the state’s Board of Appeal on Motor Vehicle Liability Policies and Bonds.

Timing is critical. To keep your coverage active during the appeal, you must file your complaint with the Board of Appeal before the policy’s cancellation date. If you file within 10 days after the cancellation date, your appeal will be heard, but your policy will be inactive, leaving you uninsured.

The process involves submitting a “Cancellation Complaint Form” with a copy of your cancellation notice to the Board of Appeal. The Mass.gov website has all the necessary forms and instructions to appeal an auto insurance cancellation.

All hearings are conducted virtually (by video or phone), and there is no fee to file a complaint.

However, you cannot appeal if you have already secured a new policy, if the cancellation was for non-payment on a taxicab, or if a finance company canceled the policy. Refusals to issue a new policy are also not appealable through this process.

Dealing with a cancellation or appeal can be overwhelming. If you find yourself in this situation, our team at Stanton Insurance can provide the guidance you need to protect your driving privileges and find the right coverage.

Frequently Asked Questions about Canceling Car Insurance in Massachusetts

Over the years, we’ve helped countless Massachusetts drivers through the how to cancel car insurance in Massachusetts process, and we’ve noticed the same questions come up time and again. Let me share the answers to the most common concerns we hear from folks just like you.

What happens if I don’t cancel my plates before trying to cancel my insurance?

Your insurance company legally cannot process your cancellation request until your plates are canceled with the RMV. In Massachusetts, insurance is tied to the registration. If you don’t cancel your plates first, you will continue to be billed for your policy, and the RMV will revoke your registration and suspend your license for being uninsured, leading to significant fines and fees.

Can I just stop paying my car insurance bill to cancel it?

No. While this will eventually end your policy, it will be a cancellation for non-payment. This goes on your insurance record, flagging you as a higher-risk customer and leading to higher rates in the future. The RMV will also be notified, resulting in a revoked registration, a suspended license, and hundreds of dollars in reinstatement fees. Always follow the proper cancellation process.

Do I need to tell the RMV I have new insurance?

No, you do not need to contact the RMV. When you purchase a new policy, your new insurance company is legally required to notify the RMV electronically. This automated system ensures the state’s records are updated without you needing to take any action.

Navigating Your Next Steps

We’ve walked through the specific steps for how to cancel car insurance in Massachusetts. The unique “plates first” rule is the most important part of the process. By following these state-mandated steps, you can avoid penalties and ensure a clean break from your old policy.

Whether you’re moving, selling your car, or switching insurers, understanding these requirements is key. At Stanton Insurance Agency, we’re here to help you steer the nuances of Massachusetts car insurance. From finding new coverage to guiding you through the cancellation process, our team is ready to provide the trusted advice you need.

Ready to explore your options or have more questions about how to cancel car insurance in Massachusetts?

Explore our Car Insurance options to find the perfect policy for your needs.