How much car insurance: Smart Guide 2025

Why Understanding Car Insurance Costs Matters

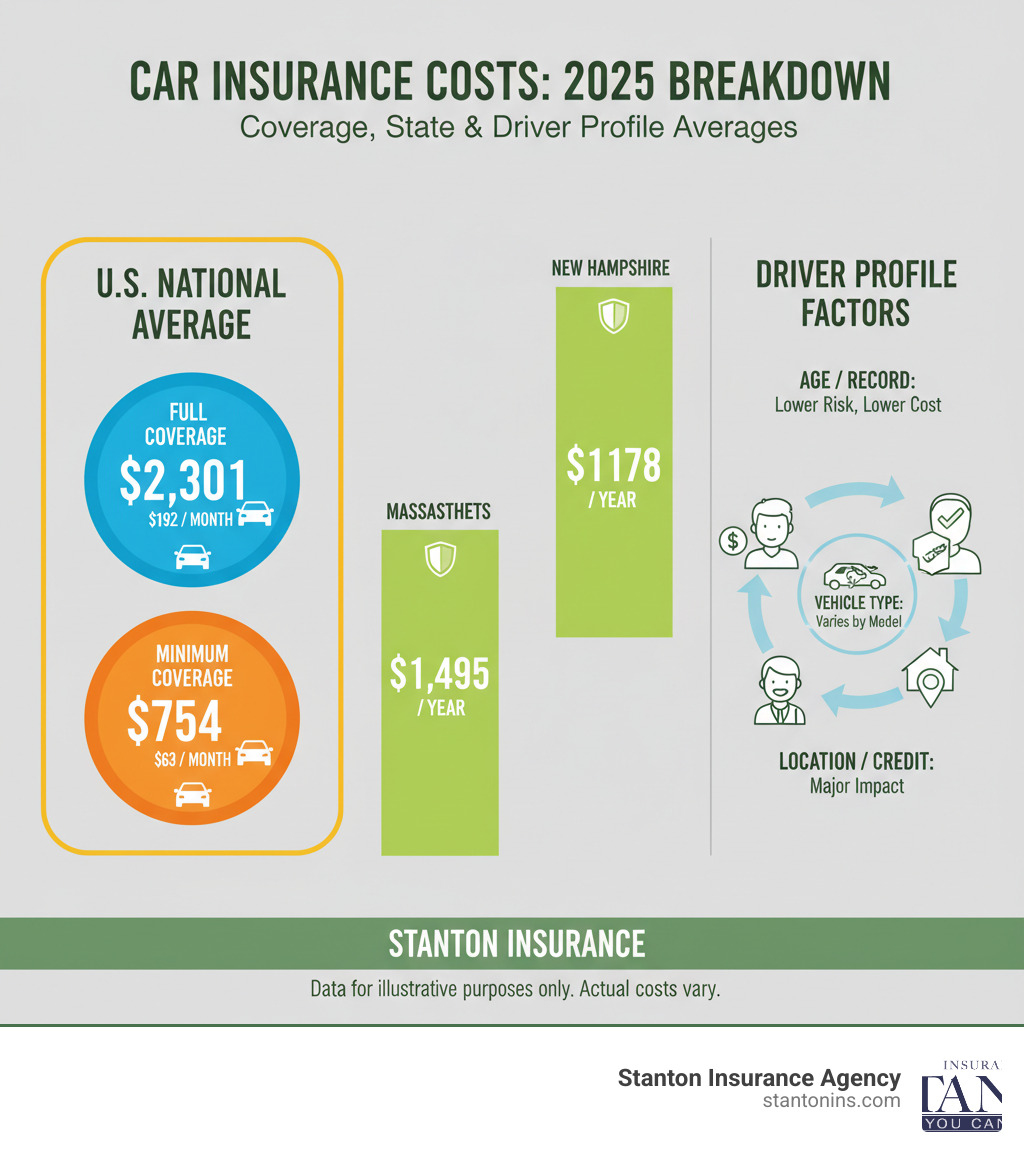

How much car insurance costs depends on your unique situation. Here are the key numbers to know:

- National average for full coverage: $2,301 per year ($192/month)

- National average for minimum coverage: $754 per year ($63/month)

- Massachusetts average for full coverage: Approximately $1,495 per year

- New Hampshire average for full coverage: Around $1,178 per year

Your actual cost will vary based on factors like your age, driving record, vehicle, and location.

Ever wondered why your neighbor pays less for car insurance, or why your premium jumped after a clean driving year? You’re not alone. Car insurance costs can feel like a mystery, but the price differences aren’t random. Understanding how insurers calculate your premium puts you in control. Knowing what drives your rate helps you make smarter choices about coverage, find savings, and protect your assets without overpaying.

Rates vary dramatically based on your ZIP code, credit score, driving record, and vehicle. For example, drivers with poor credit can pay more than double what those with good credit pay, and a single speeding ticket can add hundreds to your annual bill.

This guide walks you through the real numbers so you can estimate what you’ll pay and find practical ways to lower your costs. You’ll learn which factors matter most, how to compare coverage options, and what discounts you might be missing.

I’m Geoff Stanton, President of Stanton Insurance in Waltham, Massachusetts. I’ve helped countless clients steer how much car insurance they need and what to expect based on their unique circumstances.

Understanding the Average Cost of Car Insurance

To figure out how much car insurance you’ll pay, it helps to start with the averages. National numbers provide a baseline, but your location and coverage choices tell the real story.

National and State-by-State Averages

Across the U.S., drivers pay an average of $2,301 per year for full coverage car insurance, or about $205 per month. For minimum coverage, the national average drops to $754 annually ($63 per month).

However, these national numbers differ from local rates. In Massachusetts, the average annual cost for full coverage is approximately $1,495, while New Hampshire drivers often see even lower rates, with full coverage averaging around $1,178 per year. These differences are due to local factors like traffic, accident rates, weather, and state regulations.

Your ZIP code matters. A driver in Boston will likely pay more than someone in a rural New Hampshire town, even with an identical car and driving record. Our guides on why car insurance is so expensive in Massachusetts and car insurance rates in New Hampshire explain these regional factors.

Full Coverage vs. Minimum Required Insurance

Choosing between full and minimum coverage is one of the biggest factors affecting how much car insurance you’ll pay. The price difference is substantial—nationally, full coverage averages $205 per month versus $63 per month for minimum coverage—but so is the protection gap.

Minimum coverage is the bare minimum your state requires. In Massachusetts, this includes bodily injury to others, personal injury protection, uninsured motorist coverage, and property damage liability. While affordable, it leaves your own vehicle unprotected. If you cause an accident, it only pays for the other party’s damages, not your own. You can learn the specifics from our guides on Massachusetts minimum coverage and New Hampshire requirements.

Full coverage isn’t a single policy but a package including liability, collision, and comprehensive coverage. This combination protects you in most scenarios. Liability covers damage you cause to others. Collision pays to repair your car after an accident, regardless of fault. Comprehensive handles non-collision events like theft, vandalism, hail, or hitting a deer.

If you’re driving a newer car or have a loan, full coverage is usually the right choice. If your car is older and you could afford to replace it, minimum coverage might suffice. Our full coverage vs. liability car insurance comparison can help you decide.

What Factors Determine How Much Car Insurance You Pay?

Insurers calculate how much car insurance you’ll pay by building your risk profile from a combination of factors: who you are, what and how you drive, and where you live. Understanding these elements provides insight into your premium and reveals potential savings.

Your Personal Profile: Age, Gender, and Credit Score

Your personal details significantly affect your insurance costs.

Age is a major factor. Teen drivers face the highest premiums because they are statistically riskier. According to the IIHS, teen drivers are 4 times more likely to cause accidents than drivers 20 or older. Nationally, average annual rates for teen drivers can exceed $6,400 for females and $7,300 for males. Rates typically drop with experience, hitting a low point in middle age before ticking up again for seniors over 70.

Gender can also play a role, though the difference is often small. Nationally, the average annual rate for adult female drivers is $1,951, compared to $1,976 for males.

Your credit score can have a dramatic impact. Nationally, drivers with poor credit pay an average of $4,381 annually, more than double the $2,095 paid by those with good credit. Research shows a higher credit score can help you qualify for lower rates due to a statistical link between credit and claim frequency. Massachusetts prohibits using credit for auto insurance rating, but it may affect rates in New Hampshire.

Your Vehicle: Make, Model, and Age

The car you drive directly impacts how much car insurance you pay.

Repair costs are a major factor. Cars with advanced technology, luxury components, or specialized parts are more expensive to fix, leading to higher comprehensive and collision premiums. On the other hand, vehicles with high safety ratings and features like automatic emergency braking can earn you discounts.

Theft risk also matters. Cars that are frequently stolen have higher comprehensive coverage costs. The good news is that national vehicle theft dropped 17% in 2024, which could lead to lower premiums for some models.

Vehicle type creates different risk profiles. Here’s how average annual premiums for full coverage vary by vehicle, based on national AAA data:

| Vehicle Type | Average Annual Premium for Full Coverage |

|---|---|

| Small sedan | $1,510 |

| Medium sedan | $1,583 |

| Subcompact SUV | $1,684 |

| Compact SUV (FWD) | $1,723 |

| Medium SUV (4WD) | $1,831 |

| Mid-size pickup | $1,527 |

| Half-ton/crew-cab pickup | $1,764 |

| Hybrid vehicle | $1,643 |

| Electric vehicle | $2,059 |

Electric vehicles currently have higher insurance costs due to specialized parts and repair needs. To learn more, see if liability insurance costs more depending on the kind of car.

Your Driving History and Habits

Your record behind the wheel is a primary indicator of your risk.

At-fault accidents are costly. Nationally, one at-fault accident can raise the average annual premium to $2,940—nearly $900 more than for a driver with a clean record. Our Auto insurance accident claim complete guide can help you steer this process.

Speeding tickets can increase your annual premium by over $400. DUIs are the most serious violation and lead to substantial rate hikes, with average annual costs jumping to $3,538.

How much you drive also matters. Higher annual mileage increases your time on the road and accident risk. If you use your vehicle for ridesharing like Uber or Lyft, you’ll need specialized coverage beyond a standard personal policy.

Your Location: Why Your ZIP Code Matters

Where you live can influence your premium as much as your driving record, based on the statistical risk of the area.

Urban areas generally cost more than rural ones due to higher traffic, accident rates, and vehicle theft. Living in Boston or Manchester will likely cost more than in a quiet town. Weather also plays a role. The harsh winters in Massachusetts and New Hampshire increase the risk of accidents and damage from snow, ice, and storms. For example, Massachusetts has experienced 20 billion-dollar weather disasters since 1980, many of which involved severe winter storms. Finally, local crime rates for theft and vandalism are factored into your ZIP code’s risk assessment.

Understanding these factors is part of knowing Why auto insurance is important.

How to Lower Your Car Insurance Costs

Once you know how much car insurance you need, the next step is to lower the cost. You have more control over your premium than you might think. With a few strategic moves, most drivers can find significant savings without sacrificing protection.

Smart Shopping and Policy Adjustments

The simplest way to save is comparison shopping. Rates for identical coverage can vary by hundreds of dollars between insurers, so gathering multiple quotes is essential. Our guide on Comparing car insurance companies explains what to look for.

Adjusting your deductible is another powerful tool. Increasing your deductible from $500 to $1,000 can lower your premium, but be sure you can comfortably afford the higher out-of-pocket cost if you need to file a claim.

Reviewing your coverage needs annually is also smart. If you’re driving an older car with low market value, paying for full collision and comprehensive coverage may no longer be cost-effective. Our article When to drop collision insurance coverage? can help you decide.

Bundling your policies is an easy win. Most insurers offer a substantial discount when you combine your auto insurance with a homeowners or renters policy, simplifying your bills and saving you money.

Open uping Common Car Insurance Discounts

Insurers offer many discounts, but you often have to ask for them. The savings can add up significantly.

- Good Student Discount: For young drivers on your policy with good grades.

- Safe Driver Discount: For maintaining a clean record with no accidents or violations.

- Multi-Policy Discount: For bundling auto and home/renters insurance, often saving 10-25%.

- Low Mileage Discount: For those who work from home or drive infrequently.

- Vehicle Safety Features: For cars with anti-lock brakes, airbags, anti-theft systems, or advanced driver-assistance tech.

- Payment Discounts: For paying your premium in full, setting up automatic payments, or going paperless.

- Affiliation Discounts: For members of certain professional organizations or alumni groups.

The key is to ask your agent about every discount that might apply. Many people leave money on the table simply because they didn’t know to ask.

Understanding Your Coverage Options

To determine how much car insurance you need, you must understand what you’re buying. A policy is a layered safety net: some coverages protect others, some protect you and your vehicle, and others protect you from underinsured drivers. Key components include:

- Liability Coverage: Pays for injuries and property damage you cause to others. It is legally required in Massachusetts and New Hampshire.

- Collision Coverage: Pays to repair your car after an accident with another vehicle or object.

- Comprehensive Coverage: Covers non-collision events like theft, vandalism, fire, hail, or hitting an animal.

- Uninsured/Underinsured Motorist (UM/UIM) Coverage: Protects you if the at-fault driver has little or no insurance.

- Personal Injury Protection (PIP): Covers medical bills and lost wages for you and your passengers, regardless of fault. It is mandatory in Massachusetts.

For a complete overview, read What you need to know about auto insurance.

What Is ‘Full Coverage’ Car Insurance?

“Full coverage” isn’t an official policy type but industry shorthand for a robust policy. It typically means a policy that combines liability, collision, and comprehensive coverage. Liability covers damage you cause to others, collision pays to repair your car after a crash, and comprehensive handles non-collision events like theft or storm damage.

If you finance or lease a car, your lender will almost certainly require full coverage to protect their investment. Even if you own your car outright, it’s a wise choice for newer or more valuable vehicles. Our guides on Car insurance requirements for financed cars, Collision vs. Comprehensive, and Liability car insurance coverage provide more detail.

How much car insurance do I need for liability?

Your liability coverage is what protects your financial future after an accident. While states set minimum requirements, they are often insufficient. In Massachusetts, as of July 1, 2025, you need at least $25,000 per person and $50,000 per accident for bodily injury liability and separate coverage for property damage liability.

The truth is, a serious accident can easily result in damages exceeding these limits, making you personally responsible for the difference. This puts your savings, home, and future earnings at risk. We generally recommend carrying liability limits well above the state minimums, especially if you have significant assets. Our guide on how much liability car insurance you need can help you determine the right amount. It’s also helpful to understand if Massachusetts is a no-fault car insurance state.

How much car insurance should I get for other protections?

Beyond the core coverages, other protections provide crucial safety nets.

Uninsured/Underinsured Motorist (UM/UIM) Coverage is critical. With about 13% of drivers uninsured nationally, this coverage protects you if an uninsured or underinsured driver hits you, covering your injuries and repairs when they can’t. We consider this essential. Learn more at Do you need uninsured motorist coverage?.

In Massachusetts, mandatory Personal Injury Protection (PIP) covers up to $8,000 in medical bills and lost wages regardless of fault. New Hampshire doesn’t require PIP, but Medical Payments (MedPay) offers similar no-fault coverage for medical expenses.

Gap insurance is vital if you have a new car loan or lease. If your car is totaled, collision coverage pays its current value, which may be less than what you owe. Gap insurance covers that difference, so you aren’t left making payments on a car you no longer have. We explain it in What is gap insurance?.

Frequently Asked Questions about Car Insurance Costs

We’ve helped countless Massachusetts and New Hampshire drivers with their insurance, and a few questions always come up about how much car insurance should cost.

What is a good monthly payment for car insurance?

A “good” monthly payment provides adequate protection without straining your budget. While the national average for full coverage is around $205/month, your actual cost depends on your driving record, vehicle, location, and coverage choices. Drivers in New Hampshire might pay closer to $100/month, while Massachusetts drivers average around $125/month. The best rate balances cost and coverage.

Is it cheaper to pay for car insurance every 6 months?

Yes, it is almost always cheaper to pay your premium in full for the entire 6- or 12-month term. Insurers often add small service fees to monthly installments and may offer a “paid-in-full” discount. This is one of the easiest ways to trim your overall cost.

Why did my car insurance go up for no reason?

It’s frustrating when your rate increases despite a clean record, but your personal driving history is just one piece of the puzzle. Several external factors can cause rates to rise for everyone:

- Inflation and Repair Costs: The costs of medical care and auto parts have risen sharply. Modern cars with advanced safety systems are particularly expensive to repair. The average cost per claim has grown significantly, forcing insurers to adjust rates to cover these higher expenses.

- Your Location: An increase in accidents, vehicle thefts, or severe weather claims in your ZIP code can push rates up for all residents in that area, as insurance is based on shared risk.

- Insurer Risk Models: Insurance companies regularly review their overall claim experience and adjust rates based on their findings. As one expert noted, even when inflation slows, prices tend to remain at a higher level.

If your rate goes up, it’s a good time to shop around, as different insurers weigh these factors differently.

Get a Clear Estimate for Your Needs

You now have a clearer picture of how much car insurance you might pay and why rates vary. Understanding the key factors—driving record, vehicle, location, and more—empowers you to make smart decisions about your coverage.

There is no one-size-fits-all answer. Your ideal policy balances comprehensive protection with a premium that fits your budget. The most effective ways to manage your premiums are to review your coverage regularly, ask for every available discount, and maintain a clean driving history. Avoiding accidents and violations is the single best way to keep your rates low.

While online calculators provide a ballpark figure, they can’t account for your unique situation. A local professional can. We understand the insurance landscape in Massachusetts and New Hampshire and can help you steer your options to find the best value.

The team at Stanton Insurance Agency is here to help you steer your options and find the right policy that provides the protection you need at a price you can afford. Whether you’re a first-time buyer or a longtime policyholder looking to save, we’re ready to provide personalized guidance. Get started on your Massachusetts car insurance today, and let’s find the coverage that’s right for you.