Homeowners insurance for multi family: 7 Powerful Benefits 2025

Why Multi-Family Property Owners Need Specialized Insurance Coverage

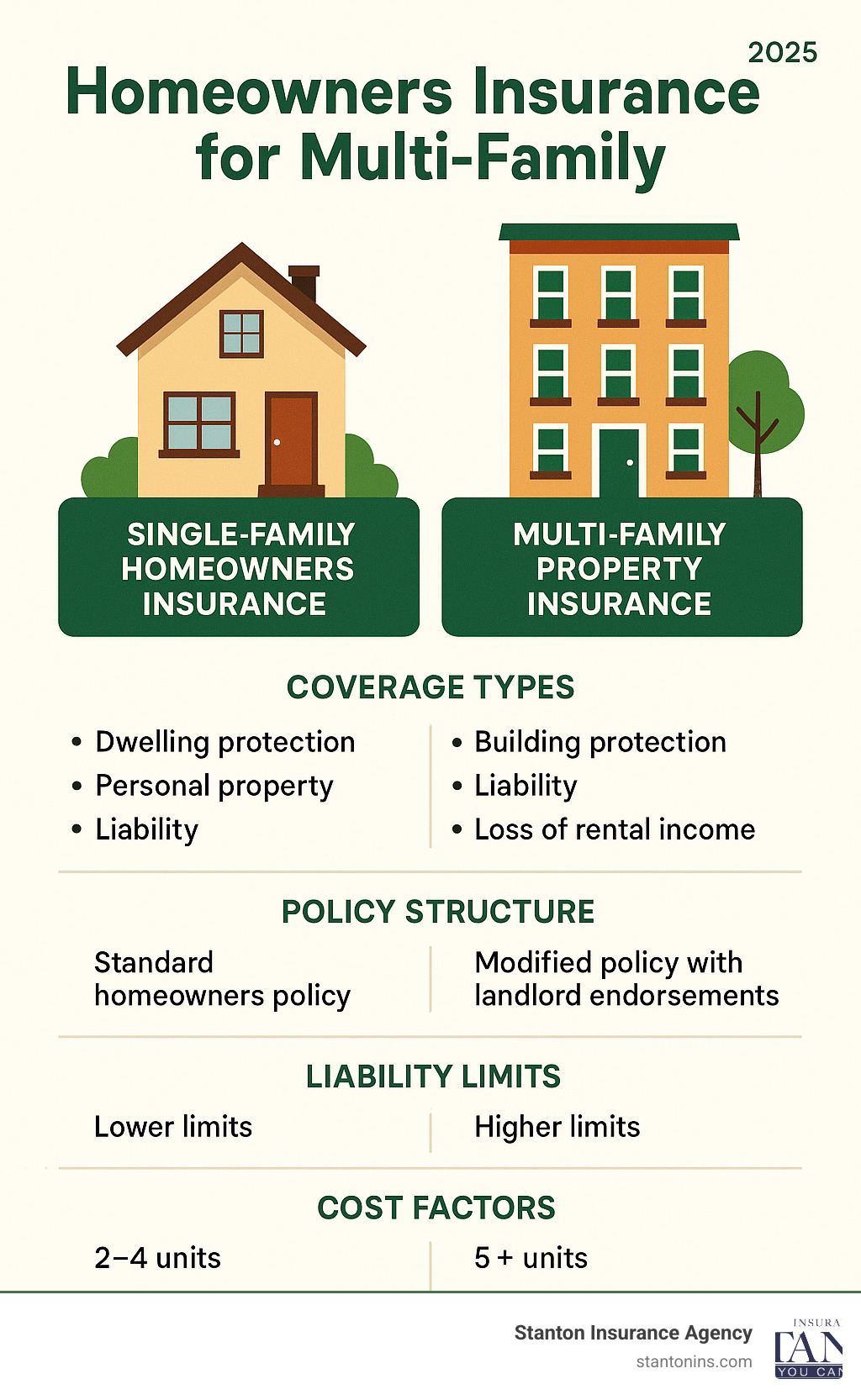

Homeowners insurance for multi family properties isn’t just regular homeowners insurance with extra coverage – it’s a completely different type of protection designed for the unique risks of owning rental properties. Whether you’re house-hacking a duplex or managing a small apartment building, standard homeowners policies won’t cover the liability exposure from multiple tenants, loss of rental income, or shared building systems that serve multiple units.

Quick Answer for Multi-Family Insurance Coverage:

- 2-4 units (owner-occupied): Modified homeowners policy with landlord endorsements

- 2-4 units (rental only): Dwelling fire policy or landlord insurance

- 5+ units: Commercial property insurance with business income coverage

- Essential coverages: Building protection, liability, loss of rental income, equipment breakdown

- Typical cost: $1,000-$3,000 per million dollars of coverage

Many investors consider multi-family properties “a solid and affordable avenue for venturing into real estate,” but the insurance complexity catches most new landlords off guard. Unlike single-family homes, multi-family properties face amplified risks from shared walls, common areas, multiple tenants, and the potential for significant income loss when units become uninhabitable.

Key differences from standard homeowners insurance:

- Covers multiple dwelling units under one structure

- Includes protection for lost rental income

- Higher liability limits for tenant and visitor injuries

- Coverage for landlord-owned contents in common areas

- Optional tenant discrimination and fair housing liability

I’m Geoff Stanton, a fourth-generation insurance professional and Certified Insurance Counselor who has specialized in multi-family property protection for over two decades at Stanton Insurance Agency. I’ve helped hundreds of New England property owners steer the transition from single-family homeowners policies to proper homeowners insurance for multi family coverage.

Simple homeowners insurance for multi family word guide:

- apartment building insurance calculator

- maximum flood insurance coverage for a multi family 5 building

- insurance for 5 unit apartment building

Understanding Homeowners Insurance for Multi Family Properties

When you own a duplex, triplex, or small apartment building, you’re entering a different world of insurance coverage. Homeowners insurance for multi family properties isn’t just your regular homeowners policy with extra coverage – it’s specialized protection designed for the unique challenges of multiple units under one roof.

Multi-family properties create complex risks that standard homeowners policies can’t handle. You’ve got multiple tenants, shared walls that can turn a small kitchen fire into a building-wide disaster, common areas where accidents happen, and rental income that disappears when units become unlivable.

Owner-occupied properties create an interesting insurance puzzle. When you live in one unit while renting others, insurers blend your personal homeowners coverage with commercial landlord protection. The magic number is five units – properties with five or more units typically cross into commercial territory with different policies and pricing structures.

| Property Type | Policy Type | Key Features |

|---|---|---|

| Owner-occupied 2-4 units | HO-3 with endorsements | Personal residence + rental coverage |

| Non-owner-occupied 2-4 units | DP-3 Dwelling Fire | Pure rental property protection |

| 5+ units | BOP or Commercial Package | Full commercial coverage with business income |

Costs of homeowners insurance for multi family

Homeowners insurance for multi family properties typically runs between $1,000 and $3,000 per million dollars of coverage. The industry uses a “per-door” metric for quick estimates – roughly $150 to $650 per unit annually, with owner-occupied properties generally costing less than pure rental properties.

Replacement cost calculations get tricky with multi-family properties. Each unit needs its own kitchen, bathroom, and often separate heating systems. Multiple sets of appliances, fixtures, and utilities mean higher reconstruction costs per square foot compared to single-family homes.

Your deductible choice makes a significant difference. Jumping from a $1,000 to a $2,500 deductible can slash your premiums by 15-25%. Claims history hits multi-family properties harder – one fire claim can bump premiums up 25-40% for three to five years.

Recent material costs and inflation have pushed premiums up 15-25% annually as lumber prices soared and skilled labor became scarce.

Choosing the right homeowners insurance for multi family

Building coverage at full replacement cost forms the foundation of any good multi-family policy. Don’t cut corners here – you need enough coverage to completely rebuild without worrying about depreciation. Include landlord contents coverage for common areas, general liability coverage for injuries, and loss of rental income coverage when units become uninhabitable.

Equipment breakdown coverage becomes crucial for shared systems like boilers and electrical panels. Water backup coverage protects against sewage backups affecting multiple units, while umbrella liability coverage provides extra protection for catastrophic claims.

The financial strength of your insurance carrier matters more for multi-family properties. Complex claims involving multiple units require carriers with strong claims-handling capabilities. We recommend sticking with carriers rated A- or higher by AM Best.

More info about Insurance for Multifamily Properties

Multi-Family Property Types & Who Needs Coverage

The world of multi-family properties ranges from cozy duplexes perfect for first-time landlords to apartment complexes housing entire communities. Each property type brings unique insurance challenges.

Duplexes are often where new landlords start. These twin-home structures share a common wall, creating fire spread risks that don’t exist with detached homes. Many house-hackers love duplexes because they can live in one side while collecting rent from the other.

Triplexes and fourplexes increase complexity with shared utility systems, common entrances, and sometimes laundry facilities serving multiple tenants. Many fourplexes still qualify for residential financing and modified homeowners policies.

Apartment buildings with five or more units enter commercial territory, requiring business property insurance with complex building systems, on-site management needs, and significant liability exposures from amenities.

Mixed-use properties combining residential units with commercial spaces need specialized coverage addressing both residential and commercial risks.

Owner-occupiers vs. pure investors

Living in your multi-family property versus owning it purely as an investment creates different insurance dynamics affecting coverage options, pricing, and protection structure.

Owner-occupied properties enjoy hybrid protection – homeowners coverage for your personal residence combined with landlord coverage for rental units. This typically qualifies you for modified HO-3 homeowners policies with landlord endorsements, while pure investment properties usually require DP-3 dwelling fire policies.

Live-in discounts reflect what insurers have learned: owner-occupiers take better care of their properties. You’re more likely to notice problems before they become major claims, leading to 10-20% premium reductions compared to absentee landlord properties.

Vacancy clauses become a non-issue for owner-occupied properties since continuous occupancy is guaranteed.

Tenant responsibilities & renters insurance

Requiring renters insurance in lease agreements has become standard practice. Typically requiring minimum coverage limits of $100,000 liability and $20,000 personal property protection, this requirement protects both you and your tenants.

Subrogation rights protect you when tenant negligence causes damage. Your insurance company can seek reimbursement from the tenant’s renters insurance carrier, protecting you from out-of-pocket expenses and keeping your claims history clean.

According to the Insurance Information Institute, renters insurance uptake has increased significantly as more landlords require coverage in lease agreements.

Core & Optional Coverages Every Policy Should Consider

Multi-family property insurance requires comprehensive protection addressing unique rental property risks while maintaining cost-effectiveness.

Property damage coverage protects the building structure against fire, wind, hail, and vandalism. Multi-family properties face amplified risks due to shared walls and multiple cooking areas where fires can quickly spread.

General liability coverage protects against lawsuits from injuries to tenants or visitors. Multi-family properties create numerous exposures through common areas, shared utilities, and increased foot traffic.

Loss of rental income coverage replaces lost rent when covered perils render units uninhabitable. This coverage typically provides 12-18 months of rental income replacement – crucial for income-dependent property owners.

Equipment breakdown coverage protects against mechanical failures of building systems like boilers, HVAC units, and electrical panels. Multi-family properties often feature complex shared systems serving multiple units.

Additional essential coverages:

- Ordinance or law coverage for code upgrade costs

- Umbrella liability for catastrophic claims

- Flood insurance (separate policies required)

- Water backup and sump overflow coverage

Coverage must-haves for 2-4 units

Building replacement cost coverage forms the foundation. Multi-family properties cost more per square foot to rebuild due to multiple kitchens, bathrooms, and utility systems.

Landlord contents coverage protects appliances and equipment in rental units and common areas. Medical payments coverage provides immediate payment for injuries regardless of fault. Water backup coverage protects against sewer backups and shared plumbing system failures.

More info about What Insurance Coverages Should You Have for a Multi-Family Apartment?

Additional protections for 5+ doors

Properties with five or more units require improved coverage addressing increased complexity and risk exposures.

Workers’ compensation insurance becomes necessary when employing maintenance staff or property managers. Boiler and machinery coverage protects against mechanical breakdown of complex heating, cooling, and elevator systems.

Environmental liability coverage addresses pollution-related claims from fuel spills or mold contamination. Terrorism coverage through TRIA provides protection for larger urban properties.

Pricing Factors & Smart Ways to Save

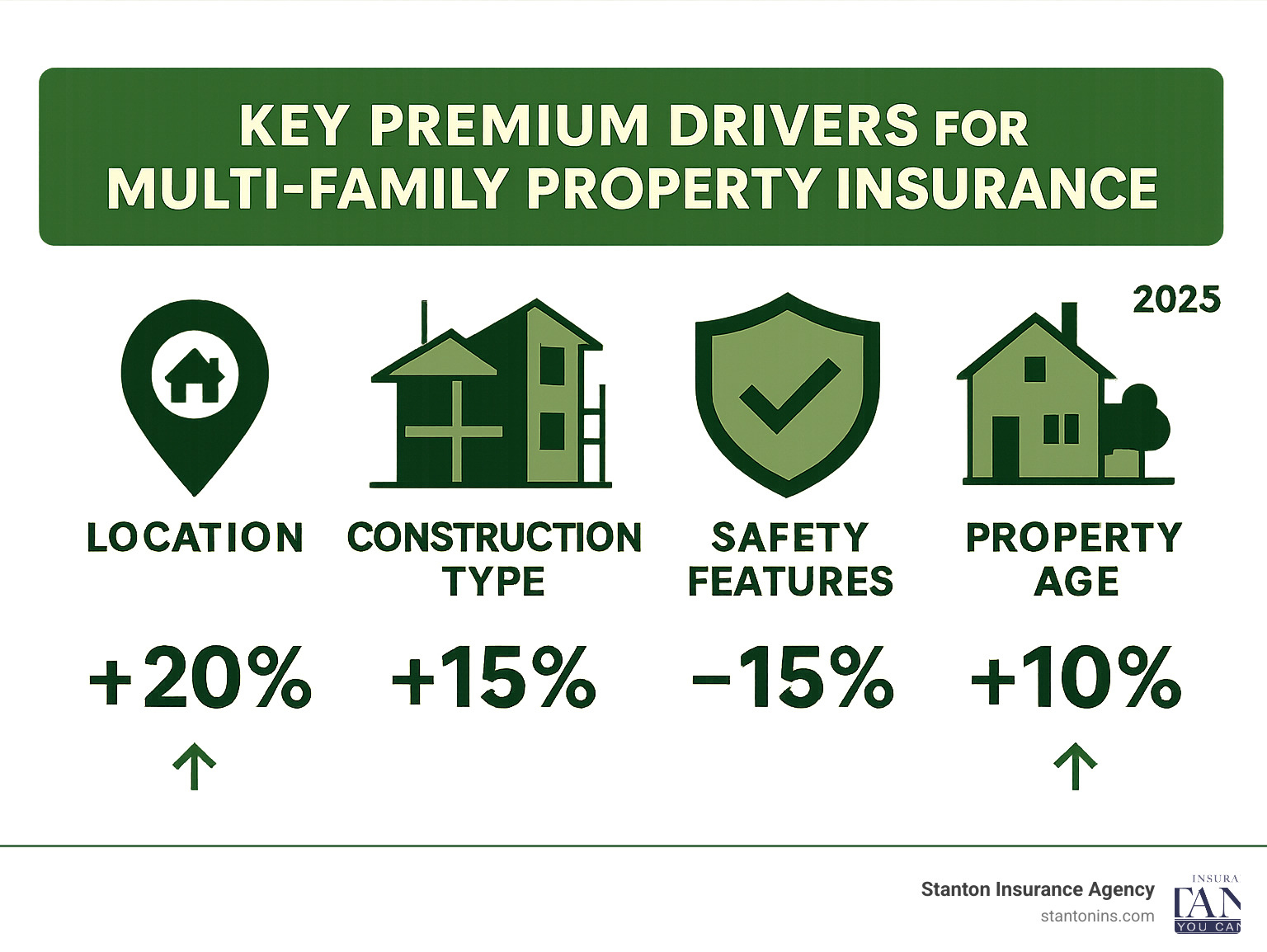

Insurance companies evaluate dozens of factors when pricing homeowners insurance for multi family properties. Understanding key drivers helps you make smart decisions keeping premiums manageable.

Location plays the biggest role in determining rates. Coastal properties face wind and flood surcharges, while urban properties cost more due to higher crime rates and liability exposure. Properties with excellent fire departments (low ISO ratings) qualify for meaningful premium reductions.

Building age and construction materials significantly impact pricing. Older properties with outdated electrical or plumbing systems face higher premiums. Frame construction typically costs more than brick or masonry due to faster fire spread.

Smart upgrade opportunities:

- Upgrading knob-and-tube wiring or polybutylene pipes can cut premiums 15-25%

- Installing firewalls between units provides substantial discounts

- Automatic sprinkler systems reduce premiums 15-25%

- Modern security systems earn 5-10% discounts

Easy money-saving strategies:

- Increase deductibles from $1,000 to $2,500 for 15-25% savings

- Bundle multiple properties with one insurer for 10-15% discounts

- Maintain claims-free history through proactive maintenance

Discounts & credits you might be missing

Multi-policy discounts offer the biggest savings – insuring several properties with the same carrier typically saves 10-15%. Claims-free discounts reward well-maintained properties with 5-10% reductions for clean loss histories.

Additional discount opportunities:

- Gated access and controlled entry systems

- Non-smoking building policies (5-10% discounts)

- Certification programs like Firewise Communities

- Green building certifications and energy-efficient upgrades

The key to maximizing savings is working with an experienced agent who understands the multi-family market and can identify all available discounts.

More info about Average Homeowners Insurance in MA Multi-Family

Navigating Quotes, Claims & Compliance

Shopping for homeowners insurance for multi family properties requires careful comparison beyond just price. That cheaper quote might exclude water damage or cap rental income coverage, costing thousands during claims.

Creating true comparisons requires attention to detail. One insurer’s policy might automatically include equipment breakdown coverage while another requires separate endorsements. Your declarations page spells out coverage limits, deductibles, and terms – ensure building coverage reflects current replacement costs, not purchase prices.

Working with specialist brokers makes this process smoother. They understand multi-family risks, know which carriers write this coverage, and can help steer risk management strategies keeping premiums manageable.

Filing a claim step-by-step

Emergency response always comes first – ensure safety, call 911 if needed, and prevent further damage. Document every emergency action and save receipts for reimbursement.

Photo and video documentation becomes crucial for multi-family claims. Take wide shots showing overall damage, then zoom in on specifics. Photograph each affected unit separately and document common area damage.

Tenant communication requires balance – keep tenants informed while managing expectations. Document communications since additional living expense coverage might reimburse tenant hotel costs.

Get multiple repair bids from qualified contractors understanding multi-family construction. Maintain reserve funds equal to at least three months of mortgage payments plus your deductible.

Annual policy check-up

Unit upgrades and renovations significantly impact coverage needs. That $15,000 kitchen renovation increases both property value and replacement cost – notify your insurer before beginning major work.

Rent roll changes directly affect loss of rental income adequacy. Review actual rental income quarterly and adjust coverage limits accordingly. Market inflation has pushed replacement costs up 20-30% in many New England areas.

More info about Multi-Family Dwelling Insurance

Frequently Asked Questions about Homeowners Insurance for Multi Family

What’s the difference between a homeowners and a landlord policy on a duplex?

If you live in one unit while renting the other, you can get a modified homeowners policy (HO-3) with landlord endorsements. This hybrid approach provides personal homeowners coverage for your unit plus landlord protection for your rental.

If you’re renting both units and living elsewhere, you need a dedicated landlord or dwelling fire policy (DP-3). These focus purely on building protection and landlord responsibilities without personal coverage.

Homeowners policies offer broader coverage and better rates because owner-occupied properties are lower risk. Landlord policies are all business – building coverage, landlord liability, and rental income protection, but typically at higher premiums.

How does loss of rental income coverage work after a fire?

Loss of rental income coverage replaces rent you’re losing while repairs happen after covered damage. Most policies provide 12-18 months of protection, kicking in immediately when loss occurs.

For example: Your duplex rents for $2,000 per unit monthly. A fire damages both units for four months. Coverage pays $2,000 × 2 units × 4 months = $16,000 to replace lost income.

Coverage goes beyond basic rent replacement, often including tenant relocation costs. It’s based on actual rent loss with solid documentation required, and vacant units typically don’t qualify.

Do I need separate flood insurance for my fourplex in New England?

Yes, you need separate flood insurance. Standard homeowners insurance for multi family properties exclude flood damage. New England faces serious flood risks from coastal storms, nor’easters, and spring snowmelt.

The National Flood Insurance Program provides up to $500,000 building coverage and $500,000 contents per building. Private flood insurance often provides higher limits and broader coverage than NFIP policies.

Flood insurance has a 30-day waiting period, so you can’t wait until storms approach. The coverage is essential since single flood events can destroy years of rental income.

Conclusion

Protecting your multi-family property investment doesn’t have to feel overwhelming. Once you understand the basics of homeowners insurance for multi family properties, you can make confident decisions that safeguard both your building and your rental income. The key is recognizing that these properties need specialized coverage – not just a regular homeowners policy with extra bells and whistles.

Whether you’re just starting out with a duplex or managing several apartment buildings across New England, the right insurance coverage acts as your financial safety net. When that unexpected fire spreads through shared walls, or when a burst pipe floods multiple units, proper coverage means the difference between a manageable setback and a devastating loss.

At Stanton Insurance Agency, we’ve walked alongside hundreds of property owners through this exact journey. Over our decades of experience, we’ve seen how the right coverage protects dreams and builds wealth, while inadequate insurance can derail even the most promising real estate ventures.

The multi-family insurance landscape continues evolving, with new risks from smart building technology and changing regulations keeping us on our toes. But the fundamentals remain solid: comprehensive building coverage protects your structure, loss of rental income coverage keeps your cash flow stable, and adequate liability protection shields you from costly lawsuits.

Here’s what successful multi-family property owners understand: owner-occupied properties get better rates and broader coverage than pure investments, regular policy reviews ensure your coverage grows with your property values, and working with experienced agents opens doors to specialized markets you might never find on your own.

Don’t let your multi-family investment become a financial liability due to inadequate insurance. The peace of mind that comes from knowing every unit, every tenant, and every dollar of rental income is properly protected allows you to focus on what you do best – growing your real estate portfolio.

Personal Insurance: Multi-Family Insurance

Your multi-family property represents more than just an investment – it’s your pathway to financial independence and generational wealth. Let Stanton Insurance Agency help you protect that journey with coverage that truly understands the unique challenges of rental property ownership. Because when you’re safeguarding every door, you’re really protecting every opportunity.