How much uninsured motorist coverage do I need: 4 Smart Steps

Why Every Massachusetts and New Hampshire Driver Needs the Right UM Coverage Amount

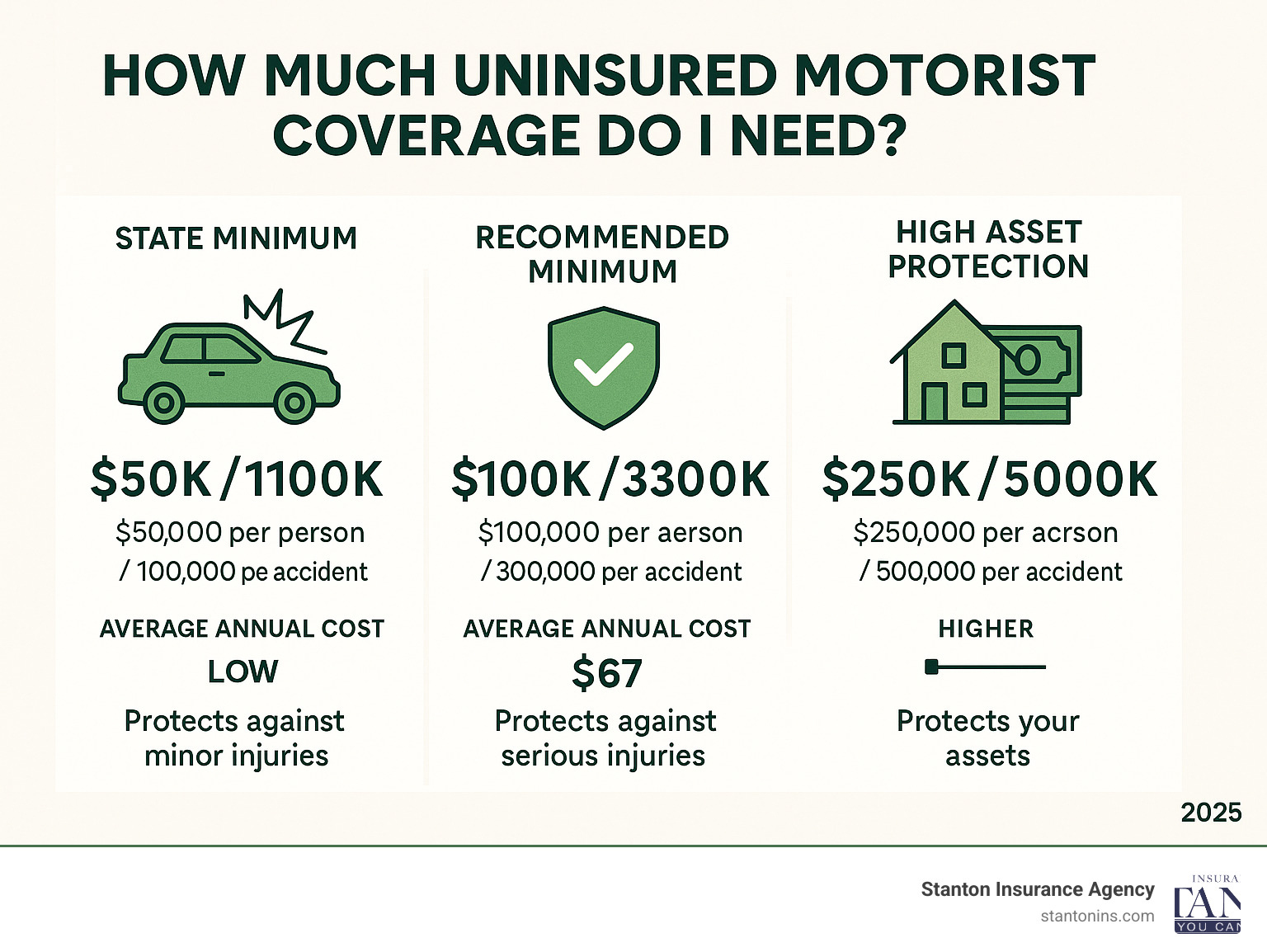

How much uninsured motorist coverage do I need? Here’s the quick answer:

- Minimum recommended: $100,000 per person / $300,000 per accident

- Rule of thumb: Match your bodily injury liability limits

- Cost: Approximately $5-10 per month for $100,000/$300,000 coverage

- Consider higher limits if: You have significant assets to protect

You’re a careful driver who follows traffic laws and maintains your vehicle. But here’s a sobering reality: while Massachusetts has one of the lowest rates of uninsured drivers in the country at just 3.5%, the rate in neighboring New Hampshire is 9.8%—much closer to the national average of 12.6%, according to the Insurance Research Council. This means that especially in New Hampshire, you have nearly a one in ten chance of being hit by a driver with no insurance at all. The risk is real across both states.

When an uninsured driver causes an accident, their lack of coverage becomes your financial problem. Medical bills from even a minor accident can easily reach $10,000-$30,000. A serious injury requiring surgery and rehabilitation? You’re looking at $100,000 or more. Without adequate uninsured motorist (UM) coverage, these costs come straight out of your pocket.

The good news is that UM coverage is surprisingly affordable – often costing just $67 per year on average. But determining exactly how much you need requires looking at your specific situation, assets, and risk tolerance.

I’m Geoff Stanton, President of Stanton Insurance Agency, and I’ve helped hundreds of Massachusetts and New Hampshire families steer the question of how much uninsured motorist coverage do I need over my 25+ years in the insurance industry. Through my experience handling claims and reviewing policies, I’ve seen how the right coverage amount can mean the difference between financial security and devastating out-of-pocket expenses.

Understanding Uninsured and Underinsured Motorist (UM/UIM) Coverage

When you’re asking yourself “how much uninsured motorist coverage do I need?” it’s important to first understand exactly what this coverage does. Think of UM/UIM coverage as your financial bodyguard – it steps in to protect you and your passengers when the other driver either has no insurance at all or simply doesn’t have enough to cover the damage they’ve caused.

This coverage becomes your lifeline in those frustrating situations where someone else’s poor choices become your expensive problem. Whether it’s a driver who decided to skip their insurance payments or someone who only bought the bare minimum coverage, UM/UIM ensures you’re not left holding the bag for their mistakes. It even covers you in hit-and-run scenarios where the responsible driver speeds away, leaving you with the aftermath.

Uninsured vs. Underinsured: What’s the Difference?

Here’s where many people get confused, and honestly, it’s understandable. The terms sound similar, but they protect you in different scenarios – both equally important for your financial security. Understanding these differences is crucial, as we explain in our comprehensive guide What You Need to Know About Auto Insurance.

Uninsured Motorist (UM) Coverage kicks in when the at-fault driver has absolutely no insurance. Picture this: someone runs a red light and slams into your car, and when the police arrive, they find the other driver has been driving without any coverage whatsoever. Without UM coverage, you’d be responsible for your own medical bills, lost wages, and other damages – even though you did nothing wrong.

Underinsured Motorist (UIM) Coverage handles a different but equally problematic situation. The at-fault driver does have insurance, but their policy limits are laughably inadequate for the damage they’ve caused. Let’s say their policy only covers $25,000 in bodily injury, but your medical bills reach $75,000. Their insurance pays their $25,000 limit, and your UIM coverage can step in to help cover the remaining $50,000, up to your policy limits.

The Components of UM/UIM Coverage

Just like other parts of your auto insurance policy, UM/UIM coverage has different components designed to protect various aspects of your financial well-being. These work together to create a comprehensive safety net, covering everything from medical expenses to vehicle repairs. The concepts mirror what we discuss in our articles about Bodily Injury Liability and Property Damage Liability.

Uninsured Motorist Bodily Injury (UMBI) is the heavyweight champion of this coverage. It takes care of medical expenses for you and your passengers, covers lost wages when injuries keep you out of work, and provides compensation for pain and suffering. This is where the real financial protection lives – medical bills from even a moderate accident can easily reach $50,000 or more, and serious injuries can push costs into six figures.

Uninsured Motorist Property Damage (UMPD) focuses on getting your vehicle repaired when an uninsured driver damages it, but how this works varies between Massachusetts and New Hampshire. In New Hampshire, UMPD is an optional coverage you can buy. It’s less critical if you already have Collision coverage, but it can be a smart, inexpensive way to protect an older, paid-off vehicle if you’ve dropped Collision. In Massachusetts, UMPD is not offered. Instead, if you have Collision coverage and are hit by an at-fault, identified uninsured driver, your Collision deductible is waived. If you don’t have Collision coverage in Massachusetts, you have no coverage for vehicle damage in this scenario.

State Requirements in Massachusetts and New Hampshire

Every state handles UM/UIM requirements differently, and if you’re driving in Massachusetts or New Hampshire, you need to know the local rules. These requirements set the foundation for your protection, though they’re often just the starting point for adequate coverage. For detailed information about your state’s specific requirements, check out our resources on Car Insurance Massachusetts and New Hampshire Automobile Insurance.

Massachusetts requires all drivers to carry Uninsured Motorist coverage with minimum limits of $20,000 per person and $40,000 per accident for bodily injury. The state treats this as mandatory coverage because lawmakers recognized how common uninsured drivers are. Underinsured Motorist coverage is optional, but given today’s medical costs, we strongly recommend adding it to your policy.

New Hampshire takes a unique approach as the only state that doesn’t require drivers to carry liability insurance at all. However, if you choose to purchase auto insurance (which is wise if you have any assets to protect), you must include Uninsured Motorist coverage with minimums of $25,000 per person and $50,000 per accident. Even in a state with such flexible insurance laws, the financial risks from uninsured drivers remain very real.

The Alarming Risk of Uninsured Drivers

Here’s a sobering truth: relying on other drivers to carry insurance is essentially gambling with your financial future. And the odds? They’re not in your favor.

According to the Insurance Research Council (IRC), the risk of encountering an uninsured driver varies significantly between our neighboring states. In Massachusetts, the rate is a low 3.5%, one of the best in the nation. However, in New Hampshire, the rate jumps to 9.8%, meaning nearly one in every ten drivers on the road is uninsured. This stark difference highlights that no matter which state you’re in, the risk never disappears entirely.

The financial impact is massive. More than $13 billion was paid out in uninsured and underinsured motorist claims in 2016 alone. That’s billion with a “B” – representing countless families who found themselves facing unexpected financial hardship through no fault of their own.

Without adequate UM/UIM coverage, you could find yourself personally responsible for thousands or even hundreds of thousands of dollars in expenses. Picture this scenario: you’re seriously injured in an accident caused by an uninsured driver. Your medical bills start piling up – $50,000 for surgery, another $30,000 for rehabilitation, plus months of lost wages while you recover.

Your health insurance might cover some medical costs, but what about the gaps? What about your lost income, your pain and suffering, or the ongoing care you might need? When you’re wondering how much uninsured motorist coverage do I need, without proper UM/UIM protection, these financial burdens land squarely on your shoulders.

It’s a harsh reminder that even the most cautious, defensive drivers need protection from the irresponsible choices of others. The question isn’t whether uninsured drivers exist – we know they do. The question is whether you’ll be financially prepared when you encounter one.

How Much Uninsured Motorist Coverage Do I Need? A Step-by-Step Guide

Figuring out how much uninsured motorist coverage do I need isn’t something you can answer with a quick Google search. It’s deeply personal, depending on your financial situation, family circumstances, and how much risk you’re comfortable taking on. Think of it like buying a winter coat – you wouldn’t choose the same jacket for someone living in Florida versus someone in Maine, right?

Let me walk you through the process I use with my clients to find their sweet spot. We’ll look at your specific situation from multiple angles to ensure you’re protected without paying for coverage you don’t need.

Step 1: Match Your Bodily Injury Liability Limits

Here’s the golden rule that insurance professionals swear by: purchase UM/UIM coverage with the same limits as your Bodily Injury Liability coverage. It’s beautifully simple logic when you think about it.

If you carry $100,000 per person and $300,000 per accident to protect others from your mistakes, why wouldn’t you want that same level of protection for yourself and your family? This 100/300/100 coverage approach ensures consistency across your policy and gives you robust protection.

I strongly recommend starting with a minimum of $100,000 per person for bodily injury coverage. For most families, the $100,000/$300,000 combination hits the sweet spot of excellent protection at a reasonable cost – typically around $78 per year. If your budget allows, bumping up to $250,000/$500,000 provides even stronger protection, especially if you have significant assets or high earning potential. Our experience with Auto Liability Insurance shows that these higher limits offer tremendous peace of mind for just a small increase in premium.

Step 2: Assess Your Assets and Financial Picture

Your UM/UIM coverage needs to do more than just cover immediate medical bills – it needs to protect your entire financial life. Take a moment to think about everything you’ve worked hard to build: your savings account, investment portfolio, home equity, and your future earning potential.

Here’s what keeps me up at night for my under-insured clients: a serious accident can generate medical bills that easily reach six or seven figures. Without adequate coverage, you might find yourself liquidating retirement accounts, selling your home, or facing wage garnishment to pay costs that should have been covered by the other driver’s insurance.

Your UM/UIM coverage acts as a financial firewall, protecting your assets from being swept away by someone else’s irresponsibility. I always tell clients to think of their coverage amount in terms of their net worth – if you have $500,000 in assets, you need coverage that can protect that wealth from a catastrophic accident.

Step 3: How much uninsured motorist coverage do I need if I have health insurance?

This question comes up in almost every consultation, and I understand why. Many people think, “I’ve got great health insurance through work, so I don’t need much UMBI coverage.” But that’s like saying you don’t need a roof because you have good walls.

Health insurance and UMBI work together, not against each other. Even with excellent health coverage, you’ll still face deductibles and co-pays that can add up quickly after a serious accident. Your health plan might not cover specialized treatments like chiropractic care or long-term rehabilitation that accident victims often need.

Here’s the bigger picture: your health insurance only covers you, not passengers in your vehicle who get hurt by an uninsured driver. And here’s the real kicker – health insurance never covers lost wages when you can’t work, or compensation for pain and suffering. UMBI fills all these gaps, creating a complete safety net that ensures you’re fully protected, not just partially covered.

Step 4: Evaluate Your Property Damage Options for MA & NH

When it comes to protecting your vehicle from an uninsured driver, your options depend on your state.

In Massachusetts, your only option for this type of damage is Collision coverage. The state does not offer a separate Uninsured Motorist Property Damage (UMPD) coverage. The good news is that if you carry Collision and are hit by an uninsured driver who is identified and found to be 100% at fault, your deductible will be waived. If you choose not to carry Collision coverage, you will have to pay for repairs out of your own pocket.

In New Hampshire, you have more flexibility. You can purchase Collision coverage, which covers damage to your car regardless of fault. Alternatively, you can purchase Uninsured Motorist Property Damage (UMPD). If you have an older, paid-off vehicle and have decided to drop the more expensive Collision coverage, adding UMPD can be a very cost-effective way to protect yourself from repair costs if an uninsured driver hits you. You can learn more about this decision in our detailed comparison at Uninsured Motorist Coverage vs. Collision.

The key is to match your coverage to your vehicle’s value and your financial situation, keeping these state-specific rules in mind.