How much does it cost to insure an apartment building 33%

Understanding the True Cost of Apartment Building Insurance

How much does it cost to insure an apartment building has become one of the most pressing questions for property owners nationwide. The answer isn’t simple – costs have surged dramatically, with owners now paying an average of $180 per unit annually, representing a staggering 33% increase year-over-year.

Quick Cost Overview:

- Average cost per unit: $180 annually (33% increase from previous year)

- Percentage of operating expenses: Over 8% of quarterly costs

- Cost range for small buildings: $1,500-$5,000 per unit annually

- High-risk areas: Up to 40% premium increases in Florida, California, and Texas

These rising costs stem from multiple factors: increased natural disasters, higher construction costs, and insurers exiting high-risk markets. Insurance now accounts for nearly double the share of operating expenses compared to five years ago.

The complexity of apartment building insurance goes far beyond a simple premium calculation. Your final cost depends on numerous factors including your building’s age, location, safety features, claims history, and the specific coverages you select. Properties in hurricane-prone areas like coastal Massachusetts face different risks than inland New Hampshire buildings, and these geographic factors significantly impact your premiums.

Understanding these cost drivers is essential for making informed decisions about protecting your investment. Whether you own a small 5-unit building or a larger complex, the right insurance strategy can help manage these rising expenses while ensuring comprehensive protection.

I’m Geoff Stanton, President of Stanton Insurance Agency, and I’ve spent over two decades helping property owners steer the complexities of how much does it cost to insure an apartment building and secure appropriate coverage. My experience has shown me that understanding these costs upfront is crucial for successful property investment planning.

How Much Does It Cost to Insure an Apartment Building?

When property owners ask “how much does it cost to insure an apartment building,” they’re often hoping for a simple answer. Unfortunately, there isn’t one magic number that applies to everyone. Your insurance cost depends on dozens of factors unique to your property – from its age and location to the safety features you’ve installed.

That said, we can look at current market data to understand what’s happening across the country. According to recent industry reports, the insurance market for apartment buildings has become significantly more expensive. Property owners are now paying an average of $180 per unit annually – a jaw-dropping 33% increase from just one year ago.

To put this in perspective, insurance now eats up over 8% of a property owner’s quarterly operating budget. Five years ago, that figure was less than half of what it is today. These aren’t just abstract statistics – they represent real money coming out of your pocket, whether you own property in Massachusetts, New Hampshire, or anywhere else in the country.

National and Regional Trends Impacting Your Premiums

The massive jump in insurance costs isn’t happening by accident. Several powerful forces are driving up premiums nationwide, and understanding them helps explain why your renewal notice might have given you sticker shock.

Catastrophic events are becoming more frequent and more expensive. Hurricanes, wildfires, and severe storms are hitting harder and more often than in previous decades. When insurers pay out billions in claims, they need to recoup those losses somehow – and that means higher premiums for everyone. In Florida alone, insurance costs per unit jumped about 37% between 2020 and 2022. Cities like Houston and Fort Worth saw even steeper increases, with some properties facing over 40% year-over-year premium hikes.

Geographic location matters more than ever. If your property sits in a high-risk area – think coastal regions prone to hurricanes or areas with wildfire risk – you’re likely seeing the steepest premium increases. Properties in states like Florida, California, and Texas are bearing the brunt of these cost increases, with some experiencing up to 40% premium jumps in a single year.

The insurance companies that insure insurance companies are also raising rates. This might sound confusing, but it’s a key piece of the puzzle. Reinsurance companies provide backup coverage to your primary insurer. When reinsurance costs go up, those expenses inevitably trickle down to property owners like you.

Everything costs more to build and repair these days. The rising cost of lumber, steel, labor, and other construction materials means your building would cost significantly more to rebuild today than it would have just a few years ago. Higher replacement costs mean insurers need to provide more coverage, which naturally leads to higher premiums. This inflation in construction costs is one of the major reasons why multifamily insurance has become so expensive – when big losses occur, it simply costs more to make things right again.

The reality is that these market forces affect everyone, regardless of where your property is located. While a coastal Massachusetts property might face different risks than an inland New Hampshire building, the underlying economic pressures are pushing costs up across the board.

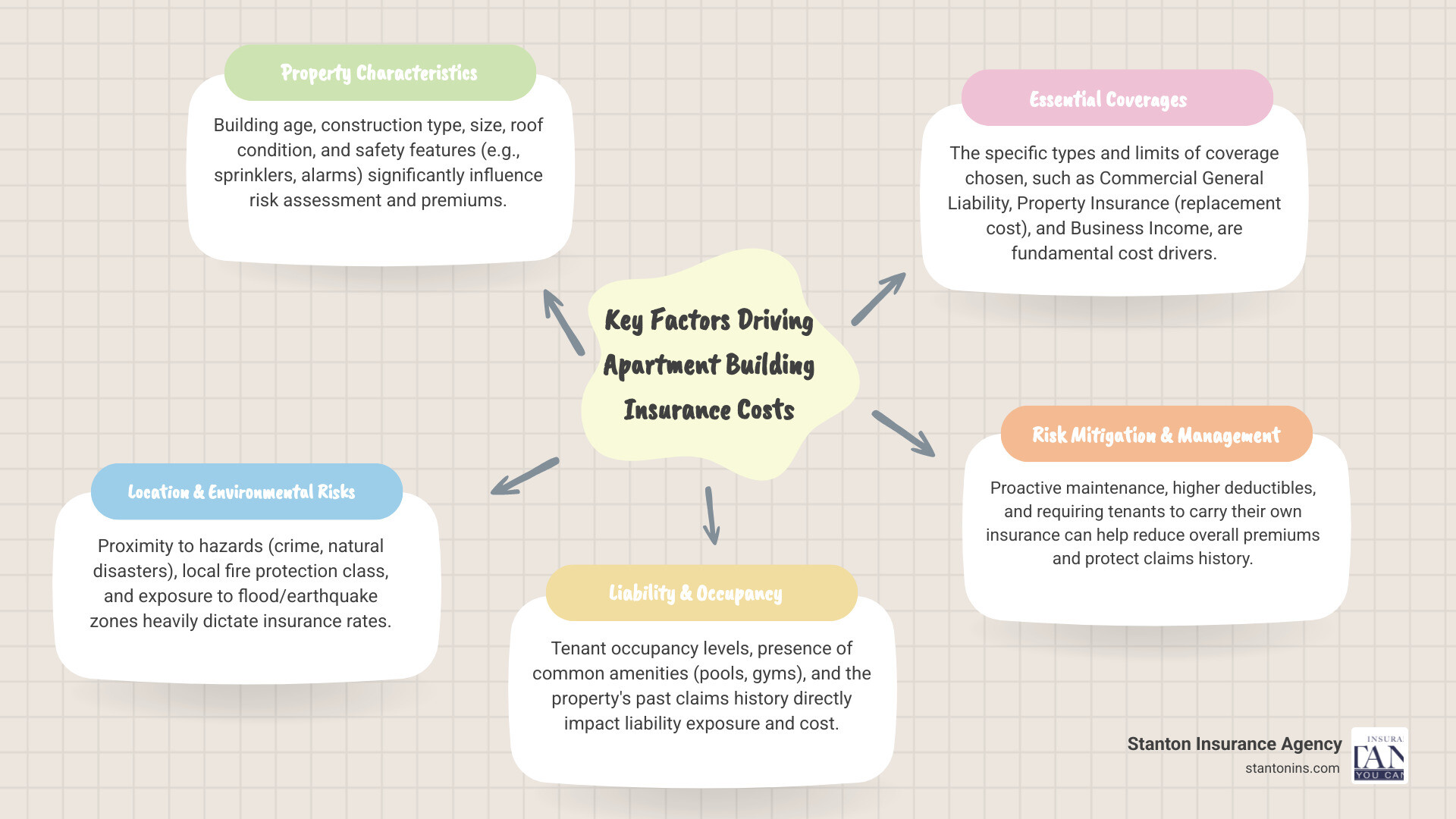

Key Factors That Drive Your Insurance Premiums

Your final insurance premium is determined by an underwriter’s assessment of your property’s unique risks. Understanding these factors empowers you to identify areas for improvement and have more informed conversations with your insurance advisor.

Property Characteristics and Condition

When insurers look at your building, they’re essentially asking one question: “What could go wrong here?” The physical attributes of your property tell that story better than anything else.

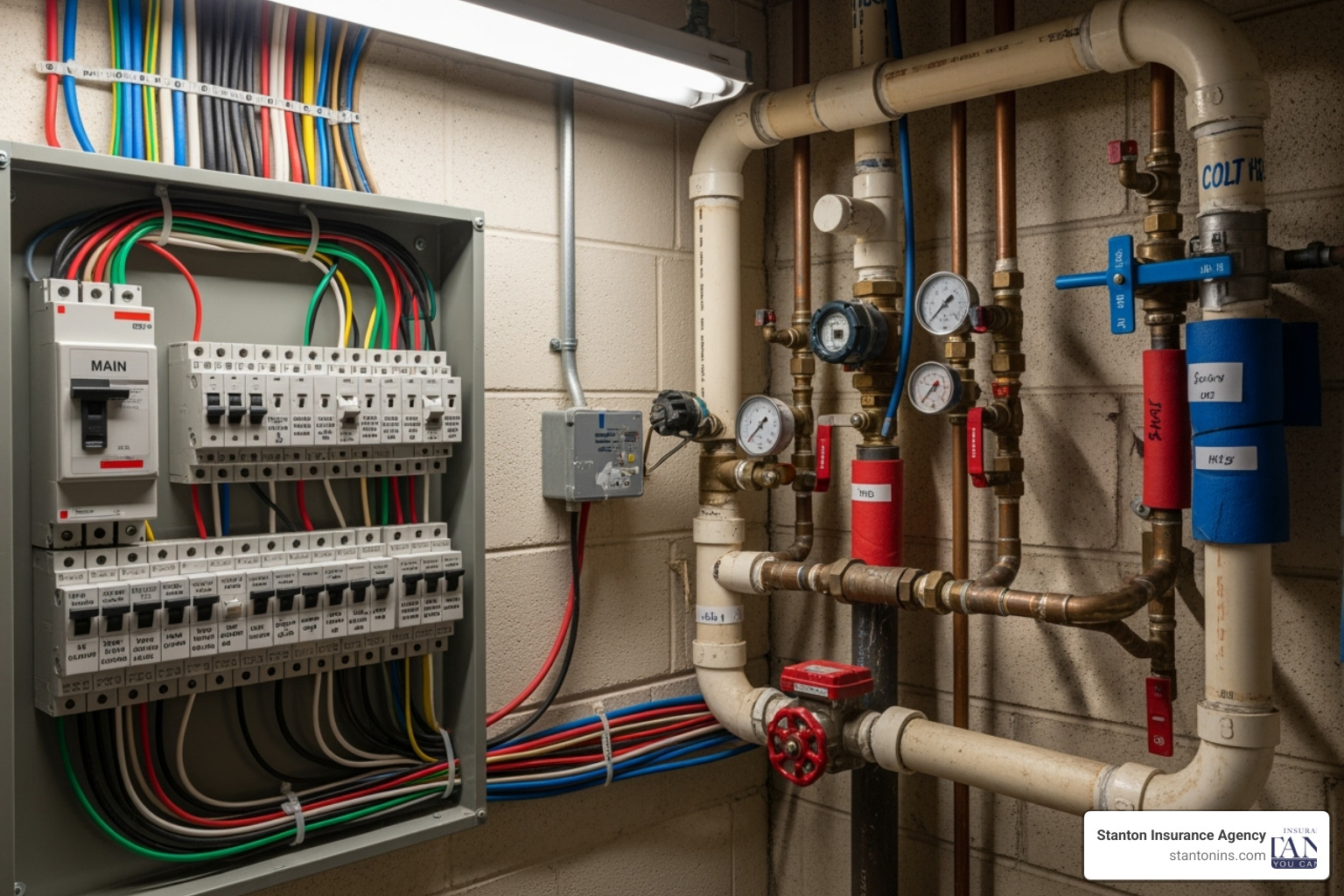

Age and construction materials are huge factors in determining how much does it cost to insure an apartment building. That charming 1920s brick building might look beautiful, but if it still has the original electrical system, insurers see dollar signs – and not in a good way. Outdated electrical, plumbing, or HVAC systems signal higher risk for fires, water damage, and system failures.

Here’s something that might surprise you: construction materials matter more than you’d think. A brick or masonry building will typically cost less to insure than a wood-frame structure. It’s simple physics – brick doesn’t burn as easily as wood.

Building size and number of units directly impact your premiums because they affect both replacement costs and liability exposure. A 5-unit apartment building presents different risks than a 50-unit complex. More units mean more tenants, more potential claims, and higher overall exposure.

Don’t underestimate the power of a good roof. Insurers love seeing recent roof replacements because your roof is your first line of defense against Mother Nature. A new roof can often open up significant premium discounts.

Safety and security features are where you can really make a difference. Modern fire alarm systems, sprinkler systems, security cameras, and secure entry points all send the same message to insurers: “This owner takes risk seriously.” These investments often pay for themselves through lower premiums.

Location and Environmental Risks

Location isn’t just important for rental income – it’s critical for insurance costs. Your building’s zip code can make or break your premium budget.

Geographic hazards play a massive role in pricing. If your property sits in a high-crime neighborhood, insurers worry about vandalism and theft claims. Coastal properties face hurricane risks, while inland buildings might deal with severe winter storms or flooding.

The recent premium spikes we’ve seen – up to 40% in places like Florida and Texas – highlight just how much location matters. These aren’t arbitrary increases; they reflect real claims data from severe weather events that have cost insurers billions.

Fire protection quality in your area affects your rates more than most people realize. Insurers actually rate your local fire department’s capabilities and proximity to your building. A full-time fire department with nearby hydrants can significantly lower your fire insurance costs compared to a volunteer department that’s 15 minutes away.

Here’s where things get expensive: flood and earthquake coverage. Standard Commercial Property Insurance policies exclude these perils. If you’re in a designated risk zone, you’ll need separate coverage through programs like the National Flood Insurance Program. This is especially relevant for properties in Massachusetts’ coastal areas, where flood risk is a real concern.

Liability and Occupancy Risks

With multiple tenants, visitors, and service providers coming and going daily, apartment buildings are liability magnets. Every person on your property represents potential risk.

Occupancy levels and tenant types significantly influence your premiums. A fully occupied building means more people, more activity, and statistically more chances for accidents. The type of tenants matters too – short-term vacation rentals typically cost more to insure than stable, long-term family tenants.

Common areas are where many liability claims originate. That swimming pool might attract great tenants, but it also attracts insurance company attention. Gyms, playgrounds, parking lots, and even sidewalks can become the site of slip-and-fall accidents or other injuries that lead to costly lawsuits.

Your claims history follows you like a shadow. Properties with frequent or severe claims face higher premiums because insurers view past claims as predictors of future problems. This is why managing small issues internally – when it makes financial sense – can help protect your claims record and keep future premiums manageable.

The bottom line? Every aspect of your property tells a risk story to insurers. Understanding what they’re looking for helps you make informed decisions about improvements, maintenance, and coverage options.

Essential Coverages for Your Apartment Building

A comprehensive Apartment Building Insurance policy isn’t just one coverage—it’s actually a carefully assembled package of protections designed to shield you from the unique risks that come with owning rental property. Think of it as your financial safety net, with each coverage addressing different scenarios that could otherwise devastate your investment.

Understanding what you truly need is the first step to ensuring you’re properly protected without paying for unnecessary coverage. Let’s walk through the essential components that should be part of your apartment building insurance strategy.

Commercial General Liability (CGL)

This is the foundation of your liability protection, and frankly, it’s non-negotiable. Commercial General Liability covers claims when someone gets hurt on your property or their belongings are damaged due to your negligence. We’re talking about slip-and-fall accidents in your lobby, injuries around the pool area, or damage caused by your maintenance activities.

Your CGL policy steps in to handle medical expenses, legal defense costs, and settlements if you’re found liable. For apartment building owners, this protection is absolutely critical. Without adequate coverage, a single serious accident could result in hundreds of thousands of dollars in lawsuits and medical bills—costs that could easily wipe out years of rental income.

The reality is that with multiple tenants, visitors, delivery drivers, and service providers coming and going daily, your liability exposure is significant. This coverage gives you peace of mind knowing you’re protected when accidents happen.

Commercial Property Insurance

Your building is likely your largest asset, so protecting its physical structure should be a top priority. Commercial Property Insurance covers your building and business personal property—like maintenance equipment, office furniture, and lobby fixtures—against perils including fire, theft, vandalism, and severe weather.

Here’s something crucial that many property owners miss: your coverage limit should be based on the building’s replacement cost, not its market value. These two numbers can be dramatically different. A building you purchased for $500,000 might cost $800,000 to rebuild from scratch, especially with today’s inflated construction costs.

This policy also protects tenant improvements and betterments—those permanent fixtures like upgraded flooring, built-in lighting, and custom cabinetry that add value to your units. Since these improvements directly impact your rental income potential, having them covered is essential for maintaining your property’s competitive edge.

Business Income and Extra Expense

Imagine a fire damages your building and forces tenants to relocate while repairs are made. Suddenly, your rental income stops, but your mortgage payments, insurance premiums, and other expenses continue. This scenario keeps many property owners awake at night—and for good reason.

Business Income and Extra Expense coverage acts as your financial lifeline during these challenging times. It replaces the rental income you would have collected and covers additional expenses you incur to get operations back to normal as quickly as possible. This might include temporary office space, expedited repair costs, or relocation assistance for tenants.

This coverage is a vital component of any Business Insurance Policy. With effective rent growth increasing in many markets, protecting this income stream has become even more critical for maintaining your investment’s profitability.

Other Important Coverages to Consider

Beyond the core coverages, several additional protections deserve serious consideration. Commercial Umbrella Insurance provides an extra layer of liability protection above your CGL limits—it’s remarkably cost-effective for the high-limit protection it provides, often covering claims from $1 million to $15 million.

If you own an older building, Ordinance or Law Coverage could save you from financial disaster. When your property is damaged, current building codes may require you to rebuild to newer, more expensive standards. This coverage helps pay for increased construction costs, demolition expenses, and the value of undamaged portions that must be torn down to comply with current codes.

Equipment Breakdown protection covers the sudden failure of essential systems like boilers, HVAC units, and elevators—breakdowns that aren’t typically covered by standard property insurance but can be extremely costly to repair or replace.

If you have employees such as maintenance staff or property managers, Workers’ Compensation is legally required in most places, including Massachusetts and New Hampshire. It covers medical expenses and lost wages for employees injured while working on your property.

Finally, don’t overlook Cyber Liability Insurance. With increasing reliance on electronic systems for tenant records, rent collection, and property management, this coverage protects against data breaches and cyber attacks that could expose sensitive tenant information and result in costly lawsuits.

The key to understanding how much does it cost to insure an apartment building lies in recognizing that each of these coverages addresses real risks that could otherwise threaten your investment. While adding coverages increases your premium, the cost is minimal compared to the financial protection they provide.

Strategies to Minimize Risk and Lower Your Insurance Costs

While many cost factors are outside your control, you can take proactive steps to make your property a more attractive risk to insurers and potentially lower your premiums.

Proactive Steps to Reduce Your Premiums

The good news about how much does it cost to insure an apartment building is that you’re not completely at the mercy of market forces. Smart property owners can take meaningful steps to reduce their premiums while making their buildings safer for everyone.

Safety and security improvements are your first line of defense against both claims and high premiums. Installing hardwired smoke detectors throughout your building isn’t just good practice—it’s a signal to insurers that you’re serious about preventing fires. Add a central fire alarm system and sprinkler system, and you’ll likely see real premium savings. Security cameras, secure entry points, and well-lit common areas don’t just deter crime; they demonstrate to underwriters that you’re actively managing risk.

A documented maintenance plan can be your secret weapon in premium negotiations. Keep detailed records of every roof inspection, HVAC service, and electrical update. When insurers see that you’re staying ahead of problems rather than reacting to them, they view your property as a better risk. This includes promptly addressing slip-and-fall hazards and keeping common areas in excellent condition.

Consider raising your deductible if you have strong cash reserves. This move can significantly lower your annual premium, though you’ll need to weigh the immediate savings against the potential out-of-pocket costs if you do have a claim. It’s a strategy that works well for owners who maintain their properties carefully and rarely file claims.

Requiring tenant insurance might not directly reduce your premium, but it’s one of the smartest risk management moves you can make. When tenants carry their own Apartment Rental Insurance, their policy responds first if they cause damage through negligence. This protects your claims history and can save you from covering your deductible when tenant-caused incidents occur.

Thorough screening processes for both tenants and employees help reduce risks across the board. Background checks and clear communication about property rules create a more stable environment with fewer incidents. Similarly, always verify that contractors working on your property carry their own liability insurance—this simple step transfers significant risk away from your policy.

Annual policy reviews with your insurance advisor ensure you’re not missing new discounts or coverage improvements. Your property’s value and risk profile change over time, and staying current with these changes helps optimize both your coverage and costs. We regularly help clients identify savings they didn’t know were available, making this review one of the most valuable hours you can spend each year.

Frequently Asked Questions about Apartment Building Insurance

Why is multifamily insurance so expensive right now?

The simple answer? It’s a perfect storm of bad news for property owners. Insurance companies are getting hit from multiple directions, and they’re passing those costs straight to you.

Severe weather is the biggest culprit. Hurricanes, wildfires, and major storms have become more frequent and more destructive. When a single hurricane causes billions in damage across thousands of properties, insurers have to raise everyone’s rates to stay afloat. It’s not just about your specific building – it’s about the entire risk pool.

Construction costs have gone through the roof (pun intended). The same materials and labor that cost $100,000 to rebuild your damaged units three years ago might cost $150,000 today. Since insurers have to cover replacement costs, your coverage limits – and premiums – have to go up too.

Then there’s the domino effect of reinsurance costs rising. These are the companies that insure your insurance company. When they raise their rates, that cost gets passed down the chain until it lands on your quarterly operating statement.

Some major insurers have simply walked away from high-risk markets entirely, leaving fewer companies to write policies. Less competition means higher prices – basic economics at work.

How do insurers calculate how much it costs to insure an apartment building?

Think of it like a very detailed report card for your property. Insurers employ underwriters who are essentially professional risk assessors, and they examine every detail that could affect your claim likelihood.

Your building’s “vital statistics” come first – age, construction type, square footage, and number of units. A 20-year-old brick building will score differently than a 50-year-old wood-frame structure. They’re calculating what it would cost to completely rebuild your property at today’s prices.

Location factors heavily into the equation. Is your building in a flood zone? How close is the nearest fire station? What’s the crime rate in your neighborhood? They even look at the quality of your local fire department and give it a rating that affects your premium.

Your claims history tells a story about how you manage risk. A property with frequent water damage claims suggests ongoing maintenance issues. No claims for five years? That’s a gold star in their book.

They also calculate something called Probable Maximum Loss (PML) – essentially their best guess at the worst-case scenario for a single event at your property. All these factors get fed into complex algorithms that spit out your premium.

The process isn’t arbitrary – it’s designed to match your premium as closely as possible to your actual risk level.

Does requiring tenants to have insurance affect my landlord insurance?

Here’s where many property owners miss a crucial opportunity. Requiring tenant insurance won’t directly lower your premium, but it’s one of the smartest risk management moves you can make.

When a tenant accidentally starts a kitchen fire or leaves a window open during a storm, their liability coverage responds first. This means their insurance company pays for the damage instead of yours. More importantly, it keeps the claim off your record entirely.

Your claims history is like your credit score – it follows you everywhere and affects your future rates. Every claim you avoid today helps keep your premiums lower tomorrow. Even if you’re not at fault, having multiple claims on your record makes insurers nervous.

There’s also the practical benefit of faster resolution. When tenant insurance covers the damage, you’re not dealing with your own deductible or waiting for your insurer’s investigation process. The tenant’s insurance handles everything, and you can focus on getting your units back to rentable condition.

Smart property owners make tenant insurance a non-negotiable lease requirement. It’s a small cost for tenants that provides huge protection for your investment and peace of mind for everyone involved.

Conclusion: Protecting Your Investment with the Right Partner

Understanding how much does it cost to insure an apartment building is just the beginning of protecting your investment. With premiums averaging $180 per unit and rising 33% year-over-year, these costs have become a major line item that demands careful attention and strategic planning.

The insurance landscape for apartment buildings has become increasingly complex. Between rising natural disasters, construction cost inflation, and insurers pulling out of high-risk markets, property owners face challenges that didn’t exist just a few years ago. However, this challenging environment also presents opportunities for savvy property owners who understand the market and work with experienced advisors.

Your success depends on more than just finding the cheapest policy. It requires a comprehensive approach that balances adequate coverage with smart risk management. The strategies we’ve discussed – from improving building safety features to requiring tenant insurance – can help you manage costs while protecting your investment from unexpected losses.

The difference between a good insurance program and a great one often comes down to the expertise of your advisor. You need someone who understands the nuances of multifamily properties, stays current with market trends, and can help you steer the increasingly complex world of commercial insurance.

At Stanton Insurance Agency, we’ve spent over two decades helping property owners in Massachusetts and New Hampshire protect their investments. We understand that every building is unique, every location has different risks, and every owner has specific goals. Our approach focuses on building long-term partnerships, not just selling policies.

We believe in proactive risk management rather than reactive problem-solving. When you work with us, we’ll help you identify potential issues before they become expensive claims. We’ll review your coverage annually to ensure it keeps pace with your property’s changing value and risks. Most importantly, we’ll be there when you need us most – when a claim occurs and you need an advocate on your side.

Ready to secure your investment? Contact us today for a comprehensive review of your apartment building insurance needs. Let’s work together to build an Insurance for Multifamily Properties strategy that protects your valuable assets and gives you peace of mind.